Automotive Diagnostic Scan Tools Market Size, Share, Trends and Forecast by Offering Type, Tool Type, Propulsion Type, Vehicle Type, and Region, 2025-2033

Automotive Diagnostic Scan Tools Market Size and Share:

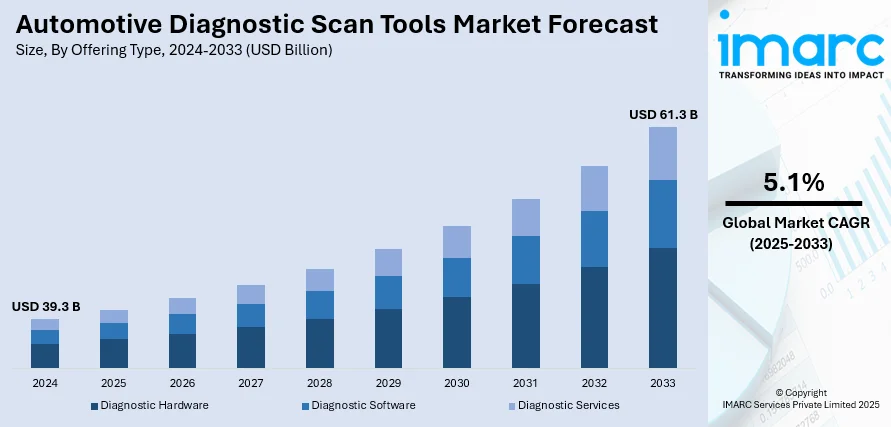

The global automotive diagnostic scan tools market size was valued at USD 39.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 61.3 Billion by 2033, exhibiting a CAGR of 5.1% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 45.0% in 2024. The dominance of the region is because of its large automotive manufacturing base, rapid technological advancements, and expanding automotive aftermarket services. The growing automotive industry, increasing vehicle sales, and rising demand for advanced diagnostic solutions further contribute to the expansion of the automotive diagnostic scan tools market share, supported by a strong presence of key market players and expanding infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 39.3 Billion |

|

Market Forecast in 2033

|

USD 61.3 Billion |

| Market Growth Rate 2025-2033 | 5.1% |

With the integration of advanced technologies like electric powertrains, automated systems, and complex electronics in vehicles, the complexity of diagnosing problems is growing. Automotive diagnostic scan tools are vital for detecting issues in these complex systems, creating a need for tools that can manage contemporary vehicle diagnostics effectively. In addition, technological progress in diagnostics, featuring the incorporation of artificial intelligence (AI), machine learning (ML), and cloud computing, is transforming the automotive diagnostic scan tools industry. These technologies enhance diagnostic precision, speed, and effectiveness, appealing to individuals and companies looking to optimize their repair methods and lower total maintenance expenses.

To get more information on this market, Request Sample

The United States is a crucial segment in the market, driven by the growing integration of advanced technologies like electric drivetrains, autonomous features, and connected car systems in vehicles, which requires sophisticated diagnostic tools. Modern vehicles require specialized equipment to diagnose complex electronic systems, fueling the market for advanced automotive diagnostic scan tools. In 2025, Launch Tech USA introduced PredictaFix™, an AI-powered automotive repair tool integrated into its diagnostic systems. The technology, powered by CarTechIQ's AI, helps technicians deliver faster, more accurate repair recommendations by analyzing diagnostic trouble codes and providing targeted solutions. This innovation aims to improve diagnostic efficiency and precision in an increasingly complex automotive landscape.

