Australia Internet of Things (IoT) Market Report by Component (Hardware, Software, Services, Connectivity), Application (Smart Home, Smart Wearables, Smart Cities, Smart Grid, IoT Industrial Internet, IoT Connected Cars, IoT Connected Healthcare, and Others), Vertical (Healthcare, Energy, Public and Services, Transportation, Retail, Individuals, and Others), and Region 2025-2033

Australia Internet of Things (IoT) Market Overview:

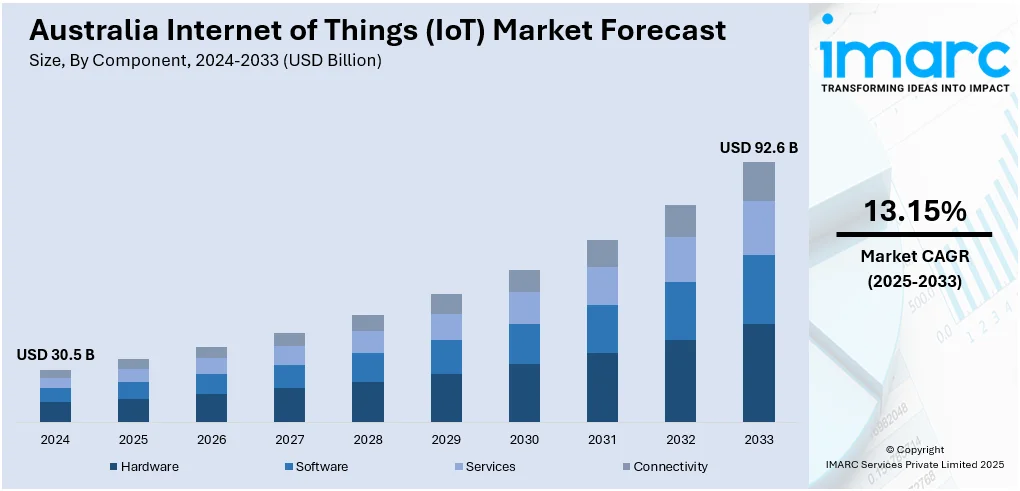

The Australia internet of things (IoT) market size reached USD 30.5 Billion in 2024. Looking forward, the market is projected to reach USD 92.6 Billion by 2033, exhibiting a growth rate (CAGR) of 13.15% during 2025-2033. Expanding smart city initiatives, increasing adoption of connected devices, advancements in 5G technology, rising demand for automation in industries, and government support towards digital transformation and data-driven solutions are fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 30.5 Billion |

| Market Forecast in 2033 | USD 92.6 Billion |

| Market Growth Rate 2025-2033 | 13.15% |

Key Trends of Australia Internet of Things (IoT) Market:

Smart city initiatives

Australia is increasingly adopting smart city initiatives, leveraging IoT to create more efficient, sustainable, and livable urban environments. These initiatives aim to use IoT-enabled solutions to manage urban infrastructure such as traffic systems, waste management, energy grids, and public safety systems. Cities like Sydney, Melbourne, and Brisbane have implemented smart technologies that monitor and optimize energy consumption, reduce traffic congestion, and enhance public services. For instance, IoT sensors embedded in roads and public infrastructure collect real-time data to improve urban planning and decision-making, making cities more responsive to the needs of their inhabitants. Consequently, the Australian government and local municipalities are investing in IoT-driven solutions to address challenges related to population growth, environmental sustainability, and resource efficiency, which is driving the market growth.

To get more information on this market, Request Sample

5G technology advancements

The deployment of 5G technology is significantly enhancing the capabilities of IoT devices and systems in Australia. 5G networks offer faster data transfer rates, lower latency, and increased device capacity, enabling more reliable and scalable IoT applications. This technological advancement is particularly important for industries that rely on real-time data processing and analysis, such as healthcare, transportation, and manufacturing. In healthcare, for example, 5G-powered IoT devices can enable real-time remote monitoring of patients, improving healthcare delivery and reducing operational costs. Similarly, in the transportation sector, 5G connectivity supports the development of connected and autonomous vehicles, which rely on seamless communication between devices and networks for safe and efficient operation. The widespread adoption of 5G is expected to unlock new opportunities for IoT solutions, creating a positive outlook for market expansion.

