Automotive Brake Booster Market Size, Share, Trends and Forecast by Product Type, Vehicle Type, End-User, and Region, 2025-2033

Automotive Brake Booster Market Size and Share:

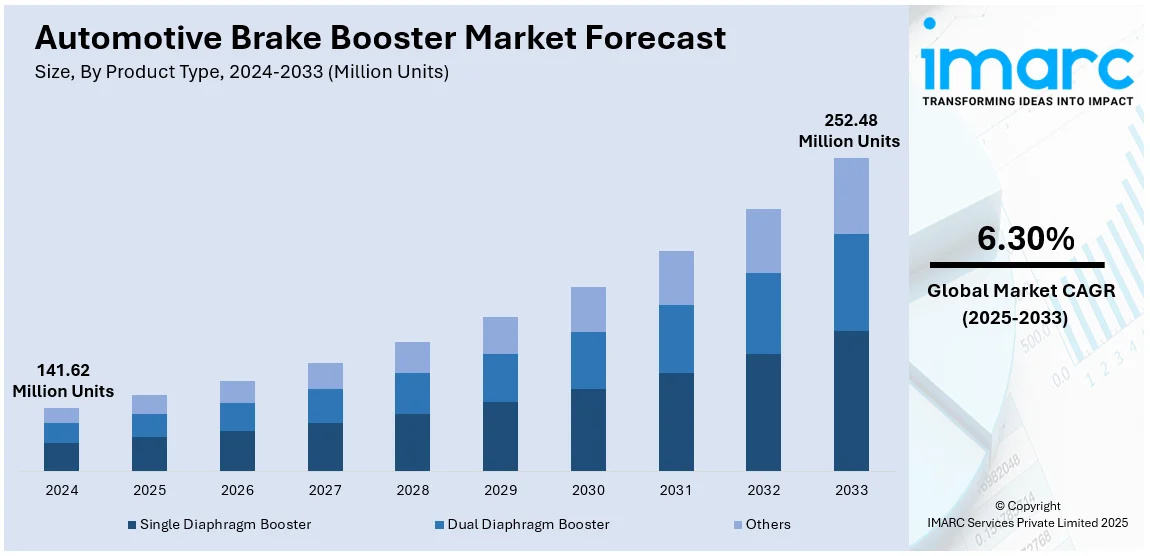

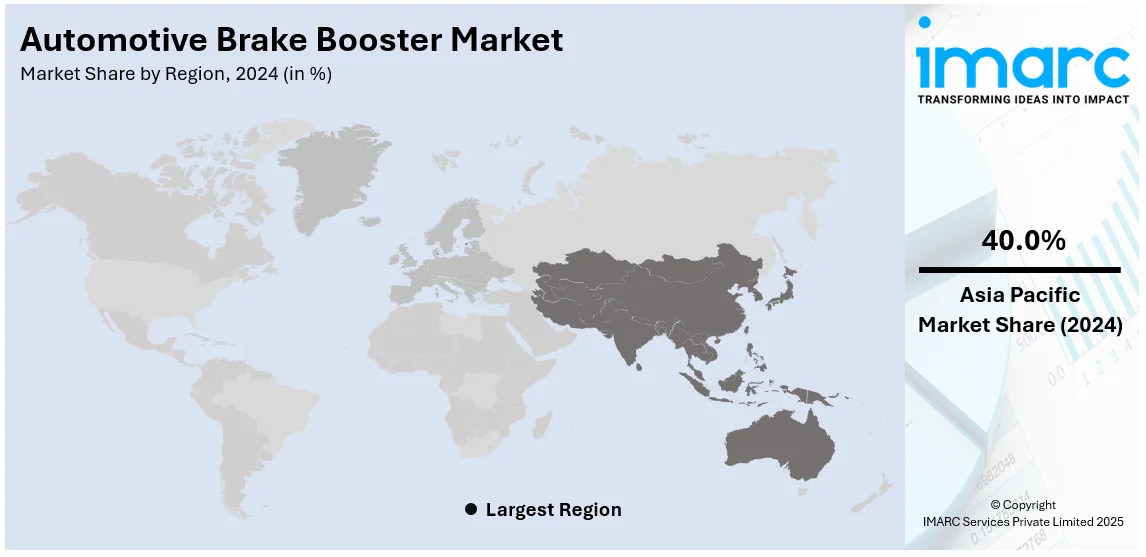

The global automotive brake booster market size was valued at 141.62 Million Units in 2024. Looking forward, IMARC Group estimates the market to reach 252.48 Million Units by 2033, exhibiting a CAGR of 6.30% during 2025-2033. Asia-Pacific currently dominates the market, holding 40.0% of the market share in 2024. The market is evolving because of rising concern with the safety of the vehicle and stringent standards for safety, advanced braking systems, growth of the automotive industry, and favorable innovations, such as brake boosters integration with electronics systems, which, in turn, is increasing the automotive brake booster market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

141.62 Million Units |

|

Market Forecast in 2033

|

252.48 Million Units |

| Market Growth Rate (2025-2033) | 6.30% |

The automotive brake booster market is gaining prominence due to surging vehicle production rates and enhanced consumer demand for better safety standards. Brake boosters are seen as one of the critical components in modern automobiles, improving braking effectiveness and reducing drivers' effort significantly. The increasing adoption of electric vehicles and the rising need for advanced driver assistance systems are acting as other growth-inducing automotive brake booster market drivers, as such technologies require stronger and more efficient braking solutions. The growing demand for brake boosters is also arising from government regulations compelling enhanced vehicle safety standards. Changes within the automotive sector are encouraging the innovation of advanced technologies, including electric and vacuum-independent brake boosters. Apart from this, growing consumer demand for lightweight, fuel-efficient vehicles is further speeding up the integration of compact yet effective product variants to meet ever-increasing automotive brake booster market demand.

The growth of the automotive brake booster market in the United States is driven by increasing attention towards vehicle safety and a wide adoption of advanced technologies in the automotive sector. Strict government regulations, such as Federal Motor Vehicle Safety Standards (FMVSS), highlight the importance of reliable braking systems, thereby increasing the automotive brake booster market revenue. The growing demand for electric vehicles (EVs) and hybrid vehicles in the U.S. market is also contributing to growth, as these vehicles require advanced, energy-efficient braking solutions. In addition to this, integrating advanced driver-assistance systems (ADAS), which