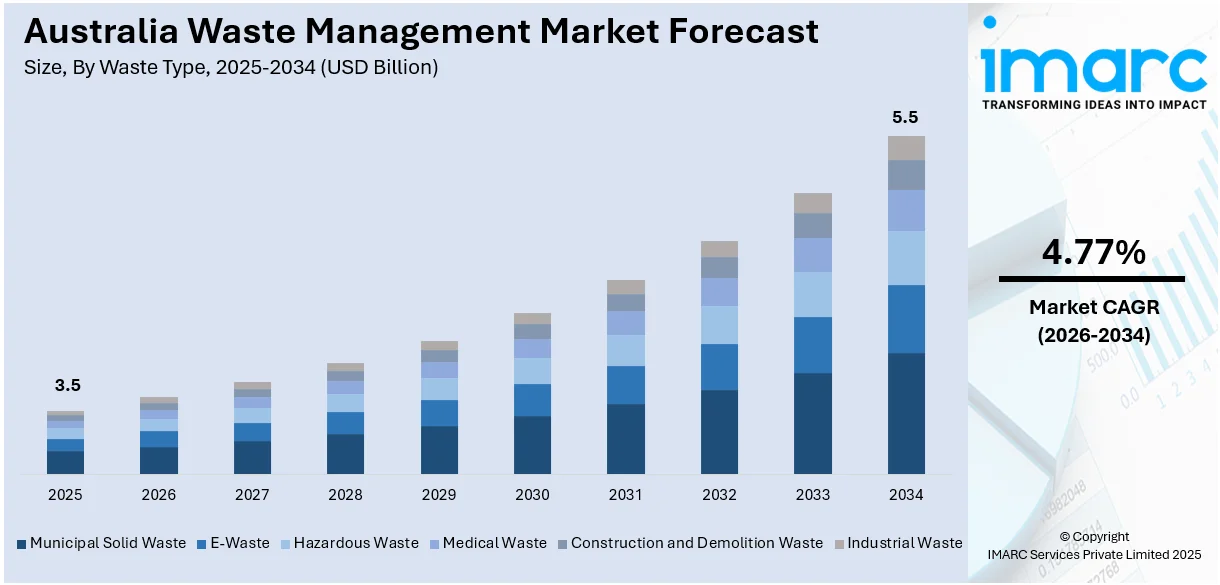

Australia Waste Management Market Report by Waste Type (Municipal Solid Waste, E-Waste, Hazardous Waste, Medical Waste, Construction and Demolition Waste, Industrial Waste), Service (Collection, Disposal), Source (Industrial, Residential, Commercial), and Region 2026-2034

Australia Waste Management Market Overview:

The Australia waste management market size reached USD 3.5 Billion in 2025. Looking forward, the market is projected to reach USD 5.5 Billion by 2034, exhibiting a growth rate (CAGR) of 4.77% during 2026-2034. There are several factors that are driving the market, which include population growth, stringent environmental regulations and policies by governing authorities, environmental impact and climate change, and rising adoption of sustainability practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.5 Billion |

| Market Forecast in 2034 | USD 5.5 Billion |

| Market Growth Rate 2026-2034 | 4.77% |

Key Trends of Australia Waste Management Market:

Population Growth

Australia’s population was 26,966,789 as on 31 December 2023, as stated by Australian Bureau of Statistics. As Australia's population is growing, the volume of waste generated is also increasing continuously. More people cause higher amounts of residential, commercial, and industrial waste. Managing this rising volume of waste requires expanded and more efficient waste management systems. In addition, the growing demand for collection, sorting, recycling, and disposal services in Australia is offering a favorable market outlook. Population growth often leads to urban expansion, which can result in higher concentrations of waste in urban areas. Managing waste effectively in densely populated cities requires advanced waste management solutions and infrastructure. Furthermore, rapid population growth can put a strain on existing waste management infrastructure such as landfills and recycling facilities. This strain is catalyzing the demand for investments in new facilities, upgrades to existing ones, and innovative waste management practices.

