Automotive Hypervisor Market Size, Share, Trends and Forecast by Type, Level of Automation, Vehicle Type, Vehicle Class, and Region, 2025-2033

Automotive Hypervisor Market Size and Share:

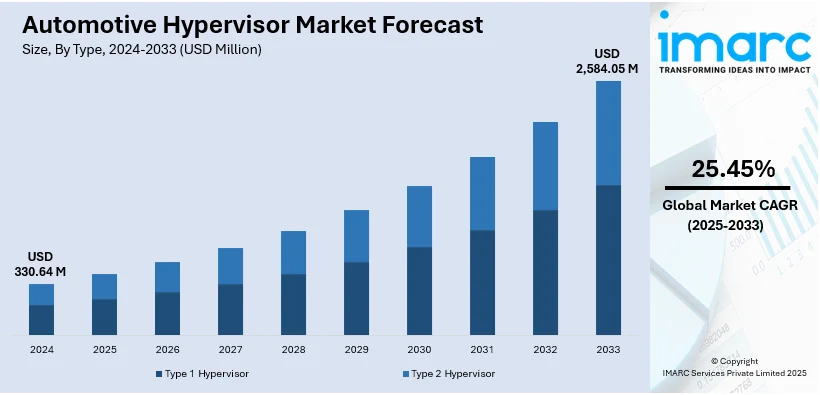

The global automotive hypervisor market size was valued at USD 330.64 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,584.05 Million by 2033, exhibiting a CAGR of 25.45% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 39.8% in 2024. The growing demand for over-the-air (OTA) updates to enhance vehicle performance and address security vulnerabilities, rising advancements in automotive systems and infotainment systems, and increasing focus on enhanced safety and security in vehicles are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 330.64 Million |

| Market Forecast in 2033 | USD 2,584.05 Million |

| Market Growth Rate (2025-2033) | 25.45% |

Presently, the rising adoption of automotive hypervisors, as they reduce the risk of software conflicts, improve fault tolerance, and facilitate software updates and maintenance, is strengthening the growth of the market. In line with this, the increasing focus on the development of more complex and capable vehicles while maintaining a high level of safety is propelling the market growth. Moreover, the escalating demand for advanced infotainment, connectivity, and automation features in vehicles among individuals is offering a favorable automotive hypervisor market outlook. In addition, the rising focus on maintaining sustainability and reducing the environmental impact of vehicles is bolstering the market growth. Besides this, the increasing focus on optimizing hardware resource utilization is contributing to the market growth. Additionally, the rising adoption of electric and autonomous vehicles among the masses around the world is providing lucrative growth opportunities to industry investors. Furthermore, stringent regulations about automotive safety are impelling the market growth.

The United States plays a critical role in the global automotive hypervisor industry, mainly propelled by its enhanced automotive manufacturing abilities and a robust focus on advancements. The magnifying incorporation of advanced driver-assistance systems (ADAS) and the gravitation towards autonomous as well as electric vehicles are prompting the requirement for hypervisor technology. For instance, according to the U.S. Energy Information Administration, the battery EVs market share elevated to 8.9% in Q3 2024, from 7.4% in Q2 2024. In addition to this, U.S. automakers are actively opting for such services to facilitate the simultaneous operation of several applications, improve vehicle safety, and upgrade resource management. Besides this, heavy investments in research and development projects, coupled with an emphasis on cybersecurity, further boost the utilization of hypervisors, establishing the U.S. as a crucial nation in automotive technology innovations.

Automotive Hypervisor Market Trends:

Growing Demand for Over-the-Air (OTA) Updates

In October 2020, Tesla made available its FSD Beta software to select Tesla owners. FSD Beta relies on a combination of AI, cameras, and sensors to provide semi-autonomous driving abilities. It has sparked much excitement and skepticism, as early testers report remarkable results in some cases, but others are encountering problems. The rising demand for over-the-air (OTA) updates to enhance vehicle performance, address security vulnerabilities, and add new features is contributing to the growth of the market. As per an industry analysis, the market for OTA updates in the automotive sector was approximately USD 2.83 billion in 2021. In line with this, automotive hypervisors facilitate OTA updates by compartmentalizing software components. Updates can be deployed to non-critical systems without affecting safety-critical functions. This not only ensures smoother updates but also minimizes the risk of software-related issues or security breaches during the update process, which is bolstering the market growth. Moreover, the increasing focus on keeping vehicles up to date with the latest software advancements among individuals is propelling the automotive hypervisor market growth.

