Automotive IC Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Automotive IC Market Size and Share:

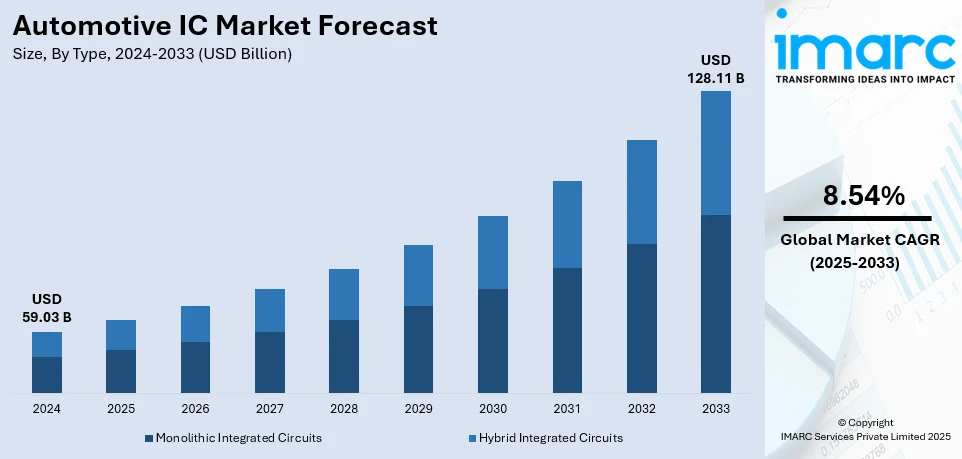

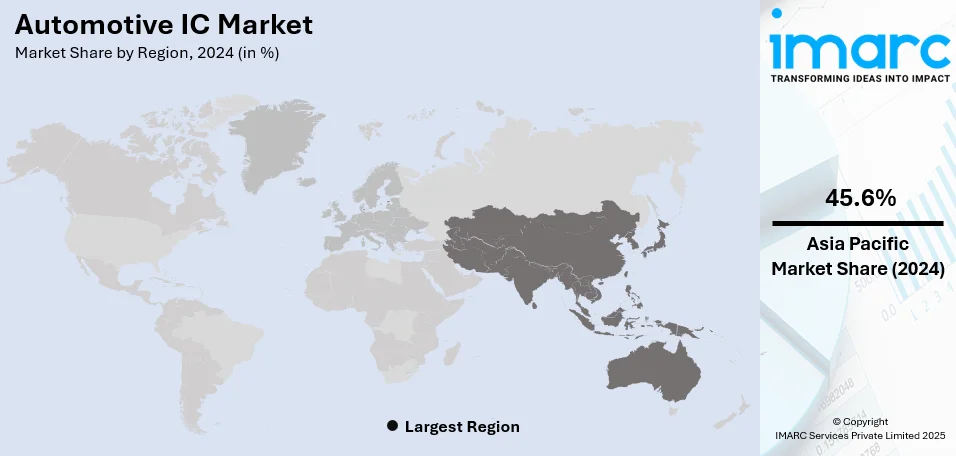

The global automotive IC market size was valued at USD 59.03 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 128.11 Billion by 2033, exhibiting a CAGR of 8.54% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 45.6% in 2024. The automotive IC market share of Asia Pacific region is increasing due to strong automotive manufacturing, rising electric vehicle (EV) adoption, technological advancements, and government regulations promoting safety and emissions standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 59.03 Billion |

|

Market Forecast in 2033

|

USD 128.11 Billion |

| Market Growth Rate (2025-2033) | 8.54% |

With a focus on improving fuel efficiency and reducing carbon footprints, automakers are turning to automotive integrated circuits (ICs) to enhance engine management, power distribution, and regenerative braking systems in both traditional and EVs. Furthermore, governing bodies worldwide are implementing tighter emission standards, encouraging automakers to adopt more advanced engine control systems that rely on automotive ICs to optimize fuel injection, exhaust gas recirculation, and other engine functions for reduced emissions. Apart from this, the increasing use of sensors like light detection and ranging (LiDAR), cameras, and radar, which are integral to modern automotive systems for safety, performance, and navigation, is bolstering the market growth. Automotive ICs are required to integrate, process, and manage the data from these sensors, enhancing vehicle capabilities.

