Australia Used Car Market Size, Share, Trends and Forecast by Vehicle Type, Vendor Type, Fuel Type, Sales Channel, and Region, 2026-2034

Australia Used Car Market Size and Share:

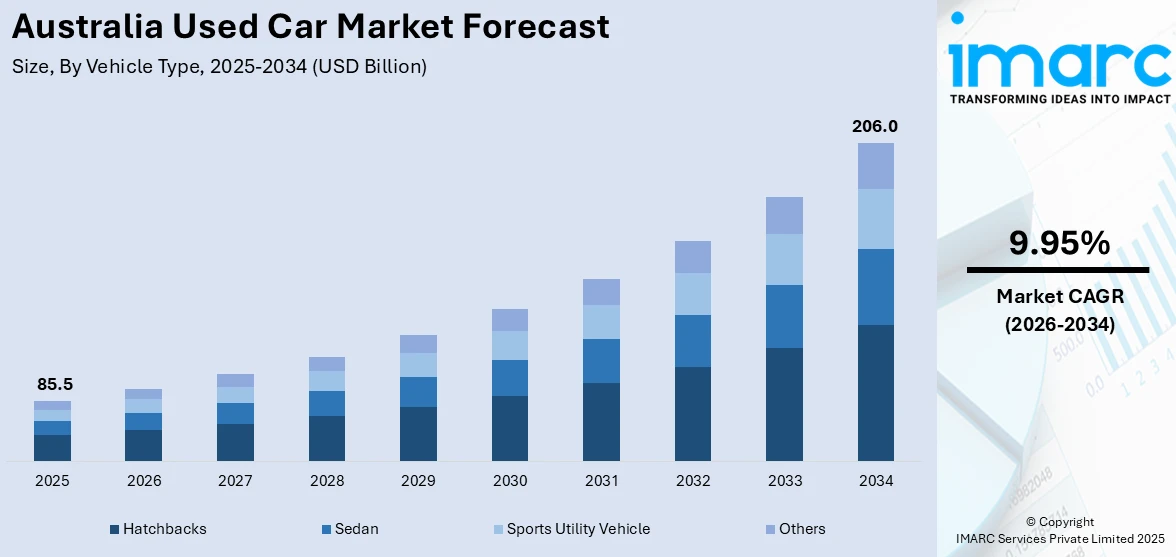

The Australia used car market size was valued at USD 85.5 Billion in 2025. Looking forward, the market is expected to reach USD 206.0 Billion by 2034, exhibiting a CAGR of 9.95% from 2026-2034. The market is witnessing robust growth, fueled by affordability, increasing demand for reliable pre-owned vehicles, and the rise of digital platforms simplifying transactions. Economic factors and a shift toward cost-effective options are further propelling the market, making it a significant contributor to the automotive industry's overall expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 85.5 Billion |

| Market Forecast in 2034 | USD 206.0 Billion |

| Market Growth Rate (2026-2034) | 9.95% |

The growing concerns about affordability and the rising cost of new cars represent one of the key factors positively influencing the Australia used car market. For instance, in 2024, Land Rover Defender models between two and four years old retained 102 percent of their value when sold on the used market of Australia. Due to economic instability and financial strains, more buyers are viewing used automobiles as dependable and affordable alternatives. The availability of certified pre-owned programs, which provide cars with comprehensive inspections and warranties, has increased user confidence and drawn in a larger clientele. Furthermore, a wider range of people may purchase pre-owned cars owing to the flexibility of financing alternatives designed specifically for used car buyers, which has enhanced market activity.

To get more information on this market Request Sample

The growing role of digital platforms in transforming the automotive industry has also been instrumental in driving the used car market. These online platforms simplify transactions by offering transparent pricing, detailed vehicle histories, and convenient access to a broader range of options. This technological advancement caters to tech-savvy buyers seeking efficient and hassle-free purchase experiences. Furthermore, the rising awareness of sustainable practices has encouraged consumers to choose pre-owned cars as an environmentally conscious alternative, reducing waste and extending vehicle lifespans. For instance, the production and sales of electric vehicles surged between April and June 2024, with sales rising 91% from the first quarter and 246% year-on-year. This growth highlights the increasing acceptance and demand for sustainable vehicles in Australia, reflecting a shift in consumer preferences toward environmentally friendly transportation options in the rapidly evolving automotive market.

