Automotive Gigacasting Market Size, Share, Trends and Forecast by Locking Force, Application, and Region, 2025-2033

Automotive Gigacasting Market Size and Share:

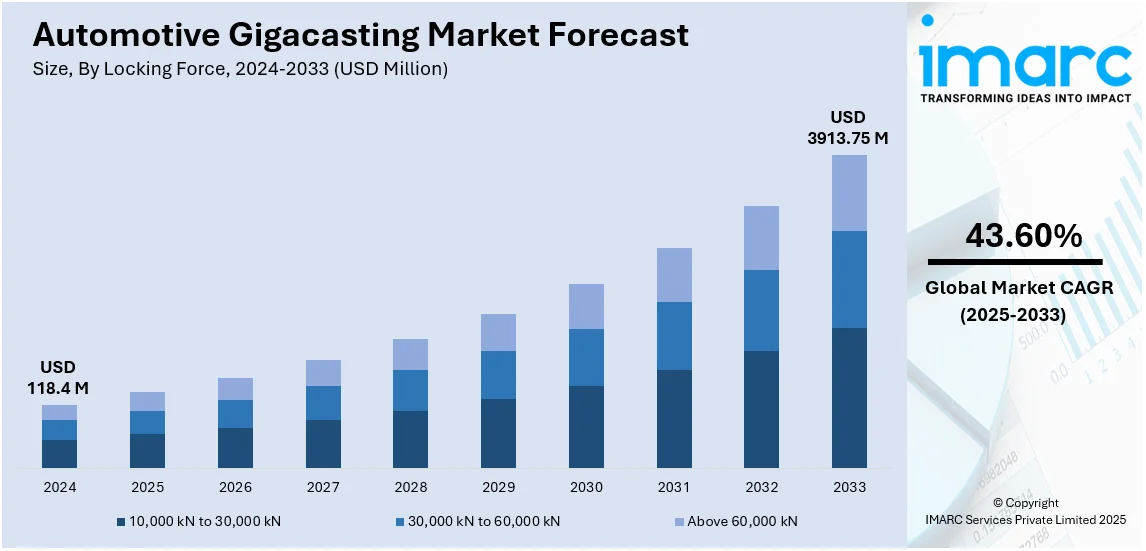

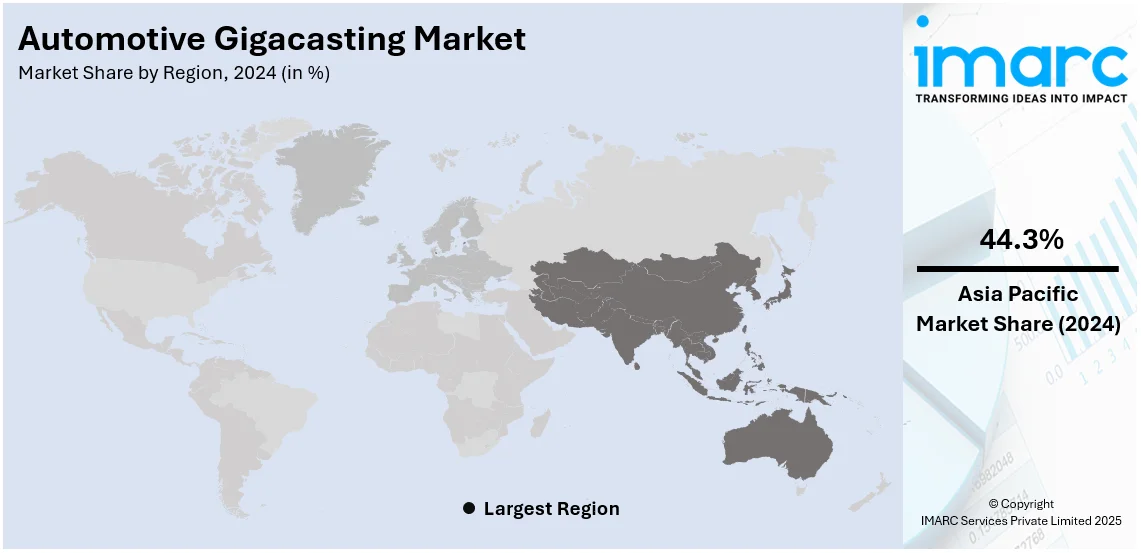

The global automotive gigacasting market size was valued at USD 118.4 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3913.75 Million by 2033, exhibiting a CAGR of 43.60% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 44.3% in 2024. The market is driven by increasing demand for lightweight, high-strength vehicle components that enhance performance and fuel efficiency. The growing popularity of electric vehicles (EVs), along with advancements in casting technology and rising environmental concerns promoting sustainable manufacturing contribute to the automotive gigacasting market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 118.4 Million |