The United States is a crucial segment in the market, owing to a well-established automotive manufacturing sector, with major automakers investing in advanced technologies. This is driving the demand for automotive ICs in various vehicle systems. Moreover, the growing popularity of EVs in the US is catalyzing the demand for ICs, particularly for power management, battery monitoring, and motor control systems. For example, it has been reported that in 2025, Honda intends to launch an affordable EV under $30,000 in North America by 2026 as part of its strategy to broaden its foothold in the EV market. The automobile will be included in the "Honda 0 Series" collection, which features the Honda 0 SUV and Honda 0 Saloon. Production will commence at Honda's Ohio plant, with the SUV debuting in the first half of 2026.

Automotive IC Market Trends:

Rising Urbanization and Demand for Advanced Automotive ICs

The increasing demand for hybrid, autonomous, and electric vehicles on account of rapid urbanization and inflating disposable incomes currently represent one of the major factors driving the need for more enhanced automotive ICs around the world. According to UN, 68% of the world population projected to live in urban areas by 2050, intensifying the need for sustainable, efficient, and advanced transportation solutions. Urban environments demand smart mobility solutions, which include electric and autonomous vehicles capable of reducing traffic congestion, improving energy efficiency, and minimizing environmental impact. Consequently, automotive manufacturers are integrating more sophisticated ICs to support these advancements, ranging from energy management and communication systems to autonomous driving technologies. The automotive IC market is also experiencing significant growth since innovations are necessary to meet the evolving needs of the automotive industry in an increasingly urbanized and tech-savvy world.

Growing Safety Concerns

The rising focus on driver and passenger safety is supporting the market growth, particularly with the integration of advanced driver assistance systems (ADAS) in vehicles. Features like lane departure warnings, adaptive cruise control, and collision avoidance systems are becoming essential components of modern vehicles, catalyzing the demand for more sophisticated automotive ICs. The World Health Organization reports that approximately 1.19 million people lose their lives each year due to road traffic crashes, highlighting the urgent need for enhanced safety measures. In response, automotive manufacturers are prioritizing the development of technologies that help prevent accidents and mitigate risks. Additionally, the increasing utilization of data analytics in the automotive industry is driving the demand for automotive ICs, as they are vital for processing vast amounts of data from sensors and cameras in real time. These combined factors are fueling the growth of the automotive IC market, with a focus on improving safety and driving technological innovation.

Technological Advancements in Power Management ICs

Ongoing developments in power management integrated circuits (PMICs) are crucial to the expansion of the market. With the growing complexity of automotive systems, there is a significant need for strong and dependable power management solutions that can cater to a variety of applications, such as chassis, powertrain, and transmission systems. These integrated circuits are essential for achieving optimal power distribution and efficient energy usage, while also ensuring elevated levels of functional safety. The automotive sector's movement towards enhanced safety standards is additionally driving the need for sophisticated PMICs that can endure extreme conditions, such as elevated temperatures. This trend toward more dependable and efficient power management solutions is driving the creation of automotive ICs, as manufacturers aim to fulfill both performance and safety standards for advanced and high-demand automotive applications. In 2025, Infineon enhanced its OPTIREG Power Management IC (PMIC) lineup by introducing the TLF35585, tailored for challenging automotive uses. This IC provides multi-rail power supply solutions for systems that demand high functional safety, including chassis, powertrain, and transmission.

Automotive IC Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive IC market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Monolithic Integrated Circuits

- Hybrid Integrated Circuits

- Analog IC

- Digital IC

- Mixed IC

Hybrid integrated circuits (analog IC, digital IC, and mixed IC) represented the largest segment. Hybrid integrated circuits hold the biggest market share due to their ability to combine multiple functions into a single compact unit. These ICs are crucial to contemporary automotive systems, facilitating vital tasks like power management, signal processing, and data conversion. Analog ICs serve a vital function in managing sensors and actuators in sectors like engine control, whereas digital ICs manage data processing for functionalities like infotainment and connectivity. Mixed ICs, which combine analog and digital elements, are crucial for enhancing the performance and efficiency of sophisticated driver assistance systems (ADAS) and entertainment systems. The increasing intricacy of automotive electronics, along with the need for multifunctional, compact solutions, further propels the widespread adoption of hybrid ICs in vehicles, providing improved performance and a lower number of components.

