Australia Patient Monitoring Market Size, Share, Trends and Forecast by Type of Devices, Application, End User, and Region, 2026-2034

Australia Patient Monitoring Market Overview:

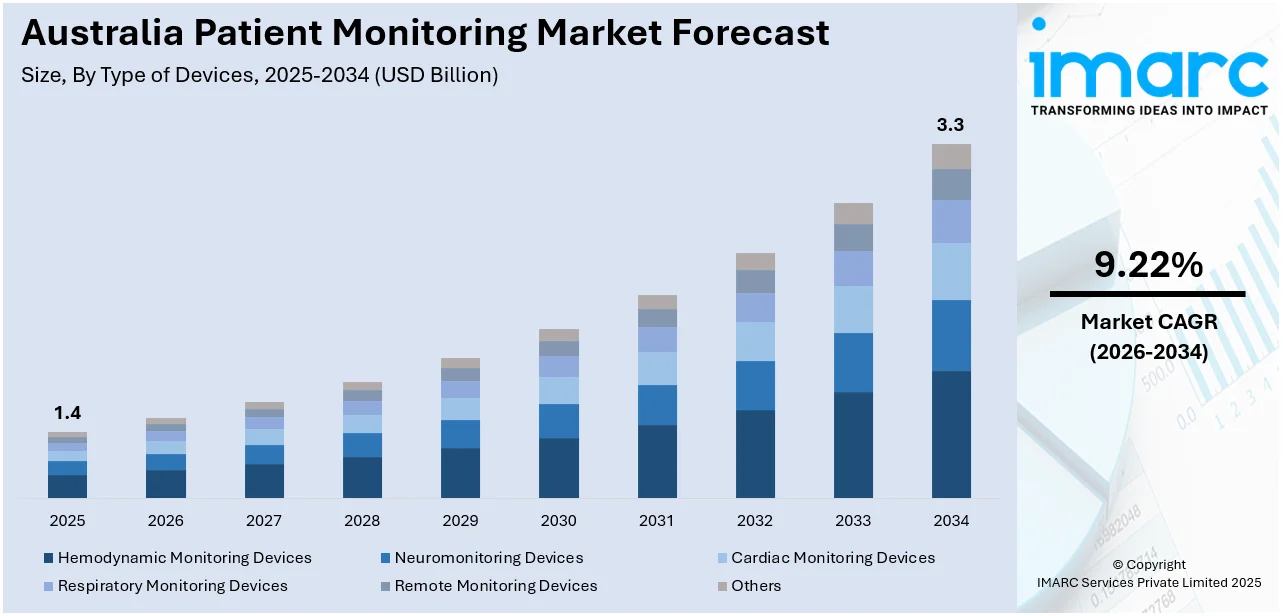

The Australia patient monitoring market size reached USD 1.4 Billion in 2025. Looking forward, the market is expected to reach USD 3.3 Billion by 2034, exhibiting a growth rate (CAGR) of 9.22% during 2026-2034. Key drivers of the Market include the increasing demand for remote monitoring solutions, fueled by technological advancements and the COVID-19 pandemic, the integration of artificial intelligence (AI) and machine learning (ML) for enhanced diagnostics, and the growing preference for home healthcare solutions, especially among the aging population and chronic patients.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.4 Billion |

| Market Forecast in 2034 | USD 3.3 Billion |

| Market Growth Rate (2026-2034) | 9.22% |

Key Trends of Australia Patient Monitoring Market:

Adoption of Remote Monitoring Solutions

The increasing need for remote patient monitoring in Australia is transforming the healthcare sector, fueled by technological innovation and the aging population. 4.2 million Australians aged 65 years and above, or 16% of the population, existed as of June 2020, and this percentage is likely to increase to over 22% by 2026. This age-related change coupled with increased usage of remote monitoring devices is changing the care for chronic conditions and minimizing hospital admissions. Remote monitoring allows health professionals to monitor patients' health parameters remotely, enhancing care accessibility, especially in rural and distant locations, and facilitating timely intervention. The COVID-19 pandemic further increased the demand for touchless care, and the proliferation of wearable technology linked to cloud platforms for real-time data processing is augmenting the incorporation of remote patient monitoring, further supporting the Australia patient monitoring market growth and development.

