Australia Kitchen Appliances Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2025-2033

Australia Kitchen Appliances Market Size and Share:

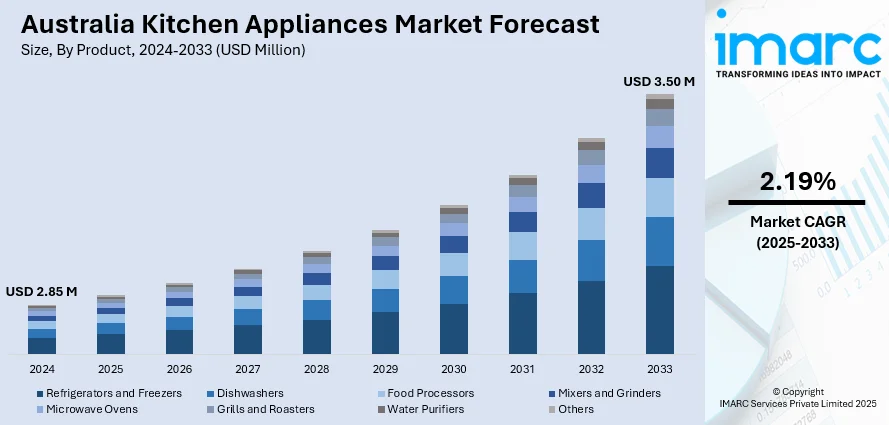

The Australia kitchen appliances market size was valued at USD 2.85 Million in 2024. The market is projected to reach USD 3.50 Million by 2033, exhibiting a CAGR of 2.19% from 2025-2033. Australia Capital Territory and New South Wales is currently dominating the market owing to the rising urbanization, increasing disposable incomes, and heightening interest in smart, energy-efficient appliances. Convenience, contemporary design, and health-conscious cooking solutions are becoming favored choices among consumers, facilitated by rising residential construction and refurbishment activities. New South Wales and the Australian Capital Territory are dominating sales on the strength of sophisticated infrastructure and lifestyle patterns, contribution to the growing Australia kitchen appliances market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.85 Million |

| Market Forecast in 2033 | USD 3.50 Million |

| Market Growth Rate 2025-2033 | 2.19% |

One of the major growth drivers in Australia's kitchen appliances market is growing emphasis on home-based lifestyles spurred by changing consumer behavior and needs. With a higher priority on convenience, functionality, and home preparation, Australians are placing higher value on the purchase of innovative and energy-saving kitchen appliances that make daily activities easier. This trend has been particularly prevalent among urban families, with time-saving attributes, space-saving designs, and multipurpose products being greatly in demand. Moreover, there is growing preference for healthier cooking by means of oil-saving cooking, steaming, and retention of nutrients, thus sparking more interest in equipment that facilitates low-oil cooking, steaming, and preservation of nutrients. This trend in behavior is also supported by increased access to smart kitchen solutions that can integrate into connected home systems, which provide remote monitoring and automation. For instance, in January 2024, Hisense Australia diversified its ConnectLife range of smart appliances, coupling refrigerators, dishwashers, and laundry products with 2024 Hisense TVs to make the home smarter and more convenient for users. Furthermore, with highly design-savvy and technologically inclined consumers, high-end kitchen appliances that provide a combination of form and function are becoming popular, driving continued Australia kitchen appliances market growth.

To get more information of this market, Request Sample

Additionally, the increasing uptake of kitchen appliances in Australia is the ongoing residential development and home renovation works. Both new housing construction and renovation projects are generating strong demand for contemporary kitchen equipment that supports renovated interiors and complies with contemporary lifestyle demands. With homeowners spending money to renovate their kitchens, there is a concomitant boost in the replacement of aging appliances with more evolved, feature-laden versions. Open-plan living ideas, which focus on integrated cooking spaces, also play a role in the demand for clean, built-in, and high-performance appliances. According to the sources, in November 2024, Midea unveiled its new-generation kitchen, refrigeration, and laundry appliances for Australian introduction in Q1 2025, highlighting energy efficiency, smart functionality, and tailor-made built-in designs. Additionally, government incentives for sustainable building design and green homes have encouraged the choice of appliances with higher energy ratings. This is in line with overall environmental consciousness and consumer demand for long-term saving. The combined effects of increased disposable income, architectural contemporary, and sustainable consumption keep pushing overall demand for technologically advanced and trendy kitchen appliances in Australian homes, especially in urban and rapidly developing suburban areas.

