Australia Luxury Goods Market Report by Product Type (Watches and Jewelery, Perfumes and Cosmetics, Clothing, Bags/Purse, and Others), Distribution Channel (Offline, Online), End User (Women, Men), and Region 2025-2033

Australia Luxury Goods Market Size and Share:

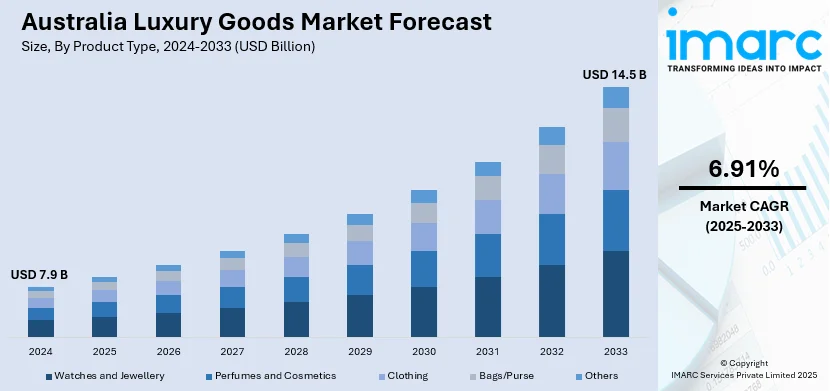

The Australia luxury goods market size reached USD 7.9 Billion in 2024. Looking forward, the market is expected to reach USD 14.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.91% during 2025-2033. The rapid urbanization and increasing disposable income levels of individuals, evolving consumer preferences, significant growth of e-commerce in luxury retail, rising influence of social media and celebrity endorsement, and cultural shifts toward experience over ownership are some of the major factors fueling the Australia luxury goods market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.9 Billion |

| Market Forecast in 2033 | USD 14.5 Billion |

| Market Growth Rate 2025-2033 | 6.91% |

Australia Luxury Goods Market Trends:

Rising Disposable Income Among High-Net-Worth Individuals

The growing disposable income among high-net-worth individuals (HNWIs) is a key driver of the luxury goods market in Australia. This demographic in Australia has been increasing consistently, leading to a higher need for luxury items such as designer clothes, expensive watches, jewelry, and luxury cars. With increased disposable income, these individuals tend to invest more in luxury products and experiences. The trend is not solely related to growing wealth and also to shifting consumption habits. High net-worth individuals in Australia depict a growing preference for luxury goods that provide both prestige and excellence, considering them as assets rather than just expenses. This change in ideology drives the desire for luxury items, as these shoppers seek products that match their sophisticated preferences and lifestyle goals.

To get more information on this market, Request Sample

Increased Tourism and International Spending

Another factor driving the market is the increasing visits of international tourists, specifically from Asia. Affluent individuals globally are increasingly preferring Australia as a destination for travelling, thus seeking more luxury items. According to the Australian Bureau of Statistics, short term visitors in the country increases by 8.4% in June 2024. Asian tourists, especially from China, are known for their interest in luxury brands, and the proximity of the country to Asia makes it an attractive shopping destination for these consumers. These tourists are attracted by the luxury retail offerings in Australia and also by the favorable exchange rates, tax refunds, and the perception of authenticity and quality associated with buying luxury goods in Australia. The well-developed retail infrastructure of the nation, which includes a mix of high-end boutiques and luxury shopping centers, caters to this demand. Additionally, the Australian government has actively promoted tourism and shopping experiences, enhancing the appeal of the country as a luxury shopping destination.