Key Trends of Australia Used Car Market:

Rising Demand for Fuel-Efficient and Eco-Friendly Vehicles

The Australia used car market is witnessing a significant rise in demand for fuel-efficient and eco-friendly vehicles, including hybrids and electric models. For instance, sales of plug-in hybrids, equipped with externally rechargeable batteries to reduce petrol use, rose by 1.49% market share by 30 June 2024, highlighting rising demand for eco-friendly vehicle options in Australia’s evolving automotive market. As fuel prices remain high and environmental awareness grows, consumers are prioritizing cars with lower emissions and better fuel economy. This shift is reshaping the inventory preferences of dealerships, with an increasing focus on sustainable options.

Expansion of Online Marketplaces

Online platforms are transforming the Australia used car market statistics by providing convenient and transparent purchasing experiences. These digital marketplaces offer comprehensive tools such as price comparisons, vehicle history reports, and financing options, which empower buyers with better decision-making capabilities. For instance, in March 2024, FinTech startup AutoSettle launched a platform to transform the vehicle-buying process in Australia. This innovative platform streamlines transactions, offering instant settlements, enhanced security, and digital identity verification. By addressing inefficiencies and reducing fraud risks, it benefits customers by providing a seamless, secure experience integrated with dealerships, financiers, and registrars, supporting digital transformation in Australia’s automotive market. This digital shift is particularly appealing to younger, tech-savvy buyers, driving substantial growth in online sales.

Growing Interest in SUVs and Crossovers

The Australia used car market demand is witnessing a surge for SUVs and crossovers, reflecting changing consumer lifestyles and preferences. For instance, in November 2024, SUV sales reached 82,494 units, reflecting a notable shift in the used car market. This shift highlights the increasing preference of Australian consumers for versatile and practical vehicles, reinforcing SUVs' position as a favored choice in the evolving automotive landscape. These vehicles are favored for their spacious interiors, practicality, and suitability for both urban and rural settings. As families and adventure-seekers seek versatile transportation options, the availability of pre-owned SUVs at competitive prices is driving this trend.

Growth Drivers of Australia Used Car Market:

Affordability & Cost-of-Living Pressures

The high cost of living in Australia, exacerbated by increasing fuel and finance costs, has encouraged consumers to turn to more affordable vehicle choices. Second-hand vehicles provide a concrete means of decreasing initial purchase costs and regular running costs like insurance and registration—most welcome among young drivers and cost-conscious families. The abundance of hybrid and fuel-efficient vehicles in the second-hand market contributes to this popularity, allowing customers to offset operating savings with eco-friendliness. As affordability tops the list of considerations, dealerships are highlighting pre-owned cars with extensive reconditioning procedures and flexible financing arrangements such as subscriptions, responding to customers looking for value without sacrificing reliability. This affordability-led trend positions used cars at the heart of Australian daily mobility.

Digital Platforms, Transparency & Buyer Confidence

According to the Australia used car market analysis, the used car market is being increasingly influenced by digital change. Online platforms—complete with detailed listings, history reports, virtual tours, and financing tools—have transformed the shopper experience through enhanced transparency and convenience. Such tools facilitate empowered buyers through price benchmarking and condition verification, alleviating information asymmetry and confidence in transactions. Concurrently, certified pre-owned (CPO) initiatives, providing warranties, vehicle inspections, and brief return periods, are gaining momentum among dealers. These programs offset risk related to used vehicles and increase consumer confidence. The acceleration of digital ecosystems mirrors changing shopper expectations and represents a market maturity, where seamless integration of online and offline (omnichannel) interactions is key to success.

New Car Supply Disruptions & Shift Toward SUVs/Hybrids

New car production supply chain disruptions, brought on by worldwide semiconductor shortages, have pushed new car deliveries back, and with that, more purchasers to the used vehicle market. In addition, rising demand for SUVs, UTEs, hybrid, and electric vehicles is being fueled by Australia's sprawling cityscapes and regional commuting requirements. Importation of used Japanese hybrid models continues as well, supported by a favorable exchange rate and Australia's emphasis on fuel-conserving transport. With a car-dominated society—Australia is among the world's highest per-capita car users—drivers increasingly are seeking used alternatives when newer models are not available. That dynamic has expanded inventory variety and emphasizes the strategic position of the used-car market in filling supply gaps and satisfying changing consumer needs.

