Australia Two-Wheeler Market Size, Share, Trends and Forecast by Type, Technology, Transmission, Engine Capacity, Fuel Type, Distribution Channel, End User, and Region, 2025-2033

Australia Two-Wheeler Market Size and Share:

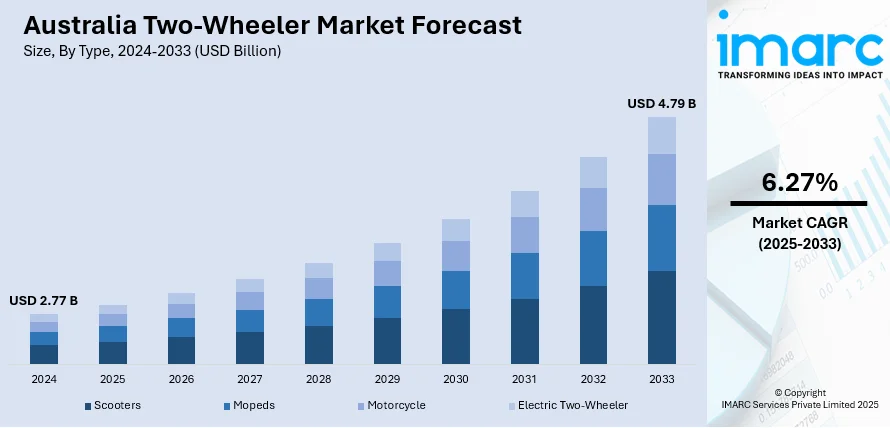

The Australia two-wheeler market size reached USD 2.77 Billion in 2024. Looking forward, the market is expected to reach USD 4.79 Billion by 2033, exhibiting a growth rate (CAGR) of 6.27% during 2025-2033. The market is driven by a strong riding culture, favorable climate, and the appeal of scenic routes, making motorcycles a popular choice for commuting and leisure. Additionally, the rising demand for electric motorcycles, supported by government incentives and environmental awareness, is contributing to market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.77 Billion |

| Market Forecast in 2033 | USD 4.79 Billion |

| Market Growth Rate 2025-2033 | 6.27% |

Key Trends of Australia Two-Wheeler Market:

Rise in Electric Two-Wheelers

Australia is experiencing a shift toward electric two-wheelers, driven by environmental concerns, rising fuel prices, and government incentives. With approximately 5–7% of Australians owning e-scooters and over 400,000 imported between 2018 and 2023, electric scooters and bikes have become popular urban commuting solutions. These vehicles offer cost-effective, low-emission alternatives, especially in congested cities. Brands like Fonz and Vmoto are expanding their electric offerings, while state-level policies provide rebates and infrastructure development to encourage EV adoption. Charging infrastructure is gradually expanding, further encouraging the adoption of two-wheelers. While the market is still in its early stages compared to regions like China and the EU, growing consumer interest in sustainability and innovation is fueling the Australia two-wheeler market share. Together, technological advancements and supportive public policy are making electric two-wheelers a viable and attractive option for Australian commuters.

To get more information on this market, Request Sample

Urban Commuting and Micro-Mobility Demand

With growing congestion in Australian cities, two-wheelers are becoming effective solutions for urban mobility. Motorbikes and scooters enable commuters to avoid traffic and save time, making them perfect for regular city commutes. This phenomenon is especially prominent among young riders and gig economy workers who need affordable, agile means of transportation further impacting the Australia two-wheeler market outlook. City governments are also retaliating with improved two-wheeler infrastructure, including exclusive parking and more liberal licensing arrangements for low-power scooters. Further, the emergence of on-demand rideshare and delivery services like Uber Eats has spurred higher demand for smaller two-wheelers. Together, these elements contribute to an emerging micro-mobility culture in larger cities such as Sydney, Melbourne, and Brisbane.

