Automotive 48V System Market Report by Architecture (Belt Driven (P0), Crankshaft Mounted (P1), Dual-Clutch Transmission-Mounted/Input Shaft of Transmission (P2/P3), Transmission Output Shaft/Rear Axle (P4)), Vehicle Class (Entry-level, Mid-range, Premium, Luxury), and Region 2025-2033

Automotive 48V System Market Size:

The global automotive 48V system market size reached USD 8.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 43.8 Billion by 2033, exhibiting a growth rate (CAGR) of 18.96% during 2025-2033. The market is witnessing substantial expansion, boosted by rising demand for reduced emissions and fuel efficiency, coupled with innovations in electric vehicle technology. At present, Asia-Pacific holds the largest market share, attributed to technological innovations, escalating vehicle production, and strict environmental policies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.5 Billion |

|

Market Forecast in 2033

|

USD 43.8 Billion |

| Market Growth Rate 2025-2033 | 18.96% |

The automotive 48V system is an advanced technology that integrates a 48-volt battery with an internal combustion (IC) engine and a regular 12-volt battery in multiple configurations. It includes various components, such as a belt alternator starter, direct current (DC)-to-DC converter, high voltage battery, inverter, power distribution box, electric motor, and charger. The automotive 48V system is widely used to provide start-stop function, torque boost, regenerative braking, and power to the electric drive, compressors, and power steering. It aids in optimizing performance, reducing weight, and improving the harness packaging in the vehicle. The automotive 48V system helps to reduce carbon dioxide emissions, improve fuel efficiency, and enable dynamic handling and performance.

Automotive 48V System Market Trends:

Heightened Adoption of Mild Hybrid Vehicles

The magnifying popularity of mild hybrid vehicles (MHEVs) is a crucial trend in the global automotive 48V system market. MHEVs, which leverage 48V systems, provide a balance between functional improvements and fuel efficiency without any elevated costs or complexity of electric as well as full hybrid vehicles. As per industry reports, by 2025, global annual production of 48V mild hybrid is anticipated to surpass 10 million units. Moreover, this technology facilitates reduced emissions and enhanced fuel economy, positioning it as an ideal option for producers that are actively striving to adhere to the stringent environmental regulatory protocols. In addition, several automakers are rapidly incorporating 48V technology into their vehicle designs as a cost-efficient approach to electrification, establishing mild hybrids as a principal growth area within the automotive sector.

Technological Innovations in Powertrain Systems

The automotive 48V system market research indicates that ongoing technological advancements in powertrain systems are significantly steering the transformation of the global market. Enhanced 48V architectures, such as electric superchargers and incorporated starter generators, are currently being deployed to enhance fuel efficiency and overall vehicle functionality. Furthermore, such systems upgrade engine operation by facilitating better energy revitalization during idling and braking processes, while also improving acceleration mechanism. For instance, Toyota announced plans to launch its 48V mild-hybrid diesel powertrain in the Indian automotive market in 2024, providing a 10% improvement in fuel efficiency. Additionally, its belt-driven electric motor offers torque assistance as required, whereas regenerative braking recharges the battery. Moreover, the steady development of excellent-performance, cost-efficient 48V components is garnering attention from numerous automakers seeking to address the emission objectives without substantial magnification in manufacturing costs. In addition, such innovations are anticipated to further boost the automotive 48V market growth across the vehicle manufacturing sector.

Strict Government Regulations on Emissions

Government regulatory policies aimed at minimizing vehicle emissions are a critical trend largely impacting the global automotive 48V system market. Stringent emissions as well as fuel efficiency protocols are notably compelling automakers to opt for cleaner technologies. The 48V system has emerged as an efficient solution, enabling vehicles to cater to such strict standards without affecting performance. In addition, this technology supports automakers in achieving regulatory compliance while maintaining vehicle efficiency. Moreover, the trend toward adopting 48V systems is projected to boost as regulatory bodies in various countries continue to reinforce stringent environmental policies, bolstering further advancements and the incorporation of low-emission, fuel-efficient technologies, significantly contributing to a positive automotive 48V system market outlook. According to a research article published in the journal Energy in October 2024, the European Union introduced an on-board monitoring regulation to significantly minimize particulate emissions, which will be enforced starting in July 2027 for heavy-duty vehicles and July 2025 for light commercial vehicles as well as passenger cars.

Automotive 48V System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on architecture and vehicle class.

