Automotive Alternator Market Size, Share, Trends and Forecast by Powertrain Type, Vehicle Type, and Region, 2025-2033

Automotive Alternator Market Size and Share:

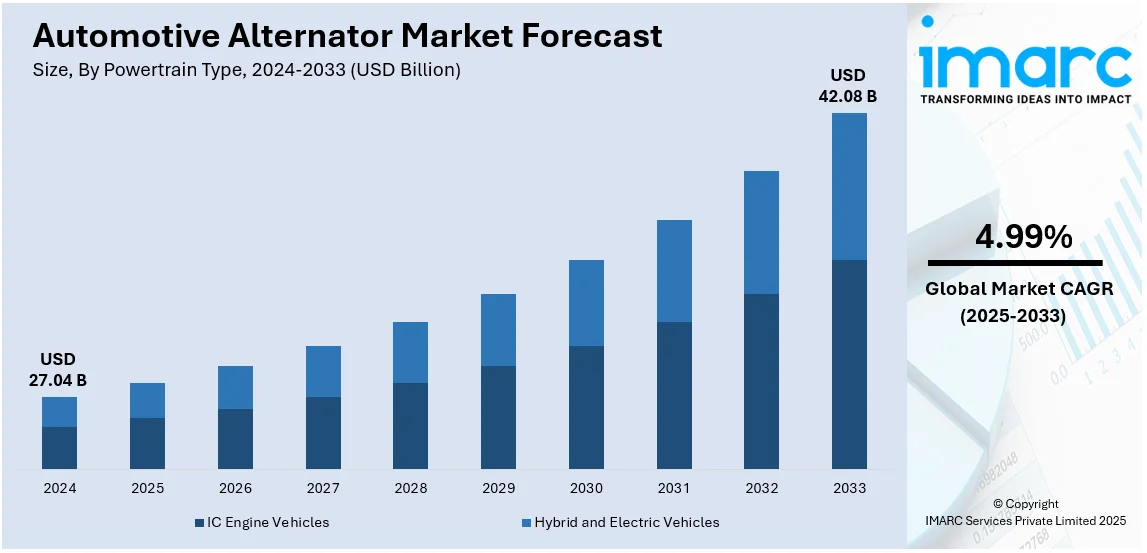

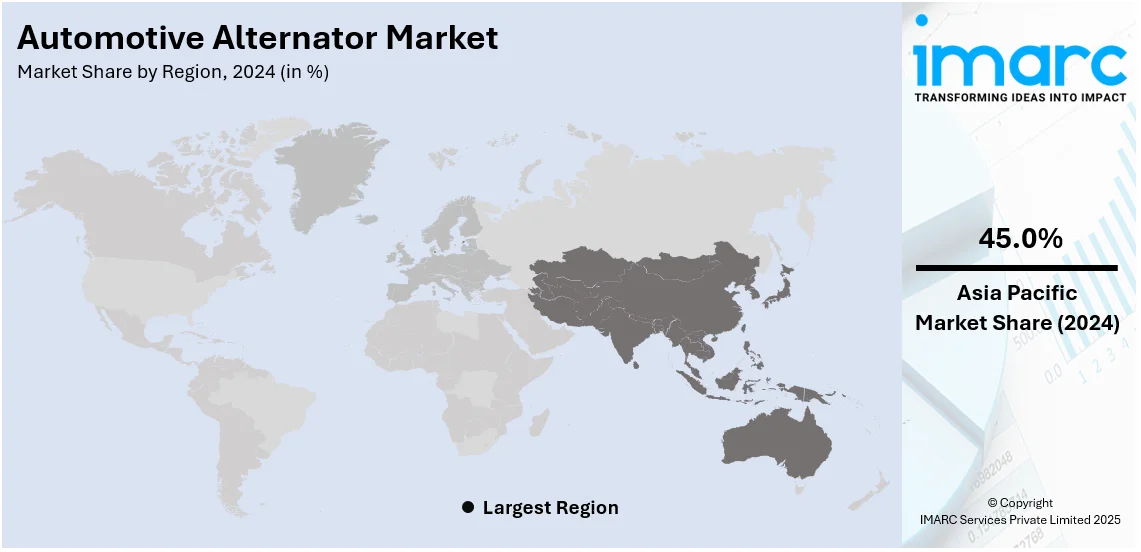

The global automotive alternator market size was valued at USD 27.04 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 42.08 Billion by 2033, exhibiting a CAGR of 4.99% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 45.0% in 2024. The market is mainly driven by the rising demand for high output alternators in order to support electric and hybrid vehicles and advanced vehicle technologies such as smart charging systems. The development of lightweight alternators in order to enhance the overall vehicle efficiency is also creating a positive outlook for the automotive alternator market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 27.04 Billion |

|

Market Forecast in 2033

|

USD 42.08 Billion |

| Market Growth Rate (2025-2033) | 4.99% |

The global automotive alternator market is driven by several key factors, including the rising demand for electric and hybrid vehicles, which require efficient power generation systems. Increasing vehicle production, particularly in emerging economies, further fuels market growth. The automotive industry in India produced 30.6 million vehicles in 2024 as per industry reports, of which 4.27 million passenger cars, 0.95 million commercial vehicles, and 19.5 million two-wheelers were sold domestically. In December, it recorded production of 1.92 million units, reflecting strong market demand. The trend of expanding automotive alternators is seen as having a beneficial effect on the automotive alternator market, driven by increasing automotive production and the growth of electrification trends. Technological advancements, such as the development of lightweight and high-efficiency alternators, are also propelling demand. Additionally, stringent emission regulations are pushing automakers to adopt advanced alternators that improve fuel efficiency and reduce carbon emissions. The growing focus on vehicle electrification and the integration of smart charging systems are other significant drivers, creating a positive automotive alternator market outlook.

