Automotive Door Handles Market Size, Share, Trends and Forecast by Type, Handle Type, Vehicle Type, Sales Channel, and Region, 2026-2034

Automotive Door Handles Market Size and Share:

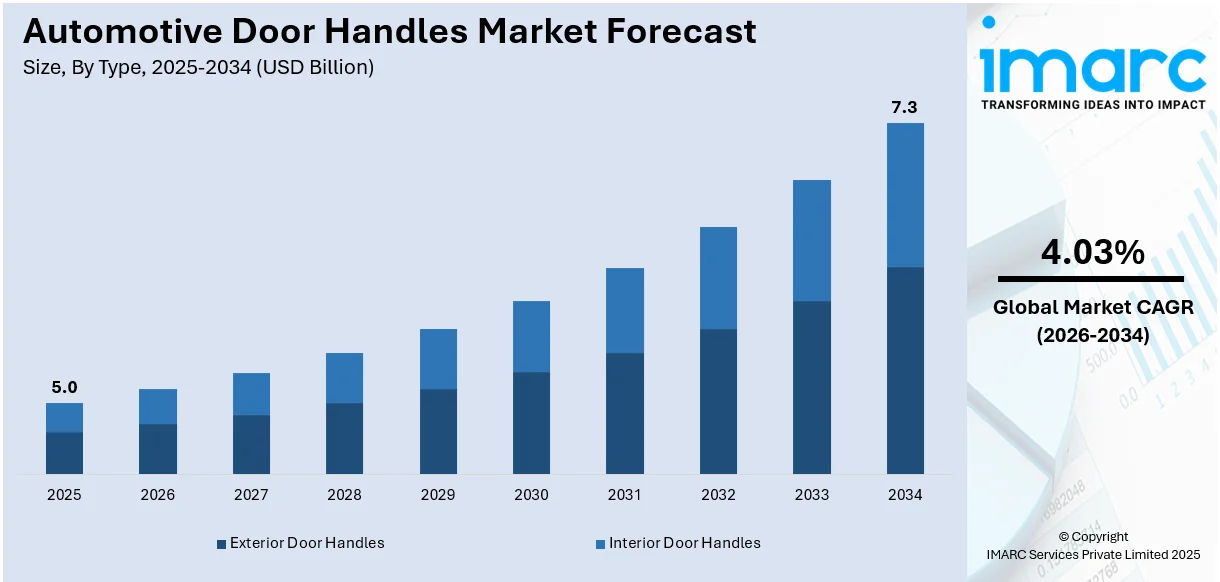

The global automotive door handles market size was valued at USD 5.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 7.3 Billion by 2034, exhibiting a CAGR of 4.03% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of over 42.0% in 2025. The increasing demand for passenger vehicles, growing investments in research and development, and technological advancements in the automotive industry represent some of the key factors driving the automotive door handles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.0 Billion |

| Market Forecast in 2034 | USD 7.3 Billion |

| Market Growth Rate (2026-2034) | 4.03% |

The market for automotive door handles is led largely by growing customer demand for greater convenience, security, and beauty in cars. Technological innovations like keyless entry systems, touch-sensitive door handles, and intelligent door handles are greatly driving market expansion. These technologies deliver a hassle-free and intuitive experience whereby drivers can unlock and open their car doors without having to touch them, making it all the more attractive in a digital-centric, security-driven world. The increasing use of electric vehicles (EVs) and autonomous vehicles is also driving the demand for futuristic, high-tech door handle designs. Additionally, the increasing use of lightweight yet strong materials, including aluminum and high-strength plastics, is improving the fuel efficiency of cars while providing long-lasting performance. Greater emphasis on vehicle design and streamlined, modern looks is also fueling demand for fashionable, integrated door handles. Additionally, strict government regulations concerning motor vehicle safety are prompting manufacturers to enhance the performance and longevity of automotive door handles.

