Australia Luxury Market Size, Share, Trends and Forecast by Type, Gender, Distribution Channel, and Region, 2026-2034

Australia Luxury Market Overview:

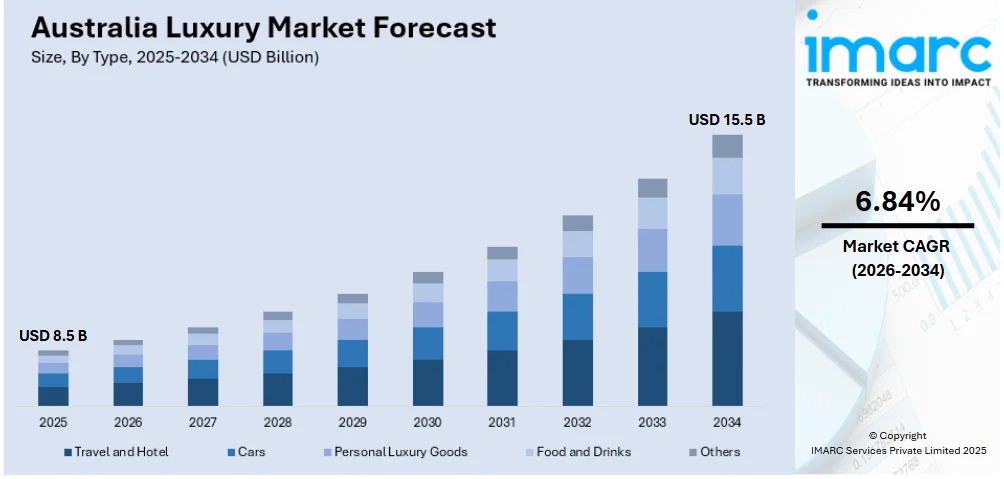

The Australia luxury market size reached USD 8.5 Billion in 2025. Looking forward, the market is expected to reach USD 15.5 Billion by 2034, exhibiting a growth rate (CAGR) of 6.84% during 2026-2034. The market is driven by a growing high-net-worth population with rising disposable incomes, fueling demand for premium goods and exclusive experiences. Additionally, global luxury trends, influenced by digital media and international travel, shape consumer preferences, driving brand expansion, personalized offerings, and high-end retail growth across various luxury segments are further fueling the Australia luxury market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.5 Billion |

| Market Forecast in 2034 | USD 15.5 Billion |

| Market Growth Rate (2026-2034) | 6.84% |

Key Trends of Australia Luxury Market:

Rise of Sustainable Luxury

Sustainability is becoming a defining trend in Australia’s luxury market as affluent consumers increasingly prioritize ethical and eco-friendly products. High-end brands are incorporating sustainable materials, responsible sourcing, and transparent supply chains to appeal to environmentally conscious buyers. Luxury fashion houses are emphasizing circular economy practices, such as recycling programs and biodegradable fabrics, while luxury automotive brands are introducing electric and hybrid models. In 2023, luxury retail trade in Australia reached a record AUD 6.2 billion, indicating a robust market for high-end products. Additionally, sustainable fine dining and eco-tourism experiences are gaining traction among affluent consumers seeking indulgence without environmental compromise. As regulatory policies and consumer expectations evolve, luxury brands are integrating sustainability as a core value, reshaping product offerings and marketing strategies to align with the growing demand for responsible luxury.

To get more information on this market Request Sample

Personalization and Experiential Luxury

Australian luxury consumers are increasingly seeking personalized products and exclusive experiences that go beyond material goods. From bespoke fashion pieces to custom-built luxury vehicles, brands are leveraging advanced technologies such as AI-driven recommendations and virtual consultations to offer tailored services. High-end hospitality and travel sectors are also capitalizing on this trend by curating unique experiences, such as private yacht charters, luxury retreats, and exclusive fine dining events. Moreover, VIP concierge services and limited-edition collaborations further enhance exclusivity, reinforcing consumer loyalty. As personalization becomes a key differentiator, luxury brands are investing in data analytics and customer insights to refine their offerings, ensuring that each experience is tailored to individual preferences and lifestyles. However, Experiential luxury in Australia is expected to record a 6% value CAGR (at constant 2024 prices) over the forecast period, driven by shifting demographics and a growing preference for unique travel experiences.

Expansion of Digital and Omnichannel Retail

The digital transformation of Australia’s luxury market is accelerating, with brands enhancing their online presence and integrating omnichannel strategies. High-end retailers are investing in immersive digital experiences, such as virtual showrooms, augmented reality (AR) try-ons, and AI-powered personal shopping assistants. E-commerce platforms are becoming more sophisticated, offering seamless purchasing options and exclusive online collections. Additionally, social commerce through platforms like Instagram and WeChat is driving direct-to-consumer sales, particularly among younger affluent consumers. Luxury brands are also focusing on hybrid retail experiences, blending digital convenience with in-store exclusivity through appointment-only shopping, virtual styling sessions, and same-day delivery services. This omnichannel approach ensures seamless engagement across digital and physical touchpoints, enhancing customer experience and brand loyalty.

