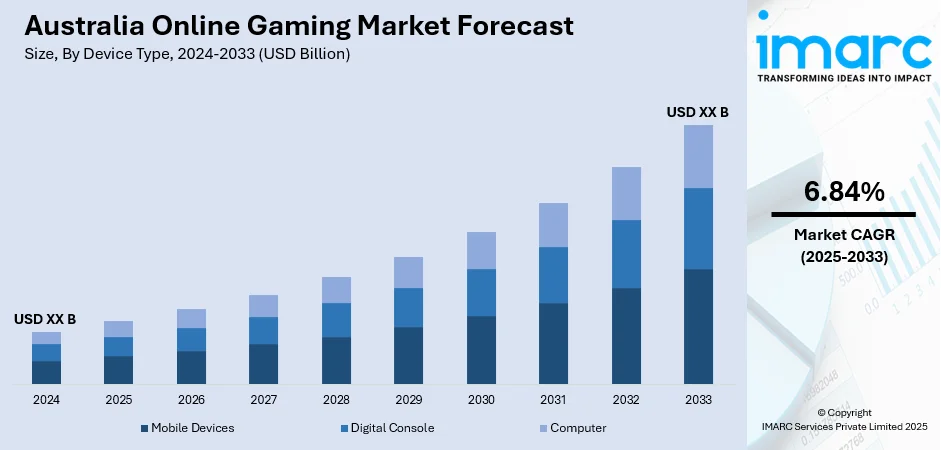

Australia Online Gaming Market Report by Device Type (Mobile Devices, Digital Console, Computer), Gaming Type (Casual Gaming, MMO Gaming, Social Gaming), Age Group (Below 18 Years, 19-25 Years, 26-35 Years, 36-45 Years, Over 46 Years), Gender Demographic (Male, Female), Model (Free-to-play Games, Pay-to-Play Games), and Region 2025-2033

Australia Online Gaming Market Overview:

The Australia online gaming market size is projected to exhibit a growth rate (CAGR) of 6.84% during 2025-2033. The market is driven by the increasing internet penetration, growing smartphone usage, rising demand for interactive entertainment, rapid surge in digital payment methods and advancements in gaming technology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Growth Rate (2025-2033) | 6.84% |

Key Trends of Australia Online Gaming Market:

Increasing Adoption of Mobile Gaming

Mobile gaming continues to be popular in Australian online gaming market, driven by the growing penetration of smartphones and mobile devices. In a study, which was carried out by Bond University and the International Games and Entertainment Association (IGEA), 1,241 Australian households were represented by participants who were at least 18 years old. Among households, 74% have two or more gaming devices, and nearly half have three or more in their possession. Australian gamers use consoles 87% of the time, smartphones 71%, and PCs 58% of the time. The study also discovered that 81% of Australian players are older than 18, with an average age of 35. Moreover, adults of working age made up the largest percentage of players (84%), while two-thirds of those in retirement also played games. With more Australians turning to their mobile devices for entertainment, mobile games offer both convenience and a wide variety of choices, from casual puzzle games to complex multiplayer titles. As internet connectivity improves and 5G networks roll out, the mobile gaming sector is expected to see further growth.

To get more information on this market, Request Sample

Growth in Online Multiplayer Games and eSports

The online gaming multiplayer and eSports are picking up traction in the Australia online gaming market share, supported by the country's ever-enhancing digital infrastructure and growing engagement of the gaming community. According to World Metrics, 62% of Australian gamers enjoy playing competitive multiplayer games online. With the increase in competitive gaming and streaming platforms, eSports has become more accessible and popular, and Australian players have been participating in global tournaments. Moreover, Australia is finding increased investment in eSports, and its revenues from this industry are expected to rise significantly over the next few years. According to Australian Department of Foreign Affairs and Trade, already one of the world's largest and fastest-growing entertainment sectors before coronavirus disease (COVID-19) hit, the digital games industry further expanded during the pandemic. Worth $240 billion globally in 2020, the market is set to reach $294 billion in 2024. This trend is likely to continue as players and brands invest in competitive gaming.

Increased Government Support and Tax Incentives

The Government of Australia has been increasingly supportive of the gaming industry, recognizing its potential for economic growth. Various policies have attracted both domestic and international investments, helping Australian developers scale up their operations and expand into new markets. This support is expected to drive continued growth in the online gaming market, making Australia an attractive hub for game development.

