Automotive Fuel Tank Market Size, Share, Trends and Forecast by Material Type, Capacity, Vehicle Type, Distribution Channel, and Region, 2026-2034

Automotive Fuel Tank Market Size and Share:

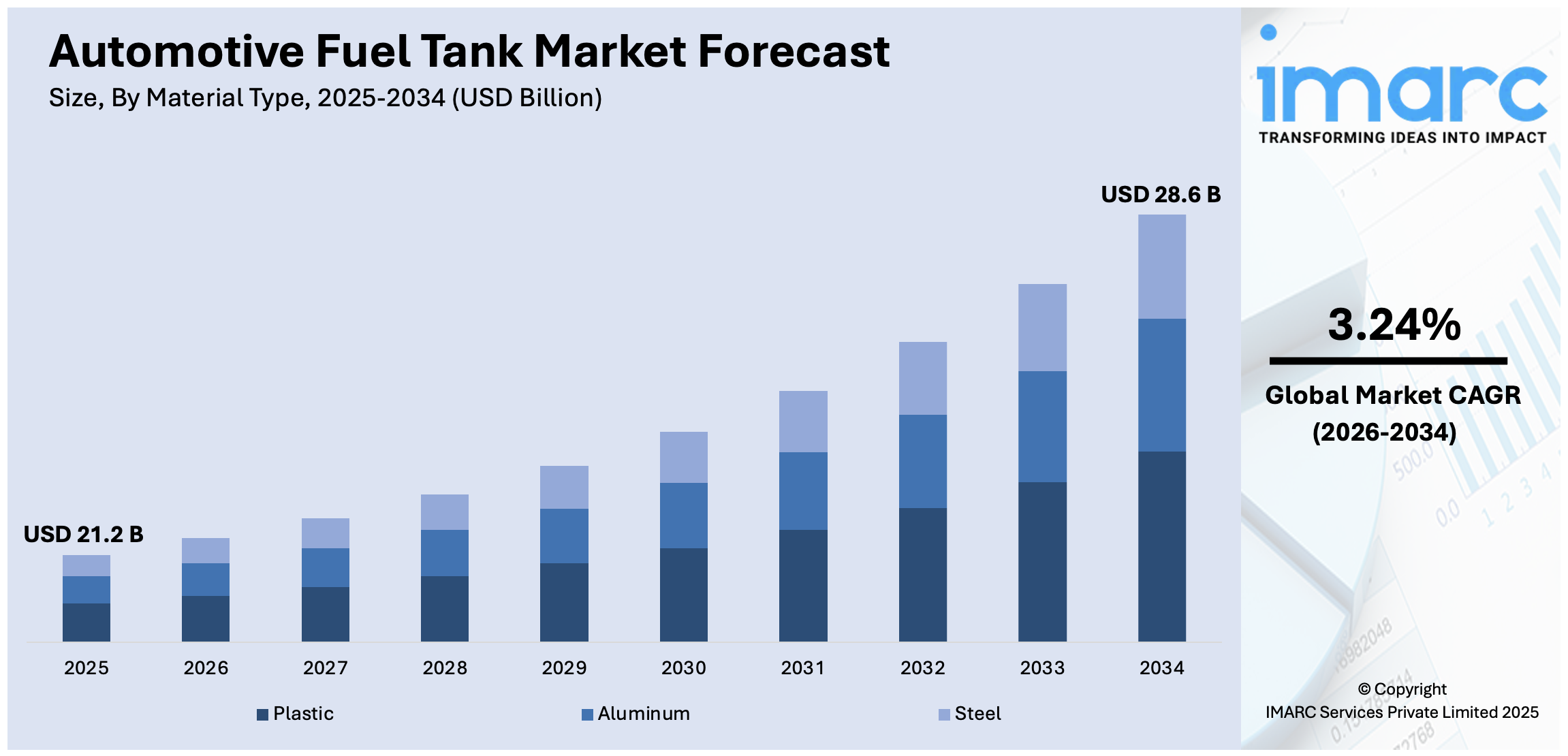

The global automotive fuel tank market size was valued at USD 21.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 28.6 Billion by 2034, exhibiting a CAGR of 3.24% during 2026-2034. Asia Pacific currently dominates the market, holding a significant market share of over 52.6% in 2025. The market is experiencing stable growth driven by the increasing adoption of vehicles among the masses, rising demand for enhanced fuel efficiency in vehicles, and stringent environmental regulations to mitigate carbon impact and maintain environmental sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 21.2 Billion |

