Automated Guided Vehicles Market Size, Share, Trends and Forecast by Type, Mode of Operation, Navigation Technology, Application, Industry, and Region, 2025-2033

Automated Guided Vehicles Market Size and Share:

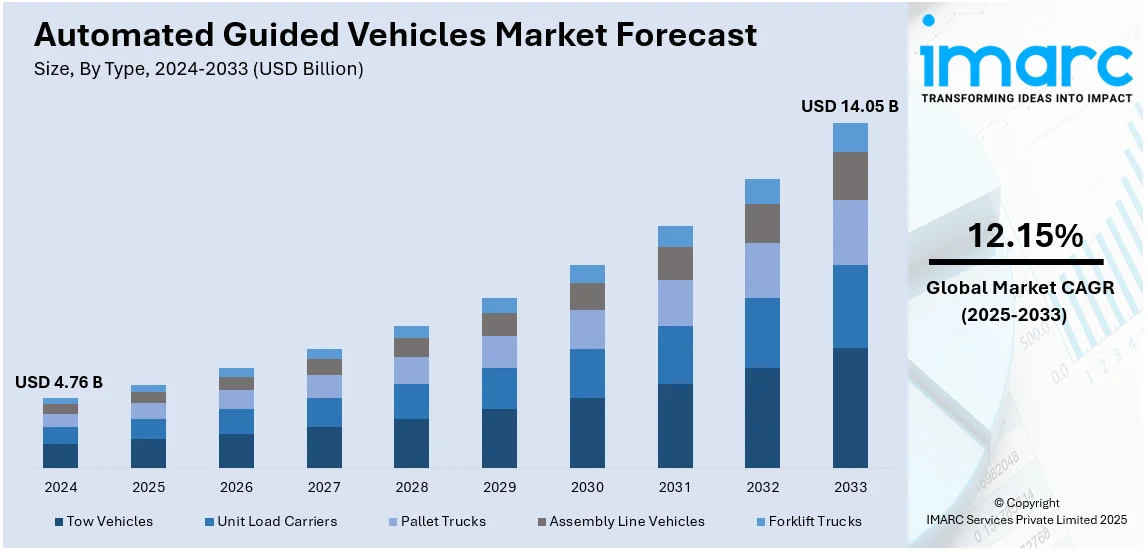

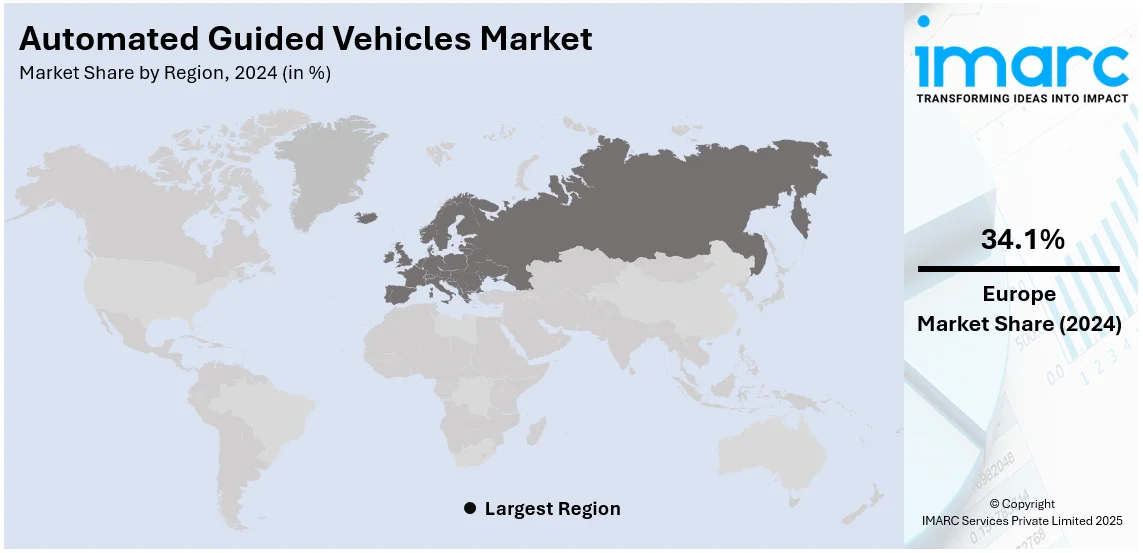

The global automated guided vehicles market size was valued at USD 4.76 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.05 Billion by 2033, exhibiting a CAGR of 12.15% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 34.1% in 2024. The market is driven by the advanced industrial automation and strong manufacturing base. Besides this, automated guided vehicles market share is influenced by high labor costs and stringent safety regulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.76 Billion |

|

Market Forecast in 2033

|

USD 14.05 Billion |

| Market Growth Rate (2025-2033) | 12.15% |

Industries are increasingly adopting automated guided vehicles to enhance efficiency and minimize their overall dependence on manual labor. Automation helps businesses address labor shortages and rising costs by ensuring consistent, round-the-clock operations. They streamline material handling processes, reducing errors and minimizing downtime in manufacturing and warehousing environments. Their integration with advanced technologies like artificial intelligence (AI) and Internet of Things (IoT) supports smart automation systems for optimized workflows. Automated solutions enable precise inventory management, meeting the demand for accuracy in fast-paced supply chains. The expansion of the e-commerce industry has intensified the need for automated guided vehicles to support rapid order fulfillment and distribution. Automation ensures safety by minimizing human involvement in hazardous or high-traffic industrial areas. Their scalability allows businesses to adapt automation to growing production needs and seasonal demands. Rising customer expectations for faster delivery are encouraging logistics companies toward automated material handling solutions.