Growth Drivers of Australia Online Gaming Market:

Extensive Internet Penetration and High Digital Usage

One of the key drivers of growth for Australia's online gaming industry is extensive internet penetration and high digital usage. Australia has a digitally educated population with a high percentage of technology-driven individuals in every age group. The growth of broadband internet, most notably with the continuing rollout of the National Broadband Network (NBN), has greatly enhanced connectivity online, facilitating faster and more engaging gaming experiences on all platforms. Urban hubs like Sydney, Melbourne, and Brisbane enjoy some of the highest internet coverage in the country, and as a result, are hubs for competitive gaming, game streaming, and multiplayer engagement. In addition, Australians are also early technology adopters, encompassing computer games hardware and cloud services. That cultural familiarity with online services and interactive entertainment has made the ground fertile for online gaming to flourish. As consumers increasingly move away from legacy consoles toward always-connected devices, the Australia online gaming market growth is further intensified.

Growth of Esports and Competitive Gaming

Australia's increasing participation in the international esports arena is another strong impeller of its online gaming market. With professional gaming competitions, streaming sites such as Twitch and YouTube Gaming, and corporate sponsorships on the rise, esports have gone from being a niche pursuit to a mass phenomenon. Local competition and tournaments like the League of Legends Circuit Oceania (LCO) have picked up strength, providing amateur and professional players alike with the chance to play at regional and global levels. Schools and universities in Australia have also started providing esports scholarships and constructing professional gaming facilities, a trend indicating wider acceptance of gaming as a valid career option. This increased interest has given rise to gaming communities, local game development studios, and investment in gaming facilities. These initiatives boost user activity and foster demand for gaming PCs with high performance, peripherals, and broadband services, further supporting the Australia online gaming market demand.

Increasing Demand for Social and Casual Gaming Experiences

Another important factor pushing Australia's online gaming industry forward is the expanding popularity of social and casual gaming experiences. In addition to hardcore players, there is a growing demographic of casual gamers who play games mainly for social interaction and leisure. Titles that provide cooperative play, socialization, and accessibility have witnessed increased demand, particularly when communities practiced social distancing and remote work. Platforms that integrate gaming with social networking capabilities have drawn various age groups, such as elderly populations and families, broadening the market base. The COVID-19 pandemic further intensified this trend by rendering digital socialization through gaming a dominant means of staying connected. Moreover, the advent of mobile gaming applications and free-to-play models with in-app purchases satisfies casual gamers in search of flexible and budget-friendly entertainment choices. This broadening appeal continues to drive market expansion, encouraging developers and publishers to innovate around community building and player engagement.

Government Initiatives of Australia Online Gaming Market:

Support for Local Game Development Through Funding and Grants

According to the Australia online gaming market analysis, the government has taken significant steps to bolster the online gaming market by providing targeted funding and grants to local developers. Given the promise of the gaming sector as an economic contributor to the country and a cultural export, initiatives such as the Screen Australia Games: Expansion Pack have been implemented to cater to independent studios and new ideas. Such programs are created to foster homegrown talent, enabling developers to produce games that are about Australian stories, settings, and cultural details, thereby making the local gaming industry grow and be recognized globally. In addition to funding, the government also promotes partnerships between education providers and the gaming sector to ensure a competent workforce for the digital economy. By maximizing creativity and innovation, these efforts have established Australia as a global competitor in the gaming sector, drawing investments and boosting the domestic gaming sector.

Regulatory Framework and Consumer Protection Measures

Australia's government has also prioritized creating a regulatory environment balancing industry development with consumer protection. Due to the intricacies involved in digital content, microtransactions, loot boxes, and gambling components in games, regulators have sought to make clear guidelines available to ensure the protection of players, particularly children. New reforms and debates concerning age restrictions, content classification, and transparency with in-game purchases demonstrate the government's emphasis on responsible gaming. These practices safeguard consumers and foster confidence in the online gaming market, which is a requirement for long-term market growth. The Australian Classification Board has played an active role in updating game ratings to correspond better with changing digital presentation and online experiences. This shifting regulatory landscape assists developers in compliance while urging ethical practices, benefiting players and the business in the long run.

Digital Infrastructure and Esports Promotion Investment

The investment by the Australian government in digital infrastructure has been vital in facilitating the development of the online gaming market. The expansion of high-speed internet coverage, especially with the National Broadband Network (NBN), has enhanced connectivity in urban and regional Australia, making it possible for Australians to enjoy high-quality online gaming. Furthermore, government-sponsored efforts to develop esports have increased the visibility and legitimacy of the industry. Education institutions and local councils increasingly sponsor esports tournaments and venues, seeing them as a source of community outreach and youth employment opportunities. Government support varies for events like the Australian Esports Open, with several demonstrating a strategic interest in developing this new segment. Through improving infrastructure and promoting esports as a cultural and economic activity, the government creates an environment where online gaming can take root, generating employment and aiding the digital economy.