Growing Demand for Sustainable and Ethical Luxury

Sustainability and ethical consumption are becoming increasingly important factors in the purchasing decisions of Australian consumers, particularly within the luxury goods market. There is a noticeable shift toward products that signify status and exclusivity and also align with ethical values, such as environmental responsibility and fair trade. As per Monash University, 51% of Australian residents state that they consider sustainability as a vital factor before making a retail purchase. Luxury brands in Australia are responding to this trend by incorporating sustainable practices into their production processes and highlighting their commitment to social responsibility in their marketing efforts. This includes using ethically sourced materials, reducing carbon footprints, and engaging in fair labor practices. Consumers are increasingly looking for transparency from luxury brands regarding their environmental and social impact, leading to a greater emphasis on sustainability in product offerings. The growing demand for sustainable luxury goods is also driven by younger, affluent consumers who prioritize values and ethics over mere brand prestige. These consumers are more likely to support brands that demonstrate a commitment to sustainability and ethical practices, viewing such purchases as a reflection of their personal values.

Growth Drivers of Australia Luxury Goods Market:

Digital Transformation and Omnichannel Retail Expansion

Australia's luxury market is benefitting from rapid digital transformation, with brands increasingly adopting omnichannel strategies. From immersive e-commerce platforms to mobile-first experiences and virtual showrooms, luxury retailers are enhancing consumer accessibility and personalization. This digital push is attracting tech-savvy affluent consumers who demand convenience and exclusivity. Integration of AI for tailored recommendations, augmented reality for product trials, and seamless logistics is redefining luxury retail. Additionally, social commerce through platforms like Instagram and TikTok allows brands to reach niche audiences and younger luxury shoppers. According to the Australia luxury goods market analysis, these innovations not only boost brand engagement but also drive sales growth across online and offline channels, enabling luxury retailers to stay competitive in a digitally driven market environment.

Cultural Shift Toward Experience-Based Consumption

Australian consumers are increasingly valuing experiences over material possessions, leading to a rise in demand for high-end services and lifestyle-oriented luxury goods. This shift includes interest in bespoke fashion, personalized fragrances, exclusive art, gourmet food, and luxury wellness services. Brands that offer memorable, personalized, and emotionally resonant experiences are gaining traction. This change in consumer mindset is pushing traditional luxury brands to innovate, offering limited-edition collections, private shopping events, and VIP services to create deeper emotional connections. The blending of experiential value with tangible products is shaping a new narrative around luxury, attracting affluent millennials and Gen Z consumers who prioritize individuality, craftsmanship, and brand authenticity.

Growth in Second-Hand and Circular Luxury Market

The pre-owned luxury segment is rapidly expanding in Australia, driven by evolving consumer attitudes and increasing awareness of circular economy principles. Affluent shoppers are now embracing resale platforms to access rare and vintage luxury items with lasting value. High-quality, authenticated second-hand products appeal to both status-conscious and environmentally aware consumers. Established luxury brands are also launching certified pre-owned programs to tap into this trend and maintain brand control. This segment is enabling broader market participation, encouraging first-time luxury buyers and collectors alike. The growth of the circular luxury market not only promotes sustainability but also boosts overall category expansion by creating additional revenue streams and enhancing brand reach without compromising exclusivity.

Opportunities of Australia Luxury Goods Market:

Expansion into Regional and Emerging Urban Markets

While luxury consumption in Australia has historically been concentrated in major cities like Sydney and Melbourne, there is growing potential in emerging urban hubs and affluent regional areas. Increased connectivity, improved logistics, and changing consumer preferences are creating a demand for premium retail experiences outside traditional hotspots. Brands that localize their offerings and tailor experiences to regional tastes can establish strong customer loyalty. Furthermore, affluent individuals in smaller cities increasingly expect the same level of service and exclusivity found in flagship stores. The expanding physical and digital presence in these markets can open new customer segments, enhance brand visibility, and reduce market saturation risks in core metro areas, which is further driving the Australia luxury goods market growth.

