Automotive HVAC System Market Size, Share, Trends and Forecast Report by Component, Technology, Vehicle Type, and Region, 2025-2033

Automotive HVAC System Market Size and Share:

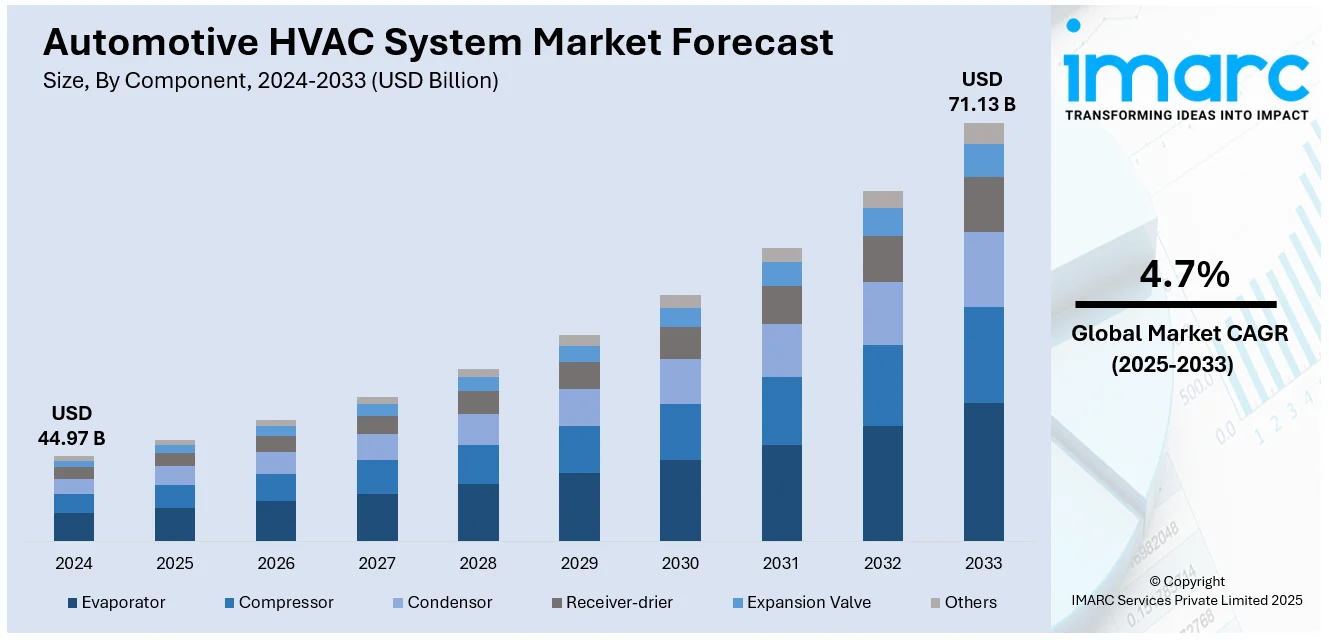

The global automotive HVAC system market size was valued at USD 44.97 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 71.13 Billion by 2033, exhibiting a CAGR of 4.7% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 49.0% in 2024. The growing user demand for comfort and convenience, advancements in air conditioning technologies, regulatory pressures for energy-efficient solutions, and rising adoption of electric and hybrid vehicles are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 44.97 Billion |

|

Market Forecast in 2033

|

USD 71.13 Billion |

| Market Growth Rate (2025-2033) | 4.7% |

The global automotive HVAC (heating, ventilation, and air conditioning) system market is primarily driven by rising demand for enhanced in-vehicle comfort and safety features. The widespread adoption of electric vehicles (EVs) has further augmented the demand for energy-efficient HVAC systems. Manufacturers are forced to create cutting-edge climate control technology by strict government rules on vehicle emissions. Additionally, consumer preferences for luxury cars and rising disposable incomes both support market growth. Additionally, technological advancements, such as automatic climate control and integration with the Internet of Things (IoT), are fostering innovation in the sector, making automotive HVAC systems a critical component in modern vehicle designs.

The United States plays a pivotal role in the global automotive HVAC system market, driven by high vehicle ownership rates, advanced technological adoption, and growing consumer demand for enhanced comfort. As per industry reports, 92% of the households in U.S. at least own 1 vehicle for personal purposes. Moreover, the market benefits from robust R&D activities and the existence of leading automotive producers. The growing focus on energy efficiency and regulatory compliance has spurred improvement in eco-friendly and advanced HVAC solutions. In addition, the development of electric and autonomous vehicle segments further accelerates HVAC system development. As a key market player, the U.S. continues to set benchmarks in performance, sustainability, and technological integration within the automotive HVAC landscape.

