Australia Refrigerated Transport Market Size, Share, Trends and Forecast by Mode of Transportation, Technology, Temperature, Application, and Region, 2025-2033

Australia Refrigerated Transport Market Overview:

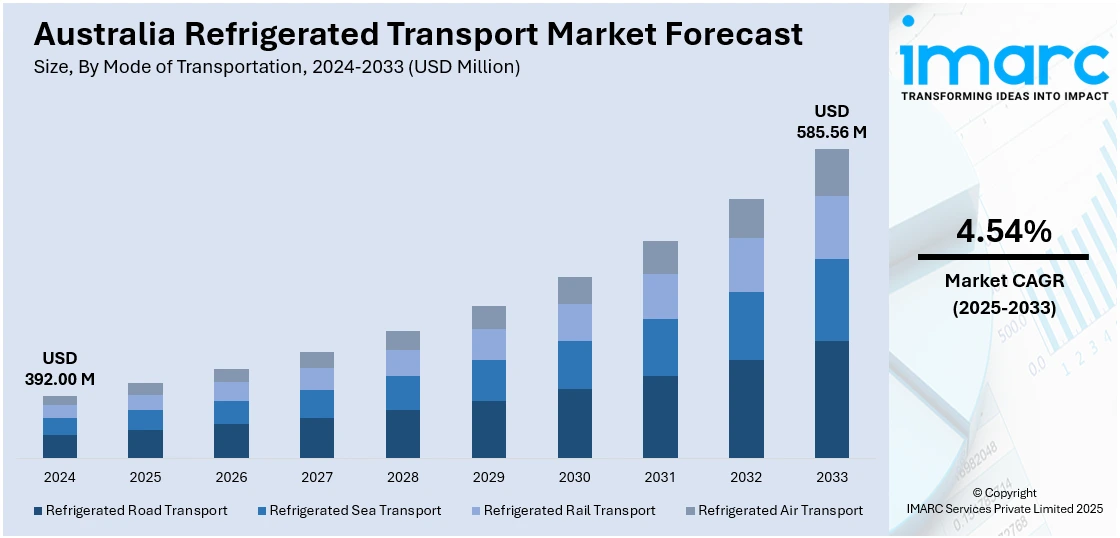

The Australia refrigerated transport market size reached USD 392.00 Million in 2024. Looking forward, the market is expected to reach USD 585.56 Million by 2033, exhibiting a growth rate (CAGR) of 4.54% during 2025-2033. The market is driven by increasing demand for perishable goods, notably in meat, seafood, and processed foods; technological advancements in refrigeration and monitoring systems; and the country's vast geography necessitating efficient cold chain logistics for quality preservation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 392.00 Million |

| Market Forecast in 2033 | USD 585.56 Million |

| Market Growth Rate 2025-2033 | 4.54% |

Key Trends of Australia Refrigerated Transport Market:

Growing Demand for Perishable Food Products

Australia's increasing consumption of perishable food products, particularly meat, dairy, seafood, and fresh produce, has significantly driven demand for refrigerated transport. As consumers prioritize food freshness and quality, retailers and food manufacturers are investing in reliable cold chain logistics to ensure safe delivery across vast distances. Supermarkets and e-commerce grocery platforms have expanded their fresh food offerings, requiring consistent temperature control from source to shelf. Additionally, Australia's reputation for high-quality, export-grade meat and seafood has increased the need for temperature-sensitive logistics to meet both domestic and international standards, which is creating a positive impact on the Australia refrigerated transport market outlook. With rising exports to Asia-Pacific markets and a shift toward organic and fresh food consumption domestically, refrigerated transport has become essential to maintain food safety, reduce spoilage, and comply with government regulations. This trend is expected to intensify with the growth of online grocery services and health-conscious consumer preferences. For instance, in June 2024, Martin Brower, a key supply chain provider and customer of Volvo Group, added its inaugural electric delivery truck to its fleet in Australia. As an essential distributor for McDonald’s, Martin Brower’s new eight-pallet Volvo FL electric refrigerated truck will provide daily deliveries to McDonald’s locations throughout the greater Sydney metropolitan region. It has a capacity of 4.6 tons and offers a range of up to 230 kilometers, designed to meet the requirements of city restaurant deliveries, which further contributes to the Australia refrigerated transport market demand.