To get more information on this market Request Sample

The United States stands out as a key market disruptor, driven by its rapid adoption of advanced automotive technologies and consumer demand for innovative features. The nation's robust automotive sector, combined with growing demand for electric vehicles (EVs) and autonomous vehicles, is driving futuristic door handle innovations. The US market, in particular, has witnessed growing demand for keyless entry systems, touch-sensitive handles, and motorized door handles, offering higher convenience, security, and premium user experience. Furthermore, the focus on car appearance and style, fueled by customer demands for slim, stylish, and high-tech looks, is leading car manufacturers to invest in future-generation door handle innovations. The United States' regulatory climate, which is increasingly looking at vehicle safety and energy efficiency, also favors the adoption of light, strong materials for door handles. These forces are jointly propelling innovation, rendering the US a critical market defining the world automotive door handle market.

Automotive Door Handles Market Trends:

Rising Disposable Income Driving Demand for Premium Door Handle Features

Increasing disposable incomes in emerging economies, particularly in regions like Asia Pacific and Latin America, are driving the demand for premium automotive door handles. According to International Energy Association, in 2024, electric car sales in the United States are projected to rise by 20% compared to the previous year. As consumers' purchasing power grows, they seek more advanced and convenient features in their vehicles. This includes keyless entry systems, touch-sensitive handles, and smart door handles that enhance both functionality and aesthetics. The shift toward higher-income brackets is influencing buying decisions, with consumers willing to invest in vehicles that offer a better user experience, superior comfort, and improved security. With growing disposable income, there is also a surge in the demand for luxury vehicles, which often come equipped with high-tech, electronic door handles as standard. As a result, automakers are focusing on incorporating these advanced door handle features into their offerings to meet the expectations of more affluent customers. This trend is fueling market growth, particularly in regions where disposable income levels are rising rapidly.

Rapid Urbanization and Changing Lifestyles

Rapid urbanization is significantly influencing the automotive door handles demand as more people migrate to cities, leading to increased vehicle ownership and a greater need for convenient, easy-to-use features. According to United Nations, 68% of the world population is projected to live in urban areas by 2050. In urban environments, where space and time are limited, consumers are seeking vehicles that offer improved accessibility and security. This has driven the demand for advanced door handle systems, such as keyless entry, hands-free technology, and automatic opening features, all of which cater to the needs of urban dwellers. Moreover, changing lifestyles, characterized by a higher focus on convenience, safety, and luxury, are prompting consumers to favor vehicles equipped with modern door handle technologies. As urban populations grow and the demand for personal mobility increases, particularly in countries like China, India, and Brazil, automakers are focusing on innovation and designing door handles that cater to the modern, fast-paced lifestyle. Consequently, urbanization and evolving consumer preferences are key drivers for the automotive door handles market.

Increasing Adoption of Smart and Sensor-Integrated Automotive Door Handles

Another major trend in the automotive door handles industry is the increasing use of smart, sensor-equipped handles. These handles use sophisticated technologies like fingerprint scanning, proximity sensors, and touch-free entry systems to provide greater convenience and security to car owners. With the rising demand for smooth and high-tech driving experiences from consumers, car manufacturers are including these smart handles in high-end and luxury cars. Proximity sensors allow the door to unlock automatically when the driver is near, while fingerprint recognition allows only certified users to enter the vehicle, increasing safety and personalization. Further, the incorporation of these smart handles also aids the overall trend of vehicle electrification and connectivity. According to the IMARC Group, the global proximity sensor market size reached USD 4.9 Billion in 2024, and is further expected to reach USD 8.4 Billion by 2033. With the automotive market trending toward more innovative, user-friendly designs, sensor-enabled door handles are increasingly present in new models, fueling growth in this category. This is a part of the larger industry push toward smart, touchless auto solutions.

Automotive Door Handles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive door handles market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, handle type, vehicle type, and sales channel.