Strategic collaboration is playing a vital role in increasing the United States automated guided vehicle market demand. Partnerships between automated guided vehicle manufacturers and technology providers are driving innovation and system integration capabilities. For instance, in September 2024, Teradyne Robotics and Siemens announced a strategic collaboration to showcase the future of automation at the Siemens Experience Center at MxD. This partnership focuses on advanced robotics, featuring collaborative robots (cobots) and autonomous mobile robots (AMRs), powered by AI-driven technologies. The collaboration aims to enhance interoperability, drive innovation in industrial automation, and help customers adopt robotics solutions for various industries. This collaboration further strengthens the role of both companies in advancing automation and robotics solutions in North America. Moreover, joint ventures with logistics providers enhance supply chain efficiency, promoting automated guided vehicle adoption in distribution centers. Collaborations with e-commerce platforms support warehouse automation, meeting the escalating demand for faster order fulfillment. Research partnerships with universities and labs are fostering breakthroughs in automated guided vehicle design, safety, and energy efficiency. Strategic alliances with software firms ensure seamless integration of automated guided vehicle into smart manufacturing ecosystems, thereby strengthening market growth.

Automated Guided Vehicles Market Trends:

Increased adoption of industry 4.0

Rising usage of automation by manufacturing and logistics companies to ease the process, enhance productivity, and reduce man-hours is contributing to an increase in the demand for automated guided vehicles. These vehicles handle materials, prevent human error, and enhance efficiency at warehouses, factories, and distribution centers. As part of the industry 4.0, automated guided vehicles form an integral component of smart, connected, and automated manufacturing processes. This further increases the implementation of automated guided vehicles with the spread of connected and smart factories. According to the World Economic Forum, there are currently 69 factories that are globally recognized as leaders in implementing Industry 4.0 technologies. Of these, China leads with 20 factories, the European Union with 19, followed by the United States with 7, and Japan has 5. The growth of these high-tech manufacturing hubs highlights the increased dependence on automated guided vehicles to attain operational efficiency and productivity and therefore posits them as a central focus of modern industrial automation.

