Australia Silica Sand Market Report by End Use (Glass Industry, Foundry, Hydraulic Fracturing, Filtration, Abrasives, and Others), and Region 2025-2033

Australia Silica Sand Market Size and Share:

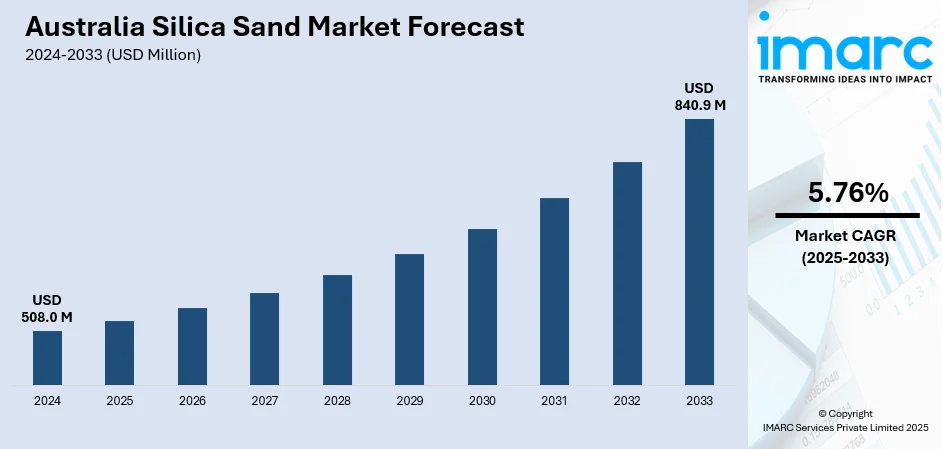

Australia silica sand market size reached USD 508.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 840.9 Million by 2033, exhibiting a growth rate (CAGR) of 5.76% during 2025-2033. The expanding automotive and manufacturing sectors, which enhance the demand for metal components, consequently influencing the need for silica sand in foundry applications, are primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 508.0 Million |

| Market Forecast in 2033 | USD 840.9 Million |

| Market Growth Rate 2025-2033 | 5.76% |

Silica sand is a granular material composed of finely divided mineral and rock particles, predominantly made up of silicon dioxide (SiO2). It is a crucial component in various industrial processes and products due to its unique physical and chemical properties. The high silica content, coupled with its hardness and resistance to chemical and physical breakdown, makes it an ideal raw material for glass production, casting metals, and manufacturing concrete. Additionally, silica sand is used in the production of silicon chips for electronics and as a proppant in hydraulic fracturing for oil and gas extraction. Its versatility and abundance in nature have led to its widespread application across diverse industries, contributing significantly to the construction, manufacturing, and technology sectors.

To get more information on this market, Request Sample

Australia Silica Sand Market Trends:

The silica sand market in Australia is experiencing robust growth, driven by several key factors. Firstly, the burgeoning construction and infrastructure development have significantly increased the demand for silica sand as a crucial component in concrete production. Moreover, the expanding regional glass industry, which heavily relies on high-quality silica sand, further propels market growth. Additionally, the surge in hydraulic fracturing activities in the oil and gas sector has led to soaring demand for silica sand as a proppant in the extraction process. Furthermore, the electronics industry's insatiable appetite for high-purity silica sand in the manufacturing of semiconductors and other electronic components has become a prominent driver of market expansion. Simultaneously, the growing emphasis on sustainable construction practices has increased the utilization of silica sand in eco-friendly alternatives, such as recycled glass and silica-based products. Notably, the market is also bolstered by technological advancements in extraction and processing techniques, enhancing the efficiency of silica sand production. Collectively, these interconnected factors create a dynamic landscape, fueling the upward trajectory of the regional market on a larger scale.

Australia Silica Sand Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on end use.

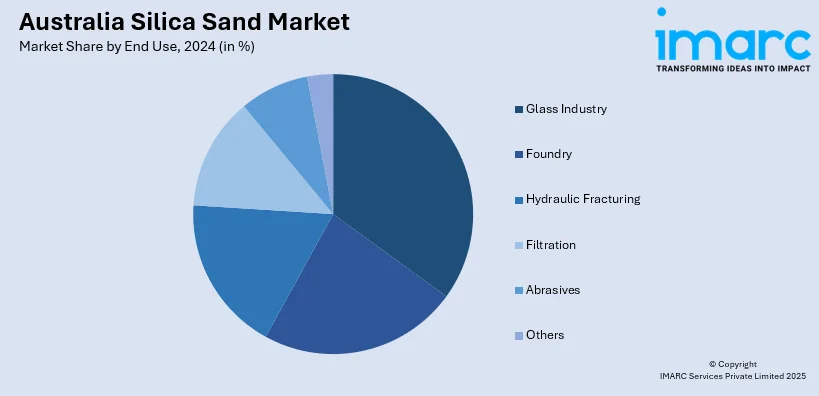

End Use Insights:

- Glass Industry

- Foundry

- Hydraulic Fracturing

- Filtration

- Abrasives

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes glass industry, foundry, hydraulic fracturing, filtration, abrasives, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Silica Sand Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End Uses Covered | Glass Industry, Foundry, Hydraulic Fracturing, Filtration, Abrasives, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia silica sand market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Australia silica sand market?

- What is the breakup of the Australia silica sand market on the basis of end use?

- What are the various stages in the value chain of the Australia silica sand market?

- What are the key driving factors and challenges in the Australia silica sand?

- What is the structure of the Australia silica sand market and who are the key players?

- What is the degree of competition in the Australia silica sand market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia silica sand market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia silica sand market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia silica sand industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)