Australia Nutraceuticals Market Report by Product Type (Functional Food, Functional Beverage, Dietary Supplements), Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, Drug Stores/Pharmacies, Online Retail Stores), and Region 2025-2033

Australia Nutraceuticals Market Size and Share:

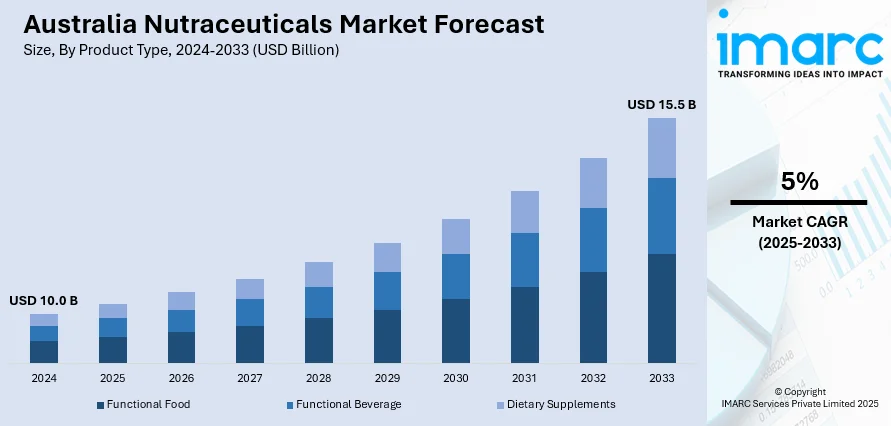

The Australia nutraceuticals market size reached USD 10.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 15.5 Billion by 2033, exhibiting a growth rate (CAGR) of 5% during 2025-2033. The market is propelled by growing health consciousness among consumers, rising demand for functional foods and dietary supplements, increasing geriatric population and associated health issues, advancements in nutraceutical product innovation and formulations, and government support and favorable regulations for health products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.0 Billion |

|

Market Forecast in 2033

|

USD 15.5 Billion |

| Market Growth Rate 2025-2033 | 5% |

Australia Nutraceuticals Market Trends:

Awareness Around Healthcare Trends

Rising consumption and awareness around health and wellness strongly influences the Australian nutraceuticals industry. The prevalence of diseases caused by modern lifestyles, obesity, and diabetes, are making residents of this country mindful of their health. Instead of seeking treatment after onset, individuals are giving priority to maintaining their health and preventing illnesses. Consequently, nutraceuticals are becoming popular as consumers seek products such as dietary supplements that promote heart health, improve digestion, and boost cognitive function. As per the US National Institutes of Health, approximately 34% of men and 47% of women regularly consume nutritional supplements in Australia. There is more demand lately for ingredients such as probiotics and omega-3 fatty acids that have many scientifically proven health benefits. On account of this trend, the nutraceuticals industry in Australia is experiencing more consumption of supplements, facilitating overall market growth.

To get more information on this market, Request Sample

Increasing Demand for Functional Foods and Beverages

The Australia nutraceuticals market is significantly impacted by the rising demand for functional foods and beverages. Functional foods provide more health benefits beyond basic nutrition. As a result, these foods have become a staple for consumers who want to improve their diet without compromising on convenience and taste. Fortified cereals, dairy products enriched with probiotics, and beverages infused with vitamins or herbal extracts are all examples of functional foods. Also, the shift toward plant-based diets is another growth-inducing factor. Due to sustainability concerns, ethical issues regarding animal farming, and recognized health benefits, more individuals are switching to plant-based functional foods to meet their nutritional needs. According to the US National Library of Medicine, Australia experienced a 46% increase in sales of plant-based ‘meat’ in 2020, with the number of products available in retail stores increasing twofold. These changing consumer preferences are stimulating innovations in plant-based proteins and vegan supplements, aiding in the development of the Australia nutraceuticals market.

