Automotive Cloud Market Size, Share, Trends and Forecast by Propulsion Type, Deployment, Vehicle Type, Application, and Region, 2025-2033

Automotive Cloud Market Size and Share:

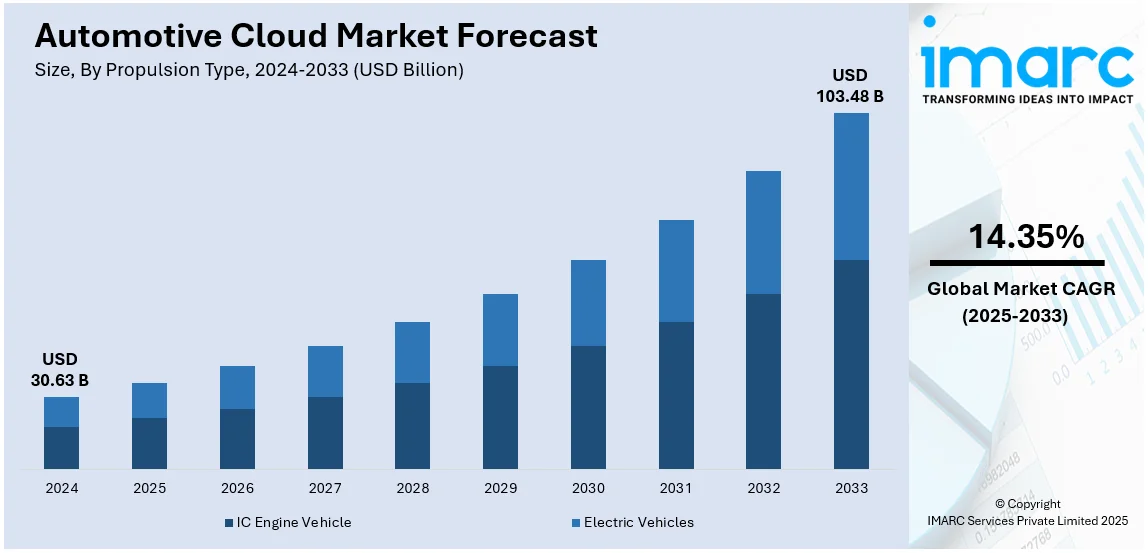

The global automotive cloud market size was valued at USD 30.63 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 103.48 Billion by 2033, exhibiting a CAGR of 14.35% from 2025-2033. North America currently dominates the market, holding a market share of over 42.1% in 2024. The market is expanding rapidly, driven by rising demand for connected vehicles, over-the-air updates, and AI-powered analytics. Automakers are leveraging cloud solutions for telematics, predictive maintenance and autonomous driving advancements. Increasing investments in digital transformation further strengthen automotive cloud market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 30.63 Billion |

|

Market Forecast in 2033

|

USD 103.48 Billion |

| Market Growth Rate (2025-2033) | 14.35% |

The automotive cloud market is driven by rising demand for connected vehicles increasing adoption of IoT and AI in automotive systems and advancements in 5G technology. For instance, in January 2025, Mercedes-Benz and Google Cloud announced their partnership to enhance the MBUX Virtual Assistant with AI-powered conversational capabilities. The new Automotive AI Agent utilizing Google Maps data allows drivers to engage naturally for navigation and point-of-interest queries. The feature will debut in the upcoming CLA model later this year. Automakers are integrating cloud-based solutions for over-the-air (OTA) updates, remote diagnostics and predictive maintenance enhancing vehicle performance and user experience. Growing investments in autonomous driving and smart mobility further boost automotive cloud market demand. Additionally, regulatory mandates for vehicle safety and emissions monitoring encourage cloud-based telematics and data analytics accelerating market expansion across OEMs and mobility service providers.

The United States automotive cloud market is driven by increasing adoption of connected vehicle technologies, growing demand for over-the-air (OTA) software updates and advancements in 5G infrastructure. For instance, in November 2023, Salesforce Automotive Cloud launched new innovations to enhance connected car experiences using data and AI. By unifying real-time vehicle and driver information companies like Toyota can offer personalized services. Key features include Connected Vehicle Visualization and actionable telematics aimed at improving fleet management and automotive finance. Automakers are leveraging cloud-based solutions for predictive maintenance, telematics, and autonomous driving developments. Rising consumer expectations for in-car infotainment and personalized experiences further accelerate cloud integration. Additionally, stringent government regulations on vehicle safety and emissions along with investments in AI-driven mobility solutions enhance cloud deployment across OEMs, fleet operators and mobility-as-a-service providers.