To get more information on this market Request Sample

Integration of Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are becoming essential components in the Australian patient monitoring market, with the potential to significantly enhance healthcare delivery. A report by Microsoft and the Tech Council of Australia suggests that generative AI could contribute between $5 billion and $13 billion annually to Australia’s healthcare sector by 2030, underscoring the economic value of AI integration. These technologies are improving diagnostic tool accuracy and enabling predictive analytics to identify potential health risks early. AI-driven algorithms analyze data from monitoring systems, providing healthcare professionals with actionable insights that enhance decision-making. Moreover, AI automates routine tasks like data entry, reducing human error and improving efficiency. As healthcare providers continue to leverage AI for better outcomes, its integration into the Australia patient monitoring market share is expected to grow, driving both operational improvements and economic benefits.

Focus on Home Healthcare Solutions

Australia's patient monitoring market is experiencing a shift toward home healthcare solutions, driven by the aging population and the growing preference for personalized care. Home healthcare devices, such as blood pressure monitors, glucose meters, and pulse oximeters, allow patients to manage their conditions from the comfort of their homes. This trend is particularly beneficial for elderly patients and those with chronic conditions who require continuous monitoring. The integration of home healthcare solutions with healthcare provider systems is facilitating seamless communication, ensuring timely interventions. As home care becomes an integral part of healthcare delivery, the Australia patient monitoring market demand, designed for at-home use is expected to increase.

Growth Drivers of Australia Patient Monitoring Market:

Aging Population and Growing Chronic Disease Prevalence

One of the key growth drivers of Australia's patient monitoring market is Australia's aging population and the rising prevalence of chronic diseases. As Australians age, the healthcare system demands more regarding ongoing care, particularly for age-related conditions such as cardiovascular diseases, diabetes, and respiratory diseases. These long-term conditions necessitate constant monitoring to deal with symptoms, identify complications at an early stage, and minimize hospitalization. Patient monitoring equipment—anything from wearable health monitors to sophisticated systems installed in the home—enables individuals to live independently while undergoing continuous medical supervision. In rural and country areas of Australia, where specialist services are restricted, such systems serve an important bridge between patients and clinicians. The transition toward home care and remote care models, facilitated by both private and public healthcare services, has further augmented the significance of monitoring systems. Consequently, the increasing population of elderly and chronic disease patients remains a dominant driving force for market growth.

Integration of Telehealth and Remote Monitoring Technologies

According to the Australia patient monitoring market analysis, the convergence of telehealth services and remote monitoring technologies has played an important role in advancing the industry. With enormous geographical distances and numerous communities spread in remote or underserved regions, the Australian healthcare system has welcomed digital health solutions to cover the gap in accessibility. Remote monitoring devices allow real-time monitoring of vital signs, and clinicians can provide timely interventions without visiting the patient. This enhances patient outcomes and decreases the load on hospitals and clinics. The COVID-19 pandemic further spurred the growth of these technologies, and regulatory changes and increased reimbursement support for virtual care followed. Healthcare professionals and aged care facilities are today increasingly investing in connected monitoring technology that is compatible with telehealth platforms. This is especially pertinent in Australia's outback and coastal communities, where these innovations are valuable and necessary. The capacity to remotely deliver care has firmly lodged monitoring technology as a fundamental healthcare tool.

Government Investment and Digital Health Initiatives

Investment and governmental support of digital health infrastructure are central drivers of growth for the patient monitoring market in Australia. With national strategies and funding initiatives, the Australian government has made healthcare modernization its priority, with a strong emphasis on going digital. Programs such as the My Health Record system and incentive payments for remote patient management programs have fostered favorable conditions for the uptake of advanced monitoring equipment. In addition, the government has demonstrated an intention to enhance health outcomes within Indigenous and rural populations, in which real-time monitoring of patients has life-or-death consequences. Grants, pilot programs, and joint ventures with private industry firms have also fueled innovation and uptake of wearable sensors, mobile health applications, and cloud-enabled platforms. These initiatives are in line with Australia's overall goal of moving toward a more proactive and preventive healthcare system. As public health policies continue to shift in the direction of digital integration, patient monitoring technologies will likely continue to be a point of focal emphasis for healthcare progress.

Australia Patient Monitoring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type of devices, application and end user.

Type of Devices Insights:

- Hemodynamic Monitoring Devices

- Neuromonitoring Devices

- Cardiac Monitoring Devices

- Respiratory Monitoring Devices

- Remote Monitoring Devices

- Others

A detailed breakup and analysis of the market based on the type of devices have also been provided in the report. This includes hemodynamic monitoring devices, neuromonitoring devices, cardiac monitoring devices, respiratory monitoring devices, remote monitoring devices, and others.