Opportunities of Australia Used Car Market:

Escalating Demand in Regional and Remote Regions

Australia's extensive geography and low public transport infrastructure in rural and remote regions provide a high chance of the second-hand car market. In rural areas and country towns where public transport is scarce or unavailable, personal cars continue to be necessary for work commutes, visits to services, and social mobility. New cars tend to have higher prices and longer delivery periods because of low dealership coverage beyond primary urban centers. Used vehicles, on the other hand, are more affordable and readily available, hence popular among rural consumers. Additionally, the off-road tolerance and durability of some second-hand vehicles, like 4WDs and UTEs, suit the requirements of regional motorists who frequently deal with unsealed roads and extended driving distances. Through focused logistics, online platforms, and adaptable financing, online marketplaces and dealerships can reach into this under-served group, building long-term customer bases in less crowded markets outside of city centers.

Electric and Hybrid Vehicle Resale Growth

As Australia speeds the move towards electric and hybrid cars, a corollary opportunity arises in the resale and second-hand market of this segment. Although EVs and hybrids have always commanded premium prices, the existence of second-hand models is bringing them within reach of middle-class and eco-friendly consumers. Numerous Australians are eager to switch to low-emission vehicles but hold back at the expense of new models or the unknown of long-term ownership. Second-hand EVs and hybrids, especially those brought in from Japan or that were previously maintained in short-term fleet lease contracts, provide a budget-friendly entry point. As charging infrastructure growth widens across the Australian cities and along highways, electric vehicle ownership is more feasible now than ever before. Sellers providing verified battery health reports and warranty choices can establish trust and differentiate themselves in this emerging niche, creating new revenue streams in an increasingly eco-conscious consumer base.

Digital Retailing and Omnichannel Expansion

Australia's strong internet penetration and growing acceptance of e-commerce create enormous opportunities for digital transformation in used car retailing. Consumers are using online platforms not only for searching listings but for full online car purchases, including financing, insurance, and trade-ins. This change is allowing used car dealers to reach more customers, such as those located in rural areas who in the past have had poor access to diverse inventories. The application of virtual showrooms, automated vehicle recommendations, and live video tours is increasingly mainstreaming, providing convenience and transparency. Furthermore, combining physical dealership experiences with digital capabilities—like click-and-collect models or mobile test drives—is assisting in creating an omnichannel experience that is seamless. Such a hybrid retail model is in line with evolving buyer behavior and suited particularly for Australia's wide-spread population. Firms that invest in easy, secure, and informative online experiences are in a stronger position to seize nascent demand and build customer loyalty in an upgraded resale marketplace.

Australia Used Car Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia used car market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on vehicle type, vendor type, fuel type, and sales channel.

Analysis by Vehicle Type:

- Hatchbacks

- Sedan

- Sports Utility Vehicle

- Others

Sports utility vehicles hold 23.1% of the market share. They offer a combination of space, comfort, and versatility, making them popular among families and adventure seekers. Their ability to handle various terrains and provide ample seating capacity appeals to buyers looking for reliable and practical vehicles. SUVs are also preferred for their higher ground clearance, which improves visibility and adds a sense of security while driving. Additionally, the growing trend of outdoor activities and road trips in Australia is driving the demand for SUVs that can support these lifestyles. Many used SUV models are equipped with advanced features, such as all-wheel drive, enhanced safety systems, and spacious interiors, further attracting buyers. The increasing availability of affordable second-hand SUVs, coupled with their reputation for durability, makes them a popular choice in the used car market in Australia.

