Australia Menswear Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2025-2033

Australia Menswear Market Overview:

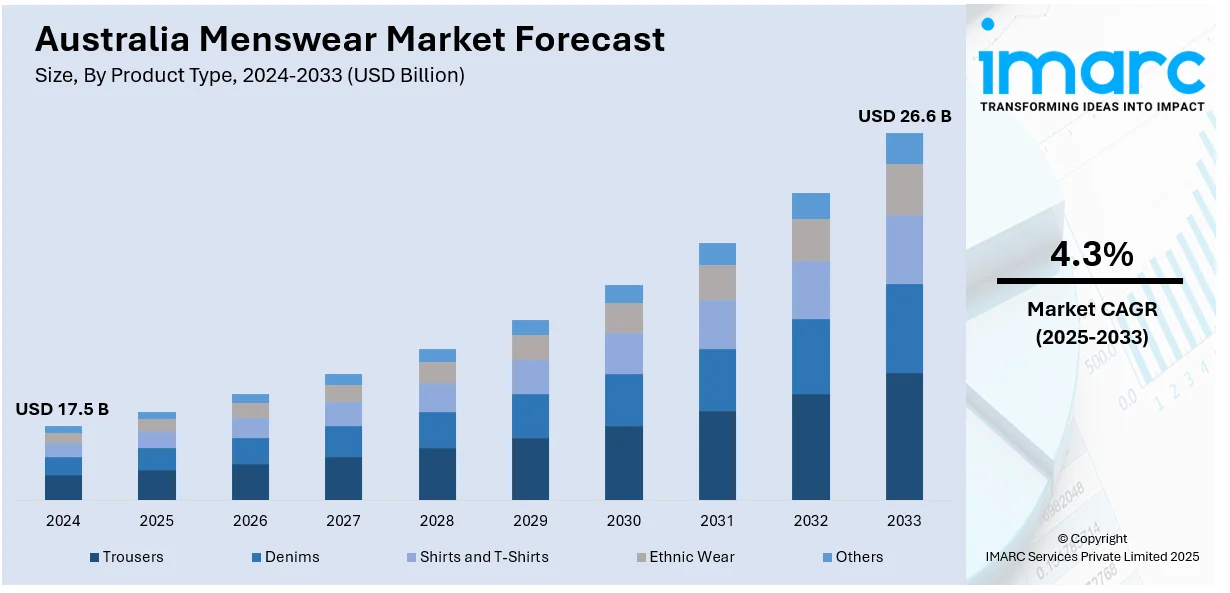

The Australia menswear market size reached USD 17.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 26.6 Billion by 2033, exhibiting a growth rate (CAGR) of 4.3% during 2025-2033. The market thrives on high-end, eco-friendly fashion movements, with increasing demand for athleisure and casual wear, digital retailing growth, and local brand expansion, fueled by environmentally friendly consumers, changing lifestyles, and international influences defining a competitive arena revolving around innovation, quality, and price competitiveness.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 26.6 Billion |

| Market Growth Rate 2025-2033 | 4.3% |

Australia Menswear Market Trends:

Shift Towards Smart Casual and Athleisure

Australian men's clothing is experiencing a significant shift toward smart casual and athleisure wear. The transformation is mostly fueled by changing workspaces, with hybrid and remote work making formalwear unnecessary. Men opt for functional garments that combine comfort and elegance—imagine joggers tailored, polo shirts with structure, and knit blazers. Performance textiles like stretch blends and moisture-wicking fabrics are now favored due to their ease of care and functionality. The trend is most apparent in cities, where day-to-evening dressing and capsule wardrobes are becoming increasingly common. Customers demand apparel that will fit across multiple social environments without sacrificing fashion. Neutral colors, clean lines, and layering items dominate the offerings now. Retailers are reacting with larger product offerings that extend the distinction between every day and business fashion. This trend benefited the Australia menswear market outlook directly, with the demand for versatile, lifestyle-suited fashion based on comfort, functionality, and contemporary style increasing.

To get more information on this market, Request Sample

Elevated Demand for Sustainable and Ethical Apparel

Sustainability is now a major concern for Australian male consumers, driving purchasing habits in several categories of menswear. For instance, in July 2023, AXL+Co launched under the Connor brand, launching a plus-sized menswear line highlighting inclusivity and sustainability, marking Australia's increased demand for size-diverse and ethical fashion. Moreover, ethically sourced materials, organic materials, and lower carbon footprint are today's most significant product attributes driving brand loyalty. Men are becoming increasingly concerned about where and how their garments are produced, favoring locally made products, slow fashion brands, and eco-friendly production processes. Clothing that provides long-term durability, classic style, and low environmental impact is preferred over fashion-forward fast fashion. Recycled cotton, biodegradable dyes, and carbon-neutral packaging are becoming increasingly prevalent in product lines targeting aware consumers. Social media and awareness campaigns have further heightened consciousness regarding the life cycle of clothing and its wider ramifications. These developments capture the changing Australia menswear market scenario, in which ecological concerns and ethical norms are getting aligned with fashion aspirations and buying intention, instilling lasting brand faith and repeat purchasing by informed buyers.