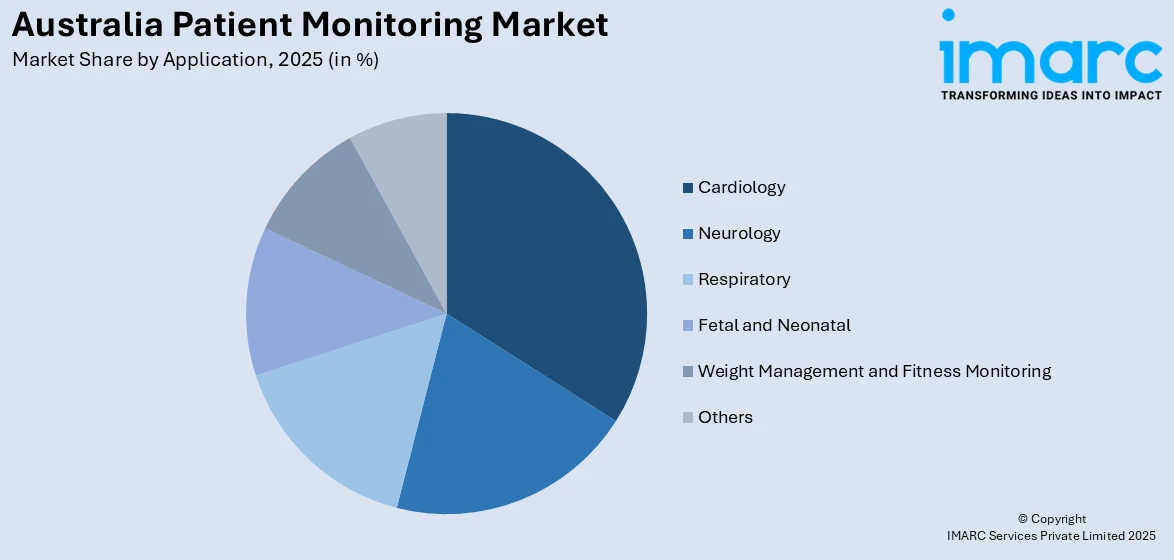

Application Insights:

Access the comprehensive market breakdown Request Sample

- Cardiology

- Neurology

- Respiratory

- Fetal and Neonatal

- Weight Management and Fitness Monitoring

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes cardiology, neurology, respiratory, fetal and neonatal, weight management and fitness monitoring, and others.

End User Insights:

- Home Healthcare

- Hospitals

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes home healthcare, hospitals, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Patient Monitoring Market News:

- In September 2024, Australia's Department of Health and Aged Care launched a telehealth service to provide virtual nursing for aged care residents. A tender has been issued to select telehealth providers to deliver person-centered care through video consultations, offer staff training, assess technology needs, and ensure accessible information for residents and families.

- In July 2024, KORE and mCare Digital launched the mCareWatch 241, a smartwatch designed for virtual patient monitoring. Aimed at individuals needing emergency assistance, such as seniors or those with disabilities, it features SOS alerts, GPS tracking, heart rate monitoring, fall detection, and more. Available in Australia for $499, the watch includes a mobile app and web dashboard, providing enhanced safety and independence for users.

- In June 2024, Prevounce Health launched the Pylo GL1-LTE, a remote blood glucose monitoring device with cellular connectivity for reliable data transmission. Integrated with Prevounce’s remote care platform, it syncs with other connected devices, supporting diabetic patients' glycemic control. The launch follows $7 million in Series A funding and continued growth in remote care services.

Australia Patient Monitoring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Devices Covered | Hemodynamic Monitoring Devices, Neuromonitoring Devices, Cardiac Monitoring Devices, Respiratory Monitoring Devices, Remote Monitoring Devices, Others |

| Applications Covered | Cardiology, Neurology, Respiratory, Fetal and Neonatal, Weight Management and Fitness Monitoring, Others |

| End Users Covered | Home Healthcare, Hospitals, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia patient monitoring market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia patient monitoring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia patient monitoring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia patient monitoring market was valued at USD 1.4 Billion in 2025.

The Australia patient monitoring market is projected to exhibit a CAGR of 9.22% during 2026-2034.

The Australia patient monitoring market is expected to reach a value of USD 3.3 Billion by 2034.

The Australia patient monitoring market trends include growing use of wearable health devices, integration with telehealth platforms, and increased demand for remote monitoring in aged care. There is a shift toward personalized, data-driven care, supported by AI and cloud-based technologies, enabling real-time tracking and better management of chronic and post-acute conditions.

The Australia patient monitoring market is driven by an ageing population, rising chronic disease burden, and increased adoption of telehealth and remote care. Government investment in digital health infrastructure, combined with growing demand for home-based monitoring solutions in rural and urban areas, further accelerates market growth across the healthcare system.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)