Australia Payment Processing Solutions Market Size, Share, Trends and Forecast by Payment Method, End Use, and Region, 2025-2033

Australia Payment Processing Solutions Market Overview:

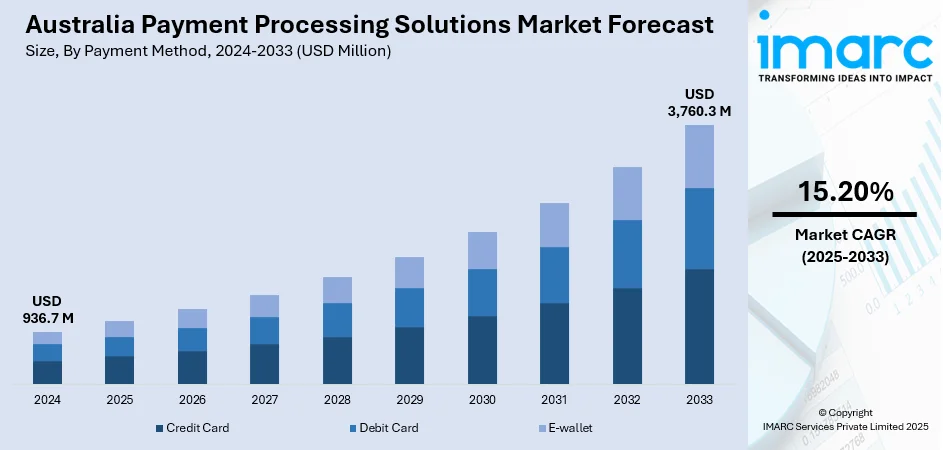

The Australia payment processing solutions market size reached USD 936.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,760.3 Million by 2033, exhibiting a growth rate (CAGR) of 15.20% during 2025-2033. Factors like increasing e-commerce adoption, technological advancements, rising demand for digital payments, numerous government initiatives, and the expansion of mobile and contactless payment options are bolstering market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 936.7 Million |

| Market Forecast in 2033 | USD 3,760.3 Million |

| Market Growth Rate 2025-2033 | 15.20% |

Australia Payment Processing Solutions Market Trends:

Digital Wallets and Contactless Payments

The growth of Australia's payment processing solutions industry has been largely fueled by the rise of digital wallets such as Apple Pay, Google Pay, and Samsung Pay. Because of their convenience and security characteristics, digital wallets are gaining popularity. Customers are increasingly avoiding the conventional dependence on actual credit cards or cash by utilizing these mobile applications to make purchases both in-person and online. In 2024, the digital payment market in Australia was estimated to be worth $118.0 billion. The IMARC Group projects that the market will expand at a compound annual growth rate (CAGR) of 20.89% from 2025 to 2033, reaching a value of $667.0 billion. Furthermore, in 2023, Australians spent around $63.6 billion online, or 16.8% of their overall retail spending, creating a positive outlook for market expansion. With this rising consumer preference for speed and convenience, the Australian government is actively promoting digital financial inclusion through programs like the National Payments Platform (NPP), which enables low-cost, real-time payments between financial institutions. Moreover, the growing adoption of point-of-sale (POS) terminals equipped with Near Field Communication (NFC) technology enables retailers to accept payments via mobile devices. This has facilitated a smoother experience for both customers and companies, which has helped contactless payment systems grow quickly.

To get more information on this market, Request Sample

AI-Powered Fraud Prevention and Risk Management

Another significant trend driving the Australian payment processing industry is the integration of artificial intelligence (AI) and machine learning (ML) technologies for risk management and fraud prevention. Strong security measures are essential for financial institutions, payment processors, and merchants since the growth of digital payments has regrettably coincided with an increase in fraud and cybercrime. Australians reported more than 601,000 scams to these groups in 2023, up 18.5% from 2022, according to the Targeting Scams report. Based on financial losses, investment scams were the most damaging, totaling $1.3 billion, followed by remote access scams at $256 million and romance scams at $201.1 million. AI and ML algorithms are increasingly being used to examine enormous quantities of transaction data in real time, since fraud activity has increased significantly in recent years. Through the recognition of suspicious patterns that conventional security systems could miss, these technologies are able to detect and stop fraudulent activities. These models excel at reducing false positives by leveraging over 4,000 fraud detection features, with 250 to 500 new characteristics being incorporated each quarter. This prominent move towards AI-powered fraud protection is essential to the market's continued expansion for payment processing solutions.

Australia Payment Processing Solutions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on payment method and end use.

Payment Method Insights:

- Credit Card

- Debit Card

- E-wallet

The report has provided a detailed breakup and analysis of the market based on the payment method. This includes credit card, debit card, and e-wallet.

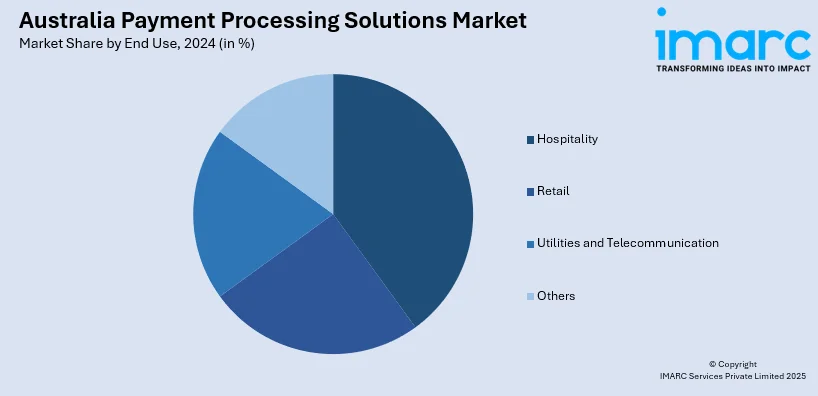

End Use Insights:

- Hospitality

- Retail

- Utilities and Telecommunication

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes hospitality, retail, utilities and telecommunication, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Payment Processing Solutions Market News:

- November 2024: Transaction Network Services (TNS) teamed up with Australia's payments sector to create a fully managed infrastructure for the Australian Payment Network's Community of Interest Network (COIN), to boost payment processing solutions with scalable, secure, and high-performance features.

- September 2024: Australian Payments Plus (AP+) collaborated with ThoughtWorks to create user experience (CX) standards for PayTo, which will improve payment processing solutions by providing safe, quick bank transfers for routine transactions such as utility bills, reservations, and digital wallet top-ups.

Australia Payment Processing Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Payment Methods Covered | Credit Card, Debit Card, E-Wallet |

| End Uses Covered | Hospitality, Retail, Utilities and Telecommunication, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia payment processing solutions market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia payment processing solutions market on the basis of payment method?

- What is the breakup of the Australia payment processing solutions market on the basis of end use?

- What are the various stages in the value chain of the Australia payment processing solutions market?

- What are the key driving factors and challenges in the Australia payment processing solutions market?

- What is the structure of the Australia payment processing solutions market and who are the key players?

- What is the degree of competition in the Australia payment processing solutions market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia payment processing solutions market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia payment processing solutions market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia payment processing solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)