Automotive Drive Shaft Market Size, Share, Trends and Forecast by Drive Shaft Type, Design Type, Position Type, Material, Vehicle Type, Sales Channel, and Region, 2025-2033

Automotive Drive Shaft Market Size and Share:

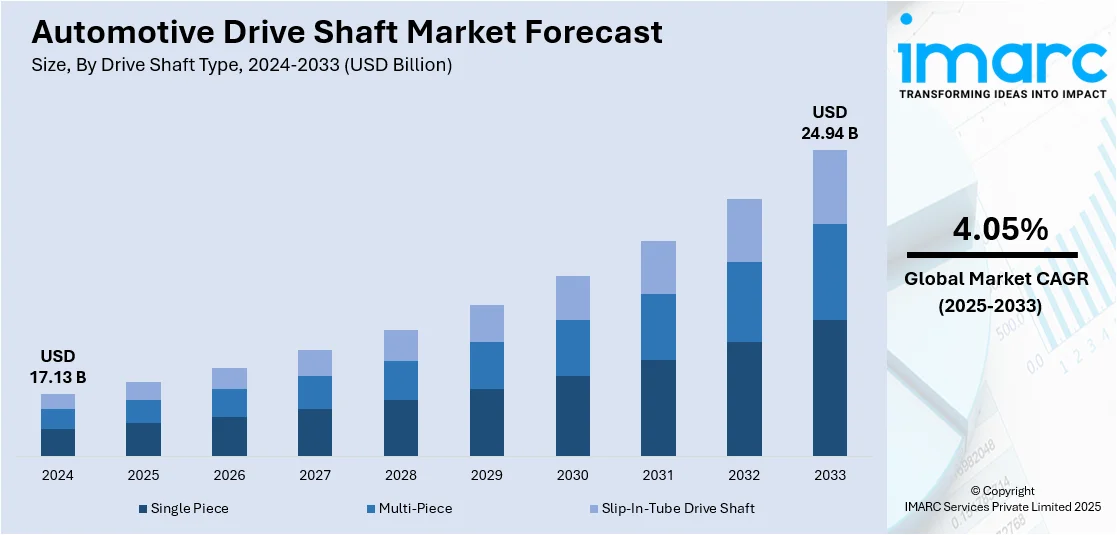

The global automotive drive shaft market size was valued at USD 17.13 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 24.94 Billion by 2033, exhibiting a CAGR of 4.05% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 36.4% in 2024. The market is driven by increasing demand for fuel-efficient, high-performance vehicles, fueled by strict emission norms globally. Increased use of electric and hybrid cars and advances in materials like carbon fiber and aluminum that improve strength while minimizing weight are also escalating product demand. Growing vehicle manufacturing in the emerging economies, fueled by rising disposable incomes and urbanization, further contributes to the automotive drive shaft market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.13 Billion |

| Market Forecast in 2033 | USD 24.94 Billion |

| Market Growth Rate (2025-2033) | 4.05% |

Fuel-efficient and performance-driven automobiles are becoming more and more popular, which is driving the automotive drive shaft industry. With governments across the globe implementing stricter emissions regulations, manufacturers are targeting lightweight yet strong drive shaft materials that improve fuel efficiency without any trade-off in strength. Additionally, the need for specialized drive shafts to handle unusual powertrain requirements is being driven by the increasing use of electric and hybrid vehicles. Advancements in technology, like the application of carbon fiber and aluminum alloys, also add to market expansion by providing enhanced strength-to-weight ratios. Rising vehicle manufacturing, especially in developing economies because of higher disposable incomes and urbanization, is another key factor. In addition, growth within the commercial vehicle segment, fueled by increased logistics and transportation demands, escalates demand for strong and durable drive shafts. Together, these drivers fuel the ongoing expansion and advancement of the worldwide market for automotive drive shafts.

