Automotive Camshaft Market Report by Manufacturing Technology, Vehicle Type, Distribution Channel, and Region, 2025-2033

Automotive Camshaft Market Size and Share:

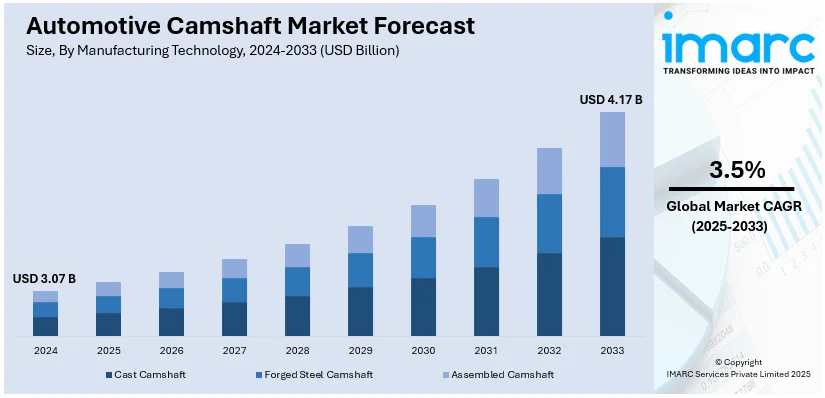

The global automotive camshaft market size was valued at USD 3.07 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.17 Billion by 2033, exhibiting a (CAGR) of 3.5% during 2025-2033. North America currently dominates the market, holding a significant market share of over 34.2% in 2024. The automotive camshaft market share is propelled due to the increasing vehicle production, demand for fuel-efficient engines, technological advancements in camshaft materials, stricter emission regulations, and growing consumer preference for high-performance, durable, and cost-effective engine components.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.07 Billion |

| Market Forecast in 2033 | USD 4.17 Billion |

| Market Growth Rate (2025-2033) | 3.5% |

The automotive camshaft market growth is mainly driven by the demand for high-performance vehicles and changes in engine technology. As consumers demand more fuel-efficient, more powerful, and greener cars, automakers integrate advanced camshaft technology like variable valve timing and lightweight camshafts into their designs. Also, with an increasing focus to curtail emission levels, this further propels the market because camshafts are key in optimizing engine performance to comply with strict environmental norms. The emergence of electric vehicles (EVs) has further stimulated development in hybrid systems, increasing the demand for special-purpose camshafts. Growth in the automotive industry in the developing markets, combined with constant research and development, is also driving market growth. Another factor providing good potential for growth in demand for camshafts is that as engine technologies advance, there will be an ever-increasing demand for high-end quality, long-lasting camshafts.

The United States stands out as a key market disruptor, driven by its strong automotive industry and ongoing technological advancements. High-performance vehicles, fewer fuel uses, and environmental standards are core demand drivers for new camshaft technologies. Thus, US companies like General Motors, Ford, and Cummins have incorporated advanced camshaft designs based on variable valve timing and lightweight materials to fulfill strict fuel economy and emissions regulations. Furthermore, the rise in EVs in the US is prompting with the automotive manufacturers to start developing camshafts specialized for hybrid powertrains. The influx of emissions reduction initiatives, in tandem with aggressive R&D, may URL set the US as a primary disruptor influencing global automotive camshaft market trends in the future.

Automotive Camshaft Market Trends:

Shift toward lightweight materials

The automotive camshaft demand has escalated due to the increasing use of lightweight materials—like aluminum and composites. The rationale for using lightweight materials is to minimize the weight of the engine so as to improve fuel efficiency and performance in view of the strict emission regulations. Lightweight camshafts help to reduce the overall weight of the vehicle, thus promoting fuel economy and decreasing CO2 emissions. As automobile manufacturers are turning toward sustainability concerns, these materials present an immediate solution to comply with environmental standards while not compromising engine performance. Enhanced manufacturing processes via precision casting and additive manufacturing have led to stronger, lighter camshafts with greater performance and durability.