Analysis by Type:

- Exterior Door Handles

- Interior Door Handles

Exterior door handles stand as the largest component in 2025with over 58.6% of the market share. Exterior door handles are the most dominant segment in the automotive door handles market because they play a vital role in vehicle functionality and appearance. Being the most widely used door handle for opening and closing vehicle doors, exterior handles are both important to provide convenience as well as protection. With increased consumer interest in streamlined, contemporary, and easy-to-use car designs, exterior handles now come equipped with touch-sensitive technology, keyless entry, and motorized functions to improve aesthetic value and usability. These new technologies provide more convenience, granting users hands-free entry and enhanced security. In addition, exterior door handles are constructed from lightweight yet strong materials like aluminum and high-strength plastics, promoting long-term functionality and overall reduction of vehicle weight for better fuel efficiency. Increased demand for superior technology and designs in the auto industry is anticipated to further push the market leadership of exterior door handles.

Analysis by Handle Type:

- Mechanical

- Automatic

Mechanical leads the market with around 73.3% of market share in 2025. Mechanical door handles continue to be the dominant segment in the automotive door handles market outlook because of their simplicity, affordability, and long-established reliability. These conventional handles are based on a manual mechanism, and hence they are a popular option for mass-market vehicles, especially in low-cost and entry-level models. Their simple design makes them easy to use and have low maintenance costs in comparison to more sophisticated electronic or touch-sensitive handles. Moreover, mechanical door handles are more resistant to technical breakdowns, providing higher security and durability, which is desired by consumers looking for reliability as opposed to enhanced features. Mechanical type is also preferred in areas where consumers are more cost-sensitive or less interested in high-end, high-technology features. Consequently, mechanical handles remain on top in the world automotive industry, especially in emerging economies where affordability is one of the determining factors. Even with advances in car technology, the mechanical sector is still a mainstay because it is functional and can easily be replaced.

Analysis by Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

Passenger vehicles lead the market with around 75.4% of market share in 2025. Passenger cars are the fastest-growing vehicle type segment in the automotive door handles market because they hold the highest market share of global automotive sales. Being the most prevalent car category, passenger cars need door handles that compromise on convenience, security, and aesthetics. Growing demand for conventional as well as innovative door handle systems, including mechanical, electronic, and touch sensor handles, is attributable to mounting consumer demand for convenience features and design appeal on passenger cars. Features like keyless entry and hands-free operation are most favored on premium and mid-range passenger vehicles, thereby driving demand for sophisticated door handle solutions. Moreover, the expansion of the global middle class and urbanization are propelling the demand for passenger cars, especially in developing markets. Since these cars continue to dominate global vehicle sales, they are still the most important segment for automotive door handle makers, shaping market trends and technological innovation.

Analysis by Sales Channel:

Access the comprehensive market breakdown Request Sample

- Original Equipment Manufacturer (OEM)