Automotive Cloud Market Trends:

Integration of Blockchain in Automotive Cloud Solutions

The use of blockchain in automotive cloud solutions improves transparency and security in the supply chain. Reports indicate that automotive companies are projected to invest approximately USD169 billion in new technologies by 2025, with around 0.6% of that investment allocated to blockchain initiatives. Automotive companies can ensure the authenticity of parts, reduce fraud, and streamline aftersales services by leveraging blockchain technology, ultimately enhancing customer trust and operational efficiency. Additionally, blockchain facilitates secure data sharing among manufacturers, suppliers, and dealerships, improving traceability. It also enhances cybersecurity in connected vehicles, mitigating risks associated with data breaches and unauthorized access.

Growth of Cloud-Connected Electric Vehicles

The growth of cloud-connected electric vehicles is transforming the automotive industry by enabling real-time data exchange, improving vehicle performance, and offering personalized services. This trend allows automakers to offer advanced features, such as over-the-air updates and remote diagnostics, which aid in enhancing efficiency and providing customer satisfaction. This is accelerating the automotive cloud market demand. Additionally, cloud integration supports fleet management, predictive maintenance, and energy optimization for EVs, enhancing operational efficiency. The expansion of 5G networks and AI-driven analytics further boosts connectivity, enabling seamless communication between vehicles, charging stations, and smart city infrastructure. Automakers are leveraging cloud platforms to optimize battery performance and charging solutions, ensuring a better user experience.

Rising Adoption of Cloud-Based Product Development Platforms

The elevating shift to cloud-based product development platforms in the automotive sector boosts efficiency by enabling seamless collaboration across teams and speeding up the design and manufacturing process. This approach reduces time to market and aligns with sustainability efforts, driving innovation in vehicle production. Cloud solutions enhance data accessibility, allowing real-time modifications and integration of AI-driven simulations for improved design accuracy. Automakers leverage these platforms to streamline supply chain coordination, reduce development costs, and optimize resource utilization. Additionally, cloud-based product development supports compliance with evolving industry regulations and facilitates the rapid prototyping of next-generation vehicles, including EVs and autonomous models.

Automotive Cloud Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive cloud market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on propulsion type, deployment, vehicle type, and application.

Analysis by Propulsion Type:

- IC Engine Vehicle

- Electric Vehicles

The automotive cloud market for internal combustion (IC) engine vehicles is driven by the need for advanced telematics, predictive maintenance, and real-time diagnostics. Cloud solutions enable over-the-air (OTA) updates, fuel efficiency monitoring, and fleet management, enhancing vehicle performance and longevity. Automakers integrate cloud-based navigation and infotainment services to improve user experience. Additionally, regulatory requirements for emissions tracking and compliance reporting drive cloud adoption, allowing manufacturers to optimize engine performance and adhere to evolving environmental standards while reducing operational costs.

Cloud adoption in electric vehicles (EVs) is accelerating due to growing demand for connectivity, battery management, and remote diagnostics. Cloud-based platforms optimize charging infrastructure, monitor battery health, and enable predictive maintenance to enhance EV performance. Real-time data exchange between vehicles and grid systems improves energy efficiency. Automakers leverage cloud computing for smart navigation, over-the-air software updates, and autonomous driving capabilities. The expansion of 5G and AI-driven analytics further strengthens cloud integration, supporting the development of sustainable and connected EV ecosystems.

Analysis by Deployment:

- Public Cloud

- Private Cloud

Private cloud leads the market with around 69.7% of market share in 2024. Private cloud leads the automotive cloud market due to its enhanced data security, customization, and scalability, making it ideal for automakers handling sensitive vehicle and customer data. It supports real-time analytics, over-the-air (OTA) updates, and AI-driven applications while ensuring compliance with stringent industry regulations. Automakers leverage private cloud infrastructure for secure vehicle-to-cloud communication, autonomous driving simulations, and predictive maintenance. Additionally, the ability to integrate proprietary software and optimize resource allocation drives adoption, making private cloud the preferred choice for automotive cloud solutions.

