Automotive Display System Market Size, Share, Trends and Forecast by Technology, Display Size, Application, Vehicle Type, Sales Channel, and Region, 2025-2033

Automotive Display System Market Size and Share:

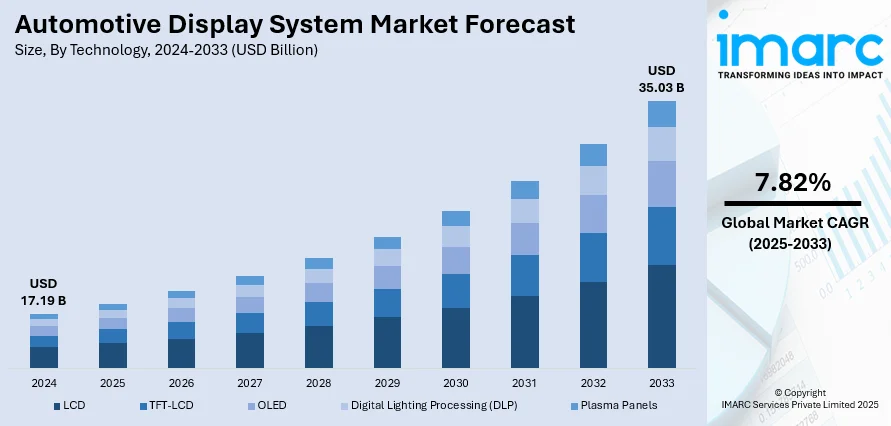

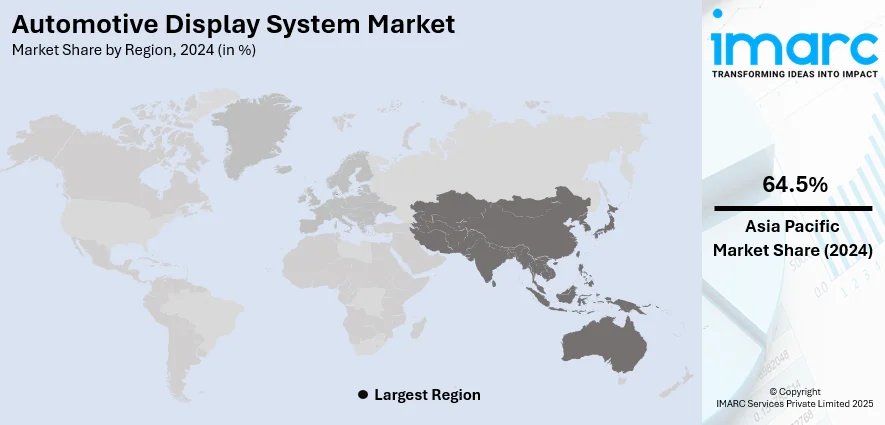

The global automotive display system market size was valued at USD 17.19 Billion in 2024. The market is projected to reach USD 35.03 Billion by 2033, exhibiting a CAGR of 7.82% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of 64.5% in 2024. At present, the growing integration of artificial intelligence (AI) into automotive systems is positively influencing the market. Rising demand for connected vehicles and electric vehicles (EVs), combined with the increasing use of heads-up displays (HUDs), is also propelling the automotive display system market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.19 Billion |

|

Market Forecast in 2033

|

USD 35.03 Billion |

| Market Growth Rate 2025-2033 | 7.82% |

At present, the market is expanding swiftly, as more digital technologies are being incorporated into cars to enhance user experience, safety, and connectivity. Conventional dashboards are being replaced with high-resolution, interactive alternatives due to the growing need for sophisticated infotainment systems, digital instrument clusters, and HUDs. The demand for screens that track energy use, navigation, and real-time car data is being further fueled by the increase in EV production. To reduce distractions and provide safety alerts, advanced driver-assistance systems (ADAS) also depend on smart displays. Additionally, automakers are focusing on organic light-emitting diode (OLED), active matrix organic light-emitting diode (AMOLED), and larger touchscreens to improve usefulness and appearance, especially in high-end cars.