Labor shortages and safety concerns

The increasing labor shortage is one of the major factors driving the demand for automated guided vehicles in warehousing, logistics, and manufacturing. Automated guided vehicles are a common solution to repetitive tasks that are risky and require less human power while making it safer at work. They can handle the dangerous operations of handling heavy loads or navigating hazardous places, which makes them one of the must-haves tools in filling gaps in the workforce. According to industry reports, the United States labor shortage stands at 70% in 2024, which is five percentage points below the global average. The lack of labor is compelling industries to implement automated guided vehicles so that operations run smoothly, and the business continues as usual. The automated guided vehicles help overcome labor shortages, but at the same time, they improve the accuracy, productivity, and standards of safety within workplaces, and therefore, automated guided vehicles are becoming an indispensable tool in modern industrial operations.

Technological advancements and cost reduction

Advances in technologies like artificial intelligence (AI), machine learning (ML), and sensors are significantly driving the adoption of automated guided vehicles. These advancements are enabling the development of automated guided vehicles with improved navigation, precision, and seamless integration with existing warehouse management systems. As the capabilities of automated guided vehicles continue to improve and production costs decrease, businesses across industries are increasingly adopting these solutions to streamline their operations and enhance productivity. A flagship example of this trend is the fact that Barcoding, Inc. acquired FRED AGV, the automated guided vehicle manufacturer, in January 2023. As a leading company in the area of supply chain efficiency, connectivity, and accuracy, Barcoding, Inc. seeks to harness the technology of FRED AGV to further optimize supply chain operations for clients. Such strategic steps underscore the growing interest in automated guided vehicle innovation as well as its increased adoption, positioning these vehicles as an epicenter for automated and efficient industrial processes around the world.

Automated Guided Vehicles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global automated guided vehicles market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on type, mode of operation, navigation technology, application, and industry.

Analysis by Type:

- Tow Vehicles

- Unit Load Carriers

- Pallet Trucks

- Assembly Line Vehicles

- Forklift Trucks

Tow vehicles lead the market with 29.1% of market share in 2024. These vehicles are widely used in automotive, logistics, and manufacturing industries for transporting materials over long distances. Their simple design and robust structure make them cost-effective and reliable for numerous uses. High versatility allows them to operate with diverse load types, enhancing operational flexibility. Tow vehicles reduce manual intervention, increasing safety and minimizing operational downtime in facilities. Industries prefer them for repetitive tasks, where efficiency and consistency are critical for smooth operations. They integrate seamlessly with automation systems, aligning with the increasing adoption of industry 4.0 technologies. The growing e-commerce and warehouse automation drive the demand for tow vehicles in distribution centers. Their scalability supports expanding operations, enabling businesses to meet growing market and customer demands. Ongoing innovations in tow vehicle design focus on energy efficiency and smart navigation features. They offer customizable configurations, catering to the particular requirements of different industry verticals. Cost advantages over other types make tow vehicles accessible for small and medium enterprises, therefore propelling the growth of the market.

Analysis by Mode of Operation:

- Indoor

- Outdoor

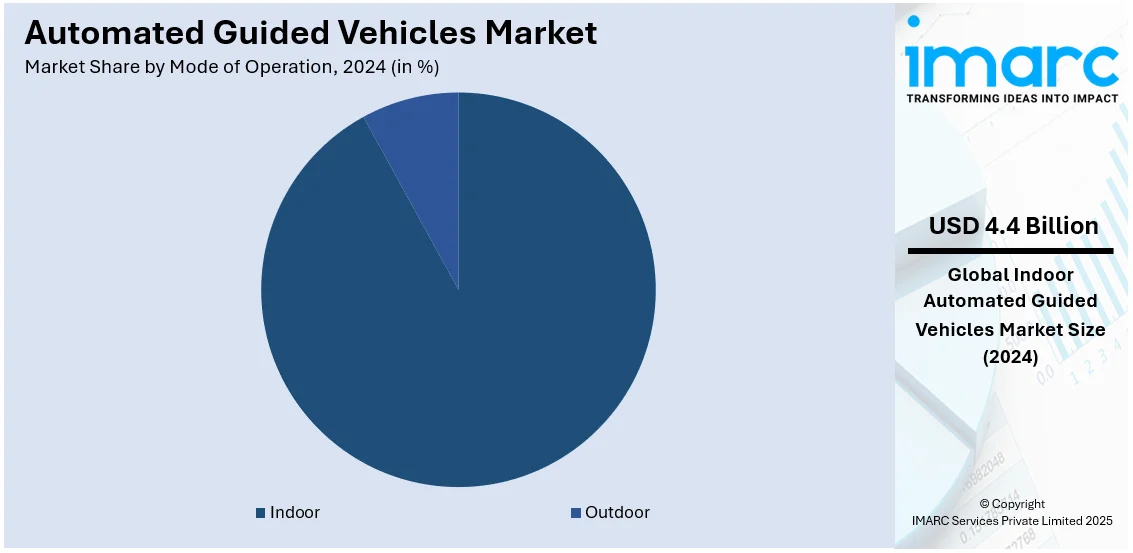

The indoor operation mode leads the market, holding a 92.3% share in 2024. Automated guided vehicles used indoors are crucial for industries that need accurate material handling in regulated settings like warehouses. They function effectively in confined environments, enhancing processes within production and logistics hubs. The need for efficient processes in e-commerce fulfillment centers drives the use of indoor automated guided vehicles. These cars are fitted with sophisticated navigation systems, guaranteeing precise accuracy and safety in tight spaces. Indoor automated guided vehicles lessen the need for human involvement, lowering the chances of mistakes and incidents in environments that are temperature-sensitive or dangerous. Their capacity to integrate with current warehouse management systems enhances productivity and operational oversight. Customization features enable indoor automated guided vehicles to manage different materials, facilitating a range of industrial uses. The growth of smart factory projects is increasing the use of indoor automated guided vehicles for automation. Rising labor expenses and the requirement for 24/7 operations are encouraging the transition to indoor automated guided vehicles. Their small size and nimbleness allow them to maneuver through narrow aisles and confined areas. Improvements in battery technology allow for extended operating periods, making them perfect for uninterrupted workflows. They aid sustainability initiatives by enhancing energy efficiency in material handling operations.

Analysis by Navigation Technology:

- Laser Guidance

- Magnetic Guidance

- Inductive Guidance

- Optical Tape Guidance

- Vision Guidance

- Others

Laser guidance leads the market with 28.6% of market share in 2024. It is favored for its superior precision and reliability in automated guided vehicle navigation systems. It enables accurate path tracking, essential for high-stakes applications in manufacturing and warehousing. Laser-guided automated guided vehicle requires minimal infrastructure changes, reducing installation costs and simplifying system deployment. This technology ensures smooth operations in complex environments, avoiding obstacles with high accuracy. Industries benefit from its flexibility, as laser guidance supports dynamic path adjustments in real time. The scalability of laser-guided systems allows businesses to expand operations without extensive reconfiguration. Integration with advanced sensors and software enhances the functionality of laser-guided automated guided vehicle. The technology’s adaptability to both indoor and outdoor environments broaden its application scope significantly. Laser guidance is instrumental in sectors like automotive, electronics, and pharmaceuticals requiring precise material handling. Its compatibility with industry 4.0 technologies supports data-driven decision-making in automated processes. advanced safety features of laser-guided automated guided vehicle reduce the risks associated with high-speed material transport. The growing investments in research and development (R&D) are driving further innovation and efficiency improvements in laser guidance systems.

Analysis by Application:

- Transportation

- Distribution

- Storage

- Assembly

- Packaging

- Waste Handling

Automated guided vehicles excel in material transportation, offering consistent performance and reducing manual labor dependency. Industries like automotive and logistics utilize automated guided vehicles to transfer raw materials and finished goods efficiently. Their ability to operate over long distances in manufacturing plants enhances overall productivity. Customizable payload capacities allow automated guided vehicles to cater to various industrial needs, from lightweight items to heavy machinery. Automation minimizes delays, ensuring timely delivery of materials and reducing bottlenecks in production.

