Automotive Lubricants Market Size, Share, Trends and Forecast by Product, Vehicle Type, and Region, 2025-2033

Automotive Lubricants Market Size and Share:

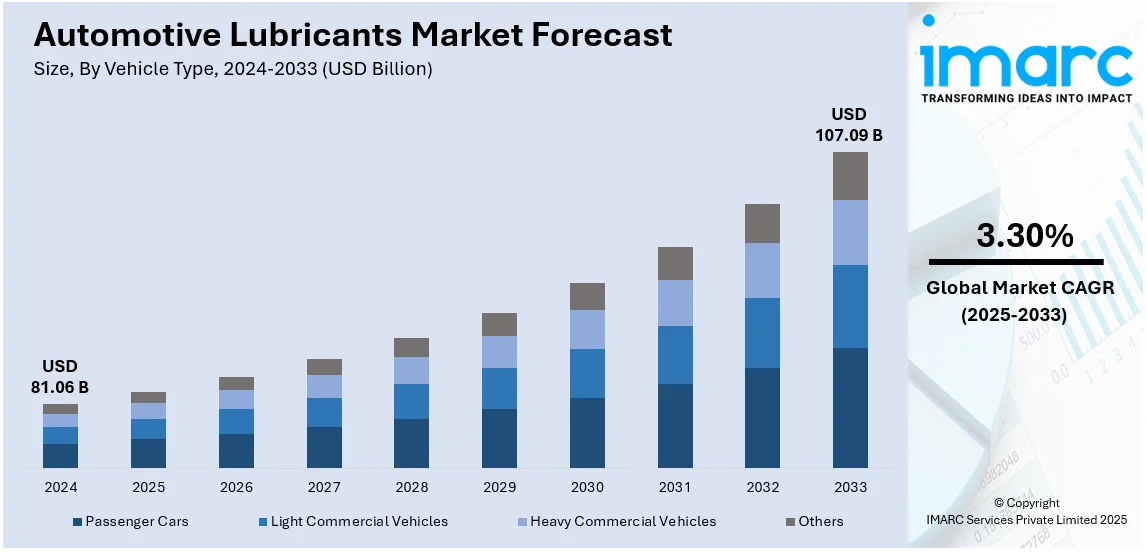

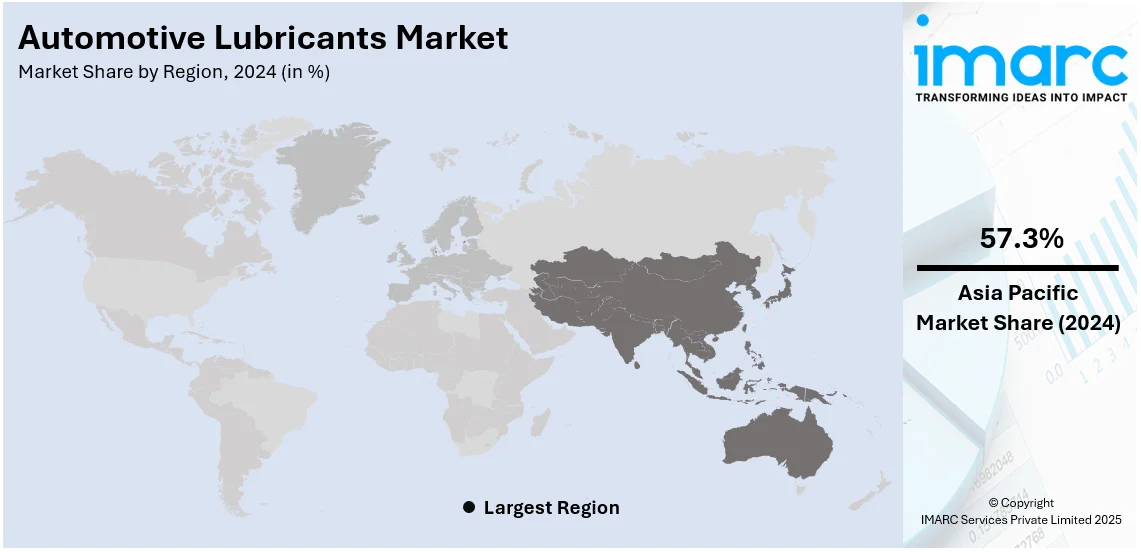

The global automotive lubricants market size was valued at USD 81.06 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 107.09 Billion by 2033, exhibiting a CAGR of 3.30% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 57.3% in 2024. The automotive lubricants market share is expanding, driven by the rising automobile sales, increasing awareness about the importance of regular vehicle maintenance, and governing agencies of several countries are implementing stringent emissions and pollution standards to maintain environmental sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 81.06 Billion |

