Automotive Logging Device Market Size, Share, Trends and Forecast by Component, Service Type, Form Factor, Vehicle Type, and Region, 2025-2033

Automotive Logging Device Market Size and Share:

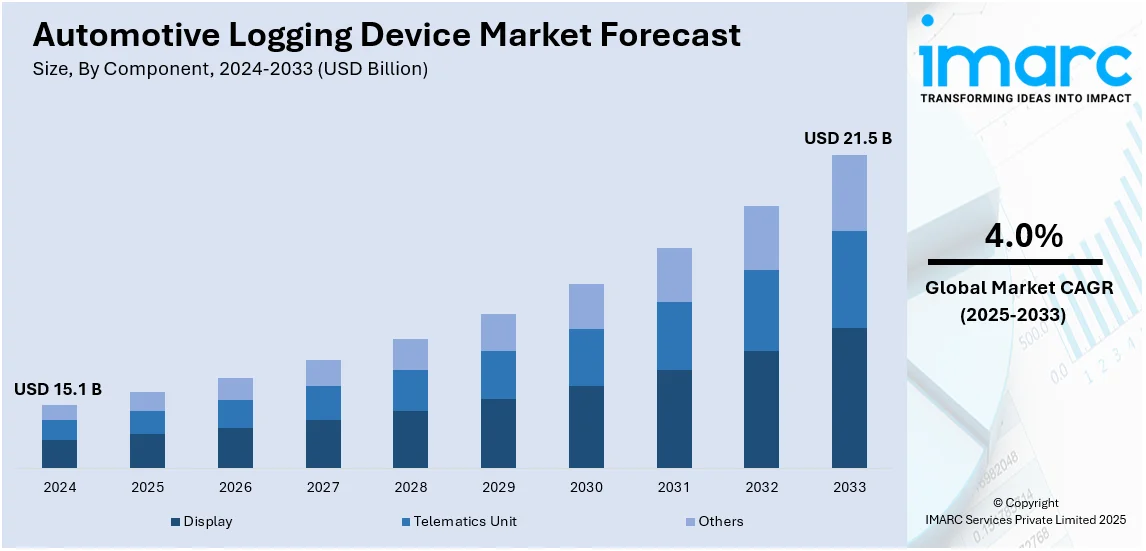

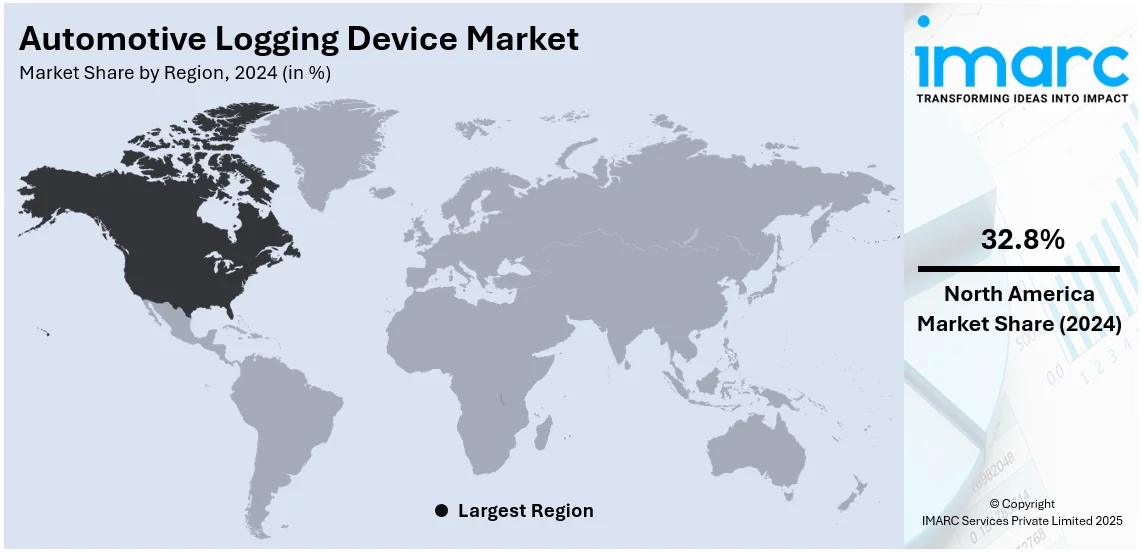

The global automotive logging device market size was valued at USD 15.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 21.5 Billion by 2033, exhibiting a CAGR of 4.0% from 2025-2033. North America currently dominates the market, owing to the significant growth in the automotive sector globally, widespread adoption of fleet management and telematics systems, heightened focus on fuel efficiency and cost savings, and the implementation of supportive government policies and initiatives are some of the factors boosting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 15.1 Billion |