rely on precise braking performance, further represent key automotive brake booster market trends. The U.S. automotive industry's focus on lightweight and fuel-efficient vehicles has also led to innovations in compact and vacuum-independent brake boosters, which enhances market growth. For instance, in July 2024, Motorcar Parts of America Inc. announced the company had expanded product coverage for its starter and alternator, brake pad, brake caliper, brake rotor, power brake booster, and wheel hub programs, with more than 150 new component numbers covering an extra 49 million vehicles in operation.

Automotive Brake Booster Market Trends:

Increasing emphasis on vehicle safety and stringent regulations

The market is greatly impacted by the increased focus on vehicle safety. Strict safety laws enforced by governments around the world are also driving this trend. On August 14th, 2024, the Ministry of Road Transport and Highways (MoRTH) announced changes to the Central Motor Vehicles Rules, 1989. Improving vehicle safety features is the main goal of the recently proposed Central Motor Vehicles (Tenth Amendment) Rules, 2024. As per the automotive brake booster market forecast, higher safety requirements are ensured by these laws, which require the incorporation of modern braking systems. Additionally, manufacturers are starting to include these systems as standard features in both luxury and economy cars because of the public's growing awareness of road safety. As manufacturers innovate and improve their products to fulfill these higher safety standards, the convergence of customer demand and regulatory requirements is fostering a strong environment for the automotive brake booster market growth.

Technological advancements and integration with electronic systems

As per the automotive brake booster market industry insights, ongoing innovations in technology are crucial in determining growth. In addition, a major driver of market expansion is the integration of electronic systems, such as Electronic Stability Control (ESC) and Anti-lock Braking Systems (ABS). According to a study by Monash University in Australia, vehicles with anti-lock brakes (ABS) had a 35% lower chance of being involved in an accident or collision than those without them. Overall vehicle performance and safety are improved by this integration, which also shortens stopping distances and improves vehicle control. Furthermore, advancements in brake booster technology, such as the creation of electric and electro-hydraulic systems, are meeting the changing requirements of modern automobiles, including hybrid and electric models. These developments increase braking systems' effectiveness and complement the global trend toward greener automotive technology, thereby creating a positive automotive brake booster market outlook.