Australia Kitchen Appliances Market Trends:

Increasing Demand for Smart, Efficient, and Time-Saving Solutions

The Australia kitchen appliance industry is expanding consistently as people focus on convenience and efficiency in their daily lives. With employment growth being 3.1% over the period 2024, more people are embracing fast-paced lifestyles requiring time-saving kitchen appliances. The greater use of multifunctional and smart kitchen appliances shows this shift, as individuals are looking for ease in cooking without sacrificing quality. Home appliances with automated features, simple controls, and integration with smart home systems are becoming highly popular. This trend is more dominant in urban homes, where small and efficient devices complement the small living space and strict schedules of householders. As Australians intensely prioritize functionality and hassle-free user experience, the demand will grow for appliances that blend performance with the least amount of user input. The demand for low-maintenance and fast-operating kitchen appliances is driving the growth of this market, and efficiency and intelligent operation are becoming focal buying considerations.

Technology Integration and Sustainability in Appliance Design

Technology is transforming the Australia kitchen appliances market trends, with shoppers increasingly attracted to products that provide smart functionality and energy efficiency. The integration of Wi-Fi connectivity, app-based controls, and AI-powered functions has completely revolutionized the way people communicate with kitchen appliances, and cooking and cleaning have become more interactive and accurate. Together with these technological advancements, energy-efficient models that are in harmony with Australia's sustainability goals are increasingly gaining popularity. People are more eco-friendly and look for products that consume less power but offer maximum performance. Manufacturers are pushing back with inverter motor-designed appliances, eco-modes, and recyclable materials. The integration of form, technology, and green engineering is affecting consumer tastes on every income level. Not only do these developments enhance household energy control but also feed back into the wider environmental objectives endorsed by policy and public opinion. Therefore, the market is observing high adoption of appliances that indicate technological advancement as well as conscious consumption.

Health-Conscious Lifestyles and Kitchen Renovation Trends

There is a growing concern with personal health and wellness that is influencing consumer behavior in the Australian kitchen appliances market. With the Health and Wellbeing Index at 7.0 out of 10, Australians are becoming more willing to adopt cooking methods that aim to deliver nutritional advantages. Devices that facilitate low-oil frying, steaming, and nutrient-retaining cooking are popular, in line with the trend toward mindful eating. This is supported by universal home-makeover design trends, as residents update kitchens to further accommodate healthy living and modern design styles. Luxury appliances blending aesthetics and functionality drive these projects, particularly in open-plan kitchen configurations that prioritize aesthetics. Consumers are also teaming up more often with interior designers to choose appliances that blend effortlessly into tailored spaces. The intersection of wellness priorities and home enhancement activity keeps driving demand for innovative kitchen solutions, a continued trend within the shifting desires of the Australian home.

Australia Kitchen Appliances Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia kitchen appliances market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product, distribution channel, and end user.

Analysis by Product:

- Refrigerators and Freezers

- Dishwashers

- Food Processors

- Mixers and Grinders

- Microwave Ovens

- Grills and Roasters

- Water Purifiers

- Others

Refrigerators and freezers are a staple in Australian households, facilitating fresh food storage and long-term preservation. Customers want energy-efficient, frost-free units with smart controls and individually customizable compartments. Ongoing product innovations and replacement purchases in new and refurbished housing stock drive the segment's steady demand across urban and regional markets.

Dishwashers are more in vogue in Australian homes based on time-saving advantages and enhanced water efficiency. Noise-less, compact, built-in designs with intelligent features are favored by contemporary customers. Growing dual-income households and environmentally responsible behaviors favor the uptake of dishwashers, especially in apartments and newly developed urban housing.

Food processors are popular due to their multi-functionality in chopping, slicing, blending, and kneading. Their multi-function promotes healthy food preparation habits and rapid meal preparation. Their space-saving design and maintenance convenience make them particularly suited for busy kitchens. The category enjoys increased interest in home meals and technology-driven kitchen convenience.

Mixers and grinders fulfill day-to-day cooking requirements in Australian kitchens, assisting with activities such as batter making and grinding spices. Well-known for their robustness and multi-attachment feature, the appliances are extensively used across multicultural homes. Simple cleaning, compact storage, and efficiency of time fuel continued demand in both traditional and modern residential contexts.