Industrial automation

The demand for industrial automation in Australia is acting as another significant factor for IoT adoption, particularly in industries such as manufacturing, mining, and agriculture. IoT devices and systems allow for real-time monitoring, predictive maintenance, and optimization of industrial processes. In manufacturing, IoT sensors are employed in tracking machinery performance, predicting failures, and optimizing production schedules, leading to increased efficiency and reduced downtime. The mining industry leverages IoT to monitor equipment, track assets, and improve safety through real-time data analytics. Similarly, the agricultural sector is adopting IoT solutions to optimize water usage, monitor crop health, and automate farm machinery, resulting in more efficient and sustainable farming practices. This shift toward automation, driven by the need to improve productivity, reduce operational costs, and address labor shortages is providing an impetus to the Australia internet of things (IoT) market growth.

Growth Drivers of Australia Internet of Things (IoT) Market:

Healthcare Digitalization

Australia's healthcare sector is quickly adopting IoT technologies with interconnected medical devices, wearable health monitors, and remote patient management systems reshaping care delivery. These advancements facilitate real-time data gathering, early diagnoses, and proactive treatment options which reduce hospital visits and enhance patient outcomes. Remote monitoring solutions are especially beneficial for managing chronic diseases and caring for the elderly as they provide timely alerts to healthcare professionals. Furthermore, the integration of IoT optimizes hospital operations improving asset tracking and managing patient flow leading to greater overall efficiency. As healthcare systems focus on digital transformation and personalized care the uptake of IoT solutions continues to expand. This growing dependence on connected healthcare technologies is significantly increasing Australia internet of things (IoT) market share within the medical sector.

Government Initiatives and Investments

The Australian government is instrumental in promoting IoT adoption by backing digital transformation efforts across various industries. Investments in smart city initiatives, energy-efficient infrastructure, and connected transportation systems are generating strong demand for IoT solutions. Policies that foster innovation establish cybersecurity standards and ensure data protection are further bolstering industry confidence in IoT integration. Additionally, funding for research and collaborations between public and private sectors is advancing the development of tailored IoT applications that meet local requirements. These actions enhance operational efficiency and stimulate long-term economic growth and competitiveness. The proactive involvement of government initiatives is a significant factor in the increasing Australia internet of things (IoT) market demand across different sectors.

Rising Consumer Adoption

One of the most significant factors driving IoT growth in Australia is consumer adoption as households and individuals increasingly invest in connected devices. Smart home technologies such as security systems, lighting, and energy management solutions are becoming popular due to their convenience and efficiency. Wearable devices including fitness trackers and smartwatches are also widely embraced supporting health monitoring and lifestyle management. Consumers are attracted to IoT solutions that offer real-time control, automation, and cost savings fueling a consistent rise in demand. Additionally, the incorporation of voice assistants and AI-enabled applications is making IoT technologies more user-friendly and accessible. According to Australia internet of things (IoT) market analysis, this broad acceptance of consumer-focused IoT technologies plays a crucial role in driving growth.

Government Support for Australia Internet of Things (IoT) Market:

Funding and Grants

The Australian government is actively supporting IoT innovation through targeted funding and grant programs. These initiatives provide essential financial assistance to startups, research institutions, and established businesses focused on IoT-based solutions. By reducing entry barriers and promoting experimentation, funding schemes encourage the advancement of new technologies in areas such as smart infrastructure, healthcare, and energy management. Such support drives innovation and aids in the commercialization of research outputs while attracting private investments. Furthermore, grant programs often promote collaboration among academia, industry, and government, facilitating the rapid scaling of IoT applications. This strategic financial support is crucial in enhancing Australia’s position as a hub for connected technologies and driving sustainable growth in the IoT market.

Digital Transformation Policies

National-level digital transformation policies in Australia are laying the groundwork for IoT adoption across various industries. These strategies prioritize efficiency, productivity, and innovation by motivating organizations to incorporate connected devices into their operations. Policies that promote automation, data-driven decision-making, and cloud-based platforms enable businesses to leverage IoT for expansion. Government frameworks also offer regulatory guidance, ensuring that IoT implementations are secure, reliable, and sustainable. Additionally, aligning IoT adoption with broader objectives such as environmental sustainability and competitiveness encourages businesses to modernize while addressing social challenges. The consistent emphasis on digital transformation highlights the government’s long-term vision of establishing a future-ready economy driven by IoT-enabled innovation and connectivity.

