Australia Utility Services Market Report by Type (Electricity Services, Water Services, Gas Services, Telecommunication Services, Others), End User (Residential, Commercial, Industrial, Government and Public Sector), and Region 2025-2033

Australia Utility Services Market Overview:

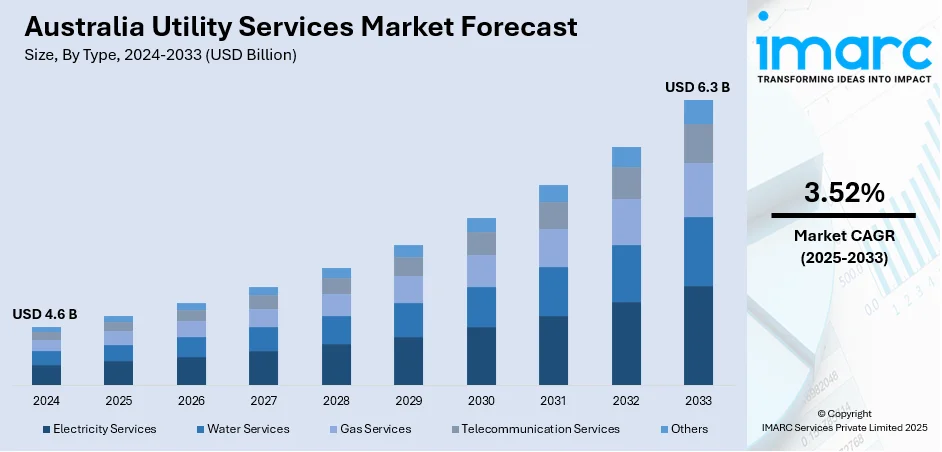

The Australia utility services market size reached USD 4.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.52% during 2025-2033. The market is primarily driven by government investments in infrastructure, regulatory frameworks, rapid urbanization, technological advancements, smart grid adoption, renewable energy integration, innovations like smart meters and grid automation, increased demand for sustainable energy solutions, and the push for decarbonization and environmentally friendly practices in utility services.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.6 Billion |

|

Market Forecast in 2033

|

USD 6.3 Billion |

| Market Growth Rate 2025-2033 | 3.52% |

Australia Utility Services Market Trends:

Government Initiatives for Urbanization and Infrastructure Development

Australia’s utility services market is strongly influenced by substantial government investments and regulatory frameworks aimed at modernizing infrastructure and ensuring sustainability. Policies such as the Renewable Energy Target (RET) and investments in smart grid technology promote the adoption of cleaner energy and efficient water management. Regulatory authorities, including the Australian Energy Regulator (AER), enforce strict guidelines to encourage utilities to reduce carbon footprints while maintaining reliability. Rapid urbanization in Australia’s key cities is significantly influencing the demand for utility services, particularly energy, water, and waste management. The growing population and increasing commercial developments are driving the need for expanded infrastructure. Utilities are responding by scaling up their capacity and modernizing systems to meet the needs of a more urbanized population. This urban growth creates continuous demand for utility services and infrastructure enhancements, including smart technologies and efficient resource management solutions, helping sustain market growth. In line with this, favorable government policies are pushing utilities toward greener operations and helping to sustain long-term market growth in both energy and water sectors.

To get more information on this market, Request Sample

Continual Technological Advancements and Renewable Energy Integration

The utility services market in Australia is experiencing significant advancements in technology, which is transforming operations and service delivery. Innovations such as smart meters, grid automation, and advanced data analytics enable more efficient resource management and predictive maintenance, improving both energy and water service reliability. Utilities are increasingly adopting these technologies to enhance operational efficiency, reduce costs, and improve customer experiences. Additionally, the increasing integration of renewable energy sources, such as solar and wind power, is a key driver of Australia’s utility services market. With a growing focus on decarbonization, the shift toward clean energy is accelerating. Investments in large-scale renewable projects, such as solar farms and offshore wind turbines, are reshaping the energy mix. Utilities are being pushed to innovate and expand their renewable capacity to meet both consumer demand for greener energy and government-mandated targets, driving sector expansion and development.

Australia Utility Services Market News:

- September 19, 2023: Prime Super acquired Active Utilities, a Macquarie-backed proptech company, for an estimated A$100m to A$120m. This acquisition expands Prime Super's presence across five Australian states, making it the largest independent provider of local energy network solutions. The deal is expected to enhance synergies with Prime Super’s other clean energy assets, like Savant Energy, and help accelerate the transition to green energy.

- September 9, 2024: Flow Power partnered with Tauondi Aboriginal College to enhance First Nations participation in the energy sector. The partnership, supported by Westpac, aims to train Aboriginal and Torres Strait Islander students through the Pathway to Electrotechnology program, leading to technical apprenticeships. This initiative seeks to address underrepresentation and create inclusive opportunities in South Australia's developing renewable energy industry.

Australia Utility Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, and end user.

Type Insights:

- Electricity Services

- Water Services

- Gas Services

- Telecommunication Services

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes electricity services, water services, gas services, telecommunication services, and others.

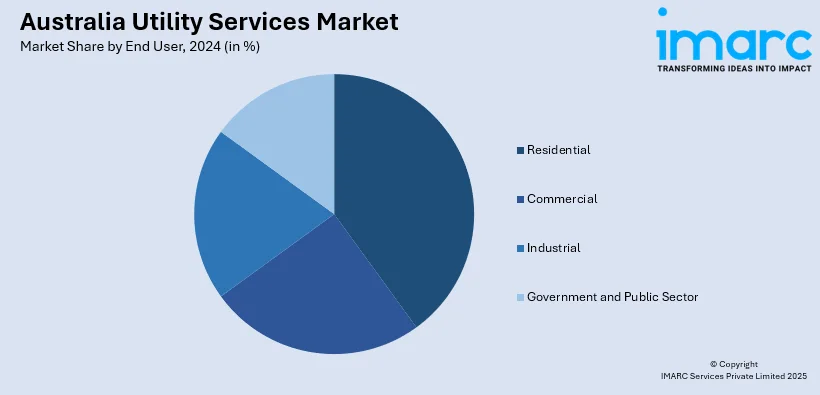

End User Insights:

- Residential

- Commercial

- Industrial

- Government and Public Sector

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, industrial, and government and public sector.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Utility Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electricity Services, Water Services, Gas Services, Telecommunication Services, Others |

| End Users Covered | Residential, Commercial, Industrial, Government and Public Sector |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia utility services market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia utility services market on the basis of type?

- What is the breakup of the Australia utility services market on the basis of end user?

- What are the various stages in the value chain of the Australia utility services market?

- What are the key driving factors and challenges in the Australia utility services?

- What is the structure of the Australia utility services market and who are the key players?

- What is the degree of competition in the Australia utility services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia utility services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia utility services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia utility services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)