To get more information on this market, Request Sample

The United States stands out as a key market disruptor, driven by innovation, regulatory influence, and market forces. The U.S. automotive industry, spearheaded by leading players like General Motors, Ford, and Stellantis, is on the cusp of adopting state-of-the-art driveline technologies. These include the development of lightweight materials like aluminum alloys and carbon fiber to enhance performance and fuel economy. Also, the rising U.S. demand for electric and hybrid vehicles is pushing demand for bespoke drive shafts designed specifically for electric powertrains. The high fuel economy and emissions standards of the U.S. government further push producers to be innovative and adopt green practices. Moreover, the country's robust aftermarket sector, characterized by a significant number of service centers and online platforms, contributes to the widespread availability and replacement of drive shafts, ensuring the longevity and performance of vehicles on the road. These factors collectively position the United States as a key disruptor, shaping the trajectory of growth and development according to the automotive drive shaft market forecast.

Automotive Drive Shaft Market Trends:

Transition Toward Lightweight Materials and New Manufacturing

Automotive drive shaft industry is witnessing an important transition toward the use of lightweight materials and advanced manufacturing methods. The manufacturers are increasingly applying materials like carbon fiber and aluminum alloys to manufacture drive shafts that have higher strength-to-weight ratios. This shift is a result of the necessity to enhance fuel efficiency and performance, especially in the scenario of increasing fuel costs and regulation of emissions. New manufacturing techniques, such as precision forging and advanced welding, are being used to optimize the quality and reliability of drive shafts. These technologies add to the overall efficiency of cars and also suit the rising consumer trend toward the use of environmentally friendly and efficient automobile systems. The combination of these materials and technologies indicates a trend that sees the industry taking an interest in fulfilling the changing requirements of the market and satisfying environmental regulations.

Integration of Electric Vehicle (EV) Drive Shafts

Electric vehicles's (EVs) increasing demand is having a significant effect on the automotive drive shaft market outlook. In contrast to conventional internal combustion engine vehicles, EVs demand custom drive shafts to meet their distinct powertrain layouts. Drive shafts used in EVs need to be optimized for delivering high torque outputs at low speed and for running in the tight packaging and light weight of EVs. For instance, in 2024, more than one in five new cars sold worldwide were electric (22 percent). In Norway, this percentage was 92%, and in China, it was nearly 50%. The increasing adoption of EVs has encouraged automakers to create drive shafts that are light but also suitable for withstanding the particular needs of electric powertrains. The trend is also enhanced by government incentives and sustainable transportation policy initiatives. As the EV market continues to grow, demand for drive shafts specifically designed for EVs will also increase, fueling innovation and development in the auto component sector.

Influence of Growing Disposable Incomes on Car Ownership

Growing disposable incomes, especially in developing economies, are leading to higher car ownership, thus fueling demand for automotive drive shafts. For example, typical household disposable incomes increased by 29.5% and 23.7% in the U.S. and Canada, respectively, between 2007 and 2024. With the increasing purchasing power of consumers, there is a demand shift toward personal transport from public transport, which leads to increased sales in both commercial and passenger vehicle segments. With this increase in automobile ownership comes a need for production of additional drive shafts to support the ever-increasing number of automobiles in the fleet. There is an upward trend in the demand for drive shafts as manufacturers scale up their production capacity and invest in research and development to manufacture drive shafts that suit a wide array of vehicles. The automotive drive shaft market growth in these countries increases the demand for drive shafts while driving economic growth through the generation of employment opportunities and industrial development.

Automotive Drive Shaft Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive drive shaft market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on drive shaft type, design type, position type, material, vehicle type, and sales channel.

Analysis by Drive Shaft Type:

- Single Piece

- Multi-Piece

- Slip-In-Tube Drive Shaft

Single piece stands as the largest component in 2024, holding around 45.3% of the market. Single piece drive shafts are becoming the dominant segmentation type in the automotive drive shaft market because of their simplicity in structure, strength, and affordability. Single piece drive shafts are a single, continuous tube extending between the transmission and differential, which reduces the number of joints and components used. This structure is lighter and has less rotational mass, resulting in better fuel economy and a smoother transmission of power. Single piece shafts are best suited to rear-wheel-drive cars and performance models, where high-speed strength and reliability are needed. They are also preferred by manufacturers because of the simplicity of production and the savings on maintenance. Where there is a shift toward compact and performance vehicles in the market, as in North America and certain areas of Europe, single piece shafts are gaining favor. While car manufacturers favor light-weight designs to ensure fuel efficiency and emissions standards, single piece drive shafts remain dominant owing to their utilitarian advantage and mechanical consistency under various driving conditions.

