Australia Veterinary Medicine Market Size, Share, Trends and Forecast by Product, Animal Type, Route of Administration, Distribution Channel, and Region, 2025-2033

Australia Veterinary Medicine Market Overview:

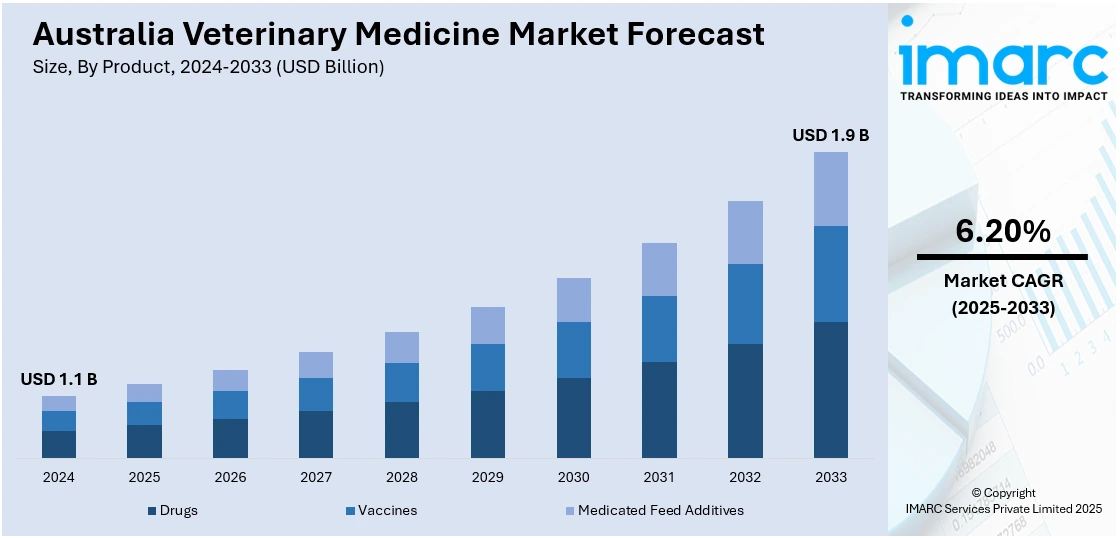

The Australia veterinary medicine market size reached USD 1.1 Billion in 2024. Looking forward, the market is projected to reach USD 1.9 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033. The growing pet ownership, rising livestock production, increasing awareness of animal health, supportive government initiatives, expanding veterinary infrastructure, and the adoption of advanced diagnostic, treatment technologies, and pharmaceutical innovations are some of the key factors contributing to the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Market Growth Rate 2025-2033 | 6.20% |

Key Trends of Australia Veterinary Medicine Market:

Growth in Animal Ownership and Pet Humanization

Australia is witnessing a significant rise in companion animal ownership, which is propelling the Australia veterinary medicine market growth. According to an industry report, approximately there were 1.4 Million Victorian households with a pet, and about 58% of adults in Victoria owned a pet in 2023. The pet humanization phenomenon is accelerating the demand for high-quality veterinary care, preventive treatments, advanced diagnostics, and wellness products. In addition to this, pet owners are increasingly opting for premium medications, routine vaccinations, dermatological treatments, and chronic disease management for their pets, which is providing an impetus to the market. Furthermore, the proliferation of pet insurance is also contributing to higher spending on veterinary medicine by reducing the financial burden on pet owners. Additionally, the growing emphasis on animal mental health and the usage of behavioral medications is adding a new layer to the veterinary pharmaceutical landscape. In response to pet owners' demands, veterinarians are expanding their offerings beyond emergency and illness-based care to include nutrition counseling, wellness plans, and long-term health management, which is leading to an increased uptake of veterinary pharmaceuticals across categories. These factors are augmenting the Australia veterinary medicine market share.

