Australia Management Consulting Market Report by Type (Strategy Consulting, Operations Consulting, Financial Advisory, Technology Consulting, Human Resources Consulting), Organization Size (Large Enterprises, Small and Medium-Sized Enterprises), Industry Vertical (BFSI, IT and Telecom, Manufacturing, Retail and E-Commerce, Public Sector, Healthcare, and Others), and Region 2025-2033

Australia Management Consulting Market Overview:

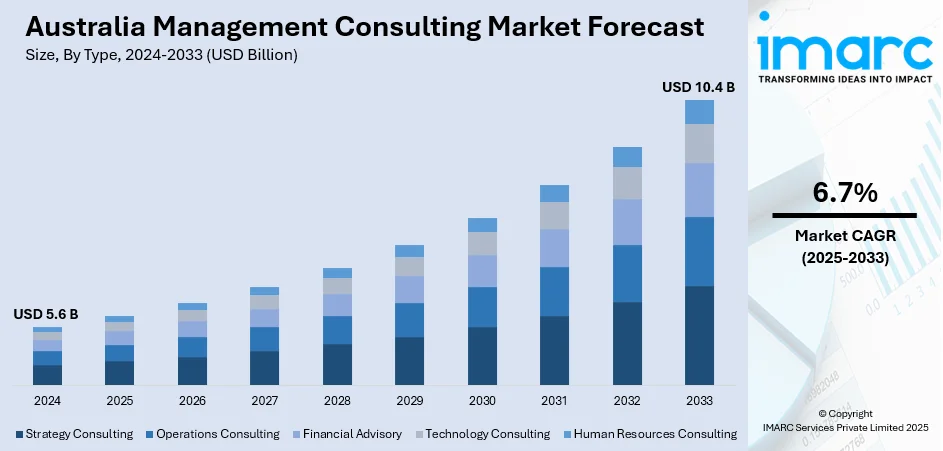

The Australia management consulting market size reached USD 5.6 Billion in 2024. Looking forward, the market is projected to reach USD 10.4 Billion by 2033, exhibiting a growth rate (CAGR) of 6.7% during 2025-2033. The increasing demand for business optimization, rising digital transformation, regulatory compliance services, companies seeking expert guidance on sustainability, operational efficiency, and navigating economic uncertainties, and growth in sectors like healthcare, technology, and financial services are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.6 Billion |

| Market Forecast in 2033 | USD 10.4 Billion |

| Market Growth Rate (2025-2033) | 6.7% |

Key Trends of Australia Management Consulting Market:

Increasing Demand for Digital Transformation

As businesses across industries strive to stay competitive in an evolving digital landscape, they seek consulting expertise to adopt new technologies, optimize processes, and integrate digital solutions. This demand is particularly strong in sectors like finance, healthcare, and retail, where digital innovation plays a key role in enhancing operational efficiency and customer experience. For instance, in 2024, the implementation of new technologies and digital tools is reshaping Australia's public sector, with new research showing 85% of government workers surveyed had recently experienced a digital initiative being implemented within their department or agency. A survey of 425 Australian government workers undertaken by Appian, a software company that automates organizational processes, found that most government workers believe that their agency's digital transformation projects have had positive impacts on the public, with 63% of those surveyed saying that the adoption of new technologies had made government services more accessible to citizens. Positively, the introduction of new technologies within government departments and agencies has led to better organizational communication, with 64% of workers experiencing improved collaboration following new solutions being deployed.

To get more information on this market, Request Sample

Rising Need for Regulatory Compliance

Regulatory compliance has become a critical concern for businesses in Australia, with stricter government regulations and industry standards requiring organizations to navigate complex legal frameworks. This has led to a growing demand for consultants who specialize in ensuring compliance with these regulations while minimizing risks and maintaining business continuity. According to an article published in 2024 in the Times of India, the Australian government should be required to disclose every consulting contract worth over A$2 million ($1.33 million) and contracts should include a requirement that providers act in the public interest, as per a senate inquiry sparked by PwC's leak of secret tax plans. The country should also be required set up a public register of conflicts of interest for consulting firms, and overhaul the rules for large partnership-based organizations that aren't covered by corporate laws and regulators, the inquiry added in a report.

