Australia Online Travel Bookings Market Size, Share, Trends and Forecast by Service Type, Booking Method, Device, and Region, 2026-2034

Australia Online Travel Bookings Market Size and Share:

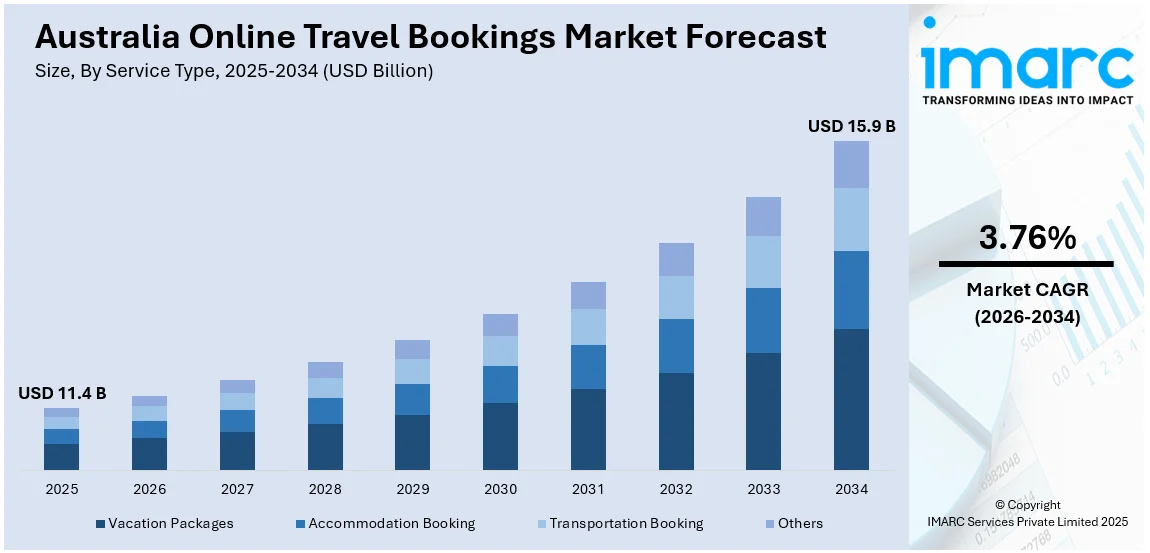

The Australia online travel bookings market size was valued at USD 11.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 15.9 Billion by 2034, exhibiting a CAGR of 3.76% from 2026-2034. The Australia online travel bookings market is driven by the increasing internet penetration, mobile app adoption, personalized pricing strategies, growth in domestic travel demand, and the expansion of affordable travel options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 11.4 Billion |

| Market Forecast in 2034 | USD 15.9 Billion |

| Market Growth Rate (2026-2034) | 3.76% |

Increased internet access in Australia has been one of the factors that have made the online travel booking market grow. According to Data Reportal, 25.21 million individuals across Australia used the internet during the beginning of 2024, leading to 94.9% of internet penetration. Companies can now reach a wide number of potential consumers online. Improved broadband speed and mobile data availability make browsing easier and therefore more likely to book the services online. Moreover, with the fact that younger generations are picking up digital technologies at a faster rate, this is expected to continue. Travel companies take advantage of this by ensuring that their platforms are optimized for mobile and desktop users so that everyone with an internet connection can access their services.

To get more information on this market Request Sample

Mobile applications revolutionized the way travelers have been booking travel services, thereby propelling the Australia online travel bookings market growth. Now, Australians can compare prices for accommodation, book flights and a rental car through mobile application. Many companies give the app-exclusive deals that can make users more prone to shift to digital platforms. Apps also provide additional options such as real-time update about flight changes or guide through destinations while traveling. Such advantages push mobile applications as a high channel for travel booking services.

Australia Online Travel Bookings Market Trends:

Personalized and dynamic pricing strategies

Online platforms use artificial intelligence and data analytics to personalize offers and dynamic pricing. For instance, frequent travelers get specific offers based on past booking records, which increases user loyalty. Dynamic pricing strategies also enable firms to adjust the prices of their products based on demand, thus ensuring profitability, yet offering consumers competitive prices in off-peak seasons. This flexibility attracts premium as well as budget-conscious travelers. Furthermore, the use of AI and data analytics in online travel booking platforms is more than mere customization. It analyzes enormous data on user search history, preferences, booking patterns, and even social media activity, making travel recommendations very personalized.

Expansion of affordable travel options

The development of low-cost airlines and budget lodging sites has highly impacted the online travel booking industry in Australia. Current platforms offer very comprehensive accommodations to budget travelers, ranging from low-cost flights, economical lodging options, to packages. Low-cost airlines, Jetstar and Tigerair Australia, have significantly increased the coverage of routes that made travelling both domestic and international much more affordable. Online booking sites also help ease the search process through inbuilt price comparison. In their search, individuals can easily filter results by budget, airlines, or types of accommodation to make well-informed decisions. Also, such campaigns as "flash sales" and "last-minute deals" attract spontaneous, low-cost travelers.

