Australia Office Furniture Market Size, Share, Trends and Forecast by Product Type, Material Type, Distribution Channel, Price Range, and Region, 2025-2033

Australia Office Furniture Market Size and Share:

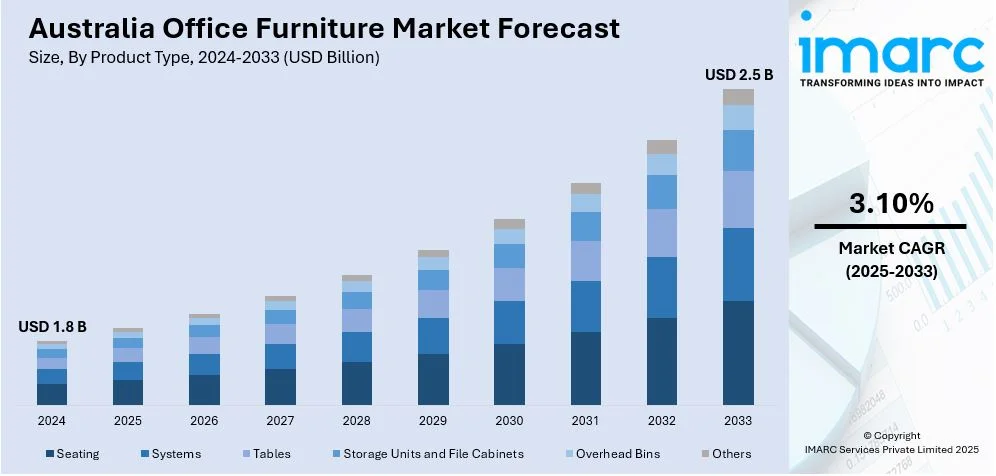

The Australia office furniture market size reached USD 1.8 Billion in 2024. Looking forward, the market is projected to reach USD 2.5 Billion by 2033, exhibiting a growth rate (CAGR) of 3.10% during 2025-2033. The market is driven by increasing demand for ergonomic and hybrid work solutions, sustainability initiatives promoting eco-friendly materials, and rising adoption of smart technology-integrated furniture. Corporate wellness programs, evolving workplace designs, and government policies supporting green procurement influencing purchasing decisions across businesses and institutions thus aiding the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Market Growth Rate 2025-2033 | 3.10% |

Key Trends of Australia Office Furniture Market:

Sustainable and Eco-Friendly Furniture

The Australia office furniture market is experiencing a shift toward sustainability as businesses increasingly prioritize eco-friendly materials and production methods. With the Australian Furniture Association reporting 8.5 million tonnes of furniture waste annually, the need for sustainable procurement and recycling initiatives is more critical than ever. Firms are stocking furniture made with recycled wood, metal, and biodegradable plastics in the effort to curtail their own carbon footprint, while increased interest in low- volatile organic compounds (VOC) finishes and non-toxic adhesives indicates greater worry about indoor air quality. Government policies and business sustainability efforts further promote sustainable practices, with suppliers becoming certified as FSC and GECA. Producers are embracing circular economy models, providing refurbishing and recycling programs to prolong product lifecycles. This movement toward sustainable office furniture not only promotes environmental objectives but also reflects larger corporate social responsibility (CSR) trends, impacting buying decisions throughout businesses and institutions.

To get more information on this market, Request Sample

Technology-Integrated Smart Furniture

The growing use of smart office furniture is revolutionizing Australian workplaces, in line with the growth of digital and artificial intelligence (AI)-based office spaces. Businesses are spending money on desks with integrated charging ports, wireless connectivity, and height-adjustable automation to improve convenience and productivity. Smart conference tables with integrated touchscreens and Internet of Things (IoT)-enabled meeting pods are becoming popular in corporate offices, facilitating smooth virtual collaboration. Sensor-enabled office chairs with posture correction capabilities and real-time analytics are gaining traction, enabling health-oriented work cultures. The increasing need for technology-driven solutions that cater to hybrid workspaces and operational effectiveness is the primary driver behind this. With companies modernizing their workplaces, smart furniture is emerging as an essential element of office space future-proofing.

