Australia Travel Insurance Market Size, Share, Trends and Forecast by Insurance Type, Coverage, Distribution Channel, End User, and Region, 2026-2034

Australia Travel Insurance Market Size and Share:

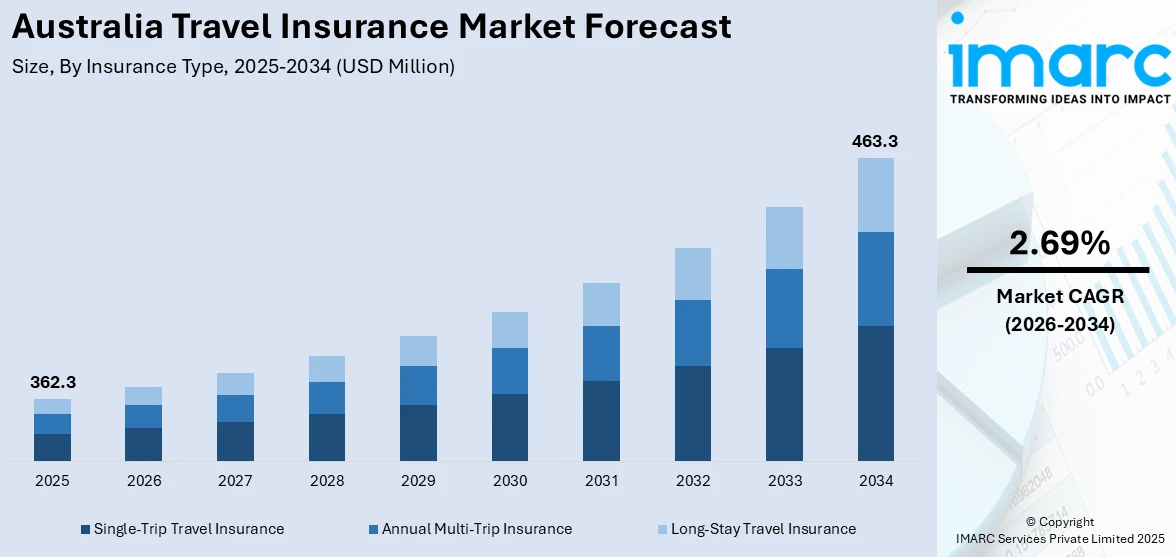

The Australia travel insurance market size was valued at USD 362.3 Million in 2025. Looking forward, the market is projected to reach USD 463.3 Million by 2034, exhibiting a CAGR of 2.69% from 2026-2034. The rising international and domestic travel, increasing awareness of unforeseen travel risks, the growing preference for comprehensive policies, and higher disposable incomes are some factors driving the market demand in the region.

Australia Travel Insurance Market Highlights:

- The Australia travel insurance market generated a revenue of USD 362.3 Million in 2025 and is expected to reach USD 463.3 Million by 2034.

- The Australia market is projected to grow at a CAGR of 2.69% from 2026-2034

- The increased adoption of digital platforms in the region is one of the major drivers for the Australia travel insurance market.

To get more information on this market Request Sample

The Australian travel insurance market is growing steadily, fueled by increasing international and domestic travel among Australians. According to the Australian Bureau of Statistics, the country reported a total travel arrival of around 1,939,260 in 2024. In addition to this, the rising disposable income in the region is promoting the growing interest of people in adventurous and remote destinations, which is supporting the market growth. Moreover, surging concerns over unpredictable events, such as natural disasters, health emergencies, and trip cancellations, are driving awareness and demand for tailored policies, thus aiding in the market expansion. Besides this, the expanding digital platforms allow easy comparison and purchase of insurance plans, making it more accessible to a broader audience, thus providing an impetus to the market.

Concurrently, the partnerships between the insurer, airline, and travel agency are encouraging people to consider insurance as a travel essential, thus boosting the market demand. Furthermore, the affordability of insurance plans is extended by policies providing special options for senior citizens, students, and those with travel-related medical complications, which is impelling the market growth. For instance, the average cost of travel insurance for Australians is about $235.37, a relatively cheap hedge for any traveler. Also, measures taken by the government that promote the significance of insurance especially for international trips are fueling the market demand in the region. Apart from this, the rising medical costs abroad and the potential for financial losses from unforeseen disruptions make travel insurance an indispensable safeguard, thereby propelling the market forward.