To get more information on this market, Request Sample

The United States stands out as a key regional market, primarily driven by the increasing complexity of vehicle electrical systems, which require reliable power generation to support advanced features including infotainment, safety, and connectivity. The growing popularity of start-stop technology in vehicles, aimed at improving fuel efficiency, has also influenced the demand for durable and high-performance alternators. Additionally, the expansion of the automotive aftermarket sector, driven by vehicle maintenance and repair needs, contributes to automotive alternator market growth. As per aa 2024 report, over the past decade, vehicle maintenance and repair costs have increased by 42.5% in the U.S., with an average cost of USD 1,160 in 2022. The highest expenditure was registered in the West at USD 1,338. The Midwest saw the biggest jump, 52.9 percent, while Black Americans faced the biggest increase of all demographics, 77.2 percent. The growing need for repairs supports a lucrative long-term prospect in the automotive alternator market due to the costly replacement of parts that being an old vehicle in proper condition requires. Rising consumer preference for enhanced driving experiences and the integration of energy-efficient components further propel the demand for innovative alternators in the U.S. automotive industry.

Automotive Alternator Market Trends:

Rise in Vehicle Electrification

Nowadays electric vehicles and hybrid electric vehicles are gaining significant traction mainly due to the rising awareness about the carbon emissions. According to reports, in 2023, around one in four new cars sold globally were electric. In Norway this share was over 90% and in China it was almost 40%. Due to the rising demand for electric vehicles and hybrid electric vehicles there is a growing need for high output alternators to manage sophisticated electrical systems. These alternators must efficiently charge the batteries, power electric motors and support auxiliary systems such as heating and cooling. Manufacturers nowadays are generally focusing on developing alternators which can handle higher electrical loads while ensuring durability and energy efficiency.