To get more information on this market, Request Sample

Technological Advancements in Refrigeration Systems

Technological innovation is a key factor propelling the Australia refrigerated transport market growth. The industry is adopting advanced refrigeration technologies such as multi-temperature systems, solar-powered units, and IoT-enabled monitoring devices. These advancements improve fuel efficiency, ensure precise temperature control, and reduce carbon emissions—aligning with sustainability goals and operational efficiency. Real-time tracking and remote monitoring allow logistics providers to proactively manage any potential issues, ensuring compliance with food safety regulations and minimizing product loss. Additionally, data analytics tools integrated into transport systems help businesses optimize routes and predict maintenance needs, further lowering operational costs. These cutting-edge technologies are increasingly necessary due to the long distances between production and consumption points in Australia. As environmental standards become more stringent and demand for fresh goods rises, investment in modern, tech-driven refrigerated vehicles is becoming a competitive advantage for logistics providers. For instance, in March 2023, Australian refrigerated vehicle manufacturer Eurocold introduced Revora, a Brisbane-based electric truck firm focused on refrigeration. Revora will leverage the experience accumulated by its founder and managing director, Avraam Solomon, over three generations in the refrigerated transport sector, combined with the low-to-zero emissions knowledge contributed by general manager Nathan Gore-Brown. The new firm seeks to enable the refrigerated transport sector to achieve a sustainable future. This reflects the ongoing shift toward eco-friendly, tech-driven logistics, a cornerstone of modern refrigerated transport, thus fueling the Australia refrigerated transport market share.

Growth Drivers of Australia Refrigerated Transport Market:

Growing Fresh Fruit Exports and Local Food Supply Chains

The thriving agricultural industry of Australia, which is world-famous for quality produce, be it high-end fruits such as mangoes and cherries or specialty meats such as lamb and beef, has really boosted the demand for dependable refrigerated transportation. This market is driven by geography: great distances from rural farms to city centers and ports require that temperature-controlled logistics be both efficient and resilient in order to maintain freshness. The diversity of climates in the nation, from tropical in the north to temperate in the south, produces variable seasonal harvests requiring speed, temperature-stable logistics. The requirements of transporting sensitive horticultural products from isolated farming areas like Victoria's fruit bowls or Queensland's banana plantations also illustrate the function of refrigerated haulage in maintaining texture, taste, and shelf life. Increased focus on local food security, particularly in isolated areas and island states, also influences contemporary cold chain infrastructure development. As city populations grow and consumption increases, supply chains are building refrigerated fleets, regional cold store facilities, and creative last-mile delivery options to provide consistent temperatures over long distances.

Growing Consumer Emphasis on Food Quality and Safety

According to the Australia refrigerated transport market analysis, consumers and retailers put a high value on freshness, food quality, and safety, which are qualities that refrigerated transport makes possible. From fresh dairy and seafood acquired at coastal hubs to sensitive berries picked in highland areas, Australia's temperate climate and geography necessitate strict temperature control in transit. Retailers and foodservice companies consistently escalate their demands, calling for visibility to temperature profiles along the delivery chain. This need supports high uptake of refrigerated transport with live monitoring systems, electronic temperature records, and sophisticated packaging solutions suited to Australia's commonly severe heat conditions. The tropical north's summer temperatures can reach extreme highs inland, posing food integrity during transport challenges, while cooler southern winters provide seasonality challenges. Trucks and rail units with adaptive refrigeration deliver consistent cold chain integrity irrespective of outside variations. Increased customer sensitivity to spoilage, and the public scrutiny triggered by any failure, encourages suppliers to upgrade refrigeration equipment and procedures to comply with minimum regulatory standards while exceeding best practice standards devised by large retailers and food aggregators.

Government Policies and Regional Infrastructure Developments

Refrigerated transport growth in Australia is underpinned by government schemes and region-specific infrastructure development to support the agricultural and food export industries. State and federal initiatives often prioritize modernizing regional road networks and port handling capabilities to facilitate smoother transfer of temperature-sensitive goods. These efforts are especially beneficial in areas like Western Australia, where long supply chains connect farms to major ports; and the Northern Territory, where extreme climate conditions require resilient cold chain solutions, particularly for meat export. Construction of inland cold stores, often siting alongside highways or along rail corridors, offers strategic pooling points that minimize risks of spoilage and shorten lead times. Further, government incentives and financing packages directed at low-emission refrigerated fleets incentivize operators to invest in cleaner units with configurations that are appropriate for long Australian routes. These low-emission refrigeration technologies are complementary to the nation's wider sustainability agenda and rural electrification policies, particularly in areas where the grid is transforming. Combined, infrastructure upgrades and policy support provide fertile soil for the growth and modernization of Australia's refrigerated transport sector.