Public-Private Partnerships

Public-private partnerships are contributing significantly to the rise of IoT in Australia. Through these collaborations, government agencies and private companies combine resources, expertise, and technology to accelerate IoT adoption in crucial sectors. In healthcare, IoT-enabled patient monitoring and smart hospital systems are enhancing care delivery. In agriculture, connected solutions are optimizing irrigation, soil monitoring, and livestock management, thereby increasing productivity and sustainability. Similarly, in energy and utilities, IoT integration facilitates smarter grids and more efficient resource distribution. These partnerships foster a supportive ecosystem for innovation, reducing implementation costs and risks for businesses. By promoting cross-sector collaboration, the government ensures that IoT adoption yields tangible benefits for society, bolstering both economic growth and technological leadership.

Australia Internet of Things (IoT) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, application, and vertical.

Component Insights:

- Hardware

- Software

- Services

- Connectivity

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, services, and connectivity.

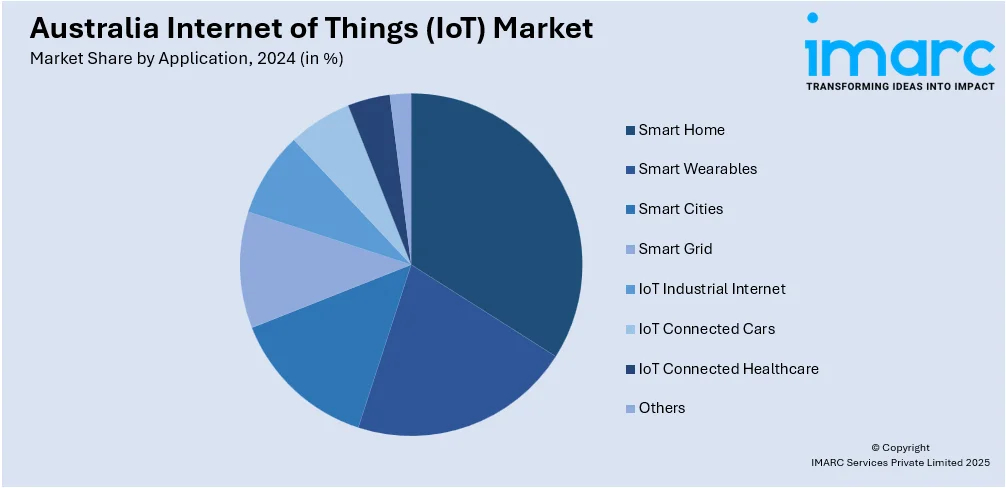

Application Insights:

- Smart Home

- Smart Wearables

- Smart Cities

- Smart Grid

- IoT Industrial Internet

- IoT Connected Cars

- IoT Connected Healthcare

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes smart home, smart wearables, smart cities, smart grid, IoT industrial internet, IoT connected cars, IoT connected healthcare, and others.

Vertical Insights:

- Healthcare

- Energy

- Public and Services

- Transportation

- Retail

- Individuals

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes healthcare, energy, public and services, transportation, retail, individuals and others.