|

Market Forecast in 2033

|

USD 21.5 Billion |

| Market Growth Rate (2025-2033) | 4.0% |

Significant growth in the automotive industry across the globe is creating a positive outlook for the market. According to International Energy Agency report, electric car sales are projected to hit 17 million in 2024, with a 25% year-on-year growth, driving demand for automotive logging devices to ensure efficient monitoring and compliance in an expanding market. Automotive logging devices are frequently employed in transportation vehicles to monitor the health of vehicle components and track drivers' working hours. Furthermore, different product advancements, such as the integration of automotive logging equipment with smartphone applications for identifying problems and collecting vehicle data, are promoting market expansion. In line with this, the utilization of the Internet of Things (IoT)-enabled sensors for real-time monitoring and remote tracking of engine health is positively impacting the automotive logging device market growth. For instance, the number of connected IoT devices is projected to grow by 13% by the end of 2024, driving advancements in automotive logging devices by enabling seamless real-time tracking and data integration for enhanced fleet efficiency.

United States stands as a major player in the automotive logging device market. The industry for fleet management systems, which includes automotive logging devices, is experiencing significant growth in the country driven largely by increasing regulatory pressure and demand for vehicle safety. For example, the Federal Motor Carrier Safety Administration (FMCSA) mandates the use of electronic logging devices (ELDs) for trucks to track hours of service (HOS) and driver performance. A 2023 survey by the American Trucking Associations revealed that more than 3.5 million truck drivers in the U.S. were using ELDs to comply with federal regulations. This growing demand for compliance solutions is driving the widespread adoption of automotive logging devices.

Automotive Logging Device Market Trends:

Growing Adoption of Telematics and Fleet Management Systems

Telematics and fleet management systems are gaining traction, with fleet operators seeking real-time tracking and operational efficiencies. According to the IMARC Group, the global commercial telematics market is expected to expand at a CAGR of 15.92% from 2025 to 2033. This growth is largely driven by the rising need for real-time vehicle tracking, performance monitoring, and the integration of advanced technologies like global positioning system (GPS) and the Internet of Things (IoT) in fleet management systems. The market is also being bolstered by the increasing adoption of connected vehicles, which further fuels the need for automotive logging devices.

Improved Fuel Efficiency and Cost Savings

Automotive logging devices are a key enabler of fuel efficiency improvements and operational cost savings. For example, an industry report found that fleet operators using telematics and logging devices have seen up to 15% reduction in fuel costs and 25% reduction in accidents, showing the effectiveness of such systems in enhancing fleet management operations. This improvement in fuel efficiency is due to the ability to monitor and reduce factors that cause fuel wastage, such as excessive idling and aggressive driving behaviors like rapid acceleration and hard braking. With these devices, fleets can also optimize routes to avoid traffic congestion, leading to more fuel-efficient journeys.

Government Incentives and Subsidies for Fleet Modernization

Government incentives and subsidies aimed at fleet modernization are also driving the automotive logging device market share. For example, the U.S. Department of Energy (DOE) launched a USD 18.6 million funding program in 2024 to encourage businesses to adopt cleaner, more efficient vehicle technologies. This funding includes grants for the installation of telematics and logging devices in commercial fleets. The program is expected to support the adoption of technologies that reduce carbon emissions and improve fleet management. Similarly, in the European Union, the Green Deal and Fit for 55 package incentivize companies to adopt cleaner fleet solutions and integrate technologies like automotive logging devices. These initiatives motivate the use of telematics and fleet management solutions into fleets, further boosting the automotive logging device market size.

Automotive Logging Device Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive logging device market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, service type, form factor, and vehicle type.

Analysis by Component:

- Display

- Telematics Unit

- Others

In the automotive logging device market, telematics unit represents the largest share due to their essential role in enabling real-time data collection, vehicle tracking, and remote diagnostics. Telematics units are equipped with advanced sensors and communication systems that allow for the transmission of critical vehicle data, including speed, fuel consumption, engine performance, and location. These devices are fundamental for fleet management, providing fleet operators with detailed insights to improve efficiency, reduce operational costs, and ensure safety compliance. The growing demand for connected vehicles, the rise of autonomous driving technologies, and the increasing focus on vehicle data analytics further fuel the market for telematics units.

