Automotive Drivetrain Market Size, Share, Trends and Forecast by Vehicle Type, Drive Type, and Region, 2026-2034

Automotive Drivetrain Market Size and Share:

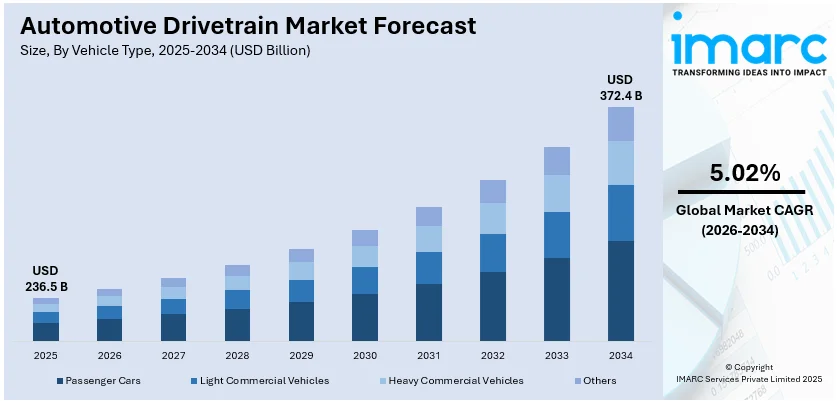

The global automotive drivetrain market size was valued at USD 236.5 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 372.4 Billion by 2034, exhibiting a CAGR of 5.02% during 2026-2034. Asia Pacific dominated the market, holding a significant market share of 40% in 2025. The rising sales rate of electric vehicles (EVs), continuous technological developments, and the increasing demand for lightweight driveshafts represent some of the key factors contributing to the automotive drivetrain market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 236.5 Billion |

|

Market Forecast in 2034

|

USD 372.4 Billion |

| Market Growth Rate (2026-2034) | 5.02% |

The automotive drivetrain industry is propelled by several driving factors. Growing demand from customers for fuel-efficient and powerful vehicles compels manufacturers to innovate. As fuel prices worldwide continue to fluctuate and emission regulations become stricter across the globe, consumers and manufacturers both focus on technologies that deliver better fuel economy without compromising power or reliability. In addition to this, stricter worldwide emission rules are driving the penetration of electric vehicles (EVs) and hybrid vehicles. Governments are providing incentives and mandates for electrically powered zero-emission cars, with a dramatic migration away from conventional internal combustion engines (ICEs) toward electrified powertrains. This has created a market for electric drivetrains that are less complex and more efficient than their ICE predecessors. Moreover, ongoing technological improvements in drivetrain systems are a key factor. Trends like high-end transmissions (e.g., dual-clutch transmissions, CVTs), combined electric drive units (e-axles), and intelligent all-wheel-drive systems improve vehicle performance, safety, and overall driving experience. The co-integration of electronics and sophisticated control units enables real-time power distribution adjustments, further driving the automotive drivetrain market growth.

To get more information on this market Request Sample

In the US, a significant consolidation is underway within the automotive drivetrain sector, driven by the industry's pivot toward electric and hybrid vehicle propulsion. Manufacturers are strategically merging to enhance their product portfolios, encompassing traditional internal combustion engine systems alongside next-generation EV technologies. This movement aims to bolster global market positions and adaptability amid the evolving landscape of vehicle power delivery. For instance, in January 2025, American Axle & Manufacturing (AAM) agreed to acquire Dowlais Group for approximately USD 1.44 Billion in cash and shares. This strategic move aims to create a combined entity with a strengthened product portfolio for internal combustion engine (ICE), hybrid, and electric vehicles (EV) drivetrains. The merger would enhance its global market position and ability to adapt to evolving propulsion trends.