|

Market Forecast in 2033

|

USD 107.09 Billion |

| Market Growth Rate 2025-2033 | 3.30% |

Automotive lubricants ensure optimal engine performance, reduce wear and tear on the vehicle's parts, and enhance fuel efficiency in vehicles. Increasingly, synthetic and semi synthetic lubricants are being taken up in the market. This is because their advanced formulations work better than those of conventional mineral-based lubricants. Synthetic lubricants provide better viscosity, better thermal stability, and a high resistance to oxidation, which ultimately results in longer engine life and lesser maintenance cost. Additionally, these synthetic lubricants have seen increased usage because people and industries are becoming increasingly concerned about minimizing carbon emissions; hence, these synthetic lubricants help improve the fuel efficiency and reduce friction losses. As vehicle manufacturers continue to recommend synthetic lubricants for new generation engines, the automotive lubricants market demand is increasing.

The United States has come to be a leading region in the automotive lubricants market because of numerous reasons. These lubricants are demanded because of their better performance characteristics: better viscosity, more oxidation stability, and more effective engine protection. Vehicle manufacturers in the United States increasingly recommend synthetic lubricants in meeting the demands of the modern engines which are often more compact and turbocharged with operation at higher temperatures and pressures. Synthetic lubricants also help improve fuel efficiency, which is in line with the demand for cost savings and environmental impact reduction. Electric vehicles are changing the automotive landscape in the US. The Marc Group predicts that the US EV market is expected to reach USD 386.5 billion by 2033.

Automotive Lubricants Market Trends:

Growing awareness about the importance of regular vehicle maintenance

Rising awareness across the masses pertaining to the frequent maintenance of the vehicle is bolstering the demand for the vehicle maintenance market. Additionally, most people are adopting the habit to prolong the lifeline and performance of an automobile. Yet, effective lubrication is yet another core part of vehicle maintenance which minimizes the friction and degradation of engine component parts. Besides, timely oil change and the usage of quality lubricants are the essentials for fuel efficiency and emission control. Additionally, automotive manufacturers are conducting campaigns to raise awareness among individuals about the long-term benefits of using quality lubricants, which is strengthening the market growth. The global car and automobile manufacturing businesses now stand at 771 as of 2025, having increased by 0.5% from the year 2024. Besides this, people realize that preventive maintenance like oil change, tire rotation, and brake inspection can be helpful in catching minor issues before they become major and costly repairs. Therefore, the proactive approach can bring a considerable diminution of total maintenance costs of a vehicle during its entire service life.

Rising automobile sales

The increasing sales of automobiles are enhancing the demand for automotive lubricants, which is positively affecting the market growth. Consequently, people are preferring vehicles for daily commutation purposes, which is driving the market growth. Additionally, the growing need for lubricants, including engine oils and transmission fluids, to enhance the performance of vehicles is offering a positive market outlook. Except this, most of the national governments are increasing their investment on road network as well as public transports to increase the accessibilities and usages of vehicle. India ranks second largest with 6.3 million km road networks. These comprise of 1,40,995 km National Highway, 1,71,039 km of State Highways, and 60,59,813 of other roads. National Highway alone has grown up by over 50% in last 7 years. Union Budget 2023 enhanced the allotment of Ministry of Road Transport and Highways with a surge of about 68% growth in itself. Another related factor propelling its growth further, because the availability of ease use has promoted so much in common people the vehicle nowadays. Notably, increased developing and sale activities of hybrid and electric vehicles towards carbon foot prints in an environment promote the market with this rate. In addition, the growing adoption of commercial vehicles among companies for business purposes is supporting the automotive lubricants market growth.

Favorable government initiatives

Escalating demand for higher quality lubricants, which owes to growing environmental concerns amidst the masses throughout the world. Other than that, the various country governing authorities are imposing significant standards on pollution and emissions in pursuit of maintaining healthy environment sustainability is boosting the growth of the said market. It has been known that 94% of global population is affected by PM2.5 exposure higher than that set by World Health Organization for safe air level at 5 μg/m3. To this end, the key companies are focusing towards sustainable practices while developing eco-friendly lubricants. Eco-friendly lubricants would reduce harmful exhausts, maximize fuel efficiency and minimize the footprint of automotive businesses on the environment. Along these lines, bio-based lubricants and nontoxic synthetic lubricants are providing growth momentum to the marker. Apart from this, governments have started giving incentives to eco-friendly lubricant consumption in terms of tax rebates and subsidies. The use of greener lubrication alternatives is also increasingly based on regulatory pressure as well as increasing demand for eco-friendly products among consumers. Additionally, technological advancements are making it possible to develop cleaner and more efficient processes and products, thereby offering a favorable automotive lubricants market outlook.

