Automation Testing Market Size, Share, Trends and Forecast by Component, Endpoint Interface, Enterprise Size, End User, and Region, 2025-2033

Automation Testing Market Size and Share:

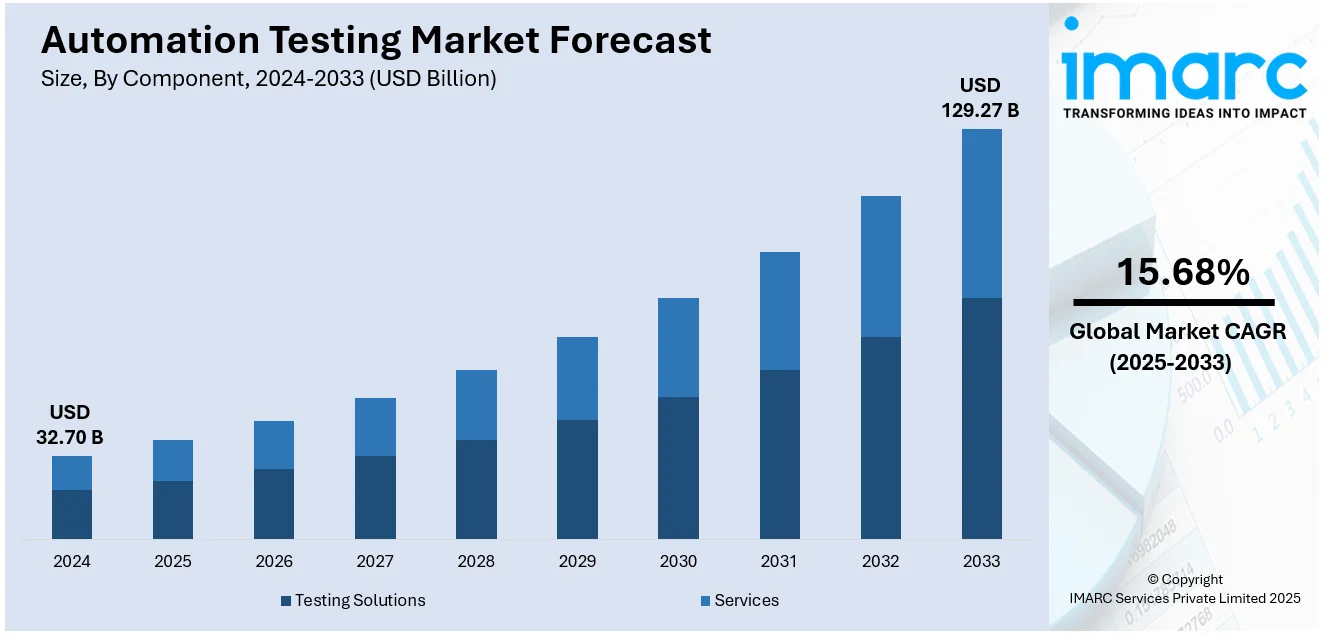

The global automation testing market size was valued at USD 32.70 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 129.27 Billion by 2033, exhibiting a CAGR of 15.68% from 2025-2033. North America currently dominates the market, holding a market share of over 38.7% in 2024. The escalating demand for faster and more efficient testing to reduce time-to-market, growing adoption of agile and DevOps methodologies in the production of new and more flexible software, and the rising need to reduce human errors in software testing represent some of the key factors driving the automation testing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 32.70 Billion |

