Automotive Differential Market Size, Share, Trends and Forecast by Type, Drive Type, Vehicle, Component, Vehicle Propulsion Type, and Region, 2025-2033

Automotive Differential Market 2024, Size and Trends:

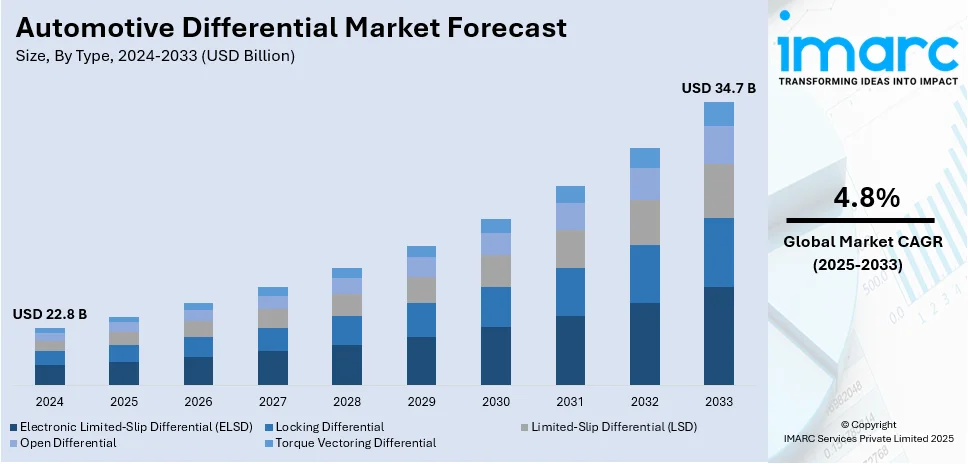

The global automotive differential market size was valued at USD 22.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 34.7 Billion by 2033, exhibiting a CAGR of 4.8% during 2025-2033. Asia Pacific currently dominates the market in 2024. The increasing vehicle production across the globe, rapid technological advancements, growing demand for electric and hybrid vehicles, imposition of various regulations by governments, and increasing adoption of sports utility vehicles (SUVs) and all-wheel drive vehicles are some of the major factors propelling the market across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 22.8 Billion |

|

Market Forecast in 2033

|

USD 34.7 Billion |

| Market Growth Rate 2025-2033 | 4.8% |

Automotive differential refers to a mechanical component that allows the wheels on the axle to rotate at different speeds. It is generally made from steel alloys due to its high strength, excellent durability, and resistance to wear. The manufacturing process of automotive differential involves casting, machining, heat treating, and assembly. It is widely used in passenger vehicles, trucks, buses, off-road vehicles, racing cars, agricultural equipment, construction machinery, all-wheel-drive systems, sports utility vehicles (SUVs), and electric vehicles (EVs). Automotive differential aids in enhancing traction, improving fuel efficiency, enabling better handling, extending tire life, and improving safety.

Several factors are driving the global automotive differential market, including the rising demand for commercial vehicles, the growing adoption of all-wheel drive (AWD) and 4WD vehicles, and the increasing production of lightweight, high-performance automotive components. In addition, the emergence of electronically limited-slip differentials, an uptick in demand from emerging countries is transforming the market dynamics. Other factors, including the rising adoption of autonomous vehicles, extensive research and development (R&D) activities, and growing demand for lightweight vehicles, are anticipated to drive the market growth.

The imposition of various regulations by governments enforcing stringent emission standards to combat climate change is facilitating product demand as it aids in enhancing fuel efficiency and reducing emission levels. Furthermore, the widespread product demand to improve vehicle navigation capabilities, owing to the rapid expansion of cities and road infrastructure, is positively influencing the market growth. Additionally, the increasing adoption of sports utility vehicles (SUVs) which requires complex differential systems, is contributing to the market growth. Moreover, the significant growth of the automotive aftermarket, which sells various replacement parts, including differentials, is boosting the market growth. Besides this, the widespread product adoption due to increasing consumer preference for a smoother and more controlled driving experience is favoring the market growth.