Rising Complexities in Automotive Systems

The growing complexities in automotive systems due to the rising integration of advanced software into vehicles are offering a positive market outlook. In addition, people are increasingly preferring vehicles with features, such as advanced driver-assistance systems (ADAS), infotainment systems, and autonomous driving capabilities. According to the IEA, in 2023, SUVs had already represented 48% of global car sales, with the record reached further solidifying the robust automobile trend of the early 21st century. As a result, there is an increase in the need for efficient software management solutions. Besides this, automotive hypervisors play a vital role in providing a structured approach for handling diverse software functions on a single hardware platform. This capability streamlines software integration, reduces development time, and enhances overall vehicle functionality. Furthermore, automotive hypervisors market demand is also strengthened by their ability to allow for the simultaneous operation of these features, ensuring they function smoothly without compromising safety or performance.

Increasing Focus on Enhanced Safety and Security

In 2022, 85.4 million motor vehicles were manufactured globally, an elevation of 5.7% compared to 2021, according to ACEA. The growing focus on enhanced safety and security on account of the rising number of interconnected vehicles is offering a positive market outlook. Apart from this, governing agencies of various countries are implementing stringent safety and security regulations due to the increasing number of cyberattacks, which is propelling the growth of the market. Moreover, automotive hypervisors play a critical role in addressing these concerns by isolating safety-critical software functions from non-critical ones. In line with this, they create distinct partitions for safety-critical components and prevent interference from non-critical software. Furthermore, automotive hypervisors enhance overall vehicle safety and cybersecurity resilience, align with regulatory mandates, and improve trust among individuals, which is impelling the automotive hypervisors market share.

Shift Towards Advanced Integrated Technologies

The market is being driven by the automotive industry’s growing focus on advanced, integrated technologies and software solutions to enhance vehicle safety, comfort, and functionality. As user expectations evolve, automakers are incorporating complex electronic control units (ECUs) and software-defined systems to deliver seamless and efficient vehicle operations. Hypervisors play a crucial role in this transformation by enabling multiple operating systems to run simultaneously on a single hardware platform, optimizing resource utilization while maintaining system reliability. This shift is further fueled by the rapid advancements in advanced driver-assistance systems (ADAS), connected car technologies, and autonomous driving features, all of which require robust virtualization solutions to manage diverse software components effectively. Additionally, hypervisors enhance cybersecurity by isolating safety-critical functions from non-essential systems, addressing growing concerns about digital threats. These factors, combined with continuous innovation, are positioning hypervisors as indispensable tools in modern automotive architectures. In 2024, BlackBerry QNX showcased its innovations at CES 2024, highlighting the QNX SDP 8.0 platform and QNX Hypervisor for secure, high-performance automotive systems. These tools support software-defined vehicles (SDVs), enabling faster development and advanced in-vehicle experiences. Additionally, BlackBerry IVY facilitates faster third-party app integration, enhancing developer experiences in the automotive space.

Automotive Hypervisor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive hypervisors market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, level of automation, vehicle type, and vehicle class.

Analysis by Type:

- Type 1 Hypervisor

- Type 2 Hypervisor

Type 1 hypervisor leads the market with around 57.8% of market share in 2024. It represented the largest segment as it runs directly on the hardware of the vehicle without the need for an underlying operating system. Moreover, type 1 hypervisor offers high levels of performance, security, and reliability, making it a preferred choice for safety-critical and mission-critical applications in the automotive industry. It is well-suited for managing real-time systems, advanced driver-assistance systems (ADAS), and other critical functions. Moreover, it provides enhanced isolation between different software components, ensuring that safety-critical systems are shielded from non-critical functions. As the automotive industry is currently focusing on both efficacy and safety, the utilization of Type 1 hypervisors is anticipated to boost, fostering the development of more dependable and sophisticated vehicle systems. Besides this, this trend highlights the importance of virtualization technology in catering to the requirements of modern automotive applications. Therefore, the automotive hypervisor market forecast indicates robust growth, driven by the increasing adoption of Type 1 hypervisors for their efficiency, security, and critical role in advancing next-generation automotive systems.

Analysis by Level of Automation:

- Semi-Autonomous

- Fully Autonomous

Semi-autonomous lead the market with around 88.2% of market share in 2024. This can be attributed to the fact that these vehicles are equipped with advanced driver-assistance systems (ADAS), which provide features like adaptive cruise control, lane-keeping assistance, and automated parking. These vehicles typically require hypervisors to manage the software for these ADAS functions efficiently. Hypervisors play a crucial role in ensuring the seamless operation and integration of various ADAS components, enhancing safety and driver assistance. Besides this, the growing demand for enhanced safety features in vehicles is positively influencing the market. As manufacturers continue to enhance as well as innovate ADAS attributes, the dependency on hypervisors will bolster, further strengthening their critical role in the development of semi-autonomous technologies. This trend reflects the crucial aspect of virtualization in enhancing automotive functionality as well as safety.