| Market Forecast in 2033 | USD 3913.75 Million |

| Market Growth Rate (2025-2033) | 43.60% |

The global automotive gigacasting market is primarily driven by the augmenting demand for lightweight and fuel-efficient automobiles, supported by stringent emission regulations worldwide. Automakers are increasingly adopting gigacasting to streamline production, reduce costs, and enhance structural integrity, particularly for electric vehicles (EVs). The rise in EV adoption, supported by government incentives as well as investments in charging infrastructure further propels the market. Additionally, advancements in casting technology, such as high-pressure aluminum die casting, enable faster manufacturing and improved component durability. On 20th December 2024, Jaya Hind Industries launched the country's biggest 4400-tonne high-pressure die-casting machine at its Urse plant near Pune, imported from Buhler-Switzerland. It can now churn out intricate aluminium structural parts, such as EVs and CVs. In doing so, Jaya Hind consolidates its leadership in new-age aluminum die-casting technology with domestic and international OEMs in its client portfolio. Moreover, the push toward sustainability and the shift to eco-friendly production processes also significantly contribute to the automotive gigacasting market growth.

The United States stands out as a key regional market, primarily driven by a growing emphasis on innovations in vehicle manufacturing and the rising adoption of electric vehicles (EVs). New electric car registrations in the United States in 2023 reached 1.4 million, 40% up from 2022, as revised Clean Vehicle Tax Credit criteria and price cuts continue to drive sales. Tesla Model Y sales increased by 50% after becoming eligible for the full USD 7,500 tax credit under the Inflation Reduction Act (IRA). Automakers in the U.S. are leveraging gigacasting to achieve cost efficiency, faster production cycles, and enhanced vehicle performance. Government policies encouraging EV adoption, such as tax incentives and carbon reduction targets, are further increasing demand for advanced manufacturing technologies such as gigacasting. Additionally, consumer demand for lightweight vehicles with improved energy efficiency is encouraging manufacturers to adopt large-scale casting methods. The need to remain competitive in a technologically advanced automotive sector also supports the automotive gigacasting market outlook in the U.S.

Automotive Gigacasting Market Trends:

Increasing Adoption of Gigacasting for Electric Vehicles (EVs)

The growing demand for electric vehicles is a key driver of gigacasting adoption, as manufacturers aim to simplify production and reduce costs. Gigacasting allows automakers to create large, complex structural components in a single process, significantly reducing the number of parts needed and reducing assembly time. This trend aligns with the rising need for lightweight vehicle designs to enhance EV range and energy efficiency. With governments providing incentives for EV production and sales, manufacturers are investing heavily in gigacasting technology to meet the automotive gigasting market demand while maintaining sustainability goals. On 25th April 2024, India sanctioned a USD 500 million Electric Vehicle (EV) Policy to lure overseas EV makers and increase indigenous manufacturing through the "Make in India" program. A minimum investment of INR 41.5 Billion, a 25% DVA by year three, and incentives such as imported duty reductions for manufacturers meeting the set criteria are some of the stipulations of the policy. As EV adoption increases globally, gigacasting is becoming an essential tool in streamlining the production of high-performance, cost-effective electric cars.

Advancements in Aluminum Die-Casting Technology

Innovations in aluminum die-casting processes are acting as one of the significant automotive gigacasting market trends by enabling manufacturers to produce stronger, lighter, and more durable components. High-pressure aluminum die casting has emerged as a game-changer, allowing companies to manufacture large vehicle parts with exceptional precision and reduced waste. These advancements have made gigacasting a preferred technique, particularly for electric and hybrid vehicle components, where weight reduction is critical. On 4th December 2024, Dongfeng Motor initiated a significant die-casting project in Wuhan, with the world's largest 16,000-ton integrated die-casting machine for the production of chassis components and battery housings for NEVs. The investment for the project is 1 Billion Yuan, with which six advanced production lines will be established, targeting 600,000 units annually. This initiative aims to enhance manufacturing efficiency, reduce vehicle weight, and strengthen China's NEV industry. Additionally, improvements in tooling design, automation, and heat treatment processes improve the efficiency and quality of gigacasting production. As the automotive industry seeks faster, more eco-friendly manufacturing solutions, ongoing advancements in die-casting technology are driving the growth of gigacasting applications.