Automotive HVAC System Market Trends:

Growing Adoption of Electric and Hybrid Vehicles

Electric and hybrid vehicles require specific HVAC systems that effectively regulate cabin temperature and maximize battery performance, as standard systems can deplete the battery rapidly. As per IEA statistics, nearly 14 million new electric vehicles were documented worldwide in 2023, raising their overall count on the roads to 40 million. The shift towards electric transportation is leading to investments in creating HVAC systems that work with electric engines. Technologies, such as heat pumps and energy recovery systems, are providing efficient climate regulation without excessive use of energy. These advancements are essential for preserving the range of vehicles and ensuring passenger comfort. The rise of electrification in the automotive sector is driving the demand for cutting-edge HVAC systems designed specifically for electric and hybrid vehicles. In September 2023, Mitsubishi Heavy Industries Thermal Systems, Ltd. (MHI Thermal Systems) introduced the TEJ35GAM, an electric-powered transport refrigeration unit designed for small and mid-size trucks. It includes a plug-in hybrid system and heat pump technology to control temperatures throughout the year efficiently. This new development was designed to improve transportation effectiveness and decrease carbon emissions.

Technological Advancements and Innovations

Progress in technology and innovations in HVAC systems to improve functionality are strengthening the market growth. The advancement of intelligent HVAC systems with sensors and IoT features enables more accurate and automated climate regulation, enhancing energy efficiency and passenger comfort. New technologies, including variable displacement compressors, environment-friendly refrigerants, and heat pump systems, are becoming more popular because of their improved efficiency and reduced environmental harm. The incorporation of these cutting-edge technologies is not just improving the performance of HVAC systems but also adhering to strict regulations on emissions and energy usage. The ongoing investments in research and development (R&D) by automotive manufacturers to create advanced HVAC solutions are bolstering the market growth. In January 2023, Volkswagen introduced the ID.7, which includes advanced air conditioning with dynamically adjusted vents to enhance cabin comfort and efficiency, establishing a new benchmark in automotive climate control technology.

Regulatory and Environmental Standards

Governing bodies in many countries are implementing rules to lower vehicle emissions and enhance fuel efficiency, encouraging car manufacturers to create more energy-efficient and environment-friendly HVAC systems. The regulatory effort is resulting in the use of low global warming potential (GWP) refrigerants and advanced technologies to reduce energy usage in HVAC systems. Adhering to these rules is crucial for companies to prevent fines and improve their market standing by meeting international sustainability objectives. These strict rules are encouraging creativity as businesses allocate resources to create advanced HVAC solutions that comply with regulations and offer top-notch performance. Adhering to these regulations is shifting the industry towards sustainable practices, ensuring long-term market expansion and technological advancement. In October 2023, Sensata introduced the Resonix RGD sensor, which is UL-certified for detecting A2L refrigerants, helping HVAC manufacturers switch to more eco-friendly refrigerants in response to changing regulations.

Automotive HVAC System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive HVAC system market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, technology, and vehicle type.

Analysis by Component:

- Evaporator

- Compressor

- Condensor

- Receiver-drier

- Expansion Valve

- Others

Compressor accounts for the majority of the market share based on the automotive HVAC system market forecast. It plays a crucial role by pressurizing the refrigerant and circulating it throughout the system, allowing for the cooling and heating functions to take place. Its significance is driven by the growing demand for advanced HVAC systems in modern vehicles, particularly with the rise of electric and hybrid vehicles that require highly efficient and reliable components. Technological advances that increase compressor efficiency, lower energy usage, and decrease environmental harm are supporting the market growth. Major companies are making notable investments in creating advanced compressor technologies like variable displacement compressors, providing better performance and flexibility in response to varying weather conditions. Hanon Systems revealed on January 29, 2024, that they had manufactured more than 500,000 CO2 (R744) electronic compressors for EV heat pumps at their Portugal facility, mainly utilized in Volkswagen's electric cars to improve heating effectiveness and increase driving distance.