Analysis by Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

Passenger vehicles lead the market with around 82.2% of market share in 2024. Passenger vehicles lead the automotive cloud market due to increasing consumer demand for connectivity, in-car infotainment, and advanced driver-assistance systems (ADAS). Cloud integration enables real-time navigation, remote diagnostics, and over-the-air (OTA) updates, enhancing vehicle performance and user experience. Automakers use cloud-based platforms to provide predictive maintenance, fleet management, and personalized services. The rise of electric and autonomous vehicles further accelerates cloud adoption, while growing 5G infrastructure strengthens vehicle-to-cloud communication, making passenger vehicles the dominant segment in automotive cloud solutions.

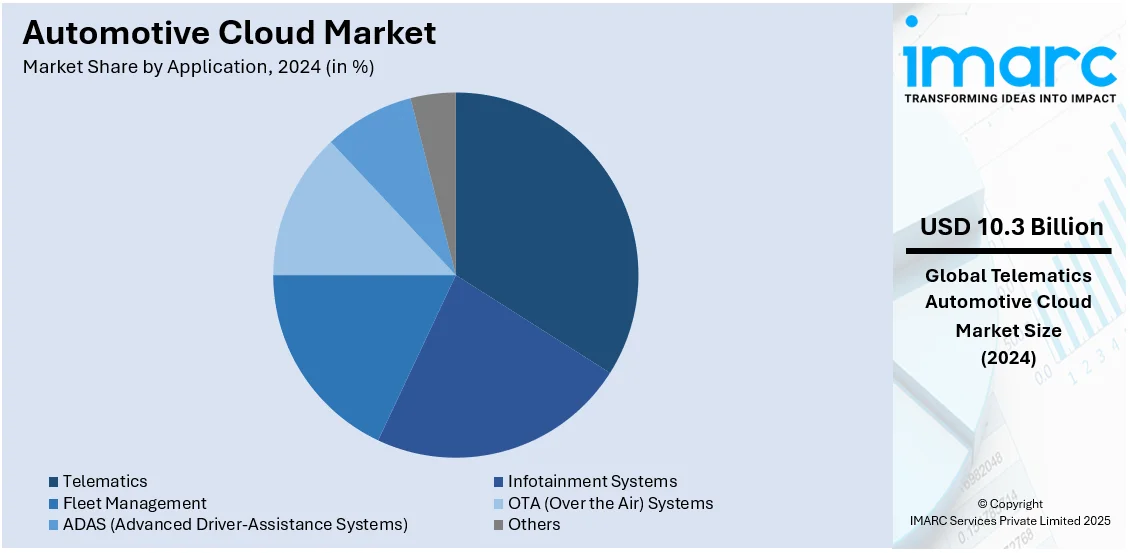

Analysis by Application:

- Infotainment Systems

- Telematics

- Fleet Management

- OTA (Over the Air) Systems

- ADAS (Advanced Driver-Assistance Systems)

- Others

Telematics leads the market with around 33.7% of market share in 2024. Telematics leads the automotive cloud market by enabling real-time vehicle tracking, remote diagnostics, and predictive maintenance. Cloud-based telematics solutions enhance fleet management, improve fuel efficiency, and support over-the-air (OTA) updates for software enhancements. Automakers and logistics companies leverage telematics for driver behavior monitoring, accident prevention, and regulatory compliance. The rise of connected vehicles, 5G networks, and AI-driven analytics further accelerates telematics adoption, making it a critical component in modern automotive cloud solutions for both passenger and commercial vehicle applications.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 42.1%. According to the automotive cloud market outlook, North America dominates the automotive cloud market because of its advanced automotive industry and the early adoption of connected vehicle technologies. Companies like Tesla leverage cloud platforms for real-time data processing and over-the-air updates, enhancing vehicle performance and user experience. In line with this, supportive government policies and the presence of tech giants, such as Amazon Web Services (AWS) and Microsoft Azure, contribute to the region's leadership in automotive cloud solutions, further strengthening its leading position in the market.

Key Regional Takeaways:

United States Automotive Cloud Market Analysis

In 2024, the United States accounted for over 87.50% of the automotive cloud market in North America. The automotive cloud market in the United States is significantly driven by the growing adoption of connected vehicles and advanced telematics. As more data is generated within vehicles, the demand for cloud-based solutions for efficient storage, processing, and analysis is increasing. Cloud services support various functions such as vehicle diagnostics, infotainment, navigation, and over-the-air (OTA) updates, all of which enhance both vehicle performance and the driving experience. U.S. automakers are also integrating artificial intelligence (AI) and machine learning (ML) into their cloud systems to improve vehicle safety, performance, and personalization. According to industry reports, it is anticipated that by 2027, 30% of software-defined vehicles will incorporate a Digital Twin 2.0 for at least one vehicle system, a substantial rise from fewer than 1% currently. Furthermore, projections indicate that by 2030, artificial intelligence will be utilized in 80% of high-value automotive processes, up from the current 20%. Collaborations between major cloud providers, such as Google, Amazon, and Microsoft, are accelerating the development of automotive-specific cloud solutions. These advancements, combined with investments in electric vehicles (EVs) and autonomous driving, contribute to the continued growth of the market in the U.S.

