Australia Water Pipeline Leak Detection System Market Size, Share, Trends and Forecast by Technology, Equipment, Pipe Type, End-Use, and Region, 2025-2033

Australia Water Pipeline Leak Detection System Market Overview:

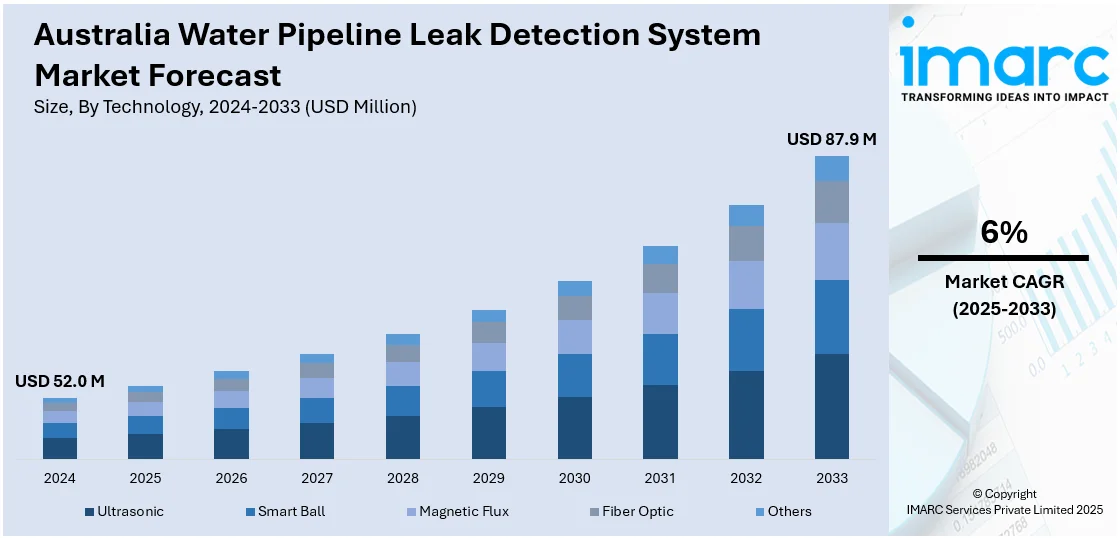

The Australia water pipeline leak detection system market size reached USD 52.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 87.9 Million by 2033, exhibiting a growth rate (CAGR) of 6% during 2025-2033. The market share is expanding, driven by ongoing urbanization activities, along with rising investments in smart technology that helps to improve water management and reduce long-term losses.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 52.0 Million |

| Market Forecast in 2033 | USD 87.9 Million |

| Market Growth Rate 2025-2033 | 6% |

Australia Water Pipeline Leak Detection System Market Trends:

Rapid urbanization

The rapid urbanization is offering a favorable Australia water pipeline leak detection system market outlook. In April 2025, the NSW government selected Stockland, in collaboration with Link Wentworth, City West Housing, and Birribee Housing, to handle the planning, design, and operations of Sydney’s new urban initiative, the Waterloo Renewal Project. It aimed to provide over 3000 new residences, with half reserved for social and affordable housing, amounting to over 1000 social units and 600 affordable units. As cities are expanding, there is a high need for reliable water infrastructure that can keep up with the increasing usage. Leak detection systems help utilities and city planners to monitor water networks in real time and catch issues early before they turn into expensive problems. As more underground pipelines are being laid in new urban areas, it is becoming more important to employ technology that can track and manage these networks efficiently. Developers and municipalities are also focusing on sustainability, creating the need for water pipeline leak detection systems. These solutions assist in reducing repair costs, which is beneficial for the economy. Moreover, with smarter city planning and increased employment of the Internet of Things (IoT) and automation in utilities, leak detection systems are becoming easier to integrate and more accurate.

To get more information on this market, Request Sample

Growing water scarcity concerns

Rising concerns among people about water scarcity is fueling the Australia water pipeline leak detection system market growth. As the population continues to increase, the pressure on existing water infrastructure rises, making it more important to manage every drop efficiently. According to the Australian Bureau of Statistics, in March 2024, Australia's population grew by 2.3%, reaching 27.1 Million individuals. Leaks in pipelines lead to significant water loss, which not only wastes a critical resource but also increases costs for utilities and users. With climate change and frequent droughts affecting the water supply, detecting and fixing leaks early has become a top priority. These systems help monitor water flow in real time, allowing faster response to any signs of leakage. Local government agencies and water authorities are more open to investing in smart technology that can improve water management and reduce long-term losses. Leak detection systems are also seen as a cost-effective solution compared to large-scale repairs or water sourcing projects. As awareness grows among the masses about the importance of sustainable water use, both public and private sectors are turning to these systems to ensure long-term water security across the country.