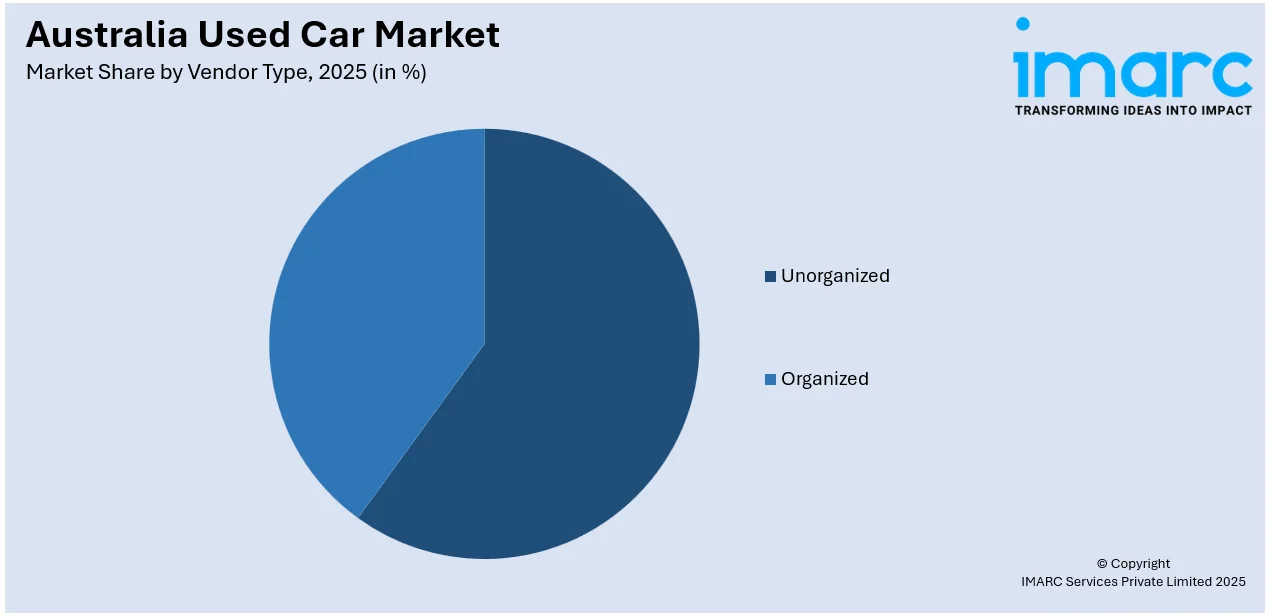

Analysis by Vendor Type:

Access the comprehensive market breakdown Request Sample

- Organized

- Unorganized

Unorganized accounts for 58.8% of the market share. It offers a wider variety of vehicles at competitive prices, attracting budget-conscious buyers. Many individuals prefer purchasing directly from private sellers or small dealerships to avoid the overhead costs typically associated with organized vendors. The unorganized sector also provides greater flexibility in price negotiation, allowing buyers to secure better deals. Additionally, the presence of online platforms and social media marketplaces has made it easier for individual sellers to connect with potential buyers, boosting sales in this segment. Since unorganized vendors often have lower operating costs, they can offer vehicles at more affordable prices, appealing to people seeking cost-effective options. The availability of diverse vehicle models, including older or rare cars, further strengthens the dominance of the unorganized sector in the market in Australia. Buyers seeking quick transactions with minimal paperwork also find the unorganized sector more convenient.

Analysis by Fuel Type:

- Gasoline

- Diesel

- Others

Gasoline holds 63.3% of the market share. Gasoline-based vehicles are widely available and have been a popular choice among Australian users for years. Many older car models, which make up a large portion of the used car market, are gasoline-powered, increasing their presence in this segment. Gasoline vehicles are also known for their lower upfront costs compared to diesel or electric options, making them more accessible to budget-conscious buyers. Additionally, gasoline cars generally have simpler engine designs, which often result in lower maintenance costs, appealing to individuals seeking affordable long-term ownership. The widespread availability of gasoline refueling stations across Australia further supports the market growth, ensuring convenience for drivers. People in rural and suburban areas especially prefer gasoline cars for their reliability and ease of use. With gasoline vehicles remaining a common and trusted option in both private sales and dealership offerings, their continued dominance in the market remains strong.

Analysis by Sales Channel:

- Online

- Offline

Offline accounts for 72.2% of the market share. Offline sales channels, including traditional dealerships, independent sellers, and local car yards, remain trusted and preferred options for buyers seeking used vehicles. Many people prefer visiting physical locations to inspect cars in person, assess their condition, and negotiate prices directly with sellers. This approach allows buyers to test drive vehicles, review service histories, and ensure transparency in the purchase process, which builds trust. Additionally, offline channels often provide personalized guidance from sales representatives, helping individuals to make informed decisions. Local dealerships frequently offer financing options, trade-in services, and warranty coverage, making offline sales convenient for many people. The presence of well-established car yards and dealership networks in both urban and regional areas further supports offline sales. With Australians often valuing face-to-face interactions and hands-on evaluation when purchasing high-value assets like cars, offline sales continue to dominate the market.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales, accounting for 34.5%, enjoys the leading position in the market. These regions have high populations, strong economic activity, and well-developed urban centers. According to the data published on the official website of the Australia Capital Territory government, by September 2024, the estimated resident population of the Australia Capital Territory stood at 475,644 individuals, equating to a rise of 0.4% during the third quarter. The presence of major cities like Sydney and Canberra drives higher demand for personal vehicles, especially for daily commuting and lifestyle needs. Additionally, the areas have a significant number of businesses, government offices, and educational institutions, contributing to increased car ownership and vehicle turnover. The strong network of dealerships, car yards, and authorized vendors in these areas also makes it easier for people to access a wide range of used car options. Moreover, the higher purchasing power in these regions is encouraging frequent vehicle upgrades, resulting in a steady supply of well-maintained used cars. With efficient transportation networks and busy urban lifestyles, individuals in Australia Capital Territory & New South Wales often seek reliable and affordable mobility solutions, further catalyzing the demand for used cars in these regions.