Automotive Diagnostic Scan Tools Market Trends:

Rising Demand for Commercial Vehicle Diagnostics

As commercial vehicles, such as trucks, buses, and light commercial vehicles (LCVs) become more integral to global supply chains, the need for specialized diagnostic tools that can support these vehicles is growing. These vehicles have complex systems that require specific diagnostic capabilities, especially for emission standards compliance, safety features, and engine performance. Diagnostic tools that are tailored for commercial vehicles, offering compatibility with various emission norms and advanced connectivity features, help fleet operators maintain vehicle performance, reduce downtime, and meet regulatory standards, thus driving the market's expansion in this sector. Manufacturers are responding by offering diagnostic tools catering to these needs. In 2024, Texa launched the TXT Bharat OBD tool in India, designed for diagnosing commercial vehicles like trucks, buses, and LCVs. The tool, priced at Rs 195,000, integrates with IDC5 Bharat software for comprehensive vehicle diagnostics, supporting BS-III to BS-VI emission standards. Developed with extensive local testing, it offers advanced features like Bluetooth connectivity and regular software updates to enhance functionality.

Cost-Effective Solutions for Technicians

As vehicle complexity increases, technicians require advanced diagnostic solutions to efficiently identify and address issues. However, the high cost of traditional diagnostic tools can limit their accessibility, especially for smaller repair shops or individual technicians. The introduction of affordable, user-friendly diagnostic tools, which offer free software updates and compatibility with a wide range of vehicles, is addressing this challenge. These cost-effective solutions enable a broader range of technicians, regardless of experience level, to access advanced diagnostic capabilities, thereby increasing the adoption of diagnostic tools and driving market expansion. In 2024, GEARWRENCH launched three new cost-effective diagnostic tools, GWSCAN, GWSMARTBT, and GWSMART07. These tools were designed for both new and experienced technicians, offering free software updates, warranties, and compatibility with over 80 car manufacturers. The tools aimed to make diagnostics accessible by eliminating costly updates and high upfront costs.

Increased Demand for Advanced Diagnostic Capabilities

As vehicles become more complex, with numerous interconnected systems, including engine control units (ECUs), infotainment, and safety systems, technicians require tools that can handle comprehensive diagnostics. Tools offering full-system and vehicle-specific diagnostics are in high demand, enabling both novice and professional users to efficiently identify and address issues. These advanced tools provide greater diagnostic accuracy, reduce repair time, and enhance service capabilities. The continual evolution of vehicle technology, alongside the need for more sophisticated diagnostic functions, is driving the demand for advanced, multi-functional diagnostic tools, fostering market expansion. In 2024, XTOOLOnline launched a new range of eight advanced automotive diagnostic tools, including the XTOOL D5, D5S, D6, D6S, and IP500 series. These tools offer varying levels of diagnostic capabilities, from basic four-system diagnostics to full-system and vehicle-specific functions. Designed for both novice and professional users, they enhance diagnostic efficiency with intuitive interfaces and robust features.

Automotive Diagnostic Scan Tools Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive diagnostic scan tools market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on offering type, tool type, propulsion type, and vehicle type.

Analysis by Offering Type:

- Diagnostic Hardware

- Scanner

- Analyzer

- Tester

- Code Reader

- Others

- Diagnostic Software

- Vehicle System Testing Software

- Vehicle Tracking and Emissions Analysis

- ECU Diagnosis Software

- Others

- Diagnostic Services

- Vehicle Maintenance and Repair

- Custom, Training, Support and Integration

Diagnostic hardware (scanner, analyzer, tester, code reader, and others) dominates the market, holding a share of 56.8%, as it plays a crucial role in delivering precise, real-time evaluations of vehicle systems. This segment aims at connecting directly to the internal computer of the vehicle, enabling technicians to detect issues, assess performance, and carry out required repairs accurately. The dependability, longevity, and effectiveness of diagnostic equipment makes it essential for professional automotive service facilities, guaranteeing prompt and efficient upkeep. Moreover, with the rising complexity of vehicles, diagnostic tools provide effective solutions to manage various problems across different systems, including engine diagnostics and electronic control units. As hardware technology advances, this segment keeps evolving, providing more robust features and functionalities that allow technicians to conduct thorough diagnostics swiftly.

