Australia Oil and Gas Market Report by Type (Upstream, Midstream, Downstream), Application (Offshore, Onshore), and Region 2026-2034

Australia Oil and Gas Market Overview:

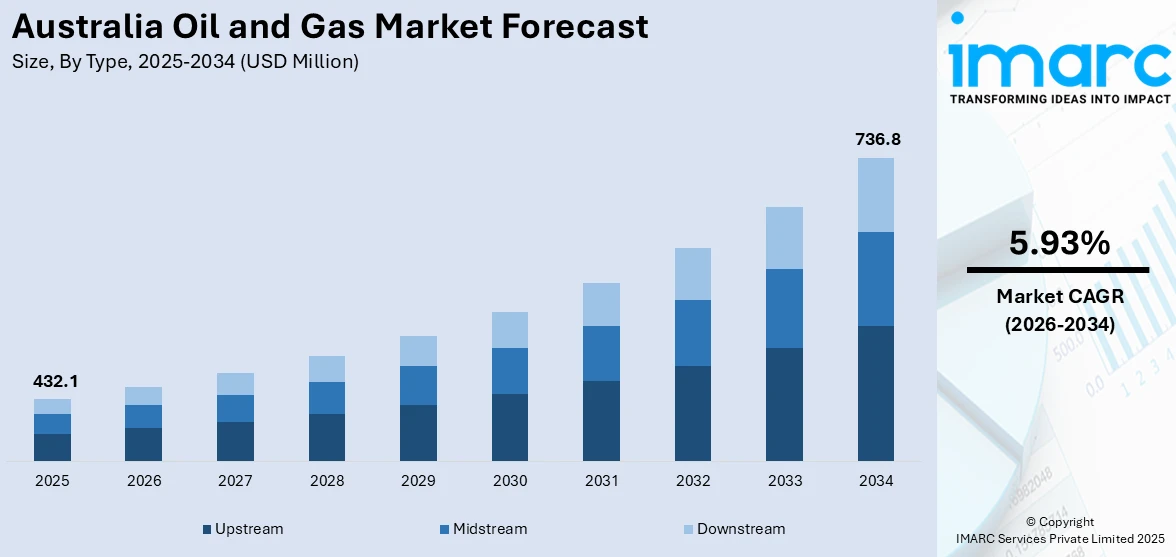

The Australia oil and gas market size reached USD 432.1 Million in 2025. Looking forward, the market is projected to reach USD 736.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.93% during 2026-2034. The market is driven by the increasing energy demand, rapid technological advancements, rising government policies and regulations, exploration and production investment, growing infrastructure development activities, export markets and international trade agreements, the escalating environmental concerns, economic growth and industrial activity, and geopolitical stability and regional conflicts.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 432.1 Million |

|

Market Forecast in 2034

|

USD 736.8 Million |

| Market Growth Rate 2026-2034 | 5.93% |

Key Trends of Australia Oil and Gas Market:

Increasing demand for natural gas

Natural gas is classified as a transitional fuel due to its low carbon emissions. It is also an appealing option for power production, industrial applications, and transportation. Governments are promoting natural gas as part of their energy transition plans to minimize greenhouse gas emissions. Furthermore, the expansion of liquefied natural gas (LNG) commerce and the development of new extraction methods, such as shale gas, drive up demand for natural gas, benefiting the oil and gas industry.

To get more information on this market Request Sample

Rising integration of AI in the oil and gas industry

AI is rapidly emerging as a significant factor in the development of upstream, downstream, and midstream processes. The application of AI improves the oil and gas industry's safety and security standards. As the oil and gas sector adopts AI, it becomes increasingly conscious of the massive effects it may have on every element of the value chain. AI has the potential to solve some of the most pressing issues in today's oilfields. AI enables predictive maintenance, reducing downtime and operational costs by anticipating equipment failures before they occur. It also enhances exploration and drilling accuracy through data analytics, optimizing resource extraction. Additionally, AI-driven automation streamlines operations, increases efficiency, and minimizes human error, fostering more sustainable and cost-effective practices throughout the industry.

Rapid technological advancements

The advancement of technology has had a significant impact on the oil and gas business, revolutionizing how resources are identified, exploited, and processed. Hydraulic fracturing (fracking) and horizontal drilling have opened up previously inaccessible reserves, greatly increasing supply and transforming the global energy market picture. Renewable energy improvements also represent a competitive threat to the traditional oil and gas business, forcing companies to adopt more efficient and environmentally friendly extraction methods. Furthermore, advances in digital technology, such as artificial intelligence and the Internet of Things (IoT), are optimizing operations, lowering costs, and improving safety in the business. Continuous innovation shapes not just the competitiveness of enterprises, but also the sustainability and resilience of the oil and gas sector in the face of mounting environmental concerns and regulatory pressures.

