Australia Subscription Box Market Size, Share, Trends and Forecast by Type, Gender, Application, and Region, 2025-2033

Australia Subscription Box Market Overview:

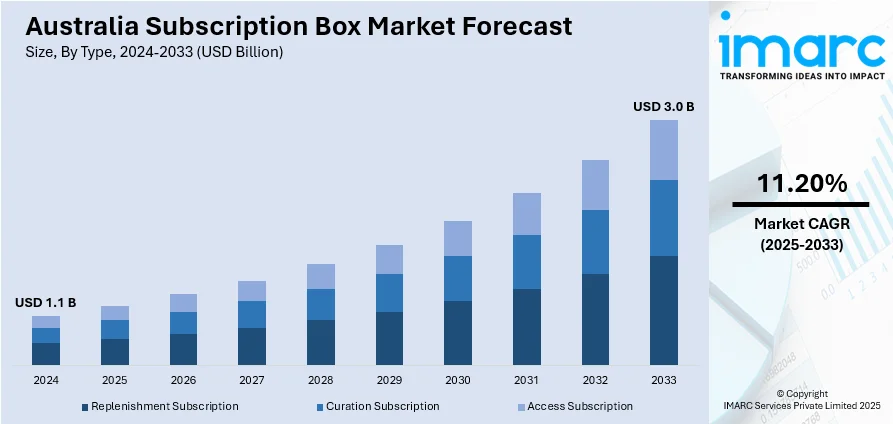

The Australia subscription box market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.0 Billion by 2033, exhibiting a growth rate (CAGR) of 11.20% during 2025-2033. Rising demand for convenience, personalized shopping, and curated experiences, rapid e-commerce growth, improved logistics, escalating social media influence, higher disposable incomes, and growing health awareness are some of the factors providing a considerable thrust to the market gorwth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Market Growth Rate 2025-2033 | 11.20% |

Australia Subscription Box Market Trends:

Demand for Convenience and Personalization

Convenience remains a top priority for Australian consumers seeking time-saving and hassle-free solutions.This has driven the demand for subscription boxes as they provide a solution, delivering curated products to the consumers. Its format enables customers to skip the burden of shopping trips and product comparisons, which is further providing a thrust to the Australia subscription box market growth. In order to increase customer satisfaction and loyalty, umpteen platforms are leveraging personalization in every box, through a quiz, preferences, or artificial intelligence (AI) powered tools, which is propelling the Australia subscription box market share. As Australians increasingly embrace work-from-home arrangements and fast-paced lifestyles, they are more inclined toward services that simplify decision-making and streamline daily routines, further fueling market growth.

To get more information on this market, Request Sample

Growth of Food and Drink Subscription Services

The Australian subscription box market for food and beverage has grown aggressively, fueled by shifting consumer patterns, convenience, and the increasing popularity of online shopping. Furthermore, rising inclination of Australians toward gourmet food and high-quality cuisine at home, and subscription is becoming a must-have component in the changing food landscape. According to the sources, the Australian meal kit industry, featuring top brands such as HelloFresh and Marley Spoon, grew by 20.3% in 2023 as a result of high demand for ready-to-cook meals. The services offer pre-measured ingredients and recipes in step-by-step instructions, minimizing food waste and making it easier to prepare meals. Besides meal kits, specialty food and drink subscriptions are on the rise.

Transition to Flexible and On-Demand Subscription Models

Consumers in Australia are increasingly choosing on-demand and flexible subscription models in place of rigid, long-term commitments. According to a report, 45% of Australian subscription users prefer to skip, pause, or cancel without incurring any charges. This shift reflects changing consumer preferences, where convenience and control are key decision factors. To adapt, companies are introducing customizable delivery frequencies, trial boxes, and one-time purchase options to attract new customers and improve retention. This trend is particularly common in fashion, beauty, and wellness subscriptions, where customers might not need a monthly supply. For example, beauty box services such as Bellabox now enable subscribers to skip deliveries or change their plans, while wellness companies such as GoodnessMe Box provide flexible prepaid plans.

Australia Subscription Box Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, gender, and application.

Type Insights:

- Replenishment Subscription

- Curation Subscription

- Access Subscription

The report has provided a detailed breakup and analysis of the market based on the type. This includes replenishment subscription, curation subscription, and access subscription.

Gender Insights:

- Male

- Female

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes male and female.

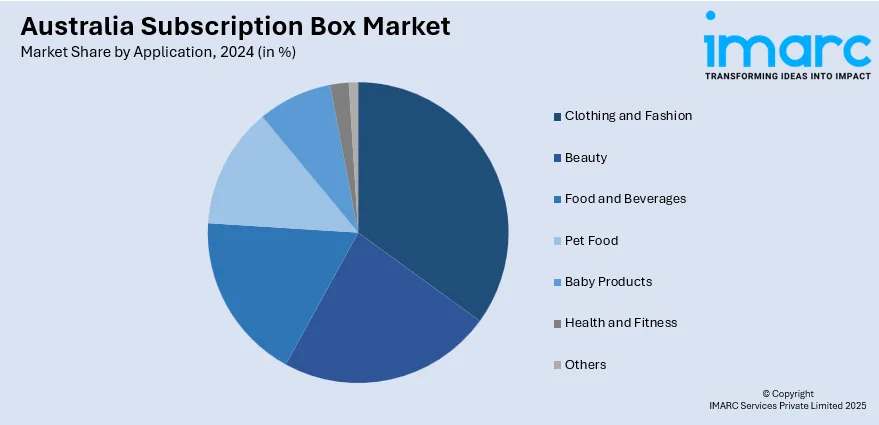

Application Insights:

- Clothing and Fashion

- Beauty

- Food and Beverages

- Pet Food

- Baby Products

- Health and Fitness

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes clothing and fashion, beauty, food and beverages, pet food, baby products, health and fitness, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major Australia markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Subscription Box Market News:

- In 2024, In March 2024, Foxtel introduced Hubbl, an aggregator streaming platform that brings together content from multiple providers within a single user interface. Hubbl is accessible through an external digital media player, the Hubbl puck, and the Hubbl Glass, a 4K LED Smart-TV with integrated services.

- In 2025, HBO Max entered Australia, a decade after Netflix debuted. The arrival increased competition among streaming services, pitting local providers such as Stan and Binge against it, and changing content acquisition trends.

Australia Subscription Box Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Replenishment Subscription, Curation Subscription, Access Subscription |

| Genders Covered | Male, Female |

| Applications Covered | Clothing And Fashion, Beauty, Food And Beverages, Pet Food, Baby Products, Health and Fitness, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia subscription box market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia subscription box market on the basis of type?

- What is the breakup of the Australia subscription box market on the basis of gender?

- What is the breakup of the Australia subscription box market on the basis of application?

- What is the breakup of the Australia subscription box market on the basis of region?

- What are the various stages in the value chain of the Australia subscription box market?

- What are the key driving factors and challenges in the Australia subscription box?

- What is the structure of the Australia subscription box market and who are the key players?

- What is the degree of competition in the Australia subscription box market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia subscription box market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia subscription box market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia subscription box industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)