Key Trends of Australia Travel Insurance Market:

Increased adoption of digital platforms

The increased adoption of digital platforms is expanding the market demand for travel insurance in Australia. In line with this, the customers are inclined toward online and mobile applications to compare and buy travel insurance policies. These platforms offer transparency, convenience, and provide customization for travelers. Moreover, the availability of customer support in real-time via chatbots and other artificial intelligence (AI) tools, makes the process seamless for the users. For example, AI-powered chatbots in travel insurance can handle up to 80% of customer inquiries, streamlining the customer experience. Besides this, with continuous advancements in digital solutions, insurance providers are targeting the use of data analysis in customizing insurance products for consumers. This is further enhancing the rates for their insurance policies thereby providing an impetus to the market.

Rising demand for comprehensive coverage

The rising demand for comprehensive travel insurance policies is surging the demand for travel insurance in Australia, as travelers seek protection against a broader range of risks. For instance, a study found that one in six Australians (16%) were not covered by any form of travel insurance when they embarked on their last international trip, highlighting the need for increased awareness. Additionally, Australian travelers are focusing on medical evacuation, trip cancellation, and baggage loss. This shift is primarily due to the growing concern with possible monetary losses during traveling, especially after the occurrence of global crises. Furthermore, insurers are developing products, addressing the different needs of travelers such as the young, elderly, and families. Besides this, the concentration on comprehensive insurance services is altering the expectations of the customers and encouraging the insurers to align with the rising demand, thus aiding the market growth.

Emphasis on sustainable and ethical travel insurance

The increasing emphasis on sustainability is driving the market demand for travel insurance in Australia. Travelers are developing more concerns regarding policies related to eco-responsible travel. For example, one in five of the insured travelers claimed to have read every detail of their product disclosure statement (PDS) before traveling, reflecting a growing awareness and careful consideration of policy terms. Concurrently, several companies are offering new products to address sustainable tourism experiences such as carbon-neutral travel and green hotels. Apart from this, the shifting trend towards promoting the right business behaviors such as insurance for the disruption of the trip is rising due to environmental and social concerns. As a result, this trend is indicative of the changing attitude of travelers' awareness of the impact they make on the environment, incorporating sustainability in insurance products, thereby catalyzing the market growth.

Growth Drivers of Australia Travel Insurance Market:

Rising Travel Activity

As travel resumes both domestically and internationally, there has been a marked rise in the demand for travel insurance. With people returning to travel post-pandemic for both short and long journeys, awareness of potential risks associated with traveling has grown. These risks encompass unexpected disruptions like flight cancellations, lost luggage, and natural disasters. Consequently, travel insurance has emerged as an essential element of travel planning. Whether traveling for business or leisure, individuals are increasingly choosing comprehensive coverage to protect their financial investments and ensure a safer, more relaxed experience. The surge in international trips and the desire for reassurance are propelling the growth of the travel insurance market in Australia.

Increased Consumer Awareness

In recent times, there has been a significant increase in consumer awareness regarding the risks connected to travel, resulting in higher adoption rates of travel insurance. Travelers are now better informed about potential challenges, such as medical emergencies, trip cancellations, lost luggage, and even risks related to terrorism. As global travel becomes increasingly complex, individuals are taking proactive steps to secure coverage that shields them from financial losses caused by these unexpected events. Amplified by social media, news coverage, and educational initiatives highlighting the importance of travel insurance, more people are acknowledging that this coverage is a vital safeguard for their travel investments, ensuring their protection throughout their journeys.

Customization Options

Insurance providers in Australia are progressively offering personalized policies tailored to the specific needs of travelers. This customization enables individuals to choose coverage that aligns with their unique interests and activities, including options for adventure sports, medical evacuation, or coverage against COVID-related disruptions. With the growth of specialized travel experiences such as eco-tourism, solo adventures, and long-term excursions, insurers are developing flexible plans that address the specific risks associated with these pursuits. Moreover, pandemic-related coverage has gained prominence in many policies due to ongoing health concerns. These tailored choices empower consumers to select the most relevant protections for them, ensuring they have adequate coverage in place. According to Australia travel insurance market analysis, this trend toward customization is likely to continue fueling market growth, as consumers increasingly seek personalized solutions.

