Automotive Engine Market Size, Share, Trends and Forecast by Placement Type, Fuel Type, Vehicle Type, and Region, 2025-2033

Automotive Engine Market 2025, Size and Share:

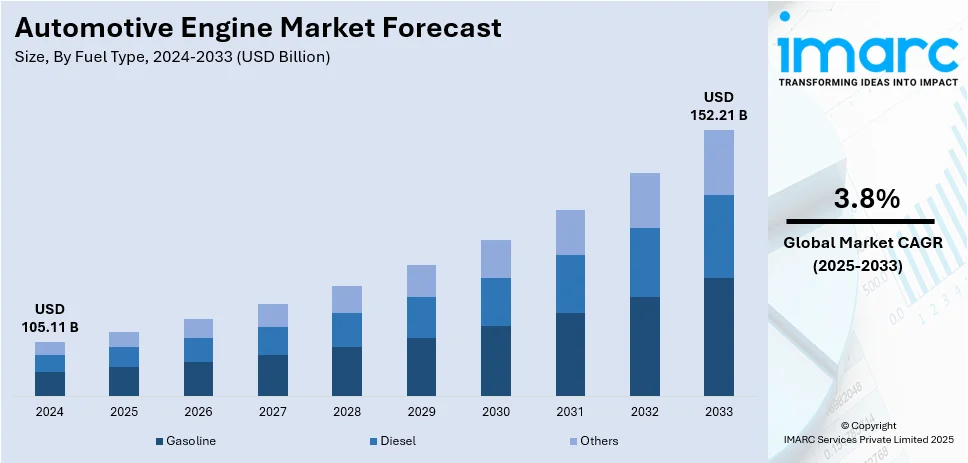

The global automotive engine market size was valued at USD 105.11 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 152.21 Billion by 2033, exhibiting a CAGR of 3.8% from 2025-2033. The market is witnessing significant growth due to the rise in global vehicle production and innovative engine manufacturing. Furthermore, the transition to electric and hybrid powertrains, focus on fuel efficiency and emission reduction, and the integration of advanced engine technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 105.11 Billion |

| Market Forecast in 2033 | USD 152.21 Billion |

| Market Growth Rate (2025-2033) | 3.8% |

One of the key factors driving the growth in the global automotive engine market is the increase in global vehicle production, especially in emerging markets. The higher demand for passenger cars and commercial vehicles due to increasing economies and urbanization accelerates the need for engines in these segments. For instance, in 2024, 25% of users explore hybrid or electric vehicles, driven by growing options as major automakers expand their lineups with new models catering to evolving consumer preferences. Developing regions with expanding middle-class populations are experiencing higher vehicle ownership rates, fueling production. Automakers are also diversifying their engine offerings to cater to different consumer preferences, including compact, fuel-efficient models and powerful engines for SUVs and trucks. This growth in vehicle manufacturing directly influences the demand for innovative and cost-effective engine solutions worldwide.

The United States plays a pivotal role in the global automotive engine market through innovation, manufacturing advanced engine technologies, and setting industry standards. Major U.S. automobile companies and suppliers are making massive investments in research and development for high-performance, fuel-efficient, and low-emission engines that meet the changing environmental regulations. Moreover, the U.S. is at the forefront of adopting electric vehicle powertrains and hybrid systems, which will determine the future of automotive propulsion. For instance, in 2024, Toyota announced a $1.3 billion investment to prepare its Kentucky factory for producing a new three-row all-electric SUV for U.S. consumers, bringing its total investment to nearly $10 billion. With a strong manufacturing base, advanced engineering expertise, and a robust supply chain, the U.S. continues to serve as a key player in the development and production of cutting-edge automotive engines.

Automotive Engine Market Trends:

Transition to Electric and Hybrid Powertrains

A key trend in the automobile engine market is electric vehicle and hybrid powertrains. As the issue of environmental sustainability grows in severity, along with tightened regulatory controls on emissions, producers are investing more in electrified and hybrid technology. For example, by 2024, Ford changed its EV strategy as it replaced all-electric SUVs with hybrid versions, which have a lower battery range but a more extended total range. That change may cost the firm up to $1.5 billion. Governments everywhere are implementing policies that reward the adoption of EVs; this is making the whole transition faster. This transition is slowly replacing traditional, more polluting ICE-based vehicles with cleaner alternatives. This shift is changing engine designs and opening new doors for suppliers in the area of battery production, electric drivetrains, and charging infrastructure. The market for hybrid engines, where internal combustion combines with electric power, is on the rise, allowing customers to enjoy the benefits of performance and reduced emissions.