Growth Drivers of Australia Oil and Gas Market:

LNG Expansion Initiatives

Australia is making significant investments to enhance its liquefied natural gas (LNG) sector in response to the rising demand from international markets, particularly in Asia. New facilities and upgrades to current terminals are boosting the nation’s LNG production capacity. These initiatives increase export volumes and generate local employment opportunities and stimulate economies in regional areas. Advances in technology are contributing to improved efficiency and lower emissions in these projects. As one of the leading LNG exporters globally, Australia benefits from a strategic position, and ongoing expansion helps to maintain or even increase its market share. As older projects reach maturity, new investments extend the life of important gas fields, solidifying Australia's long-term role in the worldwide energy supply network. Australia oil and gas market demand is expected to remain strong, driven by the global need for cleaner energy solutions, especially in Asia, and the continued development of hydrogen as a potential future energy export.

Regional Trade Agreements

Australia's favorable location and strong diplomatic relationships with major Asian countries comprising Japan, India, China, and South Korea make regional trade agreements essential for its oil and gas industry. These agreements promote long-term LNG supply contracts and help establish stable revenue for Australian producers. By encouraging energy collaboration and minimizing trade barriers, these arrangements provide Australian exporters with better access and lower regulatory obstacles. Both governments and private entities work together to ensure energy security throughout the Asia-Pacific region, fostering a reliable market for Australian gas. As energy needs in Asia grow particularly with the transition from coal to cleaner-burning gas regional trade agreements offer Australia a dependable and expanding customer base for its oil and gas exports.

Infrastructure Upgrades

In the analysis of the Australia oil and gas market, infrastructure development plays a vital role in promoting sustainable growth. Investments in pipelines, LNG export terminals, and gas processing facilities enhance supply chains and alleviate transportation challenges. These improvements increase the reliability and capacity of deliveries to both domestic and international markets. For projects located offshore and in remote areas, improved connectivity through new or upgraded pipelines reduces reliance on trucking and minimizes environmental impact. Export terminals with greater loading capacities also reduce turnaround times, supporting long-term supply agreements. Updated infrastructure draws in further investments by enhancing operational efficiency and scalability. According to Australia oil and gas market analysis, expanding infrastructure directly contributes to higher production levels and reinforces the Australia’s status in the international energy market.

Opportunities of Australia Oil and Gas Market:

Hydrogen Production

Australia is strategically positioned to emerge as a significant contributor to hydrogen production, taking advantage of its existing gas infrastructure along with plentiful solar and wind energy. There are exciting prospects for green hydrogen, produced from renewable energy sources, and blue hydrogen, which is made from natural gas using carbon capture technology. The country’s close proximity to energy-demanding Asian markets enhances its strategic appeal, especially as these nations pursue decarbonization goals. Existing LNG terminals and pipelines can be modified to manage hydrogen, minimizing initial infrastructure expenses. Numerous pilot projects are already in progress, and governmental backing for hydrogen development strategies indicates a long-term commitment. This shift aids in energy diversification and helps to position Australia as a leading exporter of clean energy, aligning with global movements towards low-emission fuels and sustainable energy systems. Australia oil and gas market share is expected to expand significantly, leveraging its hydrogen potential while maintaining its strong role in the LNG export market.

Carbon Capture and Storage (CCS)

Carbon Capture and Storage (CCS) presents a viable method for Australia to decrease emissions while still producing fossil fuels. The country possesses numerous depleted gas fields and geological formations suitable for the long-term storage of CO₂, particularly in Western Australia and the Northern Territory. By capturing emissions from industrial or energy production sites and injecting them into these underground reservoirs, operators can comply with increasingly stringent climate regulations without halting productive operations. CCS also bolsters the feasibility of blue hydrogen initiatives, offering a comprehensive solution for cleaner energy. Government funding and partnerships with industry are driving interest in this area. As global energy consumers focus more on carbon credentials, CCS can provide a competitive edge for Australian oil and gas producers.

Unconventional Gas

Australia has considerable untapped unconventional gas reserves, including shale and tight gas, mainly located in basins such as the Cooper, Beetaloo, and Canning. With traditional gas fields nearing maturity, these unconventional resources represent a viable way to ensure a sustained supply. Innovations in horizontal drilling, hydraulic fracturing, and reservoir mapping have enhanced the feasibility of these projects. Nonetheless, environmental concerns necessitate transparent management and adherence to strict regulations to gain public approval. If developed sustainably, unconventional gas could lessen reliance on imports, create regional jobs, and reinforce energy security. Additionally, this sector could supply feedstock for LNG and future hydrogen production. With rising demand both domestically and in international markets, unconventional gas represents a promising growth opportunity within Australia’s evolving energy landscape.