|

Market Forecast in 2034

|

USD 28.6 Billion |

| Market Growth Rate (2026-2034) | 3.24% |

The global automotive fuel tank market is driven by several key factors, including the increasing demand for fuel-efficient vehicles and stringent environmental regulations aimed at reducing emissions. The rise in vehicle production, particularly in emerging markets, further fuels market growth. Additionally, advancements in fuel tank technology, such as the development of lightweight materials and innovative designs, enhance performance and safety. The shift towards alternative fuel vehicles, including electric and hybrid models, is also influencing the market, as manufacturers seek to adapt fuel tank solutions to accommodate new energy sources. These drivers collectively contribute to the evolving landscape of the automotive fuel tank market.

To get more information on this market Request Sample

The United States is a significant player in the global automotive fuel tank market, characterized by a well-established automotive industry and a strong consumer demand for diverse vehicle types. The country is home to major automotive manufacturers that prioritize innovation and compliance with stringent environmental regulations. Increasing emphasis on fuel efficiency and sustainability is driving the development of advanced fuel tank technologies, including lightweight materials and enhanced safety features. Additionally, the growing adoption of hydrogen and hybrid vehicles is reshaping market dynamics, prompting manufacturers to explore alternative fuel solutions. For instance, industry reports indicate that as of November 2024, total 18,428 fuel cells electric vehicles (FCEVs) have been leased and sold in the U.S., with 44 hydrogen fuel stations solely available in California. As a result, the U.S. market is set for stable transformation and expansion.

Automotive Fuel Tank Market Trends:

Rising Adoption of Vehicles

In 2022, 85.4 million motor vehicles were produced globally, marking a 5.7% increase compared to 2021, as per European Automobile Manufacturers' Association (ACEA). The heightening need for automotive fuel tanks majorly because of the escalating sales of vehicles among the masses across the world is providing an optimistic market outlook. In line with this, the accelerating requirement for personal transportation services among individuals is bolstering the market expansion. Moreover, people are actively navigating for effective and convenient transportation options to travel to various regions for entertainment, business, or leisure purposes. Besides this, the amplifying need for enhanced automotive fuel tanks on account of magnifying inclination toward more fuel-saving and cleaner vehicles. In addition, manufacturers are heavily investing in technologies that significantly lower emissions and improve fuel efficiency. They are also manufacturing advanced fuel tank materials as well as designs, which is boosting the market expansion. Furthermore, there is an elevation in the utilization of advanced plastics as well as composite materials, which aids in the production of fuel tanks that are both impact and corrosion resistant. In addition, consumers are rapidly gaining awareness regarding environmental safety. Apart from this, the rise of alternative fuel technologies is fostering the growth of the global market.

Stringent Emission Regulations

In March 2024, the EPA finalized more protective and stringent standards designed to limit harmful air-polluting emissions from vehicles, initiating in 2027. The final rule continues development on federal greenhouse gas emission standards by EPA for passenger cars and light trucks for years 2023 through 2026. Governing agencies of numerous countries are imposing stringent rules and regulations on vehicle emissions to mitigate environmental impact, which is contributing to the growth of the market. In line with this, these regulations often include limits on fuel vapor emissions, which is leading to the development of advanced fuel tanks. Moreover, key players are introducing modern fuel tanks that incorporate features like improved sealing, vapor recovery systems, and materials with lower permeability to reduce fuel vapor emissions. Apart from this, they are constantly adapting to these evolving regulations to ensure their products comply with environmental standards. Furthermore, the integration of emission control technologies, such as carbon canisters and leak detection systems, to ensure that any potential leaks or emissions are quickly detected and addressed is propelling the market growth. In addition, manufacturers are implementing rigorous quality control measures to ensure the integrity of fuel tank components and systems, reducing the chances of leaks.

Increasing Demand for Enhanced Fuel Efficiency

The escalating demand for enhanced fuel efficiency in vehicles is supporting the growth of the market. Besides this, automakers are increasingly developing vehicles that consume less fuel and emit less greenhouse gas (GHG) emissions. In addition, they are utilizing lightweight materials and aerodynamic designs, which directly impact fuel tank specifications. Reducing the drag coefficient by 10% can improve fuel efficiency by 5-7% at highway speeds, illustrating the importance of aerodynamics in modern automotive design, according to industry reports. Apart from this, manufacturers are exploring innovative materials and shapes for fuel tanks to reduce vehicle weight and improve aerodynamics. Moreover, plastic and composite materials are becoming more prevalent due to their lower weight and design flexibility. Furthermore, reshaping fuel tanks to fit within the frame of the vehicle is crucial to minimize air resistance. In line with this, people are increasingly adopting vehicles with improved fuel efficiency to reduce carbon footprint and maintain environmental sustainability. Additionally, the growing demand for smaller and more fuel-efficient vehicles that are easier to maneuver in city environments is offering a positive market outlook.

