Australia Smart TV Market Size, Share, Trends and Forecast by Resolution Type, Screen Size, Screen Type, Technology, Platform, Distribution Channel, Application, and Region, 2025-2033

Australia Smart TV Market Size and Share:

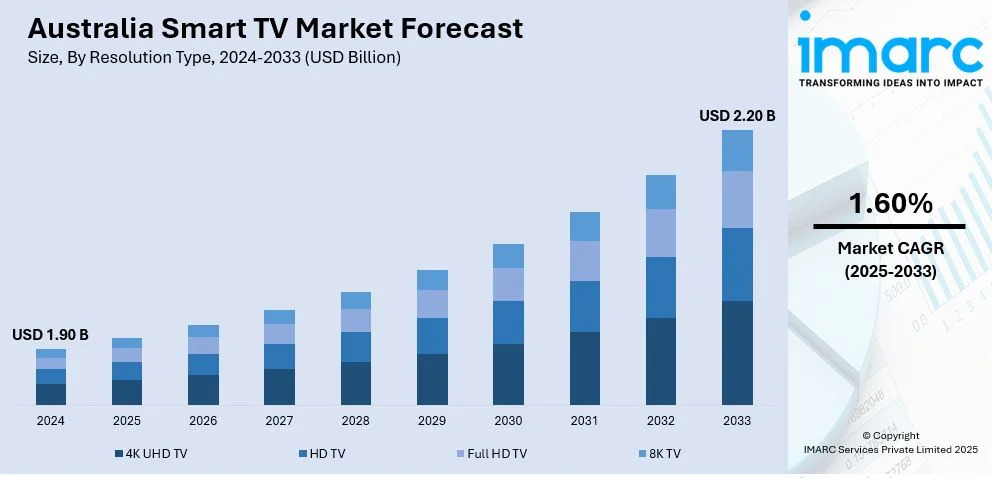

The Australia smart TV market size was valued at USD 1.90 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.20 Billion by 2033, exhibiting a CAGR of 1.60% from 2025-2033. The market is expanding due to increasing broadband penetration, rising OTT streaming adoption, and demand for high-resolution displays. Leading regions, including New South Wales and Victoria, drive growth with strong digital infrastructure, high disposable income, and growing smart home adoption, fueling demand for AI-integrated and energy-efficient smart TVs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.90 Billion |

| Market Forecast in 2033 | USD 2.20 Billion |

| Market Growth Rate (2025-2033) | 1.60% |

The Australia Smart TV market forecast is experiencing rapid growth due to widespread speed improvements, increasing high-speed broadband penetration, and over-the-top (OTT) streaming services. Fiber-optic network adoption and fifth generation (5G) technology have ensured that content is well available, hence removing unwanted buffering and improving the overall viewing experience. Consequently, there is a trend shift among consumers from reliance on basic cable subscriptions to internet-based entertainment channels. The demand for smart televisions (TVs) with the latest operating systems (OS) and application (app) integrations, as well as artificial intelligence (AI)-driven content recommendation, has seen a spike. High disposable income and the gradual shift in consumer preference toward larger screen sizes with better resolutions, from ultra-high definition (4K) to 8K, are contributing factors to market growth. For instance, in January 2024, TCL announced Australia's largest TV, a 115-inch QD-Mini LED model, featuring 20,000+ local dimming zones and 5,000 nits peak brightness. The X955 series, confirmed for Australia later this year, introduces advanced Mini LED technology in the 800 series, enhancing contrast, brightness, and 4K performance. Moreover, superior contrast and color accuracy features through organic light-emitting diode (OLED) and quantum dot light-emitting diode (QLED) technologies of smart TVs also continue influencing purchases. It also provides advanced gaming abilities, voice assistance, and even Internet of Things (IoT) connectivity within a smart television that forms a center in many smart home setups.