Challenges of Australia Oil and Gas Market:

Regulatory Uncertainty

The Australian oil and gas sector is experiencing increasing unpredictability due to changing government policies focused on emissions objectives, exploration permits, and project licensing. Frequent shifts in environmental regulations or permitting delays can hinder development timelines and deter investment. Misalignment between federal and state regulations adds further complications, creating uncertainty for both local and international investors. Many projects require extensive lead times, and any policy changes during development can significantly impact costs and overall feasibility. Investors prefer stability, yet the current environment makes long-term planning precarious. This unpredictability also hampers the adoption of innovative solutions and discourages smaller companies that lack the resources to navigate lengthy approval processes, jeopardizing the pace of future developments.

Environmental Opposition

There is considerable public resistance to fossil fuel initiatives in Australia. Environmental advocacy organizations, local communities, and Indigenous groups are increasingly voicing concerns regarding climate change, land usage, and the loss of biodiversity. Such opposition can result in legal disputes, protests, and regulatory assessments that can delay or halt projects. In particular, offshore drilling and fracking operations face intense scrutiny due to environmental concerns and potential spill risks. Companies are now expected to showcase greater social and environmental responsibility, which often entails detailed engagement with stakeholders and a commitment to transparency. This increases project costs and timelines and also heightens reputational risks. As public opinion shifts towards renewable energy, garnering support for oil and gas projects has become more challenging.

High Operational Costs

Australia's oil and gas operations rank among the highest in costs globally, influenced by various geographic, logistical, and labor-related aspects. Offshore projects, especially in deepwater regions, demand advanced technology and specialized equipment, which significantly elevate both capital and operational expenses. Onshore operations face logistical challenges due to the need to transport equipment and materials to remote areas. Additionally, a shortage of skilled labor coupled with elevated wage expectations in the industry further raise costs, particularly in remote regions like the Pilbara or Northern Territory. Compliance with stringent safety, environmental, and regulatory requirements adds another layer of expense. In comparison to producers in the Middle East or the US, Australian operations often find it difficult to maintain cost competitiveness, which affects profit margins and limits their adaptability in volatile global markets.

Government Support of Australia Oil and Gas Market:

Subsidies for Carbon Capture and Storage (CCS)

The Australian government is providing financial assistance to encourage the development and use of Carbon Capture and Storage (CCS) technologies. By offering grants and incentives, the government allows operators to continue extracting fossil fuels while aligning with emissions reduction goals. CCS projects work by capturing CO₂ emissions from industrial processes or electricity generation and securely storing them underground, thereby minimizing environmental damage. These subsidies support operators in fulfilling regulatory obligations and enhance the economic feasibility of large-scale CCS initiatives. As Australia seeks to balance its energy transition with ongoing fossil fuel production, CCS is a crucial element of the approach, particularly for LNG exporters aiming to remain competitive in a carbon-restricted global market.

Exploration Incentives

To promote new discoveries and increase production capacity, the Australian government has established programs like the Exploration Incentive Scheme (EIS), designed to alleviate the financial burdens associated with exploration activities. These grants are especially advantageous for smaller firms that may struggle to finance costly exploration in remote or less explored regions. The EIS supports geological surveys, drilling activities, and seismic studies to help companies evaluate the potential of untapped areas. Given the increasing need for new reserves to replace diminishing fields, government backing for exploration is vital for maintaining Australia’s oil and gas output. Additionally, the scheme encourages the advancement of exploration technologies, fostering more efficient and environmentally responsible methods.

Renewable Energy Integration

The Australian government is placing a greater emphasis on integrating renewable energy with existing oil and gas infrastructure as part of its shift towards cleaner energy sources. This includes initiatives aimed at promoting hydrogen production from renewable electricity as well as the incorporation of wind and solar power into the energy portfolio. By leveraging existing oil and gas infrastructure for renewable projects such as using gas pipelines for the distribution of hydrogen the transition becomes more economically viable. Furthermore, policies aimed at diminishing greenhouse gas emissions while ensuring energy security create possibilities for the oil and gas sector to broaden its range of offerings. Government incentives and funding facilitate the development of new, low-carbon solutions, making the melding of renewable energy into the oil and gas industry both practical and financially rewarding.

Australia Oil and Gas Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Upstream

- Midstream

- Downstream

The report has provided a detailed breakup and analysis of the market based on the type. This includes upstream, midstream, and downstream.