Sustainability and Eco-Friendly Manufacturing Practices

The push for sustainability is influencing automakers to adopt gigacasting as a way to reduce their environmental footprint. By consolidating multiple parts into single large castings, gigacasting minimizes material waste and reduces energy consumption during manufacturing. Additionally, the use of recyclable materials including aluminum in gigacasting aligns with the automotive industry's broader goal of promoting a circular economy. This trend is further supported by the rising awareness among consumers and regulators about the environmental impact of vehicle production. Tesla's Model Y first introduced gigacasting, which Nio, Xpeng, Geely, and Toyota will follow by 2026, using a single-piece section that replaces 175 parts in the Lexus EV platform. Gigacasting improves crash safety with replaceable zones, as in the case of a Zeekr 009 surviving a collision with a bus with its structure intact. Companies are increasingly integrating eco-friendly practices into their operations, and gigacasting plays a crucial role by offering a more sustainable approach to producing lightweight and efficient automotive components.

Automotive Gigacasting Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive gigacasting market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on locking force and application.

Analysis by Locking Force:

- 10,000 kN to 30,000 kN

- 30,000 kN to 60,000 kN

- Above 60,000 kN

The 30,000 kN to 60,000 kN locking force segment represents the largest and most prominent category in the gigacasting market, driven by its capability to produce large, complex automotive components efficiently. This locking force range is particularly suited for manufacturing structural parts, such as entire vehicle frames and battery housings for electric vehicles (EVs). The segment’s dominance is fueled by the growing adoption of gigacasting in EV production, where lightweight designs and enhanced structural integrity are critical. Additionally, the ability of this segment to handle high-pressure aluminum die-casting processes ensures precision, durability, and minimal material waste, making it a preferred choice among automakers seeking cost-efficient, high-performance solutions for mass production.

Analysis by Application:

- Body Part

- Engine Part

- Transmission Part

- Others

Body parts constitute the largest application segment in the market, driven by the growing demand for lightweight, durable, and structurally rigid components. Automakers are using gigacasting technology to manufacture large sections of vehicle bodies, such as rear underbodies and front-end frames, in a single casting process. This approach significantly reduces assembly complexity, minimizes the number of welded joints, and enhances overall structural integrity. The rise of electric vehicles (EVs) has further amplified the demand for gigacast body parts, as lightweight designs directly improve battery efficiency and vehicle range. This trend, coupled with the cost savings achieved through streamlined production, makes body parts the dominant segment in the gigacasting market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, Asia Pacific accounted for the largest market share of over 44.3%, driven by its position as a global hub for automobile manufacturing and innovation. Countries including China, Japan, and South Korea dominate the region with their robust production capacities, advanced manufacturing technologies, and rising demand for electric vehicles (EVs). The region benefits from cost-effective labor, extensive supply chains, and continuous investments in research and development for lightweight vehicle components. Additionally, government incentives supporting EV adoption and eco-friendly manufacturing practices have further fueled the growth of gigacasting in Asia Pacific. The presence of leading automakers and the increasing shift toward large-scale production of EVs make this region a key contributor to market expansion.

Key Regional Takeaways:

United States Automotive Gigacasting Market Analysis

The United States automotive gigacasting market is witnessing several emerging trends fueled by the rapid adoption of electric vehicles (EVs) and advancements in manufacturing technologies. Automakers are increasingly utilizing gigacasting to simplify vehicle production by integrating multiple components into single, large castings, reducing assembly time and costs. The growing focus on sustainability is driving the demand for lightweight materials such as aluminum, which improves vehicle efficiency and reduces emissions. Additionally, government policies, including tax credits for EV purchases and stricter emission standards, are accelerating gigacasting adoption to meet production demands. Under the IRS Code Section 30D, which was revised under the Inflation Reduction Act, a tax credit is available to individuals and businesses purchasing a new plug-in EV or FCV in the period 2023 to 2032. Qualifying requirements include use in the United States, no resale, and income under USD 300,000 for joint filers, USD 225,000 for heads of households, and USD 150,000 for others. The credit amount will be between USD 2,500 and USD 7,500 based on battery capacity. Investments in automation and high-pressure die-casting technology are also enhancing production efficiency, making gigacasting a critical component of the U.S. automotive industry’s transition toward electrification.