Ergonomic and Hybrid Work Solutions

As more employers adopt hybrid work models, ergonomic office equipment is increasingly gaining momentum in Australia as employers opt to invest in adjustable desks, ergonomic chairs, and modular workstations to maximize workers' welfare and productivity. Implementation of sit-stand desks and flexible seating layouts assists in curbing concerns pertaining to posture and musculoskeletal well-being. Additionally, businesses are integrating home office furniture solutions to support remote work, blurring the lines between office and residential design. Technology-driven solutions, such as smart desks with posture tracking and IoT-enabled adjustments, are enhancing ergonomic efficiency. However, with Australia generating 30,000 tonnes of commercial furniture waste annually, 95% of which ends up in landfills, there is an increasing call for sustainable design, recycling initiatives, and circular economy models to reduce environmental impact and support responsible workplace solutions.

Growth Drivers of Australia Office Furniture Market:

Rise of Co‑working Spaces Driving Demand for Flexible Furniture

The rapid growth of co-working and shared office environments in Australia is significantly increasing the need for adaptable and multi-functional office furniture. These innovative workspaces require furniture that is robust and space-efficient and also embodies a modern and collaborative work culture. Providers of shared office spaces are investing in items that can be easily rearranged or repurposed to suit varying team sizes and different work styles. Popular items include modular desks, mobile storage solutions, and ergonomic seating. Furthermore, the visual appeal of furniture is a crucial factor in attracting clients to these spaces, prompting greater investment in stylish and branded interiors. This shift in workplace design is driving consistent growth in demand for versatile furniture, contributing to an increasing Australia office furniture market share in both the private and commercial sectors.

SME Expansion Fueling Scalable Furniture Solutions

The steady growth of small and medium enterprises (SMEs) in Australia, especially in the tech, consulting, and service industries, is creating strong demand for affordable yet scalable office furniture. These expanding businesses are often mindful of their budgets but still seek quality solutions that enhance productivity, comfort, and support future growth. As SMEs frequently operate in compact or shared environments, they prefer modular furniture that can adjust to their evolving requirements. Popular choices include desks with storage capabilities, foldable seating, and space-efficient workstations. Additionally, many SMEs are looking for rapid delivery and easy assembly options through e-commerce platforms, further boosting demand. This trend signifies a move toward functional and flexible setups tailored for business expansion, which is ultimately increasing Australia office furniture market demand as new companies continue to emerge across the nation.

Customization and Visual Appeal Driving Design-Centric Growth

The changing expectations of contemporary workplaces in Australia are driving a demand for office furniture that merges functionality with aesthetic value. Companies are increasingly investing in tailor-made furniture designs that reflect their brand identity, culture, and overall interior themes. Whether it involves using specific color palettes, selecting unique materials, or opting for layout-friendly designs, personalization has become a pivotal factor in purchasing decisions. This trend is particularly pronounced in creative and client-oriented industries that prioritize a visually appealing and inviting office atmosphere. Manufacturers are responding by offering a broader array of design-focused, customizable furniture that enables businesses to distinguish their spaces. Consequently, design-driven demand is no longer restricted to premium buyers; it is becoming mainstream across businesses of all sizes. This rising focus on unique and branded workspaces is significantly driving overall Australia office furniture market growth.

Opportunities of Australia Office Furniture Market:

Customization and Bespoke Branding Driving Differentiation

As organizations strive to embody their identity and values within their physical environments, customization has emerged as a key growth driver in the Australian office furniture sector. Companies now favor personalized solutions that resonate with their brand aesthetics, encompassing specific color palettes, materials, and uniquely crafted layouts and furniture styles. This heightened interest in tailored office settings stems from their visual attractiveness and from the ambition to cultivate a robust corporate culture. Custom-designed spaces can enhance team morale, promote collaboration, and leave a lasting impression on visiting clients. Consequently, furniture providers that offer bespoke design services can leverage premium pricing and enhance customer loyalty. This area presents significant opportunities, especially for innovative manufacturers capable of offering flexibility, creativity, and functionality in their products.

Health and Wellness-Focused Designs Gaining Momentum

According to Australia office furniture market analysis, a notable shift toward health-centric office environments is unfolding, opening substantial avenues for wellness-oriented furniture. Organizations are increasingly investing in ergonomic chairs, sit-stand desks, lumbar support accessories, and anti-fatigue mats to boost employee comfort and productivity. These options help decrease workplace injuries, improve posture, and encourage movement throughout the workday. With a growing awareness of occupational health, particularly in sedentary roles, businesses are prioritizing furniture that enhances physical well-being. This trend is further bolstered by employee retention strategies, as wellness amenities are often seen as attractive workplace benefits. Manufacturers and suppliers focusing on innovative, wellness-centered designs can capture a devoted and expanding clientele while aligning with broader organizational objectives surrounding health, safety, and sustainable workplace performance.