To get more information of this market, Request Sample

Heightening consumer awareness on energy efficiency and sustainability are urging manufacturers to create smart TVs that consume low energy, use eco-friendly materials, and display savings. Government initiatives encouraging digital transformation along with tax incentives for embracing the technology are helping to accelerate the growth of the market further. Aggressive pricing policies, promotional discounts, and bundled streaming service subscriptions are changing the competitive landscape, and the trend of making smart TV’s more accessible to a wider demographic is emerging rapidly. Urbanization at a rapid pace and an expanding millennial base, with high digital engagement, are transforming purchasing behavior, making content availability, customization, and ease of integration with other smart devices more important. The emergence of AI-powered picture enhancement, dolby vision, and immersive audio technologies is attracting consumers seeking a premium cinematic experience at home, intensifying competition among key industry players. As manufacturers focus on research and development to differentiate their products, the continuous influx of innovations in display technology, processing power, and user interface design is driving sustained growth in the Australia smart TV market.

Australia Smart TV Market Trends:

Growing Popularity of AI-Integrated Smart TVs

AI is a game-changer in the Australian smart TV market, revolutionizing the Australia smart TV market outlook as it offers personalized content recommendations, voice-activated controls, and advanced upscaling technologies. These AI-driven algorithms scan user preferences, viewing habits, and real-time engagement, which brings about deep suggestions for content streamed across various platforms. This feature improves user experience with reduced search time and enhanced platform stickiness. For example, in March 2024, LG Electronics launched its 2024 smart TV lineup in Australia, featuring OLED Evo and QNED models with the Alpha 11 processor, 144Hz refresh rate, AI-driven upscaling, wireless Dolby Atmos, and improved brightness for enhanced viewing experiences. Furthermore, voice assistants, such as Google Assistant and Amazon Alexa, are now integrated into smart TVs, allowing users to control their devices hands-free, manage smart home appliances, and search for content using natural language processing. AI-enhanced picture optimization, powered by deep learning models, adjusts brightness, contrast, and sharpness dynamically based on ambient lighting conditions and content type, delivering an immersive experience. It further enhances gaming performance by reducing input lag and optimizing frame rates to attract the rapidly growing gaming community. As AI capabilities continue boosting, smart TVs are becoming a center hub for personal digital experiences in the Australian household.

Expansion of Cloud Gaming and Smart TV Gaming Features

Cloud gaming is changing the landscape of the Australia smart TV market, removing expensive gaming consoles and high-end hardware from the playing field. Key cloud gaming services, such as NVIDIA GeForce Now and Xbox Cloud Gaming are now more frequently integrated into smart TVs to allow instant, high-quality access to games via internet connectivity. Latency in games is one of the largest factors in cutting-edge infrastructure deployment; the trend with 5G and fibre-optic broadband infrastructure reduces those issues and presents an almost frictionless gameplay experience. The incorporation of high-refresh panels, Variable Refresh Rate (VRR) technology and dedicated gaming modes from manufacturers reduces the response rate further. Further standard features across new releases are the inclusion of Bluetooth controllers where peripherals can attach directly without external adapters. As gaming becomes mainstream in Australia, the convergence of smart TVs and gaming attracts more young consumers to drive sales growth. As cloud gaming platforms continue to improve, Smart TVs are becoming an accessible alternative to traditional gaming consoles.

Growth of Direct-to-Consumer (DTC) Streaming Services

DTC streaming services are changing the way Australians consume content because they are now turning smart TVs into unique, uninterrupted, and seamless access devices to exclusive content. More and more subscribers switch away from traditional pay-tv subscriptions as platforms like Disney+, Netflix, Amazon Prime Video, and domestic providers Stan and Binge keep investing in more original shows and movies. Smart TVs now come pre-installed with these streaming apps, eliminating the need for external devices and offering a streamlined viewing experience. The introduction of ad-supported streaming tiers is making premium content more accessible to a broader audience, encouraging further adoption. Content aggregation is another emerging trend, with smart TV interfaces integrating multiple streaming services into a single dashboard for easy navigation. Advanced AI-powered content discovery tools help enhance user engagement by suggesting personalized shows across different platforms. With the competition intensifying among streaming providers, smart TVs are becoming the primary medium for digital entertainment, reinforcing their market demand.