To get more information of this market, Request Sample

Increased Focus on Livestock Health and Biosecurity

Australia's red meat and livestock industry is a cornerstone of the national economy, generating a turnover of $81.7 Billion in 2022–23, as highlighted in an industry report. With beef, dairy, and sheep farming playing a dominant role in the agricultural landscape, the sector's economic significance is directly influencing the growing emphasis on animal health and veterinary care. Ensuring the health and productivity of livestock is becoming a critical priority, for sustaining export quality and for maintaining domestic food security. This is leading to a rising need for veterinary medicines tailored to large-animal health management, which is positively impacting the Australia veterinary medicine market outlook. Vaccination programs, antiparasitic treatments, and nutritional supplements are seeing robust demand across rural regions. In line with this, government-led initiatives and funding mechanisms aimed at improving herd health and productivity are encouraging broader adoption of veterinary medicines among commercial farmers. Furthermore, export requirements for meat and dairy products are also driving adherence to animal health standards, with traceability and disease-free certification becoming critical. Veterinarians are working closely with producers to implement herd health plans and optimize reproductive efficiency.

Growing Focus on Preventive Treatments

The veterinary industry in Australia is focusing strongly on preventative medicine, since both livestock farmers and pet owners recognize the long-term benefits of protection from an early stage. Vaccines are increasingly being used to prevent infectious diseases, thereby reducing the need for costly treatments at a later stage. Food supplements are increasingly in demand, specifically designed to boost immunity, joint function, and general health in pets and livestock alike. Parasite control solutions, such as tick, flea, and worm preventatives, are now seen as standard care against discretionary treatment. This approach not only enhances animal well-being and life expectancy but also mirrors increasing concern for zoonotic threats. The transition from reactive treatments to preventive measures is a critical element driving the Australia veterinary medicine market demand in both urban and rural areas.

Growth Drivers of Australia Veterinary Medicine Market:

Technological Advancements

The field of veterinary medicine in Australia is undergoing a transformation due to rapid technological innovations that are reshaping animal healthcare. The introduction of biologics, including vaccines and monoclonal antibodies, allows for more precise and effective treatment options. Targeted therapies designed for specific conditions help minimize side effects and enhance recovery outcomes for both pets and livestock. Furthermore, digital veterinary tools, such as telemedicine platforms, health-monitoring wearable devices, and AI-powered diagnostic systems, are improving the accessibility and accuracy of care. These advancements provide better treatment alternatives and pave the way for proactive and personalized healthcare for animals. The incorporation of these innovations is broadening the capabilities of veterinary practices and contributing to ongoing market growth throughout the nation.

Government Regulations on Animal Health

Policies from the Australian government are crucial in promoting the use of veterinary medicine, particularly with stringent biosecurity measures and animal welfare standards. Regulations support the implementation of preventive healthcare strategies that help reduce disease outbreaks in both companion animals and livestock. The need for food safety, especially within the dairy and meat export sectors, requires the reliable use of veterinary pharmaceuticals to uphold health and productivity standards. Additionally, regulations against antibiotic misuse are driving a shift toward safer alternatives, such as vaccines, probiotics, and biologics. These policies aim to protect public health and enhance the dependability of the country’s animal agriculture sector. According to Australia veterinary medicine market analysis, regulatory frameworks continue to be a primary catalyst for the sustainable demand for advanced treatments and preventive options.

Rising Awareness about Zoonotic Diseases

Growing awareness of zoonotic diseases those that can be passed from animals to humans is significantly affecting veterinary healthcare in Australia. Growing public health concerns regarding diseases such as avian influenza, leptospirosis, and tick-borne illnesses have raised consciousness about the necessity of both preventive and responsive veterinary treatments. This has resulted in heightened investments in vaccines, diagnostics, and monitoring systems aimed at minimizing transmission risks. Owners of companion animals are becoming more vigilant about regular parasite control and vaccination to protect family health. On the livestock front, farmers are implementing stricter disease management protocols to comply with domestic safety regulations as well as international export requirements. This convergence of animal and human health interests is driving investments, ensuring that veterinary medicine remains a critical component of the nation’s health resilience strategies.