Analysis by Tool Type:

- DIY Diagnostic

- OEMS Diagnostics

- Professional Diagnostics

Professional diagnostics exhibit a clear dominance in the market, holding a share of 67.8%, owing to their superior capabilities and precision in identifying intricate vehicle problems. These instruments are tailored for skilled technicians and automotive experts, providing detailed analysis, real-time information, and thorough fault detection across multiple vehicle systems. As automobiles become more advanced, demanding accurate and thorough diagnostics, specialized tools are crucial for efficient and successful repairs. The growing need for dependable, high-performance diagnostic tools in professional automotive repair shops and service centers enhances the market presence of professional diagnostics. These resources allow automotive experts to optimize repair procedures, boost efficiency, and deliver excellent service to clients. The rising sophistication of contemporary vehicles, especially with the incorporation of cutting-edge electronics and sensors, guarantees that expert diagnostics continue to be the leading option for achieving precise and prompt vehicle upkeep.

Analysis by Propulsion Type:

- IC Engine Vehicles

- Electric Vehicles

IC engine vehicles dominate the market, holding a market share of 78.1%, due to their longstanding existence and extensive use throughout the worldwide automotive sector. Most vehicles on the road continue to depend on internal combustion engines, resulting in a steady and considerable need for diagnostic tools to assist maintenance and repair efforts. These vehicles possess intricate mechanical and electronic systems that necessitate specialized tools for effective fault identification and performance enhancement. The vast service network and knowledge related to IC engine vehicles also enhance the leading position of this segment. Moreover, despite the rise of alternative propulsion technologies, the extensive number of IC engine vehicles on the road guarantees that diagnostic tools designed for this propulsion type are essential in the automotive repair and maintenance sector, thus contributing to the market growth.

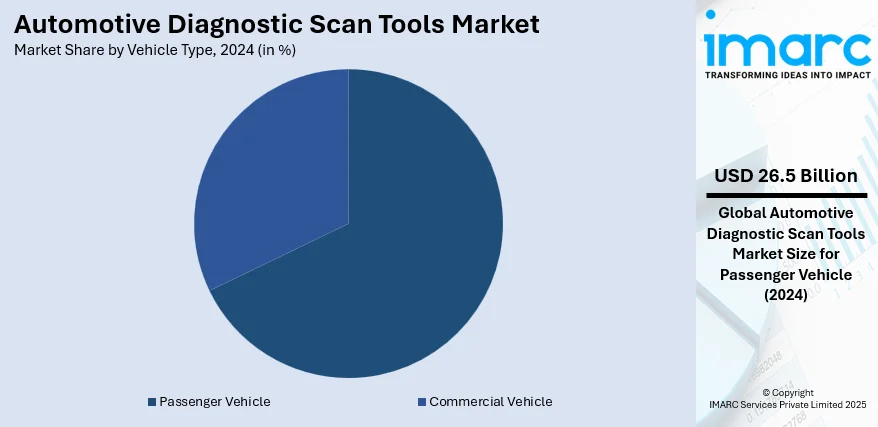

Analysis by Vehicle Type:

- Passenger Vehicle

- Commercial Vehicle

Passenger vehicle represents the largest segment with a market share of 67.5%, attributed to the growing utilization and the increasing need for effective maintenance and repair options. As passenger vehicles make up the largest part of the global automotive fleet, the demand for dependable diagnostic tools is rising to aid in their routine maintenance and care. The intricacy of contemporary passenger cars, featuring advanced electronic systems and connectivity options, is catalyzing the demand for advanced diagnostic tools capable of managing various systems and delivering precise fault identification. In addition, the growing inclination towards preventive maintenance and the heightened emphasis on vehicle safety and performance in the passenger vehicle sector are driving the need for automotive diagnostic tools. As a result, the passenger car segment continues to be the main catalyst for the advancement and expansion of diagnostic scan tools within the automotive sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia pacific leads the market, holding a share of 45.0%, because of its strong automotive manufacturing sector and swift technological progress. The area's notable rise in automobile manufacturing, along with a growing emphasis on sophisticated diagnostic technologies, enhances its market dominance. As per the IBEF, in March 2025, the aggregate output of passenger cars, three-wheelers, two-wheelers, and quadricycles reached 24,76,915 units. This increase in vehicle production is driving the demand for diagnostic tools as automotive repair shops and service centers need efficient solutions to maintain and repair a growing number of vehicles. Furthermore, the growing transition towards connected vehicles and EVs is driving the demand for specialized diagnostic tools. The existence of many automotive parts manufacturers, together with a significant number of skilled technicians and mechanics, promotes the widespread use of these tools. Robust governmental backing for infrastructure advancement and funding in research operations by major stakeholders further strengthen Asia Pacific’s leadership, establishing the area as an essential center for innovation and expansion in the automotive diagnostic tools industry.