To get more information on this market, Request Sample

The United States has emerged as a major region in the automotive display system market owing to many factors. Rising demand for advanced in-car technologies, enhanced connectivity, and safety-focused innovations is fueling the automotive display system market growth. Increasing adoption of EVs is accelerating the use of high-resolution displays for navigation, energy monitoring, and real-time diagnostics. As per industry reports, in 2024, the EV market of the United States achieved 1.56 Million sales and captured a 10% share of the total light-duty vehicle sales. Automakers in the US are also integrating larger touchscreens, digital instrument clusters, and HUDs to improve driver experience and differentiate premium models. Moreover, the popularity of infotainment features, such as smartphone integration and voice-enabled controls, is creating new opportunities.

Automotive Display System Market Trends:

Growing Demand for HUDs

Increasing demand for HUDs is offering a favorable automotive display system market outlook. HUDs offer crucial information, such as vehicle speed, navigation directions, and warnings, straight in the driver's line of sight, thus diminishing the attention of the driver. HUDs ensure drivers continuously have access to key information like speed limits, traffic signs, and directions about upcoming route without looking away from the road or the dashboard. This ensures driver comfort, particularly in situations that demand careful driving and navigating in new locations. Apart from this, several automotive system companies are improving the production of HUD systems due to their ability to enhance driving safety, convenience, and user experiences. In December 2024, Eastman, Ceres Holographics, and Covestro reached an agreement for the commercial manufacturing of holographic (HUD technology. The updated displays addressed the performance, dimensional, and shape constraints of conventional HUD systems, allowing the feasible and expandable use of several displays within a single windshield and in other side-light glazing areas.

Rising Adoption of EVs

Increasing use of EVs is among the major automotive display system market trends. EVs often have unique interface requirements compared to traditional internal combustion engine vehicles. They may need displays that provide detailed information about battery status, charging infrastructure, energy utilization, and driving range. Thus, there is a rise in the demand for specialized displays and user interfaces tailored to the needs of EV drivers. Additionally, EVs require advanced energy management systems to optimize battery performance and range. Display systems play a vital role in presenting real-time data on energy usage, charging status, and regenerative braking of energy management in the vehicle. This necessitates advanced display technologies and intuitive user interfaces to aid EV drivers in making informed decisions about their driving behavior and energy usage. As per the IBEF, the India EV market is set to expand at a CAGR of 28.52% to attain USD18.31 billion by 2029.

Increasing Need for Connected Cars

Escalating demand for connected cars is propelling the market growth. The IMARC Group’s report shows that the global connected car market reached USD 96.2 Billion in 2024. Advanced system displays are a critical enabler of connected vehicles as they ensure efficient interaction with external systems. These systems are the most important since they are the point of access to various infotainment applications, navigation, communication, and vehicle diagnostics. As buyers are prioritizing connectivity and digital integration in their vehicles, automakers are investing in more sophisticated display systems to meet these expectations. Hence, automakers are developing and integrating advanced systems in the industry to meet buyer demands. The most important role of the automotive system is the real-time delivery of this data, allowing drivers to obtain traffic status, weather updates, nearby amenities, and even the performance of their vehicles. According to the automotive display system market forecast, as the volume and complexity of connected car data continue to grow, the industry is set to expand.

Automotive Display System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive display system market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, display size, application, vehicle type, and sales channel.

Analysis by Technology:

- LCD

- TFT-LCD

- OLED

- Digital Lighting Processing (DLP)

- Plasma Panels

TFT-LCD held 53.7% of the market share in 2024. It offers an optimal balance between performance, cost-effectiveness, and reliability. It delivers high brightness, better resolution, and wide viewing angles, which are essential for in-vehicle applications like navigation, infotainment, and digital instrument clusters. Automakers prefer TFT-LCD as it is more affordable and widely available compared to OLEDs, making it suitable for mass production. Additionally, the technology has matured significantly, ensuring durability under varying temperature conditions and resilience to vibrations within vehicles. The ability of TFT-LCD to support touch functionality and integration with ADAS is further enhancing its adoption. With rising user expectations for interactive and clear displays, TFT-LCD provides a proven solution at scale. Moreover, continuous improvements in thinness, color reproduction, and energy efficiency are keeping it competitive, allowing TFT-LCD to remain the dominant choice across both mid-range and premium vehicles, securing its largest market share in the automotive display system industry.