Increased Influence of Streetwear and Global Fashion Trends

Streetwear continues to redefine the Australian menswear market growth, drawing references from global fashion capitals and pop culture. For example, in March 2024, First Nations menswear label Joseph & James was recognized as a standout label following a critical presentation at PayPal Melbourne Fashion Festival's Urban Oasis Runway, showcasing a movement towards refined streetwear. Furthermore, originally subcultural, it has transitioned into mainstream fashion with the help of oversized silhouettes, graphic prints, and amalgamated styles drawing inspiration from skate, hip-hop, and sports cultures. Men are looking for items that express individuality, cultural belonging, and social media influence. Essential pieces such as wide-leg trousers, utility jackets, logo-print sweatshirts, and bucket hats are ruling the wardrobes of younger populations. Limited drops, artist collaborations, and exclusivity drives are driving demand and establishing the genre's prestige. Global e-commerce and online portals have given Australian consumers greater ease in accessing overseas streetwear brands, spurring its uptake. Influencers, musicians, and athletes remain influential trendsetters. This rise in expressive, culture-driven fashion directly addresses the growing Australia menswear market share, reflecting an increasing hunger for statement pieces that blend global sensibilities with local identity.

Australia Menswear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, season, and distribution channel.

Product Type Insights:

- Trousers

- Denims

- Shirts and T-Shirts

- Ethnic Wear

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes trousers, denims, shirts and t-shirts, ethnic wear, and others.

Season Insights:

- Summer Wear

- Winter Wear

- All-Season Wear

A detailed breakup and analysis of the market based on the season have also been provided in the report. This includes summer wear, winter wear, all-season wear.

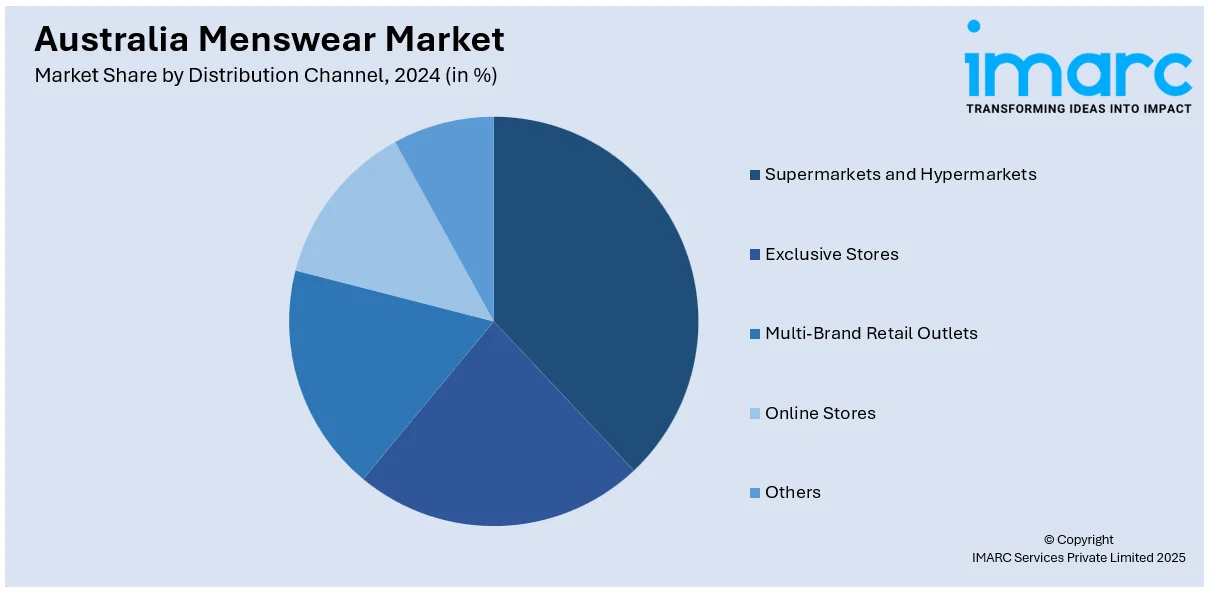

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Exclusive Stores

- Multi-Brand Retail Outlets

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, exclusive stores, multi-brand retail outlets, online stores, others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Menswear Market News:

- In February 2025, Australian brand Paire diversified its sustainable menswear range by launching BioFlex™, an activewear fabric made from corn waste. Nathan Yun and Rex Zhang, co-founders, seek to challenge fast fashion through innovative, responsibly made essentials that support Australia's transition towards sustainable, high-performance apparel in the menswear space.

- In October 2024, Australian activewear brand Doyoueven entered mass retail by launching its men's activewear range at Big W. The range, with high-performance gym wear at affordable prices, fits into Australia's expanding menswear market, receiving influencer acclaim for its clean designs, quality, and wide range of colors.

Australia Menswear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Trousers, Denims, Shirts and T-Shirts, Ethnic Wear, Others |

| Seasons Covered | Summer Wear, Winter Wear, All-Season Wear |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Exclusive Stores, Multi-Brand Retail Outlets, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia menswear market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia menswear market on the basis of product type?

- What is the breakup of the Australia menswear market on the basis of season?

- What is the breakup of the Australia menswear market on the basis of distribution channel?

- What is the breakup of the Australia menswear market on the basis of region?

- What are the various stages in the value chain of the Australia menswear market?

- What are the key driving factors and challenges in the Australia menswear?

- What is the structure of the Australia menswear market and who are the key players?

- What is the degree of competition in the Australia menswear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia menswear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia menswear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia menswear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)