To get more information on this market Request Sample

Environmental Impact and Climate Change

Governing agencies in Australia are implementing stringent regulations and policies to reduce greenhouse gas (GHG) emissions and address environmental concerns. They are undertaking initiatives like the National Waste Policy that emphasizes waste reduction, recycling, and reducing landfill use. They are also implementing waste-to-energy technologies and promoting circular economy principles. Compliance with these regulations is catalyzing the demand for advanced waste management solutions. Besides this, there is an increase in the focus on decreasing landfills, which are a significant source of methane, a potent greenhouse gas. Furthermore, many businesses are investing in waste reduction and recycling initiatives to align with climate goals and enhance their environmental credentials. For instance, on 25 July 2024, Australia's pioneering energy recovery facility in Kwinana, Western Australia, received its first waste delivery to the site. Once fully operational, Kwinana will be able to convert 460,000 tons of residential waste every year, which would have otherwise been disposed of in landfills.

Circular Economy Initiatives

Australia is experiencing a significant transition towards circular economy models that aim to reduce reliance on landfills while enhancing resource efficiency. Both businesses and local governments are increasingly focusing on recycling, composting, and repurposing materials to prolong product lifecycles and mitigate environmental impacts. This strategy encourages manufacturers to consider reuse and recyclability in their designs and promotes waste segregation from the source. Industries like construction, retail, and packaging are implementing closed-loop systems to recover and reintegrate materials. Practices associated with the circular economy assist in achieving sustainability objectives and offer cost savings and help meet regulatory requirements. As these initiatives gain traction, they are anticipated to play a significant role in widening the Australia waste management market share across various sectors.

Growth Drivers of Australia Waste Management Market:

Smart Technologies Enhancing Waste Processing Efficiency

Technological advancements are fundamentally transforming Australia’s waste management landscape. The deployment of smart waste bins equipped with sensors, automated routing systems, and AI-driven sorting technologies is optimizing waste collection and sorting processes. These innovations allow for real-time monitoring, reduce contamination, and enhance recycling rates. Furthermore, automation diminishes the need for manual labor, lowers errors, and reduces overall operational costs. As urban areas strive to become more intelligent and sustainable, technology is becoming crucial for managing the rising volumes of waste efficiently. The demand for digital solutions improves service delivery and promotes operational transparency and sustainability. Such tech-driven strategies are significantly propelling Australia waste management market demand in both public and private sectors.

Organic Waste Processing Driving Sustainability Efforts

There is a marked increase in the processing of organic waste in Australia, propelled by the rising demand for eco-friendly options such as compost, biogas, and renewable fuels. Growing awareness regarding the environmental consequences of landfill emissions is prompting more regions to invest in composting facilities and anaerobic digestion plants. These systems transform food scraps and garden waste into valuable resources that support soil health and clean energy initiatives. Moreover, businesses and municipalities are investigating organic waste diversion programs to align with sustainability goals and regulatory standards. This transition curtails methane emissions and encourages circular economy practices. According to Australia waste management market analysis, as organic waste processing becomes prioritized nationally, it is creating new opportunities and fortifying the sector.

Private Sector Investment Accelerating Infrastructure Development

The heightened involvement of the private sector is crucial for scaling Australia’s waste management capabilities. Companies are actively engaging in joint ventures, public-private partnerships, and independent investments to establish advanced infrastructure, including recycling facilities, waste-to-energy plants, and material recovery centers. This influx of investment fosters technological innovation, broadens service coverage, and accelerates project timelines. Additionally, commercial entities are exploring niche services such as e-waste recycling and hazardous waste management, which are increasingly important under new regulatory frameworks. With encouragement from the public sector for collaborative models, private enterprises are becoming key contributors to innovative and effective waste solutions. This collaborative momentum is expected to significantly influence Australia waste management market growth in the foreseeable future.