Government Initiatives for Australia Veterinary Medicine Market:

Strict Biosecurity Programs

Australia implements some of the most stringent biosecurity measures globally, aimed at safeguarding domestic livestock and facilitating international trade. These measures include rigorous border monitoring, quarantine protocols, and systems for early detection to thwart the introduction and spread of foreign animal diseases like foot-and-mouth disease and avian influenza. Regional efforts additionally focus on disease surveillance and vaccination initiatives, ensuring herd health and protecting the productivity of livestock sectors. By reducing the chances of outbreaks, these programs secure farmers’ livelihoods and bolster confidence in Australian exports. The focus on preventive strategies involving veterinary medicines, vaccines, and diagnostic tools keeps biosecurity as a primary factor driving growth in the veterinary medicine industry throughout both rural and urban areas.

Regulations on Antimicrobial Use

The Australian government is committed to regulating the use of antimicrobials in both livestock and companion animals. The excessive use of antibiotics raises concerns about antimicrobial resistance, which poses threats to the health of both animals and humans. Policies are in place to encourage veterinarians and farmers to practice controlled usage and emphasize preventive healthcare. This has led to a quicker adoption of alternatives, such as vaccines, probiotics, and advanced biologics, to support animal health without the risk of developing resistance. These regulations align with international standards, enhancing confidence in Australian meat and dairy exports. The transition toward safer, sustainable treatments fuels innovation in the veterinary medicine field, ensuring improved disease management while lessening reliance on antibiotics and ultimately transforming the approach to animal healthcare nationwide.

Animal Welfare Standards

Australia’s government enforces strict animal welfare regulations that ensure humane treatment for both companion animals and livestock. These regulations address living conditions, handling, transportation, and medical care, ensuring animals receive adequate nutrition and preventive health services. Compliance with welfare standards is crucial for livestock, impacting both domestic production and international trade, as global markets increasingly seek greater welfare assurances. For pets, these rules promote regular veterinary check-ups, vaccinations, and treatments that contribute to enhanced quality of life. By establishing clear welfare criteria, the government encourages increased reliance on veterinary medicines and preventive measures. These regulations improve animal welfare and build consumer trust in food products, highlighting the significant role of veterinary care within the Australian economy.

Opportunities of Australia Veterinary Medicine Market:

Rising Focus on Sustainable Practices

Sustainability is increasingly becoming a key focus in Australia’s veterinary medicine market due to growing demand from consumers and regulators for eco-friendly options. There is a rising concern among farmers and pet owners about the long-term effects of chemicals, residues, and the excessive use of antibiotics on animal health, food safety, and the environment. This change is driving interest in organic feed additives, plant-based supplements, residue-free parasite control, and biodegradable product formulations. In response, veterinary companies are channeling investments into greener innovations that align with worldwide sustainability objectives. Livestock producers, especially in export-oriented sectors, also gain advantages from these practices, as achieving residue-free and organic certifications can enhance their market access. The focus on sustainable veterinary care presents considerable growth and differentiation opportunities in the changing Australian market.

Digital Veterinary Care

Digital advancements are paving new paths for growth in Australia’s veterinary medicine industry. Telemedicine platforms enable pet owners and livestock farmers to consult veterinarians from a distance, broadening access to care in rural and underserved areas. Mobile applications are facilitating routine monitoring, appointment scheduling, and medication reminders, thereby improving compliance and health outcomes. The popularity of wearable devices for pets and livestock is increasing, offering real-time monitoring of vital signs, activity levels, and possible health concerns. These innovations enhance preventive care and provide veterinarians with essential data to customize treatments. The incorporation of digital tools into veterinary practice enhances service delivery, creating opportunities for both startups and established companies to broaden their offerings and boost customer engagement.