Increasing domestic travel demand

Domestic travel in Australia experienced significant growth, particularly during and after the COVID-19 pandemic when global travel options were restricted. According to Tourism Research Australia, expenditure on domestic tourism in the country increased by 1% and reached USD 396 Million in September 2024. Online reservation platforms have seized this trend by adapting their services for local travelers. They emphasize road trips, short escapes, and distinctive local activities such as discovering the Great Ocean Road or exploring Tasmania’s natural scenery. Partnerships with regional airlines, boutique hotels, and car rental services, along with domestic-focused deals, enhance the accessibility of these trips.

Australia Online Travel Bookings Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia online travel bookings market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on service type, booking method, and device.

Analysis by Service Type:

- Vacation Packages

- Accommodation Booking

- Transportation Booking

- Others

Vacation packages constitute a major portion of the online travel reservation industry, attracting travelers who desire convenience and affordability. These packages usually include flights, lodging, and occasionally extra services such as guided tours, airport transfers, or meal options. Bundling enables providers to give discounts in comparison to reserving each element individually, making vacation packages appealing for budget-minded travelers.

The booking of accommodations is a major segment within the online travel industry, fueled by platforms such as Booking.com, Agoda, and Airbnb. Travelers appreciate the capability to evaluate choices among hotels, vacation rentals, hostels, and boutique accommodations instantly. This section caters to every kind of traveler, ranging from frugal backpackers to those who seek luxury, offering a wide range of filtering choices for price, location, and facilities.

Transportation reservations encompass flights, trains, vehicle rentals, and also local travel choices such as taxis or ridesharing services. This section is crucial for those organizing both local and overseas journeys. Digital platforms compile transportation choices, allowing users to evaluate prices, timetables, and paths for smooth travel planning.

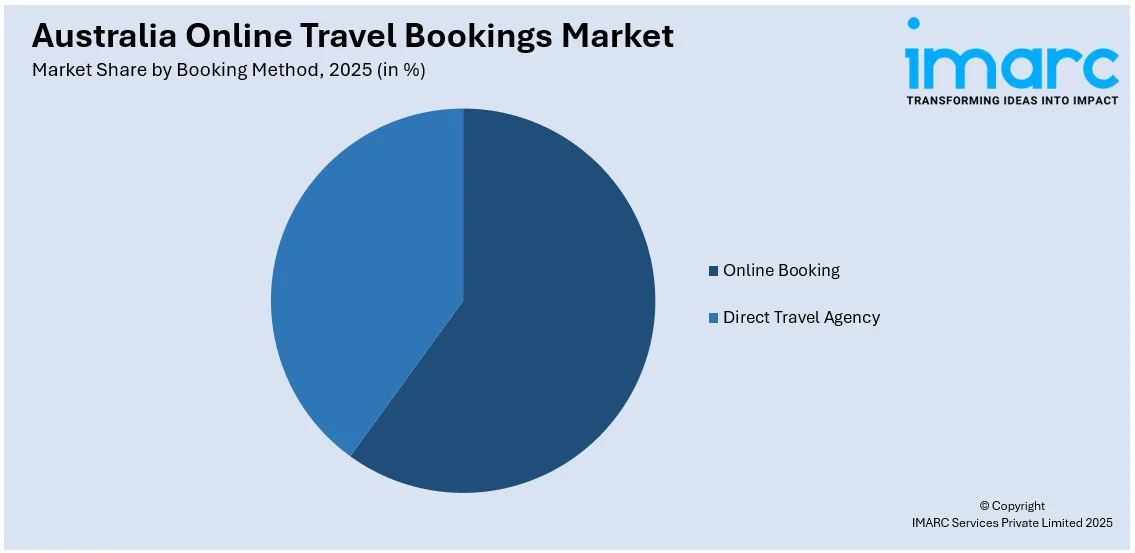

Analysis by Booking Method:

Access the comprehensive market breakdown Request Sample

- Online Booking

- Direct Travel Agency

During recent years, the online segment of booking has experienced speedy growth, mainly due to the increasing use of online applications for travel planning. A subset under this category is booking directly through websites, mobile apps, or third-party companies such as Expedia or AirAsia Booking and Booking.com. This sub-market appeals to tech-savvy consumers who seek convenient, easy comparison, and instant confirmation.

The traditional segment of direct travel agencies has primarily concentrated on in-person or phone bookings, though numerous have also adjusted to online venues. This segment appeals to tourists who appreciate tailored service and knowledgeable support, such as those planning luxury or intricate trips. Direct agencies frequently focus on particular market segments, providing customized itineraries, group excursions, or corporate travel options. Clients who might lack confidence in using online platforms or those wanting extra assistance favor utilizing a travel agent.