Expansion of the automotive sector in emerging economies

Another important factor propelling the market is the growth of the automotive industry in emerging nations. Urbanization and rising consumer buying power are driving significant increases in car manufacturing and sales in nations like China, India, and Brazil. In November 2024, sales of passenger cars in India reportedly increased 4.4% year over year to 300,459 units. Brake boosters and other automobile parts are becoming more and more in demand as a result of this expansion. Additionally, government incentives are used to promote local vehicle assembly and production in these areas, which is increasing demand for automotive parts. The market's potential is further enhanced by the growing investment made by international automakers in these regions, which makes it a crucial area of concentration for suppliers and component manufacturers.

Automotive Brake Booster Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive brake booster market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on product type, vehicle type, and end-user.

Analysis by Product Type:

- Single Diaphragm Booster

- Dual Diaphragm Booster

- Others

The single diaphragm booster segment holds the largest share of the market. This dominance is because of its uses in the passenger vehicle primarily in the compact and mid-size segments. Single diaphragm boosters are favored due to their simplicity, lower cost, and over time reliability. These are best fitted for vehicle models that contain less space in the engine compartment since they take less space relative to the dual diaphragm types. Even as new technologies surface, there is still substantial continued demand for single diaphragm boosters, particularly in regions with growing manufacturing industries and low-budget vehicle segments that cannot afford to invest heavily in production. They are still valued in the market because over many years as they supplied sufficient braking ability to ensure that they were a standard in the market.