Automotive Fuel Tank Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive fuel tank market, along with forecast at the global and regional levels from 2026-2034. The market has been categorized based on material type, capacity, vehicle type, and distribution channel.

Analysis by Material Type:

- Plastic

- Aluminum

- Steel

Plastic leads the market with around 67.5% of market share in 2025. This is due to its numerous benefits over conventional materials like metal. The lightweight profile of plastic facilitates enhanced fuel efficiency and minimized emissions in vehicles, catering to the automotive sector’s inclination toward sustainability. In addition, plastic fuel tanks provide improved resistance against both chemical degradation and corrosion, reinforcing reliability as well as longevity. Moreover, the capability to mold plastic into sophisticated shapes facilitates better design flexibility, allowing producers to upgrade space within the vehicle. Furthermore, innovations in plastic technology, mainly encompassing the formulation of high-density polyethylene (HDPE) and various other specialized polymers, have enhanced the operational attributes of plastic fuel tanks. As automakers rapidly focus on cost-efficiency and weight reduction, the adoption of plastic fuel tanks is anticipated to continue increasing, fortifying its position as the major material segment in the global market.

Analysis by Capacity:

- Less Than 45 Liter

- 45 - 70 Liter

- Above 70 Liter

Less than 45 liter leads the market with around 47.2% of market share in 2025. This segment is primarily driven by the increasing popularity of compact and subcompact vehicles. These smaller vehicles are designed to cater to urban consumers who prioritize fuel efficiency and maneuverability in congested environments. The demand for smaller fuel tanks aligns with the trend towards lightweight vehicle designs, which enhance overall performance and reduce emissions. Additionally, advancements in engine technology have allowed manufacturers to optimize fuel consumption, making smaller tanks more viable without compromising driving range. As urbanization continues to rise, the need for efficient transportation solutions will further bolster the demand for vehicles equipped with smaller fuel tanks. Consequently, this segment is expected to maintain its leading position as automakers adapt to changing consumer preferences and regulatory requirements.

Analysis by Vehicle Type:

- Passenger Vehicles

- LCVs

- HCVs

Passenger vehicles lead the market with around 65.8% of market share in 2025, reflecting the significant demand for personal transportation solutions. The growing global population and increasing urbanization have led to a surge in the number of passenger vehicles on the road, driving the need for efficient fuel tank solutions. Automakers are focusing on enhancing the performance and safety of fuel tanks in passenger vehicles, ensuring compliance with stringent regulations while meeting consumer expectations for reliability. Additionally, the shift towards electric and hybrid vehicles is influencing the design and materials used in fuel tanks, as manufacturers seek to integrate alternative fuel systems. The emphasis on comfort, convenience, and advanced technology in passenger vehicles further propels the demand for innovative fuel tank designs. As the automotive industry evolves, the passenger vehicle segment is poised to remain a key driver of growth in the automotive fuel tank market.