- Aftermarket

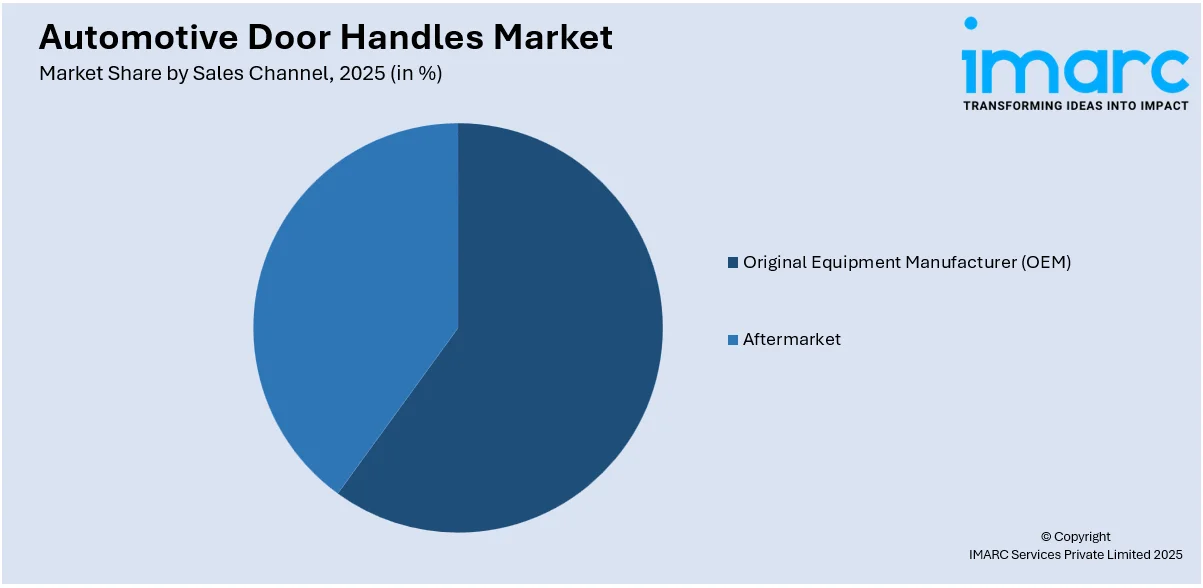

Original Equipment Manufacturer (OEM) leads the market with around 84.9% of market share in 2025. Original Equipment Manufacturers (OEMs) are the prime sales channel segment in the market for automotive door handles because they play a central role in vehicle manufacturing. OEMs directly provide automotive door handles to automakers, who install them in new cars at the time of production. This segment is strongest in the market because most vehicles are retailed through automakers, and door handles are an essential part of every car. Long-term alliances with original equipment manufacturers help OEMs experience consistent demand for door handles over a range of car models. OEMs are also in a position to ensure strict quality parameters, regulatory measures, and technologies like the infusion of electronic and smart door handles, which become a priority need in contemporary automobiles. The OEM market also offers uniformity of design, function, and security, which plays an important role for automobile producers. With the increasing growth of the automotive sector, especially in developing markets, the OEM segment is likely to continue its leadership in the automotive door handles market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of over 42.0%. Some of the factors driving the Asia Pacific automotive door handles market included technological advancements, rising demand for electric vehicles, and growing demand for luxury vehicles. The region, specifically nations such as China, Japan, and India, has emerged as a hub for auto manufacturing, with several automakers and suppliers present in these markets. Sustained urbanization, increasing disposable incomes, and an expanding middle-class population are fueling demand for passenger cars, which, in turn, is driving the demand for auto door handles. The Asia Pacific region is also experiencing a shift toward more sophisticated vehicle technologies like keyless entry and electronic door handles as customers seek increased convenience and security functions. Also, the region is inhabited by leading OEMs and a strong supply chain, which facilitates effective production and distribution of automotive door handles.

Key Regional Takeaways:

United States Automotive Door Handles Market Analysis

In 2025, the United States accounted for over 88.70% of the automotive door handles market in North America. Growing automotive door handles adoption is driven by growing investment in automotive manufacturing, leading to increased production of vehicles with advanced and aesthetically appealing door handle designs. For instance, since the start of 2021, auto manufacturers have announced investments of more than USD 75 Billion in the U.S. As automotive manufacturers expand production facilities and integrate advanced manufacturing technologies, the demand for durable, lightweight, and technologically enhanced automotive door handles continues to rise. The shift toward electric vehicles and smart mobility solutions is further influencing the need for flush-mounted and sensor-based door handles. The growing investment in automotive manufacturing is also fostering innovation in materials, with manufacturers exploring lightweight alloys and high-strength plastics to enhance efficiency. Additionally, the emphasis on safety and security features is encouraging the integration of keyless entry and biometric authentication in automotive door handles. The expansion of vehicle production is supporting mass adoption across various vehicle categories, driving suppliers to develop cost-effective and aesthetically appealing solutions.