Automotive Drivetrain Market Trends:

Accelerating Electrification of Propulsion Systems

The global automobile drivetrain industry is facing immense and fast-paced development. A huge spurt in global electric vehicle adoption radically alters the focus of the industry toward sustainable transport. This growing demand is revolutionizing industrial priorities to a great extent, leading to heavy investment in the production and large-scale manufacturing of electric motors, power electronics, and sophisticated battery systems. It requires a significant overhaul of existing production lines and new plants dedicated to electric drivetrain parts. In addition, the transition requires retraining of labor and enables new supply chain partnerships to enable high-volume production of advanced electric drivetrains. This ongoing evolution ensures a cleaner, more efficient, and technologically advanced future for transportation propulsion systems globally. According to the International Energy Agency (IEA), electric car sales topped 17 Million worldwide in 2024, marking an increase of more than 25%.

Deepening Electrified Drivetrain Integration

The automotive drivetrain market outlook is witnessing a remarkable transformation through increased cooperation between vehicle makers and system designers. This entails expanding existing working relationships to include sophisticated electric drive systems in more varied vehicle applications. Highly integrated, multi-motor, and multi-speed electric drivetrains are being emphasized that not only offer high power output but also remarkable traction and innovative functionalities. Such collaborations represent an investment in driving electric vehicle performance and efficiency to new levels, beyond simple electrification toward intricate, optimized propulsion systems. The industry as a whole is evolving toward more advanced, integrated, and high-performance electric drives, crafted through collaborative expertise and innovative engineering. For example, in February 2025, Magna expanded its long-term partnership with Mercedes-Benz by supplying the advanced eDS Duo electric drive system for the new electric off-roader. This dual-motor, 2-speed drivetrain offered up to 240 kW of power, exceptional traction, and unique features like 360-degree rotation, enhancing performance and efficiency in electrified vehicles.

Enhanced Electrified Mobility Accessibility

Based on the automotive drivetrain market forecast, the market is expected to receive a significant boost from the rapid expansion of global charging infrastructure. The widespread establishment of public charging facilities creates an unprecedented level of accessibility for electrified vehicles. This comprehensive availability is a crucial enabler, fostering increased consumer confidence in electric propulsion and directly stimulating higher demand for advanced electric drivetrains. Improved charging networks effectively alleviate concerns about vehicle range, a key historical barrier to broader adoption, thereby encouraging more individuals and fleets to embrace electric mobility. This robust infrastructure growth provides a strong positive feedback loop, validating and encouraging ongoing investment in the research, development, and manufacturing of innovative electric motors, power electronics, and integrated drivetrain systems. The increasing convenience of charging further accelerates the transition toward a future dominated by electrified vehicle technologies. For instance, the addition of more than 1.3 Million public EV charging points globally in 2024, as reported by the IEA, is projected to propel the market further in the coming years.

Automotive Drivetrain Market Opportunities:

Shift Towards EVs

The automotive drivetrain industry offers major opportunities, particularly with the worldwide transition to electric vehicles (EVs). Increasing demand for clean, fuel-efficient mobility creates a growing market for electric drivetrains. Emerging hybrid and full-electric technologies provide manufacturers with opportunities to diversify their portfolios and comply with environmental standards. Urbanization and rising vehicle ownership in developing economies also stimulate demand. Integration of intelligent technologies—such as torque vectoring and electronically controlled AWD systems—is worth more, making drivetrain systems more safe and more performing. In addition, R&D investments and strategic alliances promote innovation in lightweight materials and modular drivetrain systems. The drive for autonomous vehicles is another driver, as it needs strong and smart drivetrain systems. OEMs and suppliers who are energy efficient and sustainable will profit the most from this changing environment, capturing both premium and economy segments.

Automotive Drivetrain Market Challenges:

High Cost of Developing Advanced Drivetrain to Impede the market Growth

One of the biggest challenges is the expense of creating sophisticated drivetrain systems, especially in EVs. Battery technology is still costly, and having electric drivetrains while still maintaining performance and cost-effectiveness is complicated. Supply chain disruptions—mainly for key materials such as rare earths—can slow down manufacturing. Moreover, strict emissions regulations differ between regions, so following them can be challenging for global players. Even the shift to electric drivetrains from internal combustion engines creates infrastructure issues like poor charging networks. In addition, production facilities as well as legacy systems need to be retooled at significant expense. Competitive competition and rapid changes in technology call for ongoing innovation, which boosts R&D expenses. Lastly, consumers' acceptance of new drivetrain technologies particularly in emerging markets is still uncertain, as it depends on price, awareness, and infrastructure. All these put together present challenges for most players in sustaining profitability as well as remaining innovators.