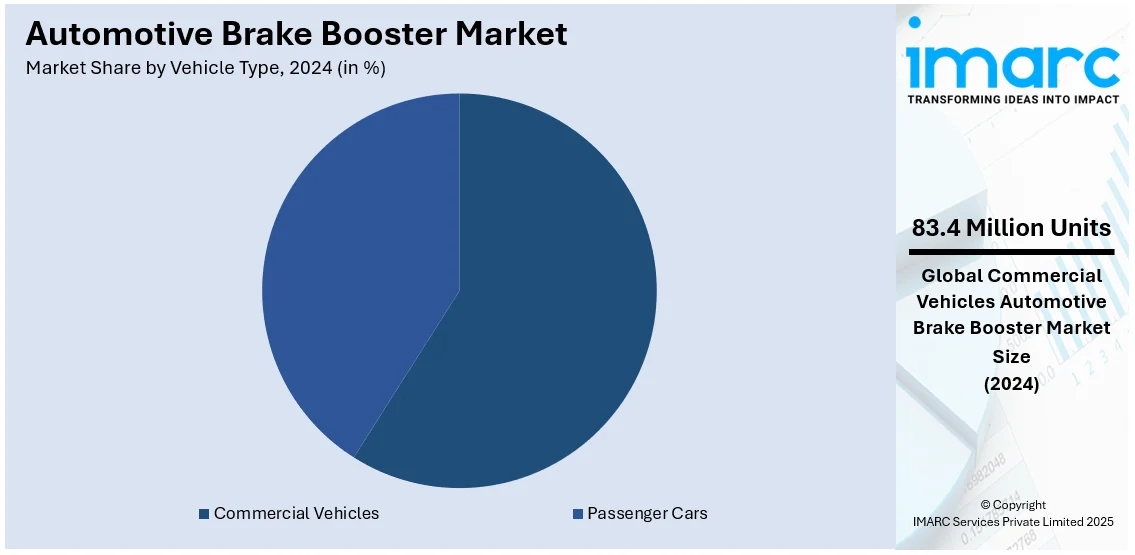

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Commercial vehicles leads the market with around 58.9% of market share in 2024. The commercial vehicles segment occupies the largest share of the market. This domination is primarily attributable to the fact that safety is a crucial factor that is foremost and unyielding in the commercial transportation industry, particularly in the function of the braking system. Buses, trucks, and vans categorized under commercial vehicles are usually exposed to much operational workload where loads are transported over large distances. Therefore, the dependability and efficiency of the brake boosters have a critical importance in this segment. Higher commercial use also means more wear and tear on the brake system, thus more frequent replacement and upgrading of brake boosters are on commercial cars. Also, the continuous rise in international sales and distribution, and the development of electronic selling are contributing to the commercial vehicle's necessity, fueling the automotive brake boosters demand in this segment. The enterprises in this segment concentrate on designing reliable and high-quality brake boosters to suit the severe demands in the operations of commercial vehicles.

Analysis by End-User:

- OEMs

- Replacement

The OEM segment commands the largest portion of the market. This dominance is influenced by the continuous production of new vehicles that necessitate the installation of brake boosters as essential safety components. OEMs integrate brake boosters directly into new vehicles, ensuring compliance with safety standards and performance requirements. The demand in this segment is closely tied to global automotive production rates. With the increasing emphasis on vehicle safety and the implementation of stringent regulations worldwide, OEMs are constantly innovating and upgrading brake booster technology. This segment's growth is further bolstered by the rising production of electric and hybrid vehicles, which require specialized brake boosters compatible with regenerative braking systems. Additionally, the strong foothold of OEMs in the market is reflective of the automotive industry's ongoing expansion and the critical role of brake boosters in new vehicle manufacturing.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 40.0%, due to rapid urbanization, rising incomes, and rising vehicle ownership in nations like China, India, and Southeast Asia. Urban individuals are increasingly purchasing vehicles owing to their busier lifestyles. By 2030, almost 40% of India's population is predicted to reside in urban regions, according to the Press Information Bureau (PIB). In line with this, as economies in the region continue to expand, the demand for passenger and commercial vehicles is witnessing significant growth, driving the need for efficient braking systems. Apart from this, governing agencies in the region are implementing stringent vehicle safety norms to reduce road accidents, leading to higher adoption of advanced braking technologies. For instance, the Bharat New Vehicle Safety Assessment Program (BNVSAP) in India and China’s New Car Assessment Program (C-NCAP) are mandating advanced braking systems, encouraging manufacturers to integrate brake boosters into vehicles. Additionally, the rise in electric vehicle (EV) adoption is another key driver in the region. These vehicles require regenerative braking systems, which often utilize advanced brake boosters to optimize performance. Various subsidies and incentives for EVs by governing agencies are further supporting the market growth. Besides this, the growth of the automotive aftermarket industry in Asia Pacific region contributes to the demand for brake boosters.

Key Regional Takeaways:

North America Automotive Brake Booster Market Analysis

In 2024, the United States represented 83.30% of the North America automobile brake booster market majorly attributed to strict safety rules coupled with the increasing customer interest in advanced braking systems. Government regulations like The National Highway Traffic Safety Administration (NHTSA) force the usage of improved vehicle features in automobiles which in turn demands the usage of high-demand brake boosters. The increase in production of electric vehicles (EVs) and hybrid vehicles in North America continues to drive market growth since these vehicles have higher demands on braking systems. Other factors influencing the market include connected car services, which incorporate precise braking in advanced driver-assistance systems (ADAS). Substantial growth in the region is driven by technological innovations featured in the electronic and vacuum-independent brake booster under changing automobile trends, thereby contributing to the automotive brake booster market growth.

United States Automotive Brake Booster Market Analysis

In 2024, the United States accounted for the largest market share of over 83.3% in North America. The demand for and growth of the United States automobile brake booster market are influenced by several factors. The increasing use of safety technologies and advanced driver assistance systems (ADAS) in automobiles is a major factor. The demand for effective braking systems is rising as customers and authorities place a higher priority on vehicle safety. Brake boosters enhance braking performance by reducing the effort required to apply brakes, making them essential for modern vehicles equipped with features like automatic emergency braking (AEB). Moreover, the increasing integration of ADAS technologies is expected to catalyze the demand for advanced brake booster systems. Besides this, the growing electric vehicle (EV) segment in the U.S. is another significant factor. EVs require brake systems with regenerative braking capabilities, which often incorporate advanced brake boosters for optimized performance. EV sales in the country saw a substantial rise in recent years, which is expected to bolster demand for innovative brake booster solutions tailored to electric and hybrid vehicles. According to the ICCT, sales of new electric light-duty vehicles in the United States reached about 1.4 Million In 2023, up from nearly 1 Million in 2022, resulting in a sales share of about 9%. This increase is driven by economic recovery and rising consumer spending. Lastly, stringent safety regulations and government mandates encouraging advanced braking systems further propel the market growth.