Australia Water Pipeline Leak Detection System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on technology, equipment, pipe type, and end-use.

Technology Insights:

- Ultrasonic

- Smart Ball

- Magnetic Flux

- Fiber Optic

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes ultrasonic, smart ball, magnetic flux, fiber optic, and others.

Equipment Insights:

- Acoustic

- Non-Acoustic

A detailed breakup and analysis of the market based on the equipment have also been provided in the report. This includes acoustic and non-acoustic.

Pipe Type Insights:

- Plastic Pipes

- Ductile Iron Pipes

- Stainless Steel Pipes

- Aluminium Pipes

- Others

The report has provided a detailed breakup and analysis of the market based on the pipe type. This includes plastic pipes, ductile iron pipes, stainless steel pipes, aluminium pipes, and others.

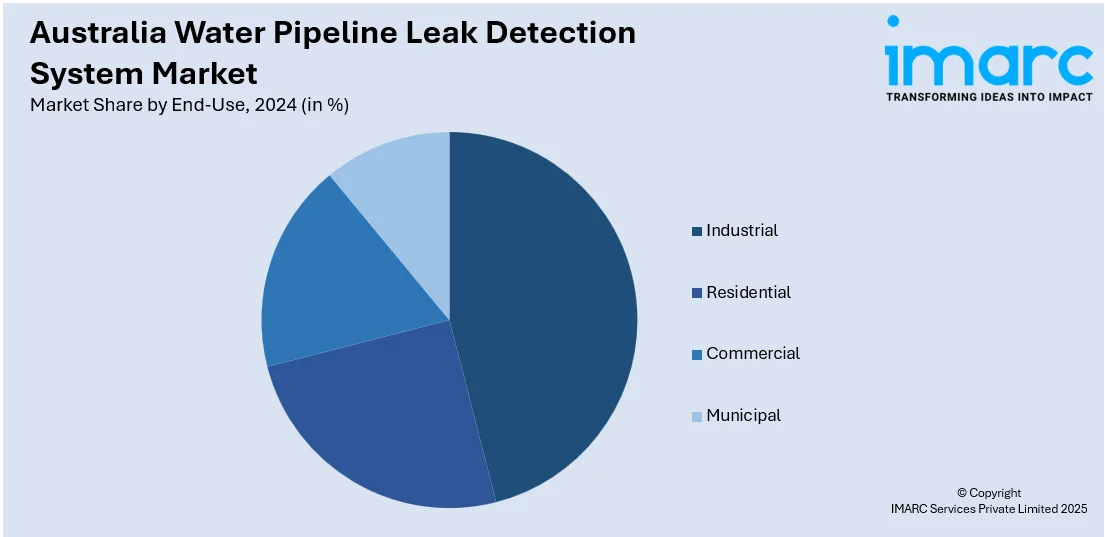

End-Use Insights:

- Industrial

- Residential

- Commercial

- Municipal

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes industrial, residential, commercial, and municipal.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Water Pipeline Leak Detection System Market News:

- In November 2025, Iplex Australia chose Phyn, the top provider of smart water solutions, as an ally for its leak detection technology for the ‘Western Australian Leak Detector Unit Program’. This initiative provided WA homeowners with reassurance and preventive measures against leaks. Phyn’s artificial intelligence (AI)-oriented technology allowed users to oversee the entire plumbing system in homes and identify leaks instantly.

- In September 2024, South East Water selected Avnet to provide Huizhong’s SCL61H-100 smart ultrasonic water meters in Australia. The authority created the 'Sotto' vibration sensor, integrated into the water meters to constantly check the network for leaks.

Australia Water Pipeline Leak Detection System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Ultrasonic, Smart Ball, Magnetic Flux, Fiber Optic, Others |

| Equipment Covered | Acoustic, Non-Acoustic |

| Pipe Types Covered | Plastic Pipes, Ductile Iron Pipes, Stainless Steel Pipes, Aluminium Pipes, Others |

| End-Uses Covered | Industrial, Residential, Commercial, Municipal |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia water pipeline leak detection system market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia water pipeline leak detection system market on the basis of technology?

- What is the breakup of the Australia water pipeline leak detection system market on the basis of equipment?

- What is the breakup of the Australia water pipeline leak detection system market on the basis of pipe type?

- What is the breakup of the Australia water pipeline leak detection system market on the basis of end-use?

- What is the breakup of the Australia water pipeline leak detection system market on the basis of region?

- What are the various stages in the value chain of the Australia water pipeline leak detection system market?

- What are the key driving factors and challenges in the Australia water pipeline leak detection system?

- What is the structure of the Australia water pipeline leak detection system market and who are the key players?

- What is the degree of competition in the Australia water pipeline leak detection system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia water pipeline leak detection system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia water pipeline leak detection system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia water pipeline leak detection system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)