Key Regional Takeaways:

United States Automotive Diagnostic Scan Tools Market Analysis

In North America, the market portion held by the United States was 88.70%, propelled by the growing intricacy of contemporary vehicles. These automobiles now include engine control units, infotainment systems, advanced driver-assistance functionalities, and strong emission-control modules, all of which necessitate complex diagnostic tools to access, interpret, and address problems effectively. Additionally, the swift uptake of electric and hybrid vehicles is presenting entirely new diagnostic issues, including battery systems, power electronics, and regenerative drive systems, which conventional scan tools cannot manage, resulting in a need for specialized diagnostics for EVs. As per the U.S. Energy Information Administration (EIA), the total sales of battery electric vehicles (BEVs), plug-in hybrid EVs, and hybrid vehicles in the United States accounted for 18.7% of all new light-duty vehicle (LDV) sales in Q2 2024, showing a significant rise from Q1 2024, where it was 17.8%. This general expansion was mainly driven by the rising sales of hybrid electric vehicles (HEVs), which saw an annual growth of 30.7%. Additionally, the increasing age of the vehicle fleet in the United States is driving the need for aftermarket services, rendering diagnostic tools vital for maintenance and repair across various models.

North America Automotive Diagnostic Scan Tools Market Analysis

The market for automotive diagnostic scan tools in North America is propelled by various essential elements, such as robust automotive sector, rising vehicle sophistication, and heightened need for advanced diagnostic solutions. The growing use of advanced vehicles, like electric and hybrid cars, along with the incorporation of more electronic systems, is catalyzing the demand for specialized diagnostic equipment. Furthermore, the emphasis on preventive maintenance and effective repair services is bolstering the market growth, as both individuals and businesses look for options that minimize downtime and lower maintenance expenses. Continuous innovations in diagnostic technology are contributing to the growing demand for high-performance diagnostic tools, as they help professionals reduce repair times, improve accuracy, and enhance overall efficiency in vehicle maintenance. In 2024, Launch Tech USA introduced the X-431 Throttle V diagnostic tool, setting a new benchmark in automotive repair technology. It featured powerful hardware, including an 8-core processor, 12GB of RAM, and a 13.6-inch display, providing fast and efficient diagnostics. With advanced software integration, the tool streamlines vehicle repairs, offering precise data and improving workflow for automotive professionals.

Europe Automotive Diagnostic Scan Tools Market Analysis

The expansion of the Europe automotive diagnostic scan tools market is driven by multiple intersecting factors. Modern European cars are increasingly equipped with advanced onboard electronics, driver assistance systems, and emissions control technologies, requiring multifunctional, precise diagnostic tools that can read fault codes, execute software updates, and calibrate complex systems. Additionally, strict emissions and safety regulations throughout EU nations are encouraging both producers and independent workshops to invest in compliant diagnostic tools. The swift expansion of EVs in Europe is also driving the need for scanners that comply with EV standards. Reports indicate that in 2022, EVs made up 80% of all passenger car sales in Norway. Likewise, EVs represented 41% of overall passenger car sales in Iceland that same year and achieved 32% in Sweden. Furthermore, the strong independent service network and multi-brand repair chains throughout the continent are catalyzing the demand for flexible, compatible scan tools. Furthermore, innovations in technology, including wireless connectivity, integration of apps for smartphones and tablets, remote cloud diagnostics, and AI-driven failure forecasting, are enhancing tools to be more intelligent and user-friendly, thus promoting broader adoption.