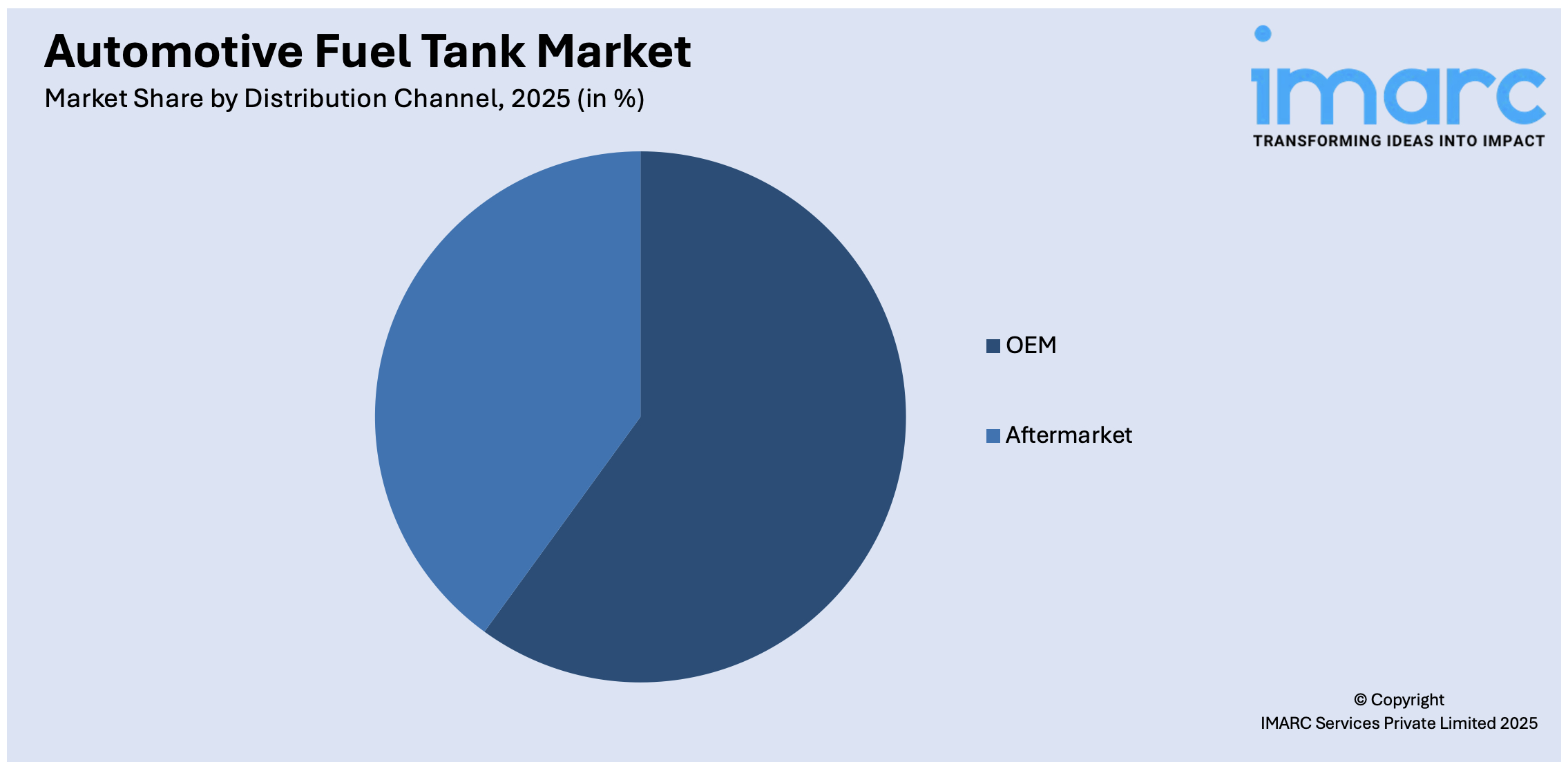

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- OEM

- Aftermarket

OEM lead the market with around 62.5% of market share in 2025. Original equipment manufacturer (OEM) supply fuel tanks directly to automobile manufacturers for incorporation into new vehicles during the manufacturing process. OEM fuel tanks are designed and manufactured to meet the specifications and requirements of automakers, ensuring seamless integration into their vehicles. OEM suppliers are collaborating with automakers to develop customized fuel tank solutions that meet safety, performance, and design criteria. As a result, OEMs have emerged as the leading distribution channel segment in this market. This domination is fueled by the escalating need for dependable, superior-quality components that comply to strict regulatory policies. Additionally, the close partnerships between OEMs and automakers facilitate innovation and efficiency in production, further solidifying their position in the market.

Regional Analysis

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2025, Asia Pacific accounted for the largest market share of over 52.6%. The Asia Pacific automotive fuel tank market is going through a rapid growth trajectory, with India's robust figures of automobile production and exports. As per IBEF, India's annual automobile production in FY23 stood at 25.9 million vehicles. There is strong domestic demand and an export market. India produced 2.36 million units in April 2024 across all segments-including passenger vehicles, three-wheelers, two-wheelers, and quadricycles. Further, in FY23, India's total automobile exports stood at 4.76 million units. The rising production and exports directly boost the demand for automotive fuel tanks since every vehicle requires a safe fuel storage solution. As India continues to grow in both domestic and international markets, the demand for high-quality, innovative fuel tank technologies will continue to rise, thus further boosting the Asia Pacific automotive fuel tank market. The region's growing automotive sector and increasing vehicle production are significant factors driving this market forward.