Analysis by Display Size:

- Less than 5”

- Between 6” to 10”

- Greater than 10”

Between 6” to 10” accounts for the largest market share. This range provides the most practical size for balancing functionality, cost, and driver usability. Display screens are large enough to clearly showcase navigation, infotainment, and vehicle control features without overwhelming dashboard space. Most mid-range and premium vehicles integrate displays within this size range, making it a standard for center stack displays, digital instrument clusters, and rear-seat entertainment systems. Additionally, it offers sufficient clarity and resolution for advanced features like real-time traffic updates, parking assistance visuals, and voice-enabled controls. From a manufacturing perspective, producing displays in this segment is more cost-efficient compared to larger sizes, while still meeting the demand for sleek and modern interfaces. Compact cars, sedans, and sport utility vehicles (SUVs) commonly adopt this screen size range, ensuring widespread market penetration.

Analysis by Application:

- Head Up Display

- Instrument Cluster

- Center Stack Display

- Rear Seat Entertainment Display

- Rear View Mirror Display

- Portable Navigation Device

- Others

Center stack display holds 42.1% of the market share. It is becoming the focal point for in-car infotainment and connectivity. Positioned centrally on the dashboard, it provides easy accessibility for both the driver and passengers, integrating critical functions, such as navigation, media, climate control, and smartphone connectivity. Automakers increasingly design vehicles with larger, more interactive center stack displays to enhance user experience and align with user expectations of seamless digital interfaces. Additionally, the growing demand for advanced features like voice assistants, real-time navigation, and multimedia streaming services has further expanded the reliance on center stack displays. Compared to instrument clusters, the center stack display serves as a multi-functional hub, supporting customization and over-the-air updates, which adds long-term value for users. The versatility, convenience, and widespread integration of these displays across vehicle segments, ranging from compact cars to luxury models, make them the most widely adopted application.

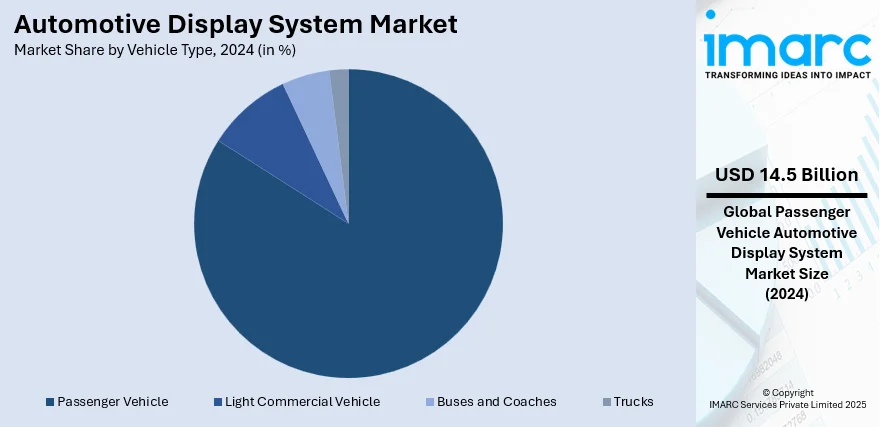

Analysis by Vehicle Type:

- Passenger Vehicle

- Hatchback

- Sedan

- Utility Vehicles

- Light Commercial Vehicle

- Buses and Coaches

- Trucks

Passenger vehicle (hatchback, sedan, and utility vehicles) accounts for 84.2% of the market share. It represents the highest volume segment in global automotive production and sales. Rising demand for comfort, safety, and infotainment has driven automakers to integrate advanced digital displays in passenger cars at a faster rate than in commercial vehicles. Features, such as touch-enabled infotainment screens, digital instrument clusters, and rear-seat entertainment systems, are becoming standard in most compact cars, sedans, and SUVs, aligning with customer preferences for enhanced driving experiences. Moreover, the growing trend of connected cars and EVs within the passenger vehicle segment has further boosted the adoption of high-tech display solutions. Automakers are also leveraging displays as a differentiating factor to attract tech-savvy buyers, especially in competitive markets. With increasing disposable incomes, urbanization, and user inclination towards digitally enhanced vehicles, passenger vehicle continues to hold dominance.