The growing demand for vehicles, especially SUVs and premium cars, worldwide is the primary driving factor for the automotive differential market. These vehicles require high-end drivetrain systems for increased performance and handling. An increase in consumer interest for off-road and all-terrain vehicles has intensified demand for strong differentials. The rise in electric and hybrid vehicle production has further driven advancements in differential technology to improve torque allocation and enhance energy efficiency. Strict governmental regulations on fuel efficiency and reduced emissions also encourage the use of lightweight and high-performance differential systems. Technological innovations in automobiles, including torque vectoring systems and electronic limited-slip differentials, also play a key role in enhancing driving safety and performance.

The United States stands out as a key market disruptor, driven by the rising demand for high-performance vehicles, in particular SUVs, trucks, and EVs that require advanced differential systems in order to ensure better torque distribution and better traction. Off-road and recreation-driven interest in vehicles have also augmented demand for rugged and effective differentials. In addition, advancements in automotive technology, which include electronic differentials and torque vectoring systems, will enhance vehicle stability, safety, and fuel efficiency, making these features highly desired in the market. This trend is also supported by growing electric and hybrid vehicle adoption, which demands special differential solutions to manage power distribution. Furthermore, strict fuel efficiency and emission regulations in the U.S. are urging auto manufacturers to design lighter and more efficient differentials. The healthy aftermarket services market also promotes the need for replacement and upgraded differential systems.

Automotive Differential Market Trends:

The increasing vehicle production across the globe

The increasing in vehicle production activities across the globe is a fundamental driver in the demand for automotive differentials. In line with this, the growing middle class with increased spending power has resulted in a higher demand for passenger vehicles. According to the Society of Indian Automobile Manufacturers, the sales of passenger cars rose from 14,67,039 to 17,47,376 units in the period 2022-2023, showing this growing demand. Apart from this, rapid globalization and the need for the transportation of goods across regions are fueling the need for trucks and other commercial vehicles. Furthermore, manufacturing sectors are also expanding, aligning with global economic growth, which is further increasing the necessity for specialized vehicles in various industries. This rise in vehicle manufacturing to meet diverse needs has resulted in a higher demand for automotive differentials to enable smooth handling and efficient operation of vehicles. The direct correlation between vehicle production and the requirement for differentials makes this factor a significant contributor to the market growth.

The rapid technological advancements

Technology is playing a vital role in advancing the automotive differential market. In line with this, the introduction of lightweight materials to design more efficient and adaptive differential systems is propelling the market growth. Furthermore, the recent advancements in computer-aided design (CAD) and manufacturing technologies allowing the creation of more precise and complex designs are acting as another growth-inducing factor. Additionally, the adoption of advanced heat treatment processes to enhance the durability and efficiency of differentials is positively influencing the market growth. Moreover, the recent development of electronically controlled differentials, which allows more adaptive control based on driving conditions, is contributing to the market growth. Besides this, the integration of differential with other vehicular systems, such as traction control, to enable a more holistic approach to vehicle handling and performance is favoring the market growth. In this context, the Indian government's approval of the Production-Linked Incentive (PLI) Scheme for the Automotive Industry on 15th September 2021, with a budgetary outlay of INR 25,938 crore (USD 3.05 Billion) over a five-year period (FY2022-23 to FY2026-27), is expected to significantly boost the manufacturing of Advanced Automotive Technology (AAT) products. The emerging market need for highly specialized, advanced automotive components, like high-performance differentials, spurs new technologies in the industry, hence further accelerating the market growth.