Analysis by Design Type:

- Hollow Shaft

- Solid Shaft

Solid shaft leads the market with around 56.6% of market share in 2024. Solid shafts are a dominant design according to the automotive drive shaft market trends owing to their rigidity, strength, and dependability in transmitting power. In contrast to hollow shafts, solid drive shafts are made from one solid material—commonly steel or aluminum—and this provides them with better torsional strength. This makes them suitable for heavy-duty use in trucks, SUVs, and commercial vans that require high torque transfer under demanding conditions. Their simple build also adds strength and minimizes the possibility of deformation or breakage due to stress. Solid shafts are especially popular in countries that have rough terrains and aggressive usage patterns, including some in the Asia-Pacific and Latin American regions. The increasing demand for utility vehicles and off-road use has also helped fuel demand for this type. Though heavier than hollow shafts, solid shafts provide reliable performance and less maintenance requirements, thus being a choice of preference among manufacturers and consumers looking for solidity and durability in vehicular components.

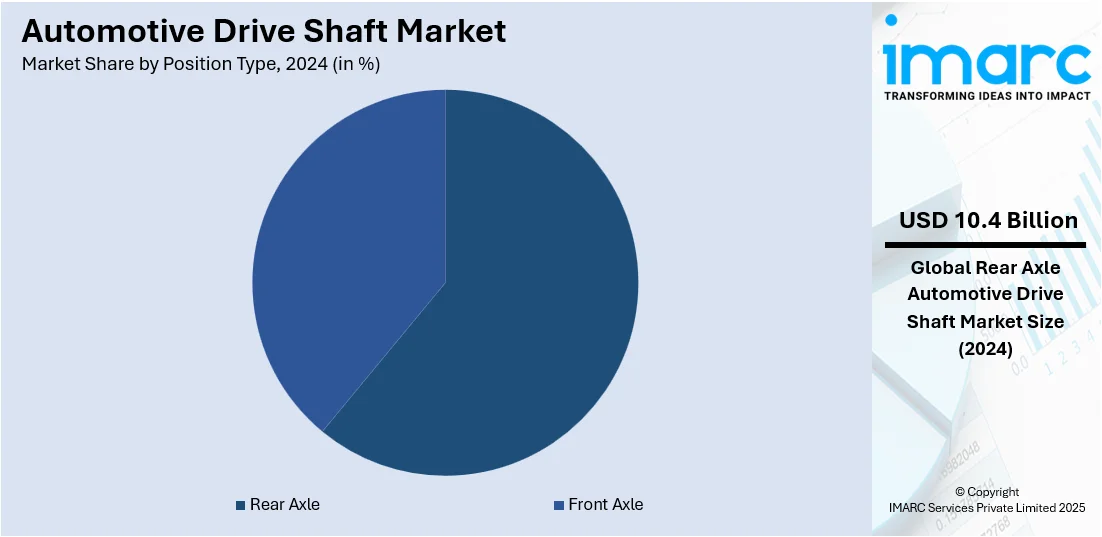

Analysis by Position Type:

- Rear Axle

- Front Axle

Rear axle leads the market with around 60.9% of market share in 2024. Rear axle drive shafts have a commanding share in the car drive shaft market because of their vital function in rear-wheel-drive and four-wheel-drive models. These shafts take the torque from the transmission or differential to the rear wheels, facilitating aggressive and stable performance—especially in trucks, SUVs, and sport cars. Their capability to handle heavy torque loads renders them suitable for use in trucks that transport heavy loads or drive on rugged terrain. High-demand areas for commercial and utility vehicles, including North America and some parts of the Asia-Pacific region, largely support rear axle systems, sustaining this segment's dominance. Technological development in material and design technology—such as high-strength steel and precision forging—has also improved the durability and efficiency of rear axle drive shafts. Rear axle drive shafts continue to be an important part in achieving the maximum balance between power transmission, fuel economy, and vehicle durability as manufacturers strive to enhance drivetrain performance and comply with emissions requirements.