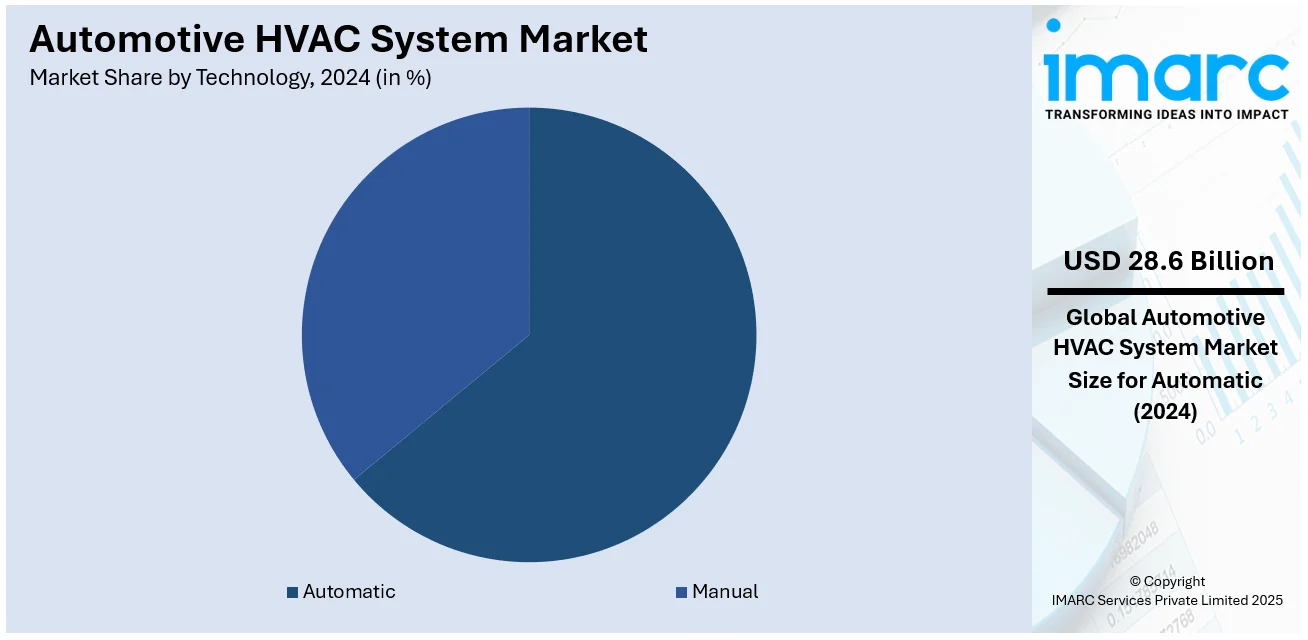

Analysis by Technology:

- Automatic

- Manual

Automatic leads the market with around 63.7% of market share in 2024. This technology plays a critical role in influencing the automotive HVAC system market outlook positively. An automatic HVAC system of the vehicle cabin is developed to avoid instance interventions by the driver or passengers. Climate control in it is done using sensors and the incorporation of a highly developed control algorithms which ensures that climate conditions are being self-regulated to the most optimum level possible comfort levels and energy saving. The growing demand for automatic HVAC systems in vehicles is mainly because of the desire of users for convenience and improved comfort features. Car manufacturers are integrating these systems into their cars to satisfy user needs and set their products apart in a competitive market.

Analysis by Vehicle Type:

- Passenger Car

- Commercial Vehicle

- Electric Vehicle

Passenger car holds the biggest segment due to the large number of passenger cars being produced and sold worldwide, driven by the growing desire of users for personal convenience and comfort. Advanced features, including dual-zone and tri-zone climate control, air quality sensors, and automatic temperature adjustments, are being added to HVAC systems in passenger cars to improve passenger comfort. Increasing user demand for luxury and convenience, as well as stringent regulations on vehicle emissions and fuel efficiency, are encouraging car manufacturers to implement advanced HVAC systems in passenger vehicles. Furthermore, the rise in disposable income and urban development, especially in developing countries, is resulting in an increase in the number of car owners, which is driving the advanced automotive HVAC system demand.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 49.0%. Asia Pacific dominates the market owing to the growing automotive production and sales in countries. The demand for passenger cars with advanced HVAC systems is increasing due to rapid urbanization, expanding middle class, and rising disposable incomes in the region. Furthermore, the presence of major automotive manufacturers and suppliers and rising investments in automotive R&D are encouraging the development of advanced HVAC technologies. Favorable government policies, such as incentives for electric and hybrid vehicles, are supporting the automotive HVAC system market growth. The dominance of the region is further strengthened by the increasing recognition of air quality and comfort, leading users to choose cars with top-notch HVAC systems. In April 2023, Valeo opened its new Kanda facility in Japan, specializing in manufacturing advanced HVAC systems and active grille shutters for improved vehicle energy efficiency and passenger comfort. The factory, belonging to Valeo Thermal Systems, focused on sustainability through the use of creative designs and reused materials.