Analysis by Application:

- Advanced Driver Assistance System (ADAS)

- In-Vehicle Networking

- Engine Management

- Transmission Control System

- Others

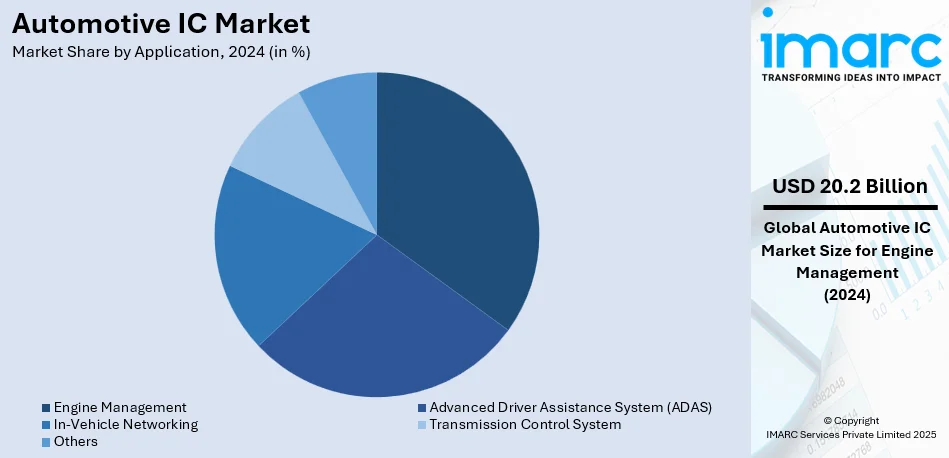

Engine management stand as the largest component in 2024, holding 34.3% of the market. Engine management constitutes the largest segment, propelled by the growing intricacy of contemporary vehicle engines and the demand for improved fuel efficiency and performance. Automotive integrated circuits in engine management systems are essential for enhancing fuel injection, exhaust gas recirculation, air-fuel ratio, and ignition timing. These systems are crucial for complying with strict emission regulations while enhancing engine performance and efficiency. As car manufacturers concentrate on enhancing vehicle performance and complying with international environmental standards, the need for sophisticated engine control units (ECUs) fitted with high-performance integrated circuits (ICs) is steadily increasing. Moreover, the transition to electric vehicles (EVs) and hybrid powertrains intensifies the demand for advanced engine management systems, which assist in regulating energy usage and improving the overall driving experience.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the Asia-Pacific region represented the highest market share, accounting 45.6%. The Asia Pacific region leads the market because of its robust automotive manufacturing sector, especially in nations such as Japan, China, and South Korea. These nations host prominent automakers and suppliers, fueling the need for innovative automotive technologies. The increasing uptake of EVs and the transition to autonomous driving further drive the demand for advanced automotive ICs. Government regulations encouraging safety and emissions criteria are likewise affecting the demand for IC solutions. Moreover, the growing inclusion of connectivity functions in cars, like infotainment systems and telematics, heightens the demand for sophisticated semiconductor elements. Furthermore, the area is experiencing significant investments in research and development as well as manufacturing capacities to aid the advancing automotive ecosystem. In 2024, Toshiba started sample deliveries of its TB9103FTG gate driver integrated circuit intended for automotive brushed DC motors, meant for uses such as power back doors and power windows. This IC supports compact design with a built-in charge pump, offering streamlined functions for systems not requiring speed control. It helps reduce equipment size and contributes to quieter and more reliable operation.

Key Regional Takeaways:

United States Automotive IC Market Analysis

In North America, the market share for the United States was 88.20% of the total. The growing adoption of automotive ICs in the United States is strongly driven by the continuous investment in the automotive manufacturing sector. For instance, since the start of 2021, auto manufacturers have announced investments of more than USD 75 Billion in the U.S. As the automotive industry progresses towards more technologically advanced vehicles, there is an increasing demand for integrated circuits to support the evolving requirements of electric vehicles, autonomous systems, and connectivity. The industry's efforts to incorporate advanced safety features, infotainment systems, and automated driving technologies are fuelling the demand for automotive ICs. Investment in the manufacturing sector contributes to innovations in semiconductor technology, driving automotive IC development for increased performance and reliability. Moreover, the focus on reducing vehicle weight for improved fuel efficiency and reducing CO2 emissions further intensifies the need for automotive ICs that optimize energy management, powertrains, and electronic systems. The regulatory push for greener technologies and smarter vehicles, combined with growing user demand for high-tech vehicles, is bolstering the adoption of automotive ICs in the region. As automotive manufacturers aim to stay competitive and meet global standards, the reliance on ICs to drive functionality, safety, and connectivity is accelerating.