Key Regional Takeaways:

United States Automotive Fuel Tank Market Analysis

In 2025, United States accounted for 82.5% of the market share in North America. The growth in the United States automotive fuel tank market is based on the constant rise in motor vehicle production. According to an industrial report, U.S. motor vehicle production rose to 10,611,555 units in December 2023, from 10,052,958 units recorded in December 2022. This means that increased production leads to increased demand for vehicles, which then translates to an increased need for automotive fuel tanks. As the production of vehicles increases, so does the demand for efficient, safe, and durable fuel storage solutions. Additionally, the rising popularity of electric vehicles (EVs) and hybrid models has a direct impact on the market as well because such vehicles need specific designs of fuel tanks for their power source, such as hydrogen storage tanks in fuel cell vehicles. The expansion in vehicle production, coupled with evolving automotive technologies, continues to be a key factor propelling the growth of the automotive fuel tank market in the U.S.

North America Automotive Fuel Tank Market Analysis

North America plays a pivotal role in the global automotive fuel tank market, driven by a robust automotive industry and a strong consumer base. The region is characterized by the presence of major automotive manufacturers and suppliers, fostering innovation in fuel tank technology. Moreover, increasing regulatory standards for emissions and safety are prompting automakers to invest in advanced fuel tank solutions, including lightweight materials and enhanced designs. For instance, the government of Canada launched a regulated target for zero-emission vehicle (ZEV) sales, mandating that 100% of passenger cars and light trucks sold be ZEVs by 2035, with provisionary targets of 20% by the year 2026 and 60% by 2030. Additionally, the growing trend towards electric and hybrid vehicles is influencing the development of alternative fuel systems, further shaping the market landscape. As consumer preferences shift towards fuel efficiency and sustainability, North America is expected to remain a significant contributor to the evolution of automotive fuel tank technologies.

Europe Automotive Fuel Tank Market Analysis

The Europe automotive fuel tank market is strongly supported by the surge in new car sales and production across the region. According to ACEA, EU new car sales increased by nearly 14%, totaling 10.5 million units in 2023. Moreover, the region is positioned as the second-largest car producer in the world, with production accounting for 12.1 million units, indicating over 11% growth. The more vehicles produced, the higher the demand for automotive fuel tanks because every new vehicle needs an efficient, safe, and reliable fuel storage solution. The increased trend of fuel-efficient and eco-friendly vehicles, including electric and hybrid models, is also creating a demand for innovative fuel tank technologies. With increasing car production, particularly in the core markets of Germany, France, and Italy, the demand for advanced fuel tank solutions will continue to be a key growth driver for the European automotive fuel tank market.

Latin America Automotive Fuel Tank Market Analysis

As large improvements in auto production are envisaged in the major automotive markets of Brazil and Mexico, the Latin American automobile fuel tank market is optimistic. Industry reports have accounted for an increase of 6.8% for Brazil's auto production up to 2.75 million units during the year 2025, signaling this industry sector's strengthening in Brazil with a subsequent boost in automobile fuel tanks. In Mexico, OEMs in November 2024, manufactured 351,535 light vehicles, which was up 6.7% in the same month of 2023. The strong automotive industry in Mexico is one of the factors where this country is a very important vehicle manufacturing hub, meaning fuel tanks are in an upward trend. As more vehicles are being produced each month in both countries, there will be a high demand for efficient and dependable fuel storage, and this can drive the market growth. The positive production outlook in the region is a key driver for the amplifying the automotive fuel tank market share.

Middle East and Africa Automotive Fuel Tank Market Analysis

According to an industrial report, Saudi Arabia has around nearly 8 million passenger cars on the road and at least 650,000 new vehicles every year; it is one of the biggest automotive markets in the Middle East. Such an enormous vehicle fleet demands increasingly more automotive fuel tanks for the market. With Saudi Arabia's automotive industry on an upward trend, especially through the sales of passenger cars, the demand for efficient fuel storage solutions is also rising. The focus of the country towards expanding infrastructure and urbanization further supports demand for automotive fuel tanks. In addition, the strong economic position of the country in a strategic location related to international trade further endorses the role of Saudi Arabia within the regional market of the automobile. With more new cars entering the marketplace, this market for the fuel tank will continue going up hand in hand with the expansion of cars. The vehicle fleet growth is directly connected to the expanding automotive fuel tank market size in Saudi Arabia and the broader Middle East and Africa region.