Asia Pacific Automotive Diagnostic Scan Tools Market Analysis

The market for automotive diagnostic scan tools in the Asia Pacific region is growing because of the swift increase in vehicle production and ownership in countries like China, India, and Southeast Asia, leading to greater demand for dependable maintenance and service equipment. For example, according to the India Brand Equity Foundation (IBEF), the overall count of passenger cars, three-wheeled vehicles, two-wheeled bikes, and quadricycles produced in India totaled 24,76,915 units in March 2025. As vehicle models become more sophisticated, featuring advanced engine management systems, hybrid drivetrains, infotainment platforms, and safety electronics, workshops and dealerships need diagnostic scanners that can connect with various systems. In addition, many nations in the area are requiring regular vehicle inspections, encouraging service centers to invest in precise and effective diagnostic equipment. The emergence of connected vehicles and the incorporation of telematics systems is driving the need for diagnostic tools capable of analyzing and handling real-time automotive information. In addition, the growing investments in vocational training and automotive education are encouraging a wider adoption of professional-grade diagnostic tools.

Latin America Automotive Diagnostic Scan Tools Market Analysis

The automotive diagnostic scan tools market in Latin America is witnessing growth, driven by the growing vehicle ownership and increasing used-car market. This is leading to higher demand for cost-effective and reliable diagnostic tools among independent repair shops and emerging multi-brand service networks. With the aging of local fleets, there is a rise in the demand for maintenance solutions that can swiftly pinpoint and resolve problems in older engines, emission systems, and electronics. Additionally, the growth of car-sharing and commercial transport services is encouraging fleet operators to invest in diagnostic tools that facilitate preventive maintenance and minimize vehicle downtime. The car sharing market in Brazil achieved USD 155.88 Million in 2024 and is anticipated to expand at a CAGR of 9.50% from 2025 to 2033, according to the IMARC Group.

Middle East and Africa Automotive Diagnostic Scan Tools Market Analysis

The automotive diagnostic scan tools market in the Middle East and Africa is greatly influenced by the growing need for advanced diagnostic features and heightened awareness regarding vehicle safety and maintenance. With the increasing number of cars on the streets, there is a heightened demand for effective equipment to swiftly identify and fix issues. For example, new vehicle registrations and sales in Saudi Arabia rose by 23% in 2021 compared to the prior year, as reported by the US Saudi Business Consortium. Moreover, the growth of automotive service centers and workshops in urban and semi-urban regions is encouraging the use of scan tools. Authorities are further promoting the implementation of vehicle emission standards and regular checks, which increases the automotive diagnostic scan tools market demand.

Competitive Landscape:

Major participants in the industry are concentrating on upgrading their product range by integrating cutting-edge technologies, such as AI, ML, and cloud solutions, to boost diagnostic precision and effectiveness. They are allocating funds for research activities to create tools that accommodate changing vehicle systems, guaranteeing alignment with advanced models. Furthermore, these companies are broadening their market presence via strategic acquisitions, enhancing client support services, and offering training programs to assist end-users in optimizing the use of diagnostic tools, thereby reinforcing their competitive standing. In 2024, MAHLE unveiled the next-generation TechPRO® 2 and BRAIN BEE Connex 2 workshop diagnostic tools. These updated devices feature a redesigned, user-friendly interface, the smallest VCI connector with integrated Diagnostics over Internet Protocol (DoIP), and enhanced functionality with smart features like video tutorials and Smart Scan. The tools were tailored to support digitalization in independent workshops and include flexible license models and compatibility with the MAHLE Cyber Security Pass.

The report provides a comprehensive analysis of the competitive landscape in the automotive diagnostic scan tools market with detailed profiles of all major companies, including:

- Actia Group

- Autel Intelligent Technology Corp. Ltd.

- AVL DiTEST GmbH (AVL List GmbH)

- Continental AG

- Delphi Technologies (BorgWarner Inc.)