Growing Popularity of Adventure and Off-Road Bikes

Australia's vast landscapes and strong outdoor culture have fueled a surge in popularity for adventure and off-road motorcycles. In 2024, off-road motorcycle sales reached 41,178 units, a 2.6% increase from the previous year, reflecting growing demand for dual-sport and trail bikes suited to both on-road travel and rugged terrains. Enthusiasts are drawn to weekend getaways, long-distance touring, and off-the-beaten-path exploration, embracing the trend of "experiential" motorcycling. Events like off-road rallies and expanding online communities further ignite interest in this segment. Major brands like KTM, Yamaha, and BMW are responding with models tailored to Australian conditions, blending durability with comfort. This niche is steadily growing, attracting both seasoned riders and newcomers eager to explore beyond city limits and experience the freedom of the open road.

Growth Drivers of Australia Two-Wheeler Market:

Rising Urban Congestion and Need for Efficient Mobility

The rising congestion in large Australian cities such as Sydney and Melbourne is driving the need for small and efficient transportation systems. Two-wheelers have an edge over cars as they save on commute time, skip traffic jams, and alleviate parking issues. As the population in the urban areas continues to increase, the pressure on the infrastructure has encouraged people to find ways that can enable them to commute to work in less time and within a volume that saves space. Personal mobility devices are also being promoted by local governments to reduce the strain on the transport networks. In addition, motorcycles and scooters are cheaper because the fuel prices are soaring high and parking in cities is very limited. As Australians continue facing delays and costs linked to conventional vehicles, the shift toward agile, two-wheeled transport solutions is gaining momentum, thus driving the market growth in both urban centers and densely populated suburban corridors.

Surging Demand for Cost-Effective Transportation

Affordability is a major factor propelling the growth of the two-wheeler market in Australia. As the cost of living and vehicle ownership rises, motorcycles and scooters present a significantly cheaper alternative for daily travel. According to the Australia two-wheeler market analysis, these vehicles offer lower upfront costs, reduced fuel consumption, and affordable insurance rates compared to passenger cars. In addition, two-wheelers often have lower maintenance expenses and require fewer resources to operate, making them especially appealing to students, gig workers, and budget-conscious consumers. With petrol prices remaining volatile and economic uncertainties affecting disposable incomes, many Australians are turning to two-wheelers for their cost efficiency. This shift is further supported by increasing availability of entry-level models and second-hand options, making personal mobility more accessible across income segments.

Expanding E-Commerce and Delivery Services

The rapid expansion of e-commerce, food delivery, and courier services across Australia has significantly boosted the demand for two-wheelers. These vehicles are preferred by last-mile delivery providers due to their maneuverability, fuel efficiency, and ability to access congested or narrow roads quickly. Companies like Uber Eats, DoorDash, and local logistics platforms increasingly rely on motorcycles and scooters to meet fast delivery expectations. As consumer preferences shift toward same-day or instant delivery, two-wheelers offer an optimal solution for improving delivery timelines and reducing operational costs. This growing segment also attracts independent contractors who seek flexible, affordable mobility tools. As e-commerce continues to grow, especially in suburban and urban locations, the demand for delivery-friendly two-wheelers is set to rise steadily, fueling overall market expansion.

Opportunities of Australia Two-Wheeler Market:

Growing Focus on Sustainability

Australia's increasing focus on sustainability and emission reduction has created a strong opportunity for electric two-wheelers. Government policies supporting green mobility, combined with rising environmental awareness among consumers, are driving interest in battery-powered motorcycles and scooters. Urban areas, in particular, are witnessing higher demand for electric models due to their low noise, minimal emissions, and lower operating costs. Incentives such as tax benefits, reduced registration fees, and charging infrastructure investment further encourage adoption. With advancements in battery range and charging speed, electric two-wheelers are becoming more viable for daily commuting and delivery services. Manufacturers and startups focusing on affordable, lightweight, and efficient electric models are well-positioned to tap into this emerging segment, signaling a transformative phase in Australia’s mobility landscape.

Technological Advancements Enhancing Rider Safety and Experience

A growing opportunity in Australia’s two-wheeler market lies in integrating advanced safety and connectivity technologies. As riders increasingly prioritize safety, manufacturers are introducing features such as anti-lock braking systems (ABS), traction control, adaptive headlights, ride-by-wire throttles, and tire pressure monitoring systems. Additionally, the rise of smart dashboards, Bluetooth-enabled helmets, GPS-based navigation, and vehicle telematics is transforming the overall riding experience. These enhancements not only improve rider confidence but also appeal to tech-savvy consumers looking for performance-oriented and connected mobility options. With regulatory bodies encouraging safety compliance and consumers willing to pay a premium for value-added features, two-wheeler makers that invest in technological innovation are well-positioned to capture long-term growth and customer loyalty in the Australian market.