Australia Smart TV Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia smart TV market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on resolution type, screen size, screen type, technology, platform, distribution channel, and application.

Analysis by Resolution Type:

- 4K UHD TV

- HD TV

- Full HD TV

- 8K TV

Australia has seen a growth in demand for 4K UHD TVs as more people enjoy enhanced quality of images, affordability, and the widely available streaming content. Consumers are opting for larger screen sizes with higher resolutions, attributed to growing OTT adoption, further gaming, and AI-powered upscaling features that improve clarity, contrast, and color accuracy for an immersed viewing experience.

HD TVs remain relevant in Australia due to affordability and suitability for budget-conscious consumers and secondary TV setups. They are commonly used in smaller rooms, kitchens, and guest spaces where ultra-high resolutions are unnecessary. Retail promotions and bundled streaming service offers continue supporting their presence in the market.

Full HD TVs are the options for mid-range buyers who would like to see better clarity than HD models at a lower price than 4K models. They are suitable for standard television broadcasting, casual gaming, and smaller screen sizes. Their sustainability in the market is due to the constant demand for secondary or non-primary viewing spaces.

Being pushed by ultra-high-definition displays, AI-driven upscaling, and superior motion processing, 8K TVs are gaining ground among the primary adopters as well as premium buyers. Limited native 8K content and high costs currently restrain mass adoption, but growing advancements in display technology and streaming capabilities will drive gradual market expansion.

Analysis by Screen Size:

- Below 32 Inches

- 32 to 45 Inches

- 46 to 55 Inches

- 56 to 65 Inches

- Above 65 Inches

Smart TVs below 32 inches are primarily chosen for compact spaces like kitchens, bedrooms, and dormitories, where large screens are unnecessary. Their affordability and suitability for basic streaming and cable viewing drive steady demand. Budget-conscious consumers and hospitality businesses also favor this segment for cost-effective entertainment solutions in limited spaces.

The 32 to 45-inch category remains quite popular among the urban households and individual users as it offers an appropriate balance of affordability and quality. These models come with advanced display technologies, smart features, and fit medium-sized rooms, so they maintain a high level of demand by providing streaming compatibility, gaming support, and energy-efficient designs for secondary TVs.

Smart TVs within the 46 to 55-inch range cater to consumers looking for immersive viewing experiences without occupying excessive space. This segment is experiencing growing demand due to amplified affordability of 4K resolution, OLED/QLED advancements, and enhanced gaming features. Mid-range buyers prefer these models for balanced screen size and premium features.

The 56 to 65-inch category is expanding rapidly due to the growing preference for cinematic home entertainment. Consumers upgrading to 4K and 8K resolutions favor this segment for its superior display clarity, HDR support, and enhanced refresh rates. AI-powered image processing and premium sound technologies further attract high-end buyers seeking immersive entertainment setups.

Smart TVs above 65 inches are gaining traction among premium buyers and home theater enthusiasts who prioritize high-definition content and an expansive screen experience. The availability of 8K resolution, AI upscaling, and smart home integration enhances demand. As prices become more competitive, this segment is expected to witness continued adoption for luxury entertainment.

Analysis by Screen Type:

- Flat

- Curved

Flat-screen smart TVs have dominated the market in Australia due to their affordability, wide adoption, and advanced display technologies like OLED and QLED. Their slim designs, mounting flexibility, and smart features further enhance user experience. Strong compatibility with gaming, streaming, and smart home devices continues to drive demand across various consumer segments.

A niche crowd for those interested in receiving fully immersive viewing experiences with extra depth perception can find curved screens, but on the downside, it eliminates glares and affords a wrapping effect that does make for better home theatres, and its expense is much steeper than an equivalent flat, fewer in-store offerings, and decreasing manufacturer focus.