Integration of variable valve timing (VVT) technology

The integration of Variable Valve Timing (VVT) technology is a growing trend in the automotive camshaft market. VVT allows for the optimization of engine performance by adjusting the timing of valve openings and closings, improving fuel efficiency and reducing emissions. This technology is particularly important as automakers strive to meet global emission standards while maintaining vehicle performance. By dynamically controlling the camshaft timing based on driving conditions, VVT can help improve engine power, fuel economy, and overall efficiency. As demand for fuel-efficient, low-emission vehicles rises, VVT technology is becoming increasingly prevalent, driving innovations in camshaft design and contributing to the market growth.

Electrification and hybrid powertrains

The incoming electrification of vehicles along with the usage of hybrid systems is changing the direction of the automotive camshaft market outlook. Indeed, camshafts have fully served traditional internal combustion engine formulations because hybrid and electric powertrains create new expectations and potential. An internal combustion engine section in hybrid vehicles requires a camshaft, prompting demand for specialized designs integrated with electric motors-direct linkages. In 2023, for example, there were typically over 10 Million EVs on roads, and yearly, more than 6 Million of such vehicles were sold. In addition, investments are being made by automobile manufacturers in camshaft technologies pertaining to hybrids, such as camshaft deactivation systems for greater efficiencies and more fuel economy, as the automotive industry moves toward electrification. As the automotive industry moves toward electrification, advances in design and manufacturing for camshaft components for hybrid applications will continue to grow the need for innovative, sophisticated camshaft solutions.

Automotive Camshaft Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive camshaft market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on manufacturing technology, vehicle type, and distribution channel.

Analysis by Manufacturing Technology:

- Cast Camshaft

- Forged Steel Camshaft

- Assembled Camshaft

Forged steel camshaft stands as the largest component in 2024. Forged steel camshafts represent the leading segment of the automotive camshaft market because of their long service life, strength, and greater performance in extreme engine conditions. They are manufactured by heating steel and molding it with high pressure; therefore, forged steel camshafts are stronger and more reliable than cast camshafts. This technology is very popular for any high-performance engine application ranging from sports cars to heavy-duty trucks and racing cars due to the fact that forged steel camshafts can take greater stresses and temperatures, leading to enhanced longevity and overall engine efficiency. Another driving factor for the demand for forged steel camshafts is their application in fuel-efficient and high-performance cars that pursue tight-emission regulations. Moreover, their performance in both conventional and hybrid powertrains makes them a preferred choice among car manufacturers, which adds further growth to the market.

Analysis by Vehicle Type:

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Passenger car leads the market with around 65.3% of market share in 2024. Passenger cars are the most prominent segment with a maximum share in the global vehicle market. These being the widely used class of vehicles create maximum demand for camshafts, an essential component in engine performance. Growing production of passenger vehicles, especially in emerging economies, is driving this segment's growth. Fuel efficiency, low emissions, and performance enhancement have now driven automotive manufacturers to embrace advanced camshaft technologies such as variable valve timing (VVT) and camless systems that enhance engine efficiency and comply with strict environmental regulations. The growth in demand for electric vehicles (EVs) and hybrid vehicles, which still employ camshaft technologies in their internal combustion engine (ICE) configurations, is another advantage for passenger cars. The trend toward small fuel-efficient engines with maximum performance, therefore, increases demand for high-performance camshafts, substantiating passenger vehicles as the leading segment in the market.

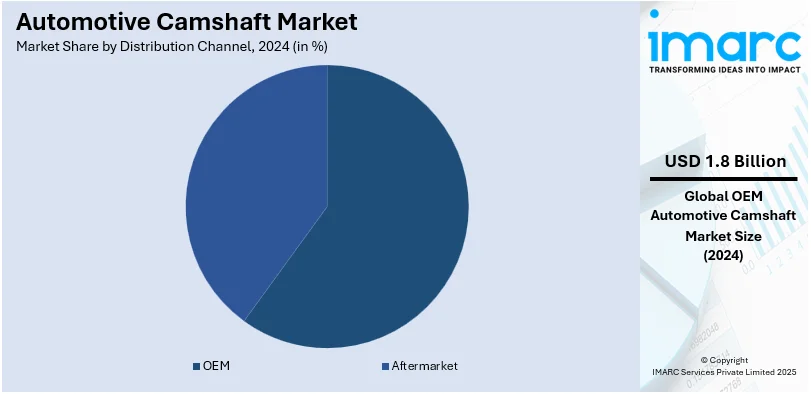

Analysis by Distribution Channel:

- OEM

- Aftermarket

OEM leads the market with around 60.0% of market share in 2024. OEMs manufacture camshafts directly for their installation in the assemblies of new vehicles and, therefore, play a very significant role in the entire automotive manufacturing ecosystem. Unmet demand for vehicles globally, particularly for the emerging markets, continues to allow OEMs the dominant player in the camshaft market since they contribute to the major weightage of camshaft production and supply. OEMs also push advances in camshaft technology, particularly VVT and integrated camshaft systems, to be in compliance with fuel efficiency and emissions regulations. It is OEM camshaft suppliers that greatly impact high-performance and environmentally friendly vehicle production, with precision-engineered camshafts formulated to increase engine performance directly influencing the automaker's approaches. Long-term contracts with automakers ensure predictable demand for camshafts by OEMs. Growth in vehicle production and demand for advanced engine technologies guarantees that the OEM segment will remain dominant in the automotive camshaft market for the foreseeable future.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 34.2%. North America, owing to an unprecedented automotive industry presence, technological advancements, and high demand for vehicle production, is presently leading the regional segmentation in the automotive camshaft market. The United States and Canada are its major markets, with an established number of automotive manufacturers in that region, including globally renowned giants like General Motors, Ford, and Stellantis. North America also has many suppliers and manufacturers of camshaft technologies, thereby supporting the market leadership by the region. The advanced development of high-performance vehicles coupled with stringent environmental regulations on fuel-efficient and low-emission engines has imposed other growth drivers in the region. Moreover, electric and hybrid vehicles are also emerging markets in North America, and these vehicles require camshaft systems-related design for internal combustion engine (ICE) configurations. Innovations in variable valve timing (VVT) and camshaft optimization inspire growth in the Automotive Camshaft market.

Key Regional Takeaways:

United States Automotive Camshaft Market Analysis

In 2024, the United States accounts for over 85.80% of the automotive camshaft market in North America. Increasing investments made in automotive manufacturing have correlated with increasing acceptance of the camshaft for automotive applications in the United States. The continuous ramping up of production facilities, along with the infusing of advanced technologies in engine components, has been a major driving factor for this application. For instance, starting from 2021, automotive manufacturers have declared investments worth more than USD 75 Billion in the U.S. Steadily being converted into fuel-efficient and high-performance engines, the demands for precision-engineered camshafts have contributed to vehicle optimization. In other words, research and development investments in the automotive sector are placing greater emphasis on improving camshaft material properties in terms of durability and weight reduction. Stringent emission regulations have compelled the adoption of Variable Valve Timing camshafts for efficient combustion by the OEMs. A further boost in domestic production capabilities has augmented the supply chain for consistent high-quality camshaft availability. Aiming to increase engine performance in internal combustion engines as well as hybrid vehicles, the lightweight camshaft is on the rise to help support fuel economy. Adoption of optimized camshaft design principles has emerged out of the need to contain manufacturing costs while maximizing engine performance. Furthermore, in line with evolving industry standards, the burgeoning domestic production of vehicles has now served to further stimulate demand for wear-resistant camshafts.

Asia Pacific Automotive Camshaft Market Analysis

Robust growth in vehicle production and the analysis of automotive manufacturing facilities are primarily behind the developing automotive camshaft adoption, caused by increasing expansion and investment in Asia-Pacific automotive. According to India Brand Equity Foundation, among April 2000 and December 2020, the cumulative equity FDI inflow in the automobile sector has been nearly USD 35.65 Billion. The region has committed to enhancing production economic efficiency through high-precision camshafts for the maximum efficiency of performance in engines. The increasing expansion of automotive production facilities has caused an upsurge in the use of advanced camshaft materials for durability and thermal resistance. Preference for increased fuel economy engines has led to increased demand for camshafts meant for applications of variable valve timing to optimize fuel economy. This dramatic increase in investments in automotive research and development promoted the acceptance of innovative camshaft technologies that reduce engine friction and augment power output. The emphasis on lower emissions has led to the use of highly precise valve actuation camshafts to boost the overall effects of combustion. The presence of more domestic and international car manufacturers has also increased the demand for camshafts with superior wear resistance.