Key Regional Takeaways:

United States Automotive HVAC Market Analysis

In 2024, the United States accounted for 80% of the market share in North America. The increased use of electric vehicles in the United States is a very significant driver of the automotive HVAC market. An industry report claims that sales of new light-duty charged electric vehicles increased from 308,000 in 2020 to 608,000 in 2021. Battery electric vehicles represented over 73% of the total chargeable electric vehicles sold, further evidencing the trend towards electric mobility. As of June 2020, in the U.S., there were almost 250 million gasoline or diesel-powered vehicles, however, with growing demand of EVs, the Automotive industry is going through some change. The U.S. government has always been supportive of this trend by providing numerous tax benefits to promote the purchase of electric cars. Electric vehicles, therefore, cannot depend on the internal combustion engine for heating and cooling purposes, making advanced, efficient, and energy-saving HVAC systems necessary. In fact, the expansion of the automotive HVAC market in the US is directly impacted by the growing demand for electric vehicles.

North America Automotive HVAC Market Analysis

North America holds a significant position in the global automotive HVAC system market due to its advanced automotive industry and strong consumer preference for comfort and convenience. The region is characterized by a high demand for passenger vehicles equipped with advanced HVAC systems, driven by fluctuating climatic conditions and rising disposable incomes. The United States dominates the regional market, benefiting from a robust automotive manufacturing base and ongoing advancements in HVAC technologies. Regulatory standards emphasizing energy efficiency and reduced emissions further drive innovation in the sector. Furthermore, the development of eco-friendly HVAC solutions is accelerated by the increasing use of electric and hybrid automobiles. For instance, as per industry reports, by 2050, ZEVs, which include battery electric and hybrid vehicles, will account for more than 90% of total vehicles on road in Canada. Key players in North America focus on integrating smart technologies, such as automatic climate control and air quality monitoring, to enhance user experience and meet evolving consumer expectations.

Europe Automotive HVAC Market Analysis

Several factors are contributing to the market growth in Europe. According to industry reports, Germany is the largest economy in the region and accounts for more than 29% of the automobile market in the EU. The country witnessed around 2.65 million passenger car sales in 2022, which indicates the immense demand for vehicles in the continent. This increased demand for advanced HVAC systems is placing a significant burden on how to achieve optimal passenger comfort and efficiency in vehicles. Also, as the European auto industry transitions to electric cars, the demand for specific automotive HVAC systems that cater particularly to EVs, designed with climate control in consideration due to their dependence on electric power, is steadily increasing. There is also an increasing focus on environmental sustainability and energy efficiency, which is driving more eco-friendly HVAC solutions. Collectively, these factors will continue to fuel growth and innovation in the European automotive HVAC market, especially as new vehicle technologies are introduced.

Latin America Automotive HVAC Market Analysis

Latin America has grown with the electric vehicle (EV) market, which is driving the region's automotive HVAC market. Argentina leads in adopting electric vehicles, while Brazil's sales of EVs and hybrids have increased significantly in recent years, despite its overall vehicle sales dropping. This rise in EVs, along with light commercial vans' popularity, shows consumers want electric models. Government policies and incentive schemes have also fueled this trend of going electric. For instance, Colombia has announced plans for 600,000 EVs in its roads by 2030 and has planned schemes with incentives and subsidies aiming at the reduction of carbon emissions, as per industry report. Similar trends could be witnessed in other south American countries, making it easier to grow the market. With electric vehicle adoption rapidly increasing, demand for high-performance HVAC systems developed specifically for EVs will be at an all-time high, driving the growth in the Latin American automotive HVAC market.

