Australia Insurance Market Report by Type (Life Insurance, Non-life Insurance), and Region 2025-2033

Australia Insurance Market Size and Share:

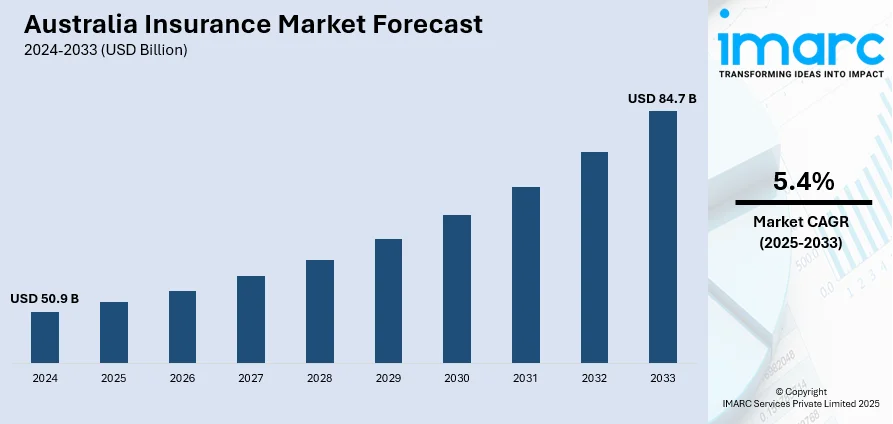

Australia insurance market size reached USD 50.9 Billion in 2024. Looking forward, the market is expected to reach USD 84.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.4% during 2025-2033. The market in Australia is being driven by the increasing aging population, rapid technological advancements, rising health awareness among individuals, regulatory changes, the growing demand for cyber insurance, and the economic growth and inflating disposable incomes of individuals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 50.9 Billion |

| Market Forecast in 2033 | USD 84.7 Billion |

| Market Growth Rate (2025-2033) | 5.4% |

Australia Insurance Market Analysis:

- Major Market Drivers: The Australia insurance market size is primarily driven by factors such as increasing awareness about risk management and insurance coverage, alongside regulatory reforms aimed at enhancing consumer protection and industry stability.

- Key Market Trends: Significant trends in the Australia insurance market include the rise of digital insurance platforms, personalized insurance products catering to niche markets, and the growing integration of artificial intelligence and data analytics for underwriting and claims processing efficiency.

- Competitive Landscape: Some of the major market players in the Australia insurance industry include

- Challenges and Opportunities: Challenges in the Australia insurance market share include navigating regulatory complexities, managing underwriting risks amidst changing climate patterns, and addressing cybersecurity threats. However, opportunities abound in expanding into emerging insurance segments such as cyber insurance, leveraging digital transformation for operational efficiency, and meeting the evolving needs of an aging population for retirement and health insurance solutions.

To get more information of this market, Request Sample

Key Trends of Australia Insurance Market:

Rising disposable incomes of individuals

Rising disposable income is bolstering the insurance market as it increases individuals' capacity to afford and purchase various insurance products. When individuals possess greater financial resources, they frequently invest in comprehensive insurance coverage for their health, lives, properties, and other assets, such as vehicles. This approach aims to safeguard against damage or theft and ensure financial stability for both them and their descendants. Furthermore, rising disposable incomes mean that customers are able to go for increased policy limits and extra add-ons that increase the size of the industry overall. Such a change has helped insurers provide specific products that match the changing needs and abilities of well-off people which has consequently promoted growth and creativity in this field.

Increasing digital transformation

Another important driver of the Australia insurance market statistics is digital transformation. The adoption of digital technologies has enabled insurers to acquire more data on customer behavior and usage trends, allowing them to provide more tailored insurance products. Furthermore, digital technology has streamlined insurers' contact with customers. It enables them to deliver a more seamless experience. Customers can now access insurance products and services via digital channels such as mobile apps and websites, making it easier to manage their policies.

Emergence of Fintech

Fintech has had a positive impact on the insurance market by making it easier for providers to provide their products and for customers to buy and manage policies. Fintech has allowed insurance businesses to employ data analytics to better understand their consumers and provide personalized policies. This information can assist insurance companies in anticipating consumer wants and developing products that are suited to the customers' individual requirements, thereby creating a favorable Australia insurance market overview.

Growth Drivers of Australia Insurance Market:

Rising Awareness about Climate Risk

Australia’s growing exposure to extreme weather events such as bushfires, cyclones, and floods has increased awareness of climate-related risks among individuals and businesses. This shift is driving higher demand for property and catastrophe insurance, as consumers seek to protect themselves from financial loss. Insurers are responding with risk-based pricing models, incentivizing customers to adopt mitigation measures like elevated foundations or fire-resistant materials. Additionally, businesses are exploring specialty coverage for business interruption and supply chain disruptions caused by climate events. This evolving risk landscape is pushing both insurers and policyholders toward proactive, prevention-focused policies. As climate volatility grows, insurance is no longer seen as optional, but essential, which contributes to consistent market growth and innovation in policy offerings.

Growth of Embedded and Usage-Based Insurance

Embedded insurance is expanding rapidly in Australia, enabling insurers to reach consumers through platforms like travel agencies, e-commerce websites, and fintech apps. These policies are offered at the point of sale, improving convenience and boosting uptake, which is driving the Australia insurance market demand. Simultaneously, usage-based insurance (UBI) models. particularly in automotive and home insurance, are gaining traction, leveraging telematics and IoT to personalize premiums based on actual usage. This improves underwriting accuracy and customer satisfaction while reducing fraud. Both trends support greater insurance penetration among younger, tech-savvy consumers and non-traditional buyers. As personalization becomes more important in consumer expectations, these models open new, scalable revenue streams and help insurers remain competitive in a digital-first, value-conscious market environment.