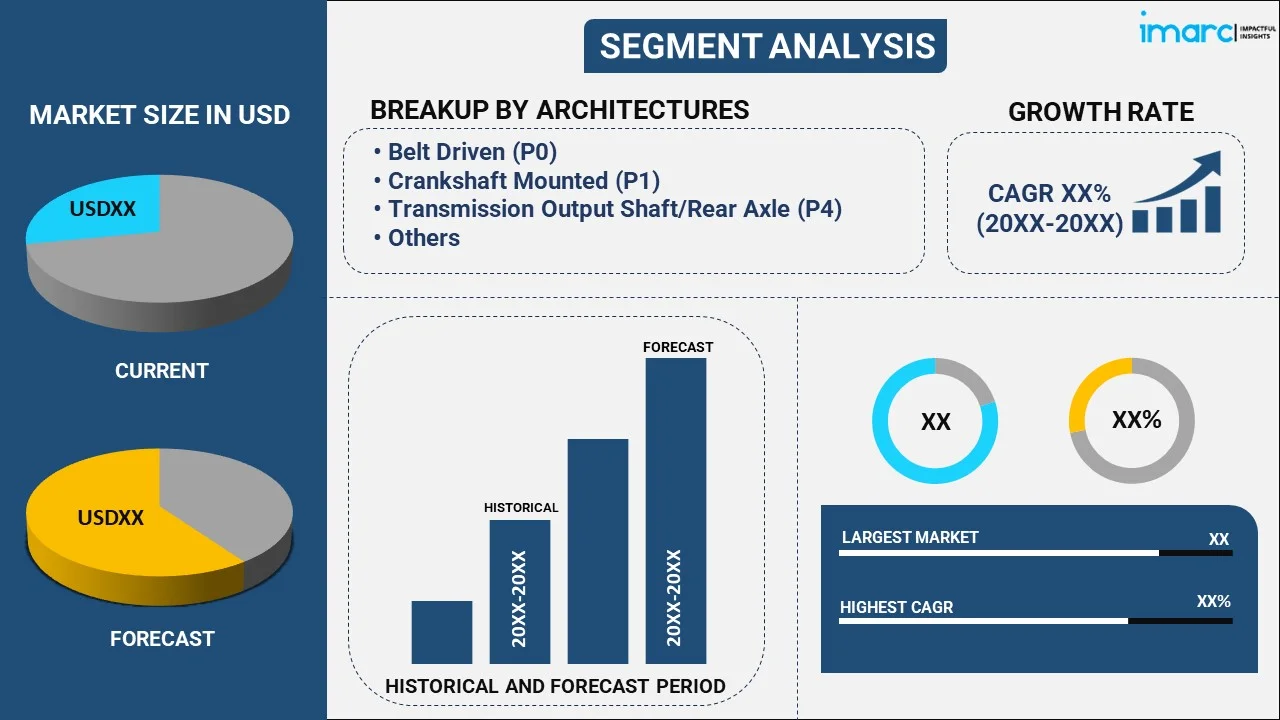

Breakup by Architecture:

- Belt Driven (P0)

- Crankshaft Mounted (P1)

- Dual-Clutch Transmission-Mounted/Input Shaft of Transmission (P2/P3)

- Transmission Output Shaft/Rear Axle (P4)

The report has also provided a detailed breakup and analysis of the automotive 48V system market based on the architecture. This includes belt driven (P0), crankshaft mounted (P1), dual-clutch transmission-mounted/Input shaft of transmission (P2/P3), and transmission output shaft/rear axle (P4). According to the report, belt driven represented the largest segment.

Breakup by Vehicle Class:

- Entry-level

- Mid-range

- Premium

- Luxury

A detailed breakup and analysis of the automotive 48V system market based on the vehicle class has been provided in the report. This includes entry-level, mid-range, premium, and luxury. According to the report, mid-range accounted for the largest market share.

Regional Insights:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for automotive 48V systems. Some of the factors expanding the automotive 48V system market share in Asia Pacific include rising expenditure capacities of consumers, increasing penetration of international automotive manufacturers, and rising environmental concerns.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global automotive 48V system market. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Borgwarner Inc.

- Continental Aktiengesellschaft

- Dana Limited

- Hyundai Motor Company

- Magna International Inc.

- MAHLE GmbH (Mahle Stiftung GmbH)

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Valeo

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Automotive 48V System Market News:

- In October 2024, Vicor launched BCM6135, DCM3735 and PRM3735, its new power modules for automotive 48V systems in electric vehicles. BCM6135, particularly, provides significant weight and cost savings in EVs manufacturing.

- In December 2023, Toyota launched its new Hilux hybrid 48V model in the European market, featuring a 2.8-liter diesel engine and offering enhanced comfort, exceptional driving performance, and improved vehicle efficiency.

Automotive 48V System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Architectures Covered | Belt Driven (P0), Crankshaft Mounted (P1), Dual-clutch Transmission-Mounted/Input Shaft of Transmission (P2/P3), Transmission Output Shaft/Rear Axle (P4) |

| Vehicle Classes Covered | Entry-Level, Mid-Range, Premium, Luxury |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Borgwarner Inc., Continental Aktiengesellschaft, Dana Limited, Hyundai Motor Company, Magna International Inc., MAHLE GmbH (Mahle Stiftung GmbH), Mitsubishi Electric Corporation, Robert Bosch GmbH, Valeo, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive 48V system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global automotive 48V system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive 48V system industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global automotive 48V system market was valued at USD 8.5 Billion in 2024.

We expect the global automotive 48V system market to exhibit a CAGR of 18.96% during 2025-2033.

The rising demand for electric and hybrid vehicles, along with the growing adoption of automotive 48V systems, as they help to reduce carbon dioxide emissions, improve fuel efficiency, and enable dynamic handling and performance, is primarily driving the global automotive 48V system market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous manufacturing units for vehicles, thereby negatively impacting the global market for automotive 48V systems.

Based on the architecture, the global automotive 48V system market has been divided into belt driven (P0), crankshaft mounted (P1), dual-clutch transmission-mounted/input shaft of transmission (P2/P3), and transmission output shaft/rear axle (P4). Among these, belt driven (P0) currently exhibits a clear dominance in the market.

Based on the vehicle class, the global automotive 48V system market can be categorized into entry-level, mid-range, premium, and luxury. Currently, mid-range accounts for the majority of the global market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global automotive 48V system market include Borgwarner Inc., Continental Aktiengesellschaft, Dana Limited, Hyundai Motor Company, Magna International Inc., MAHLE GmbH (Mahle Stiftung GmbH), Mitsubishi Electric Corporation, Robert Bosch GmbH, Valeo, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)