Analysis by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Passenger cars lead the market with around xx% of market share in 2024, driven by the increasing integration of advanced technologies in everyday vehicles. As consumer demand for enhanced safety features and connectivity rises, automakers are increasingly adopting hypervisor solutions to manage multiple applications efficiently. These technologies facilitate the efficient functioning of vehicle-to-everything (V2X) communication, advanced driver assistance systems (ADAS), and entertainment platforms, all critical components of contemporary passenger vehicles. Furthermore, the shift towards electric vehicles (EVs) is also contributing to the growth of this segment, as hypervisors facilitate the management of complex software architectures required for EV functionalities. The ability to isolate critical systems from non-critical applications enhances safety and reliability, making hypervisors indispensable in the design and operation of contemporary passenger cars. As the automotive landscape evolves, the demand for hypervisor technology in this segment is expected to continue its upward trajectory.

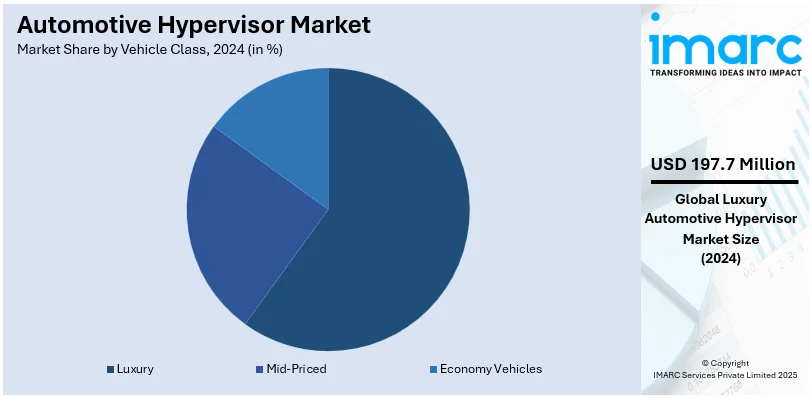

Analysis by Vehicle Class:

- Mid-Priced

- Luxury

- Economy Vehicles

Luxury leads the market with around 59.8% of market share in 2024. This segment is represented by a resilient focus on advanced technology and superior user experience. Luxury automakers are increasingly incorporating hypervisor solutions to support sophisticated features such as autonomous driving capabilities, high-end infotainment systems, and personalized driver assistance. These vehicles often require the integration of multiple operating systems to manage various functionalities, making hypervisors essential for ensuring optimal performance and security. In addition, the magnifying customer expectation for uninterrupted connectivity and enhanced safety features drives the adoption of hypervisors in luxury models. The ability to provide enhanced isolation between critical and non-critical systems not only improves safety but also elevates the overall driving experience. As luxury vehicle manufacturers continue to innovate and push the boundaries of technology, the role of hypervisors in this segment is expected to expand, further solidifying their market presence.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest automotive hypervisors market share of over 39.8%. The Asia Pacific automotive hypervisor market is growing very fast, and the reason for this growth is the amplifying ownership electric vehicle sales in China. In 2023, China registered 8.1 million new electric cars, a 35% increase compared to 2022, making EV sales the primary contributor to the overall growth of the car market, according to IEA. These measures are supplemented by government policies like the Faster Adoption and Manufacturing of Electric Vehicles (FAME II) scheme, offering purchase incentives, and the Production Linked Incentive (PLI) scheme, which is a supply-side measure. IEA further points out that tax exemptions and Go Electric campaigns have added considerable demand for EVs among consumers.

With the growing adoption of EVs, advanced technologies are required to handle complex vehicle systems. Automotive hypervisors are key to ensuring safe and efficient operation by isolating software functions, enhancing performance, and allowing seamless integration of advanced features. All these factors are expected to continue driving the growth of the automotive hypervisor market across the Asia Pacific region.

Key Regional Takeaways:

United States Automotive Hypervisor Market Analysis

In 2024, United States accounted for 74.60% of the market share in North America. The United States automotive hypervisor market is growing rapidly, primarily due to the increasing adoption of electric vehicles. In 2023, new electric car registrations in the U.S. reached 1.4 million, a rise of more than 40% from 2022, according to IEA. This increase shows the increased demand for EVs by consumers, as it is encouraged by the improvement in battery technology, increased charging infrastructure, and federal incentives for EV adoption.