Integration of Smart Technologies

Modern alternators are integrating advanced technologies including smart charging systems, regenerative braking, and start-stop functionality to enhance vehicle efficiency and lower emissions. According to estimations by the United Nations, in 2024, the overall carbon emissions in the world were calculated to reach 41.6 Billion Tons. Smart charging systems optimize battery charging based on vehicle demand, improving overall energy management. For instance, Fiat Professional recommends the REDARC In-vehicle DC-DC Battery Charger (BCDC) for vehicles with smart alternators. This solution ensures auxiliary batteries receive optimal charging, overcoming issues such as variable voltage, voltage drop, and overcharging. The BCDC is endorsed by Fiat Professional and is suitable for various applications, including off-grid power. Contact REDARC for further information. Regenerative braking systems capture kinetic energy during braking, converting it into electrical energy to recharge batteries, further enhancing efficiency. Start-stop functionality reduces fuel consumption by automatically turning off the engine during idling, with alternators quickly restarting the engine as needed, reflecting a shift towards more sustainable automotive practices.

Rising Demand for Lightweight Alternators

Manufacturers are increasingly prioritizing lightweight alternators to enhance vehicle efficiency and fuel economy. By reducing the overall weight of alternators, vehicles can achieve better fuel efficiency and performance. For instance, in March 2023, American Power Systems, Inc. (APS) introduced the new 130 HPI Series of low RPM alternators, enabling faster charging of secondary power banks even at idle speeds. This innovation reduces fuel consumption and engine strain, ideal for RVs, yachts, work trucks, and emergency vehicles. Tested for reliability and durability, the 130 HPI Series offers 24- and 48-volt options, enhancing efficiency while adhering to idling laws. Lightweight materials and advanced design techniques are being employed to achieve this goal without compromising on durability and functionality. This trend responds to consumer demand for more fuel-efficient vehicles and aligns with regulatory pressures for lower emissions, driving innovation in alternator technology towards lighter, more efficient solutions. As per the Emissions Gap Report 2024 by the United Nations, global greenhouse gas emissions are required to be reduced by 42% by 2030 and 57% by 2035 to comply with international regulations.

Automotive Alternator Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive alternator market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on powertrain type and vehicle type.

Analysis by Powertrain Type:

- IC Engine Vehicles

- Hybrid and Electric Vehicles

IC engine vehicles stand as the largest component in 2024. These vehicles, including traditional gasoline and diesel-powered cars, trucks, and buses, require alternators to generate electrical power for various systems. Despite the rise of electric vehicles (EVs), IC engine vehicles continue to drive significant automotive alternator market demand globally. Manufacturers focus on enhancing alternator efficiency, durability, and performance to meet the diverse needs of IC engine vehicles, ensuring reliable operation and supporting ongoing innovation in automotive electrical systems. As EV adoption grows, the market dynamics may shift, but IC engine vehicles remain a cornerstone of alternator demand.