Analysis by Device:

- Desktop

- Mobile

The desktop segment remains a key segment in the Australian online travel booking market, particularly for more complex travel arrangements. Many users still prefer the larger screen and detailed interface that desktops provide when booking international flights, multi-leg trips, or planning elaborate itineraries that involve accommodations, car rentals, and activities. The ease of comparison across multiple websites and the ability to handle more intricate booking details make desktop platforms a popular choice for users looking for thorough research and decision-making.

The mobile sector has experienced rapid expansion in Australia's online travel reservation market. As smartphones are everywhere in daily life, travelers are more frequently choosing to reserve flights, hotels, and rental cars while on the move, particularly for last-minute journeys or spontaneous outings. Mobile reservation applications are built for rapid, immediate choices, incorporating functionalities such as one-tap reservations, location-based services, and convenient payment methods, enabling users to finalize transactions whenever they wish.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The Australian Capital Territory (ACT) and New South Wales (NSW) area hold a significant Australia online travel booking market share. Sydney, the capital city of NSW, serves as a crucial center for both local and international visitors, playing a key role in the area's tourism income. The city presents a mixture of cultural sites, business tourism, and natural highlights such as the Blue Mountains, appealing to both leisure and corporate visitors.

Victoria and Tasmania, though small in population compared to NSW, have a different kind of experience that attracts domestic and international tourists. Melbourne, the capital of Victoria, is renowned for its arts, sports, and culinary scenes, which attract cultural travelers. Tasmania, on the other hand, is gaining popularity among nature lovers due to its pristine wilderness and eco-tourism opportunities.

Queensland stands as a prime location of the tourism sector in Australia. Its natural beauty, sandy beaches, and famous resorts such as the Great Barrier Reef and the Gold Coast boost the state's popularity around the globe. Every year, millions of individuals around the world visit Queensland-including those from Asia and Europe. Online travel booking, Queensland, is a super competitive business. There are a few portals offering different services-from relatively inexpensive vacation rentals to classy resorts. The appeal that the region has for family and adventure travelers is reflected through the demand for outdoor experience such as snorkeling and hiking, and theme parks.

Competitive Landscape:

Major players in the Australian online travel booking sector, including Expedia, Booking.com, Webjet, and Flight Centre, are fueling growth with a range of strategic initiatives. These companies aim to improve user experience by investing in cutting-edge technologies such as AI and machine learning to deliver customized recommendations, individualized offers, and flexible pricing strategies. They also emphasize mobile optimization, guaranteeing smooth booking experiences on different devices, which corresponds with the increasing trend of mobile-first consumers. Additionally, major online travel agencies in Australia are strengthening alliances with airlines, hotels, and local tourism agencies to provide exclusive offers, combined packages, and loyalty initiatives that encourage repeat reservations. To attract a wider audience, they are progressively emphasizing niche markets such as tourism, adventure travel, and authentic local experiences.

The report provides a comprehensive analysis of the competitive landscape in the Australia online travel bookings market with detailed profiles of all major companies.

Latest News and Developments:

- 4 July 2024: Commonwealth Bank has launched a new travel booking service via the CommBank app in partnership with Hopper, offering consumers the ability to search, book, and pay for flights and hotels. The service includes innovative features such as Price Prediction, Auto Price Drop, Price Watch, and a Best Price Guarantee, aiming to provide consumers with enhanced transparency, flexibility, and savings in travel bookings.

- January 2024: Luxury Escapes is launching a new industry booking portal in March to allow Australian travel agents to access exclusive travel deals and commissionable rates for their clients. The portal will benefit tens of thousands of travel agents and millions of Australians who can now book Luxury Escapes deals through their chosen travel agent.

- November 2024: ResPax, a leading Australian tour management software company has acquired ResBook, New Zealand’s first online booking engine. ResPax’s acquisition includes ResBook’s Tourism-Themed Websites, Property Management System (PMS), its dynamic Booking Engine, and membership platform Audience.

- August, 2024: Spotnana's Travel-as-a-Service platform announced a deal with Qantas to unveil its new web-based online booking and management experience designed for small business and mid-sized businesses.

Australia Online Travel Bookings Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Vacation Packages, Accommodation Booking, Transportation Booking, Others |

| Booking Methods Covered | Online Booking, Direct Travel Agency |

| Devices Covered | Desktop, Mobile |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia online travel bookings market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia online travel bookings market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia online travel bookings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Online travel bookings refer to the process of reserving travel services such as flights, hotels, car rentals, and vacation packages through websites or mobile apps.

The Australia travel insurance market was valued at USD 11.4 Billion in 2025.

IMARC estimates the Australia online travel bookings market to exhibit a CAGR of 3.76% during 2026-2034.

Factors driving the Australia online travel bookings market include increasing internet penetration, mobile app adoption, personalized pricing strategies, growth in domestic travel demand, and the expansion of affordable travel options.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)