Australia Online Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on device type, gaming type, age group, gender demographics, and model.

Device Type Insights:

- Mobile Devices

- Digital Console

- Computer

The report has provided a detailed breakup and analysis of the market based on the device type. This includes mobile devices, digital console, and computer.

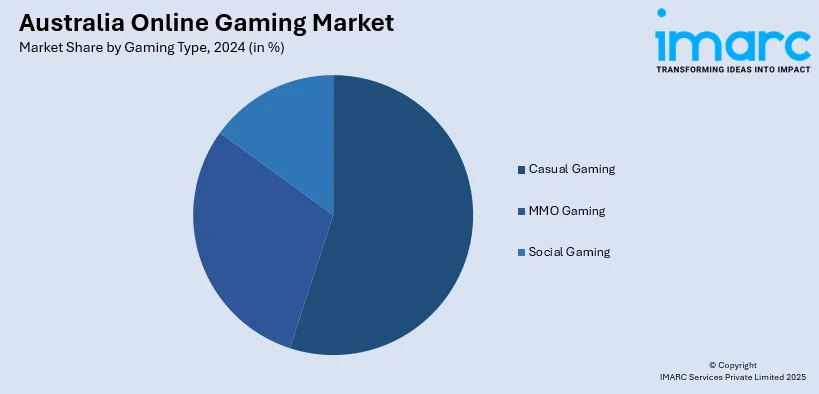

Gaming Type Insights:

- Casual Gaming

- MMO Gaming

- Social Gaming

A detailed breakup and analysis of the market based on the gaming type have also been provided in the report. This includes casual gaming, MMO gaming, and social gaming.

Age Group Insights:

- Below 18 Years

- 19-25 Years

- 26-35 Years

- 36-45 Years

- Over 46 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes below 18 years, 19-25 years, 26-35 years, 36-45 years, and over 46 years.

Gender Demographic Insights:

- Male

- Female

A detailed breakup and analysis of the market based on the gender demographics have also been provided in the report. This includes male and female.

Model Insights:

- Free-to-play Games

- Pay-to-Play Games

The report has provided a detailed breakup and analysis of the market based on the model. This includes free-to-play games and pay-to-play games.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Online Gaming Market News:

- In July 2025, new Ipsos iris data revealed that a significant number of Australians are engaging in online gaming, with almost 17 million accessing a gaming website or app in June 2025. Online gaming participation has steadily increased nationwide over the past 12 months, increasing by 3.9%. With an average of 9.8 hours, or about 20 minutes a day, spent gaming, nearly 80% of Australians (76%) over the age of 14 used a gaming website or application on a computer, mobile device, or tablet. Men and women spend almost the same amount of time playing video games online, although men and those between the ages of 14 and 24 are more likely to look for gaming information. In addition to playing games on PCs, smartphones, and tablets, 36% of households own a gaming console, according to the Ipsos iris Establishment Survey conducted in the year ending March 2025.

- On September 11, 2024, Screen Australia has announced over $2 million funding to boost the Australian games sector. This includes support for 12 games through the Games Production Fund, 27 games through the Emerging Gamemakers Fund and funding for three events through the Games Event Fund. These funds offer critical support to Australian independent game makers, aimed at providing funding for original games with budgets below $500,000; and fostering new talent with professional development opportunities.

Australia Online Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Mobile Devices, Digital Console, Computer |

| Gaming Types Covered | Casual Gaming, MMO Gaming, Social Gaming |

| Age Groups Covered | Below 18 Years, 19-25 Years, 26-35 Years, 36-45 Years, Over 46 Years |

| Gender Demographics Covered | Male, Female |

| Models Covered | Free-to-play Games, Pay-to-Play Games |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia online gaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia online gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia online gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia online gaming market is projected to exhibit a CAGR of 6.84% during 2025-2033.

The Australia online gaming market trends include rising popularity of esports, growth in mobile and cloud gaming, and increasing adoption of cross-platform play. There is also a shift toward social and casual gaming experiences, alongside greater integration of virtual reality and augmented reality technologies, enhancing player engagement and market diversity.

The Australia online gaming market is driven by widespread high-speed internet access, a growing esports culture, and strong digital engagement across diverse age groups. Government support for local developers and increasing mobile gaming adoption also fuel market expansion, making Australia a vibrant and rapidly evolving hub for online gaming entertainment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)