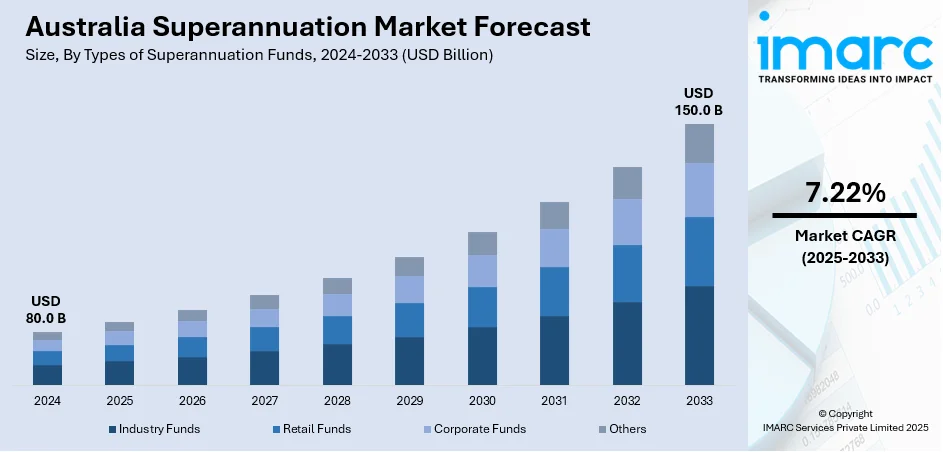

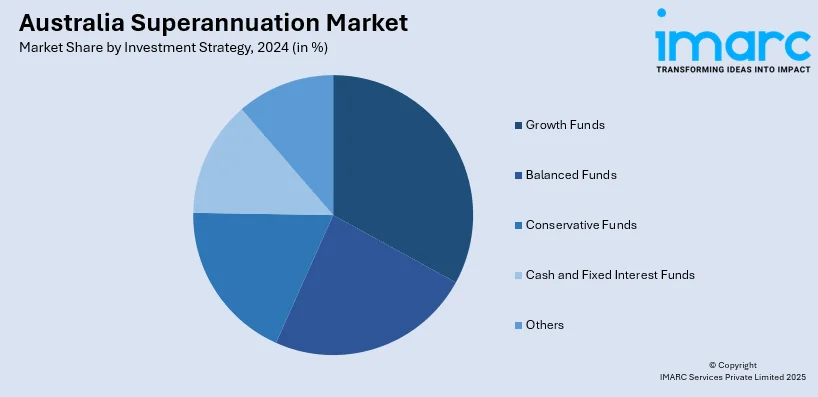

Australia Superannuation Market Report by Types of Superannuation Funds (Industry Funds, Retail Funds, Corporate Funds, and Others), Investment Strategy (Growth Funds, Balanced Funds, Conservative Funds, Cash and Fixed Interest Funds, and Others), and Region 2025-2033

Australia Superannuation Market Size and Share:

The Australia superannuation market size reached USD 80.0 Billion in 2024. Looking forward, the market is projected to reach USD 150.0 Billion by 2033, exhibiting a growth rate (CAGR) of 7.22% during 2025-2033. The market is driven by several factors, such as mandatory contributions from employers, a steadily expanding aging population base, increasing financial literacy among individuals, and favorable government policies promoting retirement savings.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 80.0 Billion |

|

Market Forecast in 2033

|

USD 150.0 Billion |

| Market Growth Rate 2025-2033 | 7.22% |

Key Trends of Australia Superannuation Market:

Mandatory Employer Contributions

One of the major drivers of the Australian superannuation market is the compulsory employer contributions mandated by the government. Under the Superannuation Guarantee, employers must contribute a fixed percentage of their employees' salaries into superannuation funds. This system has created a steady inflow of funds into the superannuation market, significantly boosting its growth. These contributions ensure that employees have retirement savings, fostering a consistent increase in fund assets over time. For instance, according to industry reports, the Australian superannuation industry, valued at AUD 3.5 trillion, is a significant player in the local investment landscape. Super funds are increasingly diversifying into non-traditional assets and exploring global opportunities. As contribution rates continue to rise, the market is expected to expand further.

To get more information on this market, Request Sample

Aging Population and Retirement Planning

Australia's aging population is another significant factor driving the superannuation market. According to the Australian Bureau of Statistics, the number of Australians aged 85 years and over is expected to double by 2042, surpassing 1 million people. This age group could represent 3% of the population. Additionally, the population aged 65 years and over will nearly double, reaching between 6.4 to 6.7 million by 2042. As the population ages and more individuals approach retirement, the need for retirement planning and adequate savings grows. The superannuation system plays a crucial role in ensuring Australians have enough funds to support their retirement years. As life expectancy increases, individuals are looking to optimize their superannuation investments for long-term financial security, which boosts market activity. This trend is expected to continue as the demographic shift toward an older population intensifies. For instance, in July 2024, Australia raised its superannuation guarantee rate from 11% to 11.5%, benefiting workers by increasing their retirement savings. This incremental rise is set to reach 12% by July 2025.

