Australia Wine Market Report by Product Type (Still Wine, Sparkling Wine, Fortified Wine and Vermouth), Color (Red Wine, Rose Wine, White Wine), Distribution Channel (Off-Trade, On-Trade), and Region 2025-2033

Market Overview:

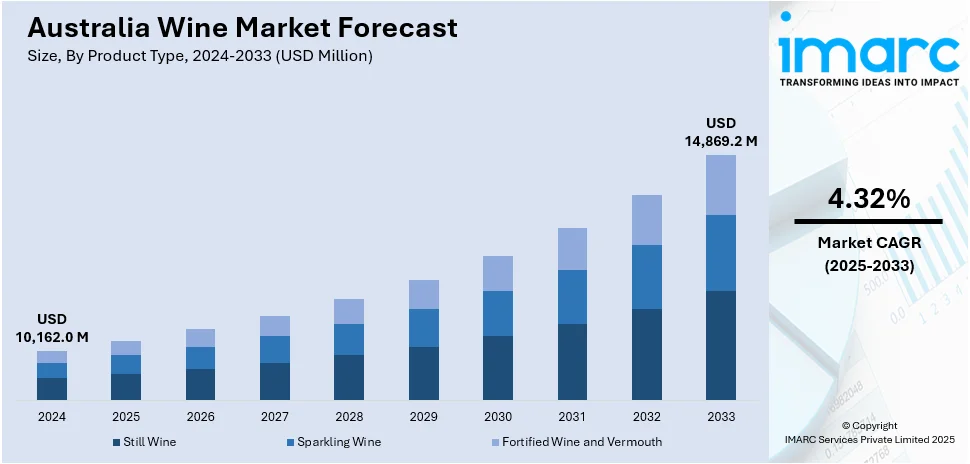

Australia wine market size reached USD 10,162.0 Million in 2024. Looking forward, the market is expected to reach USD 14,869.2 Million by 2033, exhibiting a growth rate (CAGR) of 4.32% during 2025-2033. The market is driven by rising demand for premium wines, growing interest in health-conscious and sustainable options, and expanding export opportunities in Asia and North America. Wine tourism and technological innovation further support industry growth, while eco-friendly packaging gains momentum. These factors collectively contribute to the steady expansion of the Australia wine market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10,162.0 Million |

| Market Forecast in 2033 | USD 14,869.2 Million |

| Market Growth Rate (2025-2033) | 4.32% |

Wine is an alcoholic drink typically crafted from fermented grapes or alternative fruits, standing as one of the oldest consumed alcoholic beverages. The fundamental winemaking process entails the fermentation of crushed grapes or fruit juice by yeast, a transformation that converts the sugars within the juice into alcohol and carbon dioxide. Wine is commonly available in diverse types and styles, encompassing red, white, rose, and sparkling variations. The distinct flavors and features of each wine type are shaped by factors such as the grape variety, winemaking methodologies, and the geographical origin of the grapes. This diversity highlights the intricate influence of grape variety, production techniques, and terroir on the final product, showcasing the nuanced characteristics that contribute to the world's appreciation of wine.

To get more information on this market, Request Sample

Key Trends of Australia Wine Market:

Premiumization and Evolving Consumer Preferences

A significant trend in the Australian wine market is the growing demand for premium and ultra-premium wines. Consumers, and particularly younger Millennials and Gen Z, are moving towards higher-quality, artisanal wines that focus more on terroir, craft, and sense of locale. This has increased the number of boutique wineries presenting limited-label wines, estate-grown varietals, and single-vineyard wines. Consumers are also willing to lay out more money on wine to drink at home, for special occasions, or as gifts, which fuels the premiumisation drive. Wineries are making investments in attractive packaging, narrative, and experiential brand expressions to distinguish themselves. This transformation enhances their profit margins while positioning Australian wines as a luxury product in international markets, particularly across Asia and North America.