The growing demand for electric and hybrid vehicles

The increasing emphasis on environmental sustainability and energy efficiency is driving the growth of electric and hybrid vehicles (EVs and HEVs). Governments, corporations, and consumers are recognizing the imperative need to reduce fossil fuel reliance and greenhouse gas emissions. Automotive differentials for EVs and HEVs are often specialized, as they have different requirements compared to traditional internal combustion engine vehicles. Therefore, the demand for specialized differentials that are energy efficient, compatible with electric drivetrains, and easily integrated with complex electronic systems is propelling the market growth. The growth in passenger car sales can also be attributed to the surge in electric vehicle sales, which have skyrocketed due to declining costs, advancements in technology, and strong government support, all driven by the increasing global demand. For instance, according to the International Energy Agency, more than 2.3 million electric cars were sold in the first quarter of 2023. Furthermore, the growing popularity of EVs and HEVs, supported by governmental incentives, advancements in battery technologies, charging infrastructure, and a cultural shift toward ecological responsibility, is acting as another growth-inducing factor.

Automotive Differential Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive differential market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, drive type, vehicle, component and vehicle propulsion type.

Analysis by Type:

- Electronic Limited-Slip Differential (ELSD)

- Locking Differential

- Limited-Slip Differential (LSD)

- Open Differential

- Torque Vectoring Differential

Open differential leads the market in 2024. Open differentials are dominating the market as they are less complex compared to their limited-slip and locking counterparts. This simpler design makes them easier to manufacture and also more affordable, thus contributing to their widespread use. Furthermore, they are suitable for a wide range of vehicles, including light commercial vehicles, passenger cars, and some off-road applications. Additionally, open differentials are designed to minimize unnecessary friction, thus contributing to better fuel efficiency.

Analysis by Drive Type:

- Front Wheel Drive (FWD)

- Rear Wheel Drive (RWD)

- All Wheel Drive/ Four Wheel Drive (AWD/4WD)

Front wheel drive (FWD) leads the market in 2024. Front wheel drive (FWD) dominates the market since they are cheaper to produce than the rear-wheel-drive (RWD) or all-wheel-drive (AWD) systems. The simplicity in both design and manufacture translates directly into lower prices for manufacturers as well as customers. Furthermore, they allow more effective use of interior space by placing differential and other drivetrain components at the front of the vehicle, which aids in creating more room for passenger and cargo space. Additionally, FWD offers better traction on wet or slippery roads, which ensures proper performance for driving conditions, such as city roads and highways.

Analysis by Vehicle:

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Off-highway Vehicle

Passenger car leads the market in 2024. Passenger cars are dominating the market as they are the most common type of vehicle owned by individuals and families. Their widespread use for daily commuting, errands, and personal transportation contributes to a high demand for automotive differentials specifically designed for these vehicles. Furthermore, their affordability compared to commercial and luxury vehicles broadens their appeal to a wider demographic. Additionally, the growth of urban areas and the corresponding need for personal mobility solutions drive the demand for passenger cars. They also come in diverse models, sizes, and cost ranges to suit the divergent needs of consumers. This variety further increases their market share and the demand differential.

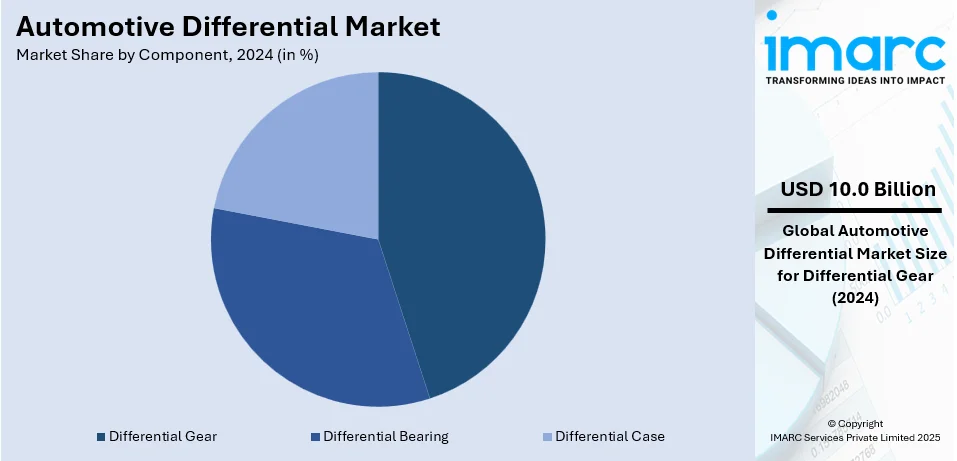

Analysis by Component:

- Differential Bearing

- Differential Gear

- Differential Case

Differential gear leads the market in 2024 since they will be an integral part of any wheeled vehicle in which the wheels can turn at different speeds in rotation. The functionality is basic to proper handling and stability, hence this component is not an option in automotive design. Furthermore, they are utilized in a broad spectrum of vehicles, including passenger cars, commercial vehicles, off-road vehicles, and even certain industrial machinery. The market growth is being driven by ongoing advancements in materials, design, and manufacturing processes, which are leading to the development of more efficient and reliable differential gears.

Analysis by Vehicle Propulsion Type:

- I.C. Engine Vehicle

- Spark Ignition Engine based Vehicle

- Compression Ignition Engine based Vehicle

- Electric Vehicle

- Battery Electric Vehicle

- Fuel Cell Electric Vehicle

- Hybrid Electric Vehicle

- Hybrid Electric

- Plug-in Hybrid Electric

I.C. engine vehicle leads the market in 2024. I.C. engine vehicles are dominating the market as they have an established infrastructure comprising fueling, maintenance, and repair facilities. Furthermore, they are more affordable and easier to maintain compared to electric and hybrid alternatives. This cost-effectiveness attracts a broad range of consumers. Additionally, I.C. engine vehicles are available in a diverse range of sizes, price points, and styles, catering to various consumer needs and preferences. Moreover, they are widely available in gasoline and diesel variants, which makes them a convenient choice for many, especially in regions where alternative fueling options are limited.

Analysis by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market due to rapid economic expansion and a rise in middle-class populations, leading to increased demand for personal vehicles. Furthermore, the presence of major automotive companies and their supply chain networks in the region further supports the demand for differentials. Additionally, the rapid urbanization activities in the Asia Pacific region translate to an increasing demand for mobility solutions, such as personal and commercial vehicles. Besides this, the imposition of supportive policies by the regional governments promoting the growth in the automotive industry and infrastructural development activities is positively influencing the market growth. Moreover, the region's manufacturers are responsive to global automotive trends, including electrification and automation, positioning them favorably in the automotive differential market.

Key Regional Takeaways:

United States Automotive Differential Market Analysis

The United States is one of the largest automotive markets in the world, thus a big growth driver for the automotive differential market. According to the International Trade Administration, the sales of U.S. light vehicles reached 14.5 million units in the year 2020. It is the world's second-largest market for vehicle sales and production, and this gives an indication of the size of its automotive sector. This high volume of vehicles produced directly translates to the increased need for automotive parts, among which are the differentials. The increased demand for vehicles is going to keep increasing the need for modern automotive technologies such as the differentials that guarantee smooth and efficient running of the vehicle. Electric vehicles and hybrid vehicles require specially designed differentials, and as individuals start to adopt more and more, the demand for new inventions is growing. Increasing production of vehicles of different types, including passenger cars, trucks, and commercial vehicles, should enhance demand for automotive differentials in the U.S. market and make it the key growth driver in the global market. Therefore, this powerful vehicle market will continue to fuel the demand for high-performance and efficient differentials.

Europe Automotive Differential Market Analysis

The European automotive market is now growing significantly, creating significant demand for automotive differentials. According to the International Energy Agency, in 2023, there were around 3.2 million new electric car registrations in Europe, a 20% increase from the figures recorded in 2022. The European Union recorded 2.4 million new electric car sales at the same rate. The EU car market grew by 13.9% in 2023, to a total of 10.5 million units, according to the European Automobile Manufacturers' Association (ACEA). One of the most striking trends in the market is the rise in hybrid-electric car registrations, which have increased by 26% in December 2023. The trend was very pronounced in major markets such as Germany (+38%), France (+32.6%), and Spain (+24.3%). As the demand for electric and hybrid-electric vehicles is increasing, so does the need for specialized automotive components, including differentials. The need for high-performance differentials catering to the specific requirements of electric drivetrains thus becomes a key driver of the European automotive differential market. This rise in electric and hybrid vehicle sales is also expected to drive the demand for advanced differentials across the region.