Government Support of Australia Travel Insurance Market:

Regulatory Framework

The Australian government has established a robust regulatory system to ensure that travel insurance providers operate fairly and transparently. This system prioritizes the protection of consumer rights by mandating that insurance companies clearly present their terms, conditions, and exclusions. Regulations set by organizations such as the Australian Prudential Regulation Authority (APRA) ensure that these providers comply with financial standards, allowing consumers to have confidence that their claims will be honored when necessary. The clear guidelines help consumers grasp the extent of their coverage, reducing the risk of misleading practices and promoting a safer, more dependable insurance environment in Australia.

Consumer Awareness Campaigns

The Australian government plays an essential role in promoting awareness about the significance of travel insurance. Through various initiatives, it educates travelers on the potential risks of traveling without insurance, emphasizing situations like trip cancellations, medical emergencies, and lost luggage. These efforts aim to help Australians recognize the financial protection and peace of mind that travel insurance provides. By offering information on the different available policy options, the government encourages travelers to make informed choices and ensure they are adequately protected. This proactive strategy aims to enhance the overall uptake of travel insurance within the Australian market.

Support During Crises

During significant disturbances like the COVID-19 pandemic, the Australian government collaborated closely with the travel insurance industry to offer more flexible coverage options for travelers. Acknowledging the uncertainty caused by the global health crisis, the government implemented measures that enabled consumers to secure coverage for cancellations, travel delays, and pandemic-related medical expenses. This included relaxing certain policy conditions and ensuring that policies could adapt to the swiftly changing circumstances. The government’s partnership with insurers played a vital role in safeguarding Australians traveling during the crisis, providing them with adequate support and assistance during challenging times and fostering trust in the industry.

Australia Travel Insurance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia travel insurance market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on insurance type, coverage, distribution channel, and end user.

Analysis by Insurance Type:

- Single-Trip Travel Insurance

- Annual Multi-Trip Insurance

- Long-Stay Travel Insurance

Single-trip travel insurance is primarily driving the demand for travel insurance in Australia, as several people are seeking short-term coverage. It is ideal for individuals or families planning one-off vacations and business trips, offering protection against medical emergencies, cancellations, and lost baggage. Its affordability and simplicity attract infrequent travelers, bolstering its widespread adoption across diverse demographics and impelling the market growth.

Additionally, annual multi-trip insurance is increasing the demand for travel insurance in Australia, as it is issued for one year and covers several trips in a one-year policy. This option is quite suitable for business people and frequent travelers who do not wish to spend more time on their errands. Besides this, comprising features such as medical emergencies and trip interruption is strengthening the market growth.

Furthermore, long-stay travel insurance is fueling the demand for travel insurance in Australia, because it is designed to embark on extended journeys, such as study abroad programs, work assignments, and gap years. This provides specific requirements such as additional medical insurance, trip cancellation, and repatriation. This plan offers a sense of security for long-term travel, thereby aiding in the market growth.

Analysis by Coverage:

- Medical Expenses

- Trip Cancellation

- Trip Delay

- Property Damage

- Others

The demand for travel insurance in Australia is primarily driven by medical expenses, as it protects against accidents and diseases while traveling. This includes hospitalization, surgeries, and evacuation in cases of medical emergencies, preventing travelers from incurring high costs, and gaining the required security. This segment is further considered the foundation of travel insurance in the region, thereby providing an impetus to the market.

Besides this, trip cancellation is rising the demand for travel insurance in Australia, as this coverage safeguards travelers against financial losses from canceled plans and unforeseen circumstances like illness or emergencies. Also, this feature is highly valued, as it reimburses prepaid expenses, such as flights or accommodations, reducing potential monetary setbacks, which is contributing to the market expansion.

Furthermore, the demand for travel insurance in Australia is driven by trip delay coverage because it reimburses the traveler for expenses that arise from a delay in the trip, meals, lodging, and lost connection. In addition, it is a real-world solution for managing the disruption of travel and improving the quality of the traveling experience and safety, thereby providing an impetus to the market.

Concurrently, property damage coverage is expanding the travel insurance demand in Australia, as it includes protection for lost, stolen, or damaged belongings, such as luggage and personal items. This feature primarily appeals to travelers seeking financial recovery for their valuables, promoting confidence in travel plans despite potential mishaps, and catalyzing the market growth.