Automotive Drivetrain Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive drivetrain market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on vehicle type and drive type.

Analysis by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Others

Passenger cars stood as the largest vehicle type in 2025, holding around 63.7% of the market due to their sheer volume and evolving technological demands. As global automotive production continues to increase, the manufacturing of passenger cars necessitates a substantial volume of diverse drivetrain components, creating robust demand across the industry. Furthermore, the increasing consumer preference for enhanced vehicle performance, safety, comfort, and fuel efficiency in passenger cars directly fuels the adoption of advanced drivetrain systems. This includes the growing integration of sophisticated electric and hybrid drivetrains, along with innovative technologies like all-wheel-drive systems and lightweight components, all contributing positively to market expansion and technological advancement within this crucial segment.

Analysis by Drive Type:

Access the comprehensive market breakdown Request Sample

- All Wheel Drive

- Front Wheel Drive

- Rear Wheel Drive

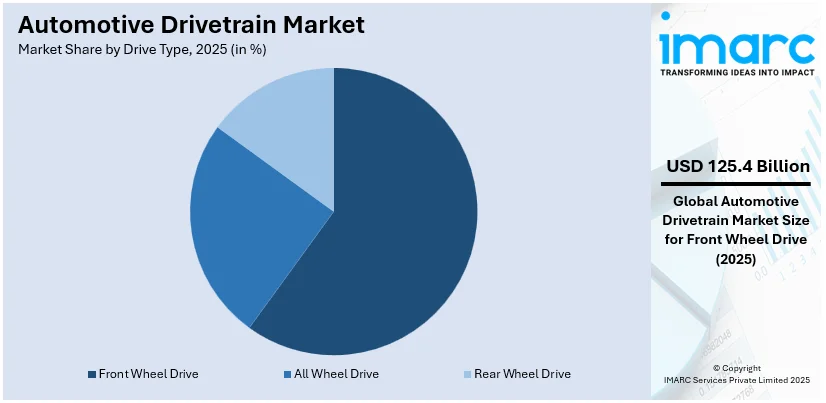

Front wheel drive leads the market with around 55.8% of market share in 2025, owing to its widespread adoption and consistent growth. FWD vehicles are highly popular globally, particularly in the passenger car segment, owing to their cost-effectiveness, fuel efficiency, and compact packaging. The substantial volume of FWD vehicle production directly translates into robust demand for associated drivetrain components such as transmissions, axles, and differentials. This segment's continued expansion, notably in regions like Asia-Pacific, fuels ongoing investment in FWD drivetrain technologies. The inherent advantages of FWD systems in terms of manufacturing simplicity and consumer appeal ensure their sustained role in propelling the overall automotive drivetrain market forward.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share of 40%, due to its prominent role as a global automotive manufacturing powerhouse. Countries like China, Japan, South Korea, and India collectively account for a significant portion of worldwide vehicle production, creating a massive inherent demand for drivetrain components. This manufacturing strength is further bolstered by factors such as a rapidly expanding middle class, increasing disposable incomes, and accelerated urbanization across the region, which drives higher vehicle sales. Moreover, governments in Asia Pacific are actively promoting the adoption of electric vehicles (EVs) through supportive policies, incentives, and substantial investments in charging infrastructure. This push toward electrification is fueling the demand for advanced and specialized electric drivetrains, solidifying the region's leading position.