Collaborations with Local Designers and Indigenous Artisans

There is a unique opportunity for luxury brands to collaborate with Australian designers and Indigenous artisans to create exclusive, culturally enriched collections. Such partnerships not only promote local heritage but also align with growing consumer interest in authenticity and storytelling. Co-branded collections that blend global luxury aesthetics with local creativity can attract both domestic buyers and international collectors. This strategy supports cultural preservation while offering fresh design narratives that differentiate brands in a competitive landscape. Moreover, aligning with community-driven initiatives can enhance brand equity, contribute to social responsibility goals, and unlock new media exposure, helping global luxury houses deepen their connection with Australian consumers.

Growth of Luxury Wellness and Lifestyle Segments

The increasing focus on holistic wellbeing among affluent Australians is opening new opportunities in the luxury wellness and lifestyle space, which is further driving the Australia luxury goods market demand. Demand is rising for premium spa services, skincare products, wellness retreats, and athleisure wear that blends comfort with luxury. Brands that incorporate wellness into their core offerings—whether through mindfulness-focused fragrances, high-end health supplements, or exclusive wellness travel packages—stand to benefit. This lifestyle shift reflects a broader redefinition of luxury as a state of balance, self-care, and purpose. By tapping into this trend, brands can diversify their portfolios, attract health-conscious consumers, and position themselves at the intersection of luxury, wellness, and personal development.

Challenges of Australia Luxury Goods Market:

High Import Tariffs and Operational Costs

Luxury brands operating in Australia often face high import duties, logistics expenses, and operational costs compared to other global markets. These financial pressures impact pricing strategies, reducing price competitiveness against international markets, particularly for price-sensitive luxury buyers. Additionally, Australia's geographic distance from key manufacturing hubs in Europe and Asia adds to lead times and freight costs. These factors can discourage global luxury brands from expanding aggressively in the region. Managing margins while maintaining brand integrity becomes increasingly difficult, especially in an environment where consumers can easily compare prices online and purchase directly from overseas sellers.

Counterfeit Market and Online Imitation Products

The proliferation of counterfeit luxury goods, especially through online marketplaces and social media platforms, presents a serious challenge to brand integrity and consumer trust. Although Australia's legal framework attempts to combat fakes, enforcement across digital platforms remains inconsistent. Consumers unknowingly purchasing imitation goods can associate negative experiences with genuine brands, damaging reputation and long-term customer loyalty. Additionally, fakes circulating at lower prices create pricing pressure and undermine the exclusivity that luxury brands rely on. Combatting this issue requires significant investment in authentication technology, consumer education, and platform partnerships to ensure secure, verified purchases and preserve the perceived value of authentic luxury products.

Shifting Consumer Loyalty and Brand Fatigue

Australian luxury consumers, especially younger demographics, are becoming increasingly brand-agnostic, often switching preferences based on trends, values, or influencer endorsements. This shift challenges traditional notions of brand loyalty, where heritage alone no longer guarantees continued consumer engagement. The saturation of luxury messaging across digital channels contributes to brand fatigue, with audiences seeking novelty and deeper meaning over legacy status. As a result, long-established brands must continuously innovate, refresh their image, and maintain cultural relevance. Failing to adapt to evolving consumer expectations may lead to stagnation and eroded market share, particularly as agile, digitally native luxury brands gain traction among next-generation buyers.

Australia Luxury Goods Market News:

- June 2025: Treasury Wine Estates (TWE) launched a striking new creative direction for its renowned Coonawarra label, Wynns, under the banner ‘Brutally, Elegant’, a concept crafted by its internal agency, Splash. Recognized for its premium appeal, Wynns has transformed to better embody its luxury status. The rebranding extends from the refined bottle design to an overall repositioning, firmly establishing Wynns as a distinguished name in the luxury wine segment.

- March 2025: MUSE introduced a digital investment platform dedicated to luxury assets, created by the Australia-based tech company and led by its Founder and CEO, Michelle Zhang. Featuring a mobile app, the platform targets premium collectibles, including rare handbags, fine wines, and luxury watches, allowing users to approach these items as investment-grade opportunities.