Asia Pacific Automotive Door Handles Market Analysis

Growing automotive door handles adoption is supported by growing FDI in automotive, accelerating the establishment of production plants and technological advancements in vehicle components. According to India Brand Equity Foundation, the automobile sector received a cumulative equity FDI inflow of about USD 35.65 Billion between April 2000 - December 2023. As foreign investments strengthen local manufacturing capabilities, automotive manufacturers are enhancing their product offerings with advanced door handle solutions that meet evolving consumer expectations. The rising presence of multinational automotive companies is fostering the development of high-quality, durable, and technologically enhanced automotive door handles. The growing FDI in automotive is also driving the adoption of smart access control systems, contributing to the demand for sensor-based and retractable door handles. With automakers emphasizing design and functionality, manufacturers are focusing on lightweight materials and improved ergonomics. The increase in production capacities is enabling cost efficiencies, making technologically advanced door handles more accessible across different vehicle categories. Furthermore, the integration of contactless entry solutions is gaining traction, aligning with consumer preferences for convenience and security.

Europe Automotive Door Handles Market Analysis

Growing automotive door handles adoption is fuelled by growing vehicle ownership, resulting in a sustained demand for aesthetically appealing and technologically advanced door handle solutions. According to International Council on Clean Transportation, about 10.6 Million new cars were registered in the 27 Member States in 2023, 14% more than in 2022. The increasing number of personal and commercial vehicles is leading to higher production volumes of automotive door handles, prompting manufacturers to develop more durable and ergonomic designs. The emphasis on premium vehicle features is driving demand for seamless, keyless entry solutions that enhance both convenience and security. Growing vehicle ownership is also contributing to the integration of retractable and sensor-based automotive door handles, aligning with the trend of modernized vehicle exteriors. Additionally, the focus on lightweight materials to improve fuel efficiency is encouraging the adoption of high-strength plastics and aluminum-based automotive door handles. With an increasing consumer preference for advanced vehicle technology, automotive manufacturers are investing in research and development to introduce innovative designs that cater to the growing demand. The surge in aftermarket replacement and customization is further driving the adoption of automotive door handles, ensuring a continuous supply of high-quality options for vehicle owners.

Latin America Automotive Door Handles Market Analysis

Growing automotive door handles adoption is influenced by growing increasing demand for passenger vehicles due to growing disposable income, leading to heightened vehicle production and sales. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. As consumers opt for modernized and technologically enhanced vehicles, the need for advanced automotive door handles continues to rise. The rising preference for comfort and convenience is driving demand for keyless entry and touch-sensitive door handles. With growing increasing demand for passenger vehicles due to growing disposable income, automotive manufacturers are incorporating aesthetically appealing and ergonomic door handle designs. The increasing focus on affordability and durability is encouraging the development of cost-effective, high-quality automotive door handles. Additionally, the expanding presence of aftermarket solutions is supporting customization and replacement trends, contributing to the sustained adoption of automotive door handles.

Middle East and Africa Automotive Door Handles Market Analysis

Growing automotive door handles adoption is driven by growing rapid urbanization and the advent of electric vehicles and autonomous driving technology has prompted automotive manufacturers to develop door handles that are more compatible with these emerging technologies. According to the UAE Ministry of Energy and Infrastructure, there are approximately 8,000 electric vehicles registered in the country. The shift toward smart mobility solutions is accelerating the demand for technologically advanced automotive door handles, including flush-mounted and sensor-based options. Growing rapid urbanization is also increasing vehicle ownership rates, further supporting the adoption of modern door handle designs. As electric vehicles and autonomous driving technology evolve, the need for seamlessly integrated, high-tech automotive door handles is becoming a priority for manufacturers. The rising demand for premium vehicle aesthetics is contributing to the adoption of retractable and touch-sensitive door handles, ensuring enhanced user convenience and security.

Competitive Landscape:

Several leading companies within the automotive door handles industry are increasingly concentrating on product innovation, technological developments, and sustainability activities to promote the growth of the market. Established manufacturers are also investing in product development of advanced and intelligent door handles, such as electronic door handles and touch-sensitive door handles, that present greater convenience, security, and aesthetics. The combination of keyless entry systems and sensors is gaining traction, enabling drivers to unlock and open doors remotely without physical touch, improving the user experience. There is also a growing focus on the utilization of lightweight, strong, and environmentally friendly materials like aluminum, plastic composites, and stainless steel to save weight and make vehicles more fuel-efficient. Sustainability has become a prominent theme, and firms have initiated eco-friendly manufacturing processes and raw materials to mitigate the carbon content of their offerings. Players also are focused on minimizing the costs of manufacturing, enhancing the reliability and overall quality of door handles to keep up with changing customers' expectations. Additionally, strategic partnerships and cooperation between vehicle original equipment manufacturers and suppliers are supporting design and performance innovation. Consequently, manufacturers of automotive door handles are poised to meet consumers' needs for security, convenience, and sustainability, propelling market growth around the world.