Europe Automotive Brake Booster Market Analysis

The European automotive brake booster market is primarily influenced by the region's leadership in vehicle safety standards and advancements in automotive technology. European Union (EU) regulations, such as the mandatory inclusion of advanced emergency braking systems (AEBS) in new vehicles, underscore the growing emphasis on brake boosters. These systems enhance safety by improving braking efficiency, aligning with the EU’s Vision Zero initiative to reduce road fatalities. In addition, countries like Norway, Germany, and the Netherlands are increasingly adopting EVs due to supportive government policies, including subsidies and tax benefits. In 2023, there were 1.54 million electric cars sold in Germany, according to reports. Brake boosters tailored for regenerative braking systems in EVs are in high demand as manufacturers prioritize energy-efficient and high-performance solutions. The market is also influenced by Europe's strong automotive manufacturing base, home to global leaders. These companies are heavily investing in research and development (R&D) to develop advanced braking systems, including vacuum-less brake boosters, to enhance vehicle safety and fuel efficiency. The European market’s focus on premium and luxury vehicles, which often feature cutting-edge safety technologies, further contributes to the demand for high-quality brake boosters. Furthermore, the increasing awareness among individuals about vehicle safety is impelling the growth of the market. People in Europe are prioritizing vehicles equipped with advanced safety features, prompting automakers to integrate state-of-the-art braking systems, including boosters, into their models.

Latin America Automotive Brake Booster Market Analysis

The rising sales and production of automobiles in major economies like Argentina, Mexico, and Brazil. The increasing demand for passenger vehicles due to rising disposable incomes has prompted automakers to incorporate cutting-edge braking technologies to improve performance and safety. According to statistics, 9,537 EVs were sold in Brazil in October 2023. Apart from this, the rising adoption of safety regulations and vehicle assessment programs is bolstering the market growth. Countries in Latin America are aligning with global standards, encouraging the inclusion of advanced braking technologies in vehicles. Additionally, the region's automotive aftermarket sector plays a pivotal role, with consumers prioritizing vehicle maintenance and safety upgrades, further boosting the demand for brake boosters. Furthermore, significant investments by global automakers and suppliers in the region to leverage cost advantages and growing markets also supports industry growth.

Middle East and Africa Automotive Brake Booster Market Analysis

The growing use of cutting-edge safety features in automobiles is driving the Middle East and Africa (MEA) automotive brake booster market. Rising consumer awareness about road safety, coupled with government initiatives to improve vehicular safety standards, is leading to a high demand for efficient braking systems, including brake boosters. Countries, like the UAE and South Africa are witnessing rising vehicle ownership, which further fuels market growth. Moreover, the rising focus on automotive aftermarket in the region is strengthening the market growth. As per the IMARC Group, the UAE automotive aftermarket market is projected to exhibit a CAGR of 4.20% during 2024-2032. Furthermore, the growing popularity of luxury and high-performance vehicles in the region is offering a favorable market outlook. High-end vehicles equipped with cutting-edge safety and braking technologies are in demand among affluent consumers, particularly in Gulf Cooperation Council (GCC) countries.

Competitive Landscape:

The automotive brake booster market is highly competitive, with key players including Bosch, Continental AG, ZF Friedrichshafen, and Aisin Seiki Co., Ltd. These companies have a large market share through their product differentiation strategies of presenting new brake booster systems and advanced brake booster technologies including electric and vacuum-independent brake boosters in the growing market need for safety, better performing, and efficient automobiles. Large auto players including OEMs and Tier-1 suppliers continue to undertake extensive research and development processes to provide auto parts compliant with higher safety regulations, as well as to tap into the electric vehicles market. Their market positions are further reinforced by strategic alliances and acquisitions. Furthermore, the market faces competition from regional suppliers who are involved in the provision of less expensive solutions and the localization of relevant products.