Value-Added Services Creating Competitive Advantage

Comprehensive furniture solutions combined with services such as on-site installation, office layout design, maintenance, and after-sales support are becoming a compelling value proposition in the Australian office furniture industry. Nowadays, organizations seek more than just furniture they desire complete solutions that minimize stress and save time. Providing package deals that encompass planning and support enables suppliers to stand out in a competitive market while catering to customer convenience and budget considerations. These offerings are particularly attractive to SMEs, startups, and co-working spaces that may lack internal resources for complicated setups. Additionally, value-added services nurture long-term relationships and recurring business through maintenance or upgrade agreements. By establishing themselves as solution providers rather than mere product sellers, companies can enhance their brand credibility and secure a larger share of the professional office furniture marketplace.

Government Support of Australia Office Furniture Market:

Workplace Health and Safety Regulations

In Australia, stringent workplace health and safety regulations mandate that employers create office environments that promote employee wellness. This requirement includes the use of ergonomically designed chairs, desks, and accessories that reduce physical strain and meet national safety regulations. Consequently, there is a rising demand for certified and ergonomically tested office furniture, especially in sectors where employee comfort is closely linked to productivity and health outcomes. These regulations advocate for improved office layouts and influence purchasing choices in both private and public sectors. Manufacturers and suppliers are required to ensure their products align with compliance standards, presenting both challenges and opportunities for innovation in ergonomic design and safety-focused offerings within the Australian office furniture market.

Sustainability and Environmental Guidelines

Australian environmental regulations stress the importance of lowering carbon footprints, encouraging recycling, and focusing on sustainable and non-toxic materials. These guidelines significantly impact the manufacturing, sourcing, and distribution of office furniture. Manufacturers are encouraged to embrace greener practices, such as utilizing FSC-certified wood, recycled plastics, and low-emission finishes. Failing to comply can restrict access to certain tenders or contracts, especially in the public sector. While environmentally friendly production may lead to increased short-term costs, it also offers chances for differentiation in a market where corporate social responsibility is becoming increasingly important. As more companies align with sustainability objectives, the demand for eco-conscious furniture continues to influence the evolution of the Australian office furniture industry.

Support for Local Manufacturing

The Australian government offers various incentives, grants, and tax benefits aimed at enhancing domestic manufacturing, including within the office furniture sector. This support aims to decrease dependence on imports, fortify local supply chains, and promote job creation. For furniture manufacturers, these initiatives present opportunities to expand operations, adopt new technologies, and invest in sustainable practices. Local production also aligns with procurement preferences in the public sector, which often favors Australian-made products. However, to take advantage of these benefits, businesses need to meet quality standards and prove efficiency and compliance. This government support empowers domestic manufacturers to compete more effectively with international brands, fostering resilience and innovation in the Australian office furniture market.

Challenges of Australia Office Furniture Market:

Supply Chain Disruptions

A significant challenge facing the Australian office furniture market is the susceptibility to global supply chain disruptions. Numerous manufacturers rely on imported components like steel parts, upholstery materials, or electronic fittings, which can be affected by shipping delays, rising freight costs, and geopolitical instabilities. Such disruptions impact production timelines, inventory availability, and ultimately customer satisfaction. Delays in material delivery can result in missed project deadlines or an inability to fulfill bulk orders, especially during high-demand periods. Companies are now looking to reduce this risk by sourcing locally, creating inventory buffers, and diversifying their supplier networks. Nevertheless, building resilient supply chains necessitates time and investment, making it an ongoing challenge for furniture suppliers in the area.

High Competition and Price Pressure

The Australian office furniture market is characterized by intense competition, featuring a variety of global brands, local manufacturers, and online retailers offering a broad range of products at different price points. This fierce competition generates considerable pressure on pricing, often squeezing margins for manufacturers and distributors. Customers increasingly expect high quality at competitive prices, compelling suppliers to find a balance between cost and value. Additionally, price-sensitive consumers may choose cheaper imported options, intensifying challenges for local manufacturers. To maintain competitiveness, businesses must prioritize innovation, brand differentiation, and high-quality customer service while managing cost efficiencies. Navigating this environment requires strategic positioning and a thorough understanding of evolving consumer preferences.

