Australia PET Bottle Market Size, Share, Trends and Forecast by Capacity, Color, Technology, Distribution Channel, End Use, and Region, 2026-2034

Australia PET Bottle Market Size and Share:

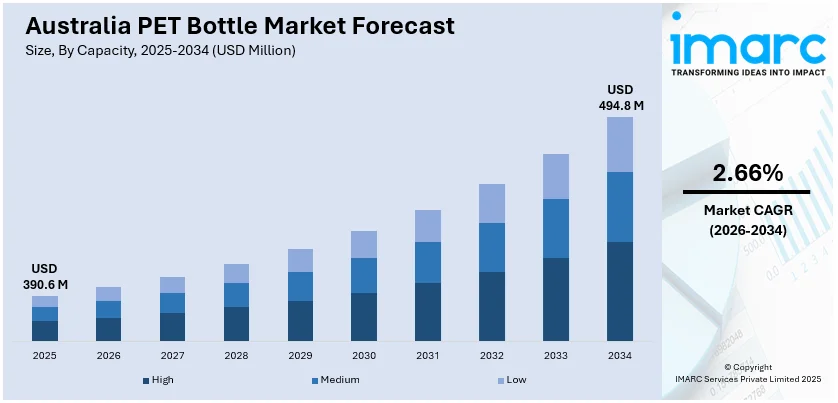

The Australia PET bottle market size was valued at USD 390.6 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 494.8 Million by 2034, exhibiting a CAGR of 2.66% from 2026-2034. The market is driven by increasing demand for sustainable packaging, the growing bottled water segment fueled by health-conscious consumers, and technological advancements in manufacturing, including lightweighting, high-speed production, and smart packaging solutions, as companies align with regulatory sustainability goals and evolving consumer preferences for eco-friendly and innovative packaging.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 390.6 Million |

|

Market Forecast in 2034

|

USD 494.8 Million |

| Market Growth Rate (2026-2034) | 2.66% |

The Australia PET bottle market share is witnessing significant growth as consumers are demanding lightweight, durable, and recyclable packaging solutions across the food and beverages (F&B), personal care, pharmaceuticals, and consumer goods industries. A significant driver for market expansion is the rising preference for bottled water and functional beverages, fueled by heightening health awareness and changing lifestyles. As the F&B industry represents a major consumer of polyethylene terephthalate (PET) bottles, demand keeps on increasing in line with boosting production as it has become inexpensive and clear packaging material that effectively retains the product's integrity. Further growth has been accelerated with the expansion of the e-commerce sector, in which PET bottles exhibit superior breakage resistance while providing lower shipping costs than its competitor, glass. In addition, manufacturers are being prompted to include recycled polyethylene terephthalate (rPET) in their packaging due to the intensifying regulatory emphasis on sustainability and extended producer responsibility, all which Australia is encouraging through its ambitious national packaging targets toward 100% recyclable, reusable, or compostable packaging. For instance, In December 2024, Synergy Packaging launched a new range of premium PET bottles in Australia, emphasizing clarity, durability, and recyclability. The locally made bottles cater to diverse industries, reinforcing Synergy’s commitment to sustainable packaging.

To get more information on this market Request Sample

Technological advancements in manufacturing PET bottles, such as the development of lightweight and high-barrier bottles with enhanced recyclability, support Australia PET bottle market growth. For example, in February 2024, Ant Packaging, Australia's first carbon-neutral plastics factory, launched customizable PET bottles made from 100% recycled materials. Designed for SMEs, these BPA-free, Australian-made bottles support sustainability with low minimum orders and various sizes up to one liter. Additionally, bio-based PET production innovations, along with the integration of circular economy principles, have further spurred industry expansion because the companies are trying to reduce dependence on virgin plastic and lower carbon footprints. Moreover, commitment from the Australian government to policy measures such as the National Plastics Plan and container deposit schemes encourages investments in PET recycling infrastructure, fostering a closed-loop system that enhances raw material availability. Multinational beverage companies, along with local players, have increasingly shown a trend toward sustainable packaging, boosting demand for PET bottles made of post-consumer recycled (PCR) content. The expansion of the dairy and plant-based beverage market and the accelerating consumption of ready-to-drink products have even promoted the PET bottle adoption since the hot-fill and aseptic processing technologies allow for stability and amplified shelf life for the product.