Middle East and Africa Automotive HVAC Market Analysis

Government policies in the Middle East and Africa (MEA) region are helping the automotive HVAC market to grow significantly, especially since the region is now adopting electric vehicles (EVs). The incentives for green vehicles in the form of tax benefits and subsidies have forced the consumers to shift toward EVs, thereby leading to an increase in demand for specialized HVAC systems, especially designed for electric models. There is also the case of very spread-out installations of EV charging stations, which enhances the infrastructures that are supposed to aid more growth of electric vehicles on the road. Less registration fees for electric cars increase the accessibility and appeal for consumers to make use of EVs. In the United Arab Emirates, the adoption of electric vehicles increased sharply from 2022 to 2023, with electric passenger car adoption increasing from 2% to 4% and electric light commercial vehicle (LCV) share rising from 0.2% to 1.09%, according to Industry Reports. As these government-backed measures continue to expand, electric vehicles adoption is expected to surge and thereby increase the demand for automotive HVAC systems designed for energy efficiency and comfort in electric vehicles. It will have factors driving sustained growth in the Middle East and Africa's automotive HVAC market.

Competitive Landscape:

Major automotive HVAC system companies are involved in developing new products, forming strategic partnerships, and pursuing mergers and acquisitions (M&A) in order to enhance their market standings. They are making investments in cutting-edge technologies, such as environment-friendly refrigerants and intelligent climate control systems, to satisfy changing user needs and meet regulatory mandates. These companies are expanding their presence worldwide through the establishment of new manufacturing facilities and research centers. Moreover, they are concentrating on improving energy efficiency and decreasing the environmental footprint of their HVAC systems, in line with the overall industry shift towards sustainability and eco-friendly technologies. In March 2024, Samsung Electronics started a major USD 6 billion M&A agreement to purchase Johnson Controls' HVAC branch. This action was taken to enhance Samsung's position in the expanding HVAC sector due to increasing interest in energy-saving systems.

The report provides a comprehensive analysis of the competitive landscape in the automotive HVAC system market with detailed profiles of all major companies, including:

- Denso Corporation

- Hanon Systems

- Highly Marelli

- Japan Climate Systems Corporation

- Johnson Electric Holdings Limited

- Mahle GmbH

- Mitsubishi Heavy Industries Ltd

- Sanden Corporation

- Sensata Technologies Inc

- Valeo

Latest News and Developments:

- February 2024: The researchers at the University of Birmingham have designed a microwave-based thermochemical system for the electric vehicle climate control that has been termed the e-Thermal bank. In its words, the novel system has the potential to add around 70% range extension for the vehicle. Being an auxiliary power source of the vehicle, it will liberate the battery from its load of heating, ventilation, and air conditioning that finally improves the range over driving.

- July 2023: Marelli unveiled a new Thermal Management Module (iTMM) for EVs that enhanced HVAC systems by merging e-powertrain, battery, and cabin thermal circuits into one single part. This advancement enhanced vehicle performance, security, and range by as much as 20%.

- May 2023: Hanon Systems, a company from South Korea specializing in HVAC and automotive thermal management, revealed plans to invest USD 40 million in constructing a new facility in Bulloch County, Georgia. This plant will manufacture HVAC parts for cars, aiding in Hyundai's EV manufacturing.

Automotive HVAC System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Evaporator, Compressor, Condensor, Receiver-drier, Expansion Valve, Others |

| Technologies Covered | Automatic, Manual |

| Vehicle Types Covered | Passenger Car, Commercial Vehicle, Electric Vehicle |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Denso Corporation, Hanon Systems, Highly Marelli, Japan Climate Systems Corporation, Johnson Electric Holdings Limited, Mahle GmbH, Mitsubishi Heavy Industries Ltd, Sanden Corporation, Sensata Technologies Inc, Valeo, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive HVAC system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive HVAC system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive HVAC system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive HVAC system market was valued at USD 44.97 Billion in 2024.

The automotive HVAC system market is projected to exhibit a CAGR of 4.7% during 2025-2033, reaching a value of USD 71.13 Billion by 2033.

The market is driven by increasing consumer demand for enhanced cabin comfort, growing vehicle production, rising adoption of electric and hybrid vehicles, advancements in energy-efficient HVAC technologies, and stringent regulations promoting reduced emissions and improved fuel efficiency in modern automotive systems.

Asia Pacific currently dominates the automotive HVAC system market, accounting for a share of 49.0% in 2024. The dominance is fueled by rising consumer demand for advanced climate control systems, increasing adoption of electric vehicles, and strong investments in automotive manufacturing infrastructure within the region.

Some of the major players in the automotive HVAC system market include Denso Corporation, Hanon Systems, Highly Marelli, Japan Climate Systems Corporation, Johnson Electric Holdings Limited, Mahle GmbH, Mitsubishi Heavy Industries Ltd, Sanden Corporation, Sensata Technologies Inc, and Valeo, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)