|

Market Forecast in 2033

|

USD 129.27 Billion |

| Market Growth Rate 2025-2033 | 15.68% |

The rapid expansion of mobile applications and Internet of Things (IoT) devices is a significant driver of the automation testing market growth. The European Commission reports that the number of connected IoT devices is projected to grow from approximately 40 billion in 2023 to 49 billion by 2026, with an annual growth rate of 7%. This surge necessitates rigorous testing to ensure seamless integration, functionality, and security across diverse platforms and devices. Automation testing offers a scalable solution to manage the complexities introduced by this proliferation. It facilitates effective evaluation of application performance and interoperability within a rapidly growing interconnected environment. According to the UK's Government Office for Science, the number of IoT devices in the UK is expected to exceed 150 million by 2024, a significant increase from 13 million in 2006. This highlights the rising need for comprehensive and reliable testing frameworks. Furthermore, the European Commission emphasizes that the IoT is a key priority area of the digital single market, with the potential to address societal challenges including climate change and resource efficiency. This underscores the critical role of automation testing in ensuring the reliability and efficiency of IoT solutions that contribute to broader policy objectives.

The automation testing market demand in the United States is witnessing substantial growth, with a share of 78.80% fueled by several critical drivers. A prominent factor is the growing integration of cutting-edge technologies like artificial intelligence (AI) and machine learning (ML). These advancements are revolutionizing testing processes, enabling smarter, faster, and more efficient automation solutions. According to the U.S. Census Bureau, AI use among small businesses has been relatively high during much of 2023 and 2024, a trend likely to continue in the near future. Additionally, the U.S. manufacturing sector's focus on enhancing productivity and competitiveness has led to increased automation. Furthermore, the U.S. Bureau of Labor Statistics (BLS) projects that the professional, scientific, and technical services sector will be the fastest-growing sector from 2023 to 2033, driven by strong demand for computer systems design and related services, including client-based IT services. These developments underscore the critical role of automation testing in ensuring software quality and reliability across various industries, thereby propelling market growth in the United States.

Automation Testing Market Trends:

The Escalating Demand for Faster and More Efficient Testing

The global automation testing market share is majorly driven by the escalating demand for faster and more efficient testing to speed up the software development process and reduce time-to-market. This can be attributed to a considerable rise in the need for faster software delivery in numerous end-use applications. Traditional manual testing methods are often too slow to keep pace with the accelerated development cycles required by modern software development practices. This has led to a significant shift towards automation testing, which enables quicker execution of tests, early detection of defects, and faster time-to-market for software products. According to the European Centre for the Development of Vocational Training (CEDEFOP), rapid digitalisation and the spread of new technologies are creating widespread disruption in EU labour markets, highlighting the need for efficient testing processes to keep up with technological advancements.

The growing adoption of agile and DevOps methodologies

The Agile and DevOps cultures in the domain of software development have adopted automation testing in their arena. Agile encompasses iterative development with a focus on collaboration and speed, whereas the integration of developments and operations called DevOps combines both for seamlessness and successful CI/CD. Indeed, automation is at the heart of these practices by reflecting the velocity required for the faster cycles of these developments. Continuous testing will test at all levels of the development life cycle, ensuring that defects are identified early. This, in turn, saves rework, cuts costs, and improves quality. Automation tools allow developers to run tests of thousands of test cases across various platforms and devices simultaneously, while developmental speed and quality are improved. More importantly, the U.S. USDS focuses on Agile's importance in enhancing government IT projects, thereby showing that the methodology is not limited to the private sector. Automation testing forms the backbone of these methodologies and provides rapid feedback loops, scalability, and error reduction.

The Growing Focus on Reducing Human Errors

The rising need to reduce human errors made via manual testing, efficient detection and resolution of defects, and to minimize operation costs is also resulting in a higher uptake of automation testing. Studies indicate that approximately 35% of the testing cycle is dedicated to manual testing, while test failure analysis accounts for an additional 22%, making it the second most time-intensive activity. Errors during manual testing can result in critical problems, such as system malfunctions, security breaches, and higher expenses. By leveraging automation testing, organizations can significantly reduce dependence on manual efforts, thereby decreasing the likelihood of human errors and improving overall testing efficiency. By automating repetitive and complex test cases, organizations can achieve higher accuracy and consistency in their testing processes. The UK’s Office for National Statistics (ONS) has highlighted the growing significance of automation in society. This shift is reshaping the job market, with an increasing emphasis on automating tasks to enhance efficiency and reduce the risk of human error.