Australia PET Bottle Market Trends:

Rising Demand for Sustainable and Recyclable Packaging

There is a new trend in Australia PET bottle market outlook, driven by government regulation and consumer preference demands, along with corporate initiatives for sustainability. The Australian Packaging Covenant Organisation (APCO) has committed to making all packaging 100% recyclable, reusable, or compostable by 2025, prompting beverage and FMCG companies to enhance their way toward rPET bottles. The country's CDS further encourage PET recycling, increasing collection rates and demand for high-quality recycled content. Major beverage brands such as Coca-Cola Amatil and Asahi Beverages are using more post-consumer recycled PET in their packaging to reduce carbon footprints and plastic waste. Advances in PET bottle manufacturing, including lightweighting and bio-based PET, also contribute to lower material consumption and enhanced recyclability. As sustainability will remain at the heart of everything that businesses do and regulatory bodies implement, going forward, one can expect more rapid acceleration into eco-friendly PET solutions.

Growth of the Bottled Water Segment

A strong rise in a health-conscious customer base is promoting the growing trend of Australians, which focuses their attention more on convenient methods for hydration that promote the sales of bottled water directly affecting demand of PET bottles. Market development through awareness toward hydrated living fitness issues and awareness for the issue that some states water quality becomes unsatisfactory or unpotable. Premium and functional water categories, such as alkaline, electrolyte-enhanced, and vitamin-infused water, are also becoming popular, accelerating the consumption of PET bottles. The tourism and hospitality industry is also one of the main contributors to the increasing demand for bottled water, as visitors and travelers look for convenient hydration solutions that are easy to carry. PET is the preferred packaging due to its light weight, durability, and cost-effectiveness compared to alternatives like glass. Beverage companies are making investments in innovative bottle designs with ergonomic features, improved caps, and resealable functionalities that enhance the consumer experience while complying with sustainability targets, including spurred rPET content in their packaging.

Technological Advancements in PET Bottle Manufacturing

The Australia PET bottle market forecast has experienced a new wave of technology with the introduction of innovations towards increased efficiency of production, sustainability, and greater flexibility in bottle designs. Better strength in bottles, along with decreased plastic consumption, is obtained with advanced blow molding techniques: injection stretch blow molding (ISBM) and extrusion blow molding (EBM). Improved efficiency in high-speed filling lines and energy-saving equipment in the manufacturing process minimize operating costs of beverage and FMCG companies. These enable customization, brand differentiation, and personalized packaging solutions, thus adapting to evolving consumer preferences. On the other hand, innovations in barrier technologies - oxygen scavengers and multilayer PET structures - allow longer shelf lives of beverages and give PET bottles more competitive advantage than alternative materials. With amplified investments in smart packaging solutions, such as QR-coded bottles for traceability and interactive engagement, PET packaging manufacturers are aligning their offerings with modern consumer demands while maintaining regulatory compliance and sustainability commitments.

Australia PET Bottle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia PET bottle market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on capacity, color, technology, distribution channel, and end use.

Analysis by Capacity:

- High

- Medium

- Low

High-capacity PET bottles over 1 liter are becoming popular in the areas of bulk water, carbonated beverages, and household products. The reason behind the increased popularity is for cost efficiency, reduced packaging waste, and convenience of using it for a longer time. Manufacturers are striving for making the packages lighter and incorporating rPET into the bottles to ensure durability and performance.