Growth Drivers of Australia Luxury Market:

Growing Affluent Consumer Base and HNWIs

The rising number of high-net-worth individuals (HNWIs) and affluent professionals in Australia is a key driver of luxury consumption. Cities like Sydney, Melbourne, and Brisbane have seen increased demand for high-end fashion, fine dining, luxury cars, and bespoke services. Wealth accumulation, coupled with a maturing financial market and rising stock and real estate values, boosts consumer spending power. Additionally, the arrival of wealthy immigrants, particularly from Asia and the Middle East, is diversifying and expanding the customer base for luxury brands across retail, hospitality, and real estate sectors.

Luxury Real Estate and Interior Design Demand

Australia’s luxury real estate market, particularly in Sydney’s waterfront areas and Melbourne’s inner suburbs, continues to thrive. High-end residential projects are incorporating bespoke design, imported furnishings, and smart-home technology, driving demand for luxury interior and lifestyle products. Affluent buyers are increasingly investing in second homes or upgrading to premium properties, spurring sales of high-end appliances, designer furniture, and curated art collections. Luxury brands have capitalized on this trend by entering partnerships with real estate developers and interior designers to integrate their products into model homes and lifestyle spaces, which is boosting the Australia luxury market demand.

Rebound of International Tourism and Duty-Free Retail

With borders reopened post-pandemic, international tourists—especially from China, Southeast Asia, and the Middle East—are returning to Australia. These visitors are major contributors to luxury spending, often purchasing premium goods in city boutiques and airports. Luxury brands in locations like Sydney’s CBD and Gold Coast benefit from duty-free shopping and tailored services for high-spending tourists. Additionally, cultural attractions and events draw affluent global travelers, increasing traffic to luxury retail hubs. This tourism-driven boost enhances demand for high-end fashion, accessories, fine wine, and luxury experiences, particularly during peak travel seasons.

Opportunities of Australia Luxury Market:

Regional Expansion Beyond Major Cities

While luxury retail has traditionally centered around Sydney and Melbourne, there is growing potential for expansion into emerging affluent regions such as Perth, Brisbane, Canberra, and the Gold Coast. These areas are seeing increasing investment, growing wealthy populations, and tourism activity. Luxury brands have opportunities to open boutique stores, host pop-up experiences, and form partnerships with local developers in high-end malls and resorts. Establishing a presence in these secondary markets allows brands to tap into previously underserved but profitable customer segments, improving overall market penetration and customer reach across the country.

Growth in Luxury Health, Wellness, and Beauty Segments

There is a rising demand for premium wellness products and services, including luxury skincare, holistic spas, cosmetic treatments, and high-end fitness clubs. Affluent Australians are increasingly investing in personal well-being, driving interest in organic beauty brands, clinical skincare, and tech-enabled wellness solutions. According to the Australia luxury market analysis, this trend creates opportunities for both international and local luxury brands to introduce bespoke offerings in wellness retreats, spa chains, and dermatological clinics. Moreover, collaborations with luxury hotels and resorts to provide exclusive beauty treatments and wellness experiences further elevate brand positioning and customer loyalty in this growing niche.

Integration with Cultural and Lifestyle Events

Luxury brands in Australia can benefit significantly by aligning with the country’s vibrant cultural and social calendar. Sponsorships of fashion weeks, art exhibitions, film festivals, and horse racing events such as the Melbourne Cup provide ideal platforms to showcase products and connect with high-spending clientele. These events attract affluent attendees and global tourists, offering brands exposure, brand-building opportunities, and elevated customer engagement. Collaborations with artists, designers, and influencers at these gatherings also allow luxury labels to reach aspirational audiences and create immersive brand experiences, strengthening their presence in Australia’s luxury ecosystem.

Challenges of Australia Luxury Market:

Geographic Isolation and Limited Brand Access

Australia’s physical distance from global fashion capitals like Paris, Milan, and New York can delay product releases, reduce supply chain efficiency, and limit immediate access to exclusive collections. Luxury consumers often travel overseas or shop online for wider selections and early access to new launches. For brands, high import duties, long shipping times, and logistics costs create barriers to maintaining timely inventory. This geographic challenge also makes it harder to host global-scale brand events, limiting in-person engagement opportunities with international designers, influencers, or celebrities.

High Operating Costs and Retail Rents

Luxury brands in Australia often face steep retail rents, particularly in prime shopping districts like Sydney’s Pitt Street and Melbourne’s Collins Street. Coupled with high labor costs, utilities, and compliance expenses, these factors can reduce profit margins—especially for new entrants or smaller boutique brands. This cost burden discourages expansion into physical retail spaces and may shift focus to e-commerce, reducing the impact of experiential in-store offerings. Maintaining profitability while offering a premium shopping environment requires careful cost control and strategic location planning.