Export Potential

Australia’s veterinary medicine sector holds promising export opportunities, especially to nearby Asia-Pacific nations where the demand for high-quality animal health solutions is on the rise. The nation's strong reputation for rigorous biosecurity, advanced research methodologies, and high animal welfare standards adds credibility to its veterinary products and expertise. Countries like Indonesia, Vietnam, and China, which have expanding livestock industries, represent lucrative markets for vaccines, feed additives, and preventive solutions. Furthermore, the burgeoning middle class in these areas is increasing the demand for companion animal care, thereby expanding market opportunities for pet medicines and supplements. By capitalizing on trade agreements and its status as a reliable exporter, Australia can broaden its international presence in veterinary medicine, thereby enhancing both its domestic industry and global partnerships.

Challenges of Australia Veterinary Medicine Market:

High Treatment Costs

The increasing expense of veterinary care presents a major challenge within Australia’s veterinary medicine market. Advanced diagnostic technologies, surgical interventions, and contemporary medications come with significant costs, which many pet owners and farmers find hard to manage. For pet owners, the lack of widespread pet insurance amplifies the financial strain, often resulting in delayed or missed treatments. In livestock farming, narrow profit margins deter investment in costly veterinary treatments, even when they could enhance productivity and prevent long-term financial losses. This financial barrier affects the overall uptake of advanced therapies and preventive care. As veterinary technology advances, the affordability gap between available solutions and consumer financial capability remains a significant obstacle to the sustainable growth of the sector.

Shortage of Veterinary Professionals

Australia is experiencing a deficiency of veterinary professionals, especially in rural and regional locations, creating a significant bottleneck for the veterinary medicine sector. Urban areas tend to attract more practitioners, leaving agricultural communities without sufficient services. This results in limited access to prompt diagnosis, treatment, and preventive care for livestock, which ultimately impacts productivity and disease management. The workload for current veterinarians is also growing, leading to stress, burnout, and challenges in retaining professionals within the field. This shortage directly affects the adoption of veterinary medicines, as farmers and pet owners struggle to find the necessary expertise for effective treatment prescriptions and administration. Tackling this issue requires long-term strategies, such as training programs, incentives for rural assignments, and enhanced support networks for the veterinary workforce.

Regulatory Hurdles

Strict regulations regarding the approval and distribution of veterinary medicines in Australia, while crucial for safety and efficacy, often hinder market expansion. The protracted approval process for new drugs and biologics delays their market entry, making it more difficult for veterinarians and farmers to access the latest innovations. Adherence to complex standards also raises expenses for manufacturers and distributors, posing challenges for smaller companies seeking to compete with established businesses. Additionally, evolving guidelines concerning antimicrobial use and biosecurity introduce further compliance layers requiring continuous adjustments. These regulations are essential for safeguarding both public and animal health; however, they can unintentionally hinder the rapid implementation of innovative therapies. Finding a balance between ensuring safety and fostering innovation continues to be one of the major challenges in the industry.

Australia Veterinary Medicine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, animal type, route of administration, and distribution channel.

Product Insights:

- Drugs

- Anti-infective

- Anti-inflammatory

- Parasiticide

- Vaccines

- Inactivated Vaccines

- Attenuated Vaccines

- Recombinant Vaccines

- Medicated Feed Additives

- Amino Acids

- Antibiotics

The report has provided a detailed breakup and analysis of the market based on the product. This includes drugs (anti-infective, anti-inflammatory, and parasiticide), vaccines (inactivated vaccines, attenuated vaccines, and recombinant vaccines), and medicated feed additives (amino acids and antibiotics).

Animal Type Insights:

- Production

- Companion

A detailed breakup and analysis of the market based on the animal type have also been provided in the report. This includes production and companion.

Route of Administration Insights:

- Oral

- Parenteral

- Topical

The report has provided a detailed breakup and analysis of the market based on the route of administration. This includes oral, parenteral, and topical.