Demand for Health-Conscious and Low-Alcohol Alternatives

Health and wellness trends are reshaping drinking habits in Australia, driving demand for lighter wine styles and low-alcohol or alcohol-free options. Consumers are becoming more conscious of calorie intake, alcohol content, and ingredient transparency, leading to a rise in wines under 9% ABV, as well as sparkling and white varietals. According to the Australia wine market analysis, this shift is particularly strong among younger and female demographics. In response, winemakers are innovating with new fermentation techniques and grape varieties to produce flavorful, low-alcohol wines without compromising quality. The category is rapidly growing and is being supported by strategic marketing, positioning such wines as refreshing, sessionable, and lifestyle-aligned, offering a modern alternative to traditional red-heavy wine consumption patterns.

Sustainability and Eco-Friendly Packaging Practices

Sustainability has become a defining trend across the Australian wine industry. Wineries are increasingly adopting organic, biodynamic, and regenerative viticulture practices to reduce environmental impact and enhance soil health. Certifications such as Sustainable Winegrowing Australia are gaining traction, reflecting a commitment to environmental responsibility. In parallel, producers are innovating with eco-friendly packaging, lightweight bottles, aluminum cans, bag-in-box formats, and recycled materials to meet growing consumer demand for greener products. These practices are especially resonant with environmentally conscious consumers and are becoming essential in premium export markets. Sustainability now serves as a value differentiator, helping brands build trust, access new segments, and future-proof their operations amid regulatory and market shifts.

Growth Drivers of Australia Wine Market:

Expanding Export Opportunities

Australia’s wine exports are rebounding, particularly with the easing of tariffs and trade restrictions in key Asian markets like China, Vietnam, and South Korea. The 2025 removal of punitive tariffs by China reopened a billion-dollar channel, significantly boosting demand for both premium and mid-range Australian wines. Trade agreements such as RCEP and CPTPP have further improved access to fast-growing economies. Exporters are also gaining ground in North America and Europe, supported by Australia’s strong reputation for consistent quality and diverse varietals. Government-backed programs and branding campaigns (like “Wine Australia”) enhance visibility and competitiveness, making international trade a primary growth engine for the industry.

Wine Tourism and Direct-to-Consumer Expansion

The growth of wine tourism is a major driver of domestic consumption and brand engagement, which is further boosting the Australia wine market demand. Australia’s renowned wine regions, such as Barossa Valley, Yarra Valley, and Margaret River, attract both local and international tourists seeking immersive cellar door experiences, vineyard tours, and food-wine pairings. These visits not only drive on-site purchases but also support long-term brand loyalty through wine clubs and subscriptions. The direct-to-consumer (DTC) model is expanding rapidly, supported by e-commerce platforms and virtual tasting events. Consumers are increasingly buying wine online after visiting a winery, providing producers with better margins and consumer data. Tourism-led marketing also elevates regional identity, fostering deeper brand connections.

Technological Innovation in Winemaking and Distribution

The Australian wine sector is embracing advanced technologies to improve efficiency, quality, and sustainability. In vineyards, precision viticulture tools like drones, satellite imaging, and soil sensors are being used to monitor crop health, optimize irrigation, and reduce inputs. In wineries, automation and AI-driven fermentation management enhance consistency and flavor profiling. These technologies help winemakers adapt to climate variability while improving product quality. Additionally, digital tools support inventory tracking, customer engagement, and route-to-market strategies. Online retail channels and data analytics also enable better forecasting and targeted marketing. Overall, technology is helping producers stay competitive, reduce costs, and meet evolving consumer expectations both domestically and internationally.

Australia Wine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, color, and distribution channel.

Product Type Insights:

- Still Wine

- Sparkling Wine

- Fortified Wine and Vermouth

The report has provided a detailed breakup and analysis of the market based on the product type. This includes still wine, sparkling wine, and fortified wine and vermouth.

Color Insights:

- Red Wine

- Rose Wine

- White Wine

A detailed breakup and analysis of the market based on the color have also been provided in the report. This includes red wine, rose wine, and white wine.