Analysis by Service Type:

- Entry Level

- Intermediate

- High Level

In the automotive logging device market, the intermediate service type holds the largest market share due to its broad application and essential functionality. Intermediate services typically include data collection, transmission, and processing, but do not extend to advanced analytics or highly customized solutions. These services are particularly attractive to customers seeking a balance between cost and functionality. For instance, fleet operators benefit from intermediate-level services, which offer vehicle tracking, fuel consumption monitoring, and maintenance alerts without the need for complex integrations or high-end analytics platforms. The affordability and simplicity of intermediate services make them appealing to both small and medium-sized businesses as well as large commercial fleets.

Analysis by Form Factor:

- Integrated

- Embedded

Embedded automotive logging devices have secured the largest market share due to their seamless integration within a vehicle’s existing systems, offering significant advantages in terms of performance, reliability, and space efficiency. These devices are built directly into a vehicle's control systems, such as the engine control unit (ECU), making them an ideal solution for both original equipment manufacturers (OEMs) and aftermarket applications. The embedded form factor is particularly favored for its durability, as it reduces the need for external devices or connectors, which could be subject to wear and tear. Embedded devices also enable more accurate data collection and real-time monitoring due to their integration with the vehicle’s core systems.

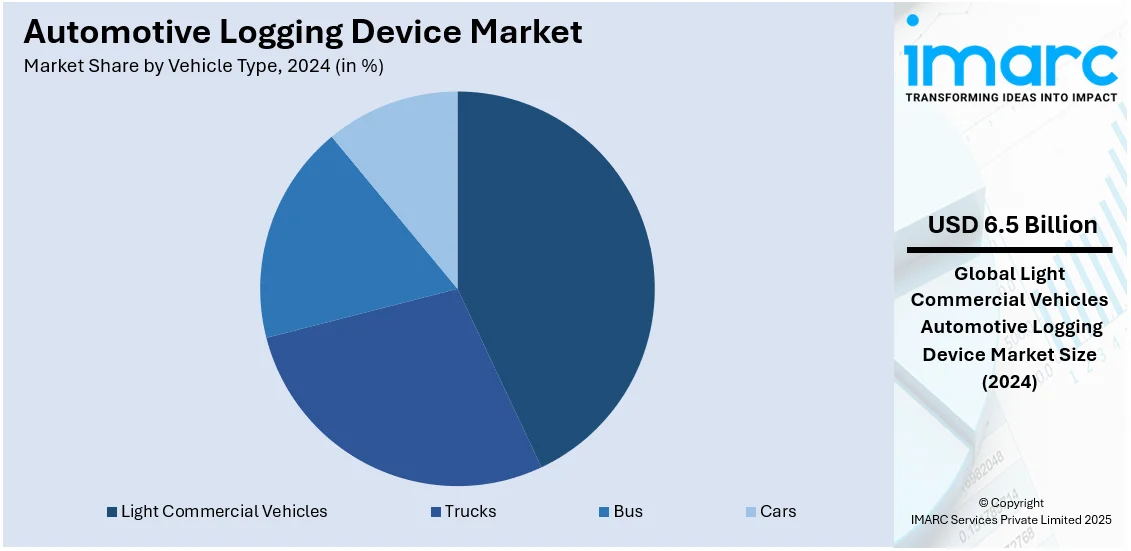

Analysis by Vehicle Type:

- Light Commercial Vehicles

- Trucks

- Bus

- Cars

Light commercial vehicles (LCVs) represent the largest market share in the automotive logging device market due to their widespread use in business operations, particularly in logistics, delivery services, and fleet management. LCVs, which include vans, small trucks, and utility vehicles, are integral to the transportation of goods and services across urban and rural areas. The increasing demand for efficient fleet management and vehicle tracking solutions in industries such as e-commerce, transportation, and logistics has propelled the adoption of automotive logging devices in LCVs. These vehicles are highly utilized, often operating on tight schedules and routes, making real-time data collection and monitoring crucial for optimizing routes, fuel efficiency, and maintenance schedules.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the automotive logging device market, driven by the robust adoption of telematics technology and government regulations that mandate the use of electronic logging devices (ELDs) for commercial vehicles. The implementation of the ELD mandate in the United States has been a major catalyst for market growth, compelling fleet operators to adopt logging devices for compliance purposes. In addition to regulatory requirements, North America’s strong automotive manufacturing base, the presence of leading telematics service providers, and the early adoption of connected vehicle technologies contribute to the region's market dominance. The growing trend of fleet management and the increasing need for data-driven decision-making in logistics and transportation also support the market's expansion in the region.