Analysis by Sales Channel:

- OEM

- Aftermarket

OEM is directly involved in the design and production of vehicles, which allows it to integrate display systems seamlessly into vehicle interiors during the manufacturing process. Moreover, the perfectly integrated display systems are compatible and operate stably, addressing performance requirements and design specifications unique to the vehicle model. In addition, OEM is developing working relationships and signed agreements with display technology developers, which provide it with up-to-date product performance commodities.

Aftermarket holds a significant portion of the market share, as it features an array of display system options that meet the criteria of varied buyers and vehicle models. It has retrofit kits and standalone display units, which can be simply mounted into existing vehicles, meaning that people can enhance their cars by using the latest display technologies without necessarily buying new cars. Additionally, aftermarket display systems usually provide more options for customization and adaptability compared to OEM installed systems.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for a share of 64.5%, enjoys the leading position in the market. The region is one of the largest and the most prominent automotive and manufacturing hubs across the globe with countries, such as China, India, and Japan. These countries are undergoing rapid industrialization and urbanization, catalyzing the demand for automobiles with advanced features and technologies like display systems. Moreover, rising income levels and expanding middle-class populations are driving the desire for vehicles with increasing security, connectivity, and entertainment capabilities, thereby boosting the overall automotive display system market value. Moreover, the increasing number of passenger vehicles launched with advanced technology and features is strengthening the growth of the market. Retail expansion is further positively influencing the market. The State Council Information Office reports showed that China's retail sales of passenger cars hit approximately 6.42 Million units during the first four months of 2024.

Key Regional Takeaways:

North America Automotive Display System Market Analysis

The North America automotive display system market is being propelled by multiple factors, with rising demand for technologically advanced vehicles playing a central role. Increasing preferences for connected cars, equipped with automotive infotainment systems and digital clusters, are fueling the adoption of sophisticated display technologies. As per the IMARC Group, the North America automotive infotainment system market size reached USD 5.63 Billion in 2024. The region’s strong presence of leading automakers and technology providers is further accelerating the integration of advanced solutions, such as augmented reality (AR)-based heads-up displays, larger touchscreens, and multi-display dashboards that enhance driving safety, convenience, and user engagement. The growing emphasis on road safety regulations and the need for real-time driver assistance features is also catalyzing the demand for clear, intuitive display systems that reduce driver distraction. Additionally, the rising penetration of EVs and hybrid models in North America is creating new opportunities, as these vehicles rely heavily on digital display interfaces for battery monitoring, energy management, and navigation. Increasing user interest in luxury and premium vehicles, which often come equipped with advanced digital clusters, is further expanding the market base. Moreover, the integration of AI into automotive systems is enabling personalized user experiences and predictive assistance.

United States Automotive Display System Market Analysis

The United States holds 85.90% of the market share in North America. The United States is witnessing a surge in automotive display system adoption, driven by the growing vehicle modification trend. For instance, in 2024, around 7.9 Million Americans altered their vehicles, with trends leaning towards performance and aesthetic enhancements. People are increasingly customizing vehicles with advanced infotainment, digital instrument clusters, and HUDs that offer both aesthetic appeal and functional improvements. The vehicle modification trend is elevating the demand for aftermarket display installations, supporting a vibrant market for high-resolution touchscreens and AR-based dashboards. Rising preferences for smart interiors and personalized vehicle interfaces is also influencing OEMs to incorporate more digital displays in new models. Enthusiasts and tech-savvy drivers are prioritizing innovations that align with their lifestyle, further stimulating the market growth. In-vehicle entertainment upgrades are becoming essential in modified cars, leading manufacturers to innovate with larger, curved, and more interactive displays across multiple vehicle categories. Moreover, the growing adoption of AI is offering a favorable market outlook.