Automotive Lubricants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive lubricants market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and vehicle type.

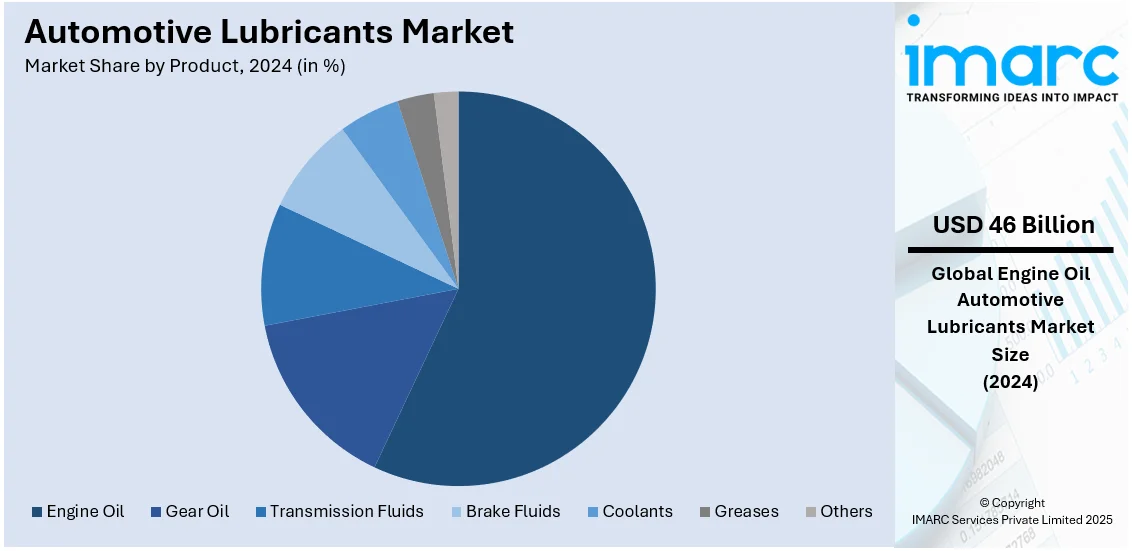

Analysis by Product:

- Engine Oil

- Gear Oil

- Transmission Fluids

- Brake Fluids

- Coolants

- Greases

- Others

Engine oil stand as the largest component in 2024, holding 56.8% of the market. Engine oil is a major lubricant employed in internal combustion engines (ICE) vehicles to reduce friction, dissipate heat, and protect engine parts. It ensures smooth engine operation, prolongs engine life, and improves fuel efficiency by preventing wear and tear. Regular oil changes are essential for maintaining engine performance and longevity. Moreover, engine oil can improve fuel efficiency. When the moving parts of an engine are properly lubricated, then there is lesser resistance in terms of friction and hence, an improvement in terms of fuel economy. This will be particularly prominent with synthetic oils that are developed to keep optimum viscosity regardless of the condition of the vehicle.

Analysis by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Others

Passenger cars lead the market with 34.7% of market share in 2024. Passenger cars, otherwise known as automobiles, function by relying on lubricants. Engine oil and transmission fluid are but a few of the most significant lubricants, helping to minimize friction between moving parts in the engine, transmission, and other components. They cool down, prevent wear, and help provide optimal performance while giving the vehicle its extended lifespan. Regular maintenance and oil changes sustain the fuel efficiency of passenger cars and ensure conformance to standards on emissions. Lubricants also cut down on detrimental emissions by limiting friction and augmenting the total efficiency of engines, which relates to environmental and governmental concerns in the automotive industry. Moreover, an increased demand for lubricants results from the growing uptake of passenger cars among the global population, supporting the growth of the lubricant market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 57.3%. In line with this, the increasing development of eco-friendly lubricants to reduce carbon emissions in the environment is propelling the growth of the market. Moreover, the rising production of automobiles in the region is bolstering the market growth. The demand for synthetic and semi-synthetic lubricants is gaining momentum in Asia-Pacific, largely due to their superior performance compared to conventional mineral-based lubricants. Synthetic lubricants offer increased thermal stability, competent viscosity control, and better engine protection under extreme temperatures and high pressures. These attributes make them ideal for modern engines, which are increasingly smaller, more powerful, and more fuel-efficient. Additionally, major players in the market are expanding their product portfolios to include cost-effective synthetic and semi-synthetic lubricants tailored to the needs of budget-conscious users. In 2024, grand launching of the "LubTop2024 Annual Review Rankings" themed on "Intelligent Innovation, Green Navigation" had been held in Beijing. An annual event designed and organized by China Lubricant Information Network (sinolub.com), in cooperation with Lubricant Market, will attract industry leader companies and widespread media.