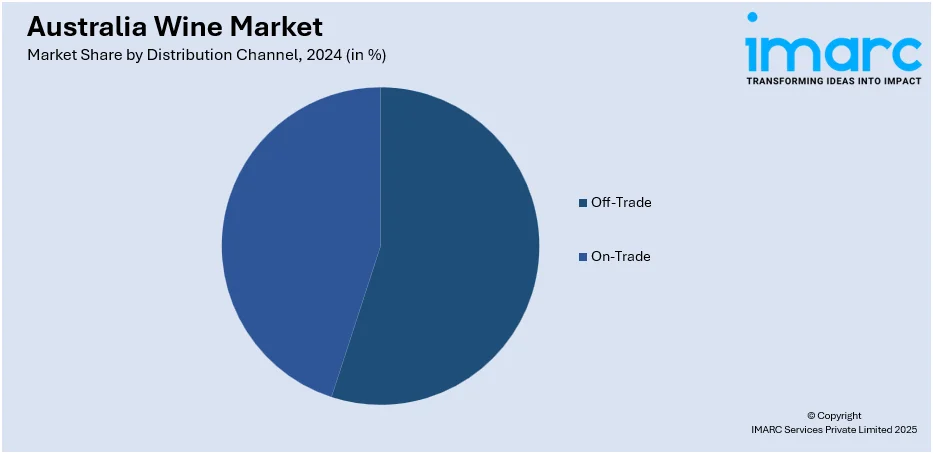

Distribution Channel Insights:

- Off-Trade

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

- On-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes off-trade (supermarkets and hypermarkets, specialty stores, online stores, and others) and on-trade.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Australian Vintage Limited

- Casella

- Kingston Estate Wines

- Meditrina Beverages

- The Australian Wine Company

- The Little Wine Company

- Treasury Wine Estates Ltd

- Vinarchy

Australia Wine Market News:

- In June 2025, the Victoria Racing Club (VRC) announced a new collaboration with acclaimed Australian winemaker De Bortoli Wines, naming the family-owned winery as the official wine partner of both the VRC and the Melbourne Cup Carnival. This exciting partnership marks a significant union between two iconic Australian institutions.

- In May 2025, Vinarchy, a newly established global wine enterprise, emerged from the merger of Accolade Wines with the wine operations in New Zealand, Spain, and Australia previously held by Pernod Ricard. The combined entity is now owned by Australian Wine Holdco Limited (AWL), a consortium comprising international institutional investors.

- In April 2025, Australian Wine Holdco Limited (AWL), a consortium comprising global institutional investors, unveiled Vinarchy, a newly formed international wine company poised to become a leading force in the industry. Vinarchy brings together the full portfolio of Accolade Wines and the Australian, New Zealand, and Spanish wine operations previously owned by Pernod Ricard, which AWL acquired.

- In July 2024, Pernod Ricard announced the signing of a deal to divest its globally significant wine brands to Australian Wine Holdco Limited (AWL), a consortium of international institutional investors and the parent company of Accolade Wines.

Australia Wine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still Wine, Sparkling Wine, Fortified Wine and Vermouth |

| Colors Covered | Red Wine, Rose Wine, White Wine |

| Distribution Channels Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Australian Vintage Limited, Casella, Kingston Estate Wines, Meditrina Beverages, The Australian Wine Company, The Little Wine Company, Treasury Wine Estates Ltd, Vinarchy, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia wine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia wine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia wine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wine market in Australia was valued at USD 10,162.0 Million in 2024.

The Australia wine market is projected to exhibit a CAGR of 4.32% during 2025-2033.

The Australia wine market is projected to reach a value of USD 14,869.2 Million by 2033.

Australia’s wine market is driven by strong export demand to emerging Asian markets, increasing popularity of wine tourism, growing interest in indigenous grape varieties, government support through trade agreements, and rising domestic consumption among younger, urban consumers exploring diverse wine experiences.

Australia’s wine market trends include a shift toward lighter wines like whites, sparkling, and low-alcohol varieties, driven by wellness-minded consumers. Producers emphasizing sustainability through organic and biodynamic practices, along with premiumization and alternative formats like cans and eco-friendly packaging are also positively impacting the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)