Analysis by Material:

- Steel

- Aluminum

- Carbon Fiber

Steel stands as the largest component in 2024. Steel is the dominant material segment in the automobile drive shaft market because of its higher strength, toughness, and cost advantages. The torsional rigidity that steel provides is necessary for an effective power transfer from the engine to the wheels, making it suitable for most types of vehicles—ranging from passenger vehicles to heavy trucks. Its excellent resistance to fatigue and impact gives it a long lifespan even in the most demanding operating conditions. Auto manufacturers stick with steel because it is easy to work with and has well-established supply chains. Additionally, advancements in steel alloys and heat treatment technologies have given rise to lighter yet tougher drive shafts that enable manufacturers to achieve today's demands for performance and fuel efficiency while not compromising durability. In emerging economies, where cost and strength are prime factors, steel drive shafts rule the roost because they provide the best combination of performance and price. With the automotive sector developing, steel continues to be a safe and known option for producing drive shafts.

Analysis by Vehicle Type:

- Passenger Vehicle

- Commercial Vehicle

Passenger vehicle leads the market share in 2024. Passenger cars are the dominant vehicle type segment in the global automotive drive shaft market because of their extensive use worldwide and steady production levels. Passenger cars such as sedans, hatchbacks, and SUVs do largely depend on effective drive shaft systems to transfer power between the engine and wheels for smooth and dependable performance. With growing urbanization and rising disposable incomes, particularly in emerging markets, demand for passenger cars keeps increasing. This growth indirectly supports higher replacement and production requirements for automotive parts, such as drive shafts. Consumer trends for technology-driven, fuel-efficient, and high-performance cars also fuel drive shaft innovation, such as the use of light materials and better handling of torque. The growing transition to electric and hybrid passenger cars further increases the demand for high-performance specialized drive shafts designed to handle the performance requirements of contemporary drivetrains. Consequently, passenger cars remain the most important driver of demand in this market.

Analysis by Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

The OEM sector leads the manufacture of automotive drive shafts since it entails drive shafts delivered directly to vehicle manufacturers in the course of the assembly. Drive shafts in these manufacture drives are manufactured to precise specs, hence having high compatibility and performance. OEM drive shafts are usually preferred due to their quality guarantee, longer life, and compliance with vehicle warranty provisions. The increasing output of automobiles and rising usage of next-generation drive technologies are fueling the growth of OEM supply chains in both developed as well as emerging automotive markets.

The aftermarket industry in the automotive drive shaft market provides replacement and customization requirements after the initial vehicle sale. It is fueled by older fleets of vehicles, growing vehicle lifespan, and vehicle owners' desire for performance enhancement or replacement. It encompasses independent workshops and authorized service facilities. Pricing flexibility, the accessibility of multiple material and design variants, and the increasing trend of do-it-yourself vehicle repairs also contribute to the strong growth of the aftermarket segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 36.4%. Asia Pacific is the dominant regional split in the automotive drive shaft market due to high-speed industrialization, urbanization, and increased vehicle manufacturing in nations such as China, India, Japan, and South Korea. Asia Pacific is home to some of the world's largest auto manufacturing bases that are backed by robust government policies for increasing local production and export capacities. The demand for electric vehicles, commercial trucks, and passenger cars—all of which require reliable and efficient drive shafts—has increased due to inflating income levels and sizable middle classes. Furthermore, the growing uptake of electric vehicles in Asia Pacific is driving faster demand for customized drive shafts to cater to electric powertrains. The location of many automotive component makers and suppliers in this region enables innovation and low-cost production. Moreover, advancements in infrastructure and pro-trade policies further enhance Asia Pacific's leadership, enabling it to become a central market for automotive drive shaft makers all over the world.