Opportunities of Australia Waste Management Market:

Expanding Waste-to-Energy Projects

Australia is experiencing increased interest in waste-to-energy (WTE) technologies as a dual approach to waste management and renewable energy generation. With landfill capacity becoming more limited and a focus on emissions reduction targets, WTE presents a feasible method for converting residual waste into usable energy. Various technologies, including incineration, gasification, and anaerobic digestion, effectively transform municipal solid waste, industrial refuse, and organic materials into electricity and heat. These initiatives lessen dependence on landfills and enhance energy diversification and local power production. Investment opportunities are on the rise as both public and private sectors seek to expand sustainable waste infrastructure. This trend promises long-term benefits for investors and is set to play a key role in modernizing Australia’s waste management ecosystem.

Surge in E-Waste Recycling

The increasing use of electronic devices in Australia is fueling the demand for specialized e-waste recycling facilities. As items like smartphones, laptops, and home appliances grow more commonplace, so does the amount of discarded electronics. E-waste holds valuable metals such as gold, copper, and rare earth elements, which can be extracted and reused through advanced recycling methods. This presents an opportunity for dedicated facilities focusing on safe dismantling, material recovery, and adherence to environmental regulations. With stricter rules regarding the disposal of hazardous waste, the need for effective e-waste management is rapidly escalating. Consequently, the sector is drawing investment and innovation, indicating strong potential for sustainable growth and efficiency in Australia's waste management landscape.

Enhancing Waste Infrastructure in Rural and Regional Areas

Australia’s extensive geography presents distinct challenges for equitable waste management, particularly in rural and regional communities. These areas frequently lack the necessary infrastructure, logistics, and services available in urban locations, leading to a reliance on landfills or insufficient disposal methods. This situation creates a significant opportunity to invest in decentralized facilities, mobile recycling units, and enhanced collection networks tailored to remote regions. Customized waste management solutions can mitigate environmental impacts while generating local jobs and fostering community development. Moreover, government initiatives aimed at promoting regional sustainability and waste equity are creating funding opportunities and avenues for collaboration. Strengthening rural infrastructure is crucial for establishing a truly national waste management strategy and bridging the service gap between urban and rural areas.

Australia Waste Management Market News:

- In March 2025, Australia's e-waste crisis took a positive turn with the launch of the Plastics Filament MICROfactorie in Sydney. Developed by UNSW, this facility recycles hard plastics from electronic waste into valuable 3D printing filament, promoting sustainability and reducing landfill waste while creating jobs and fostering a circular economy.

- In February 2025, Pure Hydrogen delivered Australia’s first hydrogen fuel cell rear loader garbage truck to Solo Resource Recovery, marking a milestone in clean energy. The truck, approved by Australian Design Rules, will begin operations in Adelaide, supporting sustainable waste management efforts and generating interest from local councils in hydrogen-powered solutions.

- In February 2025, Australia's first large bag recycling plant opened in Toowoomba, established by Big Bag Recovery and Circular Communities Australia. This facility aims to revolutionize waste management by processing woven polypropylene and low-density polyethylene bags. It is expected to divert 4,000 tonnes of waste each year, while also creating local jobs and promoting sustainability.

- In April 2024, Cleanaway and Viva Energy entered into an agreement to undertake a pre-feasibility assessment of a circular solution for soft plastics and other hard-to-recycle plastics currently sent to landfills and transform them back into feedstock for food-grade plastic resin. The partners want to provide a sustainable soft-plastic solution for food manufacturers and packaging specialists seeking to cater to the growing eco-conscious market, as well as households and businesses who want a landfill-diversion option.

- In May 2024, Turmec announced a project in Brisbane, Australia, in collaboration with Rino Recycling. They designed and installed an innovative recycling facility worth €95 million at Pinkenba. Australia's newest facility features a state-of-the-art plant capable of sorting and processing various types of both wet and dry waste under one roof.

Australia Waste Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on waste type, service, and source.