Expansion of Sharing and Subscription-Based Mobility Models

The emergence of shared mobility and vehicle subscription services presents a strong opportunity for the Australia two-wheeler market demand. With growing urbanization and rising cost-consciousness, consumers are exploring flexible, low-commitment options for transportation. Startups and mobility platforms can leverage this by offering motorbike rentals, scooter-sharing systems, and short-term lease plans in city centers, universities, and business districts. These services reduce ownership burdens while enhancing access to convenient personal mobility. Integration with digital platforms and mobile apps also improves user experience, boosting appeal among younger and tech-savvy riders. As consumer attitudes shift toward usage over ownership, this model supports both sustainability goals and urban traffic management, offering a scalable and profitable path for two-wheeler market expansion.

Challenges of Australia Two-Wheeler Market:

Safety Concerns and Infrastructure Limitations

One of the biggest challenges facing Australia’s two-wheeler market is safety. Motorcyclists and scooter riders are significantly more vulnerable on the road compared to car users. The lack of dedicated two-wheeler lanes in most cities increases the risk of accidents, particularly during peak hours. While some urban areas have bike-friendly infrastructure, it remains limited and inconsistent across regions. In addition, many motorists lack adequate awareness or respect for two-wheeler users, further raising safety concerns. These issues deter potential new riders, particularly among older demographics and families. Governments have begun investing in awareness campaigns and improving road design, but progress is gradual. Until comprehensive safety reforms and infrastructure upgrades are implemented, safety-related apprehensions will continue to hinder the wider adoption of two-wheelers in Australia.

High Ownership Costs and Limited Financing

Despite the appeal of two-wheelers as cost-effective transport options, the total cost of ownership in Australia can be relatively high. Initial purchase prices for motorcycles—especially electric or imported models—remain expensive due to tariffs, dealership fees, and limited availability of local manufacturing. Insurance premiums are often higher for two-wheelers due to perceived risk, and financing options for scooter or motorcycle buyers are not as widely accessible or flexible as for car loans. Moreover, maintenance and spare parts for premium or foreign brands may be costly or difficult to source. These economic barriers disproportionately affect younger and low-income buyers, potentially restricting market expansion. As a result, many potential users may delay or abandon the idea of switching to two-wheelers despite their functional advantages.

Regulatory Hurdles and Licensing Constraints

Navigating the regulatory landscape for two-wheeler usage in Australia can be complex, especially for new riders. Each state and territory has its licensing requirements, including mandatory learner training programs and testing that can be time-consuming and costly. Additionally, restrictions such as engine size limitations for learners (LAMS-approved bikes) may deter consumers looking for flexibility and choice. For electric two-wheelers, the lack of standardized classification and regulatory frameworks creates confusion regarding licensing, registration, and road use. These bureaucratic challenges can discourage first-time buyers or delay entry into the market. Streamlining licensing systems and introducing uniform rules for electric and conventional two-wheelers would be crucial steps toward unlocking wider participation in the sector and ensuring sustainable market growth.

Australia Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, technology, transmission, engine capacity, fuel type, distribution channel, and end user.

Type Insights:

- Scooters

- Mopeds

- Motorcycle

- Electric Two-Wheeler

The report has provided a detailed breakup and analysis of the market based on the type. This includes scooters, mopeds, motorcycle, and electric two-wheeler.

Technology Insights:

- ICE

- Electric

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes ICE and electric.

Transmission Insights:

- Manual

- Automatic

The report has provided a detailed breakup and analysis of the market based on the transmission. This includes manual and automatic.

