Australia Utility Poles Market Report by Type (Transmission Poles, Distribution Poles), Material (Concrete, Wood, Steel, Composites), Pole Size (Below 40ft, Between 40 and 70ft, Above 70ft), Application (Energy Transmission and Distribution, Telecommunication, Street Lighting, Heavy Power Lines, Subtransmission Lines, and Others), and Region 2025-2033

Market Overview:

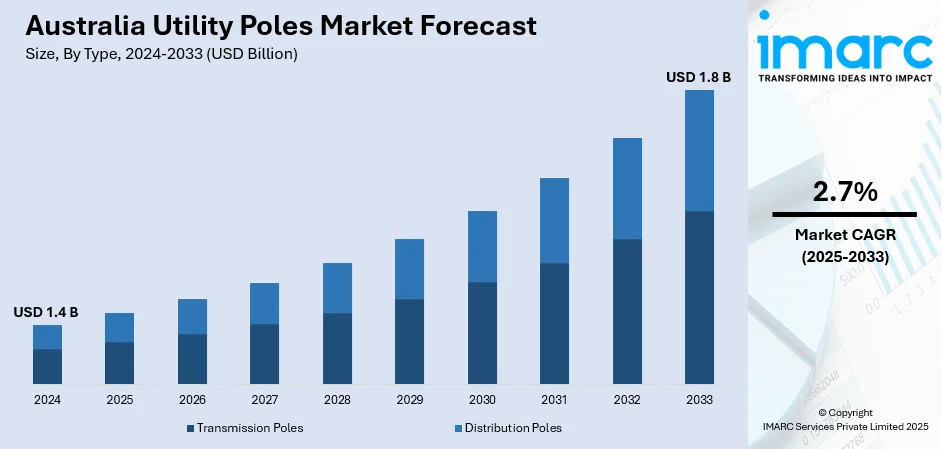

Australia utility poles market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.8 Billion by 2033, exhibiting a growth rate (CAGR) of 2.7% during 2025-2033. The expanding electricity transmission infrastructures and continuous improvements in the telecommunications industry are primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.4 Billion |

|

Market Forecast in 2033

|

USD 1.8 Billion |

| Market Growth Rate 2025-2033 | 2.7% |

Utility poles, also known as electric power poles, play a vital role in conveying electricity from power providers to consumers. These poles are furnished with various components including insulators, cross arms, cutouts, lightning arrestors, and transformers. Additionally, they provide support for a variety of wires such as primary, neutral, secondary, telephone and cable, ground, and guy wires. In the electrical system, utility poles serve as essential structures, and several types are commonly utilized. These include wooden poles, concrete poles, steel tubular poles, and rail electric poles. Each type has its specific characteristics and advantages, contributing to the diverse range of utility poles used in the transmission and distribution of electric power.

To get more information on this market, Request Sample

Australia Utility Poles Market Trends:

The Australia utility poles market is experiencing significant growth, driven by the increasing demand for infrastructure development, particularly in the power distribution sector. The need to modernize and expand electrical grids to meet growing energy requirement. Moreover, sustainability is emerging as a significant trend, prompting a shift towards environmentally friendly materials in utility pole construction. This trend aligns with Australia's commitment to eco-conscious practices and renewable energy initiatives. As a result, there is a notable rise in the use of materials such as steel and composite materials that offer durability while minimizing environmental impact. Technological advancements are also influencing the Australia utility poles market. Smart utility poles equipped with sensors and communication devices are becoming more prevalent. These smart poles enhance grid management, allowing for real-time monitoring, fault detection, and efficient energy distribution. Additionally, collaborations and partnerships between utility companies and technology providers are fostering innovation in pole design and construction. This collaborative approach ensures that utility poles meet the evolving needs of the energy infrastructure landscape in Australia. Overall, infrastructure demands, sustainability goals, and technological advancements will continue to bolster the market growth across the country in the coming years.

Australia Utility Poles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, material, pole size, and application.

Type Insights:

- Transmission Poles

- Distribution Poles

The report has provided a detailed breakup and analysis of the market based on the type. This includes transmission poles and distribution poles.

Material Insights:

- Concrete

- Wood

- Steel

- Composites

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes concrete, wood, steel, and composites.

Pole Size Insights:

- Below 40ft

- Between 40 and 70ft

- Above 70ft

The report has provided a detailed breakup and analysis of the market based on the pole size. This includes Below 40ft, between 40 and 70ft, and above 70ft.

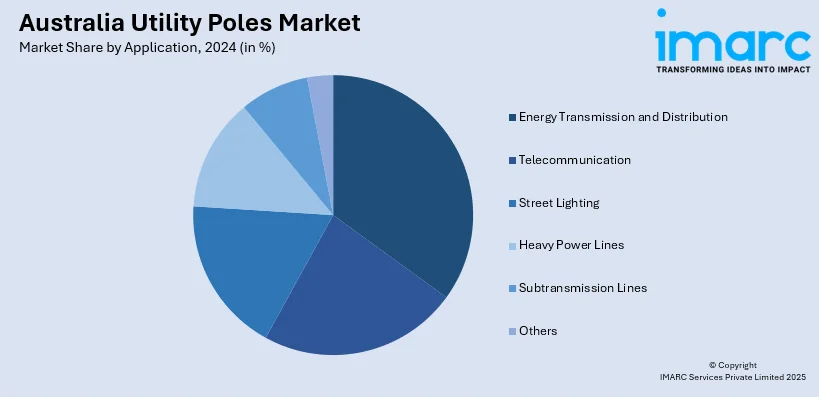

Application Insights:

- Energy Transmission and Distribution

- Telecommunication

- Street Lighting

- Heavy Power Lines

- Subtransmission Lines

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes energy transmission and distribution, telecommunication, street lighting, heavy power lines, subtransmission lines, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Utility Poles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Transmission Poles, Distribution Poles |

| Materials Covered | Concrete, Wood, Steel, Composites |

| Pole Sizes Covered | Below 40ft, Between 40 and 70ft, Above 70ft |

| Applications Covered | Energy Transmission and Distribution, Telecommunication, Street Lighting, Heavy Power Lines, Subtransmission Lines, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia utility poles market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia utility poles market on the basis of type?

- What is the breakup of the Australia utility poles market on the basis of material?

- What is the breakup of the Australia utility poles market on the basis of pole size?

- What is the breakup of the Australia utility poles market on the basis of application?

- What are the various stages in the value chain of the Australia utility poles market?

- What are the key driving factors and challenges in the Australia utility poles?

- What is the structure of the Australia utility poles market and who are the key players?

- What is the degree of competition in the Australia utility poles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia utility poles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia utility poles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia utility poles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)