Opportunities of Australia Refrigerated Transport Market:

Growth Potential in Remote and Regional Logistics

Australia's vast geographical scale and scattered population centers, ranging from the tropical north to the temperate south and sparsely settled outback regions, present a distinctive environment for refrigerated transport. One key opportunity arises from linking remote agricultural and aquaculture production centers such as Northern Queensland, Western Australia's Pilbara, and Tasmania's coastal regions into urban markets. Numerous producers along the Great Barrier Reef, distant cattle stations increasingly focusing on value-added products, or coastal Tasmanian growers require refrigerated supply chain to maintain product freshness over long hauls. The increasing minerals‑led regional growth is also introducing new worker camps and towns into previously underserved regions, putting greater demand on cold‑chain provisioning of fresh and frozen products. Logistics companies can take advantage of these opportunities by making investments in mobile cold storage systems, island‑capable refrigerated trailers, and reefer technologies powered remotely to reach those markets with efficiency, less spoilage, and the ability of rural producers to penetrate national and even export markets at little loss of quality.

Integration with Australia's Sustainability and Clean‑Energy Goals

Australia's heavy focus on moving to low emissions and more sustainability creates avenues for innovation in refrigerated transportation. Renewable energy prospects like solar, wind, and even biofuels, are abundant in regions like the desolate interior and the wind-swept southern coasts. There are electric or hybrid reefer trucks that can be used by operators that are powered through solar-topped trailers or battery packs that are recharged at renewable energy terminals in locations like South Australia's solar belt or the windfarms by the south-eastern seaboard. Businesses that create cold-chain transportation solutions based on green charging infrastructure will have access to government assistance, public favor, and collaboration with regional energy suppliers. It aligns with decarbonization goals and presents marketing appeal to environmentally aware customers in key markets such as Sydney, Melbourne and Brisbane. Increasing sustainable refrigerated transport can also stimulate offshore exporters from Fremantle or Darwin to invest in cleaner cold‑chain facilities, further enhancing Australia's clean‑export reputation.

Digital Integration with Industry 4.0 Cold‑Chain Services

Australia boasts strong digital infrastructure along its city corridors and increasingly in regional hubs such as the National Broadband Network connection to coastal and parts of inland regions, setting up the refrigerated transport industry for intelligent, networked overhauls. Operators are now able to add IoT sensors, remote temperature monitoring, and predictive maintenance to their reefer fleets to improve reliability of service and lower waste. These technology additions are most important in longer‑haul moves from Perth or Adelaide to the eastern seaboard, or in multi‑stage deliveries from Darwin via the Top End into large city markets. By combining cloud-based dashboards, real-time visibility platforms, and telematics specific to Australian regulatory requirements, companies can provide differentiated, high‑value cold‑chain services to seafood exporters in Darwin, dairy consolidators close to Adelaide Hills, or producers' distributors in southeast Queensland. This also facilitates dynamic rerouting in reaction to weather conditions like bushfire warnings or unexpected cyclonic activity, guaranteeing product safety and operational integrity, forging a competitive niche in Australia's enormous and diverse chilled transportation market.

Challenges of Australia Refrigerated Transport Market:

Immense Distances and Unmatched Climate Heterogeneity

The enormous size of the land mass of Australia and the immense distances between centers of production and consumption constitute a unique challenge for refrigerated transport operators. Ranging from tropical northern parts such as the remote cape of Cape York and Arnhem Land, to the arid outback distances of the Northern Territory and Western Australia, then to temperate and coastal population centers like Sydney, Melbourne, and Perth, the nation contains some of the most extreme and diverse climates anywhere in the world. Excessive ambient heat in the north, searing sun in the outback, and sudden fluctuation of coastal humidity impose huge strain on refrigerated equipment. Vehicles run for hours over remote distances with minimal maintenance infrastructure, spares, or power available; breakdown or refrigeration failure several hundred kilometers from a major town can cause huge spoilage. On particularly lengthy journeys such as from the farmlands of Northern Queensland to urban east coast cities via the tropical interior, operators have to deal with prolonged refrigeration loads, sometimes switching between cooling and on-off heat. The challenge is even greater than controlling temperature to encompass fuel supply logistics, servicing remote routes, and maintaining driver preparedness for long-distance, heat-exposed travel in a country as geographically vast as Australia.