Competitive Landscape:

The competitive landscape of Australia used car market is defined by the interplay between traditional dealerships, digital platforms, and certified pre-owned programs. Businesses are leveraging technology to offer streamlined processes, including virtual inspections, financing options, and enhanced transparency. The shift towards online transactions has intensified competition, pushing traditional dealers to adopt hybrid models combining physical and digital offerings. Increasing consumer demand for fuel-efficient and eco-friendly vehicles further drives competition, compelling market players to diversify inventory and cater to evolving preferences. For instance, in 2024, Australia’s second-hand market showed a 52% average increase in used car loans across three vehicle age categories, reflecting growing demand for pre-owned sustainable vehicles and highlighting changing consumer preferences in the country’s automotive sector. Furthermore, as buyers prioritize affordability, reliability, and convenience, market participants continuously enhance services to differentiate themselves in a highly dynamic environment.

The report provides a comprehensive analysis of the competitive landscape in the Australia used car market with detailed profiles of all major companies.

- BMW Group Australia (BMW Premium Certified)

- Carma (ClickCar Australia Pty Ltd)

- CARS24

- Carsales.com Limited (CAR Group Limited)

- Cartopia Pty Ltd (Only Cars)

- Drive.com.au (Nine Entertainment Co. Pty Limited)

- Gumtree Australia Markets Limited Corporate

- HelloCars Subscription Pty Ltd

- Pickles Auctions Pty Limited

- Toyota Australia (Toyota Certified Pre-Owned Vehicle)

Latest News and Developments:

-

In August 2024, Uber and Car Empire launched an Australian-first pilot to boost the second-hand EV market. Starting in Brisbane and the Gold Coast, Uber drivers can access affordable pre-owned EVs, including used Nissan Leafs, through Uber’s vehicle marketplace. The initiative supports Uber’s goal of achieving zero vehicle emissions by 2040, offering financing and incentives to accelerate EV adoption.

Australia Used Car Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchbacks, Sedan, Sports Utility Vehicle, Others |

| Vendor Types Covered | Organized, Unorganized |

| Fuel Types Covered | Gasoline, Diesel, Others |

| Sales Channels Covered | Online, Offline |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | BMW Group Australia (BMW Premium Certified), Carma (ClickCar Australia Pty Ltd), CARS24, Carsales.com Limited (CAR Group Limited), Cartopia Pty Ltd (Only Cars), Drive.com.au (Nine Entertainment Co. Pty Limited), Gumtree Australia Markets Limited Corporate, HelloCars Subscription Pty Ltd, Pickles Auctions Pty Limited, and Toyota Australia (Toyota Certified Pre-Owned Vehicle) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, Australia used car market forecasts, and dynamics of the market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia used car market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia used car industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A used car refers to a pre-owned vehicle that has been previously registered and driven by one or more owners. These vehicles are widely chosen for their affordability compared to new cars. Used cars are utilized across various applications, including personal transportation, ridesharing, and delivery services, catering to cost-conscious consumers and businesses.

The Australia used car market was valued at USD 85.5 Billion in 2025.

The Australia used car market is expected to reach a value of USD 206.0 Billion by 2034.

The Australia used car market is projected to exhibit a CAGR of 9.95% during 2026-2034.

The Australia used car market is driven by rising new vehicle costs, growing demand for affordable alternatives, and increased adoption of online platforms streamlining transactions. Additionally, consumer preferences for fuel-efficient and eco-friendly vehicles, along with flexible financing options and certified pre-owned programs, contribute significantly to the market's expansion and competitiveness.

Australia's used car market is evolving into a buyer's market, with high stocks and reduced prices relaxing cost pressures. Depreciation of EVs—reinforced by price reductions by Tesla—is reducing demand for second-hand electric cars. But increasing fear of odometer manipulation and off-the-books damage, particularly in private sales, are leading to demands for increased roadworthiness tests.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)