Europe Automotive Display System Market Analysis

Europe is advancing in automotive display system usage, fueled by the growing EV trend. According to the International Energy Association, in Europe, sales of electric cars exceeded 900,000 in the first quarter of 2025, with 625,000 units sold in the European Union. As EVs are becoming mainstream, manufacturers are prioritizing smart, minimalistic, and futuristic interiors, where digital displays replace traditional analogy components. Centralized control panels, wide-format infotainment screens, and digital driver displays are increasingly standard in EV models. The emphasis on energy efficiency and smart navigation is boosting the need for real-time performance monitoring through interactive displays. Display systems also play a pivotal role in user engagement and brand differentiation among EV offerings. The growing EV market is reshaping user expectations, with enhanced human-machine interface (HMI) solutions embedded within eco-friendly vehicle platforms.

Asia-Pacific Automotive Display System Market Analysis

The Asia-Pacific region is experiencing rapid automotive display system adoption due to the growing investments in the automotive sector. For instance, NITI Aayog's vision for the automotive industry in India by 2030 is bold and feasible. The report projects that the nation's automotive parts manufacturing will increase to USD 145 Billion in 2030, while exports are expected to rise from USD 20 Billion to USD 60 Billion. Governments and private entities are allocating substantial funds to strengthen automotive manufacturing infrastructure and boost smart vehicle technology. The increasing production capacity and the expansion of automotive research and development (R&D) hubs are enabling the integration of high-performance display systems into mass-produced vehicles. As regional suppliers and OEMs continue to scale operations, the demand for digital cockpits, central control screens, and rear-seat entertainment displays is expanding significantly.

Latin America Automotive Display System Market Analysis

Latin America is witnessing increased automotive display system utilization, supported by the growing disposable incomes. For instance, as of 2025, the average annual salary in Brazil is approximately BRL 40,200, which is equivalent to approximately USD 7,025.63 per year. As more people are gaining financial capacity, the demand for feature-rich and tech-integrated vehicles is rising. Display systems, such as infotainment touchscreens, navigation displays, and digital gauge clusters, are becoming key purchase influencers in mid- and high-end vehicle segments. Rising disposable incomes are enabling people to prioritize in-vehicle connectivity and comfort, driving the market expansion.

Middle East and Africa Automotive Display System Market Analysis

The Middle East and Africa region is observing a rise in automotive display system adoption due to the growing demand for connected cars. According to reports, the connected car market in the UAE is set to attain a projected revenue of USD 578.6 Million by 2030. A compound annual growth rate of 15.7% is anticipated for the UAE connected car market from 2025 to 2030. Connectivity features require integrated display systems that support navigation, multimedia, and telematics applications. As tech integration is becoming essential, display systems are becoming vital components in meeting the expectations of connected car users across the region.

Competitive Landscape:

Key players are continuously investing in research, innovations, and strategic collaborations to meet evolving user and industry demands. Leading companies are focusing on developing advanced display technologies, such as OLED, AR-based HUDs, and larger touchscreen interfaces, to enhance safety, connectivity, and user experience. They are partnering with automakers to integrate customized solutions that align with different vehicle segments, ranging from mass-market to luxury models. Key players also emphasize cost optimization, mass production capabilities, and energy-efficient designs to make advanced displays more accessible. Furthermore, their involvement in setting industry standards, patenting technologies, and collaborating with tech firms aids in accelerating innovations and adoption. Through these efforts, key players significantly shape market trends, user preferences, and the overall competitiveness of the automotive display system industry. For instance, in March 2025, Sony created an advanced automotive display system that included unique signal processing and independent RGB management of high-density LED backlights, allowing superior color purity, an expanded color range, and increased brightness for cinematic visuals, with intentions for mass production and incorporation into both user and professional displays.