- May 2025: IHG Hotels & Resorts strengthened its prominence in Australia’s Luxury & Lifestyle hospitality sector through a significant long-term partnership with Salter Brothers. As part of the agreement, several prominent IHG properties will undergo rebranding and repositioning under IHG’s luxury brand portfolio. Notably, Regent Hotels & Resorts is set to make its Australian comeback after nearly three decades, with the transformation of InterContinental Melbourne into Regent Melbourne scheduled for completion in 2030.

- January 2025: Louis Vuitton strengthened its association with the Australian Open by renewing its partnership, underscoring its dedication to both the sport and athletic distinction, after re-entering the tennis arena in 2023. The renowned luxury label Louis Vuitton designed bespoke Monogram trunks specifically to encase the esteemed trophies of the tournament—the Norman Brookes Challenge Cup for the men’s champion and the Daphne Akhurst Memorial Cup for the women’s winner.

- August 2023: Advent International, one of the world’s largest and most experienced private equity investors, has reached an agreement to acquire the majority of shares in ZIMMERMANN, the luxury fashion brand headquartered in Sydney, Australia. ZIMMERMANN has grown into a globally recognized iconic luxury fashion brand. Under the terms of the acquisition, Advent will acquire a majority shareholding in ZIMMERMANN from Style Capital, who together with the Zimmermann family, will retain a significant minority shareholding.

Australia Luxury Goods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Watches and Jewelry

- Perfumes and Cosmetics

- Clothing

- Bags/Purse

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes watches and jewelry, perfume and cosmetics, clothing, bags/purse, and others.

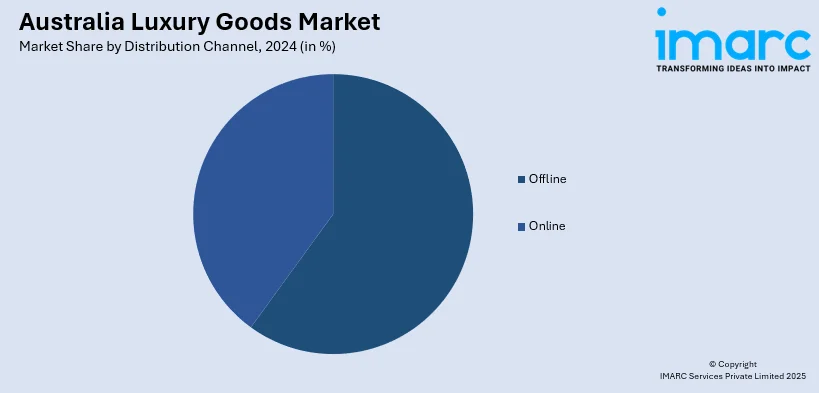

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

End User Insights:

- Women

- Men

The report has provided a detailed breakup and analysis of the market based on the end user. This includes women and men.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Luxury Goods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Watches and Jewelry, Perfumes and Cosmetics, Clothing, Bags/Purse, Others |

| Distribution Channels Covered | Offline, Online |

| End Users Covered | Women, Men |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia luxury goods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia luxury goods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia luxury goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The luxury goods market in Australia was valued at USD 7.9 Billion in 2024.

The Australia luxury goods market is projected to exhibit a CAGR of 6.91% during 2025-2033.

The Australia luxury goods market is projected to reach a value of USD 14.5 Billion by 2033.

The rise of luxury consumption in emerging urban areas is fueling expansion beyond traditional metros. Collaborations with local creatives enhancing brand authenticity, increased digital access and mobile commerce are also enabling seamless high-end shopping experiences, drawing in younger affluent buyers who value convenience, prestige, and international brand visibility.

Australian luxury goods market is propelled as the consumers are embracing digital innovation, favoring immersive virtual experiences and AI-driven personalization. Additionally, resale and rental luxury platforms are gaining traction, reflecting shifting attitudes toward ownership, value, and sustainability among younger, style-conscious consumers seeking uniqueness and flexibility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)