Europe Automotive IC Market Analysis

In Europe, the rise in vehicle ownership and the demand for high-tech vehicles are significant factors contributing to the greater uptake of automotive ICs. As reported by the International Council on Clean Transportation, roughly 10.6 million new vehicles were registered in the 27 Member States in 2023, which is a 14% increase compared to 2022. The automotive industry in the region has progressed notably in incorporating advanced electronics, largely fueled by the rising demand for electric vehicles (EVs), self-driving technologies, and vehicle connectivity. The increase in vehicle ownership, combined with rising worries over safety, ecological sustainability, and fuel efficiency, has driven the need for integrated circuits (ICs) that facilitate electric powertrains, vehicle-to-vehicle (V2V) communication, and self-driving navigation systems. The emphasis on lowering emissions via more stringent regulations is encouraging the utilization of ICs for enhancing engine management, energy recovery systems, and hybrid powertrains. Moreover, the demand for elevated safety standards, particularly advanced driver assistance systems (ADAS), is driving the requirement for automotive ICs that support functions such as collision avoidance, lane-keeping assistance, and adaptive cruise control.

Asia Pacific Automotive IC Market Analysis

The adoption of automotive ICs in the Asia-Pacific region is rapidly expanding, driven by the substantial investments in the automotive sector. According to India Brand Equity Foundation, the automobile sector received a cumulative equity FDI inflow of about USD 35.65 Billion between April 2000 - December 2023. The growing focus on producing smarter and safer vehicles in this region is prompting automakers to integrate more advanced electronics into their products. The rise of electric vehicles (EVs) and hybrid models necessitates sophisticated automotive ICs to manage energy flows, motor control, and battery management systems. The automotive industry in Asia-Pacific is also increasingly focused on incorporating enhanced infotainment and connectivity solutions, which further require the use of high-performance ICs. Rising investments in R&D and manufacturing capabilities across automotive hubs in the region are fostering innovation in the IC sector. Furthermore, increased government incentives and infrastructure development support the shift toward electric and autonomous vehicles, which drive the demand for more complex automotive ICs.

Latin America Automotive IC Market Analysis

The increasing use of automotive ICs in Latin America is propelled by swift urban development and rising disposable incomes. Reports indicate that Latin America's overall disposable income is projected to increase by almost 60% between 2021 and 2040. With the growth of urban regions, the need for more economical, fuel-efficient, and advanced technology vehicles rises, driving the automotive industry towards adopting more cohesive solutions. The increasing spending power of individuals is motivating car manufacturers to incorporate more sophisticated features in vehicles, such as improved safety systems, infotainment, and energy-efficient technologies. This increase in demand for advanced vehicles is enhancing the dependence on automotive ICs to enable features like electric powertrains, connectivity, and driver assistance systems. Moreover, as urbanization increases the demand for advanced infrastructure and vehicle connectivity, the use of automotive ICs that facilitate intelligent transportation systems is growing more common.

Middle East and Africa Automotive IC Market Analysis

The increasing emphasis on the safety of drivers and passengers in the Middle East and Africa is a crucial factor propelling the use of automotive ICs. This is primarily due to the rising number of deadly road accidents in the area, leading both individuals and governments to emphasize vehicle safety features. For example, the total number of reported car accidents in the UAE was around 3,945 during the year 2022. Consequently, car manufacturers are integrating more sophisticated safety technologies like collision avoidance systems, airbags, and improved braking systems, all of which depend on automotive ICs for optimal performance. Besides boosting safety, these ICs are essential for creating vehicles that offer better handling, stability, and driver assistance capabilities. With the advancement of vehicle safety regulations and rising individual awareness regarding safety, the necessity for automotive integrated circuits in the Middle East and Africa is anticipated to keep rising, leading to a more secure driving atmosphere.