Focus on Fuel Efficiency and Emissions Reduction

Fuel efficiency continues to be a major focus for car manufacturers, as consumers increasingly demand lower operating costs and governments set strict regulations on fuel economy and emissions. Turbocharging, direct fuel injection, and variable valve timing are being integrated into engine designs to increase efficiency without sacrificing performance. For example, in 2024, the new HELM version of the X15 diesel engine from Cummins features a 7% better fuel economy than the 2024 model, and meets the 2027 standards of emissions, and its variable geometry turbocharger enhances performance. Producers are increasingly encouraged to allocate resources toward advanced, energy-efficient engine technologies due to the drive for reduced carbon dioxide emissions. These innovations, besides supporting the automobile manufacturer to comply with environmental regulations, meet consumer demand for greener vehicles and thereby aid in the transition of the industry toward sustainability.

Integration of Advanced Engine Technologies

The automotive engine market experiences integration of highly sophisticated technology with a motive to ensure the engine produces better and improved performance, reliability, and safety. Variable compression ratio engines, smart sensors that allow for real-time monitoring of engines, as well as advanced combustion technology, are becoming more predominant to make driving easier and smoother. For example, in 2024, Holley released Hi-Ram EFI intake manifolds for classic small-block Chevy engines, providing sneaky performance upgrades with 95mm or 105mm throttle bodies, increasing power without custom fabrication or changing the appearance of the vehicle. Another is the incorporation of new materials such as aluminum and carbon fiber into engine parts to decrease weight, which then decreases fuel consumption. It also includes an increasingly important role for artificial intelligence (AI) and machine learning in predictive maintenance and engine diagnostics, which allows manufacturers to optimize engine longevity and operational efficiency.

Automotive Engine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive engine market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on placement type, fuel type, and vehicle type.

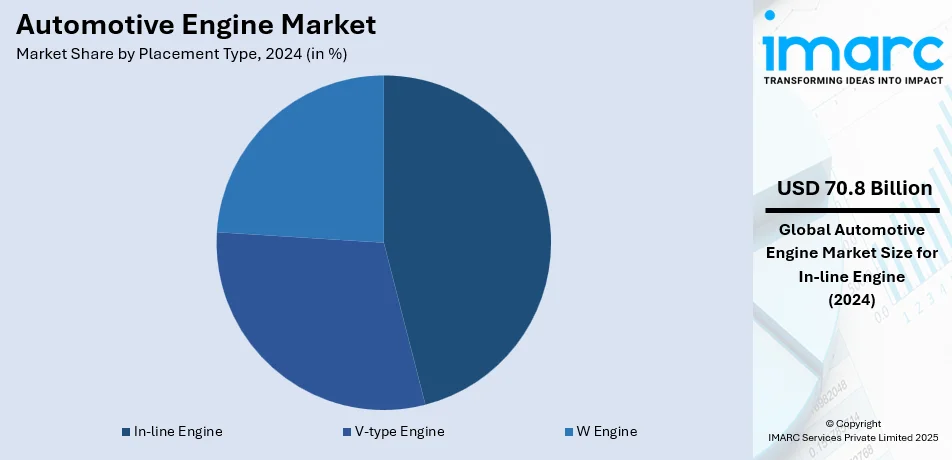

Analysis by Placement Type:

- In-line Engine

- V-type Engine

- W Engine

In-line engine accounts for the largest share of 46.5% in 2024. An in-line engine refers to a type of internal combustion engine where the cylinders are positioned in a linear arrangement along a single central axis. These engines are mostly vertical and found in the block of the engine. It is one of the widely used types of engines in the automobile industry because it is simple, compact, and less expensive. It is most commonly used in small to mid-sized vehicles and strikes a balance between performance, fuel efficiency, and cost. They are also easier to build, support, and fix than many other more complex engine arrangements, including V or flat engines. In-line engines are the perfect answer for daily mass consumer autos, therefore for the mass production of reliable fuel efficient engines and remain to be a primary element to both meet governmental regulations and the expectations of consumers who are looking for affordable efficiency transportation.