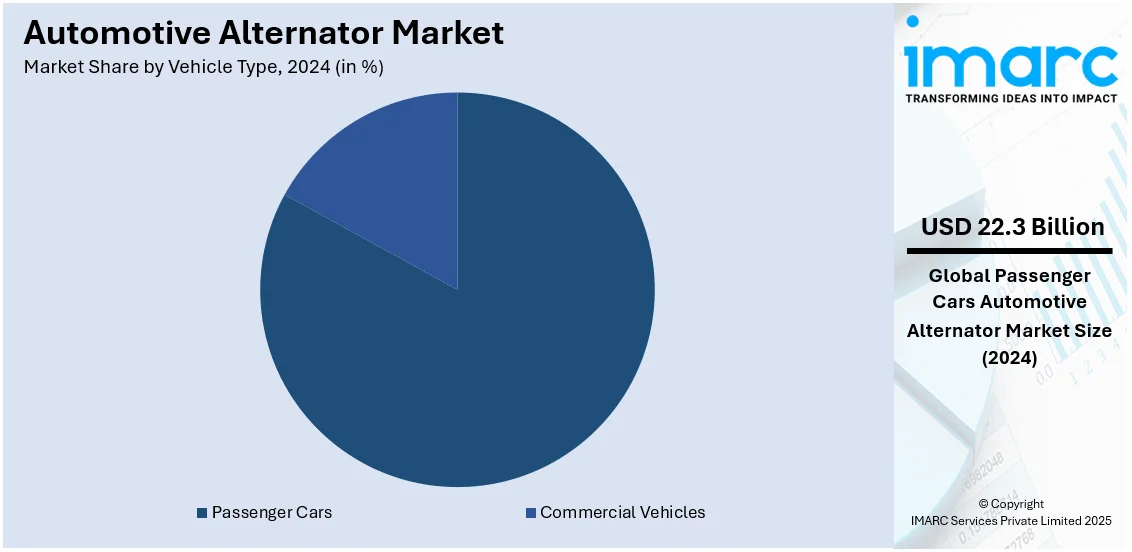

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Passenger cars lead the market with around 82.6% of market share in 2024 due to their widespread global presence and diverse electrical system requirements. Alternators in passenger cars are essential for powering various components, such as lights, infotainment systems, climate control, and safety features. As consumer demand for more advanced vehicle technologies, such as start-stop systems and regenerative braking, increases, the need for efficient alternators continues to grow. Manufacturers focus on developing lightweight and high-output alternators to enhance fuel efficiency and meet stringent emission standards, catering to the changing demands of passenger car owners worldwide.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 45.0%. Asia-Pacific dominates the automotive alternator market, holding the largest market share globally. This region's leadership is driven by its robust automotive industry, encompassing major markets such as China, Japan, India, and South Korea. Rapid industrialization, urbanization, and increasing vehicle production fuel demand for alternators. In 2023, China's auto production and exports reached all-time highs. With 30.16 million vehicles manufactured and 30 million wholesale deliveries, surpassing 2017 records, the market saw a recovery. Exports accelerated by 58% to 4.91 million units. Moreover, government initiatives promoting electric vehicle adoption and stringent emission regulations further bolster market growth. Manufacturers in Asia-Pacific focus on innovation, including lightweight materials and advanced technologies, to meet changing consumer preferences and regulatory standards, solidifying the region's pivotal role in the automotive alternator market.

Key Regional Takeaways:

United States Automotive Alternator Market Analysis

The US accounted for around 88.50% of the total North America automotive alternator market in 2024. The United States automotive alternator market is expanding, primarily driven by the increasing demand for fuel-efficient and electric vehicles (EVs). According to the International Energy Agency, sales of electric vehicles were projected to increase by 20% in the U.S. in 2024 in comparison to 2023. With rising fuel costs and stricter emission regulations set by agencies such as the Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA), automakers are focusing on improving vehicle efficiency, making high-performance alternators essential for optimizing energy generation and consumption. The growing adoption of start-stop technology in modern vehicles is another significant driver, as it requires advanced alternators capable of handling frequent engine restarts while maintaining battery charge. Additionally, the shift toward hybrid and mild-hybrid electric vehicles (HEVs) is increasing the demand for more efficient alternators with enhanced power generation capabilities. Rising consumer preference for high-tech vehicle features, including advanced infotainment systems, adaptive lighting, and driver assistance technologies, is further fueling the need for reliable alternators that can support higher electrical loads. The aftermarket segment is also witnessing steady growth due to the increasing average vehicle age in the U.S., leading to higher demand for alternator replacements and upgrades. Technological advancements, such as smart alternators with variable voltage regulation, are further improving efficiency, making them a crucial component in modern automotive electrical systems.

Asia Pacific Automotive Alternator Market Analysis

The Asia Pacific automotive alternator market is expanding due to the rapid growth of the automotive industry, particularly in China, India, and Japan. For instance, during FY23, India produced 25.9 Million vehicles and exported 47,61,487 automobiles in total. Similarly, in 2022, the number of new passenger car sales in Japan amounted to 3,448,272. Increasing vehicle production, driven by rising disposable incomes and expanding urbanization, is fueling demand for advanced alternators in both passenger and commercial vehicles. Additionally, the shift toward hybrid and fuel-efficient vehicles, supported by government regulations on emissions, is propelling automakers to adopt high-performance alternators with improved energy efficiency. Furthermore, increasing demand for electric power steering, infotainment systems, and safety features is creating a need for more reliable alternators. Other than this, rising demand for premium and luxury vehicles with advanced electrical features, such as adaptive lighting and digital dashboards, is also contributing to industry expansion.