Bottled water, soft drinks, and functional beverages markets are dominated by medium-capacity PET bottles with a volume of 500ml to 1 liter. Such a balance between portability and volume makes it suitable for on-the-go consumers. Brands highly use ergonomic designs, smart packaging, and increased post-consumer recycled content to meet both sustainability goals and evolving consumer preferences.

Low-capacity PET bottles, below 500ml, are found to be used for impulsive purchases, on-the-go beverages, personal care products, and the like. Broad application in energy drinks, flavored water, and cosmetics is expected to maintain steady demand. Manufacturers work on innovative shapes, tamper-evident features, and single-serve convenience, with biodegradable additives and rPET in place to meet the emerging environmental concerns.

Analysis by Color:

- Transparent

- Coloured

PET bottles are very transparent and widely used in the beverage industry, especially in bottled water, soft drinks, and juices, since they improve the visibility of the product and trust from the consumer. Their high recyclability makes them popular for sustainability-focused initiatives, such as mounted rPET usage. Brands invest in UV protection coatings and lightweight designs to maintain product integrity and environmental compliance.

Colored PET bottles are utilized intensely for dairy, personal care, and pharmaceutical products providing protection against UV and visual brand differentiation. Though bright colours or colors improve shelf appearance, they cause recycling problems due to sorting issues. Manufacturers are seeking ecoliteracy dyes and mono-material solutions to enhance recyclability without sacrificing aesthetics and performance requirements for niche applications.

Analysis by Technology:

- Stretch Blow Molding

- Injection Molding

- Extrusion Blow Molding

- Thermoforming

- Others

As a widely used technology, stretch blow molding is considered perfect for PET bottle manufacturing mainly in the beverage industry due to its ability to produce lightweight, high-strength, and also transparent bottles. It empowers the precise capability to control wall thickness and design for optimized material use, hence making it perfect for water, soft drinks, and functional beverages.

PET preforms are made through injection molding, which then gets blown into bottles through stretch blow molding. This process helps in achieving higher precision, consistency, and efficiency in mass production. It further supports the inclusion of recycled PET and advanced additives to enhance the performance of the bottle, as well as make it more sustainable and compliant with regulations.

The majority of non-beverage PET bottles, such as personal care, pharmaceutical, and household chemical containers, are typically manufactured through the process of extrusion blow molding. It affords complex geometries and multi-layered constructions, offering higher barrier properties, as recyclability is also a challenge with this approach versus single-layer solutions for PET bottles.

Thermoforming is more used for the PET-based container and packaging trays than bottles. Food packing, however, benefits from this as it produces very lightweight, robust, and inexpensive solutions. In response to growing sustainability concerns, recyclable and biodegradable PET thermoformed packaging are being researched further to address regulatory and consumer demands.

Other technologies, such as 3D printing and hybrid molding techniques, are now surfacing to support customization, small-batch production, and innovative PET bottle designs. Such technologies support rapid prototyping, brand differentiation, and sustainable packaging solutions while aligning with the industry's transition towards circular economy initiatives and plastic waste reduction.

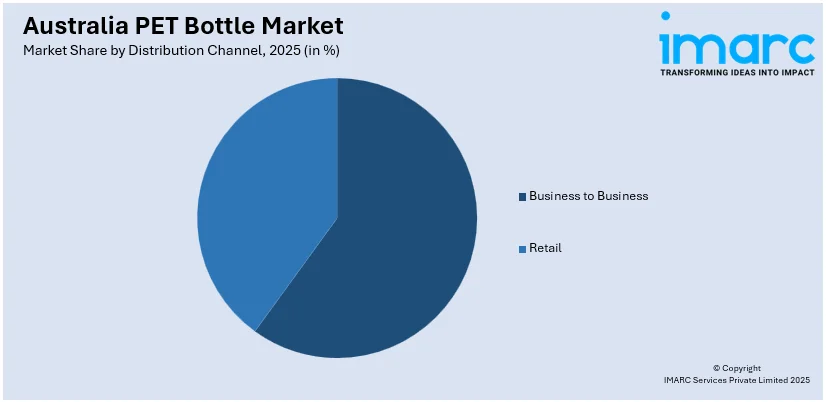

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Business to Business

- Retail

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Business-to-business or B2B is the predominant type of distribution for the market for PET bottles in Australia as this supplies major beverage, personal care, and pharmaceutical manufacturers. Big players supplying to FMCG brands offer tailored solutions, mass orders, and environmentally friendly innovation for packaging to create demands for rPET and light weights.