Automation Testing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automation testing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, endpoint interface, enterprise size, and end user.

Analysis by Component:

- Testing Solutions

- Functional Testing

- API Testing

- Security Testing

- Compliance Testing

- Usability Testing

- Others

- Services

- Professional Services

- Managed Service

As per the latest automation testing market forecast, services take the largest share of 58.7% as more and more customers are now demanding specialized support and expertise to implement and manage automated testing solutions. Consulting, implementation, and support services guarantee that automation testing tools are used efficiently in the development pipeline and thus maximize the ROI. Managed testing services are also gaining popularity as companies seek to outsource testing operations to reduce costs and focus on core business activities. According to a report by the U.S. Department of Commerce, IT consulting services in the U.S. reached a valuation of over $80 billion in 2023, reflecting the increasing reliance on service providers. These services can help organizations move toward adopting automation tools and help scale them further, while also aiding in overcoming deficiencies in resources or skills.

Analysis by Endpoint Interface:

- Web

- Mobile

- Desktop

- Embedded Software

Based on the latest automation testing market outlook, mobile interfaces are the market leader. This is primarily due to the fast-paced adoption of mobile applications and the increased use of smartphones in daily life. With over 6.9 billion smartphone users worldwide in 2023, according to ITU, the need for robust mobile application testing has risen. Mobile automation testing will ensure cross-platform compatibility, performance optimization, and security. In today's digital era, where mobile applications play a pivotal role in driving customer engagement, their importance cannot be overstated. Governments all over the world, including the European Union, have focused on mobile app security through updated regulations, which will further boost the market for mobile-focused testing tools. Increasing adoption of mobile banking, healthcare, and retail apps underlines the importance of this segment.