Analysis by Fuel Type:

- Gasoline

- Diesel

- Others

Gasoline represents the largest fuel type holding a 36.2% share in 2024. Gasoline serves as a widely utilized fuel for internal combustion engines, predominantly powering passenger vehicles. Being extracted from crude oil, gasoline finds favor in applications due to its high energy density and ease of storage. Moreover, gasoline, being less expensive than any other type of fuel, powers the majority of the light-duty vehicles in the automotive engine market because of its widespread availability across global fuel infrastructure. It serves the market by offering a well-established and efficient solution for consumer transportation, with engines optimized for performance, fuel efficiency, and reduced emissions. While the market is moving toward alternative fuels and electric vehicles, gasoline remains the dominant fuel type, thereby supporting continued demand for traditional internal combustion engine (ICE) vehicles and contributing to their widespread adoption and accessibility.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Passenger cars account for the largest share of 67.2% in 2024. Passenger cars are among the most significant vehicle categories in the automotive industry. Primarily, they are intended to carry people and smaller groups. These vehicles, which are predominantly equipped with ICE or hybrid/electric powertrains, form the basis of personal mobility on this planet. Passenger cars in the automotive engine market generate huge demand for a whole spectrum of engine technologies including gasoline, diesel, hybrid, and electric engines. They contribute to market growth by requiring continuous innovation in the efficiency, performance, and reduction of emissions of engines. Passenger cars are at the heart of the adoption of hybrid and electric engines, which drives the development of next-generation automotive technologies and sustainable engine solutions as consumer preference shifts towards more fuel-efficient and environmentally friendly options.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

Key Regional Takeaways:

North America Automotive Engine Market Analysis

The North American automotive engine market remains robust, driven by technological advancements and a strong demand for fuel-efficient and performance-oriented vehicles. The region's focus on reducing emissions has spurred the adoption of hybrid and electric powertrains, complemented by continued innovation in internal combustion engines (ICE). For instance, in 2024, Ford Pro partnered with Ecolab to electrify its North American fleet by 2030, starting in California with over 1,000 Ford F-150 Lightning Pro trucks and Mustang Mach-E SUVs. Regulatory measures such as CAFÉ standards push automakers to enhance efficiency while maintaining engine performance.

United States Automotive Engine Market Analysis

US accounts for 83.7% share in the market in North America. The automotive engine market of United States is growing dynamically because emphasis on fuel efficiency, good performance, and sustainability keeps on increasing. Still, the traditional internal combustion engine (ICE) still tops the list, however hybrid or electric powertrain becomes considerably popular due to strong governmental enforcement of environmental regulations as well as consumer's acceptance and demand for green vehicle emissions. The U.S. automakers are heavily investing in advanced technologies, such as turbocharging, direct fuel injection, and variable valve timing, to enhance engine performance with reduced emissions. The increasing popularity of electric vehicles is another factor changing the market dynamics, as the companies are making heavy investments in battery technology and electric vehicle infrastructure. For instance, in 2024, U.S. electric vehicle market share hit a record high, with 90% of fleet operators planning to expand EV adoption, leveraging electric vans and trucks to lower ownership and operating costs. In addition, the United States is still a major part of the global automotive engine industry, with significant research, development, and manufacturing capabilities. This change is making it a leader in sustainable automobile engineering.

Europe Automotive Engine Market Analysis

Strict environmental standards, increasing consumer preference for fuel-efficient vehicles, and the expanding transition to electrification are significant factors shaping the European automotive engine industry. For instance, the EPP highlights the 2025 EU fleet emissions target of 94g/km. Traditional internal combustion engines (ICE) are being optimized by technologies such as turbocharging, direct injection, and hybrid systems to meet the environmental standards. However, with aggressive carbon reduction targets of the EU and incentives given to electric vehicles, the market is rapidly shifting towards electric and hybrid powertrains. European automobile companies, such as Volkswagen, BMW, and Mercedes-Benz, are investing highly in the development of electric vehicles, battery technologies, and sustainable engine solutions, making Europe a world leader in the transformation of the global automotive engine market.

Asia Pacific Automotive Engine Market Analysis

The Asia Pacific automobile engine market has witnessed intense growth owing to the steady rise in the demand for vehicles, technologically evolved engines, and increased significance of sustainability within the region. Major automobile makers in countries including China, Japan, and India are the spearheads responsible for both internal combustion and hybrid powertrain development processes. For instance, in 2024, Toyota led Japanese manufacturers in market share, dominating Indonesia with 35.0% in September, followed by Daihatsu at 17.4% and Honda at 10.9%. The transition to electric vehicles (EVs) is gaining momentum, driven by governmental incentives, strict emissions standards, and growing consumer demand for environmentally sustainable options. As a result, automakers are investing heavily in electric vehicle infrastructure and battery technologies, positioning Asia Pacific as a key player in the global automotive engine market transition toward cleaner, more efficient powertrains.