Europe Automotive Alternator Market Analysis

The Europe automotive alternator market is growing due to increasing vehicle electrification, stringent emission regulations, and advancements in automotive technology. With the focus of the European Union on lower carbon emissions and fuel efficiency, automakers are integrating advanced alternators to optimize energy management in internal combustion engine (ICE) vehicles and hybrid models. As per the European Commission, greenhouse gas emissions from the economies of the European Union were approximately 790 Million Tons of CO2-equivalents in the second quarter of 2024, recording a reduction of 2.6% in comparison to the corresponding period in 2023. Additionally, the rise of 48V mild-hybrid electric vehicles (MHEVs) in Europe is propelling the need for more efficient alternators with higher power output to support electrical components in hybrid drivetrains. The growing use of advanced vehicle features, such as electric power steering, infotainment systems, and adaptive lighting, is further increasing demand for robust alternators with variable voltage regulation. Other than this, the expansion of electric turbochargers and electrically powered auxiliaries in modern vehicles is placing greater emphasis on alternator efficiency. The focus of the EU on sustainable mobility is also encouraging the development of lightweight, high-efficiency alternators that contribute to reduced fuel consumption and lower emissions. Growth in commercial vehicle electrification, particularly in logistics and public transport sectors, is further increasing demand for durable and high-output alternators.

Latin America Automotive Alternator Market Analysis

The Latin America automotive alternator market is driven by rising vehicle production, particularly in Brazil, Mexico, and Argentina, as automakers expand manufacturing operations to meet growing domestic and export demand. Increasing urbanization and disposable income are fueling passenger car sales, leading to higher demand for reliable alternators. According to recent industry reports, 88.1% of the total population in Latin America lived in urban areas in 2024. Additionally, the expanding commercial vehicle sector in the region, driven by logistics, construction, and agriculture, is improving the need for high-performance alternators. Growth in off-road and agricultural vehicle sales, particularly in Argentina and Brazil, is further contributing to market demand. Other than this, a strong automotive aftermarket, supported by extended vehicle lifespans and high replacement rates, further supports industry expansion.

Middle East and Africa Automotive Alternator Market Analysis

The Middle East and Africa automotive alternator market is growing as a result of the increasing demand for commercial and off-road vehicles in industries such as mining, oil and gas, and agriculture. The expansion of vehicle manufacturing and assembly plants, particularly in countries such as Morocco, Egypt, and Turkey, is driving the need for locally sourced automotive components, including alternators. Additionally, rising investments in electric and hybrid vehicles, particularly in GCC nations such as the UAE and Saudi Arabia, are encouraging the development of high-efficiency alternators. According to a report published by the IMARC Group, the GCC electric vehicles market size reached 40.3 Thousand Units in 2024 and is expected to grow at a CAGR of 9.3% during 2025-2033. Besides this, the strong reliance on imported vehicles across several African nations is fueling a growing aftermarket sector, enhancing demand for replacement alternators.

Competitive Landscape:

The competitive landscape of the automotive alternator market is characterized by intense rivalry among key players striving to enhance their market position through innovation and strategic initiatives. Companies are focusing on developing advanced alternators with improved efficiency, durability, and lightweight designs to meet changing industry standards and consumer demands. Many are investing heavily in research and development to integrate smart technologies and energy-efficient solutions, catering to the growing adoption of electric and hybrid vehicles. Strategic partnerships, mergers, and acquisitions are also common, enabling players to expand their product portfolios and geographic reach. Additionally, a strong emphasis on sustainability and compliance with stringent emission regulations is driving competition as manufacturers aim to deliver eco-friendly and high-performance alternators.

The report provides a comprehensive analysis of the competitive landscape in the automotive alternator market with detailed profiles of all major companies, including:

- AS PL Sp. z o.o.

- DENSO Products and Services Americas, Inc.

- Forvia Hella

- Jinzhou Halla Electrical Equipment Co. Ltd

- Motorcar Parts of America, Inc.