The report provides a comprehensive analysis of the competitive landscape in the automotive display system market with detailed profiles of all major companies, including:

- Alps Alpine Co. Ltd.

- AUO Corporation

- Continental AG

- DENSO Corporation

- Innolux Corporation

- Japan Display Inc. (Sony Corporation)

- LG Display Co. Ltd.

- Nippon Seiki Co. Ltd.

- Panasonic Holdings Corporation

- Robert Bosch GmbH

- Valeo SA

- Visteon Corporation

- YAZAKI Corporation

Latest News and Developments:

- May 2025: Aston Martin introduced Apple’s latest CarPlay Ultra, representing the arrival of a vehicle display system that incorporated Apple’s interface on all in-car screens, such as the instrument panel. This feature was standard for new orders of DBX, Vantage, DB12, and Vanquish, with updates planned for current models to come later.

- May 2025: The advanced CarPlay Ultra automotive display system was set to launch in new Aston Martin vehicles in the US and Canada, providing a highly integrated iPhone-car experience with live data accessible on all driver screens. The system was also revealed to be arriving soon for current models through a software upgrade, with worldwide car manufacturers, such as Hyundai, Kia, and Genesis, planning to implement it.

- April 2025: Continental’s Automotive Group Sector was rebranded as Aumovio during Auto Shanghai 2025, emphasizing smart mobility and technologies, such as automotive display systems. This underscored its dedication to software-defined vehicles and global market innovation.

- March 2025: Renesas launched the RAA278830, a well-integrated LCD video processor aimed at ISO 26262-compliant ASIL B automotive display systems, improving safety in heads-up displays, digital clusters, and electronic mirrors by identifying video corruption, frozen frames, and signal problems.

Automotive Display System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Automotive Display System Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | LCD, TFT-LCD, OLED, Digital Lighting Processing (DLP), Plasma Panels |

| Display Sizes Covered | Less than 5”, Between 6” to 10”, Greater than 10” |

| Applications Covered | Head Up Display, Instrument Cluster, Center Stack Display, Rear Seat Entertainment Display, Rear View Mirror Display, Portable Navigation Device, Others |

| Vehicle Types Covered | Passenger Vehicle (Hatchback, Sedan, Utility Vehicles), Light Commercial Vehicle, Buses & Coaches, Trucks |

| Sales Channels Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alps Alpine Co. Ltd., AUO Corporation, Continental AG, DENSO Corporation, Innolux Corporation, Japan Display Inc. (Sony Corporation), LG Display Co. Ltd., Nippon Seiki Co. Ltd., Panasonic Holdings Corporation, Robert Bosch GmbH, Valeo SA, Visteon Corporation, YAZAKI Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive display system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive display system market.

- The study maps the leading as well as the fastest growing regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive display system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive display system market was valued at USD 17.19 Billion in 2024.

The automotive display system market is projected to exhibit a CAGR of 7.82% during 2025-2033, reaching a value of USD 35.03 Billion by 2033.

Rising demand for modern infotainment systems and digital instrument clusters is replacing traditional analog dashboards, offering real-time navigation, entertainment, and vehicle diagnostics. The growing adoption of connected vehicles is also driving the demand for high-resolution displays that support energy monitoring, connectivity, and smart features. Moreover, the rise of ADAS and HUDs is improving road safety by minimizing driver distractions.

Asia-Pacific currently dominates the automotive display system market, accounting for a share of 64.5% in 2024, due to its large automotive production base, strong user demand, and rising disposable incomes. The rapid adoption of digital technologies, supported by government initiatives, is positively influencing the market across the region.

Some of the major players in the automotive display system market include Alps Alpine Co. Ltd., AUO Corporation, Continental AG, DENSO Corporation, Innolux Corporation, Japan Display Inc. (Sony Corporation), LG Display Co. Ltd., Nippon Seiki Co. Ltd., Panasonic Holdings Corporation, Robert Bosch GmbH, Valeo SA, Visteon Corporation, YAZAKI Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)