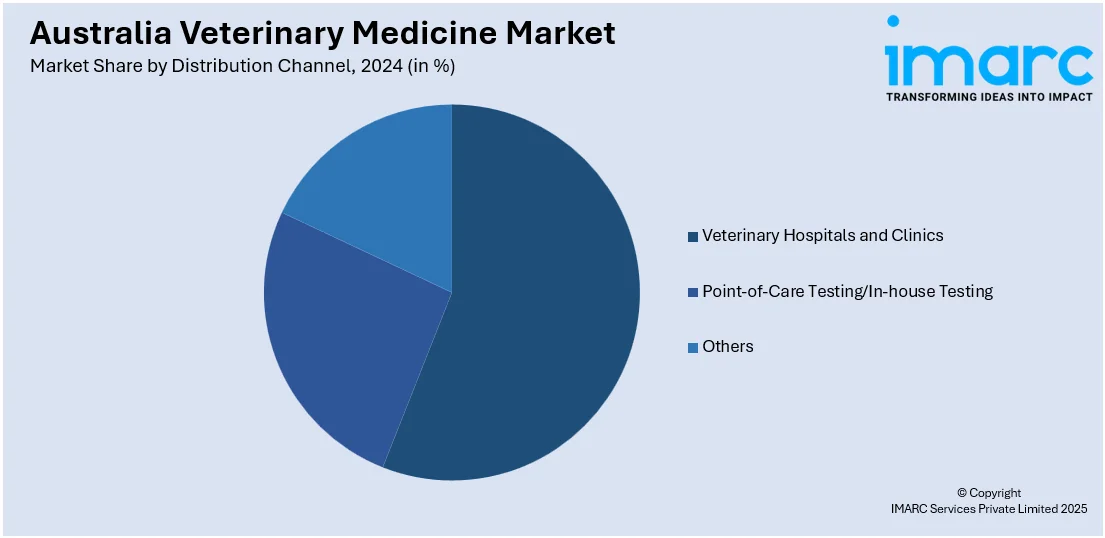

Distribution Channel Insights:

- Veterinary Hospitals and Clinics

- Point-of-Care Testing/In-house Testing

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes veterinary hospitals and clinics, point-of-care testing/in-house testing, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Veterinary Medicine Market News:

- On June 7, 2024, Apiam Animal Health announced a strategic partnership with German firm Veyx-Pharma to distribute innovative animal health products across Australia. This collaboration aims to introduce Veyx-Pharma's advanced technologies to the Australian pig industry, with a product launch anticipated in the coming months following extensive research by Apiam. Both companies view this alliance as a significant step towards enhancing animal health and productivity.

- On February 10, 2025, Animal Medicines Australia (AMA) welcomed the Albanese Government's announcement of a USD 13 Million funding boost to the Australian Pesticides and Veterinary Medicines Authority (APVMA) to enhance access to safe and effective veterinary medicines and animal health products. AMA Executive Director Ben Stapley acknowledged this as a positive initial step towards establishing a sustainable funding model for the APVMA, emphasizing the importance of ongoing collaboration between the regulator and the industry.

Australia Veterinary Medicine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Animal Types Covered | Production, Companion |

| Route of Administrations Covered | Oral, Parenteral, Topical |

| Distribution Channels Covered | Veterinary Hospitals and Clinics, Point-of-Care Testing/In-house Testing, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia veterinary medicine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia veterinary medicine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia veterinary medicine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The veterinary medicine market in Australia was valued at USD 1.1 Billion in 2024.

The Australia veterinary medicine market is projected to exhibit a compound annual growth rate (CAGR) of 6.20% during 2025-2033.

The Australia veterinary medicine market is expected to reach a value of USD 1.9 Billion by 2033.

The Australia veterinary medicine market is witnessing trends such as rising adoption of advanced biologics and vaccines, increased use of telemedicine for pet care, growing demand for preventive healthcare, expansion of specialty veterinary services, and integration of digital tools for diagnostics and treatment management.

Growth in the Australia veterinary medicine market is influenced by a rise in pet ownership, heightened awareness about animal health and preventive care, an increase in livestock production needing veterinary assistance, advancements in veterinary drugs and biologics, and a growing emphasis on pet wellness and longevity, which leads to higher spending on medical and therapeutic products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)