Automated guided vehicles play a pivotal role in automating distribution tasks within warehouses and logistics hubs. They enable precise picking and placement of goods, improving speed and reducing errors in sorting. Integration with warehouse management systems ensures optimized distribution processes and efficient inventory tracking. Their scalability supports businesses in managing high-volume operations during peak demand periods. Automated guided vehicles enhance workplace safety by replacing forklifts and other manual methods prone to accidents.

Automated guided vehicles optimize storage operations by efficiently handling inventory in high-density environments. They enable dynamic shelving and retrieval, maximizing space utilization and reducing storage costs. Advanced navigation technologies allow automated guided vehicles to operate in narrow aisles and confined warehouse spaces. Their ability to work continuously ensures seamless inventory management in fast-paced industries. Integration with automated storage and retrieval systems (AS/RS) enhances overall warehouse efficiency.

In assembly lines, automated guided vehicles facilitate seamless movement of components to ensure uninterrupted production workflows. Their high precision enables accurate placement of parts, improving product quality and consistency. Flexible programming allows automated guided vehicles to adapt to diverse assembly tasks across multiple industries. Advanced navigation systems enable automated guided vehicles to operate in close coordination with human workers. Automating assembly tasks reduces labor costs and enhances overall manufacturing efficiency.

Automated guided vehicles streamline packaging operations by transporting products between packaging stations and storage areas. They ensure timely delivery of materials, minimizing downtime in high-speed packaging environments. their accuracy reduces the risk of damage during material handling, improving overall product quality. Automated guided vehicles adaptability supports diverse packaging requirements in diverse industries, including retail, food, and pharmaceuticals.

Automated guided vehicles automate waste collection and disposal, endorsing a cleaner and more organized work environment. They efficiently transport waste materials, reducing manual efforts and improving workplace safety. Industries benefit from automated guided vehicle’s ability to segregate and manage different types of waste. Their usage minimizes delays in waste handling, sustaining smooth operations in industrial settings. Integration with recycling and disposal systems supports sustainability initiatives and regulatory compliance.

Analysis by Industry:

- Automotive

- Manufacturing

- Food and Beverages

- Aerospace

- Healthcare

- Logistics

- Retail

- Others

The automotive industry extensively uses automated guided vehicles for material handling in manufacturing plants and assembly lines. These vehicles enhance efficiency by automating the transport of components and finished vehicles. Automated guided vehicles support just-in-time (JIT) and lean manufacturing practices, reducing waste and improving productivity. Customizable configurations enable automated guided vehicles to manage heavy loads, such as engines and car bodies. Their precise navigation ensures safe and accurate handling of high-value automotive parts.

Automated guided vehicles are crucial in automating repetitive tasks, improving operational efficiency in manufacturing facilities. They handle raw materials, semi-finished goods, and finished products, minimizing dependence on manual labor. Advanced technologies allow automated guided vehicles to operate in complex environments, enhancing safety and precision. Their scalability supports manufacturers in adapting to changing production demands and batch sizes. Integration with Industry 4.0 technologies ensure seamless communication with other automated systems.

The food and beverage industry utilizes automated guided vehicles to improve hygiene and efficiency in material handling. They transport raw ingredients and packaged goods, ensuring contamination-free operations. Automated guided vehicles equipped with temperature control features are ideal for cold storage and refrigerated environments. Automation minimizes errors and ensures timely delivery of perishable items within production and distribution facilities. These vehicles support compliance with stringent food safety regulations by reducing human contact with products.