Europe Automotive Cloud Market Analysis

Europe plays a critical role in the global market, propelled by its strong automotive manufacturing sector and the rapid adoption of electric and autonomous vehicles. An industry report suggests that the region's electric vehicle (EV) market is set for significant growth, with a projected 40% increase by 2025, reaching 2.7 million EVs, where battery-electric vehicles (BEVs) are expected to make up 22% of the overall market. By 2026, sales are expected to hit 3 million EVs, with Germany, the UK, and France identified as key markets driving this trend. This growth is propelled by regulatory pressures, consumer interest, and a wide array of EV options available in the market. Cloud technologies play a pivotal role in improving vehicle performance, safety, and customer engagement by supporting advanced features like in-car connectivity, fleet management, and predictive maintenance. Moreover, the push for environmental sustainability and regulatory compliance is driving the demand for cloud solutions that optimize vehicle emissions and energy efficiency. Investment in 5G networks and government initiatives supporting smart cities and electric mobility further accelerate the adoption of cloud-based applications, solidifying Europe’s position as a leader in the automotive cloud market.

Asia Pacific Automotive Cloud Market Analysis

Asia Pacific is experiencing rapid growth in the automotive cloud market, fueled by the widespread adoption of connected vehicles and the rising popularity of electric vehicles (EVs) in key markets like China, Japan, and South Korea. The region's automotive industry is increasingly utilizing cloud technologies to enhance vehicle connectivity, streamline manufacturing processes, and develop autonomous driving capabilities. China, as the largest EV market, is leading the charge in integrating cloud solutions for vehicle fleet management, smart charging, and data analytics. With the availability of 5G technology across the region, the automotive cloud market is expected to see significant acceleration, offering high-speed data transfer and real-time analytics. According to the GSMA Mobile Economy Asia Pacific 2024, mobile technologies contributed USD 880 billion to the regional economy in 2023, representing 5.3% of GDP. By 2030, it is expected that 95% of connections in advanced Asia Pacific markets will be 5G, and this infrastructure development, coupled with smart city initiatives, will further boost the automotive cloud market.

Latin America Automotive Cloud Market Analysis

The market in Latin America is growing as consumers increasingly embrace connected cars, prompting automakers to explore cloud-based solutions for services like navigation, diagnostics, and entertainment. The shift toward electric vehicles and renewable energy is driving the adoption of cloud applications for fleet management, charging stations, and energy consumption. Brazil and Mexico are leading infrastructure development to support this transition. However, challenges like internet connectivity in rural areas persist. Government initiatives, such as Brazil's "Mover Program," which allocates USD 19 billion from 2024 to 2028 for low-carbon technologies and provides tax incentives for low-emission vehicles, are also promoting cloud adoption. Additionally, stricter emissions regulations and an increase in biodiesel mixtures will support the transition toward sustainable mobility in the region.

Middle East and Africa Automotive Cloud Market Analysis

The automotive cloud market in the Middle East and Africa is experiencing growth driven by the adoption of smart technologies and a rising interest in electric and autonomous vehicles. According to the Dubai Water and Electricity Authority (DEWA), the number of electric vehicles (EVs) in Dubai rose from 15,100 in 2022 to 25,929 by December 2023. UAE and Saudi Arabia are investing in smart city initiatives with cloud-based automotive solutions further driving the market. Demand for connected vehicle services like infotainment, predictive maintenance, and fleet management is rising, particularly in urban areas which is turn is favoring the market. The region’s focus on carbon reduction and renewable energy is augmenting cloud solutions for electric vehicle performance and charging, while 5G connectivity enhances data transfer.

Competitive Landscape:

The automotive cloud market is highly competitive, with technology providers, automakers, and software developers focusing on innovation, security, and scalability. Companies are investing in AI-driven analytics, edge computing, and 5G integration to enhance cloud-based vehicle connectivity. Partnerships and collaborations between cloud service providers and automotive manufacturers are driving advancements in telematics, over-the-air updates, and autonomous vehicle solutions. Market participants are prioritizing cybersecurity measures to protect vehicle data and ensure regulatory compliance. The growing demand for personalized in-car experiences, predictive maintenance, and fleet management solutions intensifies competition, pushing firms to differentiate through advanced cloud infrastructure and seamless integration capabilities.