Government Policies and Tax Incentives

Government policies and tax incentives have played a pivotal role in shaping the superannuation market. Various tax advantages, such as concessional tax rates on contributions and earnings, make superannuation a tax-effective way to save for retirement. Additionally, government co-contributions for lower-income earners and incentives for voluntary contributions encourage individuals to maximize their superannuation savings. For instance, in March 2024, the Albanese government, the federal executive government of Australia, announced that from July 2025, eligible parents will receive an additional 12% superannuation on their government-funded parental leave. This initiative aims to close the retirement savings gap between men and women, as women typically retire with 25% less super than men due to time spent out of the workforce for caregiving. The policy, expected to cost $250 Million annually, reflects the government’s focus on gender equality. Moreover, the Fair Work Commission in January 2024 recommended changes to the laws allowing people with disabilities in supported employment to receive lower superannuation rates than other workers. Currently, these employees receive 9.5% super, while the rest of the workforce gets 11%. The proposed change would align the super rate with the national standard, reflecting updates to superannuation laws. These policies stimulate higher contributions and promote long-term investment growth, further driving the expansion of the superannuation market in Australia.

Growth Drivers of Australia Superannuation Market:

Workforce Participation Expanding the Contributor Base

The ongoing increase in workforce participation particularly among women, part-time workers, and older Australians is crucial for broadening the contributor base of the superannuation system. As more individuals enter or return to the labor market the number of mandatory contributions under the Superannuation Guarantee continues to rise. This expansion enhances the overall fund pool and provides superannuation providers with greater opportunities for varied investments and long-term strategies. Additionally, changes in workforce demographics such as postponed retirement and flexible working conditions are maintaining contributions for an extended period. This evolving employment landscape is reinforcing the overall Australia superannuation market share and solidifying its importance in ensuring long-term financial security and capital accumulation.

Asset Diversification Boosting Market Performance

Superannuation funds in Australia are increasingly moving away from traditional domestic investments towards a more diversified global portfolio, which includes equities, infrastructure, real estate, and alternative assets. This strategic approach to diversification aims to balance risk with the goal of enhancing long-term returns, especially in a low-interest-rate climate. The shift also demonstrates a growing focus on sustainable and socially responsible investing that resonates with contemporary contributors. By distributing risk across various asset classes and geographical regions, super funds can achieve more stable results and better withstand economic variability. This trend is fostering improved fund performance, thereby boosting investor confidence and encouraging voluntary contributions, which, in turn, supports the growth of overall Australia superannuation market demand.

Digital Tools Transforming Superannuation Engagement

The incorporation of digital tools within the superannuation framework is transforming user experiences and operational efficiency. Online dashboards, mobile applications, and automated advisory services are enabling members to easily track contributions, modify investment strategies, and plan for retirement goals with increased transparency. These platforms enhance member engagement and streamline processes for fund managers. Younger generations, in particular, tend to favor digital interfaces, which helps stimulate early contributions and long-term financial planning. The use of advanced data analytics and AI-driven tools is also facilitating improved decision-making and fund management. This escalating dependence on technology is reshaping the retirement landscape according to Australia superannuation market analysis, making digital transformation a vital growth driver.

Opportunities of Australia Superannuation Market:

Rise of ESG Investing Aligning with Member Values

Environmental, Social, and Governance (ESG) investing is becoming a significant opportunity in Australia’s superannuation sector. An increasing number of members, particularly younger contributors, are seeking ethical and sustainable investment options that align with their beliefs. Super funds are responding by embedding ESG frameworks into their investment strategies, directing capital towards clean energy, social infrastructure, and responsible corporate behavior. This approach improves long-term risk management and fosters greater member trust and loyalty. Funds that emphasize ESG strategies are likely to achieve a competitive advantage in attracting and retaining members. By intertwining financial returns with social impact, ESG investing is emerging as a vital factor in Australia superannuation market growth in terms of both value and significance.

Reaching the Gig and Freelance Workforce

The growing gig and freelance economy in Australia present an underutilized opportunity for the superannuation sector. Independent workers often miss out on regular employer contributions and encounter hurdles in maintaining consistent savings. By developing flexible contribution structures such as micro-contributions, mobile payment solutions, or real-time deductions based on earnings super funds can cater to self-employed individuals. Customized educational initiatives and user-friendly digital onboarding processes can also enhance participation rates. Engaging this workforce expands the contributor base and promotes long-term financial inclusivity. As the non-traditional workforce expands, super funds that tailor their offerings to meet these workers’ unique needs can tap into a valuable demographic and diversify their sources of capital.