Key Regional Takeaways:

United States Automotive Lubricants Market Analysis

The automotive lubricants market in the United States is witnessing robust growth, accounting for a share of 78.80%, driven by several key factors. One of the major drivers is the escalating requirement for high-performance lubricants, particularly as advancements in vehicle engine technologies continue. The shift toward electric vehicles (EVs) is a notable trend; in 2023, nearly 1.2 Million US vehicle buyers opted for EVs, marking a record-breaking surge according to industry reports. Additionally, stringent government regulations on emissions and fuel efficiency have encouraged the development of advanced lubricants that improve the performance of the engine and minimize impact of the environment. The rising preference for synthetic lubricants, which offer longer service life and superior protection, further fuels market growth. The growing vehicle fleet and higher ownership rates contribute to a steady demand for automotive maintenance products. As vehicle owners look to extend their vehicle’s lifespan and reduce maintenance costs, high-quality lubricants are becoming increasingly popular. Moreover, the expanding aftersales services and service center networks play a crucial role in sustaining lubricant demand, further propelling market expansion.

Asia Pacific Automotive Lubricants Market Analysis

The Asia-Pacific automotive lubricants market is experiencing significant growth, driven by an expanding automotive sector and rapid urbanization. World Bank claims that the region of East Asia and the Pacific is the most rapidly urbanizing region in the world, where an average urbanization rate reaches 3% annually, contributing to the vehicle demand and further to the need for automotive lubricants. Rising disposable incomes across key markets like China, India, and Japan are leading to increased vehicle ownership and maintenance, further propelling lubricant consumption. The growing preference for fuel-efficient, low-emission vehicles is also contributing to the demand for advanced lubricants, especially synthetic ones that support high-performance engines. In addition, the rising trend of electric vehicle adoption is creating a need for specialized lubricants tailored for electric and hybrid vehicles. The expanding aftermarket sector, combined with a growing network of service centers, is further driving lubricant consumption in the region. Moreover, local manufacturers are tailoring products to meet the unique needs of the diverse APAC market, fostering market growth.

Europe Automotive Lubricants Market Analysis

The European automotive lubricants market is driven by several key factors, with stringent regulations on emissions and fuel efficiency being a major influence. The European Union’s regulations, such as Euro 6, have spurred the adoption of advanced lubricants designed to meet high-performance standards while minimizing environmental impact. Additionally, Europe has seen a remarkable surge in electric vehicle (EV) adoption, with new electric car registrations reaching nearly 3.2 Million in 2023, an increase of almost 20% compared to 2022, according to the International Energy Agency (IEA). In the European Union, sales amounted to 2.4 Million, reflecting similar growth rates. This rise in EV registrations is fueling demand for specialized lubricants formulated for electric and hybrid vehicles. As a result, the market for eco-friendly and synthetic lubricants is expanding, driven by increasing consumer demand for sustainable solutions. Moreover, the rising number of vehicles on European roads, particularly in countries such as Germany, France, and the UK, continues to drive lubricant consumption. The expansion of the aftermarket sector, along with rising vehicle servicing and maintenance, also contributes to the growing demand for automotive lubricants. Additionally, advancements in engine technology further boost the demand for high-quality lubricants that enhance engine protection and efficiency.

Latin America Automotive Lubricants Market Analysis

The automotive lubricants market in Latin America is primarily driven by the increasing number of vehicles on the road. According to the International Dairy Federation (IDF), there were 128 Million cars and light trucks in the region by the end of 2022, contributing to a rising demand for automotive lubricants. As disposable incomes grow and urbanization increases, vehicle ownership continues to rise, further propelling lubricant consumption. The growing focus on sustainability and the transfer toward fuel-efficient and low-emission automobiles are also driving the use of advanced lubricants. Additionally, the expanding aftermarket sector supports continued growth in lubricant demand.