- Prestolite Electric Incorporated

- Robert Bosch LLC

- Spark Minda

- TERREPOWER

- Valeo Service

Latest News and Developments:

- October 2024: Lexus has added new features to their LX, launching the LX 700h, which is equipped with the company’s recently created hybrid system. In contrast to other Lexus hybrid vehicles, this system is the first to have a starter, as well as an alternator, as standard equipment. A gradual deployment of this system is planned to start in late 2024 in numerous regions.

- June 2024: NTT DATA and DENSO formed a strategic partnership to establish a global system with 3,000 engineers by 2030, focusing on in-vehicle software for the era of software-defined vehicles (SDVs). The collaboration aims to address the growing importance of in-vehicle software in the automotive industry and support SDVs, automated driving, and electrification. The companies will also cultivate advanced software engineers and enhance the platform to support software development.

- May 2024: BorgWarner secured contracts with XPeng, a Chinese Smart EV manufacturer, to supply high-voltage hairpin (HVH) eMotors for two future SUV models. The eMotor systems, which will be used on vehicles starting in 2025, offer high power and torque density, enhanced efficiency, and superior durability. This deal solidifies BorgWarner's technology leadership and partnership with XPeng. The eMotors feature advanced oil-cooled 800V systems and patented high-voltage hairpin winding technology.

- May 2024: EcoFlow, a renowned provider of portable energy and environmentally friendly power solutions, is broadening its line of On-the-Road Power Solutions with the introduction of its innovative Alternator Charger. By utilizing their surplus automotive alternator power, outdoor enthusiasts and travelers can now fast-charge their vehicles with this novel technology.

- February 2024: Cummins has introduced the cutting-edge X15 diesel engine in North America, which is a component of the HELM 15-liter fuel agnostic system. The X15 model makes use of an aftertreatment heating system and a belt-driven, high power 48-volt alternator, calibrated to help meet strict emission regulations.

- November 2023: Bosch is expanding its line of alternators and starters for various workshops. Numerous commercial automobiles, passenger vehicles, and off-the-road applications are already covered by Bosch's selection of modern alternators and starters. This expansion will further enable workshops to upgrade the faulty original equipment starters and alternators from different manufacturers in the future.

- June 2023: The brand-new Colt compact hatchback has been introduced in Europe by Mitsubishi Motors Europe B.V., the European division of Mitsubishi Motors. The All-New COLT is available in an eco-friendly complete hybrid version, as well as a gasoline-powered edition. The HEV variant has a 1.6 Liter Gasoline engine and features two electrically powered motors, an alternator-starter and a primary motor.

Automotive Alternator Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Powertrain Types Covered | IC Engine Vehicles, Hybrid and Electric Vehicles |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicle |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AS PL Sp. z o.o., DENSO Products and Services Americas, Inc., Forvia Hella, Jinzhou Halla Electrical Equipment Co. Ltd, Motorcar Parts of America, Inc., Prestolite Electric Incorporated, Robert Bosch LLC, Spark Minda, TERREPOWER, Valeo Service, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive alternator market from 2019-2033.

- The automotive alternator market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive alternator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive alternator market was valued at USD 27.04 Billion in 2024.

IMARC estimates the automotive alternator market to exhibit a CAGR of 4.99% during 2025-2033, reaching a value of USD 42.08 Billion by 2033.

The market is primarily driven by the rising demand for electric and hybrid vehicles, increasing vehicle production in emerging economies, and technological advancements such as lightweight and high-efficiency alternators. Additionally, stringent emission regulations and the integration of smart charging systems are further fueling market growth.

Asia-Pacific currently dominates the automotive alternator market, accounting for a share exceeding 45.0%. This dominance is fueled by rapid industrialization, rising vehicle production in key markets like China, India, and Japan, and government initiatives promoting EV adoption.

Some of the major players in the automotive alternator market include AS PL Sp. z o.o., DENSO Products and Services Americas, Inc., Forvia Hella, Jinzhou Halla Electrical Equipment Co. Ltd, Motorcar Parts of America, Inc., Prestolite Electric Incorporated, Robert Bosch LLC, Spark Minda, TERREPOWER, and Valeo Service, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)