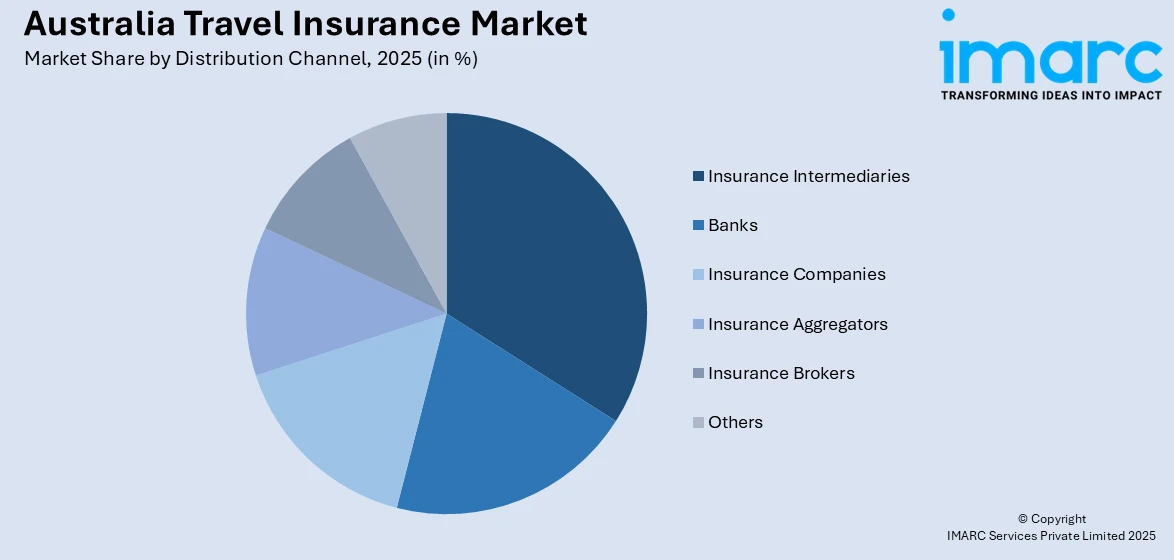

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Insurance Intermediaries

- Banks

- Insurance Companies

- Insurance Aggregators

- Insurance Brokers

- Others

Insurance intermediaries are increasing the demand for travel insurance in Australia owing to their significant role in linking customers to appropriate travel insurance policies. It makes it easy to understand and select policies as they are assigned according to the needs of a person. Also, first-time buyers are the most frequent users of this channel as they require assistance and individual attention, which is aiding the market growth.

Moreover, the demand for travel insurance in Australia is rising due to travel insurance as it is an added-value financial service provided by banks as a package service with credit cards or premium accounts. Banks are a popular channel among travelers because of their existing clients and their confidence in financial products to ensure frequent users, which is significantly contributing to the market expansion.

Besides this, insurance companies are growing the demand for travel insurance in Australia, as direct purchase is a preferred choice for many Australians. Companies provide comprehensive policy options and competitive pricing, often paired with dedicated customer support. This makes them a reliable and accessible channel for travelers which is bolstering the market demand.

Additionally, the demand for travel insurance in Australia is surging due to online insurance aggregators, as they facilitate easy comparisons of policies from multiple providers, enabling informed decisions. Their transparency and user-friendly platforms appeal to tech-savvy customers seeking convenience, driving digital adoption and impelling the market growth.

Furthermore, insurance brokers are fueling the demand for travel insurance in Australia because they are intermediaries who provide necessary information and help in choosing proper travel insurance products. They serve specific requirements like business travel, and long-term coverage, which is a good choice for detailed and individual services, propelling the market forward.

Analysis by End User:

- Senior Citizens

- Education Travelers

- Business Travelers

- Family Travelers

- Others

Senior citizens prioritize travel insurance for coverage against medical emergencies and trip cancellations, which is boosting the demand for travel insurance in the region. Policies catering to their specific needs, such as pre-existing medical conditions and extended coverage, provide reassurance, significantly contributing to the market expansion.

Additionally, education travelers, including students studying abroad and participating in exchange programs, require long-term coverage for medical expenses, tuition protection, and trip cancellations, thus providing an impetus to the market. These tailored policies support the unique needs of this segment, ensuring peace of mind for students and families, which is strengthening the market share.