Analysis by Technology:

- Liquid Crystal Display (LCD)

- Light Emitting Diode (LED)

- Organic Light Emitting Diode (OLED)

- Quantum Dot Light Emitting Diode (QLED)

A large number of customers in Australia view Liquid Crystal Display (LCD) smart TVs to be within affordable reach for price-sensitive consumers. These models project images through a backlight, creating decent picture qualities at lower cost. They miss the deep blacks and contrast with newer technologies; however, as they are plentiful and affordable for entry-level buyers, they're still in wide use.

Energy-efficient, better brightness, and wider color gamut compared to traditional LCDs is the reason why LED smart TVs dominate. It is also available in numerous resolutions such as 4K and 8K; hence many mass customers prefer purchasing such displays. The longer lifespan and power consumption have also boosted the demand for this market.

Organic Light Emitting Diode (OLED) smart TVs attract premium buyers with superior contrast, deep blacks, and faster refresh rates. They offer better viewing angles and more vibrant colors, making them ideal for home theaters and gaming. Despite higher costs, OLED adoption is rising as manufacturing efficiencies improve and prices become more competitive.

Quantum Dot Light Emitting Diode (QLED) smart TVs appeal to consumers seeking enhanced brightness, richer colors, and improved HDR performance. This technology, pioneered by major brands like Samsung, delivers better color accuracy than standard LED TVs. QLED models are positioned as a mid-to-premium segment option, bridging the gap between LED and OLED displays.

Platform Analysis:

- Android

- Roku

- WebOS

- Tizen OS

- iOS

- My Home Screen

- Others

Android smart TVs occupy the largest chunk of the market in Australia with their huge repository of apps, Google Assistant capabilities, and a seamless Chromecast experience. This means they always have the most recent updates from Google, offer AI-driven content recommendations, and are integrated perfectly with Google services, which helps users to experience customization, voice control, and access to most applications.

Roku smart TVs capture budget-conscious users with a simple interface and good support for the streaming services. Their affordability, easy navigation, and cross-platform search functionality appeal to non-tech-savvy users. They are less feature-rich than Android or WebOS, but since Roku is highly focused on the streaming business, it ensures solid demand among entry-level buyers.

WebOS smart TVs are built in LG models, offering a smooth, intuitive interface and a superior AI-powered content recommendation engine. This platform allows for hands-free voice control, supports a wide range of apps, and boots up fast. Multitasking features and Magic Remote make this product such a strong competitor for the premium market.

Tizen OS is Samsung's proprietary platform, which is adopted widely because of its fast performance, clean interface, and integration into Samsung's smart ecosystem. It supports Bixby, Alexa, and Google Assistant, allowing users to switch flexibly between voice control. The security features, energy-efficient performance, and direct access to exclusive Samsung services help boost the popularity in the mid-to-premium range.

iOS-based smart TVs, mostly Apple TV-based products, cater mainly to Apple user groups, such as seamless iPhone, iPad, and Mac connection. Convenience accelerates with AirPlay, HomeKit, and Siri voice control capabilities, but few standalone iOS-based smart TVs keep the technology niche. Compatibility with premium services through Apple helps it maintain demand by brand loyal users.

My Home Screen, Panasonic’s proprietary OS, offers a straightforward and customizable interface with smooth navigation. It supports key streaming services but lacks the extensive app library of Android or WebOS. Its market presence is limited, appealing mainly to Panasonic TV users who prioritize reliability and picture quality over app diversity.

Other smart TV platforms, including proprietary OS versions from brands like Hisense (VIDAA) and Vizio (SmartCast), serve specific user segments with tailored features. These platforms focus on affordability, content aggregation, and smart home integration, but they face competition from more established ecosystems like Android and Tizen, limiting their overall market share.