Public Sector Consulting Growth

The Australian government is increasingly turning to management consulting firms to boost the effectiveness and efficiency of its operations. Notable areas of engagement include policy reform, digital infrastructure, public health systems, and climate-related planning. Consulting firms are strategically involved in developing and executing modernization initiatives that align with national priorities. Additionally, there is a heightened emphasis on enhancing citizen services, transparency, and regulatory compliance, creating more opportunities for advisory partnerships. This increased dependence on consultants is significantly impacting the overall Australia management consulting market share, especially in the public sector segment.

Growth Drivers of Australia Management Consulting Market:

Business Model Innovation Boosting Advisory Engagement

In a competitive and rapidly evolving business landscape, Australian firms are actively reevaluating their operational frameworks to enhance efficiency and long-term value. Management consultants are sought to create innovative business models, restructure internal workflows, and spearhead strategic transformations. These experts assist in aligning operational objectives with digital capabilities, market dynamics, and customer needs. By providing customized solutions, consultants enable organizations to reduce costs, expedite decision-making, and tap into new revenue streams. The demand for agility and innovation across various sectors is substantially driving the Australia management consulting market demand, particularly among companies aiming to remain relevant and prepared for the future.

Consulting Support During Economic Volatility

The Australian economy has experienced heightened uncertainty due to global disruptions, inflationary challenges, and shifting consumer behaviors. In this context, businesses are increasingly relying on consultants to manage financial risks, optimize expenditures, and navigate crisis situations. From liquidity management and workforce restructuring to market entry strategies in challenging conditions, consultants offer essential tools for flexible decision-making. Their role in fostering organizational resilience and stability during turbulent times has become more crucial than ever. This rising dependency on advisory services during uncertainty underscores significant trends according to the Australia management consulting market analysis.

Startup Ecosystem Driving Consulting Expansion

The growth of Australia’s startups and SMEs is a key factor fueling consulting market activity. These enterprises often operate with limited resources and require expert advice to scale their operations, refine business approaches, and explore new markets. Management consultants provide critical support in areas such as financial structuring, branding, operational planning, and regulatory adherence. As competition intensifies, startups are increasingly reaching out to external advisors to accelerate growth and enhance decision-making. This rise in entrepreneurial ventures, combined with growing innovation demands, is instrumental in propelling Australia management consulting market growth, particularly in dynamic and emerging business sectors.

Opportunities of Australia Management Consulting Market:

Indigenous and Regional Development Programs

Australia’s dedication to inclusive growth has resulted in a greater emphasis on empowering Indigenous businesses and promoting regional development. Both governmental bodies and private sector organizations are launching initiatives to create sustainable economic opportunities in underserved regions. Management consultants play a vital role in crafting policies, delivering training programs, and ensuring the effective implementation of development projects. These professionals assist in identifying local needs, aligning funding strategies, and developing culturally suitable business models. With a strong focus on reconciliation and decentralization, this segment provides long-term consulting opportunities that offer meaningful social impact and business value.

Rising Demand for Cybersecurity and Risk Consulting Services

The rising intricacy of cyber threats, along with stricter compliance mandates, is fostering a strong market for cybersecurity and risk management consulting in Australia. Organizations across various sectors are pursuing expert guidance to protect their digital infrastructure, safeguard sensitive data, and comply with evolving regulations. Management consultants are helping businesses in formulating comprehensive security strategies, conducting risk evaluations, and establishing governance frameworks. With the rise of hybrid work environments and digital adoption heightening vulnerabilities, the need for customized risk management and cybersecurity services continues to expand. This area has become a crucial specialization for numerous consulting firms in the country.

Mergers, Acquisitions, and Restructuring

In a post-COVID business landscape characterized by economic shifts and sectoral realignments, companies in Australia are increasingly considering mergers, acquisitions, and restructuring to maintain competitiveness. This trend is creating significant opportunities for management consultants who specialize in financial modeling, due diligence, integration planning, and strategic turnaround. Consulting firms provide critical support in aligning organizational structures, assessing synergies, and managing change across merged entities. As businesses aim for operational efficiency and growth through strategic consolidation, advisory services are becoming indispensable. This evolving landscape continues to fuel demand for consultants in transactional and restructuring domains.

Australia Management Consulting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, organization size, and industry vertical.