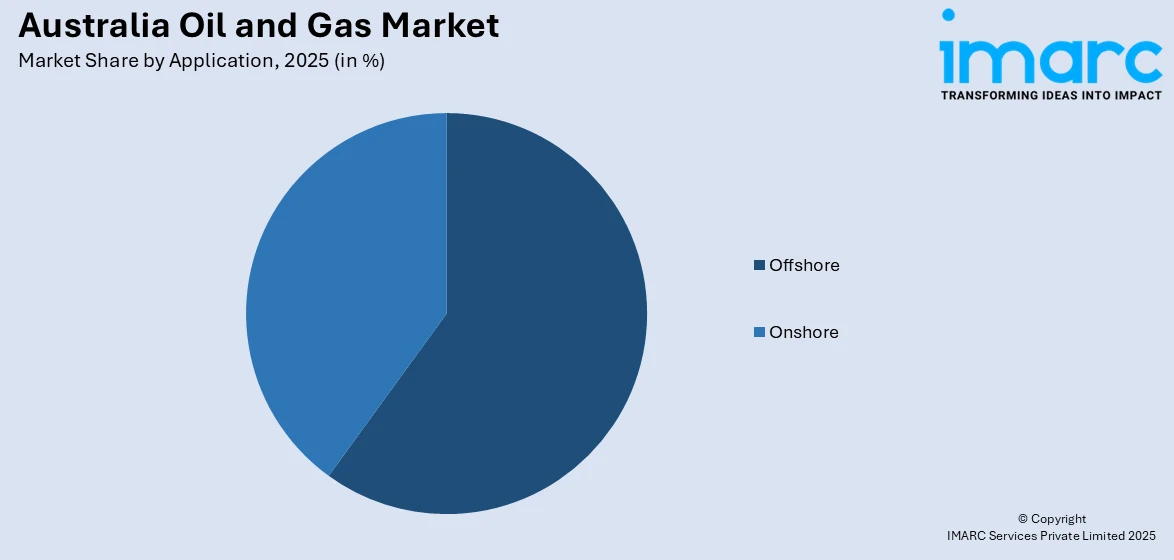

Application Insights:

Access the comprehensive market breakdown Request Sample

- Offshore

- Onshore

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes offshore and onshore.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Amplitude Energy

- Beach Energy Limited

- BP p.l.c.

- Chevron Corporation

- Exxon Mobil Corporation

- Omega Oil and Gas Limited

- Origin Energy Limited

- Santos Ltd

- Shell Energy Operations Pty Ltd

- Woodside Energy

Australia Oil and Gas Market News:

- May 31, 2024: Woodside, an Australian energy company, has secured a $1billion loan agreement with the Japan Bank for International Cooperation to fund its Scarborough Energy Project in Western Australia. The project aims to produce its first LNG cargo in 2026 and involves the development of the Scarborough gas field in the Carnarvon Basin. The agreement with JBIC will diversify Woodside's funding sources and enhance liquidity. Additionally, the project includes the construction of new offshore facilities and a pipeline to connect to existing infrastructure.

- May 28, 2024: Santos Limited announced the signing of a binding long-term LNG Supply and Purchase Agreement (SPA) with Hokkaido Gas Co., Ltd. to provide LNG from Santos’ portfolio of world-class LNG assets.

Australia Oil and Gas Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Upstream, Midstream, Downstream |

| Applications Covered | Offshore, Onshore |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Amplitude Energy, Beach Energy Limited, BP p.l.c., Chevron Corporation, Exxon Mobil Corporation, Omega Oil and Gas Limited, Origin Energy Limited, Santos Ltd, Shell Energy Operations Pty Ltd, Woodside Energy, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia oil and gas market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia oil and gas market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia oil and gas industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The oil and gas market in the Australia was valued at USD 432.1 Million in 2025.

The Australia oil and gas market is projected to exhibit a compound annual growth rate (CAGR) of 5.93% during 2026-2034.

The Australia oil and gas market is expected to reach a value of USD 736.8 Million by 2034.

Australia’s oil and gas market is witnessing increased investment in LNG infrastructure, rising focus on carbon capture technologies, and greater integration of digital tools for operational efficiency. There is also a shift toward decarbonisation strategies and exploration of offshore reserves to boost long-term production capacity.

The market is driven by strong export demand, especially from Asia, supportive government energy policies, and new offshore discoveries. Expansion of LNG terminals and sustained global energy needs also contribute to growth. Additionally, rising domestic energy consumption continues to stimulate upstream and midstream developments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)