Government Support and Regulatory Frameworks

Government support and favorable regulatory standards are vital in shaping the growth of the Australia nutraceuticals market. To guarantee the efficacy, safety, and quality of nutraceutical products, the Government of Australia has put into effect many legislations and regulations. This has instilled consumer confidence in these products. Moreover, the Therapeutic Goods Administration (TGA) regulates dietary supplements and functional foods under strict guidelines, to ensure that they meet high standards of safety and effectiveness. These robust regulatory standards promote market growth by guaranteeing consumers that the nutraceuticals they purchase are reliable and beneficial. Other than this, the Government of Australia is also encouraging healthier lifestyle choices and eating foods that are rich in nutrients. On account of these governmental health initiatives aiming to reduce the burden of chronic illnesses, individuals are continually seeking nutraceuticals that meet their wellness needs. This support for health-conscious living is creating a favorable market outlook for Australian nutraceuticals.

Australia Nutraceuticals Market News:

- 1 September 2023: As per the Australian Therapeutic Goods Administration (TGA), sports supplements are in medicinal dosage forms (tablets, capsules, or pills) and make claims about performance in exercise, sports, or leisure activities will be classified as therapeutic goods as of 30 November 2023.

Australia Nutraceuticals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Functional Food

- Cereals

- Bakery and Confectionery

- Dairy

- Snacks

- Others

- Functional Beverage

- Energy Drinks

- Sports Drinks

- Fortified Drinks

- Dairy and Dairy Alternative Beverages

- Others

- Dietary Supplements

- Vitamins

- Minerals

- Botanicals

- Enzymes

- Fatty Acids

- Proteins

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes functional food (cereals, bakery and confectionery, dairy, snacks, and others), functional beverage (energy drinks, sports drinks, fortified drinks, dairy and dairy alternatives beverages, and others), and dietary supplements (vitamins, minerals, botanicals, enzymes, fatty acids, proteins, and others).

Distribution Channel Insights:

- Specialty Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- Drug Stores/Pharmacies

- Online Retail Stores

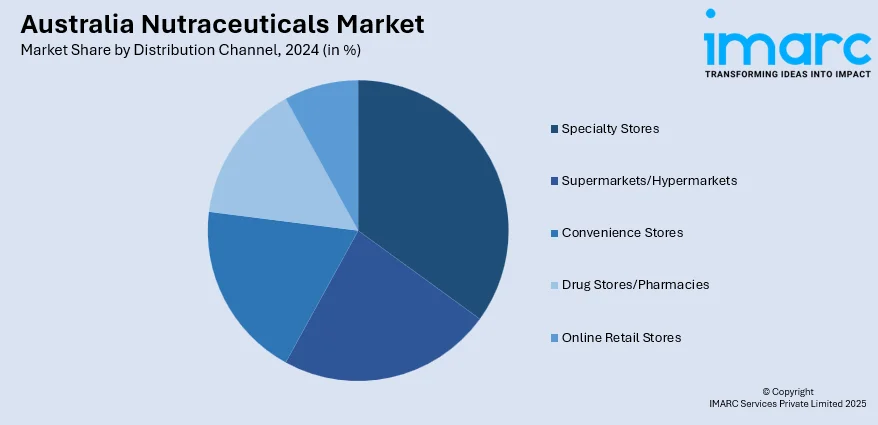

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialty stores, supermarkets/hypermarkets, convenience stores, drug stores/pharmacies, and online retail stores.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Nutraceuticals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, Drug Stores/Pharmacies, Online Retail Stores |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia nutraceuticals market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia nutraceuticals market on the basis of product type?

- What is the breakup of the Australia nutraceuticals market on the basis of distribution channel?

- What are the various stages in the value chain of the Australia nutraceuticals market?

- What are the key driving factors and challenges in the Australia nutraceuticals?

- What is the structure of the Australia nutraceuticals market and who are the key players?

- What is the degree of competition in the Australia nutraceuticals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia nutraceuticals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia nutraceuticals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia nutraceuticals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)