Changing Work Models Creating Demand Uncertainty

The emergence of hybrid and remote work configurations has altered the use of office spaces, complicating demand forecasting for furniture suppliers. While some companies are reducing their office spaces, others are reconfiguring them to promote collaboration and flexibility. This ongoing transformation has disrupted traditional bulk purchasing patterns and created a need for compact, mobile, or home-friendly furniture. For manufacturers and retailers, this necessitates the adaptation of product lines and marketing strategies to align with the changing landscape of workspace utilization. However, the lack of clarity around long-term workspace trends poses a planning challenge, especially for inventory management and supply forecasting. Staying agile and responsive to these changes is essential for navigating this transitional period in the Australia office furniture market.

Australia Office Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, material type, distribution channel, and price range.

Product Type Insights:

- Seating Furniture

- Modular Systems

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seating furniture, modular systems.

Material Type Insights:

- Wood

- Metal

- Plastic and Fiber

- Glass

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes wood, metal, plastic and fiber, glass, and others.

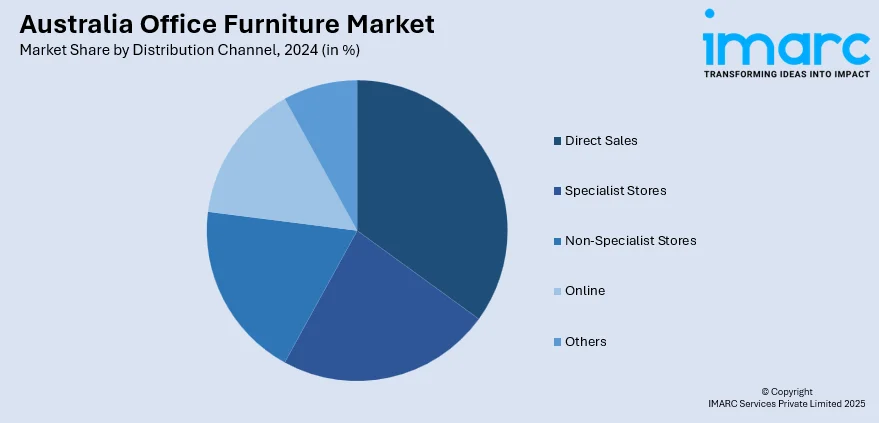

Distribution Channel Insights:

- Direct Sales

- Specialist Stores

- Non-Specialist Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes direct sales, specialist stores, non-specialist stores, online, and others.

Price Range Insights:

- Low

- Medium

- High

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low, medium, and high.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Office Furniture Market News:

- In March 2025, Danny's Desks and Chairs is growing its line of ergonomic office furniture to satisfy increased demand as Australia's market expands from USD 2.01 billion in 2024 to USD 2.89 billion in 2034. As companies focus on workplace comfort and efficiency, the company launches additional ergonomic chairs, sit-stand desks, and flexible workstations to suit changing hybrid and corporate office requirements.

- In February 2024, Value Office Furniture, one of Australia's top wholesale office furniture suppliers, launched a new range of ergonomic office chairs. The fashionable and comfortable chairs use the newest ergonomic technology to improve office spaces, resulting in better comfort and support. The new range is created to address the increasing need for more effective workplace seating.

Australia Office Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seating Furniture, Modular Systems |

| Material Types Covered | Wood, Metal, Plastic and Fiber, Glass, Others |

| Distribution Channels Covered | Direct Sales, Specialist Stores, Non-Specialist Stores, Online, Others |

| Price Ranges Covered | Low, Medium, High |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia office furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia office furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia office furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The office furniture market in Australia was valued at USD 1.8 Billion in 2024.

The Australia office furniture market is projected to exhibit a compound annual growth rate (CAGR)of 3.10% during 2025-2033.

The Australia office furniture market is expected to reach a value of USD 2.5 Billion by 2033.

The market is witnessing rising demand for smart furniture with integrated tech features, along with growing preference for space-saving designs suited for hybrid work setups. There is also an increasing shift toward minimalist aesthetics, modular configurations, and eco-conscious designs that align with sustainability goals.

Increasing investments in workplace modernization, rising health awareness promoting ergonomic adoption, and strong demand from co-working and SME sectors are fueling market expansion. Additionally, government support for local manufacturing and the rise in home office setups continue to drive steady growth across diverse user segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)