The aerospace industry benefits from automated guided vehicle’s capability of handling large and heavy components with precision. They automate the transportation of aircraft parts, engines, and tools within manufacturing facilities. Advanced navigation systems allow automated guided vehicles to operate safely in high-tech aerospace production environments. Automated guided vehicles support just-in-sequence (JIS) manufacturing processes, enhancing efficiency in aircraft assembly. Customization options enable automated guided vehicles to manage unique aerospace requirements, such as cleanroom operations.

In healthcare, automated guided vehicles improve operational efficiency by automating material transport in hospitals and laboratories. They handle tasks like delivering medicines, medical supplies, and laboratory samples within healthcare facilities. Advanced navigation ensures automated guided vehicles can operate safely in environments with high human traffic. Automation reduces human error, ensuring accurate and timely delivery of critical items.

The logistics industry relies heavily on automated guided vehicles to streamline operations in warehouses and distribution centers. These vehicles automate picking, packing, and transporting tasks, improving speed and accuracy. Advanced technologies enable automated guided vehicles to optimize warehouse layouts and reduce labor-intensive processes. Integration with warehouse management systems allows real-time tracking of inventory and shipments. Scalability supports logistics companies in handling seasonal demand fluctuations and large order volumes.

In retail, automated guided vehicles enhance inventory management and optimize material handling in distribution centers and stores. They automate the movement of goods, ensuring timely restocking and order fulfillment. Integration with inventory management systems offers real-time visibility of stock levels and locations. Automated guided vehicles support faster delivery operations, aligning with consumer demand for quick and efficient service. Automation reduces costs, allowing retailers to improve operational efficiency in competitive markets.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 34.1%. High labor costs in Europe are accelerating the adoption of automated solutions for material handling. In September 2024, Toyota Material Handling Europe introduced Swarm Automation Storage, a high-density of automated guided vehicle and pallet shuttle solution designed to optimize warehouse space and enhance operational efficiency. This system combines automated reach trucks, radio shuttles, and of automated guided vehicles to offer aisle-free storage, reducing costs and improving storage density by up to 80%. It is ideal for managing palletized loads in various environments, providing flexibility and scalability for increased throughput. This affordable, versatile solution meets the increasing need for automation due to labor difficulties. Additionally, strict safety regulations in the workplace encourage the use of automated guided vehicles to reduce human contact with machinery. The area's dedication to sustainability fosters investments in energy-saving and environmentally friendly automated guided vehicle technologies. The robust presence of automotive, aerospace, and logistics sectors drives steady demand for automated guided vehicles across Europe. Regional governments actively promote automation by providing funding and tax incentives for innovation. Europe's strong research environment promotes the advancement of innovative automated guided vehicle technologies and systems. The extensive implementation of Industry 4.0 techniques guarantees the incorporation of automated guided vehicles in intelligent factories throughout Europe. Major companies based in the region play a vital role in the progress of automated guided vehicle technologies. The growing demand for online shopping has heightened the necessity for automated warehouses and distribution centers. The vast transportation and logistics networks in Europe generate a continuous demand for effective material handling systems.

Key Regional Takeaways:

United States Automated Guided Vehicles Market Analysis

The United States hold 82.10% of the market share in North America. The United States is a massive market for of automated guided vehicles, primarily led by the power of the manufacturing and automotive industries. In 2023, manufacturing contributed USD 2.3 trillion to the US GDP, accounting for 10.2% of the total GDP, as reported by the National Institute of Standards and Technology (NIST). Industry employs of automated guided vehicles for material handling, streamlined production processes, and efficiency in facilities. The automotive industry further necessitates the implementation of automation. The United States has been ranked as the world's second biggest market in sales and production of vehicles. International Trade Administration stated that new light vehicle sales were 11.5 million units in the US in 2022. In this particular industry, automated guided vehicles play important transport functions for parts, tools, and finished vehicles and minimize human error and operating costs. With a strong focus on Industry 4.0 and automation, automated guided vehicles are becoming a must-have for answering labor shortages and raising productivity across industries in the region.