Retail distribution involves supermarkets, convenience stores, and online commerce platforms that sell PET bottled products to consumers. Health-conscious and on-the-go lifestyles increase the demand for bottled water and functional beverages. Boosted online retail amplifies PET bottle demand, with designs emphasizing look and format, mainly focusing on single-serve formats and sustainable packaging for environmentally conscious consumers.

Analysis by End Use:

- Packaged Water

- Carbonated Soft Drinks

- Food Bottles and Jars

- Non-Food Bottles and Jars

- Fruit Juice

- Beer

- Others

Packaged water is the largest end-use segment for PET bottles, since increasing consumer demand for convenient hydration solutions is mainly responsible for the segment. The trend for health-conscious, rising disposable incomes, and concerns over tap water quality are all contributing to market growth. Brands that integrate rPET and lightweight designs meet sustainability targets but have improved cost efficiency.

Because of its light weight and toughness, carbonated soft drinks remain one of the key applications for PET bottles. Beverage brands are shifting their focus towards the premium retention of CO₂, ergonomically designed bottle shape, and sustainable packaging solutions that enhance shelf appeal and also ensure compliance with environmental regulations as the pressure to reduce plastic waste escalates.

PET is used for food bottles and jars of sauces, condiments, dairy products, and edible oils. Its transparency, durability, and resistance to contamination make it popular. Manufacturers invest in tamper-evident closures and improved barrier properties to extend shelf life and maintain product freshness.

Non-food bottles and jars meet the requirements of personal care, household, and pharmaceutical industries through durable, cost-effective packaging. PET's light weight and chemical resistance qualify it for use in shampoos, detergents, and medicines. The segment is increasingly moving towards bio-based PET and fully recyclable packaging that suits the preference of eco-conscious consumers.

Due to their clarity, lightweight nature, and ability to preserve freshness, PET bottles are extensively used for fruit juice packaging. Advanced oxygen barrier technologies, aseptic filling techniques, and other strategies ensure extended shelf life for brands. Sustainability commitments also favor rPET bottle demand in the segment.

Beer packaging in PET bottles is growing, especially for events, travel, and outdoor consumption, where glass restrictions apply. Advanced PET barrier coatings and UV protection ensure product stability. However, concerns over recyclability and consumer preference for glass continue to be a challenge, with innovations in returnable PET bottle solutions and improvements in recycling processes.

Other applications include PET packaging for dairy, energy drinks, pharmaceuticals, and homecare products. Its segment is growing with the growth of functional beverages, premium dairy products, and sustainable packaging initiatives. Companies are working to enhance recyclability, lightweighting, and integration of smart features into packaging to meet the ever-changing demands of markets.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales are core markets for PET bottles, considering high urbanization, a stronger retail sector, and a significant beverage industry. The demand of bottled water, soft drinks, and personal care products in the city of Sydney is driving demand for PET in the region. Sustainability policies along with recycling initiations are boosting the adoption of rPET solutions.

Victoria & Tasmania require huge PET bottle volumes because of their well-known food and beverage industries. Melbourne, the commercial center, also supports large, packaged water and soft drink consumption. Tasmania's focus is on eco-friendly packaging and recycling programs, thus supporting the innovations in PET bottle sustainability: bio-based and lightweight packaging solutions.