Key Regional Takeaways:

United States Automotive Logging Device Market Analysis

Urbanization is a transformative force propelling the adoption of automotive logging devices in metropolitan areas. These systems improve fleet management, fuel efficiency, and maintenance scheduling, addressing the unique demands of densely populated cities. According to reports, 83% of fleet operators now use telematics, underscoring its growing role in fleet management. The technology enhances compliance and efficiency, especially in automotive logging devices, by streamlining data tracking and operations. In urban environments, they enable ride-sharing services to track driver behaviour and optimize routes, mitigating traffic congestion. Delivery networks benefit from improved route planning, enhancing punctuality and reducing operational costs. The integration of GPS and real-time tracking supports emergency response units, ensuring faster service dispatch in crowded areas. Additionally, logging devices promote sustainable urban growth by minimizing carbon footprints through enhanced engine monitoring and fuel consumption analysis. With cities expanding rapidly, the demand for solutions that streamline urban mobility continues to rise.

Europe Automotive Logging Device Market Analysis

The increasing use of electric vehicles, including buses, has significantly impacted the adoption of automotive logging devices. According to International Energy Agency, electric vehicle registrations in Europe surged to 3.2 Million in 2023, up 20% from 2022, with 2.4 Million in the EU, boosting demand for automotive logging devices to enhance efficiency and data tracking. These devices provide benefits such as real-time energy consumption tracking and optimized battery management, critical for the efficient operation of electric fleets. Furthermore, the integration of logging devices with smart energy solutions ensures seamless scheduling of charging cycles and route optimization. The region’s focus on sustainable transport infrastructure and emission reduction supports the broader adoption of such technologies. Automotive logging devices also enable better monitoring of performance metrics, aiding public transportation systems in enhancing reliability. Their advanced data analytics capabilities contribute to achieving sustainability goals, making them indispensable for the growing network of electric vehicles.

Asia Pacific Automotive Logging Device Market Analysis

Growing interest in connected solutions is bolstering the uptake of automotive logging devices in this region. By incorporating IoT and GPS capabilities, these tools provide precise location tracking, seamless communication, and predictive maintenance features. The burgeoning vehicle sector has driven the necessity for advanced systems that enhance both passenger safety and operational efficiency. For instance, Indian passenger vehicle sales rose by 4.4% year-over-year in November 2024, highlighting growth opportunities for automotive logging devices. This surge supports the increasing need for efficient fleet management and compliance solutions in the sector. Businesses utilize these devices to ensure delivery accuracy and maintain regulatory compliance. Consumers benefit from user-friendly interfaces that improve vehicle diagnostics and security. Public-private initiatives to modernize logistics and public transit further elevate the importance of these devices, while their ability to minimize environmental impact through optimized fuel usage underscores their sustainable edge.

Latin America Automotive Logging Device Market Analysis

The increasing disposable income among individuals contributes to the rising adoption of automotive logging devices. For instance, disposable income in Latin America is projected to grow by nearly 60% from 2021 to 2040, driven by economic shifts and technological progress, fostering increased adoption of automotive logging devices as affordability rises. With enhanced affordability, more businesses and private vehicle owners invest in these devices to gain benefits like improved safety, operational efficiency, and cost savings. The devices’ ability to provide precise vehicle diagnostics and predictive maintenance helps reduce operational disruptions, aligning with the financial priorities of users. Additionally, their integration with mobile applications makes them accessible and user-friendly, further encouraging their uptake.

Middle East and Africa Automotive Logging Device Market Analysis

The rise in transportation and real estate developments contributes to the growing need for automotive logging devices. According to Dubai’s RTA report, there is 13% rise in public transport ridership, reaching 702 Million in 2023 from 621.4 Million in 2022, averaging 1.92 Million daily users, driving the growing adoption of automotive logging devices for efficient transport management. These devices support advantages such as route optimization, enhanced asset tracking, and efficient fleet management, critical in large-scale logistics and construction operations. The integration of these devices with advanced mapping systems ensures timely deliveries and better coordination among stakeholders. Their ability to streamline operations and enhance productivity makes them an asset in the dynamic infrastructure landscape of the region.

Competitive Landscape:

Leading players are focusing on advancing technology and expanding their product offerings to meet the growing demand for real-time vehicle data tracking and analysis. Many are investing in the integration of advanced features like GPS tracking, telematics, driver behavior monitoring, and vehicle diagnostics, enabling fleet managers and individual users to enhance operational efficiency, reduce costs, and improve safety. The market is seeing a trend toward cloud-based platforms, where collected data can be securely stored and easily accessed for analysis, reporting, and decision-making. Furthermore, the development of user-friendly interfaces and mobile apps is becoming a key priority, allowing customers to access vehicle data seamlessly. There is also a growing emphasis on providing value-added services, such as predictive maintenance, accident detection, and fleet optimization solutions.