Asia Pacific Automotive Differential Market Analysis

The Asia-Pacific automotive differential market is expected to experience significant growth due to the synergy of economic development, government initiatives, and the enhancement of demand for advanced auto parts. In 2023, the region accounted for 56.4% share of the global heavy truck market share, which is expected to see an increase to 60.9% by the year 2028, according to an industrial news article. The growing economies of China and India, along with rising income levels, particularly among middle-class consumers, are fueling the demand for automotive vehicles, including heavy trucks. Together, China and India account for over 60% of the world's automotive differential market. Emerging markets in Southeast Asia, such as Indonesia, Bangladesh, and Vietnam, are also showing positive growth. Government policies in India, including the 'Make in India' initiative, are further boosting the automotive sector by encouraging local manufacturing and attracting foreign investments. The push by India toward electric vehicles, aiming to convert all fuel-run vehicles into fully or semi-electric vehicles by 2035, is driving the demand for specialized automotive differentials. Such factors provide a positive outlook toward the automobile differential market in the Asia-Pacific region.

Latin America Automotive Differential Market Analysis

The Latin American automotive differential market is expected to grow steadily with the growth of the region's vehicle sales and the economic influence of its largest markets, including Brazil, Mexico, and Argentina. In 2023, the Latin American market recorded 4.9 million vehicle sales, which is a 4.1% increase from the previous year, making it the 4th largest sub-regional market globally, as per an industry report. This expansion in sales car and trucks will result directly in a demand increase on automotive differentials that make sure the performance of vehicle running and efficiency. Brazilian and Mexican and Argentine automotive markets are some of the strongest players in the three, particularly Brazil is the leader, but Mexico and Argentina significantly perform in both the production and consumption of automobiles. With efforts by Latin American governments toward increasing the automotive sector and improving manufacturing, along with calls for more sustainable vehicle technology, such as electric cars, the demand for further specified differential markets continues. Thus, the Latin America auto differential market is likely to continue to grow with its domestic demand and the rise of interest worldwide on automotive products.

Middle East and Africa Automotive Differential Market Analysis

The market for the automotive differential in the Middle East and Africa is likely to grow in the near future, owing to the region's growing electric vehicle market. According to an industrial report, the Middle East is still at a nascent stage but is expected to reach USD 54 Billion in 2035, where it may comprise nearly two-thirds of new car sales with EVs. This shift towards EVs is nudging the region into transformational automobile landscape, thereby producing a demand for exclusive automotive parts like advanced differential designed for electric drivetrain. Public and private interest overlaps in the development of the region as a viable 'ecosystem' for a healthy 'ecology', with emphases on development of infrastructure, technological improvements and policy, including incentives, that support shifts to clean energy. This wave of adoption is expected to fuel demand for energy-efficient differentials that are compatible with electric and hybrid vehicles and function smoothly with electronic systems. Market growth in the Middle East and Africa will be further pushed by sustainable transportation and new technologies.

Competitive Landscape:

The leading automotive differential companies are heavily investing in research and development (R&D) to introduce new differential technologies. This includes improvements in efficiency, weight reduction, and integration with other vehicle systems. Furthermore, companies are expanding their manufacturing and sales networks across different regions by entering emerging markets and strengthening their positions in established ones to tap into new consumer bases. Additionally, several key players are forming strategic alliances, partnerships, and joint ventures with other industry players to leverage complementary strengths and accelerate development and market penetration. Moreover, top companies are working on producing differentials that contribute to better fuel efficiency and lower emissions, which aligns with global sustainability goals and regulatory requirements. Besides this, they are incorporating digital tools and automation in design, manufacturing, and supply chain processes to enhance efficiency, quality, and adaptability.