Key Regional Takeaways:

United States Automotive Drivetrain Market Analysis

In 2025, the United States accounted for 85.2% of the market share in North America. The automotive drivetrain industry in the United States is growing steadily, driven by changing customer tastes for high-performance cars and increased use of all-wheel drive (AWD) and four-wheel drive (4WD) systems in passenger and utility vehicles. The market benefits from the use of modern drivetrain technology that improves vehicle dynamics, traction control, and fuel efficiency. The growth of connected and autonomous car technologies is increasing demand for advanced drivetrain systems that can enable intelligent mobility solutions. According to the report, new-car sales in the U.S. in 2025 started on a strong note, rising by 4% compared to 2024, reaching 3.9 Million vehicles, which further underscores the expanding market potential. Additionally, drivetrain component upgrades and customization are supported by a thriving aftermarket and a well-established automotive modification culture. The expansion of the off-road and leisure vehicle markets creates further demand. The tech-savvy customer base and emphasis on performance-driven advancements need ongoing drivetrain innovation, with research focused on lightweight materials and torque vectoring technologies to improve durability and energy efficiency.

Europe Automotive Drivetrain Market Analysis

The automobile drivetrain market in Europe is undergoing a substantial transition as a result of rigorous environmental requirements and a governmental push for sustainable mobility solutions. The trend toward electric drivetrains, particularly plug-in hybrids, is being pushed by customers' increasing desire for fuel economy and carbon footprint reduction. Furthermore, the European Regions Research and Innovation Network highlights the Climate-Neutral and Smart Cities Mission, which supports 100 European cities in becoming climate-neutral by 2030, positioning them as innovation hubs and setting a path for all European cities to achieve climate neutrality by 2050. The emphasis on improving urban transportation has resulted in the development of small drivetrain systems specifically designed for metropolitan contexts. Drivetrain software innovation is gaining pace, notably in terms of power distribution optimization and energy regeneration. Furthermore, the growing popularity of shared and fleet mobility services is influencing drivetrain needs for durability and adaptability in high-usage environments.

Asia Pacific Automotive Drivetrain Market Analysis

Asia Pacific's automotive drivetrain market is growing steadily, backed by strong growth in vehicle manufacturing and increasing consumer demand for technologically sophisticated mobility. The Society of Indian Automobile Manufacturers states that the region's passenger vehicles (PVs) achieved their all-time high sales at 4.3 Million Units during FY 2024-25, an increase of 2% from a year earlier. Utility vehicles (UVs) at 65% of total PV sales remain a key driver of growth, with drivetrain choices driven by a trend toward all-wheel and performance-oriented systems. Urbanization and changing mobility requirements have created mounting demand for compact yet efficient drivetrain configurations that can address congested urban traffic scenarios. The region is a source of drivetrain innovation because of technological partnerships, minimized emissions, better road networks, and greater affordability of advanced cars. This has resulted in hybrid and modular drivetrain architecture development, increasing stability, handling, and performance.

Latin America Automotive Drivetrain Market Analysis

Latin America's automotive drivetrain market is gaining momentum due to rising vehicle ownership, increased demand for load-handling and performance vehicles, economic recovery, and infrastructure development. There is a growing interest in drivetrain technologies that support fuel economy while offering improved traction and off-road capability, particularly in utility and transport vehicles. Additionally, the market is witnessing a gradual shift toward electrification, as highlighted by Climate Scorecard, which reports that Brazil registered around 177,000 electric vehicles in 2024. This trend is encouraging the adoption of advanced electric and hybrid drivetrain systems across the region. The market also benefits from increasing investments in automotive assembly operations, boosting the regional integration of drivetrain systems into locally manufactured vehicles. With evolving consumer preferences and regional mobility demands, Latin America is steadily embracing sophisticated drivetrain configurations tailored for both urban and rural applications.

Middle East and Africa Automotive Drivetrain Market Analysis

The automotive drivetrain market in the Middle East and Africa is heavily influenced by unique terrain demands and the rising popularity of multi-utility vehicles. Drivetrain systems that deliver high torque and enhanced stability are increasingly sought after to tackle desert, mountainous, and mixed-surface driving conditions. With the commercial transport and logistics sectors expanding rapidly, drivetrain performance and durability have become critical selection criteria. A report highlights that the commercial vehicle market in Saudi Arabia alone is projected to reach a staggering USD 6.7 Billion by 2025, underscoring the region’s growth potential. Urban centers are adopting drivetrain technologies for improved efficiency and smoother power delivery, driven by increased technological awareness and consumer preference for ride quality without compromising fuel economy.