Fragmented Infrastructure and Regulatory Complexity

Australia's refrigerated transport industry is also beset by its highly fractured infrastructure environment and the variety of state-centric regulations. Every jurisdiction, that is, Western Australia, South Australia, Victoria, or the northern states, has its own set of compliance rules for cold-chain cleanliness, vehicle emissions, and driver licenses. A cross-border refrigerated truck may have to conform to varying certification regulations, biosecurity controls, and handling procedures for perishables such as seafood, tropical fruits, or meat. Australia's legendary emphasis on biosecurity to shield fragile ecosystems in Tasmania, the Northern Territory, or the Kimberley, is built on layers of process steps for inspection, cleaning between loading areas, and paperwork. These regulatory border crossings tend to introduce logistical resistance, slowdown, and extra expense. In the meantime, infrastructure inequality continues: Darwin, Fremantle, or Burnie ports may have limited cold-storage or reefer plug-in capabilities compared to more established facilities at Sydney or Melbourne. Regional road networks, in remote and rugged regions such as the Kimberley, western Queensland, or the Pilbara, are not necessarily optimized for heavy refrigerated fleets, resulting in inconsistent equipment wear, longer maintenance cycles, and challenges to scaling operations statewide.

Labor Shortages and Skill Gaps in Specialized Cold‑Chain Roles

One of the greatest challenges facing Australia's refrigerated freight sector is in attracting and retaining specialized labor, especially in regional and remote locations where cold-chain skills are critically needed but in short supply. Skilled operators who can handle reefer calibration, temperature-controlled loading, and maintenance of hybrid or electric refrigeration systems are found mainly in metropolitan hubs. By way of contrast, tropical north Northern Territory farms, chilled-fish processors on Tasmania's rugged coast, or abattoirs in country South Australia tend not to find it easy to obtain suitably qualified staff for loading supervision, temperature audit, or digital monitoring. Concurrently, long-distance drivers on outback highways such as the Stuart, Eyre, or Great Northern Highways need training not only in broad logistics and heavy vehicle operation, but also in emergency refrigeration repair and perishable-specific safety procedures. Without this, product cannot safely hold its cold integrity, particularly during inter-jurisdictional hops. This shortage of labor is compounded by the challenge of recruiting staff to isolated postings, especially for positions that require technical refrigeration expertise and compliance with high-quality cold-chain protocols. Training courses at Regional TAFE facilities or industry organizations may be available, but transit between metropolitan training schools and isolated operating areas proves to be a vexed issue, one that could threaten consistency and expansion potential in Australia's complex refrigerated transport sector.

Australia Refrigerated Transport Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on mode of transportation, technology, temperature, and application.

Mode of Transportation Insights:

- Refrigerated Road Transport

- Refrigerated Sea Transport

- Refrigerated Rail Transport

- Refrigerated Air Transport

The report has provided a detailed breakup and analysis of the market based on the mode of transportation. This includes refrigerated road transport, refrigerated sea transport, refrigerated rail transport, and refrigerated air transport.

Technology Insights:

- Vapor Compression Systems

- Air-Blown Evaporators

- Eutectic Devices

- Cryogenic Systems

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes vapor compression systems, air-blown evaporators, eutectic devices, and cryogenic systems.

Temperature Insights:

- Single-Temperature

- Multi-Temperature

A detailed breakup and analysis of the market based on the temperature have also been provided in the report. This includes single-temperature and multi-temperature.