Middle East and Africa Automotive Lubricants Market Analysis

The market for automotive lubricants in the Middle East is witnessing significant growth, fueled by rising vehicle ownership, especially in nations such as Saudi Arabia. According to the National Statistical Office, the number of passenger cars per 1,000 people in Saudi Arabia rose by 1.59% to 156 vehicles in 2019, reflecting a growing demand for automotive products, including lubricants. Additionally, the region’s harsh climatic conditions drive the need for high-quality lubricants that offer better engine protection. The expanding vehicle fleet, combined with rising disposable incomes and increased awareness of the benefits of premium lubricants, further boosts market growth.

Competitive Landscape:

To remain competitive, market participants must invest significantly in research to produce high-performance, innovative lubricants. Advances in automotive technology, including the rise of hybrid and electric vehicles (EVs), are driving the need for specialized lubricants that meet unique performance requirements. Developing synthetic lubricants, low-viscosity oils, bio-based lubricants, and EV-specific fluids can help companies cater to emerging demand. For instance, in 2024, Savita Oil Technologies Ltd. announced the launch of Ester 5 brand of lubricants. Sustainability is becoming a major purchasing criterion for people and corporations. To align with global and regional environmental regulations, companies should expand their portfolio of eco-friendly lubricants. Developing bio-lubricants derived from renewable resources, reducing the carbon footprint of production processes, and ensuring the biodegradability of products can enhance a company's image and attract environmentally conscious customers. Expanding and optimizing distribution networks is crucial for increasing market reach. This is especially important in emerging economies, where the automotive market is growing rapidly.

The report provides a comprehensive analysis of the competitive landscape in the automotive lubricants market with detailed profiles of all major companies, including:

- Amsoil Inc.

- BP plc

- Chevron Corporation

- China National Petroleum Corporation

- Exxon Mobil Corporation

- Fuchs Group

- Petronas Lubricants International Sdn Bhd

- Phillips 66 Company

- Royal Dutch Shell plc

- SK Lubricants Co. Ltd.

- Total SE

- Valvoline Inc.

Latest News and Developments:

- November 2024: EnerG Lubricants collaborated with GAT GmbH to launch GAT X ENERG product range in India. The brand also launched ENERG G1 Xtreme PLUS 5W30 API SP - ACEA C3 Fully Synthetic Engine Oil, the first Indian-manufactured lubricant with global certifications from Mercedes-Benz.

- April 2024: Savsol Lubricants launched Savsol Ester 5, a biodegradable lubricant for high-end automotive and railway applications. Made from edible oil fatty acids, it is supplied to companies like Harley Davidson and Tata Motors. The lubricant may also be used in EV batteries and high-speed railway coaches for better mileage and reduced friction. Savsol aims to blend it with synthetic oils for broader affordability.

Automotive Lubricants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Engine Oil, Gear Oil, Transmission Fluids, Brake Fluids, Coolants, Greases, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amsoil Inc., BP plc, Chevron Corporation, China National Petroleum Corporation, Exxon Mobil Corporation, Fuchs Group, Petronas Lubricants International Sdn Bhd, Phillips 66 Company, Royal Dutch Shell plc, SK Lubricants Co. Ltd., Total SE, Valvoline Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive lubricants market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive lubricants market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive lubricants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive lubricants market was valued at USD 81.06 Billion in 2024.

The automotive lubricants market is projected to exhibit a CAGR of 3.30% during 2025-2033, reaching a value of USD 107.09 Billion by 2033.

The market is driven by rising automobile sales, growing awareness about regular vehicle maintenance, increasing adoption of synthetic lubricants, and stringent environmental regulations promoting eco-friendly and fuel-efficient products. Additionally, the growth of electric and hybrid vehicles and government initiatives to reduce carbon emissions are bolstering market growth.

Asia Pacific currently dominates the market, driven by rising automobile production, expanding road networks, and increasing adoption of synthetic lubricants to meet the performance demands of modern engines and environmental standards.

Some of the major players in the automotive lubricants market include Amsoil Inc., BP plc, Chevron Corporation, China National Petroleum Corporation, Exxon Mobil Corporation, Fuchs Group, Petronas Lubricants International Sdn Bhd, Phillips 66 Company, Royal Dutch Shell plc, SK Lubricants Co. Ltd., Total SE, Valvoline Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)