Queensland's warm climate and tourism industry drive high bottled water and soft drink consumption, increasing PET bottle demand. The state's beverage sector continues to innovate in sustainable packaging, with companies investing in rPET and lightweight designs. The hospitality sector also plays a crucial role in PET bottle sales across major tourist destinations.

The Northern Territory & South Australia have average PET bottle demand, with water packaging and non-food products dominating. FMCG growth in Adelaide creates an upsurge for PET packaging. Remote areas of the Northern Territory make use of robust and light PET bottles to ensure safe distribution of beverages. Recycling infrastructure in both regions is also being enhanced.

The hot climate and the mining workforce are key drivers for the demand for PET bottles in Western Australia. Perth's beverage and retail sectors fuel the sale of PET bottles, while initiatives in sustainability help promote the uptake of rPET and closed-loop recycling solutions.

Competitive Landscape:

Australia's PET bottle market is highly competitive, with multiple manufacturers, packaging companies, and recyclers battling for market share. Key players focus on innovation, sustainability, and cost efficiency to meet changing consumer and regulatory demands. With the increasing interest in rPET, competition is intensifying as more companies invest in advanced recycling technologies and partnerships that secure high-quality post-consumer PET. Lightweighting strategies, better barrier technologies, and intelligent packaging solutions are also dominating the domain to boost product attractiveness as well as ensure sustainability. Companies are expanding manufacturing capacities and implementing automated manufacturing technologies to enhance operational efficiency and achieve low cost of production. Regulatory pressure driven by packaging sustainability targets and container deposit schemes is also compelling industry players to develop green alternatives along with closed-loop recycling models. The collaborations with beverage and FMCG brands also play a very important role in shaping market dynamics, as businesses seek customized, sustainable, and innovative PET bottle solutions to strengthen brand positioning and meet consumer preferences.

The report provides a comprehensive analysis of the competitive landscape in the Australia PET bottle market with detailed profiles of all major companies.

Latest News and Developments:

- In February 2024, Conta-Pack launched 375ml PET foamer bottles with high-dose (1.6ml/T) 42mm foamer pumps, expanding its Brisbane-made range. Designed for personal care and household products, this innovation reinforces Conta-Pack’s commitment to high-quality, locally manufactured packaging solutions for the Australian market.

- In February 2024, Primo Plastics introduced a new range of high-quality PET and HDPE skincare bottles and jars. Offering customizable designs and multiple size options, these packaging solutions provide durability and aesthetic appeal. Available in bulk across Australia, they cater to skincare brands seeking reliable, eco-friendly packaging solutions.

- In December 2023, Circular Plastics Australia (PET) opened Victoria’s largest PET bottle recycling plant in Melbourne. The $50 million facility can recycle up to one billion 600ml bottles annually, producing 20,000 tonnes of high-quality recycled PET resin for new beverage bottles and food packaging, supporting Australia’s circular economy.

Australia PET Bottle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Capacities Covered | High, Medium, Low |

| Colors Covered | Transparent, Coloured |

| Technologies Covered | Stretch Blow Molding, Injection Molding, Extrusion Blow Molding, Thermoforming, Others |

| Distribution Channels Covered |

|

| End Uses Covered | Packaged Water, Carbonated Soft Drinks, Food Bottles and Jars, Non-Food Bottles and Jars, Fruit Juice, Beer, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia PET bottle market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia PET bottle market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia PET bottle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia PET bottle market in the Australia was valued at USD 390.6 Million in 2025.

The growth of the Australia PET bottle market is driven by rising demand for recyclable and sustainable packaging, increasing bottled water consumption due to health-conscious consumers, government regulations promoting circular economy initiatives, advancements in PET manufacturing technology, and the cost-effectiveness, lightweight nature, and durability of PET compared to alternative packaging materials.

The Australia PET bottle market is projected to exhibit a CAGR of 2.66% during 2026-2034, reaching a value of USD 494.8 Million by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)