Competitive Landscape:

The automotive drivetrain market is experiencing robust expansion, driven by the increasing global adoption of electric vehicles and overall automotive production growth. Product innovation is thriving, with continuous advancements in hybrid and electric drivetrain systems, including integrated eAxle technologies that enhance efficiency and compactness. Strategic partnerships and collaborations are widespread, fostering innovation and strengthening market positions. Governments globally are actively supporting this transition through ambitious EV mandates, consumer incentives, and significant investments in charging infrastructure. Research and development efforts are intensely focused on creating intelligent, adaptive, and highly efficient drivetrain systems, leveraging lightweight materials and advanced AI-based solutions. These collective efforts are ensuring continuous technological advancement, market leadership, and the development of more accessible and sustainable mobility solutions.

The report provides a comprehensive analysis of the competitive landscape in the automotive drivetrain market with detailed profiles of all major companies, including:

- Aisin Seiki Co. Ltd.

- American Axle & Manufacturing Inc.

- Borgwarner Inc.

- Dana Incorporated

- ZF Friedrichshafen AG (9Zeppelin-Stiftung)

- GKN Automotive Limited (Melrose Industries)

- JTEKT Corporation

- Magna International Inc.

- Schaeffler Technologies AG & Co. KG

- Showa Corporation

Latest News and Developments:

- May 2025: Stellantis unveiled the DS N°4 with upgraded electric and PHEV drivetrains. The E-Tense offers 213 HP, a 58.3 kWh battery, and 450km range, while the PHEV combined a 180 hp engine with a 125 hp motor and a new 14.6 kWh battery. Both systems enhance performance, efficiency, and charging capabilities for diverse driving needs.

- March 2025: BMW's Neue Klasse introduced a new digital architecture featuring four high-performance "Superbrains", each dedicated to specific vehicle functions: driving dynamics, automated driving, infotainment, and core operations. These Superbrains, offering over 20 times the computing power of current systems, enable seamless integration across all drivetrain types. Additionally, the new zonal wiring architecture reduces weight by 30% and improves energy efficiency by 20%, marking a significant leap in automotive technology.

- March 2025: Toyota Kirloskar Motor (TKM) launched the Hilux Black Edition in India. This special edition retains the 2.8L four-cylinder turbo-diesel engine, delivering 500 Nm of torque through a 6-speed automatic transmission. The Hilux Black Edition is equipped with a 4X4 drivetrain, offering superior off-road capability, and boasts a 700 mm water wading capacity.

Automotive Drivetrain Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Others |

| Drive Types Covered | All Wheel Drive, Front Wheel Drive, Rear Wheel Drive |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aisin Seiki Co. Ltd., American Axle & Manufacturing Inc., Borgwarner Inc., Dana Incorporated, ZF Friedrichshafen AG (9Zeppelin-Stiftung), GKN Automotive Limited (Melrose Industries), JTEKT Corporation, Magna International Inc., Schaeffler Technologies AG & Co. KG and Showa Corporation. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive drivetrain market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive drivetrain market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive drivetrain industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive drivetrain market was valued at USD 236.5 Billion in 2025.

The automotive drivetrain market is projected to exhibit a CAGR of 5.02% during 2026-2034, reaching a value of USD 372.4 Billion by 2034.

The automotive drivetrain market is primarily driven by the increasing demand for fuel-efficient and high-performance vehicles, stricter emission regulations accelerating EV adoption, and continuous technological advancements in drivetrain systems for enhanced driving experience and safety.

Asia Pacific dominated the automotive drivetrain market in 2024, accounting for a share of 40% due to major manufacturing hubs (China, Japan, South Korea, and India), rising disposable incomes, urbanization, and strong government support for EV adoption and advanced technologies.

Some of the major players in the automotive drivetrain market include Aisin Seiki Co. Ltd., American Axle & Manufacturing Inc., Borgwarner Inc., Dana Incorporated, ZF Friedrichshafen AG (9Zeppelin-Stiftung), GKN Automotive Limited (Melrose Industries), JTEKT Corporation, Magna International Inc., Schaeffler Technologies AG & Co. KG, Showa Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)