The report provides a comprehensive analysis of the competitive landscape in the automotive door handles market with detailed profiles of all major companies, including:

- ALPHA Corporation

- CI Car International Pvt. Ltd.

- Huf Hulsbeck & Furst GmbH & Co. KG

- HUSHAN Autoparts Inc.

- MinebeaMitsumi Inc.

- Sakae Riken Kogyo Co. Ltd.

- Sandhar Technologies Limited

- TriMark Corporation

- Xin Point Corporation

Latest News and Developments:

- October 2024: The 2024 Mercedes-Benz E-Class was launched in India, featuring new flush door handles for a sleeker design. Along with the updated grille sporting a star pattern, the luxury sedan now offers more advanced technology and added features. Its extended length enhances comfort, making it a standout in its segment. The E-Class starts at ₹78.5 lakh, reinforcing its premium appeal.

- August 2024: Geely Auto launched its latest electric SUV, the E5, in Guiyang, China, featuring a minimalist design. CEO Jerry Gan announced plans to share core technology for safely unlocking hidden door handles in new energy vehicles. This initiative aims to enhance industry-wide NEV safety standards. The E5 is built on the global intelligent new energy architecture GEA for a seamless user experience.

- August 2024: The 2024 Hyundai Alcazar introduces smartphone-operated door handles with Digital Key and NFC technology. This feature allows seamless keyless entry, enhancing convenience for users. Alongside, the SUV boasts dual 10.25-inch screens and over 70 connected car features. The Alcazar is set to launch on September 9, 2024.

- April 2024: The upcoming Tata Curvv will feature flush door handles, enhancing its sleek design and aerodynamics. Spy shots reveal Tata Motors' commitment to modern styling and advanced technology in the 2024 SUV. The innovative door handle design aligns with premium C-segment rivals like the Hyundai Creta and Kia Seltos. This addition complements the Curvv’s futuristic appeal, set to launch later this year.

Automotive Door Handles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Exterior Door Handles, Interior Door Handles |

| Handle Types Covered | Mechanical, Automatic |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles |

| Sales Channels Covered | Original Equipment Manufacturer (OEM), Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ALPHA Corporation, CI Car International Pvt. Ltd., Huf Hulsbeck & Furst GmbH & Co. KG, HUSHAN Autoparts Inc., MinebeaMitsumi Inc., Sakae Riken Kogyo Co. Ltd., Sandhar Technologies Limited, TriMark Corporation, Xin Point Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive door handles market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive door handles market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive door handles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive door handles market was valued at USD 5.0 Billion in 2025.

The automotive door handles market is projected to exhibit a CAGR of 4.03% during 2026-2034, reaching a value of USD 7.3 Billion by 2034.

The automotive door handles market is driven by increasing demand for advanced features like keyless entry, enhanced security, and aesthetic designs. Rising consumer preferences for convenience and innovation, along with growing vehicle production, particularly in emerging markets, and advancements in materials and technology, are also contributing to market growth.

Asia Pacific currently dominates the automotive door handles market due to rapid urbanization, rising disposable incomes, and a growing middle class. Increasing vehicle production, especially in China and India, alongside demand for advanced features like keyless entry and smart door handles, is further boosting the market in this region.

Some of the major players in the automotive door handles market include ALPHA Corporation, CI Car International Pvt. Ltd., Huf Hulsbeck & Furst GmbH & Co. KG, HUSHAN Autoparts Inc., MinebeaMitsumi Inc., Sakae Riken Kogyo Co. Ltd., Sandhar Technologies Limited, TriMark Corporation, Xin Point Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)