Enhancing Member Experience Through Digital Innovation

Digital innovation is creating new pathways for engagement and personalization within the superannuation sector. Advanced member platforms that feature intuitive dashboards, mobile applications, and robo-advisors enable users to manage their retirement savings with improved control and transparency. These tools provide real-time access to account balances, investment performance, and planning calculators encouraging more proactive decision-making regarding retirement. Personalization elements, such as goal-setting and customized advice, enhance emotional and financial connections with the fund. As tech-savvy younger generations join the workforce, a strong digital experience is becoming a crucial differentiator. Funds that focus on digital transformation enhance member loyalty and position themselves for sustained relevance in a fast-evolving market.

Challenges of Australia Superannuation Market:

Regulatory Uncertainty Impacting Long-Term Stability

A major issue confronting Australia’s superannuation sector is the unpredictability of regulations. Frequent adjustments in governmental policies, tax regulations, and contribution rules can disrupt strategic planning for both superannuation funds and their members. Super funds often find it challenging to quickly adapt to changing legislative environments, which can influence investment strategies, administrative processes, and compliance measures. For contributors, unexpected modifications in retirement age, tax advantages, or access guidelines can generate confusion and erode trust in the system. This lack of stability complicates the ability to confidently plan for long-term retirement objectives. A consistent regulatory framework is crucial for building trust and ensuring the sustainable development of the superannuation sector in the future.

Low Member Engagement Limiting Superannuation Potential

Limited member engagement continues to be a significant obstacle to fully realizing the potential of Australia’s superannuation system. Numerous individuals, especially younger and lower-income earners, exhibit minimal interest in tracking or managing their retirement savings. A deficiency in financial literacy, coupled with the perceived complexity of superannuation, frequently results in passive account behavior, missed opportunities for voluntary contributions, and poorly aligned investment decisions. This disengagement can lead to less favorable retirement outcomes and decreased satisfaction with fund performance. Superannuation providers are tasked with the challenge of educating their members, simplifying access to accounts, and offering tools that enable users to make informed choices. Boosting member awareness and participation is vital for the long-term success and inclusiveness of the super system.

Pressure to Improve Fee Transparency and Performance

Superannuation funds in Australia are facing mounting pressure to clarify their fee structures amidst increasing public and regulatory oversight. Members are seeking clearer insights into the management of their funds and the associated costs, particularly concerning investment returns and administrative services. High fees can significantly diminish long-term savings, especially if not accompanied by solid performance. Regulatory authorities are also advocating for transparency and comparability among funds to foster competition and add value for members. This situation compels superannuation providers to find a balance between reducing operational expenses and maintaining high standards of service. In this cost-conscious environment, funds must innovate and enhance efficiency without compromising investment outcomes or member satisfaction.

Australia Superannuation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on types of superannuation funds, and investment strategy.

Types of Superannuation Funds Insights:

- Industry Funds

- Retail Funds

- Corporate Funds

- Others

The report has provided a detailed breakup and analysis of the market based on the types of superannuation funds. This includes industry funds, retail funds, corporate funds, and others.

Investment Strategy Insights:

- Growth Funds

- Balanced Funds

- Conservative Funds

- Cash and Fixed Interest Funds

- Others

A detailed breakup and analysis of the market based on the investment strategy have also been provided in the report. This includes growth funds, balanced funds, conservative funds, cash and fixed interest funds, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Superannuation Market News:

- In May 2024, AustralianSuper announced that they have made significant advancements in its withdrawal process. Post adjustments, the success rate for online withdrawals increased by 10%. Support calls related to withdrawals decreased, resulting in an estimated annual savings of $800,000. These enhancements have streamlined the experience for all members, reflecting AustralianSuper's commitment to continuous system improvements.

Australia Superannuation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Superannuation Funds Covered | Industry Funds, Retail Funds, Corporate Funds, Others |

| Investment Strategies Covered | Growth Funds, Balanced Funds, Conservative Funds, Cash and Fixed Interest Funds, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia superannuation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia superannuation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia superannuation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The superannuation market in Australia was valued at USD 80.0 Billion in 2024.

The Australia superannuation market is projected to exhibit a compound annual growth rate (CAGR) of 7.22% during 2025-2033.

The Australia superannuation market is expected to reach a value of USD 150.0 Billion by 2033.

The key trends of the market are growing interest in ESG-aligned investments, digital member engagement tools, and tailored retirement planning services. Funds are also shifting toward global asset diversification and offering personalized financial advice to improve member outcomes and long-term fund performance.

Mandatory employer contributions, rising workforce participation, and increasing life expectancy are the major growth drivers. Tax incentives, demand for post-retirement income solutions, and the expansion of self-managed super funds (SMSFs) are further driving deeper market penetration and sustained capital accumulation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)