Microwave ovens are the preferred choice for reheating, defrosting, and quick meal cooking. Solo, grill, and convection models suit different kinds of consumers. Smart features and inverter technology add to appeal. Space-efficient designs and affordability drive popularity, particularly among busy urban Australian apartment and small-to-medium household dwellers.

Grills and roasters are widely used for making grilled vegetables, meat, and baked foods at home. They find support in increasing demand for healthy, oilless cooking. Small electric versions are popular in urban areas, whereas bigger models are best for suburban outdoor places. The segment gets support from changes in lifestyle and food experimentation.

Water filters are becoming increasingly popular in Australia because of increasing awareness of health as well as water quality. RO, UV, and carbon filtration technologies are the most popular. Small size, under-sink, and wall-mount models are best for modern kitchens. Increasing focus on safe drinking water and eco-friendliness drives continued demand across residential and small commercial segments.

Others segment consists of need-based small appliances such as kettles, toasters, air fryers, and coffee makers. These items provide convenience, instant usage, and portability. Steady replacement demand and fashion-led design advancement maintain market vitality. City dwellers, especially younger consumers, prefer compact models that complement kitchen decor and accommodate fast-paced, on-the-go lifestyles.

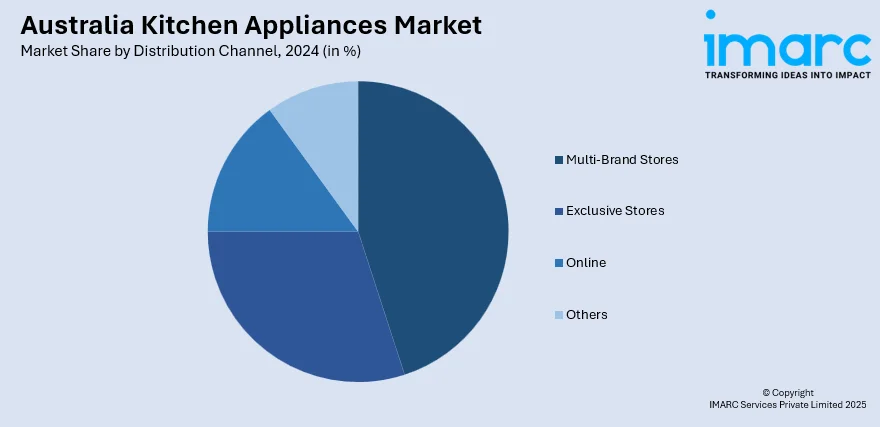

Analysis by Distribution Channel:

- Multi-Brand Stores

- Exclusive Stores

- Online

- Others

The distribution channel for kitchen appliances is supermarkets and hypermarkets in North Australia, which appeals to customers by virtue of accessibility, product visibility, and bundled promotional campaigns. These big-box retailers provide a broad range of small and mid-sized kitchen appliances like kettles, mixers, blenders, microwaves, and toasters, meeting everyday consumer requirements. The strength of the segment is in its capability to ensure prompt product availability, competitive prices, and safe retailing environments, especially within regional centers where specialty electronics outlets can be sparse. Holiday promotions, in-store demonstrations, and holiday discounts all support a pleasant shopping experience, particularly for price-conscious or first-time customers. Supermarkets and hypermarkets also take advantage of household traffic to sell appliances along with routine grocery shopping. This convenience-driven tactic has proven especially successful in North Australia, where retailing habits of community flair and malls centered in the area make these outlets more attractive. Consequently, this distribution channel has consistent market significance in the region.

Analysis by End User:

- Residential

- Commercial

Residential segment leads the Australia kitchen appliances market forecast, fueled by increased urbanization, homeownership, and lifestyle improvement. Urban consumers are looking for contemporary, energy-saving appliances that facilitate convenience and healthy cooking. Increased home remodeling trends, coupled with enhanced attention to aesthetics as well as functionality, continue to drive demand in this segment.