Europe Automotive Gigacasting Market Analysis

The Europe market is driven by the region's focus on sustainability, electric vehicle (EV) adoption, and advancements in manufacturing technologies. Strict environmental regulations, such as the European Green Deal, are driving automakers to adopt lightweight materials and efficient production methods to reduce emissions. Gigacasting plays a crucial role in achieving these goals by consolidating components into single castings, improving energy efficiency, and reducing waste. The growing demand for EVs, supported by government subsidies and investments in charging infrastructure, is further accelerating gigacasting adoption. In September 2024, new car registrations in the EU fell by 6.1% year-over-year, reflecting a shrinking market. Despite this, battery-electric vehicle (BEV) sales grew by 9.8%, highlighting continued interest in EVs. Additionally, Europe’s well-established automotive industry, combined with advancements in aluminum die-casting technology, ensures the region remains at the forefront of innovation, making gigacasting a vital component of future vehicle production.

Asia Pacific Automotive Gigacasting Market Analysis

The Asia Pacific market is experiencing considerable growth, supported by the rapid expansion of electric vehicle (EV) manufacturing and rising investments in advanced production technologies. On 12th September 2024, the company Tata Power EV Charging Solutions, under Tata Power Renewable Energy, agreed to establish 200 fast-charging stations for electric commercial vehicles in metropolitan cities of India. The cities mentioned include Mumbai, Delhi, Chennai, Bengaluru, and Kolkata. These stations will cater to convenient charging for small electric commercial vehicles, enhancing sustainable mobility. Countries such as China, Japan, and South Korea dominate the region with their innovative ideas in automotive by using gigacasting for their manufacturing process to fulfill their demand for energy-efficient, light-weighted cars. In addition, government policies and incentives, as well as strong industrial supply chains that support EV usage, have stimulated the adoption of gigacasting further. Additionally, the growing focus on cost-effective mass production and sustainability has encouraged automakers to adopt high-pressure aluminum die-casting technologies. Asia Pacific’s dominance in the global automotive market ensures its continued leadership in the integration of gigacasting into next-generation vehicle production.

Latin America Automotive Gigacasting Market Analysis

The Latin America market is growing steadily, driven by increasing investments in automotive manufacturing and the rising adoption of electric vehicles (EVs). Countries including Mexico and Brazil are emerging as key players due to their strong automotive production bases and access to cost-effective labor. On 22nd March 2024, the first teardown of a Tesla Cybertruck showed that 25% of its parts were made in Mexico, including steering and suspension components, while 65% of its parts are from the U.S. or Canada. It is equipped with a 123 kWh structural 4680 battery integrated into the chassis, along with a new 48V steer-by-wire system with dual redundant motors, and rear gigacasting of the Cybertruck. Automakers in the region are adopting gigacasting to reduce production prices and improve efficiency. Additionally, growing environmental awareness and regional policies supporting lightweight vehicle designs are enhancing the demand for gigacasting technologies.

Middle East and Africa Automotive Gigacasting Market Analysis

The Middle East and Africa market is witnessing stable growth due to the rising adoption of advanced manufacturing technologies aimed at improving production efficiency. The demand for lightweight automotive components and electric vehicles is driving investments in gigacasting technology across the region. On 16th September 2024, the new McLaren GTS debuted in the Middle East at an exclusive event in Abu Dhabi, where it presents a perfect combination of lightweight engineering and luxury. Equipped with a 4.0-litre twin-turbo V8 good for 635PS, this super-lightweight GTS reaches 100km/h in 3.2 seconds, 200km/h in 8.9 seconds, and boasts daily usability in combination with exceptional performance from a supercar. Furthermore, initiatives by the governments of various countries in the region related to sustainable practices and technology are propelling market development. In addition to this, the integration of automation and smart manufacturing solutions is changing the capabilities of production and offering growth opportunities.