The report provides a comprehensive analysis of the competitive landscape in the automotive differential market with detailed profiles of all major companies, including:

- American Axle & Manufacturing Inc.

- Borgwarner Inc.

- Dana Incorporated

- Eaton Corporation Inc.

- GKN Automotive Limited

- Hyundai WIA Corporation

- JTEKT Corporation

- PowerTrax

- Quaife Engineering, Ltd.

- Yager Gear Enterprise Co Ltd

- ZF Friedrichshafen AG

Latest News and Developments:

- May 2024: The U.S. government declared its intentions to invest about USD 1.3 Billion to expand EV infrastructure nationwide.

- May 2024: Borgwarner Inc. launched its new electric Torque Vectoring and Disconnect (LVD) system for numerous battery electric vehicles (BEVs). The LVD system will be applied in enhancing stability, providing high dynamic performance, traction control, and others for intelligent wheel torque control.

- March 2024: The firm Sona BLW Precision Forgings Ltd, provider of differential solutions, has marked various production milestones, wherein the company has achieved an ability to produce 400 million differential gears and 6 million differential assemblies to cater for demand in countries such as India and China.

- In January 2024: American Axle & Manufacturing introduced groundbreaking driveline technologies for electric vehicles, passenger cars, and trucks, marking a major advancement for the automotive industry. At CES 2024, the company showcased its 3-in-1 electric drive units (eDUs), fully integrated e-Beam axles, differential solutions, and other innovative components that are helping to shape the future of global mobility.

- In April 2023: Sona BLW Precision Forgings Ltd (Sona Comstar) opened its second-largest production unit in Chakan, near Pune, one of India's biggest automotive and industrial centers.

- In May 2023: Sona BLW Precision Forgings Ltd (Sona Comstar) opened its second-largest production unit in Chakan, near Pune, one of India's biggest automotive and industrial centers, in May 2023. The unit employs cutting-edge testing and inspection technology, and it is slated to produce 20.1 million differential gears by fiscal year 25.

Automotive Differential Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Electronic Limited-Slip Differential (ELSD), Locking Differential, Limited-Slip Differential (LSD), Open Differential, Torque Vectoring Differential |

| Drive Types Covered | Front Wheel Drive (FWD), Rear Wheel Drive (RWD), All Wheel Drive/ Four Wheel Drive (AWD/4WD) |

| Vehicles Covered | Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle, Off-highway Vehicle |

| Components Covered | Differential Bearing, Differential Gear, Differential Case |

| Vehicle Propulsion Types Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Axle & Manufacturing Inc., Borgwarner Inc., Dana Incorporated, Eaton Corporation Inc., GKN Automotive Limited, Hyundai WIA Corporation, JTEKT Corporation, PowerTrax, Quaife Engineering, Ltd., Yager Gear Enterprise Co Ltd, ZF Friedrichshafen AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive differential market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive differential market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive differential industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive differential market was valued at USD 22.8 Billion in 2024.

IMARC estimates the global automotive differential market to exhibit a CAGR of 4.8% during 2025-2033.

Key factors driving the global automotive differential market include the increasing demand for performance and off-road vehicles, the rise of electric and hybrid vehicles, advancements in drivetrain technology, and the need for improved fuel efficiency and safety features.

Open differential leads the market in 2024, driven by its cost-effectiveness, simplicity, and wide application in automotive engineering.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global automotive differential market include American Axle & Manufacturing Inc., Borgwarner Inc., Dana Incorporated, Eaton Corporation Inc., GKN Automotive Limited, Hyundai WIA Corporation, JTEKT Corporation, PowerTrax, Quaife Engineering, Ltd., Yager Gear Enterprise Co Ltd, ZF Friedrichshafen AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)