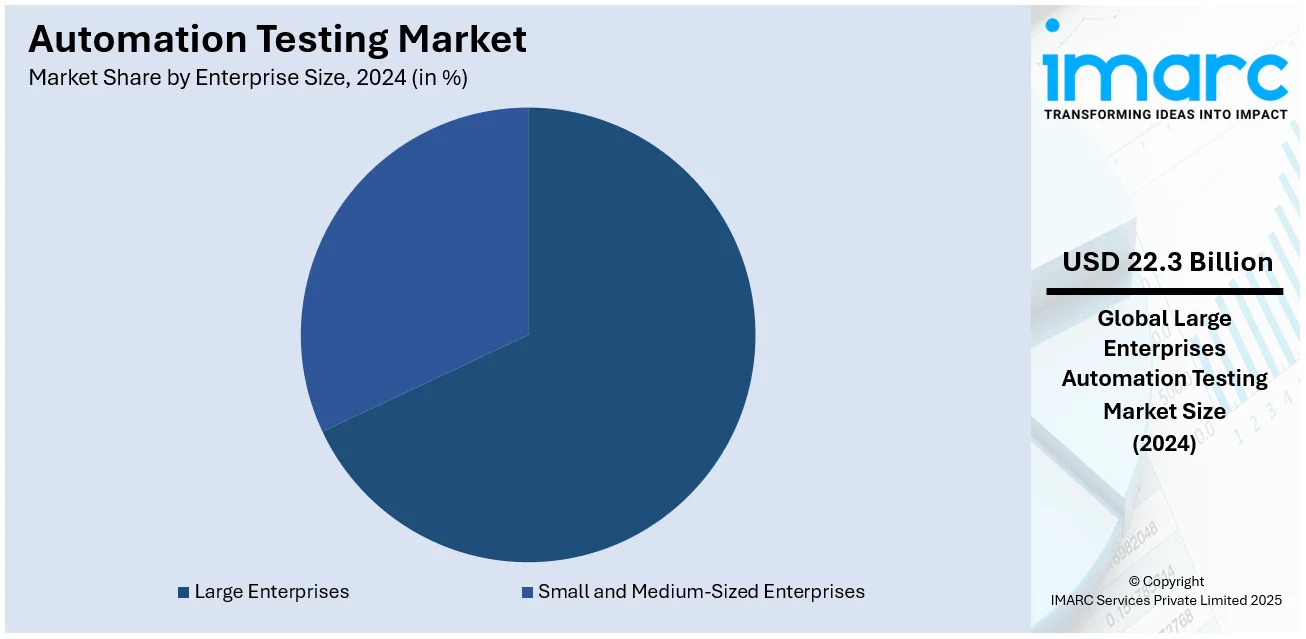

Analysis by Enterprise Size:

- Small and Medium-Sized Enterprises

- Large Enterprises

Large enterprises have the highest share of 68.3% in the automation testing market because of their huge IT infrastructure, complex software requirements, and large budgets for technology adoption. Large enterprises use automation testing to improve the quality of their software while reducing time-to-market and operational costs. Automation also helps large enterprises scale their testing operations across diverse environments, ensuring consistent performance. The International Labour Organization (ILO) reports that large-scale enterprises are increasingly prioritizing digital transformation to enhance efficiency and competitiveness. Automation technologies have increased by more than 20% every year. They also employ enterprise-grade automation tools to fulfill regulatory requirements and to provide customers with better experiences.

Analysis by End User:

- IT and Telecommunication

- BFSI

- Healthcare

- Retail

- Transportation and Logistics

- Others

The IT and telecommunication sector is a strong driver for automation testing, given the dependence of this sector on software solutions to manage networks, roll out 5G, and enhance cloud services. The reliability and rapid deployment of complex systems are assured through automated testing.

The BFSI (Banking, Financial Services, and Insurance) sector relies heavily on automation testing to ensure that digital transactions are both secure and efficient, safeguarding user data while enhancing operational reliability. Fintech and digital wallets have increased in popularity, but the risk of cyber threats and regulatory non-compliance calls for solid testing frameworks.

Healthcare organizations apply automation testing to ensure the reliability of software solutions such as telehealth platforms, electronic health records, and diagnostic tools, hence ensuring patient safety and compliance with healthcare regulations.

Automation testing in retail ensures smooth e-commerce operations through compatibility across various platforms, improving website performance, and optimizing payment gateways during peak seasons.

In the transportation and logistics sectors, automation testing ensures that logistics software, tracking systems, and fleet management applications are working correctly, thus allowing for real-time visibility and operational efficiency.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the automation testing market, holding 38.7% share, mainly because of its strong IT infrastructure and high adoption of emerging technologies. There is a significant investment in digital transformation in the region. The United States is home to the most innovating technology leaders in the world; therefore, it is responsible for the majority share in the region. Government initiatives, like the NIST programs, emphasize software quality and cybersecurity, thereby encouraging more demand for automation testing. The market's innovation is further accelerated by the presence of major technology leaders, who drive advancements through cutting-edge solutions and extensive research and development initiatives. In Canada, government-backed programs such as Digital Charter emphasize the importance of software reliability, further propelling automation testing adoption. The region's focus on enhancing customer experience, coupled with stringent regulatory requirements, ensures sustained market growth.

Key Regional Takeaways:

United States Automation Testing Market Analysis

There are several critical drivers for the United States automation testing market, but the most critical ones are related to the increased adoption of DevOps and Agile methodologies. DevOps and Agile methodologies focus on continuous integration and delivery, hence requiring strong, efficient automation testing tools to facilitate smooth software deployment. The trend of digital transformation in industries like banking, healthcare, and retail is also promoting the use of automated testing in order to increase operational efficiency and reduce time-to-market for applications. A key driver of progress is the rapid expansion of artificial intelligence (AI) and machine learning (ML) technologies, which are revolutionizing industries by enabling smarter, more efficient, and adaptive solutions. They progressively improve automation testing tool functionality with the adoption of smarter, self-correcting scripts, predictive analytics, and even intelligent test generation. This significantly enhances the overall accuracy and efficiency of testing processes, ensuring faster and more reliable results. Further, the increased usage of mobile and web applications due to the rising penetration of the internet and smartphone usage calls for a large number of automated solutions to deal with complex testing requirements across various platforms. According to studies, nearly 98% of Americans own a cell phone, and nearly nine out of ten adults own a smartphone in 2024. More stringent regulatory standards, especially for industries like health care and finance, compel the organizations to follow automation testing as a method for compliance and to reduce the risks involved. In addition, cost savings in the context of automated testing over the processes that involve human intervention is an important reason behind its adoption. As businesses look to stay competitive, automation testing is a scalable and reliable solution that can deliver quality products efficiently.

Europe Automation Testing Market Analysis

Industries such as healthcare, automotive, and financial services are progressively embracing advanced technologies like the Internet of Things (IoT) and artificial intelligence (AI) to drive innovation and improve operational efficiency. All this is placing greater demands on testing frameworks in terms of making systems reliable and performant. Automation testing solutions represent an efficient method for managing complexity related to such technologies, fueling their adoption across industries. A critical driver here is the stricter regulatory environment within Europe. Finance and healthcare-related industries are those that have serious compliance standards related to GDPR and ISO certifications and require thorough software and system testing. Automation testing ensures accuracy and consistency in the compliance testing procedure, making this an indispensable tool for businesses within these regulated markets. In furtherance of this, increased demand for continuous integration and delivery (CI/CD) pipelines propels the growth of the market. As organizations strive to reduce development cycles and deliver high-quality software as quickly as possible, automation testing is fast becoming the bedrock of DevOps practices. In addition, the increased dependence on cloud-based applications and platforms increases the demand for scalable and efficient testing solutions that can ensure smooth operation across diverse environments. Data from reports reveals that in 2023, 45.2% of enterprises across the European Union utilized cloud computing services, highlighting the growing reliance on cloud technologies to enhance business operations and scalability. Additionally, the European strategy of sustainability and energy efficiency influences software development procedures. Automation testing tools have been proven to be extremely helpful in optimising energy consumption during the testing procedure while maximising resources usage. Presence of established technology hubs in countries such as Germany, the UK, and France along with investments in R&D contributes to the growth of the automation testing market in the region.

Asia Pacific Automation Testing Market Analysis

The automation testing market in the Asia Pacific region is experiencing significant growth, fueled by rapid digitalization in emerging economies like India, China, and countries in Southeast Asia. This transformation is driving the adoption of advanced testing solutions to support the region's expanding digital infrastructure. Increased adoption of cloud computing and SaaS solutions has created a growing need for automation testing to ensure smooth performance and scalability of applications. With the expansion of businesses into the online world, the demand for automated testing tools to address complex multi-platform testing requirements is growing significantly. Another key factor propelling growth in the Asia Pacific automation testing market is the thriving IT outsourcing industry. The region's competitive labor costs, skilled workforce, and technological advancements make it a global hub for outsourced IT services, including software testing. Countries like India and the Philippines are global hubs for software development and testing services, which necessitates the adoption of advanced automation testing frameworks to meet global quality standards efficiently. The growing focus on mobile application development, propelled by the rising smartphone penetration and digital payment systems, is heightening the need for automation testing tools tailored to mobile platforms. Digital payment systems, such as mobile wallets, online banking, and peer-to-peer payment services, are becoming more widespread, further accelerating the demand for mobile app development. In this regard, automation testing tools have been a critical tool for the assurance of quality and performance of mobile applications. The PIB report states that in India, digital payment transactions volume reached 187,370 Million in the financial year 2023-24. Besides this, government initiatives such as digital transformation and smart city projects are moving ahead in other countries, especially China, Singapore, and South Korea, driving the need for strong software testing frameworks.