Competitive Landscape:

The competitive market landscape is driven by continuous innovation, strategic partnerships, and considerable investments in high-end manufacturing technologies. The key players are increasingly focusing on developing high-pressure die-casting solutions that meet the rapidly growing demand for lightweight and strong components, mainly for electric vehicles. Companies are further augmenting their production capacities and automating their plants to cut costs and improve operations. Besides, the widespread demand for sustainability has impelled manufacturers adapt to green technologies, including the use of recyclable materials. The market is experiencing increased competition as firms geographically expand to meet growing regional demand. Moreover, partnerships with automakers to co-develop gigacasting solutions have also become a critical strategy to gain a competitive edge in this changing industry.

The report provides a comprehensive analysis of the competitive landscape in the automotive gigacasting market with detailed profiles of all major companies, including:

- Idra S.r.l.

- L.K. Technology Holdings Limited

- Bühler Holding AG

- Birch Machinery Company

- Handtmann Group

- HAITIAN DIE CASTING

- Oskar Frech GmbH + Co. KG

- Shibaura Machine CO., LTD.

- SUZHOU SANJI FOUNDRY EQUIPMENT CO., LTD.

- UBE Machinery Inc.

- Yizumi Holdings Co., Ltd.

- ZITAI PRECISION MACHINERY CO., LTD.

Latest News and Developments:

- October 04, 2024: Bühler Group secured a major contract to supply four Carat 920 mega-casting cells to China's Duoli Technology. The deal represents one of the biggest single orders received by the Bühler Group. It will significantly increase the capacity of Duoli Technology in producing large structural components for EVs, such as one-shot rear underbodies, on behalf of global OEMs. Duoli Technology, which has three foundries in China, now solidifies its position as one of the largest mega-casting suppliers worldwide.

- November 20, 2024: Shibaura Machine Co., Ltd. unveiled plans to launch its ultra-large die casting machines in the giga-casting market. Among these is a 12,000-ton model, scheduled for launch in FY2025. The company, already experienced in developing space-saving designs and service capabilities, hopes to meet growing demand from Japanese car manufacturers who have started adopting giga-casting. It continues to develop low-pressure casting technology for efficient, compact production solutions.

Automotive Gigacasting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Locking Forces Covered | 10,000 kN to 30,000 kN, 30,000 kN to 60,000 kN, Above 60,000 kN |

| Applications Covered | Body Part, Engine Part, Transmission Part, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Idra S.r.l., L.K. Technology Holdings Limited, Bühler Holding AG, Birch Machinery Company, Handtmann Group, HAITIAN DIE CASTING, Oskar Frech GmbH + Co. KG, Shibaura Machine CO., LTD., SUZHOU SANJI FOUNDRY EQUIPMENT CO., LTD., UBE Machinery Inc., Yizumi Holdings Co., Ltd., ZITAI PRECISION MACHINERY CO., LTD., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive gigacasting market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive gigacasting market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive gigacasting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive gigacasting market was valued at USD 118.4 Million in 2024.

IMARC estimates the automotive gigacasting market to exhibit a CAGR of 43.60% during 2025-2033, reaching a value of USD 3913.75 Million by 2033.

The market is driven by the growing demand for lightweight, high-strength vehicle components to enhance performance and fuel efficiency, the rising adoption of electric vehicles (EVs) supported by government incentives, advancements in high-pressure die-casting technologies, and the push for sustainability and eco-friendly manufacturing processes.

Asia Pacific currently dominates the automotive gigacasting market, accounting for a share exceeding 44.3% in 2024. This dominance is fueled by the region's robust automotive manufacturing capabilities, investments in EV production, and favorable government policies promoting eco-friendly manufacturing.

Some of the major players in the automotive gigacasting market include Idra S.r.l., L.K. Technology Holdings Limited, Bühler Holding AG, Birch Machinery Company, Handtmann Group, HAITIAN DIE CASTING, Oskar Frech GmbH + Co. KG, Shibaura Machine CO., LTD., SUZHOU SANJI FOUNDRY EQUIPMENT CO., LTD., UBE Machinery Inc., Yizumi Holdings Co., Ltd., and ZITAI PRECISION MACHINERY CO., LTD., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)