Brand Loyalty and Price Sensitivity Among Local Consumers

Despite rising wealth, Australian luxury consumers can be discerning and price-conscious, especially when compared to buyers in Asia or the Middle East. Many prefer to shop during international travel, take advantage of tax-free prices overseas, or use global e-commerce platforms to access lower pricing. This behavior makes it difficult for local retailers to match international discounts while covering high domestic operating costs. Additionally, brand loyalty in Australia is less entrenched, requiring luxury companies to invest heavily in marketing, local storytelling, and relationship-building to retain and grow their customer base over time.

Australia Luxury Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type, gender, and distribution channel.

Type Insights:

- Travel and Hotel

- Cars

- Personal Luxury Goods

- Food and Drinks

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes travel and hotel, cars, personal luxury goods, food and drinks, others.

Gender Insights:

- Male

- Female

The report has provided a detailed breakup and analysis of the market based on the gender. This includes male and female.

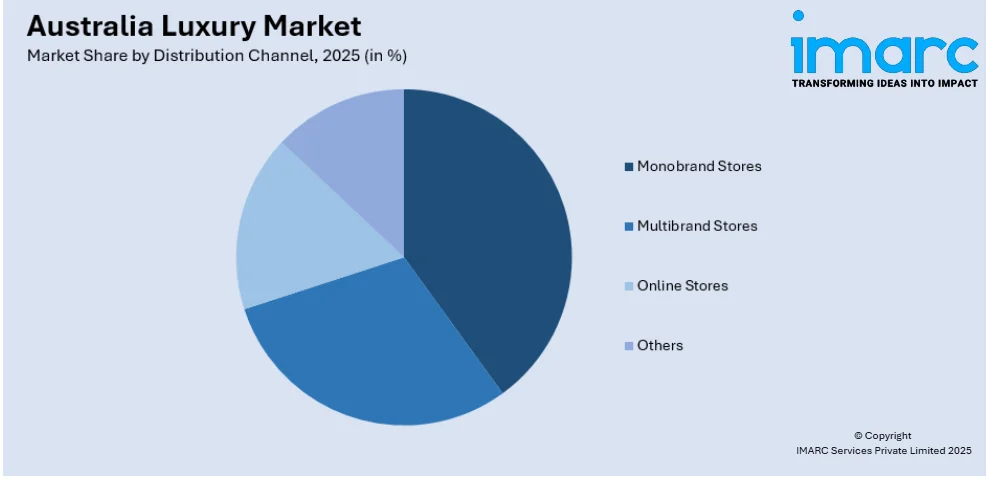

Distribution Channel Insights:

Access the Comprehensive Market Breakdown Request Sample

- Monobrand Stores

- Multibrand Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes monobrand stores, multibrand stores, online stores, others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Luxury Market News:

- In January 2025, Ark Capital Partners, along with Lead Global and support from Pioneer Wealth, successfully acquired Melbourne Place Hotel. This acquisition marks the beginning of a new co-branded hotel fund, signaling a strategic partnership between Ark Capital Partners and Lead Global. The deal is seen as a significant step in both companies' growth strategies within the hospitality sector, with plans for further opportunities and successful transactions in the future.

- In April 2024, La Bottega acquired a majority stake in Vanity Group, a leader in designer hotel guest amenities, marking a major milestone in the luxury hospitality industry. La Bottega, known for its luxury toiletries with a strong Italian heritage, joins forces with Vanity Group, which recently earned B Corp certification. This acquisition brings together two industry giants with a shared vision of innovation and luxury, further strengthening their presence in the global hospitality market.

- In March 2024, Luxury Escapes launched its Luxury Escapes Agent Hub, a platform designed to help Australian travel agents access exclusive travel deals and streamline booking processes. The hub's launch follows significant interest from over 2,000 agents. Major Australian agency groups, including Savenio, itravel, and Australian Travel Agents Co-operative, have been onboarded to enhance the platform’s reach and offer agents seamless access to luxury travel products and services.

Australia Luxury Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Travel And Hotel, Cars, Personal Luxury Goods, Food and Drinks, Others. |

| Genders Covered | Male, Female |

| Distribution Channels Covered | Monobrand Stores, Multibrand Stores, Online Stores, Others. |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia luxury market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia luxury market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia luxury industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The luxury market in Australia was valued at USD 8.5 Billion in 2025.

The Australia luxury market is projected to exhibit a CAGR of 6.84% during 2026-2034.

The Australia luxury market is projected to reach a value of USD 15.5 Billion by 2034.

Growth in Australia’s luxury market is fueled by increased investment in premium real estate, rising demand for high-end local artisanal brands, growth of VIP client services, luxury car sales, and elevated spending during cultural, fashion, and lifestyle events nationwide.

Australia’s luxury market is driven by rising High-Net-Worth Individuals (HNWIs) and affluent immigrants, particularly Millennials and Gen Z; a strong post-COVID tourism rebound, especially from Asia; expanding boutique store presence beyond Sydney/Melbourne; digital innovation—omnichannel shopping and social-media influence; and growing demand for sustainable, personalized, and wellness-focused luxury.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)