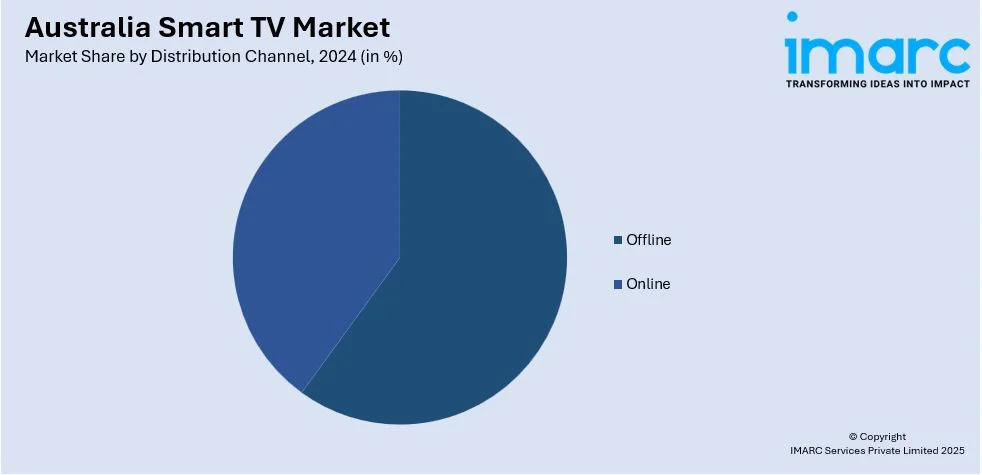

Distribution Channel Analysis:

- Offline

- Online

Offline distribution channels have a higher market share in Australia Smart TV. Consumers prefer buying in stores as they can test the product personally, get advice from experts, and have immediate availability. Retail chains and showrooms provide financing, installation support, and in-store discounts exclusively for premium models. Interactive product displays and personalized assistance boost consumer confidence and purchase decisions.

With increased convenience, competitive prices, and more extensive offerings, online channels for distribution are highly being sought. E-commerce portals provide access to customer reviews, doorstep delivery, and various flexible payment modes. Online-specific deals, festive seasons, and the use of augmented reality, enabling virtual TV placement, amplifies the involvement of customers with the brand, hence leading to more smart TV sales through digital retailing.

Application Analysis:

- Residential

- Commercial

Residential applications dominate the Australia Smart TV market, with households embracing high-resolution displays for streaming, gaming, and smart home integration. Demand for 4K and OLED models, AI-enhanced content recommendations, and voice-controlled interfaces further drives adoption. Consumers are focused on immersive entertainment, energy efficiency, and seamless connectivity with other smart devices, driving market expansion.

Commercial applications, which include hotels, offices, retail, and healthcare, are other areas that play a significant role in the demand for smart TV. Hospitality industries incorporate smart TVs to entertain room occupants, and corporate environments employ them for presentation and digital signage. Retail outlets use high-definition displays for advertisement, and hospitals utilize them to engage patients. Customization and connectivity features have improved commercial uptake.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales lead the Smart TV market with high urbanization, strong broadband penetration, and tech-savvy consumers. Premium models like OLED and 8K TVs are in greater demand as levels of disposable income boosts. Metro influence in Sydney and growing adoption of smart homes further drive regional market expansion.

The strength of Smart TV adoption in Victoria & Tasmania results from a mixture of urban & suburban households, with Melbourne supporting 4K and AI integration due to an advanced high-speed internet infrastructure coupled with digital entertainment preferences. For Tasmania, it is steady with improving e-commerce accessibility and strong demand for energy-efficient models adapted for residential purposes.

Queensland experiences rising Smart TV demand due to increasing digital content consumption and growing tourism-related hospitality investments. Hotels and resorts integrate smart TVs for guest entertainment, while residential users seek large-screen, high-resolution models. Expanding internet connectivity in regional areas further supports market penetration across urban and semi-urban regions.