- Fluke Corporation (Fortive Corporation)

- Robert Bosch GmbH (Robert Bosch Stiftung GmbH)

- Snap-On Incorporated

- Softing AG

Latest News and Developments:

- August 2025: Parma Car Care Specialists introduced a new Ford diagnostic scan tool and software in order to allow for more accurate maintenance and repairs on late-model Ford automobiles. This latest addition demonstrates the business's ongoing commitment to investing in technology that adapts to the changing requirements of modern automobiles and their electrical systems.

- July 2025: leagend officially launched the MS300 OBD II Trouble Code Diagnostic Tool, further expanding its portfolio of OBD II automotive diagnostic scan tools. The newly launched device is a dependable, easy-to-use tool built to simplify engine code reading, identify issues, and assist in preventative maintenance procedures.

- June 2025: OTOFIX unveiled the D1 Lite, a compact automotive diagnostic scan tool for mobile workers, small garages, and trainees. Supported by Autel, the D1 Lite is a lightweight, user-friendly device that offers real-time information, active component testing, full-system scanning, and more.

- May 2025: Snap-on officially launched TRITON, the company’s latest automotive diagnostic scan platform. Developed to optimize workflow, boost production, and improve efficiency, TRITON utilizes wireless capabilities to deliver quick, dependable connectivity throughout the bay.

- February 2025: Rotunda Capital Partners announced the successful acquisition of AirPro Diagnostics, a renowned provider of Advanced Driver Assistance Systems (ADAS) solutions and other automotive diagnostic scan tools. This acquisition aims to expand AirPro’s presence across key markets and support the company’s growth strategy.

- January 2025: Dealerslink introduced its new On-Board Diagnostics scanner, the Dealerslink OBD, establishing a new benchmark for automotive diagnostic scan equipment. This innovative tool marks a significant advancement in automotive innovation, offering specialists in the dealership environment previously unheard-of capabilities.

Automotive Diagnostic Scan Tools Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offering Types Covered |

|

| Tool Types Covered | DIY Diagnostic, OEMS Diagnostics, Professional Diagnostics |

| Propulsion Types Covered | IC Engine Vehicles, Electric Vehicles |

| Vehicle Types Covered | Passenger Vehicle, Commercial Vehicle |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Actia Group, Autel Intelligent Technology Corp. Ltd., AVL DiTEST GmbH (AVL List GmbH), Continental AG, Delphi Technologies (BorgWarner Inc.), Fluke Corporation (Fortive Corporation), Robert Bosch GmbH (Robert Bosch Stiftung GmbH), Snap-On Incorporated, Softing AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive diagnostic scan tools market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive diagnostic scan tools market.

- The study maps the leading as well as the fastest growing regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive diagnostic scan tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive diagnostic scan tools market was valued at USD 39.3 Billion in 2024.

The automotive diagnostic scan tools market is projected to exhibit a CAGR of 5.1% during 2025-2033, reaching a value of USD 61.3 Billion by 2033.

The automotive diagnostic scan tools market is driven by the growing demand for vehicle maintenance, advancements in automotive technology, and the need for efficient repair solutions. The increasing vehicle complexity, a shift toward preventive maintenance, and the rising adoption of connected cars further contribute to the market growth, enabling faster, more accurate diagnostics and cost-effective repairs for individuals and businesses alike.

Asia Pacific currently dominates the automotive diagnostic scan tools market, accounting for a share of 45.0%. The dominance of the region is attributed to its large automotive manufacturing base, rapid technological advancements, and expanding automotive aftermarket services. The region's growing automotive industry, increasing vehicle sales, and rising demand for advanced diagnostic solutions further contribute to its dominance.

Some of the major players in the automotive diagnostic scan tools market include Actia Group, Autel Intelligent Technology Corp. Ltd., AVL DiTEST GmbH (AVL List GmbH), Continental AG, Delphi Technologies (BorgWarner Inc.), Fluke Corporation (Fortive Corporation), Robert Bosch GmbH (Robert Bosch Stiftung GmbH), Snap-On Incorporated, Softing AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)