Demographic Shifts and Aging Population

Australia’s aging population is reshaping the insurance landscape, particularly in the health, life, and income protection segments. Older adults are seeking more comprehensive policies that cover chronic illnesses, assisted living, and long-term care, while younger families are looking for child health and life insurance products. These demographic changes are prompting insurers to diversify offerings and tailor solutions to suit evolving life stages. Additionally, increased life expectancy and retirement planning awareness are fueling demand for annuities and hybrid insurance-investment products. This generational shift offers insurers a growing and stable customer base. As demographic patterns continue to evolve, insurers who align their product strategies with life-stage needs will gain a competitive edge in an increasingly segmented market.

Government Support of Australia Insurance Market:

Reinsurance Pools and Disaster Mitigation Programs

To manage the impact of rising natural disasters, the Australian government has implemented support mechanisms such as the Cyclone Reinsurance Pool. This initiative, overseen by the Australian Reinsurance Pool Corporation, helps reduce premium costs for properties in cyclone-prone regions by distributing risk nationally. In parallel, disaster mitigation programs—like federal and state co-funding for flood levees and bushfire resilience—support infrastructure upgrades that lower long-term insurance claims. These efforts not only encourage insurance uptake in high-risk zones but also enable insurers to offer affordable and comprehensive coverage. By reducing insurers’ exposure to catastrophic losses, the government is fostering a more resilient, stable insurance environment that protects vulnerable communities and reinforces sustainable growth in the market.

Private Health Insurance Incentives

The Australian government incentivizes private health insurance participation through a combination of tax penalties and rebates. The Medicare Levy Surcharge penalizes higher-income earners without private hospital cover, while the Lifetime Health Cover loading imposes a premium penalty on those who delay joining after age 31. In contrast, the Private Health Insurance Rebate provides income-based premium subsidies. These incentives collectively encourage early and sustained participation in private health insurance, alleviating pressure on the public healthcare system. The clear financial benefits, combined with government-endorsed messaging, ensure high levels of consumer engagement. This policy framework helps maintain a balance between public and private care, supporting overall healthcare system sustainability and expanding the reach of private health insurance providers.

Regulatory Enhancements for Consumer Protection

Australian regulators have introduced a series of reforms aimed at improving consumer trust and competitive practices within the insurance sector. The Australian Securities and Investments Commission (ASIC) has mandated clearer product disclosure statements, streamlined claims processing guidelines, and enhanced complaint resolution mechanisms. Additionally, the Hayne Royal Commission spurred crackdowns on unethical sales practices and pushed insurers to eliminate junk insurance and misleading upselling. These actions have strengthened transparency and accountability across the industry. Further, the establishment of digital comparison tools has empowered consumers to make informed decisions, driving market competition. These regulatory safeguards ensure insurers remain compliant and customer-focused, ultimately creating a fairer and more stable insurance ecosystem backed by public confidence and legal oversight.

Australia Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

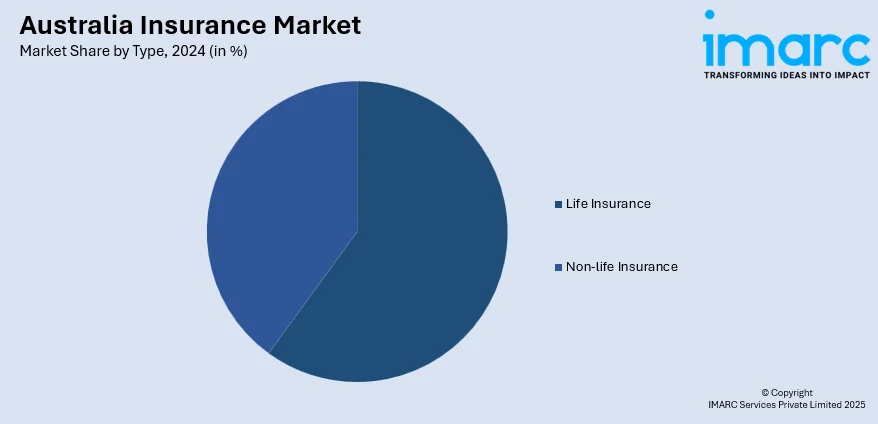

Breakup by Type:

- Life Insurance

- Non-life Insurance

- Automobile Insurance

- Fire Insurance

- Liability Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes life insurance and non-life insurance (automobile insurance, fire insurance, liability insurance, and others).

Breakup by Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major markets in the region, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- The market is characterized by a large number of regional players meeting the requirements of insurance. The key insurance companies are focusing on adopting various strategic initiatives, such as mergers and acquisitions, product launches, and partnerships to stay ahead of the competition and offer innovative solutions to their customers. As traditional insurers grapple with the challenges posed by shifting consumer preferences and technological advancements, insurance companies have capitalized on the opportunity to introduce innovative products and services that cater to the needs of their clientele. Artificial intelligence and machine learning help insurance companies to streamline underwriting and deliver more personalized coverage alternatives.

Australia Insurance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia insurance market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Australia insurance market?

- What is the breakup of the Australia insurance market on the basis of type?

- What are the various stages in the value chain of the Australia insurance market?

- What are the key driving factors and challenges in the Australia insurance market?

- What is the structure of the Australia insurance market, and who are the key players?

- What is the degree of competition in the Australia insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia insurance market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia insurance industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)