Europe Automotive Camshaft Market Analysis

The growing automotive camshaft adoption due to growing vehicle ownership in Europe is supported by the rising demand for fuel-efficient and performance-oriented vehicles, thereby pushing the need for advanced camshaft technologies. The International Council on Clean Transportation reported 10.6 million new car registrations in the 27 Member States in 2023 which was an increase of 14% year on year from 2022. The increasing shift toward hybrids and internal combustion engines with optimized power delivery has led to an inclination toward precision-engineered camshafts. The reduction of emissions and improvement of engine efficiency has mandated the usage of variable valve timing camshafts which support better combustion dynamics. The development of vehicle production in the region has further demanded camshafts with superior durability and thermal resistance to meet ever-evolving automotive standards. Increasing vehicle ownership has favored the growth of the aftermarket thereby increasing the demand for those camshafts that offer enhanced wear resistance. Continuous research and development efforts go toward lightweight camshaft integration for improved fuel economy. With the shift of technology toward performance-enhancing engine components, a growing preference toward camshafts with superior metallurgical composition for long-term reliability has emerged.

Latin America Automotive Camshaft Market Analysis

The growing automotive camshaft adoption due to growing passenger car in disposable income in Latin America is influenced by the rising preference for fuel-efficient and cost-effective vehicles, increasing the demand for precision-engineered camshafts. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. The expanding automotive sector has led to the integration of camshafts designed for optimized engine performance, ensuring enhanced fuel economy. The rising disposable income has contributed to increased vehicle purchases, driving the need for camshafts with superior durability and wear resistance. The growing demand for passenger cars has resulted in the preference for camshafts with advanced valve timing mechanisms, improving combustion efficiency. The shift toward high-performance and fuel-efficient engines has encouraged the adoption of camshafts with refined metallurgical properties. The expansion of automotive manufacturing capabilities has further supported the demand for lightweight camshaft designs, optimizing engine performance.

Middle East and Africa Automotive Camshaft Market Analysis

The growing automotive camshaft adoption due to growing electric vehicles (EVs) in Middle East and Africa is influenced by the increasing shift toward sustainable mobility, driving the need for high-performance camshafts in hybrid and range-extender engines. For instance, in 2023, the UAE sold nearly 35,000 EVs, while Saudi Arabia sold around 1,500. The rise in EV adoption has encouraged the use of lightweight camshafts, optimizing energy efficiency. The expanding focus on improving vehicle performance has led to the integration of precision-engineered camshafts, ensuring enhanced engine dynamics. The growing demand for hybrid vehicles has contributed to the preference for camshafts designed for optimized fuel economy. The increasing presence of automotive manufacturers has further supported the adoption of camshafts with superior durability and wear resistance. The shift toward regulatory compliance has influenced the demand for camshafts with refined valve actuation, reducing energy loss.

Competitive Landscape:

Key players in the automotive camshaft market provide high-performance camshafts used in a wide range of vehicles, including passenger cars, trucks, and hybrid/electric vehicles. These players focus on innovation, enhancing camshaft performance with technologies like variable valve timing (VVT) and lightweight materials to meet growing fuel efficiency and emission standards. Major trends in the market include the increasing demand for advanced camshaft technologies to optimize engine performance, as well as the adoption of automation in manufacturing processes. Additionally, the rise of electric and hybrid vehicles has led to the development of specialized camshaft solutions for these powertrains. As automakers focus on sustainability and regulatory compliance, these companies are investing heavily in R&D to maintain a competitive edge.

The report provides a comprehensive analysis of the competitive landscape in the automotive camshaft market with detailed profiles of all major companies, including:

- Mahle GmbH

- JD Norman Industries, Inc.

- Thyssenkrupp AG

- Linamar Corporation

- Estas Camshaft & Chilled Cast

- Crance Cams Inc.