Northern Territory & South Australia show moderate Smart TV adoption, driven by expanding digital infrastructure and rising demand in residential and commercial sectors. Adelaide’s urban centers favor high-definition smart TVs, while remote areas gradually upgrade from traditional television setups. Government-led broadband initiatives improve accessibility, boosting sales of affordable and mid-range smart TVs.

Western Australia sees steady growth in Smart TV adoption, driven by urban expansion in Perth and increasing online shopping trends. Consumers prefer energy-efficient and high-performance models suited for large living spaces. The region’s mining and corporate sector investments also contribute to demand for commercial smart TVs in office and accommodation facilities.

Competitive Landscape:

Australia smart TV market is highly competitive with many international and regional brands competing on advanced technology, pricing strategy, and distribution network. They promote innovation by integrating AI-powered upscaling, voice assistants, and smart home compatibility to create a better experience for their consumers. Manufacturers emphasize energy efficiency, gaming optimizations, and seamless streaming service integration to attract diverse customer segments. Competitive pricing strategies, including seasonal discounts, bundled offers with streaming subscriptions, and financing options, further drive market expansion. Retail presence through online and offline channels plays a crucial role, with e-commerce platforms offering aggressive promotional deals. Customer loyalty is strengthened through frequent software updates, extended warranties, and after-sales support. Continuous investments in research and development drive product differentiation, ensuring sustained competition. As consumer preferences evolve, brands focus on localized marketing strategies to cater to distinct regional demands across Australia.

The report provides a comprehensive analysis of the competitive landscape in the Australia smart TV market with detailed profiles of all major companies.

Latest News and Developments:

- In April 2024, Samsung Electronics Australia launched its AI-driven Smart TV lineup, featuring Neo QLED 8K, 4K, and glare-free OLED models. With advanced upscaling, gaming enhancements, and ultra-large 98-inch screens, the new range integrates premium soundbars and smart home connectivity, reinforcing Samsung’s leadership in Australia’s Smart TV market.

- In April 2024, Sony Australia launched its latest BRAVIA lineup, featuring BRAVIA 9 Mini LED TVs with XR Processor, high peak luminance, and precise backlight control. Integrated with BRAVIA Theatre audio, the series enhances home cinema with Dolby Atmos, supreme contrast, and filmmaker-intended visuals, catering to Australia’s growing streaming audience.

- In January 2024, Hisense introduced its enhanced Mini-LED TV lineup, featuring the flagship UXAU, U8NAU, and U7NAU models with improved brightness, clarity, and AI-powered enhancements. The range includes sizes up to 110 inches, a new VIDAA U7 operating system, solar-powered remotes, and Game Mode Pro for an optimized gaming experience.

Australia Smart TV Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resolution Types Covered | 4K UHD TV, HD TV, Full HD TV, 8K TV |

| Screen Sizes Covered | Below 32 Inches, 32 to 45 Inches, 46 to 55 Inches, 56 to 65 Inches, Above 65 Inches |

| Screen Types Covered | Flat, Curved |

| Technologies Covered | Liquid Crystal Display (LCD), Light Emitting Diode (LED), Organic Light Emitting Diode (OLED), Quantum Dot Light Emitting Diode (QLED) |

| Platforms Covered | Android, Roku, WebOS, Tizen OS, iOS, My Home Screen, Others |

| Distribution Channels Covered | Offline, Online |

| Applications Covered | Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smart TV market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia smart TV market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smart TV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart TV market in the Australia was valued at USD 1.90 Billion in 2024.

The Australia Smart TV market is growing due to rising broadband penetration, increasing OTT streaming adoption, demand for high-resolution displays (4K, 8K), AI-driven content recommendations, smart home integration, gaming enhancements, energy-efficient designs, government digital initiatives, aggressive pricing, and advanced display technologies like OLED, QLED, and Dolby Vision.

The Australia smart TV market is projected to exhibit a CAGR of 1.60% during 2025-2033, reaching a value of USD 2.20 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)