Such an environment has also created an intense need for managing sophisticated software. This is where the automotive hypervisors come into play, because it integrates complex systems including advanced driver-assistance systems (ADAS), infotainment platforms and battery management systems onto one piece of hardware. This way, critical and non-critical systems can be operated without there being a compromise with safety and cyber-security; meanwhile, the U.S. EV market expanded rapidly. Automotive hypervisors are positioned as an essential component of modern vehicle architecture, which drives market growth.

North America Automotive Hypervisor Market Analysis

North America is a crucial region in the global automotive hypervisor industry, represented by a robust base for automotive manufacturing and a resilient aim for technological advancements. The establishment of leading technology companies and automotive firms fuels the utilization of hypervisor solutions, especially as vehicles increasingly are actively integrating ADAS and connectivity attributes. The region's active emphasis on electric and autonomous vehicles further heightens the need for hypervisors, which foster the effective management of complicated software architectures. For instance, as per industry reports, around 1 in 6 new cars purchased across Canada during the third quarter of 2024 was a zero-emission vehicle, reflecting a 14.4% elevation in overall sale volume in comparison to Q2 2024. In addition to this, stricter safety policies and customer expectations for improved vehicle security as well as performance incentivize manufacturers to incorporate hypervisor technology. Resultantly, North America is established as one of the key players in steering the future of automotive hypervisor applications.

Europe Automotive Hypervisor Market Analysis

The European automotive hypervisor market is in huge growth due to the adoption of electric vehicles in the region. In 2023, electric car registrations reached nearly 3.2 million in Europe; this was up by almost 20% on 2022, as indicated by IEA. Within the European Union, EV sales have reached 2.4 million units, a similar growth rate in the region. This shows a clear commitment by the region to its transition towards a sustainable mobility approach and reducing carbon emissions.

Increasing adoption of EVs is leading to the requirement for innovative software solutions that can manage the complex electronic systems within modern vehicles. Hypervisors play a key role in enabling the integration of different software applications on a single hardware platform without jeopardizing operational safety and reliability. In addition, Europe's highly stringent regulatory environment and focus on vehicle safety and cybersecurity further amplify the need for hypervisors. These trends position automotive hypervisors as a key enabler of innovation in Europe's rapidly evolving EV market.

Latin America Automotive Hypervisor Market Analysis

Latin America is experiencing the growth of automotive hypervisor markets due to increased adoption of electric vehicles. In 2023, electric car sales in the region nearly reached 90,000 units, with Brazil, Colombia, Costa Rica, and Mexico being at the forefront. Brazil saw electric car registrations almost triple year-over-year to more than 50,000 units, according to IEA. In addition, the Green Mobility and Innovation Programme launched by Brazil at the end of 2023, offering tax incentives for companies to develop low-emissions road transport technology, further speeds up the transition to EVs. This aggregates to more than Brazilian Real19 Billion (USD 3.8 Billion) in incentives over the 2024-2028 period, according to IEA. As the demand for EVs and their advanced technologies increases, the expansion in the need for automotive hypervisors that manage complex software functions, ensuring safe and secure operation of EV systems, is likely to propel the market forward.

Middle East and Africa Automotive Hypervisor Market Analysis

Rising penetration of electric vehicles (EVs) in the Middle East and Africa (MEA) region drives demand for automotive hypervisors. As per reports, the electric car sales share is also at the highest level in Jordan at over 45%, due to significantly lower import duties as compared with those of ICEs. This trend is also witnessed in the United Arab Emirates, where EV sales represent 13% of the market. As EV adoption rises, the need for sophisticated software management solutions like automotive hypervisors becomes crucial. These hypervisors enable the seamless operation of complex software systems, such as advanced driver-assistance systems (ADAS), infotainment, and autonomous driving features, all while ensuring high levels of safety and security. The increasing demand for connected and autonomous vehicle technologies in the MEA region, and the growing presence of EVs are expected to contribute to the automotive hypervisor market growth.

Competitive Landscape:

Key manufacturers in the industry are investing in research and development activities to improve performance, security, and compatibility of hypervisors with a wide range of hardware and software components. They are also focusing on addressing the specific requirements of different vehicle types and levels of automation. In line with this, companies are working closely with automakers to tailor their hypervisor offerings to meet the unique software and hardware requirements of each vehicle model. This customization ensures seamless integration with existing automotive systems. For instance, in January 2025, BlackBerry Limited's divison QNX announced a tactical collaboration with Microsoft to boost the development of software-defined vehicles by making testing, designing, or refining software withing cloud convenient for automakers. Under this partnership, QNX Software Development Platform (SDP) 8.0 will be made available on Microsoft Azure, offering developers a certified and resilient cloud environment to incorporate software that will power applications associated with next-gen automotive. Besides this, major players are working on safeguarding hypervisors against potential cyber threats and vulnerabilities and providing automakers a peace of mind regarding the safety of their vehicles.