The commercial market is expanding consistently with the growth of food service restaurants, cafes, and catering services. These customers need appliances that are durable, have high capacity, and are energy-efficient. There is a growing demand for professional appliances with sophisticated features, particularly in urban areas where operation speed and efficiency are utmost priorities.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory and New South Wales contributed a commanding 34.2% share in Australia kitchen appliances market outlook in 2024, led by strong urbanization, population density, and high consumer buying power. The location of metropolitan hubs like Sydney and Canberra creates high demand for technologically sophisticated and design-oriented kitchen solutions. These markets exhibit higher affinity towards built-in and smart appliances that comply with modern home design concepts and space-saving needs. Further, increasing residential construction and refurbishment projects in these markets continue to drive appliance replacement across various demographic segments. The purchasing behavior within NSW and ACT exhibits willingness to accept energy-efficient and sustainable products, complemented by awareness initiatives and state policy focus on ecologically friendly living. Premiumization trends are also more visible in this case, with households spending on high-performance appliances for convenience and better kitchen look-and-feel. The robustly developed retail ecosystem aided by offline as well as digital channels further supports this market leadership.

Competitive Landscape:

The Australia kitchen appliances market competitive structure is marked by established domestic competitors and multinational manufacturers who have products of a large variety to suit local tastes. Innovation, with a focus on efficiency in terms of energy, connectivity, and aesthetics, is what the market players are targeting as they seek to address the changing needs of Australian consumers. There is a visible trend towards built-in and modular appliances that can accommodate contemporary kitchen designs and design sensibilities. The premium categories are observing more traction, fueled by growing disposable incomes and lifestyle enhancement. Retail channels, such as large format stores and online shopping sites, are seeing an overarching importance in reaching out and providing bundled offers and seasonal sales. Brand loyalty, product credibility, and post-sales service continue to play a significant role in buying decisions. The market is also regionally diverse, with coastal and urban centers exhibiting greater demand for compact and multifunctional products. Ongoing product launches and differentiation by features are still the major strategies in such a competitive market.

The report provides a comprehensive analysis of the competitive landscape in the Australia kitchen appliances market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Electrolux launched a new premium AEG kitchen appliance range in Australia, aiming to elevate high-end cooking experiences and intensify competition with brands like Bosch, Miele, and Fisher & Paykel. The range featured AI-powered CookSmart Touch Displays, interactive control panels, an Airfry function with thermal probe, and access to an AI taste assist tool.

- May 2025: LG partnered with MasterChef Australia to showcase innovative kitchen appliances that boosted cooking confidence and creativity in Australian homes. The collaboration featured LG’s InstaView Full Steam Oven and smart fridges throughout the show, promoting accessible and enjoyable home cooking experiences.

- May 2025: Beko launched the BDFB1650ADX dishwasher in Australia, tailoring it to consumer feedback and featuring a dark stainlzess steel finish. The kitchen appliance included AutoDose, SelfDry, and Hygiene Intense technologies to enhance convenience, efficiency, and hygiene.

- April 2025: LG Electronics Australia launched its quietest kitchen appliance, a 15 Place QuadWash Dishwasher, designed for open-plan living. The model featured 40dBA noise levels, TrueSteam cleaning, Dual Zone Wash, interior LED lights, and a wine rack to reduce fragile item breakage.

- February 2025: Vorwerk launched the Thermomix TM7 in Australia and New Zealand, introducing advanced kitchen appliances with AI-supported cooking, voice control, and smartphone connectivity. Priced at AUD USD 2,649, the TM7 featured a 10-inch display, "Open Cooking" mode, and a digital twin, marking a technological leap in Australia’s smart kitchen appliance segment.

Australia Kitchen Appliances Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Refrigerators and Freezers, Dishwashers, Food Processors, Mixers and Grinders, Microwave Ovens, Grills and Roasters, Water Purifiers, Others |

| Distribution Channels Covered | Multi-Brand Stores, Exclusive Stores, Online, Others |

| End Users Covered | Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia kitchen appliances market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia kitchen appliances market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia kitchen appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The kitchen appliances market in the Australia was valued at USD 2.85 Million in 2024.

The Australia kitchen appliances market is projected to exhibit a CAGR of 2.19% during 2025-2033, reaching a value of USD 3.50 Million by 2033.

Key drivers of the Australia kitchen appliances market are urbanization, growing demand for energy-efficient and intelligent appliances, and consumer emphasis on convenience in cooking. Health-related lifestyles, kitchen renovation frequencies, and modern interior design trends also fuel product adoption at faster rates. Expanding retail networks and increased disposable incomes complement longer-term market growth rates across the nation.

Australia Capital Territory and New South Wales dominated the Australia kitchen appliances market in 2024, capturing a share of 34.2%. It is due to high levels of urbanization, robust purchasing power, and constant residential renovations. The modern, energy-efficient appliances preference and well-established retail network of the region play a critical role in its position as the largest market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)