Latin America Automation Testing Market Analysis

The increased focus on digital transformation and the upgrading of IT infrastructure in the region is one of the primary factors fueling the automation testing market. These measures have helped companies adopt new technologies and become more streamlined in their operations. The governing agencies and private companies are also investing heavily in digital initiatives such as e-governance, e-commerce, and fintech platforms, which necessitate efficient and reliable software testing solutions. As online platforms become more complex and scale, there is a strong demand for e-commerce software testing solutions that are robust and efficient. E-commerce websites and mobile applications ensure that seamless user experiences take place, with safe payment transactions as well as cross-browser and multi-device support. With automation testing, performance, functionality, security, and cross-platform compatibility can be confirmed, minimizing the chances of bugs or system crashes during peak shopping seasons. The increasing online shoppers in the region are contributing to the market growth. It is reported that 70% of e-commerce transactions in Brazil take place through mobile devices, highlighting the region's mobile-first approach to online retail. Moreover, the adoption of cloud computing has accelerated this growth even further, allowing businesses to scale up their operations and implement robust automation testing solutions efficiently. Organizations migrating to cloud-based solutions and creating mobile-first strategies are increasing the demand for automation testing to cover complex, multi-environment scenarios.

Middle East and Africa Automation Testing Market Analysis

The automation testing market in the Middle East and Africa is mainly driven by the region's digital transformation initiatives. Governments and enterprises are increasing investments in the adoption of cutting-edge technologies for infrastructure modernization, process efficiency, and better service delivery across multiple sectors. In the quest for economic growth, governments and enterprises are adopting cloud computing, IoT, and AI technologies, thereby driving a growing need for robust software testing frameworks. Automation testing provides an effective means to ensure the quality and reliability of advanced technologies being adopted in the Middle East and Africa (MEA). In addition, the rapid growth of the IT and telecom sectors in the region is a significant growth driver as these industries are highly dependent on robust testing frameworks to maintain system performance and deliver seamless user experiences. As 5G infrastructure and mobile application development investments increase, the need for scalable and efficient testing solutions has also been on the rise. The GCC region is expected to reach 62 million 5G mobile subscriptions by the end of 2026, says Ericsson. This increase in 5G adoption shows an increasing demand for advanced technologies, and efficient automation testing is more important than ever to ensure a seamless network and user experience. In addition, the growing e-commerce industry in the UAE and South Africa is creating an increasing demand for automated testing in order to deliver seamless customer experiences and secure online transactions.

Competitive Landscape:

As per the emerging automation testing market trends, leading players are adopting innovative strategies to maintain their competitive edge and meet the evolving demands of the industry. Leading companies are making significant investments in research and development (R&D) to enhance their automation tools by integrating advanced technologies like artificial intelligence (AI) and machine learning (ML). These innovations aim to improve testing efficiency, accuracy, and adaptability to evolving technological demands. AI-powered automation enables predictive analytics, intelligent test generation, and self-healing test scripts, significantly improving efficiency and accuracy. Beyond technological advancements, market leaders are prioritizing the expansion of their service offerings to include managed testing services, consulting, and implementation support. This strategic approach aims to provide comprehensive solutions that address diverse client needs while enhancing customer satisfaction and market competitiveness. This helps organizations streamline their testing processes and achieve faster time-to-market. Strategic partnerships and acquisitions have emerged as a significant trend, enabling companies to integrate advanced capabilities into their offerings. These collaborations allow businesses to expand their technological expertise, enhance their service portfolios, and strengthen their competitive position in the market. Moreover, leading players are addressing the surge in mobile and IoT testing by developing specialized solutions for multi-platform compatibility and enhanced security.

The report provides a comprehensive analysis of the competitive landscape in the automation testing market with detailed profiles of all major companies, including:

- Accenture plc

- Broadcom Inc.