The report provides a comprehensive analysis of the competitive landscape in the automotive hypervisor market with detailed profiles of all major companies, including:

- BlackBerry Limited

- Green Hills Software

- IBM Corporation

- OpenSynergy GmbH (Panasonic Holdings Corporation)

- Siemens AG

- Wind River Systems Inc. (Aptiv Plc, Intel Corporation)

Latest News and Developments:

- October 2024: Telechips and P3 announced a partnership to create a pre-integrated software and hardware solution for automotive infotainment. The Dolphin3 processor from Telechips is integrated with P3’s SPARQ OS, enabling faster product launches and enhanced user experiences for vehicle manufacturers. The hypervisorless approach reduces system complexity, improving performance and efficiency for advanced in-vehicle infotainment systems.

- June 2024: Renesas Electronics has introduced the R-Car Open Access (RoX) platform for software-defined vehicle (SDV) development. RoX Whitebox includes royalty-free operating systems and hypervisors like Android Automotive OS, Linux, Xen, and Zephyr RTOS, while RoX Licensed features commercial solutions such as QNX and Red Hat. This platform supports cloud-native development, AI deployment, and simulation-based testing, simplifying vehicle software innovation for OEMs and Tier 1 suppliers.

- January 2024: AMD introduced the Versal AI Edge XA adaptive SoC and Ryzen Embedded V2000A Series processor at CES 2024, designed for automotive applications. These chips feature AI engines and support for hypervisors, enhancing in-vehicle experiences, safety, and autonomous driving systems. They aim to power next-gen infotainment, digital cockpits, and advanced driver assistance systems.

- April 2024: BlackBerry Limited partnered with ETAS GmbH to collaborate in promoting and selling software solutions for improving the safety-critical features of next-generation software-defined vehicles.

- January 2024: Panasonic Automotive introduced its Neuron™ High-Performance Compute (HPC) system at CES 2024, designed to enhance software-defined mobility. This innovative system supports software and hardware upgrades, consolidating multiple electronic control units (ECUs) to reduce complexity and costs by up to 80%. Neuron™ HPC integrates advanced processors for various automotive functions, ensuring scalability and thermal management. Additionally, it features cloud-native capabilities for efficient software updates and robust cybersecurity measures, positioning it as a future-proof solution for evolving automotive technologies.

- November 2023: Panasonic Automotive Systems Company launched the Virtual SkipGen (vSkipGen) on the AWS Marketplace. This innovation allows automotive engineers and developers to begin the development process earlier, without relying on physical hardware. The vSkipGen is a virtual model of the physical third-generation Digital Cockpit solution, SkipGen, marking a significant milestone in Panasonic and Amazon's collaboration to advance eCockpit technology.

Automotive Hypervisor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Type 1 Hypervisor, Type 2 Hypervisor |

| Level of Automations Covered | Semi-Autonomous, Fully Autonomous |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Vehicle Classes Covered | Mid-Priced, Luxury, Economy Vehicles |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BlackBerry Limited, Green Hills Software, IBM Corporation, OpenSynergy GmbH (Panasonic Holdings Corporation), Siemens AG, Wind River Systems Inc. (Aptiv Plc, Intel Corporation), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive hypervisor market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive hypervisor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive hypervisor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive hypervisor market was valued at USD 330.64 Million in 2024.

IMARC estimates the automotive hypervisor market to reach USD 2,584.05 Million by 2033, exhibiting a CAGR of 25.45% during 2025-2033.

The market is driven by the bolstering need for advanced driver-assistance systems and improved safety attributes in vehicles. In addition, the requirement for cost effectiveness and performance enhancements is compelling manufacturers to opt for hypervisor technology, which enables multiple operating systems to function on a single hardware platform concurrently.

Asia Pacific currently dominates the automotive hypervisor market, accounting for a share exceeding 39.8%. This dominance is fueled by its resilient automotive manufacturing base, fueling adoption of innovative technologies, and amplifying investments in both autonomous and electric vehicle development.

Some of the major players in the automotive hypervisor market include BlackBerry Limited, Green Hills Software, IBM Corporation, OpenSynergy GmbH (Panasonic Holdings Corporation), Siemens AG, Wind River Systems Inc. (Aptiv Plc, Intel Corporation), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)