Moreover, business travelers rely on travel insurance for coverage against trip delays, cancellations, and medical emergencies, aiding the market growth. Policies often include specialized features such as liability protection and emergency assistance, making them indispensable for corporate travel and frequent professional trips, thus fueling the market demand.

Concurrently, family travelers seek comprehensive insurance that covers multiple individuals for medical emergencies, trip cancellations, and lost baggage, aiding the market growth. Group policies designed for families provide convenience and cost-efficiency, driving demand among those traveling with children or extended family members, thereby catalyzing the market demand.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

In the Australia Capital Territory and New South Wales, the demand for travel insurance is rising because of the large population and high number of travelers. Also, preventive care is common with people choosing to be insured for their foreign travel, medical costs, cancellation of trips, and family travel insurance, thus bolstering the market demand.

The demand for travel insurance in Victoria and Tasmania is increasing concern due to the growing adoption of international traveling for tourism and studying purposes. Policies targeting students and families are widely preferred as they capture the mobility trends of this population in this region, which is impelling the market growth.

In Queensland, the demand for travel insurance is surging, as it is a tourist destination with an active travel population, domestically and internationally. In line with this, the demand for adventure coverage and family policies aligns with the travel-loving state, fostering the market expansion.

The demand for travel insurance in the Northern Territory and Southern Australia is expanding, driven by the extensive requirements of travel medical insurance for overseas travel. Apart from this, specific policy solutions receive attention due to the long-stay and adventure travel patterns characteristic of this region, supporting the market growth.

In Western Australia, the demand for travel insurance is fueled by its strong economic base and frequent business and leisure travel. Furthermore, policies addressing corporate travel needs and extended international coverage are significantly contributing to the market expansion.

Competitive Landscape:

The competitive landscape of the Australian travel insurance market is characterized by a mix of established insurance companies, specialized travel insurers, and emerging digital platforms. Major players, including domestic providers and international brands, compete by offering comprehensive coverage plans tailored to various traveler segments, such as families, students, and senior citizens. Moreover, the market is increasingly driven by digital transformation, with aggregators and mobile apps simplifying policy comparison and purchase, giving smaller players an edge in accessibility. Besides this, strategic cooperation with insurance companies on airlines and travel agencies improves market access and addressability. Furthermore, the flexibility of offering prices that are comparable to that of competitors, and value-added services such as any time helpline and telemedicine are considered strengths. Apart from this, new specialized fields are gradually being developed due to the changes in customer requirements, such as increasing emphasis on sustainability and the growing interest in coverage of adventure tourism.

The report provides a comprehensive analysis of the competitive landscape in the Australia travel insurance market with detailed profiles of all major companies.

Latest News and Developments:

- In July 2024, the National Roads and Motorists Association (NRMA) Insurance released a campaign that sought to rebrand it as a help company. This initiative is to enhance the branding and build trust associated with the brands among Australian consumers.

- In June 2024, Southern Cross Travel Insurance (SCTI) published its latest ‘Future of Travel’ report looking at Australian travel intentions and how the cost-of-living crisis is affecting travel. According to the report, 83 percent of Australians expect to cut back on travel costs, which has informed SCTI’s creation of cheaper travel insurance products.

Australia Travel Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Single-Trip Travel Insurance, Annual Multi-Trip Insurance, Long-Stay Travel Insurance |

| Coverages Covered | Medical Expenses, Trip Cancellation, Trip Delay, Property Damage, Others |

| Distribution Channels Covered | Insurance Intermediaries, Banks, Insurance Companies, Insurance Aggregators, Insurance Brokers, Others |

| End Users Covered | Senior Citizens, Education Travelers, Business Travelers, Family Travelers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia travel insurance market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia travel insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia travel insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Travel insurance is a financial product providing coverage for unexpected events that occur during travel, such as trip cancellations, medical emergencies, delays, lost baggage, and property damage. It ensures financial protection and peace of mind, making it essential for domestic and international trips.

The Australia travel insurance market was valued at USD 362.3 Million in 2025.

IMARC estimates the Australia travel insurance market to exhibit a CAGR of 2.69% during 2026-2034.

Key factors driving the Australia travel insurance market are increasing international and domestic travel, rising awareness of travel-related risks, digital platforms simplifying policy access, surging demand for comprehensive coverage, and evolving traveler preferences.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)