Asia Pacific Automated Guided Vehicles Market Analysis

Asia-Pacific region is propelling market growth of automated guided vehicles, driven by rapid developments in manufacturing, logistics, and e-commerce. For India, e-commerce is crucial to its growth due to substantial development. The Indian e-commerce sector is projected to expand at a CAGR of 27% and attain USD 163 billion by 2026, as stated by the India Brand Equity Foundation (IBEF). E-commerce in India recorded a gross merchandise value of USD 60 Billion for FY23, marking a 22% increase compared to the prior year. This directly impacts the demand for automated guided vehicles, as an increasing number of warehouses are optimizing automated guided vehicles for order fulfillment and inventory management processes. In addition, the manufacturing sector of Asia Pacific continues to grow with automated guided vehicles playing an important role in improving operational efficiency, reducing labor dependency, and safety in factories and distribution centers. As automation technology advances, automated guided vehicle adoption in the region is expected to accelerate, strengthening the market growth across various industries.

Latin America Automated Guided Vehicles Market Analysis

The e-commerce industry is thriving in Brazil, the largest economy in Latin America, as it drives the demand for additional automated solutions. Predicted to expand by 14.3% by 2026, the Brazilian e-commerce sector will surpass USD 200 Billion by 2026, according to reports. This expansion will only increase the need for logistics and warehouse solutions, with automated guided vehicles being one of the most sought-after automated options that assist in automating material handling, fulfilling orders, and managing inventory. Latin American countries like Brazil, are implementing automation technology in their businesses with growing demand for e-commerce solutions. The final industries to be focused on by automated guided vehicles are manufacturing, retail, and logistics. The vehicle offers numerous advantages, including enhanced efficiency, lower labor expenses, and increased safety in the workplace.

Middle East and Africa Automated Guided Vehicles Market Analysis

The UAE is the leading e-commerce nation in the Gulf Cooperation Council (GCC) countries, with an impressive 53% growth in 2020, totaling USD 3.9 Billion in e-commerce sales, as per reports. The figure accounted for 10% of the total retail sales, which shows that online commerce is gaining traction in the region. With the thriving e-commerce industry, the requirement for efficient logistics and warehousing solutions, including automated guided vehicles, is also increasing. Automated guided vehicles are increasingly being adopted to automate material handling, cut operational costs, and optimize supply chain operations in retail, manufacturing, and logistics sectors. The fact that the UAE is already a pioneer in e-commerce is bound to lead other Middle Eastern and African nations to implement automated guided vehicles to facilitate their businesses. Companies are focusing on automation to sustain their growing demand in e-commerce. The automated guided vehicle market in the Middle East and Africa is set to experience substantial growth, bringing this region forward to become one of the key regions for major automated supply chain solutions.

Competitive Landscape:

Key participants are consistently allocating funds towards research and development (R&D) to enhance automated guided vehicle efficiency and capabilities. These players emphasize the incorporation of cutting-edge technologies such as AI, IoT, and ML into systems for automated guided vehicles. Collaborative partnerships with sectors like e-commerce and manufacturing aid in broadening the usage range of automated guided vehicles. Providing tailored solutions for particular industrial needs fosters customer engagement and market entry. Essential participants also guarantee adherence to safety and regulatory guidelines to enhance customer trust. They are broadening their international presence by creating distribution networks and regional production sites. Ongoing product innovation enables them to serve industries that require highly efficient material handling systems. Partnerships with tech suppliers facilitate the smooth incorporation of automated guided vehicles into current industrial systems. In September 2024, Bastian Solutions LLC (Toyota Industries Corporation) strategically invested in Gideon, a firm focused on autonomous mobile robotics (AMR) to automate warehouse and manufacturing operations. This collaboration seeks to improve Toyota's automated vehicle offerings by incorporating Gideon's sophisticated AI and vision technology. It will enable faster implementation, enhanced adaptability, and scalability in automated solutions like collaborative case picking and truck unloading.