The report provides a comprehensive analysis of the competitive landscape in the automotive cloud market with detailed profiles of all major companies, including:

- Amazon Web Services Inc. (Amazon.com Inc.)

- BlackBerry Limited

- CloudMade (Valeo)

- Continental Aktiengesellschaft

- Harman International Industries (Samsung Electronics Co. Ltd.)

- Intellias

- Robert Bosch GmbH (Robert Bosch Stiftung GmbH)

- Telefonaktiebolaget LM Ericsson

- Telenav Inc.

- TomTom International BV.

- Visteon Corporation

Latest News and Developments:

- December 2024: HARMAN Automotive unveiled two innovative software solutions: Ready CQuence Loop and Ready Link Marketplace. Ready CQuence Loop improves the automotive software development process by providing a completely virtualized setting, which boosts productivity and lowers expenses. Ready Link Marketplace serves as a digital commerce platform for services within vehicles, allowing automakers to offer customized apps and features, thereby increasing revenue opportunities.

- June 2024: MG Motor launched the Cloud EV, a crossover utility vehicle featuring a distinctive design. This vehicle includes a luxurious interior with a 360-degree camera, dual digital displays, climate control, and level 2 ADAS driver assistance, alongside power-adjustable seats.

- June 2024: Mahindra & Mahindra chose Dassault Systèmes, a leader in the 3D experience platform sector, to lead its automotive division's digital transformation. This project is designed to improve product development efficiency, shorten time to market, and promote sustainability by encouraging collaboration and innovation within a unified virtual framework.

- March 28, 2024: Valeo expanded its collaboration with Google Cloud to create cloud-based generative AI tools. This partnership aims to boost Valeo's productivity and efficiency in product development, vehicle design, and customer service. With priority access to new AI technologies, Valeo plans to integrate these tools to improve its software engineering processes and overall operations.

- January 2024: Tuhu Car introduced a function for auto parts traceability utilizing Huawei Cloud's blockchain technology. This advancement ensures the verification of authenticity and anti-counterfeit certifications, thereby enhancing trust and transparency within the automotive cloud ecosystem.

Automotive Cloud Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Propulsion Types Covered | IC Engine Vehicle, Electric Vehicles |

| Deployments Covered | Public Cloud, Private Cloud |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles |

| Applications Covered | Infotainment Systems, Telematics, Fleet Management, OTA (Over The Air) Systems, ADAS (Advanced Driver-Assistance Systems), Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon Web Services Inc. (Amazon.com Inc.), BlackBerry Limited, CloudMade (Valeo), Continental Aktiengesellschaft, Harman International Industries (Samsung Electronics Co. Ltd.), Intellias, Robert Bosch GmbH (Robert Bosch Stiftung GmbH), Telefonaktiebolaget LM Ericsson, Telenav Inc., TomTom International BV., Visteon Corporation., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive cloud market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive cloud market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive cloud market was valued at USD 30.63 Billion in 2024.

IMARC estimates the automotive cloud market to reach USD 103.48 Billion by 2033, exhibiting a CAGR of 14.35% during 2025-2033.

The automotive cloud market is driven by rising demand for connected vehicles, over-the-air (OTA) updates, and advanced telematics. Increasing adoption of AI, 5G, and IoT enhances real-time data processing, improving vehicle safety and efficiency. Automakers leverage cloud solutions for predictive maintenance, fleet management, and autonomous driving advancements, boosting market growth.

North America currently holds the largest automotive cloud market share, driven by the high adoption of connected vehicles, advanced telematics, and over-the-air (OTA) updates. Strong investments in AI, 5G, and autonomous driving technologies further boost cloud integration. Regulatory mandates for vehicle safety and emissions also accelerate market growth in the region.

Amazon Web Services Inc. (Amazon.com Inc.), BlackBerry Limited, CloudMade (Valeo), Continental Aktiengesellschaft, Harman International Industries (Samsung Electronics Co. Ltd.), Intellias, Robert Bosch GmbH (Robert Bosch Stiftung GmbH), Telefonaktiebolaget LM Ericsson, Telenav Inc., TomTom International BV., Visteon Corporation., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)