Key Regional Takeaways:

United States Automotive Drive Shaft Market Analysis

In 2024, the United States accounted for over 84.30% of the automotive drive shaft market in North America. United States is witnessing increased automotive drive shaft adoption due to growing investment in automobile manufacturing. For example, the Automobile & Light Duty Motor Vehicle Manufacturing sector in the United States, which employs 228 companies, grew at a compound annual growth rate (CAGR) of 3.4% between 2020 and 2025. Rising capital expenditure in production facilities and expansion of assembly lines across multiple states are pushing the need for high-performance drive shaft systems. Enhanced integration of lightweight materials in manufacturing processes is also promoting advanced drive shaft solutions. With OEMs focusing on localizing supply chains, domestic sourcing of components, including drive shafts, is intensifying. This strategic emphasis on domestic automobile manufacturing is further supported by favorable incentives and subsidies. Technological advancements in drive shafts aligned with emission norms are also gaining traction.

Asia Pacific Automotive Drive Shaft Market Analysis

Asia-Pacific is experiencing a rise in automotive drive shaft adoption fuelled by growing FDI in the automobile sector. The India Brand Equity Foundation estimates that between April 2000 and September 2024, the automotive industry attracted a total equity FDI inflow of approximately Rs. 3,22,015 crore (USD 36.21 billion). Strategic foreign investments are accelerating the establishment of new production units and technology transfer initiatives. Global manufacturers are expanding their footprint to leverage low-cost production and skilled labour, increasing the volume of drive shaft usage. As the automobile sector matures in this region, joint ventures and technical collaborations are enabling local players to integrate advanced drive shaft technologies. Growing FDI in the automobile sector is driving innovation and supporting the mass production of vehicles equipped with efficient drive shafts. With rising vehicle exports and expanded manufacturing hubs, the automotive supply chain is becoming increasingly reliant on consistent drive shaft quality and supply.

Europe Automotive Drive Shaft Market Analysis

Europe is showing heightened automotive drive shaft adoption due to growing vehicle ownership across the region. For instance, in 2024, there were 12,963,614 new passenger cars registered in Europe (EU, EFTA, UK), with an increase of 0.9%. The increase in personal transportation needs, combined with expanding suburban populations, is contributing to elevated vehicle purchases. Demand for passenger and commercial vehicles is translating into a greater need for efficient and durable drive shafts. As consumers seek high-performance and fuel-efficient vehicles, drive shaft manufacturers are optimizing materials and design to meet evolving standards. Growing vehicle ownership is also linked to rising mobility needs, which drive the requirement for reliable drivetrain components. Automakers are increasingly offering vehicles with enhanced drive shaft features to improve safety, handling, and transmission efficiency. The development of hybrid and electric models is also incorporating advanced drive shafts, ensuring smooth power delivery.

Latin America Automotive Drive Shaft Market Analysis

Latin America is observing increased automotive drive shaft adoption driven by growing passenger cars due to growing disposable income. For instance, the Latin American automotive market is the 4th largest sub-regional market in the world, reporting 4.9 Million sales in 2023 (+4.1%). It includes sales from 41 countries but is heavily influenced by the largest countries Brazil, Mexico and Argentina. A shift in consumer spending patterns is encouraging vehicle purchases across urban and semi-urban areas. As household incomes rise, more consumers are opting for personal mobility solutions, leading to higher demand for passenger cars equipped with reliable drive shafts.

Middle East and Africa Automotive Drive Shaft Market Analysis

Middle East and Africa is experiencing growth in automotive drive shaft adoption owing to growing urban population and rising demand in electric and autonomous vehicles. For example, it is anticipated that there would be 7,331 electric cars (EVs) in the United Arab Emirates as of 2023, with the majority of them being in Dubai. This number is anticipated to increase dramatically, with estimates putting the number of EVs at 12,852 by 2025. The need for both private and shared transportation options is rising as metropolitan areas expand.

Competitive Landscape:

Several major players in the automobile drive shaft industry are driving industry development aggressively through strategic efforts aimed at innovation, sustainability, and market growth. Players such as GKN Automotive, Dana Limited, and JTEKT Corporation lead the pack, putting a lot of capital into R&D to enhance product performance and meet the evolving demands of the automotive sector. These efforts include the development of lightweight materials, such as carbon fiber and aluminum, to improve fuel economy and reduce emissions. Manufacturers are also creating specialized drive shafts designed specifically for electric and hybrid vehicles, taking into account the power and torque delivery special needs of these powertrains. Strategic alliances and acquisitions are also common, allowing firms to grow their technology expertise as well as market influence. For example, the partnership of GKN Automotive with Tata Technologies is focused on driving e-mobility solutions forward, while Dana's move into new manufacturing plants reflects a willingness to address worldwide demand. These joint efforts by industry giants are shaping the future of the automotive drive shaft market, ensuring efficient, sustainable, and high-performance driveline solutions are developed.