Waste Type Insights:

- Municipal Solid Waste

- E-Waste

- Hazardous Waste

- Medical Waste

- Construction and Demolition Waste

- Industrial Waste

The report has provided a detailed breakup and analysis of the market based on the waste type. This includes municipal solid waste, e-waste, hazardous waste, medical waste, construction and demolition waste, and industrial waste.

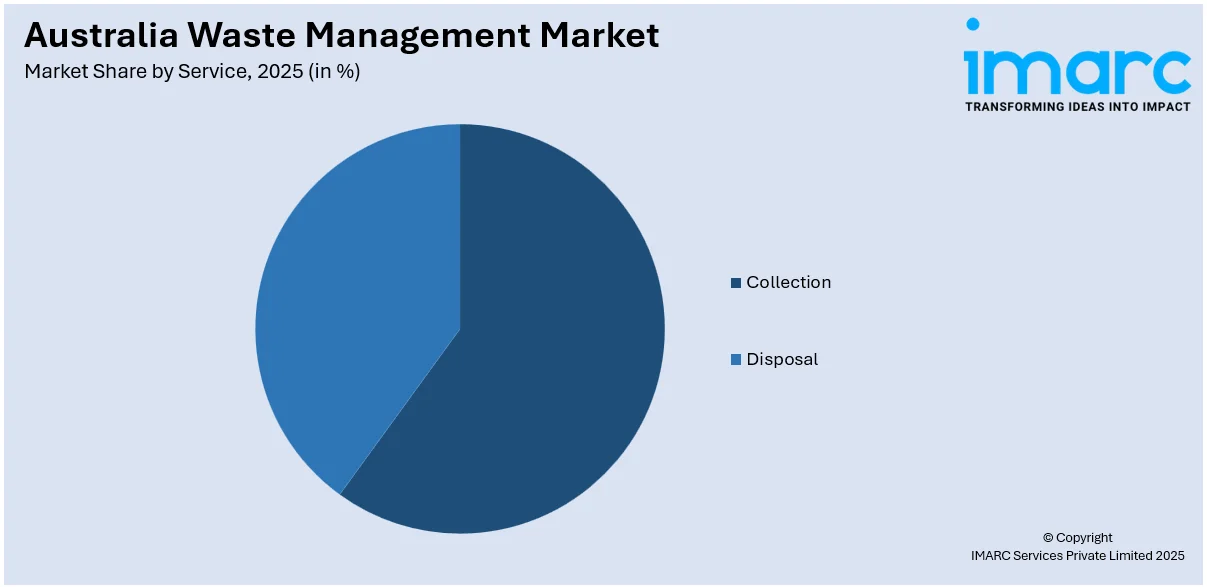

Service Insights:

Access the comprehensive market breakdown Request Sample

- Collection

- Disposal

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes collection and disposal.

Source Insights:

- Industrial

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the source. This includes industrial, residential, and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Waste Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Waste Types Covered | Municipal Solid Waste, E-Waste, Hazardous Waste, Medical Waste, Construction and Demolition Waste, Industrial Waste |

| Services Covered | Collection, Disposal |

| Sources Covered | Industrial, Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia waste management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia waste management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia waste management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The waste management market in Australia was valued at USD 3.5 Billion in 2025.

The Australia waste management market is projected to exhibit a compound annual growth rate (CAGR) of 4.77% during 2026-2034.

The Australia waste management market is expected to reach a value of USD 5.5 Billion by 2034.

Population growth, urban expansion, and evolving sustainability regulations are fueling demand for modern waste solutions. Increased corporate responsibility, innovation in recycling technologies, and rising awareness about environmental impact are encouraging both public and private investment. Supportive policies and funding for infrastructure upgrades further drive market growth across all waste streams.

The primary trend of the Australia waste management market is a shift toward circular waste practices, with rising adoption of smart collection systems and automated sorting technologies. Another major trend is the converting organic and residual waste into energy and compost, alongside greater public engagement in recycling, segregation, and zero-waste lifestyle initiatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)