The report provides a comprehensive analysis of the competitive landscape in the automotive logging device market with detailed profiles of all major companies, including:

- AT&T Business

- Coretex USA Inc

- ELD Solutions, Inc

- Garmin Ltd

- Geotab Inc.

- Motive Technologies, Inc.

- Orbcomm

- Teletrac Navman US Ltd

- Zonar Systems, Inc.

Latest News and Developments:

- December 2024: MIT-WPU researchers have unveiled a 5G-enabled real-time vehicle data tracking system. The innovation supports fleet operators, insurers, manufacturers, and logistics with features like geo-fencing and emergency alerts. This system aids smart city planning by enhancing monitoring and safety. Developed in Pune, it promises significant benefits across industries.

- December 2024: San Jose-based KIOXIA America, Inc. has declared that its Universal Flash Storage (UFS) Ver. 4.0 devices for automotive applications have earned Automotive SPICE® (ASPICE) Level 2 certification. This recognition highlights KIOXIA's excellence in structured software development and project management, meeting stringent automotive industry standards. The achievement reinforces KIOXIA's leadership in automotive-grade embedded memory solutions.

- December 2024: SureCam and Blackout Technologies have launched a video telematics solution integrating a fleet dashcam with mobile device blocking. The system prevents illegal smartphone use, tackling distractions like messaging and social media while driving. This collaboration aims to enhance road safety by promoting driver focus and responsible habits. The app connects seamlessly to SureCam’s dashcam without requiring extra hardware.

- November 2024: The GEODNET Foundation has unveiled GEO-PULSE, an innovative automotive GPS device offering sub-decimeter positioning accuracy. Powered by GEODNET’s vast RTK network, it tackles navigation challenges like obstructions and interference. Priced at USD 129, it includes a year of enhanced accuracy service, revolutionizing GPS reliability for 1.4 Billion drivers worldwide.

- November 2024: Jimi IoT has unveiled the VL110C, an advanced LTE vehicle terminal with GNSS/LTE jamming detection, enhancing fleet security and reliability. The device marks a breakthrough in vehicle telematics, catering to diverse industry needs. This innovation reinforces Jimi IoT's commitment to cutting-edge solutions. The VL110C sets new standards in fleet management technology.

Automotive Logging Device Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Display, Telematics Unit, Others |

| Service Types Covered | Entry Level, Intermediate, High Level |

| Form Factors Covered | Integrated, Embedded |

| Vehicle Types Covered | Light Commercial Vehicles, Trucks, Bus, Cars |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AT&T Business, Coretex USA Inc, ELD Solutions, Inc, Garmin Ltd, Geotab Inc., Motive Technologies, Inc., Orbcomm, Teletrac Navman US Ltd, Zonar Systems, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive logging device market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive logging device market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive logging device industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

An automotive logging device is a type of technology used in vehicles to record and monitor various aspects of vehicle performance, driver behavior, and environmental factors. These devices collect data related to the operation of the vehicle, such as speed, location, fuel consumption, engine performance, and maintenance needs. The data is often transmitted in real time to a central system for analysis, reporting, and decision-making.

The automotive logging device market was valued at USD 15.1 Billion in 2024.

IMARC estimates the global automotive logging device market to exhibit a CAGR of 4.0% during 2025-2033.

Significant growth in the automotive sector globally, widespread adoption of fleet management and telematics systems, heightened focus on fuel efficiency and cost savings, and the implementation of supportive government policies and initiatives are some of the factors boosting the market growth.

In 2024, telematics unit represented the largest segment by component, driven by due to their essential role in enabling real-time data collection, vehicle tracking, and remote diagnostics.

Immediate leads the market by service type owing to due to its broad application and essential functionality.

The embedded is the leading segment by form factor due to their seamless integration within a vehicle’s existing systems, offering significant advantages in terms of performance, reliability, and space efficiency.

The light commercial vehicle is the leading segment by vehicle type due to their widespread use in business operations, particularly in logistics, delivery services, and fleet management.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global automotive logging device market include AT&T Business, Coretex USA Inc, ELD Solutions, Inc, Garmin Ltd, Geotab Inc., Motive Technologies, Inc., Orbcomm, Teletrac Navman US Ltd, Zonar Systems, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)