Type Insights:

- Strategy Consulting

- Operations Consulting

- Financial Advisory

- Corporate Finance

- Accounting Advisory

- Tax Advisory

- Transaction Services

- Risk Management

- Others

- Technology Consulting

- Human Resources Consulting

The report has provided a detailed breakup and analysis of the market based on the type. This includes strategy consulting, operations consulting, financial advisory (corporate finance, accounting advisory, tax advisory, transaction services, risk management, and others), technology consulting, and human resources consulting.

Organization Size Insights:

- Large Enterprises

- Small and Medium-Sized Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes large enterprises and small and medium-sized enterprises.

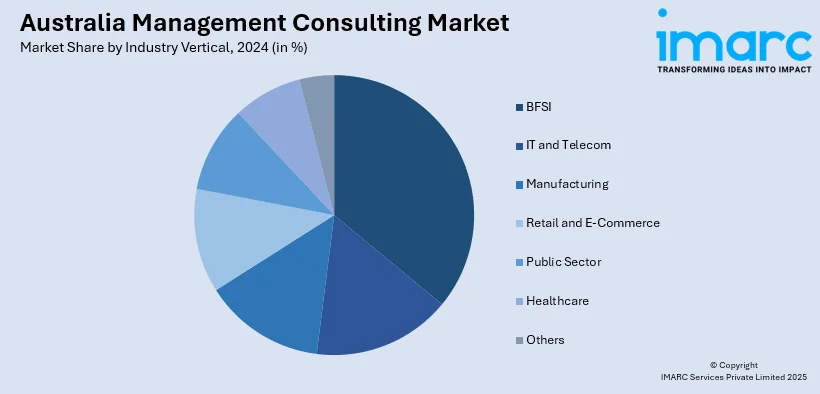

Industry Vertical Insights:

- BFSI

- IT and Telecom

- Manufacturing

- Retail and E-Commerce

- Public Sector

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes BFSI, IT and telecom, manufacturing, retail and e-commerce, public sector, healthcare, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Accenture

- Boston Consulting Group

- CGI Inc.

- DataESG

- Grant Thornton Australia Limited

- Grosvenor Performance Group

- GSA Management Consulting

- KPMG Australia

- McKinsey & Company

- Nous Group

- Oliver Wyman, LLC

- Protiviti

- Right Lane Consulting

Australia Management Consulting Market News:

- In July 2024, the international management consultancy, Nous Group, announced its acquisition of specialist consulting firm, Health Policy Analysis (HPA), as the business expands its health practice and gears up for continued growth in the sector. Working together, Nous and HPA will provide clients with a smoother, end-to-end experience and open access to new opportunities in the market.

- In July 2024, Deloitte Australia announced the purchase of a minority stake in the market-leading First Nations consulting business formerly known as PIC (PwC Indigenous Consulting). This milestone marks the evolution of the business after more than 10 years of successful operations, delivering impact for First Nations communities. In honor of its deep relationships with Aboriginal and Torres Strait Islander peoples and communities, and its commitment to partnering to achieve outcomes, the business will be renamed yamagigu. The Wiradyuri word meaning “our purpose is to go with you” encapsulates the spirit of partnership and shared journey.

Australia Management Consulting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Organization Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Industry Verticals Covered | BFSI, IT and Telecom, Manufacturing, Retail and E-Commerce, Public Sector, Healthcare, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Accenture, Boston Consulting Group, CGI Inc., DataESG, Grant Thornton Australia Limited, Grosvenor Performance Group, GSA Management Consulting, KPMG Australia, McKinsey & Company, Nous Group, Oliver Wyman, LLC, Protiviti, Right Lane Consulting, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia management consulting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia management consulting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia management consulting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The management consulting market in Australia was valued at USD 5.6 Billion in 2024.

The Australia management consulting market is projected to exhibit a compound annual growth rate (CAGR) of 6.7% during 2025-2033.

The Australia management consulting market is expected to reach a value of USD 10.4 Billion by 2033.

Key drivers include increased regulatory complexity, economic realignment, and heightened focus on operational efficiency. Businesses are turning to consultants for cost optimization, risk management, and leadership transformation. Growing demand from startups, sustainability initiatives, and public-private collaboration also contribute to expanding the consulting market landscape.

The key trend of the Australia management consulting market is a shift toward digital transformation advisory, ESG integration, and agile business model design. Firms are also focusing on industry-specific expertise, hybrid workforce consulting, and public sector modernization.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)