Engine Capacity Insights:

- <100cc

- 100-125cc

- 126-180cc

- 181-250cc

- 251-500cc

- 501-800cc

- 801-1600cc

- >1600cc

A detailed breakup and analysis of the market based on the engine capacity have also been provided in the report. This includes <100cc, 100-125cc, 126-180cc, 181-250cc, 251-500cc, 501-800cc, 801-1600cc, and >1600cc.

Fuel Type Insights:

- Gasoline

- Petrol

- Diesel

- LPG/CNG

- Battery

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes gasoline, petrol, diesel, LPG/CNG, and battery.

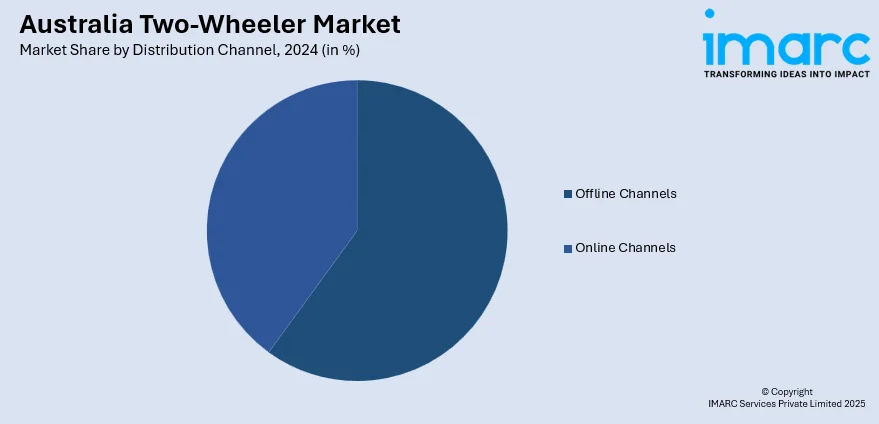

Distribution Channel Insights:

- Offline Channels

- Online Channels

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline channels and online channels.

End User Insights:

- Personal

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes personal and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Two-Wheeler Market News:

- In March 2025, Royal Enfield’s 2025 Classic 350 landed in Australia, offering riders a nostalgic yet robust ride. With styling rooted in the 1950s, it features a modern LED headlight and a substantial, roomy feel uncommon in its class. Inspired by legends like the Bullet 500, the Classic 350 combines heritage design with a plush seat and wide handlebars, delivering timeless charm and comfort for old-school motorcycling enthusiasts.

- In November 2024, The flagship 60kW Alpha and 40kW Delta variants of the 2024 C-Series were introduced by Australian startup Savic Motorcycles. With sleek design, impressive performance (0-100 km/h in 3.5 seconds), and zero emissions, these electric bikes are set to disrupt the market. Priced from $19,990, Savic aims for global expansion and an IPO, offering a premium, sustainable option for both motorbike enthusiasts and commuters.

Australia Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Scooters, Mopeds, Motorcycle, Electric Two-Wheeler |

| Technologies Covered | ICE, Electric |

| Transmissions Covered | Manual, Automatic |

| Engine Capacities Covered | <100cc, 100-125cc, 126-180cc, 181-250cc, 251-500cc, 501-800cc, 801-1600cc, >1600cc |

| Fuel Types Covered | Gasoline, Petrol, Diesel, LPG/CNG, Battery |

| Distribution Channels Covered | Offline Channels, Online Channels |

| End Users Covered | Personal, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The two-wheeler market in Australia was valued at USD 2.77 Billion in 2024.

The Australia two-wheeler market is projected to exhibit a CAGR of 6.27% during 2025-2033.

The Australia two-wheeler market is projected to reach a value of USD 4.79 Billion by 2033.

Urban congestion and limited parking boost scooter and motorcycle adoption. The cost-efficiency and fuel savings also attract budget-conscious commuters, thus driving the market. The gig economy’s rise fuels demand for delivery riders, and environmental awareness alongside electric vehicle incentives supports broader EV two-wheeler growth.

The Australia two-wheeler market is witnessing growth due to the rising demand for electric bikes, increasing adoption of two-wheelers for urban commuting, and growing popularity of adventure and off-road models. Enhanced safety features, smartphone connectivity, and eco-conscious consumer preferences are also influencing product innovations and driving market evolution.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)