The report provides a comprehensive analysis of the competitive landscape in the automotive drive shaft market with detailed profiles of all major companies, including:

- American Axle & Manufacturing

- Cummins Inc.

- Dana Limited

- GKN Automotive

- Hyundai WIA Corporation

- IFA Holding GmbH

- JTEKT Corporation

- Neapco

- NKN, Ltd.

- NTN Corporation

Latest News and Developments:

- April 2025: Newton Golf Company launched the Fast Motion shaft, a lightweight, Tour-tested innovation designed for distance and control, and expanded its U.S. manufacturing footprint. The product incorporated advanced features like Kinetic Energy Storage and Symmetry 360, and gained rapid adoption among professionals.

- April 2025: Nexteer Automotive unveiled advanced driveline technologies, including innovations in the automotive drive shaft, to meet the rising demands of electric and multi-powertrain vehicles. The launch featured the upgraded Face Spline Axle, lighter 8-Ball Joint, and refined Premium Double Offset Joint, all designed to reduce weight, noise, and vibration.

- March 2025: Shaftec expanded its automotive drive shaft offerings by launching new axle shafts, also known as half shafts, to meet rising customer demand. These parts were essential to drivetrain performance since they transferred power from the transmission to the wheels.

- January 2025: ZF unveiled its EasyTurn axle concept in India, featuring an 80-degree steering angle to enhance maneuverability in tight urban spaces. It supported MacPherson axle systems and electric vehicles, offering up to 30% turning radius reduction and benefiting both passenger and cargo vehicles.

- January 2025: AAM acquired GKN Automotive in a USD 1.4 Billion deal that reshaped the automotive driveline sector and boosted electric vehicle production capabilities. The merger strengthened AAM’s position in automotive drive shaft systems and disrupted existing supply chains.

Automotive Drive Shaft Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drive Shaft Types Covered | Single Piece, Multi-Piece, Slip-In-Tube Drive Shaft |

| Design Types Covered | Hollow Shaft, Solid Shaft |

| Position Types Covered | Rear Axle, Front Axle |

| Materials Covered | Steel, Aluminum, Carbon Fiber |

| Vehicle Types Covered | Passenger Vehicle, Commercial Vehicle |

| Sales Channels Covered | Original Equipment Manufacturer (OEM), Aftermarket |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Axle & Manufacturing, Cummins Inc., Dana Limited, GKN Automotive, Hyundai WIA Corporation, IFA Holding GmbH, JTEKT Corporation, Neapco, NKN, Ltd., NTN Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive drive shaft market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive drive shaft market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive drive shaft industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive drive shaft market was valued at USD 17.13 Billion in 2024.

The automotive drive shaft market is projected to exhibit a CAGR of 4.05% during 2025-2033, reaching a value of USD 24.94 Billion by 2033.

The automotive drive shaft market is driven by the increasing demand for electric and hybrid vehicles which has led to a rise in the need for lightweight and high-performance drive shafts. Advancements in material technology are enabling manufacturers to develop durable and efficient drive shafts, enhancing the overall energy efficiency of vehicles. Additionally, the region's rapid industrialization and technological advancements are contributing to the expansion of the market.

Asia-Pacific currently dominates the automotive drive shaft market, driven by the increasing demand for electric and hybrid vehicles which has led to a rise in the need for lightweight and high-performance drive shafts. Advancements in material technology are enabling manufacturers to develop durable and efficient drive shafts, enhancing the overall energy efficiency of vehicles. Additionally, the region's rapid industrialization and technological advancements are contributing to the expansion of the market.

Some of the major players in the automotive drive shaft market include American Axle & Manufacturing, Cummins Inc., Dana Limited, GKN Automotive, Hyundai WIA Corporation, IFA Holding GmbH, JTEKT Corporation, Neapco, NKN, Ltd., NTN Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)