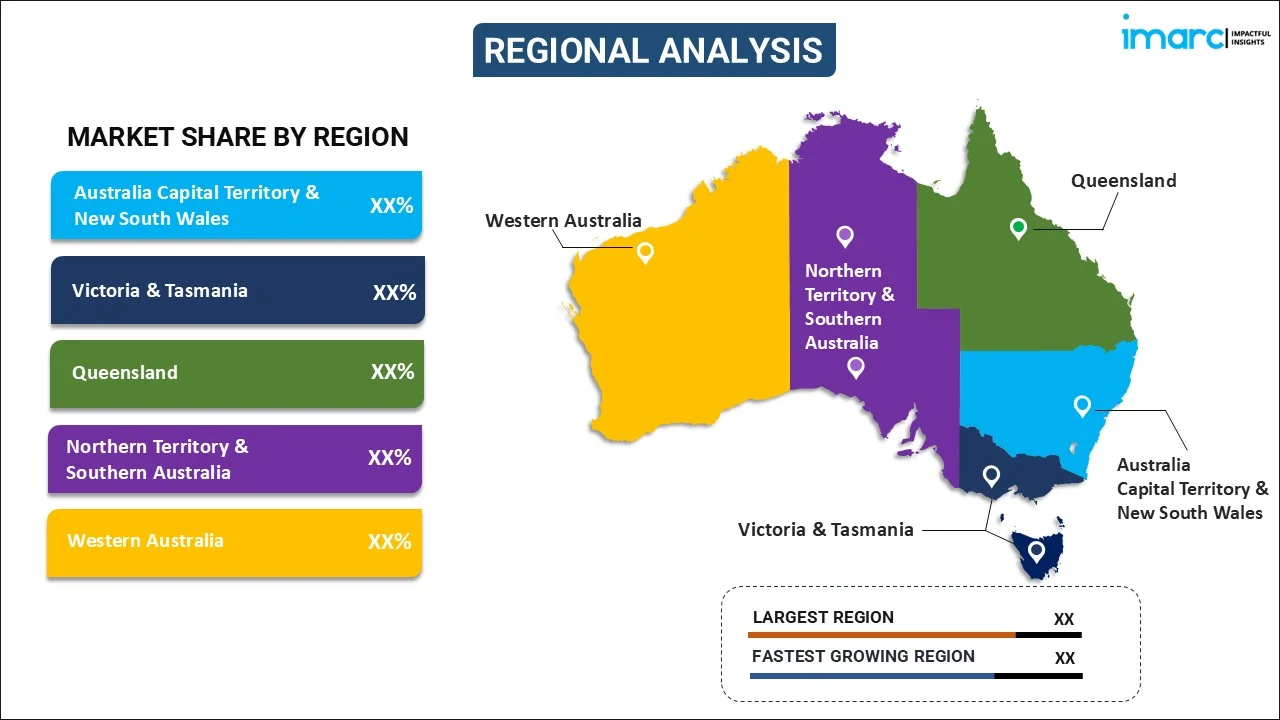

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Internet of Things (IoT) Market News:

- In June 2025, M2M One launched M2M One Satellite Airtime, a new satellite IoT service for remote industries in Australia and New Zealand. The solution integrates data plans with hardware, facilitating reliable connectivity for sectors like mining and agriculture. Byron Thanoupoulos has been appointed Director of Product Management to oversee this initiative.

- In May 2025, Sateliot officially entered the Australian market, securing contracts to connect over 300,000 IoT devices, generating over 15 million AUD in recurring revenue. With regulatory approvals in place, the company aims to provide affordable 5G satellite connectivity, enhancing services in remote areas. Commercial rollout is set for late 2025.

- In March 2025, Myriota launched its Myriota HyperPulse satellite NB-IoT service in partnership with Viasat, enhancing connectivity. Meanwhile, Sateliot secured €70 million in its Series B funding, targeting a constellation of satellites for IoT connectivity. Both companies aim to address remote monitoring needs, tapping into the growing satellite communications market.

- In April 2024, Sydney-based security firm Secolve signed a distribution deal to bring Asimily's IoT risk management and security platform to Australia. The platform helps secure IoT devices with features like device visibility, vulnerability mitigation, threat detection, incident response, and risk modeling. The partnership will help organizations in Australia stay ahead of IoT security threats.

- In April 2024, Itron, Inc. partnered with the Cairns Regional Council in Queensland, Australia, to modernize its water distribution system. The partnership will involve the deployment of Itron's intelligent connectivity and analytic solution, which includes Intelis wSource NB-IoT water meters and the council's existing mesh network technology. The project includes the deployment of Itron's ultrasonic water meters and integrated IoT network solutions.

Australia Internet of Things (IoT) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services, Connectivity |

| Applications Covered | Smart Home, Smart Wearables, Smart Cities, Smart Grid, IoT Industrial Internet, IoT Connected Cars, IoT Connected Healthcare, Others |

| Verticals Covered | Healthcare, Energy, Public and Services, Transportation, Retail, Individuals, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia internet of things (IoT) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia internet of things (IoT) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia internet of things (IoT) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The internet of things (IoT) market in Australia was valued at USD 30.5 Billion in 2024.

The Australia internet of things (IoT) market is projected to exhibit a compound annual growth rate (CAGR) of 13.15% during 2025-2033.

The Australia internet of things (IoT) market is expected to reach a value of USD 92.6 Billion by 2033.

The Australia IoT market is witnessing trends such as the rise of edge computing, adoption of AI-powered analytics, growing use of IoT in sustainability solutions, and increased focus on cybersecurity. Expansion of IoT ecosystems through interoperable platforms is also shaping industry transformation.

Market growth is fueled by strong demand for real-time data insights, expansion of connected logistics and supply chain networks, and rising adoption of IoT in predictive maintenance. Supportive infrastructure development and increasing reliance on automation across multiple industries are further accelerating adoption and market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)