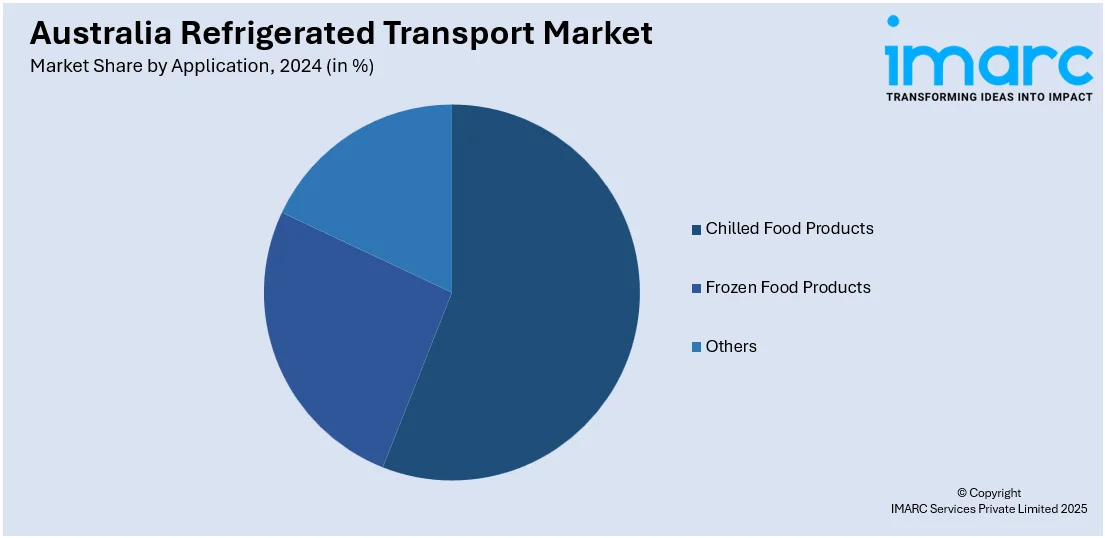

Application Insights:

- Chilled Food Products

- Dairy Products

- Bakery and Confectionery Products

- Fresh Fruits and Vegetables

- Others

- Frozen Food Products

- Frozen Dairy Products

- Processed Meat Products

- Fish and Seafood Products

- Others

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes chilled food products (dairy products, bakery and confectionery products, fresh fruits and vegetables, and others), frozen food products (frozen dairy products, processed meat products, fish and seafood products, and others), and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Refrigerated Transport Market News:

- In February 2025, Eurocold, Australia’s cold fleet associate, will debut on the ground floor at the Brisbane Truck Show 2025, coinciding with a period of extraordinary transformation for the refrigerated transport industry. In the ever-changing realm of cold chain logistics, Eurocold is the ally that companies require to steer toward the future. With a worldwide outlook and profound knowledge of the sector and the Australian market, Eurocold collaborates with its clients to attain enduring success.

- In December 2024, Australian transport firm Hawk Logistics announced its acquisition of refrigerated transport and warehousing business Farragher Logistics. Farragher Logistics boasts 91 years of experience in the Australian transport sector, providing refrigerated transport and cold storage services nationwide since its inception in 1933 as TJ Farragher Furniture Removalists.

Australia Refrigerated Transport Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modes of Transportation Covered | Refrigerated Road Transport, Refrigerated Sea Transport, Refrigerated Rail Transport, Refrigerated Air Transport |

| Technologies Covered | Vapor Compression Systems, Air-Blown Evaporators, Eutectic Devices, Cryogenic Systems |

| Temperatures Covered | Single-Temperature, Multi-Temperature |

| Applications Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia refrigerated transport market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia refrigerated transport market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia refrigerated transport industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia refrigerated transport market was valued at USD 392.00 Million in 2024.

The Australia refrigerated transport market is projected to exhibit a CAGR of 4.54% during 2025-2033.

The Australia refrigerated transport market is expected to reach a value of USD 585.56 Million by 2033.

Key trends in Australia refrigerated transport market include rising use of electric refrigerated trucks, smart temperature monitoring systems, and eco-friendly refrigerants. Demand from online grocery, meal delivery, and pharmaceutical sectors is growing. Additionally, automation, route optimization, and focus on reducing carbon emissions are transforming cold chain logistics operations nationwide.

Growing demand for perishable goods, rising e-commerce in food delivery, and stringent regulations on food safety drive Australia's refrigerated transport market. Urbanization, supermarket expansion, and advancements in cold chain technology also boost growth. Increasing exports of meat and dairy products further fuel demand for reliable, temperature-controlled logistics solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)