Competitive Landscape:

Key players are investing in research and development (R&D) activities to explore and adopt advanced materials like composite plastics and lightweight alloys. These materials help reduce the weight of fuel tanks while improving overall vehicle fuel efficiency. In line with this, companies are innovating fuel tank design to optimize space within vehicles and improve safety features by developing uniquely shaped tanks to fit within vehicle frames efficiently and incorporating anti-slosh technology. They are also investing in technologies that reduce fuel vapor emissions from fuel tanks and enhance sealing mechanisms that are integrated into fuel tank designs to ensure compliance. Furthermore, manufacturers are improving safety features in fuel tanks, such as reinforced tank designs, crash-resistant materials, and enhanced leak prevention systems. In addition, strategic collaborations are prevalent that are effectively boosting the competitive dynamics. For instance, in August 2024, Toyota and BMW announced plans to upgrade their tactical partnership under which Toyota will supply BMW with more critical automotive components, such as hydrogen tanks. This collaboration highlights the growing interest in hydrogen as a viable energy source for vehicles, which could significantly impact the fuel tank market by driving innovation and investment in hydrogen storage solutions.

The report provides a comprehensive analysis of the competitive landscape in the automotive fuel tank market with detailed profiles of all major companies, including:

- Plastic Omnium

- Kautex Textron

- Yapp Automotive

- TI Automotive

- Yachiyo Industries Co. Limited

- Magna International

- Martinrea International Inc.

- Unipres Corporation

- Continental

- Lyondell Basell

- Allgaier Automotive

- Boyd Welding

- Dali and Samir Engineering

- Posco co. Ltd

- Baosteel Group Corporation

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- March 2024: Eaton announced the launch of a new fuel tank isolation valve (FTIV) designed for hybrid vehicles.

- November 2023: Robert Bosch GmbH unveiled the launch of H2 Mobility, which is an advanced solution consisting of a tank system, fuel injection system, sensors, exhaust gas treatment system, and controllers. It is equipped with several components, including an ignition coil, injectors, control unit, rail, DNOX, spark plug, Pr. sensor-EGT, and throttle valve. The company provides H2E technology to long-haul trucks and offers products in various segments, such as LCVs, SUVs, coaches, and heavy-duty buses.

- October 2020: ElringKlinger and Plastic Omnium formed a joint venture, EKPO Fuel Cell Technologies, to advance hydrogen mobility. ElringKlinger will hold a 60% stake, contributing its extensive fuel cell expertise and assets, while Plastic Omnium will own 40% and enhance development capabilities. The venture aims to mass-produce fuel cell stacks for CO2-neutral mobility, starting with an initial capacity of 10,000 units. Additionally, Plastic Omnium has acquired ElringKlinger's Austrian subsidiary specializing in integrated hydrogen systems to bolster its hydrogen strategy.

- March 2020: Martinrea International Inc. completed the acquisition of Metalsa S.A. de C.V.'s Structural Components for Passenger Cars division for USD $19.5 million. This deal adds six plants across Germany, the U.S., Mexico, South Africa, and China, enhancing Martinrea's capabilities in metal forming technologies and lightweight structures.

Automotive Fuel Tank Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Plastic, Aluminum, Steel |

| Capacities Covered | Less Than 45 Liter, 45 - 70 Liter, Above 70 Liter |

| Vehicle Types Covered | Passenger Vehicles, LCVs, HCVs |

| Distribution Channels Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Plastic Omnium, Kautex Textron, Yapp Automotive, TI Automotive, Yachiyo Industries Co. Limited, Magna International, Martinrea International Inc., Unipres Corporation, Continental, Lyondell Basell, Allgaier Automotive, Boyd Welding, Dali and Samir Engineering, Posco co. Ltd, Baosteel group corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive fuel tank market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive fuel tank market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive fuel tank industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global automotive fuel tank market was valued at USD 21.2 Billion in 2025.

IMARC Group estimates the market to reach USD 28.6 Billion by 2034, exhibiting a CAGR of 3.24% during 2026-2034.

Key factors driving the market include the rising demand for fuel-efficient vehicles, stringent environmental regulations, and advancements in fuel tank technology. Additionally, the growth of electric and hybrid vehicles necessitates innovative fuel solutions, further influencing market dynamics and development.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global automotive fuel tank market include Plastic Omnium, Kautex Textron, Yapp Automotive, TI Automotive, Yachiyo Industries Co. Limited, Magna International, Martinrea International Inc., Unipres Corporation, Continental, Lyondell Basell, Allgaier Automotive, Boyd Welding, Dali and Samir Engineering, Posco co. Ltd, Baosteel group corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)