Competitive Landscape:

Major market players are concentrating on improving their product offerings by making significant investments in research and development. They are proactively enhancing their abilities to meet the increasing demand for electric vehicles, self-driving technology, and advanced safety features. Partnering with car manufacturers and tech companies is essential to incorporate advanced solutions like sensors, power management, and connectivity systems into future vehicles. Firms are also focusing on creating more energy-efficient and dependable components to comply with strict industry standards. Moreover, the shift towards system-on-chip (SoC) technologies is growing, facilitating higher integration and performance while minimizing component dimensions. Athletes are likewise enhancing production methods and investigating creative supply chain solutions to satisfy the increasing worldwide demand. In 2023, the Singapore-based start-up SiNBLE introduced a service for implementing integrated circuit (IC) design. The service specializes in FinFET nodes, aiding fabless IC design firms, system integrators, and ASIC vendors in reaching quick time-to-market and optimal resource management. The team at SiNBLE focuses on research and development for cutting-edge process technologies ranging from 3nm to 8nm, aiding applications in mobile devices, high-performance computing, and automotive sectors.

The report provides a comprehensive analysis of the competitive landscape in the automotive IC market with detailed profiles of all major companies, including:

- Infineon Technologies AG

- NXP Semiconductors N.V

- Qualcomm Incorporated

- Robert Bosch GmbH (Robert Bosch Stiftung GmbH)

- Rohm Co. Ltd.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

Latest News and Developments:

- November 2024: indie Semiconductor has launched a system basis safety IC for vehicle powertrains, developed with a leading European Tier 1 automotive system integrator. Certified by SGS-TÜV Saar to ASIL-D, the highest functional safety rating, it provides essential safety monitoring for powertrain operations. The IC features advanced failure detection and integrity measures to ensure reliable performance.

- November 2024: Cyient enhanced its collaboration with Allegro MicroSystems by launching a Center of Excellence (CoE) in Hyderabad, India, aimed at creating next-generation magnetic sensors and power semiconductor products for the automotive industry. The CoE will prioritize developing IC technologies for electric vehicles, ADAS, and various automotive applications, supported by a team of more than 100 expert engineers. This partnership seeks to expedite the creation of cutting-edge sensor and power IC products, targeting important trends in the automotive sector.

- November 2024: ABLIC has introduced the S-19193 Series of automotive battery monitoring protection ICs, designed for EVs and e-Bikes. These ICs meet ISO26262 functional safety standards, offering fail-safe, fail-operational, and fail-degraded protection. This new solution ensures continuous monitoring, enhancing safety in automated driving systems.

- October 2024: Infineon Technologies introduces new fingerprint sensor ICs, the CYFP10020A00 and CYFP10020S00, designed for automotive applications. These sensors offer accurate, cost-effective biometric authentication for in-vehicle personalization and services like payment and parking. Infineon partners with Precise Biometrics to enhance the identification capabilities with advanced software.

- February 2024: BYD will launch its advanced ADAS tech, City Pilot, by March, starting with the Denza N7 SUV. The system allows hands-free driving in specific situations, with safety checks every 15 seconds. BYD plans to invest USD 14 Billion in smart driving tech and will standardize it on higher-priced models.

- January 2024: Texas Instruments (TI) introduced new automotive semiconductors at CES 2024, including the AWR2544 radar sensor chip for satellite architectures, improving vehicle sensing ranges and ADAS decision-making. The DRV3946-Q1 and DRV3901-Q1 driver chips support safe battery management and powertrain systems, with built-in diagnostics and functional safety. These innovations aim to enhance vehicle safety, autonomy, and efficiency.

Automotive IC Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Applications Covered | Advanced Driver Assistance System (ADAS), In-Vehicle Networking, Engine Management, Transmission Control System, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Infineon Technologies AG, NXP Semiconductors N.V, Qualcomm Incorporated, Robert Bosch GmbH (Robert Bosch Stiftung GmbH), Rohm Co. Ltd., STMicroelectronics N.V., Texas Instruments Incorporated, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive IC market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive IC market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive IC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive IC market was valued at USD 59.03 Billion in 2024.

IMARC estimates the automotive IC market to exhibit a CAGR of 8.54% during 2025-2033, reaching a value of USD 128.11 Billion by 2033.

The market is growing because of advancements in vehicle electrification, increasing adoption of autonomous driving technologies, and demand for enhanced safety features like ADAS. Additionally, the rising focus on energy efficiency, vehicle connectivity, and regulatory mandates for emission reductions contribute significantly to the growth of this sector.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market because of the presence of numerous automotive manufacturers in the region.

Some of the major players in the automotive IC market include Infineon Technologies AG, NXP Semiconductors N.V, Qualcomm Incorporated, Robert Bosch GmbH (Robert Bosch Stiftung GmbH), Rohm Co. Ltd., STMicroelectronics N.V., Texas Instruments Incorporated, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)