- Capgemini SE

- Cigniti Technologies

- International Business Machines Corporation

- Keysight Technologies Inc

- Micro Focus Inc

- Parasoft

- Ranorex Gmbh

- Sauce Labs Inc.

- SmartBear Software Inc

- Tricentis USA Corp.

Latest News and Developments:

- November 2024: BrowserStack, a global leader in software testing platforms, introduced Low Code Automation, a groundbreaking solution designed to make test automation accessible to QA teams, developers, and non-technical testers. This innovation addresses several key challenges faced by software teams, including the delays caused by lengthy manual testing cycles that impede release timelines. Traditional automation tools, such as Selenium, often require significant technical expertise and extended onboarding periods, delaying returns on investment. Additionally, organizations frequently grapple with a shortage of skilled automation engineers, while talented testers may lack the coding skills needed to effectively use traditional automation tools. BrowserStack’s Low Code Automation bridges this gap by empowering teams with simplified and efficient testing capabilities, ensuring faster and more inclusive adoption of automation.

- November 2024: QualityKiosk Technologies, a renowned global provider of digital assurance and reliability engineering solutions, entered into a strategic partnership with Qualitia to revolutionize test automation. The collaboration leverages Qualitia's Boson platform, an AI-driven, self-healing solution tailored for Salesforce deployments. This partnership aims to deliver seamless and scalable test automation solutions specifically designed for the banking, financial services, and insurance (BFSI) sector, as well as software and SaaS platform providers. By combining QualityKiosk's expertise in digital assurance with Qualitia's advanced technology, the initiative addresses critical industry needs for efficient, reliable, and scalable testing processes, ultimately enabling businesses to accelerate their digital transformation efforts.

- June 2023: Leapwork announced a strategic partnership with Microsoft aimed at enhancing its AI-powered test automation platform. This collaboration will enable enterprise companies to achieve continuous quality in their software testing processes. Leapwork's platform is designed to help teams deliver higher-quality user experiences across applications, APIs, and data. With features like an intuitive visual workflow and generative AI capabilities, users ranging from engineers to business professionals can create, maintain, and scale complex data-driven tests more efficiently.

- June 2023: Keysight Technologies expanded its autonomous driving test solutions with the E8717A Lidar Target Simulator (LTS), designed for automakers and lidar manufacturers to validate sensors for autonomous vehicles. This compact setup simulates target distances from 3 to 300 meters and surface reflectivity from 10% to 94%, optimizing test space. The automated testing software enhances sensor design and performance analytics, facilitating efficient testing for mass production.

Automation Testing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Endpoint Interfaces Covered | Web, Mobile, Desktop, Embedded Software |

| Enterprise Sizes Covered | Small and Medium-Sized Enterprises, Large Enterprises |

| End Users Covered | IT and Telecommunication, BFSI, Healthcare, Retail, Transportation and Logistics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, Broadcom Inc., Capgemini SE, Cigniti Technologies, International Business Machines Corporation, Keysight Technologies Inc, Micro Focus Inc, Parasoft, Ranorex Gmbh, Sauce Labs Inc., SmartBear Software Inc, Tricentis USA Corp., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automation testing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automation testing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automation testing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automation testing market was valued at USD 32.70 Billion in 2024.

IMARC estimates the automation testing market to exhibit a CAGR of 15.68% during -2025-2033, reaching USD 129.27 Billion by 2033.

The escalating demand for faster and more efficient testing to reduce time-to-market, growing adoption of agile and DevOps methodologies in the production of new and more flexible software, and the rising need to reduce human errors in software testing represent some of the key factors driving the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the automation testing market include Accenture plc, Broadcom Inc., Capgemini SE, Cigniti Technologies, International Business Machines Corporation, Keysight Technologies Inc, Micro Focus Inc, Parasoft, Ranorex Gmbh, Sauce Labs Inc., SmartBear Software Inc, Tricentis USA Corp., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)