The report provides a comprehensive analysis of the competitive landscape in the automated guided vehicles market with detailed profiles of all major companies, including:

- Bastian Solutions LLC (Toyota Industries Corporation)

- Daifuku Co. Ltd.

- Ek Robotics Gmbh

- IKV Robot Nanchang Co. Ltd.

- John Bean Technologies Corporation

- Jungheinrich AG

- Kion Group AG

- KUKA Aktiengesellschaft

- Murata Machinery Ltd.

- Schaefer Systems International Pvt Ltd.

- Scott Systems International Inc.

- Simplex Robotics Pvt. Ltd.

Recent Developments:

- March 2024: FFT introduced a new automated guided vehicle system at Wiferion, a company specializing in inductive charging technology. BMW implemented this system at its Leipzig plant, featuring wireless charging and automated guided vehicles, enhancing productivity and efficiency. FFT also established a manufacturing facility dedicated to this advanced technology.

- March 2024: Cypher Robotics introduced the Captis Autonomous Ground Vehicle, designed for accurate cycle counting and industrial scanning. This automated guided vehicle navigates warehouses without infrastructure modifications, avoiding collisions with people or objects for safe operation.

- November 2023: US-based sensor technology company Movella, Inc. collaborated with Taiwanese IoT specialist Advantech to create advanced automated guided vehicle and autonomous mobile robot solutions. This partnership aims to streamline material handling, resolve compatibility challenges, and accelerate time-to-market for their customers' operations.

Automated Guided Vehicles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Tow Vehicles, Unit Load Carriers, Pallet Trucks, Assembly Line Vehicles, Forklift Trucks |

| Mode of Operations Covered | Indoor, Outdoor |

| Navigation Technologies Covered | Laser Guidance, Magnetic Guidance, Inductive Guidance, Optical Tape Guidance, Vision Guidance, Others |

| Applications Covered | Transportation, Distribution, Storage, Assembly, Packaging, Waste Handling |

| Industries Covered | Automotive, Manufacturing, Food and Beverages, Aerospace, Healthcare, Logistics, Retail, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bastian Solutions LLC (Toyota Industries Corporation), Daifuku Co. Ltd., Ek Robotics Gmbh, IKV Robot Nanchang Co. Ltd., John Bean Technologies Corporation, Jungheinrich AG, Kion Group AG, KUKA Aktiengesellschaft, Murata Machinery Ltd., Schaefer Systems International Pvt Ltd., Scott Systems International Inc. and Simplex Robotics Pvt. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, automated guided vehicles market outlook, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global automated guided vehicles market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automated guided vehicles industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automated guided vehicles market was valued at USD 4.76 Billion in 2024.

The automated guided vehicles market is projected to exhibit a CAGR of 12.15% during 2025-2033, reaching a value of USD 14.05 Billion by 2033.

The automated guided vehicles market growth is driven by increasing demand for industrial automation to enhance efficiency and reduce labor costs. Rapid e-commerce growth catalyzes the need for efficient material handling in warehouses and distribution centers. Advancements in navigation technologies, including AI and IoT integration, improve automated guided vehicle performance and adoption. Rising labor shortages and workplace safety concerns further encourage automated guided vehicle deployment.

Europe currently dominates the automated guided vehicles market, accounting for a share of over 34.1% in 2024. Europe holds the largest share, driven by its advanced industrial automation and strong manufacturing base. High labor costs in the region encourage the adoption of automated solutions, while stringent workplace safety regulations further increase automated guided vehicles deployment.

Some of the major players in the automated guided vehicles market include Bastian Solutions LLC (Toyota Industries Corporation), Daifuku Co. Ltd., Ek Robotics Gmbh, IKV Robot Nanchang Co. Ltd., John Bean Technologies Corporation, Jungheinrich AG, Kion Group AG, KUKA Aktiengesellschaft, Murata Machinery Ltd., Schaefer Systems International Pvt Ltd., Scott Systems International Inc. and Simplex Robotics Pvt. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)