Latin America Automotive Engine Market Analysis

The Latin American automobile engine market is increasing rapidly because of growing vehicle demands, urbanization, and a rise in disposable income. Even though the segment for traditional internal combustion (ICE) is more prevailing, there is an increase in the development of hybrid and electric vehicle demand due to environmental sensitivity and strict regulations. For example, ABVE of Brazil, in 2024, predicted the sales of fully electric and hybrid vehicles to increase by 60%. This represents a substantial growth in the country's shift toward sustainable automotive solutions. Conventional and emerging engine technologies have significant markets in Brazil, Mexico, and Argentina. Automakers are investing in fuel-efficient solutions, and governments are gradually implementing policies to support sustainable transportation. This shift is positioning Latin America as a developing hub for automotive engine innovation and adoption of cleaner technologies.

Middle East and Africa Automotive Engine Market Analysis

The Middle East and Africa automotive engine market is driven by increasing vehicle sales, urbanization, and rising demand for fuel-efficient engines. Traditional internal combustion engines (ICE) remain dominant, though there is growing interest in hybrid and electric vehicles (EVs) due to environmental concerns and government incentives. Key markets like Saudi Arabia, South Africa, and the UAE are witnessing a shift towards more sustainable engine technologies. Investments in fuel-efficient solutions and cleaner technologies are expected to drive growth, with a focus on emissions reduction and energy efficiency. For instance, in 2024, Saudis invested in gasoline engine maker HORSE, boosting its value to $7.9 billion, shifting focus to refined oil fuel amid a slowdown in the electric vehicle market.

Competitive Landscape:

The competitive landscape of the automotive engine market is characterized by significant rivalry among global automotive manufacturers, component suppliers, and emerging technology firms. Major players dominate the market, continually advancing engine performance, fuel efficiency, and emissions reductions. Additionally, leading suppliers deliver essential parts, such as turbochargers, fuel delivery systems, and electronic management units. The rise of electric vehicles (EVs) and hybrid powertrains has intensified competition, with companies investing in alternative propulsion technologies to meet environmental standards and shifting consumer preferences for sustainability. For instance, in 2024, Ford patented a new Positive Crankcase Ventilation (PCV) system, repurposing blow-by gases to improve combustion efficiency, reducing emissions and enhancing fuel use by bypassing the over-pressurized blow-off stage.

The report provides a comprehensive analysis of the competitive landscape in the automotive engine market with detailed profiles of all major companies, including:

- AB Volvo

- American Honda Motor Co., Inc. (Honda Motor Co., Ltd)

- Cummins Inc

- Ford Motor Company

- General Motors

- Mercedes-Benz Group AG

- Mitsubishi Heavy Industries - VST Diesel Engines Pvt Ltd.

- Toyota Industries Corporation

- Volkswagen

Latest News and Developments:

- In December 2024, the Department of Commerce agreed to provide $225 million in proposed funding to Bosch for expanding its silicon carbide (SiC) manufacturing facility in Roseville, California. This development further highlights the market's trajectory toward integrating innovative materials to support cutting-edge engine solutions.

- In December 2024, Honda and Nissan planned to merge and become the world's third-largest automobile seller. This strategic move highlights the automotive engine market's shift as manufacturers adapt to the transition from fossil fuels, focusing on hybrid, electric, and advanced engine technologies to meet evolving consumer demand and regulatory requirements.

Automotive Engine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Placement Types Covered | In-line Engine, V-type Engine, W Engine |

| Fuel Types Covered | Gasoline, Diesel, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Volvo, American Honda Motor Co., Inc. (Honda Motor Co., Ltd), Cummins Inc, Ford Motor Company, General Motors, Mercedes-Benz Group AG, Mitsubishi Heavy Industries - VST Diesel Engines Pvt Ltd., Toyota Industries Corporation, Volkswagen, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive engine market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive engine market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive engine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive engine market was valued at USD 105.11 Billion in 2024.

IMARC estimates the global automotive engine market to reach USD 152.21 Billion by 2033, exhibiting a CAGR of 3.8% during 2025-2033.

Key factors driving the global automotive engine market include rising vehicle production, increasing demand for fuel-efficient and low-emission technologies, regulatory mandates for cleaner engines, advancements in hybrid and electric powertrains, and consumer preference for performance-oriented engines. Emerging markets and technological innovations further contribute to the market's growth and diversification.

In 2024, in-line engine represented the largest segment by placement type, driven by their simpler design, cost-effectiveness, ease of manufacturing, and widespread use in passenger cars and light commercial vehicles.

Some of the major players in the automotive engine market include AB Volvo, American Honda Motor Co., Inc. (Honda Motor Co., Ltd), Cummins Inc, Ford Motor Company, General Motors, Mercedes-Benz Group AG, Mitsubishi Heavy Industries - VST Diesel Engines Pvt Ltd., Toyota Industries Corporation, Volkswagen, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)