- Aichi Forge USA Inc.

- Engine Power Components Inc.

- Hirschvogel Holding GmbH

- Kautex Textron Gmbh & Co. KG

- Shadbolt Cams

- Comp Performance Group

- Precision Camshafts Ltd.

- Varroc Group

- Camshaft Machine Company

Latest News and Developments:

- January 2025: Elgin Industries launched their new five Elgin PRO-STOCK® Camshaft Kits, which enhance racing and street-performance engines. This lineup includes three ‘Sloppy Stage’ Camshafts and two GM LS Performance Camshafts and are all precision-matched with valve springs and push rods. Made in the USA, these camshaft kits ensure superior engine optimization and are now available through top performance distributors.

- August 2024: DRiV™ has recently launched its Wagner Sensors, which is an expansion of its global portfolio with new automotive solutions. The product line includes Camshaft and Crankshaft Position Sensors, alongside Oxygen, Temperature, and Pressure sensors. The product was initially available in the U.S. and Canada, and was then followed by Europe in September, along with further global rollouts planned. Wagner Sensors aim to enhance vehicle performance with easy installation and reliability.

- July 2024: thyssenkrupp Dynamic Components secured a ten-year contract to supply truck camshafts at its Chemnitz site, producing 200,000 units annually. The deal strengthens its role in the automotive industry and ensures long-term operations in Chemnitz. Production will commence gradually from summer 2025. To meet demand, thyssenkrupp plans investments in expanding grinding and turning lines.

- May 2024: Standard Motor Products expands its Camshaft and Crankshaft Position Sensor program, adding late-model coverage for import and domestic vehicles. Engineered for accuracy, speed, and durability, the sensors ensure optimal engine performance. With nearly 1,000 SKUs covering over 250 Million vehicles, the program enhances reliability. Each Camshaft sensor undergoes rigorous testing to meet industry standards.

- January 2024: Dorman Products, Inc. launched 325 new motor vehicle parts, expanding sales opportunities for aftermarket distributors. Notable releases include a Dorman® OE FIX™ transmission oil cooler bypass valve and camshaft phaser repair bolts for Ford and Lincoln vehicles. These innovations enhance repair efficiency and reliability across Millions of vehicles. Dorman reinforces its leadership in comprehensive powertrain solutions with these latest offerings.

Automotive Camshaft Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Manufacturing Technologies Covered | Cast Camshaft, Forged Steel Camshaft, Assembled Camshaft |

| Vehicle Types Covered | Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle |

| Distribution Channels Covered | OEM, Aftermarket |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Mahle GmbH, JD Norman Industries, Inc., Thyssenkrupp AG, Linamar Corporation, Estas Camshaft & Chilled Cast, Crance Cams Inc., Aichi Forge USA Inc., Engine Power Components Inc., Hirschvogel Holding GmbH, Kautex Textron Gmbh & Co. KG, Shadbolt Cams, Comp Performance Group, Precision Camshafts Ltd., Varroc Group, Camshaft Machine Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive camshaft market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive camshaft market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive camshaft industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive camshaft market was valued at USD 3.07 Billion in 2024.

The automotive camshaft market is projected to exhibit a CAGR of 3.5% during 2025-2033.

The automotive camshaft market is driven by increasing demand for fuel-efficient vehicles, rigorous emission policies, and developments in engine technology. The growing focus on performance optimization, including variable valve timing (VVT) and lightweight materials, alongside the shift toward hybrid and electric powertrains further fuels the market growth and innovation.

North America currently dominates the market driven by the demand for high-performance vehicles, stringent emission standards, and advancements in engine technologies.

Some of the major players in the automotive camshaft market include Mahle GmbH, JD Norman Industries, Inc., Thyssenkrupp AG, Linamar Corporation, Estas Camshaft & Chilled Cast, Crance Cams Inc., Aichi Forge USA Inc., Engine Power Components Inc., Hirschvogel Holding GmbH, Kautex Textron Gmbh & Co. KG, Shadbolt Cams, Comp Performance Group, Precision Camshafts Ltd., Varroc Group, Camshaft Machine Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)