The report has also analysed the competitive landscape of the global automotive brake booster market with some of the key players being:

- Aisin Seiki Co., Ltd.

- Hyundai Mobis

- Continnetal

- TRW Automotive

- Mando Corporation

- Robert Bosch GmbH

- Nissin Kogyo

- Hitachi

- Jilin Dongguang Aowei Brake System Co., Ltd.

- Wanxiang Group Corporation

- Zhejiang VIE Science & Technology Co.

- FTE automotive Group

- APG

- BWI Group

- Wuhu Bethel

- CARDONE

- Liuzhou Wuling Automobile Industry Co., Ltd.

Latest News and Developments:

- January 2025: ZF secures substantial brake-by-wire technology business for light vehicles. The project will combine ZF's Integrated Brake Control and conventional front calipers with the Electro-Mechanical Brake and by-wire technology on the rear brakes to create a "hybrid" braking system that combines hydraulics and by-wire, giving the manufacturer more flexibility.

- November 2024: Disc Brakes Australia (DBA) unveiled the launch of its advanced brake boosters, designed to augment braking performance and safety for exclusive 4WD models. The new "Upgrade Performance" range of brake boosters from DBA was created especially to handle the demands of off-roading, towing, and hauling big loads.

- July 2024: Classic Performance Products (CPP) announced the introduction of PN 6772EBK-SB, its new electric power brake booster kit, for enabling power brakes for improved stopping performance. CPP’s electric power brake booster will ensure that you never have to worry about losing your braking assistance again due to a lack of engine vacuum, power steering, or engine bay real estate.

- April 2023: ZF Aftermarket announced the expansion of its range of electric car spare parts with the launch of the Electronic Brake Booster (EBB). The system supports many drivers assistance and comfort functions for electric vehicles. EBB needs little installation space and eliminates the need for a vacuum pump as a brake booster, due to its compact design.

Automotive Brake Booster Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Single Diaphragm Booster, Dual Diaphragm Booster, Others |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| End-Users Covered | OEMs, Replacement |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Aisin Seiki Co., Ltd., Hyundai Mobis, Continnetal, TRW Automotive, Mando Corporation, Robert Bosch GmbH, Nissin Kogyo, Hitachi, Jilin Dongguang Aowei Brake System Co., Ltd., Wanxiang Group Corporation, Zhejiang VIE Science & Technology Co., FTE automotive Group, APG, BWI Group, Wuhu Bethel, CARDONE, Liuzhou Wuling Automobile Industry Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive brake booster market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive brake booster market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive brake booster industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive brake booster market was valued at 141.62 Million Units in 2024.

IMARC estimates the automotive brake booster market to reach 252.48 Million Units by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033.

Key factors driving the automotive brake booster market include increasing vehicle production, stringent safety regulations, and rising demand for advanced braking systems in electric vehicles (EVs) and hybrid cars. The growing adoption of advanced driver-assistance systems (ADAS) and innovations in brake booster technology also contribute to market expansion.

Asia Pacific currently leads the market, driven by its dominant automotive manufacturing base, particularly in countries like China, Japan, and India. The region benefits from high vehicle production rates, increasing demand for advanced safety features, and a growing automotive industry. Additionally, cost-effective production capabilities, technological advancements in brake systems, and strong automotive aftermarket services further boost the region's leadership in the brake booster market.

Some of the major players in the automotive brake booster market include Aisin Seiki Co., Ltd., Hyundai Mobis, Continnetal, TRW Automotive, Mando Corporation, Robert Bosch GmbH, Nissin Kogyo, Hitachi, Jilin Dongguang Aowei Brake System Co., Ltd., Wanxiang Group Corporation, Zhejiang VIE Science & Technology Co., FTE automotive Group, APG, BWI Group, Wuhu Bethel, CARDONE, Liuzhou Wuling Automobile Industry Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)